Thoroughly analyzing TS Inter 2nd Year Commerce Model Papers and TS Inter 2nd Year Commerce Question Paper March 2023 helps students identify their strengths and weaknesses.

TS Inter 2nd Year Commerce Question Paper March 2023 with Solutions

Time: 3 Hours

Maximum Marks: 100

Part – I (50 Marks)

Section – A

(2 × 10 = 20)

Answer any two of the following questions in not exceeding 40 lines each.

Question 1.

What are the differences between the Money market and the Capital market?

Question 2.

Explain the principles of Management.

Question 3.

Explain the functions of an entrepreneur.

Section – B

(4 × 5 = 20)

Answer any four of the following questions in not exceeding 20 lines each.

Question 4.

What are the differences between the Primary Market and the Secondary Market?

Question 5.

What is E-Banking? Explain any four advantages of E-Banking.

![]()

Question 6.

Define insurance. Explain any four principles of insurance.

Question 7.

How does the government of Telangana extend special support to the SC/ST entrepreneurs in our State?

Question 8.

Explain any five objectives of SEZs.

Question 9.

Define the staffing process and explain the four steps involved in it.

Section – C

(5 × 2 = 10)

Answer any five of the following questions in not exceeding 5 lines each.

Question 10.

What do you mean by Lame duck?

Question 11.

What is Cash Credit?

Question 12.

What do you mean by Overdraft?

Question 13.

What is Fire Insurance?

Question 14.

What do you mean by Bridge Loans?

Question 15.

What do you mean by Cheap Jacks?

Question 16.

What is a Bill of Lading?

![]()

Question 17.

Meaning of Control.

Part – II (50 Marks)

Section – D

(1 × 20 = 20)

Answer the following question.

Question 18.

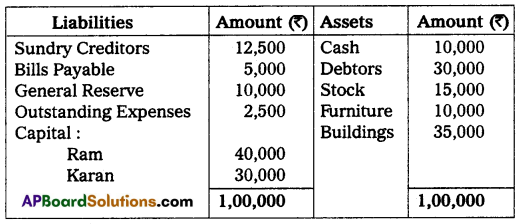

Ram and Karan are partners sharing profits and losses in the ratio of 3 : 2 respectively. Their Balance Sheet as of 31st March 2021 was as follows:

On 1st April 2021, they decided to admit Mr. Sharath for 1/5th of the share in profits. The terms of admission are

(a) He has to bring ₹ 20,000 towards capital and ₹ 10,000 towards goodwill in cash.

(b) Furniture is to be depreciated by ₹ 1,000.

(c) Create a provision of ₹ 1,500 for bad debts and debtors.

(d) Appreciate the value of buildings by ₹ 5,000.

Prepare necessary ledger accounts and open the balance sheet of the new firm.

Section – E

(1 × 10 = 10)

Answer any one of the following questions.

Question 19.

On 1st January 2021, Ravi of Hyderabad consigned goods valued ₹ 60,000 to Karan of Karimnagar. Ravi paid cartage and other expenditures ₹ 4,000. On 31st March 2021, Karan sent an account sales with the following information:

(a) 50% of the goods sold for ₹ 50,000.

(b) Karan incurred expenses ₹ 3,000.

(c) Karan is entitled to commission @ 6% on sales. A bank draft was enclosed for the balance due.

Prepare the necessary Ledger Accounts in the books of Ravi.

Question 20.

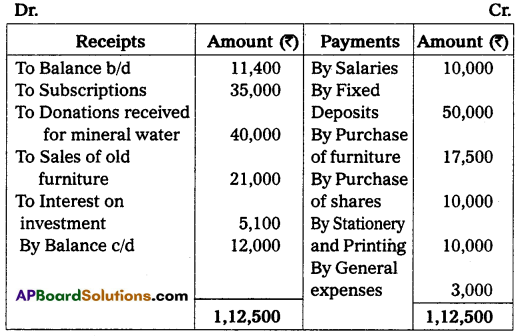

Hyderabad Youth Club gives you their Receipts and Payments Account and other information and requests you to prepare their Income and Expenditure Account for the year ended 31-03-2021.

Receipt and Payments Account for the year ended 31-03-2021

Additional Information:

(a) Outstanding subscription on 31-03-2021 ₹ 750.

(b) Subscriptions received in advance on 31-03-2021 ₹ 250.

(c) The value of old furniture sold is ₹ 22,500

Section – F

(2 × 5 = 10)

Answer any two of the following questions.

Question 21.

Distinguish any five differences between the Consignment and Sales.

Question 22.

Rama bought a plant and machine on 1st April 2017 for ₹ 23,000 and paid ₹ 2,000 for its installation. Depreciation is to be allowed at 10% under the straight-line method. On 31st March 2020, the plant was sold for ₹ 12,000. Assuming the accounts are closed at the end of the financial year, prepare the Plant & Machine Account.

Question 23.

From the following details, prepare the Receipts and Payments Account of the NGO’s club for the year ending 31st March 2021.

Opening Balance of Cash – ₹ 3,000

Opening Bank Balance – ₹ 9,000

Subscriptions collected – ₹ 16,000

Entertainment show receipts – ₹ 8,000

Entrance fee received – ₹ 4,000

Computer purchased – ₹ 6,000

Tournament expenses – ₹ 6,000

Entertainment show – ₹ 3,600

Paid for Magazines – ₹ 2,400

Salaries paid – ₹ 2,400

Rent paid – ₹ 8,000

Cash in hand at close – ₹ 3,600

![]()

Question 24.

Write any five limitations of Computerized Accounting.

Section – G

(5 × 2 = 10)

Answer any five of the following questions.

Question 25.

Define the term Depreciation.

Question 26.

What is depletion?

Question 27.

What is account sales?

Question 28.

What do you mean by Entrance fee?

Question 29.

What is the Ratio of Gaining?

Question 30.

What is a Password?

![]()

Question 31.

What is a sheet?

Question 32.

X and Y are partners sharing profit and loss in the ratio of 3 : 2. They decided to admit Z for 1/5th share in profit. Calculate the new profit-sharing ratio of X, Y, and Z.