The strategic use of TS Inter 1st Year Economics Model Papers Set 2 allows students to focus on weaker areas for improvement.

TS Inter 1st Year Economics Model Paper Set 2 with Solutions

Time: 3 Hours

Maximum Marks: 100

Section – A

Note : Answer ANY THREE out of the following five questions in not exceeding 40 lines each. (3 × 10 = 30 )

Question 1.

Discuss the consumer’s equilibrium with the help of law of equi-marginal utility?

Answer:

Law of equi-marginal utility is an important law of consumption. It-is called as “Gossen’s Second Law”, as its formulation is associated with the name of H.H. Gossen. According to Marshall, “If a person has a thing which can be put to several uses, he will distribute it among these uses in sucn a way that it has the same marginal utility in all uses. If it had a greater marginal utility in one use than in another, he would gain by taking away some of it from the second ana applying it to the first”.

According to this law the consumer has to distribute his money income on different uses in such a manner that the last rupee spent on each commodity gives him the same marginal utility. Equalisation of marginal utility in different uses will maximise his total satisfaction. Hence, this law is known as the “Law of equi-marginal utility”. The fundamental condition for consumer’s equilibrium can be explained in the following way.

Where, MUx, MUy, MUz, MUm = Marginal utilities of commodities x,.y, z, money (m), and Px, Py, Pz = Prices of x, y, z goods.

This law can be explained with the help of a table. Suppose the consumer is prepared to spend his money income is ₹ 26/- on two goods say X and Y. Market prices of two goods are ₹ 4/- & ₹ 5/- respectively. Now the marginal utilities of good X, good Y are shown below.

| Units Ux | MUx | Units Uy | MUy |

| 1 | 44 | 1 | 45 |

| 2 | 40 | 2 | 40 |

| 3 | 36 | 3 | 35 |

| 4 | 32 | 4 | 30 |

| 5 | 28 | 5 | 25 |

For explaining consumer’s maximum satisfaction and consequent equilibrium position we need to reconstruct the above table by dividing marginal utilities of X by its price ₹ 4/- and marginal utility of Y by ₹ 5/-. This is shown in the following table.

| Units Ux | \(\frac{\mathbf{M U}_{\mathbf{X}}}{\mathbf{P}_{\mathbf{X}}}\) | Units Uy | \(\frac{\mathbf{M U}_{\mathbf{Y}}}{\mathbf{P}_{\mathbf{Y}}}\) |

| 1 | 11 | 1 | 9 |

| 2 | 10 | 2 | 8 |

| 3 | 9 | 3 | 7 |

| 4 | 8 | 4 | 6 |

| 5 | 7 | 5 | 5 |

In the table it is clear that when consumer purchases 4 units of goods X & 2 units of good Y. Therefore, Consumer will be in equilibrium when he is spending (4 × 4 = 16 + 2 × 5 = 10) ₹ 26/- on them.

Assumptions of the law : The law of equi-marginal utility depends on the following assumptions.

- This law is based on cardinal measurement of utility.

- Consumer is a rational man always aiming at maximum satisfaction.

- The marginal utility of money remains constant.

- Consumer’s income is limited and he is proposed to spent the entire amount on different goods.

- The price of goods are unchanged.

- Utility derived from one commodity is independent of the utility of the other commodity.

Limitations of the law: The law of equi-marginal utility has been subject to certain limitations which are as given below :

- The law assumes that consumer is a rational man and al-ways tries to get maximum satisfaction. But, in real life, several obstacles may obstruct rational behaviour.

- This law is not applicable when goods are indivisible.

- The law is based on unrealistic assumptions like cardinal measurement of utility and marginal utility of money re-mains constant. In real world, MU of money does not re-main constant.

- This law will not be applicable to complementary goods.

- Another limitations of this law is that there is no fixed accounting period for the consumer in which he can buy and consume goods.

Importance of the Law : The law of equi-marginal utility is of great practical importance in economics.

- Basis of Consumer Expenditure: The expenditure pattern of every consumer is based on this law.

- Basis for Savings and Consumption: A prudent consumer will try to distribute his limited means between present and future consumption so as to have equal marginal util¬ity in each. This is how the law guides us.

- In the Field of Production: To the businessman and the manufacturer the law is of special importance. He works towards .the most economical combination of the factors of production. For this he will substitute one factor for another till their marginal productivities are the same.

- Its application to Exchange: In all our exchanges, this law works. Exchange is nothing but substitution of one thing for another.

- Price Determination: This principle has an important bearing on the determination of value and price.

- Public Finance: Public expenditure of a government con-forms to this law. Taxes are also levied in such a manner that the marginal sacrifice of each tax payer is equal.

![]()

Question 2.

Write an essay on revenue analysis.

Answer:

The amount of money that the producer receives in exchange for the goods (sale proceeds) is called producer’s receipts or revenue. In other words, the total sale proceeds of a firm are known as revenue. We can conceive three types of revenue. They are : total revenue, average revenue and marginal revenue.

a) Total Revenue (TR) : Total amount of money or income received by the firm from the s’ale of a certain quantity of output is called total revenue. It is obtained by multiplying the price of a commodity by the number of units sold, i.e., TR = PQ.

Where,

P = Price of the good and

Q = the quantity of the good sold.

b) Average Revenue (AR) : Average revenue is the revenue per unit of goods sold. It is computed by dividing the total revenue by the number of the units of a good sold. Thus, AR = TR / Q = PQ / Q = R It is clear from the above formula that the average revenue at each level of output is equal to the price per unit.

c) Marginal Revenue (MR):

It is the net addition to the total revenue by selling additional units of the goods i.e. the revenue which would be earned by selling an addi¬tional unit of the good. Marginal revenue can be expressed as : MR = ∆TR / ∆Q, where, ∆TR = change in total revenue and ∆Q = change in quantity. In other form, MRn = TRn -TRn-1.

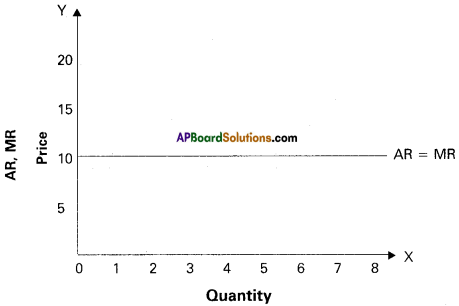

AR and MR Curves under Perfect Competition:

Under perfect competition, there exist large number of sellers and large number of buyers. The sellers under this competition offer homogenous products and, therefore, neither sellers nor buyers have any control on the price of the product. The seller can sell any amount of the good and buyers can buy any amount of the good at the ruling market price. In this case, total revenue (TR), average revenue (AR) and marginal revenue (MR) of a perfectly competitive firm are analyzed here under using table and diagram.

| Output | Price | Total Revenue PQ | Average Revenue = TR/Output |

| 1 | 10 | 10 | 10 |

| 2 | 10 | 20 | 10 |

| 3 | 10 | 30 | 10 |

| 4 | 10 | 40 | 10 |

| 5 | 10 | 50 | 10 |

| 6 | 10 | 60 | 10 |

Since the price of the product remains constant under perfect competition, the output sold increases and therefore, revenue also increases. Due to homogeneity, the goods are sold at single price under perfect competition therefore, additional units are also sold at the same price. Hence, under this competition, the AR equals MR all through. Because of this, P = AR= MR. The nature of AR and MR curves is shown with the help of figure.

By the diagram, output is measured on OX axis and price / AR / MR on OY axis. OP price in the diagram indicates existence of single price. Since, P = AR = MR, the AR and MR curves will be parallel to OX axis as shown in figure.

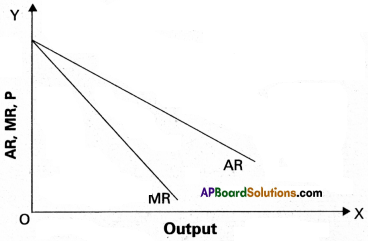

AR and MR Curves under Monopoly : Under monopoly, there is a single seller. The commodity offered by a monoplist may be or may not be homogenous. Monopolist can control price and output of the commodity, but he can’t determine both simultaneously due to existence of left to right down¬ward sloping demand curve in the market. He can sell more quantity at lower price and less quantity at higher pfice. The relationship between TR, AR and MR is shown in table.

| Output | Price | Total Revenue PQ | Average Revenue = TR / Output | Marginal Revenue |

| 1 | 10 | 10 | 10 | 10 |

| 2 | 9 | 18 | 9 | 8 |

| 3 | 8 | 24 | 8 | 6 |

| 4 | 7 | 28 | 7 | 4 |

| 5 | 6 | 30 | 6 | 2 |

The table reveals that as price falls, sales may improve and total revenue also increases but average revenue (AR) and marginal revenue falls continuously. Here, MR declines at faster rate than that of AR. Thus, MR curve lies below the AR as shown in the figure.

Relationship between AR and MR under Monopoly In figure, AR and MR represent average revenue and mar-ginal revenue curves respectively. The monopolist can sell higher quantity at lower price and therefore, always AR is greater than MR. Thus, AR curve lies above MR curve.

![]()

Question 3.

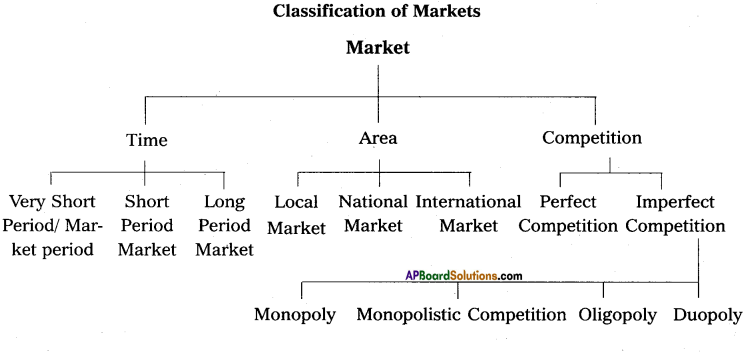

Describe the classificati on of markets.

Answer:

Edwards defined “Market as a mechanism by which buyers and sellers are brought together”. Hence, market means where selling and buying transactions take place. The classification of markets is based on three factors.

1. On the basis of area

2. On the basis of time

3. On the basis of competition.

- On the Basis of Area : According to the area, markets can be of three types.

- Local Market: When a commodity is sold at particular locality. It is called a local market. Ex: Vegetables, flowers, fruits etc.

- National Market: When a commodity is demanded and supplied throughout the country is called national market. Ex : Wheat, rice etc.

- International Market: When a commodity is demanded and supplied all over the world is called international market. Ex : Gold, silver etc.

- On the Basis of Time : It can be further classified into three types.

- Market Period or Very Short Period : In this period where producer cannot make any changes in supply of a commodity. Here, supply remains constant. Ex : Perishable goods.

- Short Period: In this period supply can be changed to some extent by changing the variable factors of production.

- Long Period: In this period supply can be adjusted in accordance with change in demand. In long run all factors will become variable in.

- On the Basis of Competition: This can be classified into two types.

- Perfect Market: A perfect market is one in which the number of buyers and sellers is very large, all engaged in buying and selling a homogeneous products without any restrictions.

- Imperfect Market: In this market, competition is imperfect among the buyers and sellers. These markets are divided into

- Monopoly

- Duopoly

- Oligopoly

- Monopolistic competition.

Question 4.

Explain critically the marginal productivity theory of distribution.

Answer:

This theory was developed by J.B.Clark. According to this theory, the remuneration of a factor of production will be equal to its marginal productivity. The theory assumes perfect competition in the market for factors of production. In such a market, average cost and marginal cost of each unit of factor of production are the same as they are equal to the price or cost of a factor of production.

For example, if four tailors can stitch ten shirts in a day and five tailors can stitch thirteen shirts in a day, then the marginal physical product of the 5th tailor _is 3 shirts. If stitching charge for a shirt is ₹ 100/-, then the marginal value product of three shirts is ₹ 300/-. According to this theory, the 5th person will be remunerated ₹ 300/-. Marginal physical product is the additional output obtained by using an additional unit of the factor of production. If we multiply the additional output by market price we will get marginal value product or marginal revenue product.

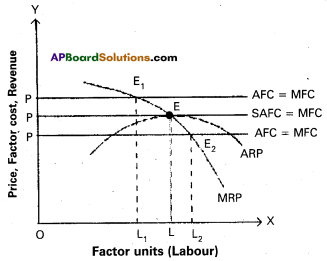

At first stage when additional units of labour are employed the marginal productivity of labourer increases up to certain extent due to economies of scale . If additional units of labour are employed beyond that point the marginal productivity of labour decreases. This can be shown in the given figure.

In the figure, OX axis represent units of labour and OY represent price/revenue/cost. At a given price, OP the firm will employ OL units of labour where price OP = L. If it employs less than OL’ i.e., OL1 units, MRP will be E1L1, which is higher than the price OP. If firm employs more than OL units upto OL2, price is OP is more than E2L2. So the firm decreases employment until price = MRP till OL. At that point ‘E’ the additional unit of labour is remunerated equal to his marginal productivity.

Question 5.

Explain the keynesian theory of employment.

Answer:

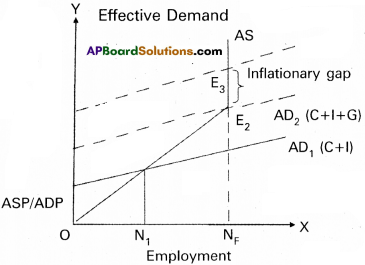

Keynes theory of employment is the principle of effective demand. He called his theory, general theory because it deals with all levels of employment. Keynes explains that lack of aggregate demand is the cause of unemployment. He used the terms aggregate demand, aggregate supply. It means total. The term effective demand is used to denote that level of aggregate demand which is equal to aggregate supply.

According to Keynes where aggregate demand and aggregate supply are intersected at that point effective demand is determined. This effective demand will determine the level of employment.

Aggregate supply schedule:

The aggregate supply schedule shows the various amounts of the commodity that will be offered for sale at a series of price. As the level of output increases with the level of employment. The aggregate supply price also increases with every increase in the level of employment. The aggregate supply curve slopes upwards from left to right. But when the economy reaches the level of the full employment, the aggregate supply curve becomes vertical.

Aggregate demand schedule:

The various aggregate demand prices at different level of employment is called aggregate demand price schedule. As the level of employment rises, the total income of the community also rises and therefore the aggregate demand price also increases. The aggregate demand curve slopes upward from left to right.

Equilibrium level of income:

The two determinants of effective demand aggregate supply and aggregate demand prices combined schedule is shown in the following table.

| Level of employment (in lakhs of workers) | Aggregate supply price (in crores of ₹) | Aggregate demand price (in crores of ₹) |

| 20 | 200 | 175 |

| 30 | 250 | 225 |

| 40 | 300 | 300 AD = AS |

| 50 | 350 | 325 |

| 60 | 400 | 425 |

The table shows that so long as the demand price is higher than the aggregate supply price. The level of employment 40 lakh workers aggregate demand price is equal to aggregate supply price i.e., 300 crores. So effective demand in the above table is ₹ 300 crores. This can be shown in the following diagrams.

In the diagram ‘X’ axis represents the employment and Y’ axis represents price. A.S is aggregate supply curve A.D is aggregate demand curve. The point of intersection between the two ‘E1‘ point. This is effective demand where all workers are employed at this point the entrepreneurs expectation of profits are maximised. At any other points the entrepreneurs will either incur losses or earn sub-normal profits.

Section – B

Question 6.

Explain the differences between free goods and economic goods.

Answer:

Differences between Microeconomics and Macro economics

| Free Goods | Economic Goods |

| free goods are nature’s gift. | Economic goods are man made. |

| Their supply is abun-dant. | Supply is always less than their demand. |

| They do not have price. | These goods have prices. |

| There is no cost of pro duction. | These goods have cost of production. |

| They have value in use and do not have value in exchange. | These goods have value in use and also value in exchange. |

| Their values are not included in national income. | Their values are included in national income. |

Question 7.

Discuss the limitations and importance of law of equimarginal utility.

Answer:

Definition of the Law : “If a person has a thing which can be put to several uses, he will distribute it among these uses in such a way that it has the same marginal utility in all. If it has a greater marginal utility in one use than in another, he would gain by taking away some of it from the second and applying it to the first.” Alfred Marshall.

Limitations of the Law of Equi-Marginal Utility: The equi-marginal principle is subject to certain limitations which may be set forth hereunder :

- The law is based upon the assumption of rationality on part of the consumer. But in real life, several obstacles may obstruct rational behaviour.

- This law works out fully only if the goods are divisible. If goods happen to be large and indivisible, it is not pos-sible to equate the marginal utility of money spent on them.

- Non availability of certain goods prevents the consumers from maximizing their satisfaction out of their expenditure. Therefore, the law fails to work.

- Prices of goods often fluctuate in the market with the re-sult that their utilities also keep changing from time to time. This prevents the working of the law.

- The law of maximum satisfaction will not be applicable to complementary goods.

- Another limitation of this law is that there is no fixed accounting period for the consumer in which he can buy and consume goods.

- Cardinal measurement of utility, marginal utility of money remaining constant etc., are not realistic assumptions. They are not valid.

- It is assumed that the consumer has a perfect knowledge. But this is not correct.

Importance of the Law:

The law of equi-marginal utility is of great practical importance in economics.

- Basis of Consumer Expenditure: The expenditure pat¬ern of every consumer is based on this law.

- Basis for Savings and Consumption:

A prudent consumer will try to distribute his limited means between present and future consumption so as to have equal marginal utility in each. This is how the law guides us. - In the Field of Production:

To the businessman and the manufacturer the law is of special importance. He works towards the most economical combination of the factors of production. For this he will substitute one factor for another till their marginal productivities are the same. - Its application to Exchange:

In all our exchanges, this law works. Exchange is nothing but substitution of one thing for another. - Price Determination:

This principle has an important bearing on the determination of value and price. - Public Finance:

Public expenditure of a government con-forms to this law. Taxes are also levied in such a manner that the marginal sacrifice of each tax payer is equal.

![]()

Question 8.

Explain the exceptions of law of demand.

Answer:

In Economics demand means a desire which is backed up by ability to buy and willingness to pay the price. Thus demand will be always at a price and time. According to Marshall “The amount demanded increases with a fall in price and diminishes with rise in price when other things remain the same”.

Exceptions:

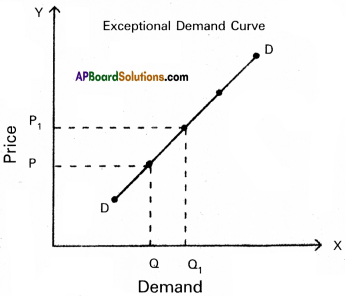

In certain situations, more will be demanded at higher price and less will be demanded at a lower price. In such cases the demand curve slopes upward from left to right which is called an exceptional demand curve. This can be shown in the following diagram.

In the diagram when price increases from OP to OP,, de-mand also increases from OQ to OQ,. This is opposite to law of demand.

1) Giffen’s Paradox:

This was stated by Sir Robert Giffen. He observed that poor people will demand more of infe-rior goods, if their prices rise. Inferior goods are known as Giffen goods. Ex : Ragee, Jowar etc. He pointed out that in case of the English workers, the law of demand does not apply to bread. Giffen noticed that workers spent a major portion of their income on bread and only small portion on meat.

2) Veblen Effect (Prestigious goods) : This exception was stated by Veblen. Costly goods like diamonds and pre-cious stones are called prestige goods or veblen goods. Generally rich people purchase those goods for the sake of prestige. Hence, rich people may buy more such goods when their prices rise.

3) Speculation:

When the price of a commodity rises the group of speculators expect that it will rise still further. Therefore, they buy more of that commodity. If they expect that there is a fall in price, the demand may not expand. Ex : Shares in the stock market.

4) Illusion:

Sometimes,’ consumer develop to false idea that a high priced good will have a better quality instead of low priced good. If the price of such good falls, demand decreases, which is contrary to the law of demand.

Question 9.

Explain the concept of returns to scale.

Answer:

The law of returns to scale is concerned with the study of production function in the long run. The law of returns to scale studies the behaviour of output in response to change in scale. A change in scale means that all inputs or factors are varied in the same proportion, keeping the factor proportions constant.

When a producer increases all the inputs in a given proportions, there are three possibilities, viz., total output may increase more than proportionately, just proportionately or less than proportionately. According to returns to scale concept, these possibilities are familiarly known as a) Increasing Returns To Scale (IRTS), b) Constant Returns To Scale (CRTS) and c) Decreasing Returns To Scale (DRTS).

Assumptions :

- All inputs except entrepreneurship are variable.

- State of technology remains the same.

- There is perfect competition in the market.

- Production is measured in physical quantities.

Explanation of the Law :

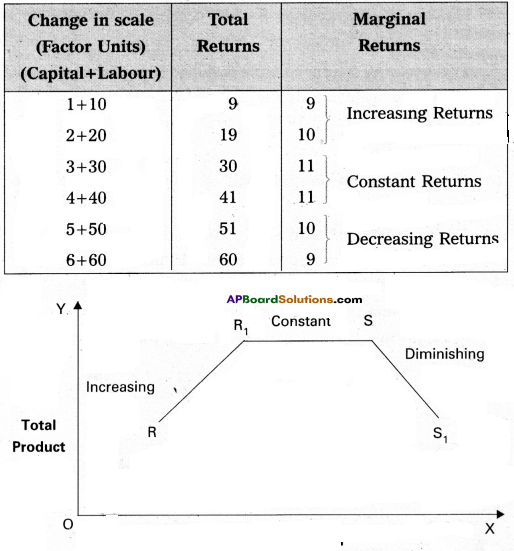

A description on returns to scale is presented in table. It can be seen from this table that the total product is 9 units in the beginning with 10L + IK. As the factors of production are doubled (20L + 2K), the total

output increased to 19 units, which is more than proportional change and therefore, it represents increasing returns to scale (IRTS). Marginal product (MP) increased from 9 to 10 units uder this stage. MP is remaining the same at 11 units when the scale is 30L + 3K and 40L + 4K therefore, it denotes constant returns to scale (CRTS). A decrease in MP is observed at 50L + 5K and 60L + 6K. This situation can be called as decreasing returns to scale (DRTS). These three kinds of returns to scale are also explained by using figure. In this figure, R to R1 shows IRTS, R1 to S shows CRTS and S to S1 indicates DRTS.

Question 10.

Write a note on classification of markets based on time and area.

Answer:

Edwards defined, “Market as a mechanism by which buyers and sellers are brought together”. Hence, market means where selling and buying transactions take place. The classification of markets is based on three factors.

1. On the basis of area

2. On the basis of time

3. On the basis of competition.

- On the Basis of Area: According to the area, markets can be of three types.

- Local Market: When a commodity is sold at particular locality, it is called a local market. Ex: Vegetables, flowers, fruits etc.

- National Market:

When a commodity is demanded and supplied throughout the country is called national market. Ex : Wheat, rice etc. - International Market:

When a commodity is demanded and supplied all over the world is called international market. Ex : Gold, silver etc.

- On the Basis of Time: It can be further classified into three types.

- Market Period or Very Short Period:

In this period where producer cannot make any changes in supply of a commodity. Here supply remains constant. Ex : Perishable goods. - Short Period:

In this period supply can be changed to some extent by changing the variable factors of production. - Long Period:

In this period supply can be adjusted in according to change in demand. In long run all factors will become variable.

- Market Period or Very Short Period:

- On the Basis of Competition: This can be classified into two types.

- Perfect market:

A perfect market is one in which the number of buyers and sellers is very large, all engaged in buying and selling a homogeneous products without any restrictions. - Imperfect Market:

In this market, competition is imperfect among the buyers and sellers. These markets are divided into- Monopoly

- Duopoly

- Oligopoly

- Monopolistic competition.

- Perfect market:

Question 11.

What are the determining factors of real wages?

Answer:

Real wages refer to the purchasing power of money wages received by the labourer. Real wages are expressed in terms of goods and services that a worker can buy with his money wages. The real wage is said to be high when a labourer obtains larger quantity of goods and services with his money income.

Factors Determining Real Wages : Real wages depend on the following factors :

1) Price Level:

Purchasing power of money determines the real wage. Purchasing power of money depends on the price level. If price level is high, purchasing power of money will be low. On the contrary, if price level is low, purchasing power of money will be high. Similarly, given the price level, if money wage is high real wage will also increase and when money wage decreases real wage also decreases.

2) Method of Payment:

Besides money wages, labourers get certain additional facilities provided by their management. Like free housing, free medical facilities, free education facilities to children, free transport etc. If such facilities are high, the real wages of labourers will also be high.

3) Regularity of Employment:

Real wages depend on the regularity of employment. If the job is permanent, his real wage will be high even though his money wage is low. In case of temporary employment, his real wage will be low though his money wage is high. Thus, certainty of job influences real wages.

4) Nature of Work:

Real wages are also determined by the risk and danger involved in the work. If the work is risky real wages of labourer will be low though money wages are high. For instance, a captain in a submarine, miners etc., always face danger and risk.

5) Conditions of Work:

The working conditions also determine the real wage of a labourer. Less duration of work, ventilation, light, fresh air, recreation facilities etc., certainly result in the high real wages. If these facilities are lacking, real wages are low even though money wages are high.

6) Subsidiary Earnings:

If a labourer earns extra income in addition to his wage, his real wage will be higher. For instance, a government doctor may supplement his earnings by undertaking private practice.

7) Future Prospects:

Real wage is said to be higher in those jobs where there is a possibility of promotions, hike in wage and vice-versa.

8) Timely Payment:

If a labourer receives payment regularly and timely, the real wage of the labourer is high although his money wage is pretty less and vice versa.

9) Social Prestige:

Although money wages of a bank officer and Judge are equal, the real wage of a Judge is higher than the bank officer due to social status.

10) Period and Expenses of Education:

Period and expenses of education also affect real wage. For example, if one person is a graduate and the other is an undergraduate who are working as clerks, the real wage of the undergraduate is high because his period of learning and expenses on education are lower than the graduate labourer.

![]()

Question 12.

What are the factors that determine National Income?

Answer:

National Income is the total market value of all goods and serviçes produced in a country during a given period of time. There are many factors that influence and determine the size of national income of a country.

a) Natural Resources:

The availability of natural resources in a country, its climatic conditions, geographical features, fertility of soil, mines and fuel resources etc., influence the size of National Income.

b) Quality and Quantity of Factors of Production:

The national income of a country is largely influenced by the quality and quantity of a country’s stock of factors of production.

c) State of Technology:

Output and national income are influenced by the level of technical progress achieved by the country. Advanced techniques of production help in optimum utilization of a country’s natural resources.

d) Political Will and Stability: Political will and stability in a country helps in planned economic development and for a faster growth of National Income.

Question 13.

What are the sources of public revenue?

Answer:

Revenue received by the government from different sources is called public revenue.

Public revenue is classified into two kinds.

1) Tax revenue

2. Non-Tax revenue.

1) Tax Revenue:

Revenue received through collection of taxes from the public is called tax revenue. Both the state and central government collect taxes as per their allocation in the constitution. Taxes are two types :

a) Direct taxes :

i) Taxes on income and expenditure. Ex : Income tax, Corporate tax etc.

ii) Taxes on property and capital assests. Ex: Wealth tax, Gift tax etc.

b) Indirect taxes : Taxes levied on goods and services. Ex : Excise duty, Service tax.

2) Non – tax revenue:

Government receives revenue from sources other than taxes and such revenue is called nontax revenue. They are :

a) Administrative revenue: Government receives money for certain administrative services. Ex: License fee, Tuition fee etc.

b) Commercial revenue: Modern governments establish public sector units to manufacture certain goods and offer certain services. The goods and services are exchanged for the price. So such units earn revenue by way of selling their products. Ex : Indian Oil Corporation, Bharath Sanchar Nigam Ltd, Bharath Heavy Electricals, Indian Railways, State Road Transport Corporations, Indian Air lines etc.

c) Loans and advances: When the revenue received by the government from taxes and from the above non-tax sources is not sufficient to meet the needs of government expenditure, it may receive loans from the financial institutions operating within the country and also from the public. Modern government also taken loans from international financial institutions.

d) Grants-in-aid : Grants are amount received without any condition of repayment. They are not repaid.

Question 14.

Define inflation and explain its types.

Answer:

Inflation, we mean a general rise in the prices in the ordinary language it is rapid upward movement of prices in a broader sense. The term inflation refers to persistent rise in the general price level over a long period of time.

According to Prof.Hawtrey : “Issue of too much currency”

According to ‘Dalton’: Defined inflation as “Too much Money is chasing too few goods”.

According to ‘Pigou’: “Inflation exists when money income is expanding more than in proportion to increase in earning activity”.

According to Irving Fisher : “Inflation occurs when the volume of money increases faster than the available supply of goods”.

According to Samuelson : “Inflation denotes a rise in the general level of prices”.

Types of Inflation :

- Creeping inflation:

When rise in the prices is very slow and small, it is called creeping inflation. - Walking inflation: This is the second stage of inflation. The inflation rate will be between 2% and ‘4%.

- Running inflation: When the rate of inflation is in the range of 4-10% per annum, it is called running inflation.

- Galloping inflation or hyper inflation : If the inflation, rate exceeds 10%, galloping inflation occurs. It may also called hyper inflation.

Question 15.

Explain the definition of money.

Answer:

Money plays a vital role in modern economy. A modern economy is rightly known as monetary economy because at the crucial position that money occupies. In the olden days goods were exchanged for goods. Such system is called barter system. However when economics grew there was a tremendous increase in the wants of the people as well as in the number of»transactions then barter system became more difficult, in order to eliminate the difficulties in the barter system money came into existence.

Definition of money:

Several economists have defined money in several ways. Some of the prominent definitions are given below.

According to Waker’ – “Money is what money does”. According to ’Robertson’ – Money as” anything which is widely accepted in payment for goods or in discharge of other kinds of business obligations”.

According to ‘Seligman’ – Money as “one that possesses general acceptability”. According to ’Crowther” – Money as “anything that is generally acceptable as a medium of exchange and which at the same time acts as a measure and store of value”.

It may be found from the above definitions that the main focus is on general acceptability. Anything that used as money should have the general acceptance of the public as medium of exchange because it is for direct exchange of commodities money ,is fundamentally required. It acts as a common measure of value. However its suitability as a store of value is equally important. Therefore we can consider Crowther’s definition as relatively more comprehensive. It is elaborate and covers the most important functions of money.

![]()

Question 16.

Point out the redemption methods of public debt.

Answer:

Repayment of debt by government is called redemption of public debt. Internal debt can be repaid in the domestic currency but foreign exchange is necessary to repay external, debt.

Redemption of Public Debt: The following are the methods of redemption of public debt.

1) Surplus Budgets:

Surplus budget means having public revenue in excess of public expenditure. If the government plans for a surplus budget, the excess revenue may be utilized to repay public debt.

2) Refunding:

Refunding implies the issue of fresh bonds and securities by the government so that the matured loans can be used for repayment of public debt.

3) Annuities:

By this method the government repays part of the public debt every year. Such annual payments are

made regularly till the debt is completely cleared.

4) Sinking Fund:

By this method, the government creates a separate fund called ‘Sinking fund’ for the purpose of repaying public debt. A part of the public revenue is deposited into this fund every year so that public debt is repaid from the sinking fund. This is considered as the best method of redemption.

5) Conversion:

Conversion means that the existing loans are changed into new loans before the date of their maturity. This metOhod is advantageous when the rate of interest charged on the new loans is less than the rate of interest to be paid on the existing loAnswer:

Question 17.

What is Statistics? Explain its relationship with economics.

Answer:

There is a close relationship between statistics, and economics. In the words of Tugwell, “The science of economics is becoming statistical in its method”. All the economic laws are pronounced on the basis of statistical facts and figures. The theory of population of Malthus, the’law of family expenditure of Engels etc., were propounded after statistical tests. Statistics helps the economics to become an exact science.

In the study of theoretical economics, the application and use of statistical methods are of great importance. Most of the doctrines of economics are based on the study of a large number of units and their analysis. This is done through statistical methods. Law of demand was formulated because of statistical methods.

The importance of statistics is felt in all branches of knowl-edge in accountancy and auditing in banking, in insurance, in research and in many fields. Without statistics no branch of knowledge is complete.

Section – C

Question 18.

What are free goods?

Answer:

Anything which satisfy human want is known as good: Goods which are freely supplied by the nature and without prices are known as free goods. The supply of these goods is always abundantly greater thatn their demand. Hence, they do not command price. Free goods possess only value-in-use, no value-in-exchage. For example, air, water, sunshine.

Question 19.

Explain the capital goods.

Answer:

Goods which are used in the production of other goods are called producer or capital goods. They satisfy human wants indirectly. Ex : Machines, tools, buildings etc.

Question 20.

Explain cardinal utility.

Answer:

Alfred Marshall developed cardinal utility analysis. According to this analysis, the utilities derived from consumption of different commodities can be measured in terms of arbitary units called utils. 1, 2, 3, 4 are called cardinal numbers.

Question 21.

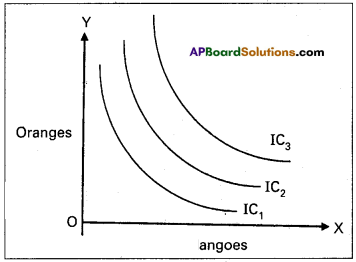

Draw the indifference map.

Answer:

A set of indifference curves drawn for different income levels is called indifference map.

From the above diagram it is clear that an indifference map of IC1, IC2, IC3. Each curve shows a certain level of satisfaction to the consumer.

Question 22.

What is demand function?

Answer:

Demand function shows the functional relationship between quantity demanded at various factors that determine the demand for a commodity. It can be expressed as follows.

Dx = f(Px,P1,….. Pn,Y,T)

Where,

Dx = Demand for good X .

Px = price of X

P1 …. Pn = Prices of substitutes and complementary

Y = Income of consumer

T = Tastes

f = functional relationship.

![]()

Question 23.

Explain relatively Elastic demand.

Answer:

When a proportionate change in price leads to more than proportionate change in quantity demand iscalled relatively elastic demand..

Question 24.

What is division of labour?

Answer:

It is an important feature of modern industrial organisation. It refers to scheme of dividing the given activity among workers in such a way that each worker is supposed to do o,ne activity or only a limited and narrow segment of an activity. Thus, division of labour increases output per worker on account of higher efficiency and specialised skill.

Question 25.

Explain the Technical economies.

Answer:

It is one of the internal economies.

The large firms will have more resources at their disposal. Hence, these firms can install the most suitable machinery. As a result larger firms experience lower cost of production. There are four different ways in which technical economies can arise.

a) Large size machines.

b) Linking processes.

c) Superior techniques,

d) Increased specialization.

Question 26.

Define market.

Answer:

Market is place where commodities are brought and sold and where buyers and sellers meet. Communication facilities help us today to purchase and sell without going to the market. All the activities take place is now called as market.

Question 27.

What is Monopolistic Competition?

Answer:

It is a market where several firms produce same commodity with small differences is called monopolistic competition. In this market producers to produce close substitute goods. Ex : Soaps, cosmetics etc.

Question 28.

What is Net profit?

Answer:

Net profit is the reward paid for the organizer’s entrepre¬neurial skills.

Net profit = Gross profit – [Implicit rent + Implicit wage + Implicit interest + Depreciation charges + Insurance premium]

Question 29.

What are time wages?

Answer:

Time wage is the amount paid for labourers for a fixed period of work i.e., weakly, daily, monthly etc.

Question 30.

Expand C.S.O. What is its responsibility?

Answer:

C.S.O. is Central Statistical Organisation and Responsibility of preparing national income estimates.

![]()

Question 31.

Distinguish between Per Capital Income and National Income.

| Per Capital Income | National Income |

| Per Capita income is the average income of people in a country in a particular year. | National income is the market value of goods and services produced annually in a country. |

Question 32.

Define public finance.

Answer:

It deals with the income and expenditure of the public authorities. (Central state and local government.

Question 33.

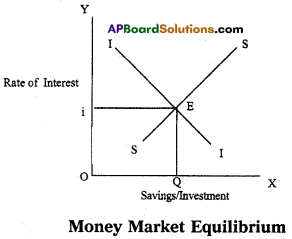

What is Money Market Equilibrium?

Answer:

Money Market Equilibrium (Savings Investment Equilibrium) : The goods market equilibrium leads to bring equilibrium in both money and labour markets. In the goods market, it is assumed that the total income is spent. The classical economists agree that part of the income may be saved, but the savings are gradually spent on capital goods. The expenditure on capital goods is called investment. It is assumed equality between savings and investment (S = I) is brought by the flexible rate of interest. This is explained in the Fig.

In diagram, savings and investment are measured on the OX axis and rate of interest is shown on the OY axis. Savings and investments are equal at Oi rate of interest where the curves intersect each other. Hence, Oi is the equilibrium rate of interest which will come to stay in the market. If any change in the demand for investment and supply of savings comes about, the curves will shift accordingly, and the equilibrium rate of interest will also change and further it brings savings and investment into equality. Thus, money market equilibrium can be automatically brought through the rate of interest flexibility.

Question 34.

What is Barter system?

Answer:

Prior to the introduction of money, the barter system was in vogue. In the system on commodity was exchanged for another commodity. Under this system, no one was able to produce all goods at their disposal. As a consequence, they used to exchange commodities among themselves. For instance, a producer for paddy used to exchange paddy for clothes from the producers of cloths. Thus, this system was be set with several difficulties.

Question 35.

What is Clearance House?

Answer:

Businessmen and other customers issue cheques towards payment for their transactions. A businessman or customer may get a cheque issued on a bank in which he has no account. He has to deposit it in his bank and which collects the amount from the bank on which the cheque is issued. This happens on a large scale everyday and calls for interbank settlement of accounts. Since all the commercial banks maintain deposit accounts with the Reserve Bank of India, it all cheques to settle the inter-bank transactions by making appropriate entries in the accounts of the commercial banks. For this purpose the Reserve Bank established clearing houses at different places.

Question 36.

Explain the concept of mode.

Answer:

Mode is most frequently occuring value in data.

Question 37.

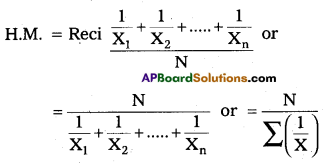

Explain the concept of Harmonic mean.

Answer:

Harmonic Mean (H.M.):

The Harmonic mean of a series is the reciprocal or the arithmetic average of the reciprocal of the values of its various items. It can be calculated by using the following formula :