The strategic use of TS Inter 1st Year Economics Model Papers Set 8 allows students to focus on weaker areas for improvement.

TS Inter 1st Year Economics Model Paper Set 8 with Solutions

Time: 3 Hours

Maximum Marks: 100

Section – A

Question 1.

Explain the nature and scope of Economics.

Answer:

The nature of economics took a definite shape with the writings of Adam Smith, known as Father of Economics, made a beginning in defining economics and its scope with the publication of his famous book on the wealth of nations. Then a number of economists defined economics and its subject matter in different ways.

The scope of any science explains what the science is con-cerned with. In economics, traditional economic theory is di-vided into various branches like consmption, production, ex-change, distribution, income, employment, planning and de-velopment; where as modem economic theory is divided into two branches viz. micro economics and macro economics. Economics not only explains things as they are, but also elu-cidates with what it ought to be. For example, economics discuses the existing level of wages, prices and tax rates in the economy and also suggest how they ought to be. Eco-nomics is thus, both a positive and normative science.

Traditional economics is basically concerned with con-sumption, productio, exchange distribution, income, employ-ment, planning and development.

1. Consumption:

Consumption can be defined as ‘extract-ing utility from goods and services’. Consumption is the act of using final goods and services to satisfy current wants. Consumption is the basis for production, exchange, distribution.

2. Production:

In the economics production is the process of conversion of raw materials into final goods by adding

form, place and time utility to the raw materials. The fac-tors which participate in production are called factors of production. They are land, labour, capital and organiza-tion.

3. Exchange:

It is concerned with exchange of a good. A good may be exchanged for another good or for money. Before the evolution of money when barter system was in practice,. goods were exchanged for goods. There were many problems in barter system. With the introduction of money, value of every good is

expressed in terms of money and can be exchanged for money.

4. Distribution:

Distribution is another important activity in economics. It explains how goods and services are dis-tributed amongst the various factors of production which are responsible for the production. Each factor of pro-duction gets its reward. Various theories are there to de-termine the factor prices.

5. Income:

Individuals earn income by participating in vari- , ous economic activities. The activities are related to pro-duction of material goods or the services. Income is a con-tinuous flow. Various concepts of national income and the measuring methods of national income are discussed as part of macro economics for analysing economic growth and development.

6. Employment:

The level of employment in an economy depends on the demand for consumption goods and de-mand for investment goods. Full employment means em-ployment of all those who are able and willing to work at the prevailing wage rates.

7. Planning and Economic Development:

Economic plan-ning is essential for proper and efficient utilization of the available resources. By economic planning we mean achieving the various predetermined targets systematically in a specific period of time. Economic planning is the method by which an optimum allocation of scarce re-sources amongst the various sectors is made in order to acheive speedy development of the economy and improve the welfare of the people.

![]()

Question 2.

Explain the concepts of Income and cross demands with suitable diagrams.

Answer:

The concept of demand has great significance in economics. In general language, demand means a desire but in economics the desire backed up by ability to buy and willingness to pay the price.

Types of demands: The demand may be classified into 3 types.

- Price demand.

- Income demand.

- Cross demand.

1) Price demand:

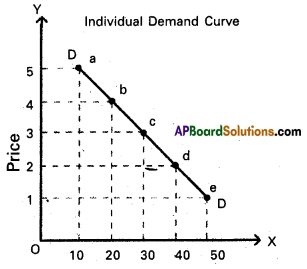

Price demand explains the relationship between price and quantity demanded of a commodity it shows the inverse relationship between price and demand when the other things like consumer’s income, taste etc., remains constant. It means the price falls demand extends and price rises demand contracts. The price demand can be expressed Dx = f(Px) Price demand can be explained with the help of de-mand schedule.

| Price | Quantity Demand |

| 5 | 10 |

| 4 | 20 |

| 3 | 30 |

| 2 | 40 |

| 1 | 50 |

As price falls to ₹ 1/- the quantity demand is 50 units, when price of apple is ₹ 5/- he is buying 10 units. So, the table ‘ shows inverse relationship between price and demand. Price demand can be explained with the help of the de-mand curve.

On OX axis shows demand, OY axis shows price. We can obtain the demand curve ’DD’ by joining all the points A, B, C, D, E which represents various quantities of demand at various prices. ‘DD’ is demand curve. It slopes downwards from left to right. It shows the inverse relationship between price and demand.

2) Income demand:

It explains the relationship between consumer’s income and various quantities of various lev-els of income assuming other factors like price of goods, related goods, taste etc., remain the same. It means if in-come increases quantity demand increases and vice-versa.

This can be shown in the following form. Dx = f(Y) The functional relationship between income and demand may be inverse or direct depending on the nature of the commodity. This can be shown in the following table.

| Income | Demand | |

| Superior good | Inferior good | |

| 2,000 | 4 | 12 |

| 4,000 | 6 | 10 |

| 6,000 | 8 | 8 |

| 8,000 | 10 | 6 |

| 10,000 | 4 | Inferior good |

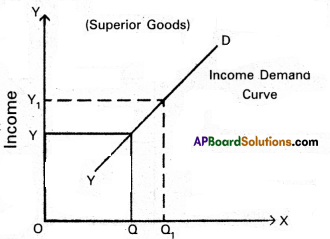

Superior goods:

In case of superior goods quantity demanded will increase when there is an increase in the income of consumers. In the diagram ‘X’ axis represents demand, OY axis represents income, YD represents the income demand curve. It showing positive slope whenever income increased from OY to OYp the demand of superior or normal goods increases from OQ to OQr This may happen in case of Veblen goods.

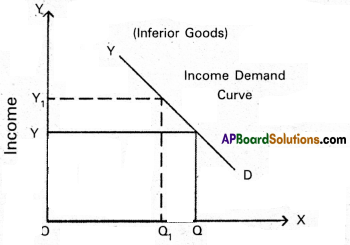

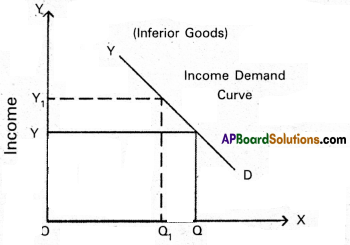

Inferior goods:

On the contrary quantity demanded of inferior goods decreases with the increase in incomes of consumers. In the diagram on ‘OX’ axis measures demand and OY axis represents income of the consumer. When the consumer income increases from OY to OYx the demand for a commodity decreases from OQ to OQr So the YD’ curve is negative sloping.

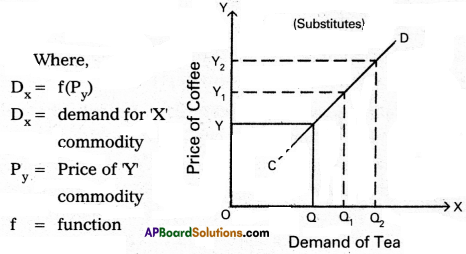

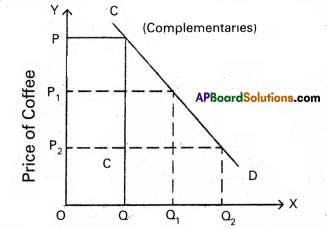

3) Cross demand:

Cross demand refers to the relationship between any two goods which are either complementary to each other or substitute for each other. It explains the functional relationship between the price of one commodity and quantity demanded of another commodity is called cross demand.

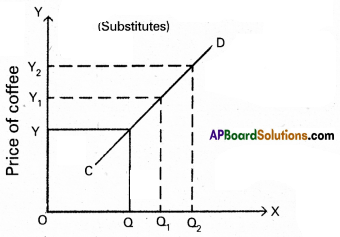

Substitutes:

The goods which satisfy the same want are called substitutes.Ex: Tea and coffee; pepsi and coca-cola etc. In the case of sub-stitutes, the demand curve has a positive slope. In the diagram ‘OX’ axis represents demand of tea and OY axis represents price of coffee. Increase in the price of coffee from OY to OY2 leads to increase in the demand of tea from OQ to OQ2.

Complementaries:

In case of complementary goods, with the increase in price of one commodity, the quantity demanded of another commodity falls. Ex : Car and Petrol. Hence, the demand curve of these goods slopes downward to the right. In the diagram, if price of car decreases from OP to OP2 the quantity demand of petrol increases from OQ to OQ2. So cross demand i.e., CD curve is downward sloped.

![]()

Question 3.

Explain the concept of public debt. Describe the various methods of redumption of Public debt.

Answer:

When the government’s expenditure exceeds its revenue one option it has is to go for public debt. A government can borrow funds from sources within the country or from abroad. This creates public debt.

Types of Public Debt: On the basis of the sources, public debt is classified into two categories :

i) Internal debt:

Internal debt is the debt raised from the sources such as banks, financial institutions and private individuals within the country.

ii) External debt:

The borrowings of the government from the sources outside the country are called external debt. A government can raise external debt from the govern¬ments of other countries; international financial institutions like World Bank and International Monetary Fund (IMF) and other funding agencies.

Redemption of public debt means repayment of public debt. All government debts should be rapid promptly. There are various methods of repayment which may be discussed under the following heads.

- Surplus budget:

Surplus budget means having public revenue in excess of public expenditure. If the government plans for a surplus budget, the excess revenue may be utilized to repay public debt. - Refunding:

Refunding implies the issue of fresh bands and securities by government so that the matured loans can be used for repayment of public debt. - Annuities:

By this method, the government repays past of the public debt every year. Such annual payments are made regularly till the debt is completely cleared. - Sinking fund:

By this method, the government creates a separate fund called ‘Sinking fund’ for the purpose of repaying public debt. This is considered as the best method of redemption. - Conversion:

Conversion means that the existing loans are changed into new loans before the date of their maturity. - Additional taxation:

Government may resort to additional taxation so as to raise necessary funds to repay public debt under this method new taxes are imposed. - Capital levy:

Capital levy is a heavy one time tax on the capital assets and estates. - Surplus Balance of payments:

This is useful to repay external debt for which foreign exchange is required surplus balance of payment implies exports in excess of imports by which reserves of foreign exchange can be created.

Question 4.

Discuss the evolution of money. Explain its types.

Answer:

Money occupies a unique place in any economic system. Society needs money for a variety of transactions undertaken by the people and the government in the day to day life. Now- a-days, we cannot imagine a society without a role for money. Evolution of money:

The term ‘money’ was derived from the name of goddess Juno Moneta of Rome. Prior to the introductioh of money, the barter system was in vogue. In that system one commodity was exchanged for another commodity. Money was coined in order to overcome the difficulties of the barter system. In the initial stages, animal was used in place of money. Gradually metallic’money in the form of gold, silver, bronze and nickel replaced it. In the third stage coins came into use. That was followed by paper money. The latest stage is the credit money in the form of drafts, cheques, debit cards, credit cards etc. Thus, money has undergone different stages in the process of evolution.

Types of money:

1) Commodity Money and Representative Money:

Commodity money includes metallic coins whose face

value and intrinsic value are same. It is also called as full-bodied money. Representative money includes coins and paper money Whose intrinsic value is less than their face value.

2) Legal Tender Money and Optional Money:

On the basis of legality, money is divided into legal tender money and optional money. Legal tender money is the money which is accepted as per the law by everyone in payment for commodities and services. Credit creation by the com-mercial banks in the form of drafts, cheques etc., are called as optional money.

3) Metallic Money and Paper Money:

Metallic money is made up of metals such as silver, nickel, steel etc. All coins are metallic money. Paper money is money printed on paper. Currency notes in the form of ₹ 1,000, ₹ 500, ₹100, ₹ 50 and ₹10 are paper money.

4) Standard Money and Token Money:

Standard money is the money whose face value and intrinsic value are same. Token money is money or unit of currency whose face value is higher than the intrinsic value, e.g. 50 paisa, 1 rupee coins etc.

5) Credit Money:

This is also called as bank money. This is created by commercial banks. This refers to the bank deposits that are repayable on demand and which can be transferred from one individual to the other through cheques.

Question 5.

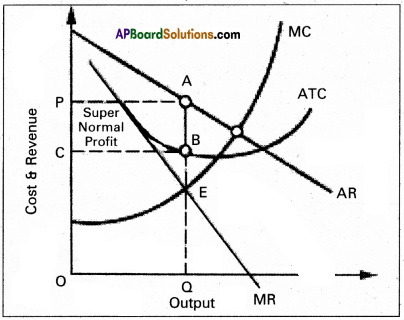

What is monopoly? Explain how price is determined under monopoly.

Answer:

Monopoly is one of the market in the imperfect competition. The word Mono’ means ‘single’ and ‘Poly’ means ’seller’. Thus, monopoly means single seller market.

In the words of Bilas, “Monopoly is represented by a market situation in which there is a single seller of a product for which there are no close substitutes, this single seller is unaffected by and does not affect, the prices and outputs of other products sold in the economy”. Monopoly exists under the following conditions:

- There is a single seller of product.

- There are no close substitutes.

- Strong barriers to entry into the industry exist.

Features of Monopoly:

- There is no single seller in the market.

- No close substitutes.

- There is no difference between firm and industry.

- The monopolist either fix the price or output.

Price Determination:

Under monopoly, the monopolist has complete control over the supply of the product. He is price maker who can set the price to attain maximum profit. But he cannot do both things simultaneously. Either he can fix the price and leave the output to be determined by consumer demand at a particular price. Or he can fix the output to be produced and leave the price to be determined by the consumer demand for his product. This can be shown in the diagram.

In the above diagram, on ‘OX’ axis measures output and ‘OY’ axis measures cost. AR is Average Revenue curve, AC is Average Cost curve. In the above diagram, at point E where MC = MR at that point the monopolist determines the output. Price is determined where this output line touches the AR line. In the above diagram for producing OQ quantity cost of production is OCBQ and revenue is OPAQ.

Profit = Revenue – Cost.

= PACB shaded area is profit under monopoly.

Section – B

Question 6.

Explain the fundamental problems of an economy.

Answer:

Fundamental Problems of an Economy :

There are certain fundamental problems in any type of economy with which economists are concerned. The following are the basic economic problems. These are interrelated and interdependent.

- What type of goods are to be produced and in what quantities?

- How to produce these goods?

- For whom to produce these goods and services?

- How efficient the productive resources are in use? Whether available resources are fully utilized?

- Is the economy growing or static over a period of time?

Question 7.

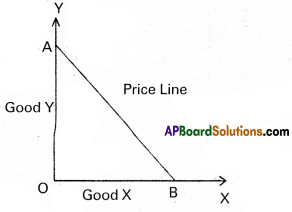

How do you define Budget line of the consumer?

Answer:

The budget line or price line shows all possible combinations of two goods that a consumer can buy with the given income and prices of the two goods. The concept of budget / price line will be shown in the following example. Suppose that a consumer has t 150 (income) to buy two goods namely X and Y. Whose prices are ₹ 15 and ₹ 30 each. With the given information now we can draw the budget or price line as shown in the diagram.In the diagram ‘AB’ is the ‘budget or price line’.

The slope of the line AB represents the ratio of the prices of X and Y in such a manner that 10 of X will be equal to 5 of Y.

Question 8.

Explain the concept of cross demand.

Answer:

Cross demand:

Cross demand refers to the relationship between any two goods which are either complementary to each other or substitute for each other. It explains the functional relationship between the price of one commodity and quantity demanded of another commodity is called cross demand.

Dx = f(Py)

Where, Dx = demand for ‘X’ commodity Py = Price of ‘y’ commodity f = function

Substitutes:

The goods which satisfy the same want are called substitutes. Ex : Tea and coffee; pepsi and coca-cola etc. In the case of substitutes, the demand curve has a positive slope. In the diagram ‘OX’ axis represents demand of tea and OY axis represents price of coffee. Increase in the price of coffee from OY to OY2 leads to increase in the demand of tea from OQ to OQ2.

Complementaries:

In case of complementary goods, with the increase in price of one commodity, the quantity demanded of another commodity falls. Ex : Car and Petrol. Hence, the demand curve of these goods slopes downward to the right. In the diagram if price of car decreases from OP to OP2 the quantity demand of petrol increases from OQ to OQ2. So cross demand i.e., CD curve is downward sloping.

Question 9.

Write a note on capital

Answer:

Capital as that part of wealth of an individual or a community which is used for further production of wealth. Capital (stock concept) yields periodical income (flow concept). Capital is nothing but ‘produced means of production’. The term capital is generally used for capital goods, E.g. plant and machinery, tools and accessories, stocks of raw materials, goods in process and fuel.

Types of Capital: Capital can be classified into :

1) Real Capital and Human Capital:

Real capital refers to physical goods, i.e., buildings, plant, machinery etc. As against this, human capital refers to human skill and ability.

2) Individual Capital and Social Capital:

Individual capital is the personal property, and the other, social capital is what belongs to the community as a whole in the form of roads, bridge etc.

3) Fixed Capital and Variable Capital:

Expenditure incurred on machinery and building in the production process is called as fixed capital. The amount spent on purchase of raw materials, daily wages to labour, electricity charges etc., are known as variable capital.

4) Tangible Capital and Intangible Capital:

Tangible capital may be perceived by senses where as intangible capital is in the form of certain rights and benefits. Eg. good- will, patent rights, etc. Importance of Capital: Let us point out the importance of capital in brief.

- Capital plays a very vital role in the modem productive system. Production without capital is almost impossible.

- The productivity of work force depends upon the amount of capital available per worker. The greater the capital per worker, the greater the efficiency and productivity of the worker.

- Capital occupies a central position in the process of eco-nomic development.

- It promotes the technological progress.

- It helps in the creation of employment opportunities.

![]()

Question 10.

Explain the relationship between total cost, total variable cost and total fixed cost.

Answer:

In short-run, the costs faced by a firm can be classified into fixed and variable costs.

1) Fixed Costs and Variable Costs:

The fixed costs of a firm are those costs that do not vary with the size of its output. It is due to this, the value of fixed costs is always positive even if production activity does not take place or it is zero. The best way of defining fixed costs is to say that they are the costs which a firm has to bear even when it is temporarily shut down. Alfred Marshall called these costs as ‘Supplementary costs’ or ‘Overhead costs’. E.g. costs of plant and equipment, rent on buildings, salaries to permanent employees are part of fixed costs.

On the other hand, variable costs are those costs which change with changes in the volume of output. Marshall called these costs as ‘Prime costs’. Daily wages to employees, payment to raw materials, fuel and power, excise taxes, interest on short-term loans etc., are examples for variable costs.

2) Nature of short run Cost Curves:

As mentioned earlier, short – run is a period of time within which the firm can vary its output by varying only variable factors of production. The fixed factors such as capital equipment, top management personnel etc., cannot be varied. Therefore, short-run cost structure of a firm reveals fixed costs and variable costs, Total Cost (TQ, Total Fixed Costs (TFQ, Total Variable Costs (TVQ, Total Average Costs (SAC) and Marginal Costs (SMC). But in the long-run, all costs are variables. The nature of short-run costs and the curvature of these costs are explained by using table and figure.

In table, short-run costs faced by a firm are analyzed. As mentioned earlier, total fixed cost is the cost of fixed factors which remains constant irrespective of level of output. It is at ? 300/- Total variable cost, on the other hand, implies expenses on variable factors of production. It is zero when output is nothing or zero and goes on increasing along with the level of output. Total cost is the sum of total fixed cost and total variable cost i.e., TC = TFC + TVC. Though TFC remains constant, TVC increase along with the level of output, TC also increases if TVC increases. A description of the relationship between these three curves is presented in figure.

Img-1

Question 11.

Explain the concepts of gross profits.

Answer:

Gross profit is considered as a difference between total rev-enue and cost of production. The following are the compo-nents of gross profit:

- The rent payable to his own land or buildings includes gross profit.

- The interest payable to his own business capital.

- The wage payable to the entrepreneur for his management includes gross profit.

- Depreciation charges or user cost of production and insurance charges are included in gross profit.

Net profits:

Net profits are reward paid for the organiser’s entrepreneurial skills. Components:

- Reward for Risk Bearing:

Net profit is the reward for bearing uninsurable risks and uncertainties. - Reward for Co-ordination:

It is the reward paid for co-ordinating the factors of production in right proportion in the process of production. - Reward for Marketing Services:

It is the profit paid to the entrepreneur for his ability to- purchase the services of factors of production. - Reward for Innovations:

It is the reward paid for innovations of new products and alternative uses to natural resources. - Wind Fall Gains:

These gains arise as a result of natural calamities, wars and artificial scarcity are also included in net profits.

Question 12.

Analyse any two methods of Measuring National Income. Answer: There are three methods of measuring National Income. These are:

1) Output method or Product method

2) Income method, and .

3) Expenditure method.

CaimCross says, “National Income can be looked in any one of the three ways, as the national income measured by adding up everybody’s output by adding up everybody’s income and by adding up the value of all things that people buy and adding in their savings.

1) Output Method or Product Method:

It is also known as inventory method or commodity service method. In this method we find the the market value of all final goods and services produced in a country in a year. The entire output of final goods and services are multiplied by their respective market prices to find out the gross national product.

GNP = (P1Q1 + P2Q2 + …. PnQn) + Net income from abroad. Where, GNP = gross national product,

P = Price of the goods or services

Q = Quantity of goods or services produced

1,2, 3 n are the various goods and services produced.

The values of the intermediary goods and services should not be include^. Only final goods and services should be taken into account. Here, we find out the value of output by the different sectors like agriculture, government, professionals, industry. .

2) Income method:

In this method, the incomes earned by all factors of production are aggregated to arrive at the National Income of a country. The four factors of production receives income in the form of wages, rent, interest and profits. Incomes in the form of transfer payment is not included in it. This is also known as national income at factor cost.

NI = R + W + I + P NI = National income W = Wages R = Rent I = Interest P = Profits.

Question 13.

Point out the redemption methods of public debt.

Answer:

Repayment of debt by government is called redemption of public debt. Internal debt can be repaid in the domestic currency but foreign exchange is necessary to repay external debt.

Redemption of Public Debt: The following are the methods of redemption of public debt.

1) Surplus Budgets:

Surplus budget means having public revenue in excess of public expenditure. If the government plans for a surplus budget, the excess revenue may be utilized to repay public debt.

2) Refunding:

Refunding implies the issue of fresh bonds and securities by the government so that the matured loans can be used for repayment of public debt.

3) Annuities:

By this method the government repays part of the public debt every year. Such annual payments are made regularly till the debt is completely cleared.

4) Sinking Fund:

By this method, the government creates a separate fund called ‘Sinking fund’ for the purpose of repaying public debt. A part of the public revenue is deposited into this fund every year sd that public debt is repaid from the sinking fund. This is considered as the best method of redemption.

5) Conversion:

Conversion means that the existing loans are changed into new loans before the date of their maturity. This method is advantageous when the rate of interest charged on the new loans is less than the rate of interest to be paid on the existing loAnswer:

Question 14.

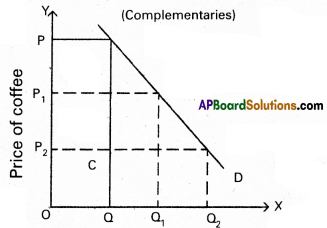

Explain the concept of effective demand.

Answer:

Effective demand means where aggregate demand equals the aggregate supply. When aggregate demand is equal to aggregate supply the economy is in equilibrium. This can be shown in the table.

| Level of employment | Aggregate supply price | Aggregate demand price |

| 10 | 500 | 600 |

| 11 | 550 | 625 |

| 12 | 600 | 650 |

| 13 | 650 | 675 |

| 14 | 700 | 700 AD = AS |

| 15 | 750 | 725 |

| 16 | 800 | 750 |

In the table when the level of employment is 14 lakh workers, aggregate demand price is equal to aggregate supply price i.e., t 700 crores. This can be shown in the following diagram. In the above diagram aggregate demand price curve (AD) and the aggregate supply price curve (AS) interest each other at point E1. It shows the equilibrium point. The equilibrium has been attained at ON1 level of employment. It is assumed that ON1 in the above diagram does not indicate full employment as the economy is having idle factors of production. So it is considered as under-employment equilibrium.

According to Keynes, to achieve full employment an up-ward shift of aggregate demand curve is required. This can be possible through government expenditure on goods and services supplied in the economy, whenever private entre-preneurs may not show interest to invest. With this the ADX curve (C + I) shift as AD2 (C + I + G) at new point of effec-tive demand E2, where the economy reaches full employment level i.e., ONE

Question 15.

Define money and explain the functions of money.

Answer:

Money plays a vital role in modern economy. A modern economy is rightly known as monetary economy because ofthe crucial position that money occupies.

- According to ‘Robertson’ : “Anything which is widely accepted in payment for goods or it discharges of other kinds of business obligations”.

- According to ‘Seligman’ : “One that possesses general acceptability”.

- According to Waker’ : “Money is what money does”. Functions of money:

1. Primary functions:

a) Medium of exchange:

Money serves as a medium of exchange. It removes the inconveniences of the barter system in which exchange of goods was possible if only there was double coincidence of wants. But money facilitates exchange of commodities without double coincidence wants. Any commodity can be exchanged for money. People can exchange goods and services through the medium of money.

b) Measure of value:

Money serves as a measure of value of goods and services. As common measure of value it has removed the difficulty of the barter system and has made transactions simple and easy. The value of each commodity is expressed in the units of money. We call it as price.

2. Secondary functions:

a) Store of value: The value of commodities and services can be stored in the form of more. Certain commodities are perishable. If they are exchanged for money before they perish, their value be preserved in the form of money.

b) Standard of deferred payments:

Money serves as a stan-dard of deferred payments. In the modern economies most of the business transactions take place on the basis of credit. An individual consumer or a business man may now purchase a commodity and pay for it in future. As this function makes it possible to express fu¬ture payments in terms of money.

c) Transfer of money:

Money can be transferred from one person to another at any time at any place.

3. Contingent functions:

a) Measurement and distribution of National income:

National income of a country be measured in money by aggregating the value of all commodities. This is not possible in a barter system similarly national income can be distributed to different factors of production by making them payment in money.

b) Money equalizes marginal utilits/productivities:

The consumers can equalize marginal utilities of different commodities purchased by them with the help of money. We know how consumers equalize the marginal utility of the taste rupee they speed on each commodity. Similarly firms can also equalize the marginal productivities of different factors of production and maximize profits.

c) Basis of credit:

Credit is created by banks from out of the primary deposits of money supply of credit, in an economy it is dependent on the supply of nominal money.

d) Liquidity:

Money is the most important liquid asset. Interms of liquidity, it is superior than other assets. Money is centpercent liquid.

![]()

Question 16.

What are the causes of Inflation?

Answer:

Inflation means a rise in the general price level over a long period of time. It occur due to the following reasons.

1) Increase in the aggregate demand of commodities.

2) Inadequate supply of commodities.

3) Increase in the cost of production.

- The factors that effect the increase in demand:

- Heavy pressure of population.

- Increase in economy’s money supply.

- More public expenditure towards various welfare schemes.

- Reduce in rates of direct taxes.

- Increase in the income levels of individuals.

- Deficit financing by government.

- Conspicuous spending by the people having black money.

- Production in direct tax rates.

- IFactors that increase the cost of production:

- Increase in costs of various factors of production.

- Increase in tax rates.

- Increase in the prices of technology.

- Devaluation of domestic currency.

- Inefficient management and no control on expenditure.

- Lack of optimum allocation of resources.

- Devaluation of domestic currency.

- Factors that cause inadequate supply:

- Irregular monsoons, floods, interior seeds in agriculture.

- Non-availability of scarcity of inputs and raw materials.

- Under-utilisation of productive capacity.

- Shortage of investment due to non-availability of institutional credit.

- Artificial scarcity due to black-marketing. .

- Exports at the cost of domestic supply.

- Long gestation period of certain industries.

Remedial Measures:

Government has to take several steps to control inflation. Some of them are enlisted hereunder:

- Importing the goods which are in short supply in the country.

- Introducing rationing and quota system in case of mass consumption goods whose supply in inadequate to improve their distribution among all the needy sections of the people.

- Controlling prices and eliminating black markets.

- Taking steps to increase production of consumer goods.

- Reducing the supply of money and credit Jay way of implementing appropriate monetary and fiscal

policies.

Question 17.

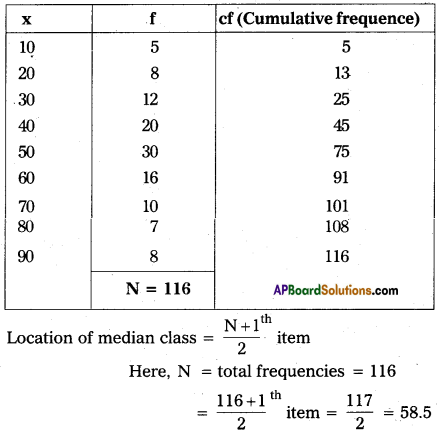

Calculate median for the following data.

Answer:

The 58.5th item is included in the cumulative freauencev of 75. The corresponding class of the median is 50.

Section – C

Question 18.

Explain the uses of sub divided bar diagrams.

Answer:

In a sub-divided bar diagram, the bar is sub-divided into various parts in proportion to the values given in the data and the whole bar represents the total. Such diagram is also called “component bar diagram”. Such a diagram shows total as well as various components.

Question 19.

What are the drawbacks of Median?

Answer:

Drawbacks of median:

- Even if the value of extreme items is too large, it does not affect too much, due to this reason, sometimes median does not remain the representative of the series.

- Median cannot be used for further algebraic treatment.

- In a continuous series it has to be interpolated.

- If the number of series is even, we can only make its estimate; as the A.M. of two middle terms is taken as Median.

Question 20.

Distinguish between Saving deposits and Time deposits.

Answer:

Savings deposits : These are the deposits made into the savings account of a bank. The public with small savings fund it safe to keep their money in the savings account of the banks. They encourage savings habit among the public. They are most convenient savings habit among the public. They are most convenient to the small businessmen, salaried employees, artisans and people belonging to the low and middle income groups. The interest paid on these deposits is comparatively low and is around 4% per annum.

Time deposits:

These are also called fixed deposits because the money is deposited with the bank for a fixed period of time. The deposit can be withdrawn only after the expirty of maturity period. However, the depositor has an option to borrow against the security of these deposits. These deposits carry more interest than the savings deposits. The rate of interest varies from 6% per annum to 12% per annum, depending on the period of deposit.

Question 21.

Write about the main objectives of Central Bank.

Answer:

Central Bank is the apex institution of the banking system in a country. It controls, regulates and supervises the activities of the country’s banking system. The Reserve Bank of India works to achieve the following objectives :

a) Regulating the issue of currency notes.

b) Achieving the monetary stability in the economy.

c) Controlling the credit system.

d) Providing guidance to commercial banks.

e) Evolving and implementing uniform credit policy through-out country.

Question 22.

Mention the functions of Finance Commission:

Answer:

The functions of the finance commission can be explicitly stated as :

- Distribution of net proceeds of taxes between centre and . the states, to be divided as per their respective contribu- tions to the taxes.

- Determine factors governing grants-in aid to the states and the magnitude of the same.

- To make recommendations to President as to the measures needed to augment the consolidated fund of a state to supplement the resources of the panchayats and mu-nicipalities in the state on the basis of the recommendations made by the finance commission.

Question 23.

Differentiate tax revenue and non – tax revenue

Answer:

Tax Revenues: Revenue received through collection of taxes from the public is called tax revenue. Both the central and state governments collect taxes as per their allocation in the constitution.

Broadly taxes are divided into two categories: (a) direct taxes, (b) indirect taxes.

2. Non – Tax revenue:

Government also receives revenue from sources other than taxes and such revenue is called the non – tax revenue. The sources of non – tax revenues are as follows :

a) Administrative Revenue

b) Commercial Revenue

c) Loan and advances

d) Grants – in – AID.

![]()

Question 24.

What are the components of National Income ?

Answer:

These are the four components of National Income.

a) Consumption (C):

It is the total expenditure made by households on goods and services. It depends on the level of income.

b) Investment (I): It include expenditure on capital goods and machinery, foadways, bridges etc.

c) Government Expenditure (G): It is the expenditure made by the government on infrastructural facilities for the use of society.

d) Net Foreign Income: It is the income earned by a country through international trade.

Question 25.

What is Net National Product at factor cost ?

Answer:

It is aslo called as national income. It is the total income received by the four factors of production in the form of rent, wages, interest and profits in an economy during a year. NNP at market prices is not available for distribution among the factors of production. The amount of indirect taxes (which are included in the prices) are paid by the firms to the government and not to the factors of production. Similarly, the government gives subsidies to firms for production of certain types of goods and services and that part of the ‘ production cost is borne by the government. Hence, the goods are sold in the market at a lower price than the actual cost of production. Therefore, this volume of subsidies has to be added to the net national income at market prices.

Thus, NNP at factor cost = NNP at market prices – Indirect taxes + Subsidies.

In another way,

NNP at factor cost = GNP at market prices – Depreciation- Indirect taxes + Subsidies.

Question 26.

What is Gross profit?

Answer:

Gross profit is considered as a difference between total revenue and cost of production.

Gross profit = Net profit + [Implicit rent + Implicit wage + Implicit interest + Depreciation charges + Insurance premium]

Question 27.

What is Economic rent?

Answer:

The ordinary use of the term ‘rent’ means any periodic payment for the hire of anything such as garriages, buildings etc. Economic rent is the pure rent payable as a reward for utilising the productivity of land. It is derived by subtracting the elements like1 interest, wages, profits and depreciation from the gross rent or contract rent. To David Ricardo, it is surplus over costs or expenses of cultivation.

Question 28.

Give a note on the Time Based Markets.

Answer:

Supply of a good can be adjusted depending on time factor. On the basis of time, markets are divided into three types, i.e., very short period, short period and long period.

a) Market Period or Very Short Period:

This is a period where producer cannot make any changes in the supply of a good. Hence, the supply is fixed. As we know supply can be changed by making changes in inputs. Inputs cannot be changed in the very short period. Supply remains constant in this period. Perishable goods will have this kind of markets.

b) Short Period:

It is a period in which supply can be changed to a little extent. It is possible by changing certain variable inputs like labour.

c) Long Period:

The market in which the supply can be changed to meet the increased demand, producer can make changes in all inputs depending upon the demand in the long period. It is possible to make adjustments in supply in long period.

Question 29.

What is Monopolistic competition?

Answer:

It is a market where several firms produce same commodity with small differences is called monopolistic competition. In , this market producers to produce close substitute goods. Ex : Soaps, cosmetics etc.

Question 30.

What are Money costs?

Answer:

The money spent by a firm in the process of production of its output is money cost. These costs would be in the form of wages and salaries paid to labour, expenditure on machinery, payment for material, power, light, fuel and transportation. These costs are further divided into explicit costs and implicit costs.

![]()

Question 31.

WhatisanApportunitycost?

Answer:

Opportunity cost: It is also called alternative cost or economic cost. Opportunity cost is next best alternative use of factors of production. If a scarce factor possesses alternative uses, ‘ the factor can be used only in one activity 6y foregoing other possibilities. Ill other words, opportunity cost is nothing but next best alternative foregone by a factor. For example, if a farmer decides to grow wheat instead of rice, the opportunity cost of the wheat would be the rice, which he might have grown rather. Thus, opportunity cost is the cost of foregone alternative.

Question 32.

Explain Substitute goods.

Answer:

These are goods which satisfy the same want. Ex : Tea and coffee. In this case the relationship between demand for a product and the price of its substitute is positive in its nature.

Question 33.

Explain Income Elasticity of Demand.

Answer:

It is the percentage change in quantity demanded of a commodity as a result of percentage change in the income of the consumer. Percentage change in quantify demanded Percentage change in consumer’s income

Question 34.

Explain Cardinal Utility.

Answer:

Alfred Marshall developed cardinal Utility analysis. According to this analysis, the utilities derived from consumption of different commodities can be measured in terms of arbitary units called utils. 1, 2, 3, 4 are called cardinal numbers.

Question 35.

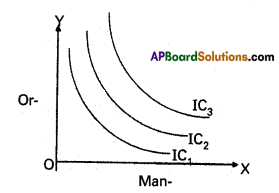

Draw the indifference map.

Answer:

A set of indifference curves drawn for different income levels is called indifference map.

From the above diagram it is clear that an indifference map of IC1 IC2, IC3. Each curve shows a certain level of satisfaction to the consumer.

Question 36.

Explain value in exchange concept.

Answer:

Exchange value is the purchasing power of one commodity for another. Only economic goods have exchange value.

Question 37.

What are single use and durable use goods?

Answer:

Single use capital Goods:

There goods are used only once in the production process. For Example : Raw materials coal and Electricity.

Durable use capital Goods: These goods are used for long time in the process of production. Machines, tools etc., are the durable capital Goods.