The strategic use of TS Inter 1st Year Economics Model Papers Set 7 allows students to focus on weaker areas for improvement.

TS Inter 1st Year Economics Model Paper Set 7 with Solutions

Time: 3 Hours

Maximum Marks: 100

Section – A

Question 1.

Explain the concepts and scope of Micrco Economics and Macro Economics.

Answer:

Modern economic theory divided it into two branches, namely (i) Micro Economics (ii) Macro Economics. Ragnar Frisch was the first economist to use the words “Micro and Macro” in economic theory in 1930.

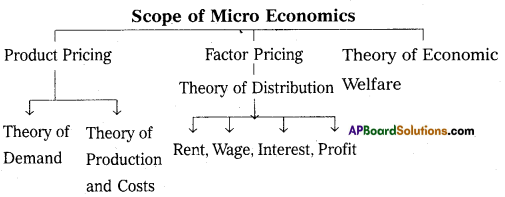

Micro Economics:

The term “Micro Economics” is derived from the Greek word ‘MIKROS’ which means small. Thus, micro economics is the theory of small. It was developed by classical economists like Adam Smith, J.B. Say, J.S. Mill, Ricardo, Marshall etc. It studies about individual units or behaviour of that particular units like individual income, price, demand etc. Micro Economics is also known as partial analysis.

It mainly, concentrates on the determination of prices of commodities and factors of production. It is also known as “Price theory”. According to K.E. Boulding, “Micro Economics is the study of particular firms, particular households, individual prices, wages, incomes individual industries and particular commodities”. Shapiro says “Micro Economics has got relation with small segments of the society.

Macro Economics:

The term Macro Economics is derived from the Greek word ‘MAKROS’ which means large. Thus, Macro Economics is the study of economic system as a whole. It was developed by J.M. Keynes. It studies aggregates in the economy like national income, total consumption, total sav¬ing and total employment etc. It is also known as Income and Employment theory.

According to Boulding “Macro Economics studies national income not individual income, general price level instead of individual prices arid national output instead of individual output”. Macro Economics also studies the economic prob-lems like poverty, unemployment, economic growth,, devel-opment etc. It also deals with the theory of distribution.

The difference between Micro Economics and Macro Eco-nomics: Micro and Macro Economics are interrelated to each other. Inspite of close relationship between the two branches of economics, fundamentally they differ from each other.

| Micro Economics | Macro Economics |

| 1. The word micro derived from the Greek” word ‘Mikros’ means “small”. | 1. The word macro derived from the Greek word ‘Makros’ which means “large”. |

| 2. Micro Economics is the study of individual units of the economy. | 2. Macro Economics is the study of economy as a whole. |

| 3. It is known as ‘Price theory’. | 3. It is known as ‘Income and Employment theory’. |

| 4. Micro Economics explains price determination in both commodity and factor markets. | 4. Macro Economics deals with national income, total employment, general price level and economic growth etc. |

| 5. Micro Economics is based on price mechanism which depends on demand and supply. | 5. Macro Economics based on aggregate demand and aggregate supply. |

![]()

Question 2.

What is price elasticity of demand? Illustrate the – irious types of price elasticities of demand.

Answer:

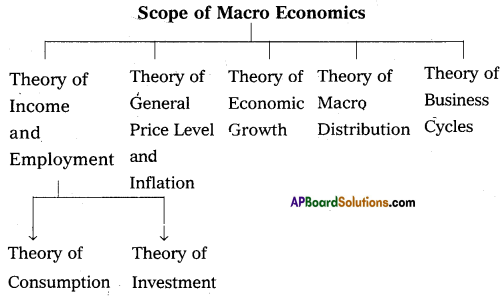

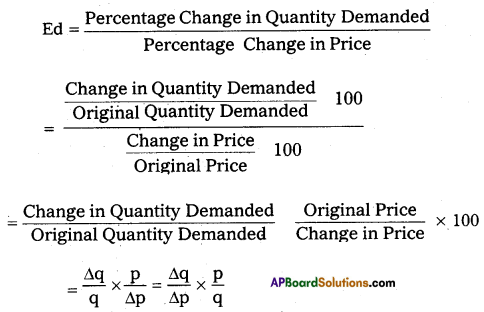

Alfred Marshall developed the concept of price elasticity of demand. Price elasticity measures, other things remaining constant, change in the demanded of a good in response to a change in its price. Thus, price elasticity of demand is the ratio of percentage change in quantity demanded of a good and percentage change in its price. Price elasticity can be written as stated below.

Where, q = quantity; p = price; Aq = change in demand; ∆p = change in price

Types of Price Elasticity of Demand: Based on numerical value, price elasticity of demand can be of five types.

- Perfectly Elastic demand (Ed = ∞)

- Perfectly Inelastic demand (Ed = 0)

- Unitary Elastic demand (Ed =1)

- Relatively Elastic demand (Ed > 1)

- Relatively Inelastic demand (Ed < 1)

1) Perfectly Elastic demand:

It is also known as “infinite elastic demand”. A small change in price leads to an infinite change in demand is called perfectly elastic demand. It is horizontal straight line to ‘X’ axis. The numerical value of perfectly elastic demand is infinite (Ed = ∞). It can be shown in the diagram.

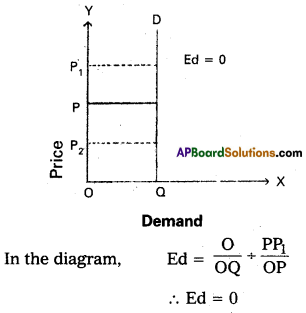

2) Perfectly Inelastic demand:

It is also known as “zero elastic demand”. In this case even a great rise or fall in price does not lead to any change in quantity demanded is known as perfectly inelastic demand. The demand curve will be vertical to the V axis. The numerical value is ‘O’. This can be shown in the following diagram.

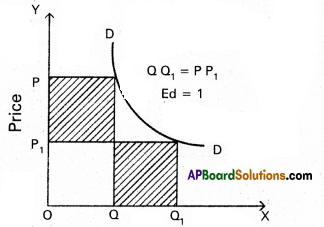

3) Unitary Elastic demand :

The percentage change in price leads to same percentage change in demand is called uni¬tary elastic demand. In this case the elasticity of demand is equal to one. The shape of demand curve is “Rectangu¬lar Hyperbola”, This can be shown in the following.

In the diagram, Ed = OP1Q1 = OPQ

(or)

OQ1 – PP1

∴ Ed = l

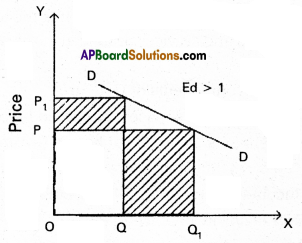

4) Relatively Elastic demand:

When a percentage change in price leads to more than percentage change in quantity demand is called relatively elastic demand. In this case the numerical value of Ed is greater than one (Ed > 1)

In the diagram, Ed = OQ1 > PP1

∴ Ed > 1

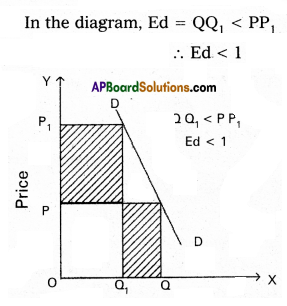

5) Relatively Inelastic demand:

When the percentage change in price leads to a less than percentage change in quantity demand is called relatively inelastic demand. Here the numerical value is less than one (Ed < 1). This can be shown to following diagram.

Question 3.

Define national income and explain the various concepts of National Income.

Answer:

National Income means the aggregate value of all the final goods and services produced in the economy in one year.

Concepts of National Income:

1) Gross National Product (GNP): It is the total value of all final goods and services produced in

the economy in one year.

The main components of GNP are :

a) The goods and services purchased by consumers – C.

b) Investments made by public and private sectors – I.

c) Government expenditure on public utility services – G.

d) Income earned through International Trade (x – m).

e) Net factor income from abroad.

GNP at market prices = C + I – G + (x – m) + Net factor income from abroad.

2) Gross Domestic Product (GDP):

The market value of the total goods and services produced in a country in one particular period usually in a year is the GDP.

GDP = C + I + G

3) Net National Product (NNP) : Firms use continuously machines and tools for the production of goods and services. This result in a loss of value due to wear and tear of fixed capital. The loss suffered by fixed capital is called depreciation. When we substract depreciation from GNP we get NNP

NNP = GNP – depreciation.

4) National Income at Factor Cost:

The cost of production of a good is equal to the rewards paid to the factors which participated in the production process. So the cost of production of a firm is the rent paid on land, wages paid to labour, interest paid on capital and profits of the entrepreneur.

National Income at factor cost = NNP + Subsidies – Indirect Taxes – Profits of Govt, owned firms.

5) Personal Income:

It is the total of incomes received by all persons from all sources in a specific time period. Personal income is not equal to National Income. Because social security payments. Corporate taxes, undistributed profits are deducted from national income and only the remaining is received by persons.

Personal Income = National Income at factor cost – Undistributed profits – Corporate taxes – Social security contributions + Transfer payments.

6) Disposable Income: Personal income totally is not available for spending. Income tax is a payment which must be deducted to obtain disposable income.

Disposable Income = Personal income – Personal taxes D.I = Consumption + Savings

7) Per Capita Income:

National Income when divided by country’s population, we get per capita income.

Per Capita Income = \(\frac{\mathrm{National Income }}{\mathrm{Total Population}}\)

The average standard of living of a country is indicated by per capita income.

![]()

Question 4.

Analyse the central, state financial relation in India.

Answer:

The financial relationship between the centre (union) and the states is provided in the constitution. The constitution gives a detailed scheme of distribution of financial resources between union and the states. The constitution makes a broad distinction between the power to levy a tax and the power to appropriate the proceeds of a tax. Thus the legislature which levies a tax is not necessarily the authority which retains the proceeds of a tax levied.

The constitution grants the union parliament exclusive power to levy taxes on several items. The state legislatures enjoy similar power with regard to several other specified items. In general, the union parliament levies taxes on items mentioned in the union list while the state legislatures levy taxes on items mentioned in the state list.

1) Exclusive Powers of Union Government:

The subjects on whom the union government has the ‘exclusive powers to levy taxes are :

a) Customs duty,

b) Corporation tax,

c) Capital gains,

c) Surcharge on income tax and

d) Railway fares etc.

2) Exclusive Powers of State Governments:

State’s exclusive powers to tax include :

a) Land revenue,

b) Stamp duty,

c) Estate duty,

d) Entry tax,

e) Sales tax and

f) Taxes on vehicles and Luxuries etc.

The residuary power of taxation belongs to the centre. It means that the subjects which have not been included either in the union or in the state list may be taxed only by the ‘ union government. In the matter of taxation, the constitution recognizes no concurrent jurisdiction. Hence there is no subject who may be taxed both by the union and the state governments.

Besides the exclusive power of taxation of the union and ‘ the state governments, there are 3 other categories of taxes. They are:

a) Taxes levied by the union government but collected and appropriated by the states. Stamp duties on bills of exchange, excise duties on medicinal and toilet preparations fall in this category.

b) Certain duties are levied and collected by the union but the net proceeds of such taxes are distributed among the states. Each state gets that amount of the tax as is col-lected with in its territory. Succession duty, estate duty on property other than agricultural land, taxes on railway fares and freights, taxes on news paper sales and adver-tisements etc., fall in this category.

c) Certain taxes are levied and collected by the union but the proceeds are distributed between the centre and the states. Taxes on non-agricultural income (Art. 270) and excise duties on items in the union list except medicinal and toilet preparations fall in this category.

3) Miscellaneous Powers:

i) After 73rd and 74th Amendment of the Constitution, a provision is made for the constitution of the consolidated fund of state from which resources are to be provided to the village panchayats and municipalities.

ii) According to Article 360, during the proclamation of financial emergency, the President can give financial direc- fives to the states. The union government supplements the financial resources of the states by two other means besides distribution of tax revenues. There are : a) Advancement of central loans and b) Grants-in-aid given to the states.

Question 5.

What arethe functions of Reserve Bank of India?

Answer:

The Central Bank of our country is Reserve Bank of India. It was established in April 1935, with a share capital of X 5 crores. It was originally owned by private shareholders but was nationalised by the government of India in 1949. It performs all its activities under the Reserve Bank of India Act 1934.

The main aim of RBI is to achieve the monetary stability and to control the credit system pf an economy. It performs the following functions.

1) Note issue:

Reserve Bank of India enjoys the monopoly of note issue in the country. It maintains a minimum t 200 crores Of gold and foreign exchange reserves of which gold should be ₹ 115 crores. It issue notes in the denomi-nations of ₹ 1,000, ₹ 500, 100, ₹ 50, 20, ₹ 10, ₹ 5 and ₹ 2. One rupee note and coins are issued by the finance de-partment of the Government of India. Reserve Bank of India prints all the currency notes in the security press of . the Government of India.

2) Banker to Government:

Reserve Bank of India acts as the banker, agent and adviser to the Government of India. It receives money and make payments on behalf of the government and gives temporary advances to the government. It advises the government in all financial matters.

3) Banker’s Bank:

Reserve Bank serves as a banker not only to the government but also to the banks. It provides financial assistance to the commercial banks by giving loans and rediscounting the bills of exchange. It helps the banks by acting as a clearing house for settlement of inter bank transactions and controls the supply of money in the economy through cash reserve ratio.

4) Lender of last resort:

It acts as lender of last resort by granting loans and advances to the commercial banks against some securities viz., treasury bonds, treasury bills and other approved securities. It also provides financial help to banks by rediscounting the eligible bills of exchange.

5) Custodian of foreign exchange reserves:

Reserve Bank of India as a member of the International Monetary fund. It regulates all foreign exchange transactions in the country. It controls and regulates the purchase and sale of foreign exchange through restrictions on exports and imports to maintain the official rate of exchange.

6) Credit controller:

Reserve Bank of India controls the volume of credit in the country. It controls the credit through different methods by appropriate monetary or fiscal policies. It announces credit policy for every six months based on the credit needs of the country. Through this’it controls the inflation and deflation.

7) Promotional and development functions:

Reserve Bank of India in order to achieve economic development per¬forms certain promotional and developmental functions. They are :

1) Promoting various financial institutions to provide indus¬trial finance.

2) It takes steps for establishment of banks throughout the country and expansion of their branches.

3) Encourage the financial institution to provide financial help to agriculture and rural credit.

Section – B

Question 6.

Explain the growth definition of economics.

Answer:

In the words of Samuelson, “Economics is the study how people and society choose, with or without the use of money, to employ scarce and productive resources which could have ‘ alternative uses, to produce various commodities over time and distribute them for consumption, now and in the future, among various people and groups in the society. It analyses the benefits of improving patterns of resource allocation”.

Important Points:

Some of the important points in Samuelsons’ definition are :

- His definition like Robbins agreed that resources are not only limited but also have several uses.

- Samuelson’s definition is dynamic in nature as it consid-ers both the present and future consumption, production and distribution.

- Growth definition deals with the problem of choice in a dynamic society. Hence, this definition

broadened the scope ‘ of economomics. - Samuelson’s definition is superior to that of Robbins’ be-cause he shifted the emphasis from the scarcity of re-sources to income, output and employment and later to the problems of economic growth.

Samuelson’s definition appears to be the most acceptable at the moment.

Question 7.

Explain the concept of Law of equi-marginal utility. Point otititsassumptious.

Answer:

This is an important law of consumption and was derived from the law of diminishing marginal utility. It is known by various names such as the law of equi-marginal utility, the law of substitution, the law of maximum satisfaction etc. It is also called as Gossen’s Second Law as its formulation is associated with the name of H.H. Qossen. The law of diminishing marginal utility explains the consumer’s behaviour, consuming only one good. But in actual life, consumer buys a certain combination of goods with his limited income and maximises utility. The law of equi-marginal utility explains the same.

Definition of the Law: “If a person has a thing which can be put to several uses, he will distribute it among these uses in such a way that it has the same margined utility in all. If it has a greater marginal utility in one use than in ainother, he would gain by taking away some of it from the second and applying it to the first.” – Alfred Marshall.

Assumptions of the Law :

The law of equi-marginal utility depends on the following assumptions:

- Cardinal measurement of utility is assumed.

- Rationality on the part of the consumer so as to get maxi-mum satisfaction and to attain equilibrium is also assumed.

- Marginal utility of money remains constant.

- The income of the consumer is given and remains con-stant and he spends entire amount on different goods.

- The prices of goods are given and constant.

- Utilities are independent.

![]()

Question 8.

Define Price Elasticity of demand.

Answer:

Price elasticity of- demand is the responsiveness of quantity demanded of a good to a change in the price of that com-modity. Alfred Marshall developed the concept of price elasticity of demand. A change in the price of a particular good will never bring uniform change in the quantity demanded.

Other things remaining constant, price elasticity measures the change in the quantity demanded of a good in response to a change in its price. Thus, price elasticity of demand is the ratio of percentage change in quantity demanded of a good and percentage change in its price. Prof. Marshall suggested the fallowing formula to measure price elasticity of demand.

Where,

q = quantity;

p = price;

∆q = change in demand;

∆p = change in price

It is to be noted that while calculating price elasticity of demand other things like income, prices of all related goods, tastes, preference etc. are assumed to be constant. It is also ‘ to be noted that price elasticity of demand is negative because of the inverse relationship between price and quantity demanded. For the sake of convenience or simplicity the minus sign is ignored and only the numerical value of the elasticity coefficient is considered.

Types of Price Elasticity of Demand:

If the price of a com-modity increases, its quantity demanded will fall. The rate of change in demand is not always proportionate to the rate of change in price. For some commodities a smaller change in price leads to a greater change in quantity demanded. In such a case, the demand is elastic on the other hand, even a greater change in price may lead to only a smaller change in the quan¬tity demanded. In such a case, we say that the demand is inelastic. The following are the types of elasticity of demand:

1) Perfectly Elastic demand (Ed = oo)

2) Perfectly Inelastic demand (Ed = 0)

3) Unitary Elastic demand (Ed =1)

4) Relatively Elastic demand (Ed > 1) and

5) Relatively Inelastic demand (Ed < 1)

Question 9.

Describe the main features of factors of production, namely land and labour.

Answer:

Land, labour, capital and entrepreneurial ability (organisation) are called as factors of production which make it possible to produce goods and services. The basic features of these factors of production are presented in the following paragraphs.

1) Land (N) : The term land is used in a special sense in economics. It does not mean soil or earth’s surface alone but refers to all free gifts of nature Which include besides land, in common practice, natural resources, fertility of soil, water, air, natural vegetation etc.

Characteristics of Land : We may list the following char-acteristics of land as a factor of production.

- Land is a free gift of nature.

- The supply of land is perfectly inelastic from the point of view of the economy.

- Land cannot be shifted from one place to another place.

- Land is said to be a specific factor of production in the sense that it does not yield any result unless human efforts are employed.

- Land provides infinite variation of degree of fertility and situation so that no two pieces of land are exactly alike.

2) Labour (L) : The term labour means mental or physical exertion directed to produce goods or services. In eco-nomics it is used in a wider sense. Any work, whether manual or mental, which is undertaken for a monetary consideration is called labour.

Characteristics of Labour : Let us identify the character-istics of labour:

- Labour is inseparable from the labourer himself. It im-plies that whereas labour is sold, the producer of labour retains the capacity to work.

- Labour is highly ‘perishable’ in the sense that a day’s loss of labour cannot be stored and so he has no re-serve price for his labour.

- Labour has a very weak bargaining power.

- Labour power differes from labourer to labourer. Therefore, labour may be classified as unskilled labour, semi skilled labour and skilled labour.

- The supply curve of a labourer is backward bending.

![]()

Question 10.

What are the characteristics of monopolistic competition?

Answer:

It is a market with many sellers for a product but the products are different in certain respects. It is mid way of monopoly and perfect competition. Prof. E.H. Chamberlin and Mrs. Joan Robinson pioneered this market analysis. Characteristics of Monopolistic Competition:

- Relatively Small Number of Firms:

The number of firms in this market are less than that of perfect competition. No one can control the output in the market as a result of high competition. - Product Differentiation:

One of the features of monopolistic competition is product differentiation. It takes the form of brand names, trade marks etc. Its cross elasticity of demand is very high. - Entry and Exit:

Entry into the industry is unrestricted. New firms are able to commence production of very close substitutes for the existing brands of the product. - Selling Cost: Advertisement or sales promotion tech-nique is the important feature of Monopolistic competi-tion. Such costs are called selling costs.

- More Elastic Demand : Under this competition the de mand curve slopes downwards from left to the right. It is highly elastic.

Question 11.

What is meant by profit?

Answer:

Profit is the reward paid to the entrepreneur for his services as an organizer in the process of production. Theories of Profit :

1. Dynamic theory of profit:

This theory was propounded by J.B.Clark. According to Clark, “Profit is the difference between the price and cost of production of commodity”. He viewed that profit as a reward for entrepreneurial dyna

mism. Dynamic changes like increase in population, new method of production etc., result in increase in profit. In a static economy due to lack of these changes entrepre-neurs receive only wages but not profit. Hence, profits are the result of the dynamic changes only.

2. Innovation theoiy of profit:

This theory was developed by Joseph Schumpeter. According to Schumpeter, “profit is the reward paid to the entrepreneur for his inventive skills”. Because of these inventions profits arise as a difference between prices and costs of production. According to Schumpeter, entrepreneur must break the circular flow by introducing innovations. They are:

- Introduction of new good.

- Introduction of new method of production.

- Reorganisation of industry.

- Opening up of a new market.

- Discovery of new source of raw materials.

So these innovations, the cost of production remains below its selling price and thus, profit arises. Thus profit is paid to entrepreneur for innovating but not for risk taking.

3. The risk theory of profit:

This theory was proposed by Prof. Hawley. Profits are the reward for an entrepreneur for risk-taking. So the residual part of income.after paying all factors of production goes to the entrepreneur for risk taking. Fluctuations in future prices, demand etc., are involved in ris k taking. According to Prof. Hawley, “those who face risks ir business will be able to earn an excess of payment above the actual value of risk in the form of profit”.

4. Uncertainty theory of profit:

This theory was formulated by Prof. Knight. It is a modified version of risk bearing theory of profits. According to him, profit as’the reward for bearing uninsurable risks and uncertainties. He .classified risks into two types.

1. Unforeseen insurable risks like fire, theft.

2. Unforeseen non insurable risks like changes in prices, demand and supply. These uninsurable risks cannot be calculated. According to Prof. Knight, “Profit cannot be treated as the reward for risk taking only for reward for uncertainty bearing”.

5. Walker’s theory of profit:

This theory was developed by Walker. According to Walker, “Profits are a rent paid for the abilities of entrepreneur”. Walker theory states that profits arise due to the differences in efficiency and ability of entrepreneurs. Hence, efficient and able entrepreneurs are paid profits.

Question 12.

Analyse any two methods of measuring National Income.

Answer:

There are three methods of measuring National Income. These are:

- Output method or Product method

- Income method, and

- Expenditure method

CairnCross says, “National Income can be looked in any one of the three ways, as the national income measured by , adding up everybody’s output by adding up everybodys income and by adding up the value of all things that people buy and adding in their savings.

1) Output Method or Product Method:

It is also known as inventory method or commodity service method: In this method we find the the market value of all final goods and services produced in a country in a year. The entire output of final goods and services are multiplied by their respective market prices to find out the gross national product.

GNP = (P1Q1 + P2Q2 + •••• PnQn) + Net income from abroad.

Where, GNP = gross national product,

P = Price of the goods or services

Q = Quantity of goods or services produced

1,2,3 n are the various goods and services produced.

The values of the intermediary goods an’d services should not be included. Only final goods and services should be taken into account. Here, we find out the value of output by the different sectors like agriculture, government, professionals, industry.

2) Income method: In this method, the incomes earned by all factors of production are aggregated to arrive at the National Income of a country. The four factors of produc¬tion receives income in the form of wages, rent, interest and profits. Incomes in the form of transfer payment is not included in it. This is also known as national income at factor cost. f

NI = R + W + I + P

NI = National income

W = Wages * –

R = Rent I = Interest

P = Profits.

![]()

Question 13.

Distinguish between aggregate supply price and aggregate demand price.

Answer:

Aggregate supply price : When an entrepreneur gives employment to certain amount of labour. It requires the use of other factors of production or inputs. All these inputs have to be paid remunerations. When all these are added what we get is the value of the output produced or the expenditure incurred to supply employment for a specific number of labourers. By selling the output the entrepreneurs must expect to receive atleast what they have spent. This is known as the “Aggregate supply price” of the output or level of employment. As the level of output increases with the level of employment, aggregate supply price also increases with every increase in the level of employment.

Aggregate demand price:

In Keynes theory the aggregate demand determines the level of employment. The aggregate demand price for a given output is the amount of money which the firms expect to receive from the sale of that output. Then aggregate demand will be equal to the sum of consumption (Q investment (T) and Government expenditure (G) for goods and services. Therefore, Aggregate demand (AD) = C+ I + G.

As the level of employment rises, the total income of the community also rises and therefore the aggregate demand, price also increases.

Question 14.

Write a note on Finance Commission and its function.

Answer:

The Finance Commission of India came into existence in 1951. It was established under Article 280 of the Indian Constitution by the President of India. It was formed to define the financial relations between the centre and the state. As per the Constitution, the commission is appointed for every five years and consists of a chairman, secretary and four other members.

The first finance commission submitted its report in 1952. The finance commission advises the President, what percentage of the income tax should be retained by the centre, and what principles should be adopted to distribute the divisible pool of the income tax among the states. Since the institution of the first finance commission, stark changes have occurred in the Indian economy causing changes in the macro economic scenario. This has led to major changes in the finance commission’s recommendations over the years. Till date, fourteen finance commissions have submitted their reports. Functions of Finance Commission :

The functions of the finance commission can be explicitly stated as :

- Distribution of net proceeds of taxes between centre and the states, to be divided as per their respective contribu-tions to the taxes.

- Determine factors governing grants-in aid to the states and the magnitude of the same.

- To make recommendations to President as to the mea-sures needed to augment the consolidated fund of a state to supplement the resources of the panchayats and mu-nicipalities in the state on the basis of the recommenda-tions made by the finance commission.

Question 15.

Explain different types of loans and advances paid by the commercial banks.

Answer:

According to “Crowther”- “A bank is a dealer in debts his own and other people”. Banking means the accepting for the purpose of lending or investment of deposits of money from the public repayable or demand or otherwise and withdrawable by cheque, draft or otherwise. *

Advancing loans : Commercial banks release funds so collected for productive ‘purposes by way of loans and advances. Commercial bank usually lend money by way of loans, cash credit, overdrafts and by discounting bills of exchange.

a) Cash credit: In this case, the borrower is given a loan is deposited in his account in the bank. The loan is not normally paid in cash. The borrower can draw money out of his account as per his needs.

b) Overdraft: It means allowing the depositor to overdraft his account upto a previously agreed limit. Banks allow overdraft only to those persons who have their accounts in the bank. The overdraft is granted only for a short period for customers.

c) Loans : Usually a loan is granted against the securities of assets or personal security of the borrowed bank loans, and advances carry a high rate of interest. In addition, banks grant call loans for every short period. Term loans for longer period and also grant consumer credit for buying durable goods.

d) Discounting bills of exchange: The bank facilitates trade and commerce’ by discounting the bills of exchange. This is the most popular form of bank lending.

![]()

Question 16.

What are the components of Money supply.

Answer:

Money supply includes all money in circulation in the ecojiomy. The components of money supply may vary from country to country. Broadly speaking, money supply consists of the following :

1. Currency Issued by the Central Bank:

In any country the central bank issues currency. Currency consists of paper notes and coins. In India Reserve Bank of India, which is the central bank of the country, issues notes in the denominations of 2,000, 500, 100, 50, 20 and 10 rupees. The one rupee note (which is not in circulation in practice) and coins are issued by the Finance Ministry of the Government of India.

2. Demand Deposits Created by Commercial Banks:

Bank deposits are a prominent component of money supply. Commercial banks create credit from the primary deposits of money received from the public. Credit is created in the form deposits called derived or secondary deposits. In developed countries they constitute nearly 80 per cent of money supply.

Question 17.

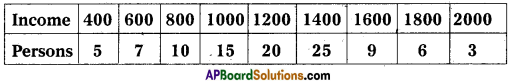

Calculate arithmetic mean for the data given below.

Answer:

A = Assumed mean = 1200 Efd = Sum of product of the step deviation

(d1) taken from the assumed mean multiplied with its respective frequencies – 600

N = Total no, of frequencies = 100

Substitute these values in above formula

= 1200 + \(\frac{(-600)}{100}\)

= 1200 + (-6) = 1194 × = 1194.

Section – C

Question 18.

What is positive economics?

Answer:

A positive science is defined as a body of systematised knowledge concerning ‘what it is’. The classical school economists were of the opinion that economics is purely a positive science which had no right to comment upon the rightness or wrongness of economic policy. Here, economists cannot give any final judgement on any matter.

Question 19.

Explain Value in use concepts.

Answer:

The value.of any good or service is the power to command other article or service in exchange.. Value’ in economics is classified into two concepts. They are;

Value in Use : ’fi infers to the capacity of the good to satisfy , human wants. Free goods have value in use and they do not have any value in exchange. For example, water has a greater value in use but no value in exchange.

Question 20.

Explain Total utility.

Answer:

Total utility is the total amount of utility which a consumer derives from a given stock of a commodity.

TUn = f(Qn)

Question 21.

Define marginal utility.

Answer:

Marginal utility is the additional utility obtained from the consumption of additional unit of the commodity.

MUn = TUn – TU(n-1))

(or)

MU = \(\frac{O}{O Q} \div \frac{P_1}{O P}\)

Question 22.

What is Price demand?

Answer:

It explains the functional relationship between price of good and quantity demanded when the remaining factors are constant. It shows inverse relationship between price and demand.

Dx = f(Px)

Dx = Demand for X commodity

Px = Price of X.

![]()

Question 23.

What is Perfectly Elastic Demand?

Answer:

If a negligible change in price leads to an infinite cha age in demand is called perfectly elastic demand. In this ce >e the demand curve is horizontal to X’ axis.

Question 24.

Define the Production Function.

Answer:

The production function is the relationship betwe i, the physical inputs and the physical outputs of a firm. Proi :tion of a firm, production function explains the functional relationship between inputs and outputs this can be as follows Gx = f(L,K,R,N,T).

Question 25.

Define Supply function.

Answer:

Supply of a commodity depends upon a number of factors, the important among these can be presented in the form of a supply function, ft explains the functional relationship between supply of a commodity and other determinants of supply of that commodity. This can be explained as follows.

Sx = f (Px, Py, Pf> T, Gf, Gp)

Sx= Supply of commodity x

f = Functional relationship

px = Price of good

py x = Price of related good

pf = Price of factors

T = Technical progress

Gf = Goal of the producer

Gp = Government policy.

Question 26.

What is Perfect competitions?

Answer:

In this market there are large number of buyers and sellers who promote competition. In this market goods are homo-geneous. There is no transport fares and publicity costs. So price is uniform of any market.

Question 27.

What are the Selling costs?

Answer:

An important feature of monopolistic market is every firm makes expenditure to sell more output. Advertisements through newspapers, journals, electronic media etc., these methods are used to attract more consumers by each firm.

Question 28.

What is net profit?

Answer:

Net profit is the reward paid for the organizer’s entrepreneurial skills.

Net profit = Gross profit – [Implicit rent + Implicit wage + Implicit interest + Depreciation charges + Insurance premium]

Question 29.

What are the determining factors of the demand for a factor?

Answer:

1) The demand for the factors of production is derived demand. It depends on the demand for the goods produc edby it.

2) Price of the factor determines its demand.

3) Prices of other factors which will help in the production also determine the demand for a factor.

Question 30.

Mention the factors that determine National Income.

Answer:

There are many factors that influence and determine the size of national income in a country. These factors are responsible for the differences in national income of various countries.

a) Natural Resources:

The availability of natural resources in a country, its climatic conditions, geographical features, fertility of soil, mines and fuel resources etc., influence the size of national income.

b) Quality and Quantity of Factors of Production:

The national income of a country is largely influenced by the quality and quantity of a country’s stock of factors of production. For example, the quantity of agricultural production and hence, the size of National income.

c) State of Technology:

Output and national income are influenced by the level of technical progress achieved by the country. Advanced techniques of production Kelp in optimum utilization of a country’s natural resources.

d) Political Will and Stability:

Political will and stability in a country helps *for planned economic development for a faster growth of national income.

![]()

Question 31.

What are subsidies?

Answer:

A subsidy or government incentive is a form of financial aid or support extended to an economic sector generally with the aim of promoting economic and social policy ….. consumer / consumption subsidies. Commonly reduce the price of goods and services to the consumer.

Question 32.

How do you explain the term classical economics?

Answer:

The term classical economics refers to the body of economic group which held their influence from the letter half of the 18th century to the early part of the.20th century. The most important principle of classicism are personal liberty. Private property and freedom of private enterprise.

Question 33.

What is Say’s law of markets?

Answer:

J.B Say a-French economist advocated the famous ‘Law of markets’ on which the classical theory of employment is based. According to this law “supply creates its own demand”. According to this law whenever additional output is created. The factors of production which participate in that production receive incomes equal to that value of that output. This income would be spent either on consumption goods or on capital goods. Thus additional demand is created matching the additional supply.

Question 34.

What is paper money?

Answer:

Paper money is made of paper. Currency notes in the form of 12,000, ? 500, ? 100, ? 50, ? 20, ? 10 are printed on paper in India.

![]()

Question 35.

Write about the main objectives of Central Bank.

Answer:

Central Bank is the apex institution of the banking system in a country. It controls, regulates and supervises the activities of the country’s banking system. The Reserve Bank of India works to achieve the following objectives :

- Regulating, the issue of currency notes.

- Achieving the monetary stability in the economy.

- Controlling the credit system.

- Providing guidance to commercial banks.

- Evolving and implementing uniform credit policy throughout country.

Question 36.

What are the merits of median?

Answer:

Merits of Median:

- It is rigidly defined.

- Even if the value of extreme item is much different from other values, it is not much affected by these values.

- It can be located graphically.

- It can be easily calculated and is also easy to understand.

Question 37.

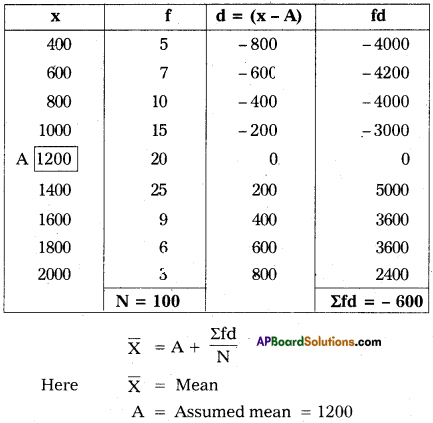

Find the mode from the following data.

Answer:

From the given data, it can be seen that Rs. 480 occurred many times in the series.

∴ Mode = 480