The strategic use of TS Inter 1st Year Economics Model Papers Set 6 allows students to focus on weaker areas for improvement.

TS Inter 1st Year Economics Model Paper Set 6 with Solutions

Time: 3 Hours

Maximum Marks: 100

Section – A

Question 1.

Discuss the consumer’s equilibrium with the help of Law of equi-marginal utility.

Answer:

Law of equi-marginal utility is an important law of consumption. It is called as “Gossen’s Second Law”, as its formulation is associated with the name of H.H. Gossen. According to Marshall, “If a person has a thing which can be put to several uses, he will distribute it among these uses in such a way that it has the same marginal utility in all uses. If it had a greater marginal utility in one use than in another, he would gain by taking away some of it from the second and applying it to the first”‘

According to this law the consumer has to distribute his money income on different uses in such a manner that the last rupee spent on each commodity gives him the same marginal utility. Equalisation of marginal utility in different uses will maximise his total satisfaction. Hence, this law is known as the “Law of equi-marginal utility”. The fundamental condition for consumer’s equilibrium can be explained in the following way.

\(\frac{\mathrm{MU}_{\mathrm{x}}}{\mathrm{P}_{\mathrm{x}}}=\frac{\mathrm{MU}_{\mathrm{y}}}{\mathrm{P}_{\mathrm{y}}}=\frac{\mathrm{MU}_{\mathrm{z}}}{\mathrm{P}_{\mathrm{z}}}=\mathrm{MU}_{\mathrm{m}}\)Where, MUx, MUy, MUz, MUm = Marginal utilities of com¬modities x, y, z, money (m), and Px, Py, Pz = Prices of x, y, z goods.

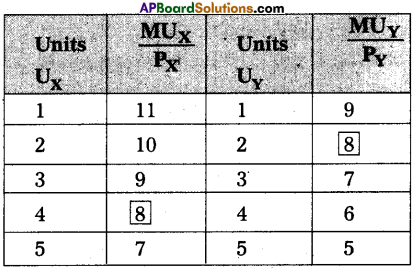

This law can be explained with the help of a table. Suppose the consumer is prepared to spend his money income is ₹ 26/ – on two goods say X and Y. Market prices of two goods are ₹ 4/- & ₹ 5/- respectively. Now the marginal utilities of good X, good Y are shown below.

| links U<sub>x</sub> | MU<sub>x</sub> | Units | MU<sub>y</sub> |

| 1 | 44 | 1 | 45 |

| 2 | 40 | 2 | 40 |

| 3 | 36 | 3 | 35 |

| 4 | 32 | 4 | 30 |

| 5 | 28 | 5 | 25 |

For explaining consumer’s maximum satisfaction and consequent equilibrium position we need to reconstruct the above table by dividing marginal utilities of X by its price ₹ 4/- and marginal utility of Y by ₹ 5/-. This is shown in the following table.

In the table it is clear that when consumer purchases 4 units of goods X & 2 units of good Y. Therefore, Consumer will be in equilibrium when he is spending (4 × 4 = 16 + 2 × 5 = 10) ₹ 26/- on them.

Assumptions of the law: The law of equi-marginal utility depends on the following assumptions.

- This law is based on cardinal measurement of utility.

- Consumer is a rational man always aiming at maximum satisfaction.

- The marginal utility of money remains constant.

- Consumer’s income is limited and he is proposed to spent the entire amount on different goods.

- The price of goods are unchanged.

- Utility derived from one commodity is independent of the utility of the other commodity.

Limitations of the law: The law of equi-marginal utility has been subject to certain limitations which are as given below:

- The law assumes that consumer is a rational man and always tries, to get maximum satisfaction. But, in real life, several obstacles may obstruct rational behaviour.

- his law is not applicable when goods are indivisible.

- The law is based on unrealistic assumptions like cardinal measurement of utility and marginal utility of money remains constant. In real world, MU of money does not re¬main constant.

- This law will not be applicable to complementary goods.

- Another limitations of this law is that there is no fixed accounting period for the consumer in which he can buy and consume goods.

Importance of the Law : The law of equi-marginal utility is of great practical importance in economics.

- Basis of Consumer Expenditure:

The expenditure pat-tern of every consumer is based on this law. - Basis for Savings and Consumption:

A prudent consumer will try to distribute his limited means between present and future consumption so as to have equal marginal utility in each. This is how the law guides us. - In the Field of Production:

To the businessman and the manufacturer the law is of special importance. He works towards the most economical combination of the factors of production. For this he will substitute one factor for another till their marginal productivities are the same. - Its application to Exchange:

In all our exchanges, this law works. Exchange is nothing but substitution of one thing for another. - Price Determination:

This principle has an important bearing on the determination of value and price. - Public Finance:

Public expenditure of a government conforms to this law. Taxes are also levied in such a manner that the marginal sacrifice of each tax payer is equal.

Question 2.

Explain the law of demand and examine its exceptions.

Answer:

Demand means a desire which is backed up by ability to buy and willingness to pay the price is called Demand in Economics. Thus demand will be always to a price and time. Demand has the following features.

- Desire for the commodify.

- Ability to buy the commodity.

- Willing to pay the price of commodity.

- Demand is always at a price.

- Demand is per unit of time i.e., per day, week etc. Therefore, the price demand may be expressed in the form of small equation. Dx = f(Px)

Price demand explains the relation between price and quantity demanded of a commodity. Price demand states that there is an inverse relationship between price and demand.

Law of demand:

Marshall defines the law of demand as, “The amount demanded increases with a fall in price and diminishes with a rise in price when other things remain the same”. So, the law of demand explains the inverse relationship between the price and quantity demanded of a commodity.

Demand schedule:

It means a list of the quantities demanded at various prices in a given period of time in a market. An imaginary example given below.

| Pricein ₹ | Quantity Demanded units |

| 5 | 10 |

| 4 | 20 |

| 3 | 30 |

| 2 | 40 |

| 1 | 50 |

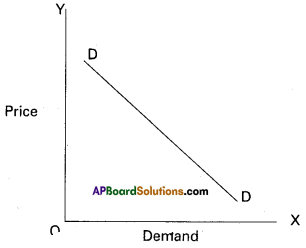

The table shows that as the price falls to ₹ 1/- the quantity demanded 50 units, when price ₹ 5/- he is buying 10 units. So, there is inverse relationship between price and demand. Price is low demand will be high and price is high demand will be low. We can illustrate the above schedule in a diagram.

In the above diagram on X-axis demand is shown and price is on Y-axis. DD is the demand curve. Demand curve slopes downwards from left to right. Assumptions :

- No change in the income of consumer.

- The taste and preferences consumers remain same.

- The prices of related goods remain the same.

- New substitutes are not discovered.

- No expectation of future price changes.

Exceptions:

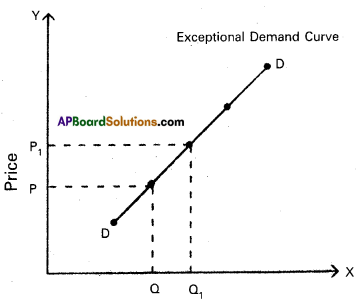

In certain situations, more will be demanded at higher price and less will be demanded at a lower price. In such cases the demand curve slopes upward from left to right which is called an exceptional demand curve. This can be shown in the following diagram.

In the diagram when price increases from OP to OP1 demand also increases from OQ to OQ1 This is opposite to law of demand.

1) Giffen’s Paradox:

This was stated by Sir Robert Giffen. He observed that poor people will demand more of infe-rior goods, if their prices rise. Inferior goods are known as Giffen goods. Ex : Ragee, Jowar etc. He pointed out that in case of the English workers, the law of demand does not apply to bread. Giffen noticed that workers spend a major portion of their income on bread and only small portion on meat.

2) Veblen Effect (Prestigious goods):

This exception was stated by Veblen. Costly goods like diamonds and precious stones are called prestige goods or veblen goods. Generally, rich people purchase those goods for the sake of prestige. Hence, rich people may buy more such goods when their prices rise.

3) Speculation:

When the price of a commodity rises the group of speculators expect that it will rise still further. Therefore, they buy more of that commodity. If they expect that there is a fall in price, the demand may not expand. Ex : Shares in the stock market.

4) Illusion:

Sometimes, consumer develop to false idea that a high priced good will have a better quality instead of low priced good. If the price of such good falls, demand decreases, which is contrary to the law of demand.

Question 3.

What are the various definitions of National income? De-scribe the determining factors of National Income?

Answer:

National Income has been defined in a number of ways. National income is the total market value of all goods and services produced annually in a country. In other way, the total income accruing to a country from economic activities in a year’s time is called national income. It includes payments made to all factors of production in the form of rent, wages, interest and profits.

The definitions of national income can be divided into two classes. They are :

i) traditional definitions advocated by Marshall, Pigou and Fisher, and ii) modern definitions.

1) Marshall’s Definition:

According to Alfred Marshall, “the labour and capital of a country acting on its natural resources, produce annually a certain net aggregate of commodities; material and non-material including services of all kinds. This is the true net annual income or revenue of the country”. In this definition, the word ‘net’ refers to deduction of depreciation from the gross national income and to this income from abroad must be added.

2) Pigou’s Definition:

According to A.C.Pigou, “National Income is that part of the objective income of the community including of income derived from abroad which can be measured in money”. He has included that income which can be measured in terms of money. This definition is better than the Marshallian definition.

3) Fisher’s Definition:

Fisher adopted consumption as the criterion of national income. Marshall and Pigou regarded it as the production. According to Fisher, “the national income consists solely of services as received by ultimate consumers, whether from their material or from their human environment. Only the services rendered during this year are income”.

4) Kuznets’ Definition:

From the mpdem point of view, according to Kuznets, “national income is the net output of commodities and services flowing during the year from the country’s productive system into the hands of the ultimate consumers”.

Determining Factors of National income:

There are many factors that influence and determine the size of national income in a country. These factors are responsible for the differences in national income of various countries.

a) Natural Resources:

The availability of natural resources in a country, its climatic conditions, geographical features, fertility of soil, mines and fuel resources etc., influence the size of national income.

b) Quality and Quantity of Factors of Production:

The national income of a country is largely influenced by the quality and quantity of a country’s stock of factors of production.

c) State of Technology:

Output and national income are influenced by the level of technical progress achieved by the country. Advanced techniques of production help in optimum utilization of a country’s natural resources.

d) Political Will and Stability:

Political will and stability in a country helps in planned economic development and for a faster growth of national income.

Question 4.

Discuss the concept of public finance. Describe the sources of public revenue.

Answer:

Public finance deals with the income and expenditure of public authorities (government). The word public is used to denote state of government: central, state and local bodies. According to Prof. Hugh Dalton “it is concerned with the income and expenditure of public authorities and with the adjustment of one to another”.

Modern governments play a major role in creating economic and social infrastructure. They spend lots of money on construction of roads, railways, on creating communication systems, education and health, on providing irrigation facilities and electricity etc. Of late modern governments have been spending huge amounts on various welfare measures to ameliorate the difficulties of poor and downtrodden sections of their population.

Public Revenue:

As explained in the previous paragraphs, a modern government has many functions to perform. It needs huge revenue for the performance of all its functions efficiently. Therefore it collects revenue by imposing taxes and also receives money from the people in many other forms. Revenue received by the government from different sources is called public revenue. Public revenue is broadly classified into two kinds :

1) Tax revenue and

2) Non-Tax revenue.

1) Tax Revenue:

Revenue received through collection of taxes from the public is called tax revenue. Both the central and state governments collect taxes as per their allocation in the Constitution. Broadly taxes are divided into two categories :

a) direct taxes,

b) indirect taxes.

a) Direct Taxes:

i) Taxes imposed on individuals and companies based on income and expenditure. Ex : Personal income tax, corporate tax, interest tax and expenditure tax.

ii) Taxes imposed on property and capital assets of individuals and companies. Ex : Wealth tax, gift tax, estate duty.

b) Indirect Taxes :

Taxes levied on goods and services. Ex : Excise duty, customs duty, service tax.

2) Non – Tax Revenue : Government receives revenue from sources other than taxes and such revenue is called the non-tax revenue. The sources of non-tax revenues are as follows:

a) Administrative Revenue:

Government receives money for certain administrative services. Ex : License fee, Tuition fee, Penalty etc.

b) Commercial Revenue:

Modem governments establish public sector units to manufacture certain goods and offer certain services. The goods and services are exchanged for the price. So such units earn revenue by way of selling their products. Some of the examples of the public sector units are Indian Oil Corporation, Bharath Sanchar Nigam Ltd, Bharath Heavy Electricals, Indian Railways, State Road Transport Corporations, Air India etc.

c) Loans and Advances:

When the revenue received by the government from taxes and from non-tax sources is not sufficient to meet the needs of government expenditure, it may receive loans from the financial institutions operating within the country and also from the public. Modern government can also obtain loans from foreign government and international financial institutions.

d) Grants-in-Aid :

Grants are amounts received without any condition of repayment. They are not repaid. State governments receive such grants from the central government. The central government may receive such grants from foreign governments or any international funding agency.

Grants are of two types :

- General Grants:

When a grant is given to meet shortage of funds in general without specifying a purpose, it is called general grant. - Specific Grants:

When a grant is given for a specific purpose it is called a specific grant. It cannot be spent on any other purpose. Ex : education grant and family planning grant etc.

5. Discuss the evolution of money. Explain its types.

Answer:

Money occupies a unique place in any economic system. Society needs money for a variety of transactions undertaken by the people and the government in the day to day life. Now¬, a-days, we cannot imagine a society without a role for money. Evolution of money:

The term ‘money’ was derived from the name of goddess Juno Moneta of Rome. Prior to the introduction of money, the barter system was in vogue. In that system one commodity was exchanged for another commodity. Money was coined in order to overcome the difficulties of the barter system. In the initial stages, animal was used in place of money. Gradually metallic money in the form of gold, silver, bronze and nickel replaced it. In the third stage coins came into use. That was followed by paper money. The latest stage is the credit money in the form of drafts, cheques, debit cards, credit cards etc. Thus, money has undergone different stages in the process of evolution.

Types of money:

1) Commodity Money and Representative Money:

Commodity money includes metallic coins whose face value and intrinsic value are same. It is also called as full-bodied money. Representative money includes coins and paper money whose intrinsic value is less than their face value.

2) Legal Tender Money and Optional Money:

On the basis of legality, money is divided into legal tender money and optional money. Legal tender money is the money which is accepted as per the law by everyone in payment for commodities and services. Credit creation by the commercial banks in the form of drafts, cheques etc., are called as optional money.

3) Metallic Money and Paper Money:

Metallic money is made up of metals such as silver, nickel, steel etc. All coins are metallic money. Paper money is money printed on paper. Currency notes in the form of ₹ 1,000, ₹ 500, HOO, ₹ 50 and ₹10 are paper money.

4) Standard Money and Token Money: Standard money is the money whose face value and intrinsic value are same. Token money is money or unit of currency whose face value is higher than the intrinsic value, e.g. 50 paisa, 1 rupee coins etc.

5) Credit Money:

This is also called as bank money. This is created by commercial banks. This refers to the bank deposits that are repayable on demand and which can be transferred from one individual to the other through cheques.

Question 6.

Explain the scarcity definition of economics.

Answer:

Marshall’s welfare definition until the publication of Lionel Robbins’ book “An Essay on the Nature and Significance of Economic Science” in 1932. Robbins’ definition brought out the logical inconsistencies and inadequacies of the earlier definitions and formulated his own definition of economics. He has given a more scientific definition of economics. In the words of Robbins, “Economics is the science which studies human behavior as a relationship between ends and scarce means which have alternative uses.'”

I. Main Features :

1. Human Wants are Unlimited: The fulfillment of one want gives rise to a number of new wants.

2. Means are Scarce : The means of a person by which his wants may be satisfied are limited. It leads to economic problems as all wants cannot be satisfied by these limited means.

3. Alternative Uses of Scarce Means : Resources are not only scarce but also have multiple uses. For example, electricity can be used in homes and also in industries . A piece of land can be used to produce rice or wheat. If a scarce factor is used for the satisfaction of one want, less of it will be available for other wants. Hence, man has to make a decision regarding the alternative uses of resources.

4. Man has therefore, to choose between wants. Problem, of choice arises.

II. Superiority of Robbins’ Definition:

Robbins’ definition is superior to the earlier definition in more than one way. The reasons are given below :

1. It is non-classificatory, as it includes all human activi-ties whether they promote human welfare or not.

2. This is universally accepted definition. It is applicable to all types of societies, because the scarcity of re-sources is felt by individuals as well as by societies.

3. Robbins’ definition of economics is neutral between ends. Being a positive science it does not pass any value judgements regarding ends.

Question 7.

Examine the limitations of the law of diminishing Marginal utility. Analyse its importance.

Answer:

The law of diminishing marginal utility was originally explained by Hermann Heinrich Gossen in 1854. Jevans called it as Gossen’s first law. But Alfred Marshall popularised this law and analysed it in a scientific manner.

Meaning:

The law says that as a consumer takes more units of good, the extra satisfaction that he derives from extra unit of a good goes on falling. The relationship between quantity consumed and utility derived from each successive unit con¬sumed is called the law of diminishing marginal utility. Limitations of the Law :

The following are some of the exceptions to the law of di-minishing marginal utility:

1) Rational Consumer:

The consumer should be an economic human being with rational behaviour. If he is un-der the influence of an intoxicant, the utility of the later units will rise in the beginning but ultimately it falls and even becomes negative.

2) If goods are not independent, this law will not work. Complimentary goods can be one of the example.

3) Marginal utility of money is not constant. Our desire for money increases as we have more of it. The marginal utility of money will not be zero, but definitely it falls, when a person acquires more and more money.

4) If the goods are not homogeneous, this law will not work.

5) If the goods are too big or too small in size, problem arises. If the size is too big, consumer may not require second unit and similarly if the size is too small. Utility of the subsequent units may increase.

6) In the case of durable goods, it is not possible to calculate their utility because their use is spread over a period of time. A consumer does not buy more durable goods for personal consumption.

7) If there is any change in consumer’s income or tastes or habits, this law does not hold good.

8) If the goods are not ordinary, like diamonds or hobby goods like stamps and Coins, the utility of the additional units may be greater than the earlier units. Infact law is applicable in these cases also. The collector of stamps or coins never like to have innumerable pieces. The person may not collect more than one or two of the same coin or same stamp.

Importance of the Law:

- The law of diminishing marginal utility is the basic law of consumption and it is the basis for the law of demand, the law of equi-marginal utility etc.

- The changes in design, pattern and packing of goods will be brought by the producers by keeping this law in view.

- The law explains the theory of value that the price of a good falls when supply increases. Because with the in-crease in the stock of a good, its marginal utility dimin-ishes.

- Diamond-water paradox can be explained with the help of this law. Due to relative scarcity, diamonds possess high exchange value and less use value. Similarly, water is rela¬tively abundant and so it posseses low exchange value but more use value.

Question 8.

What is elasticity of Demand?

Answer:

In Economic theory, the concept of elasticity of demand has a significant role. Elasticity of demand means the percentage change in quantity demanded in response to the percentage change in one of the variables on which demand depends. Elasticity of demand changes from person to person, place to place, time to time and one commodity to another.

According to Marshall, “The elasticity of demand in a market is great or small according as the amount demanded increases much or little for a given fall in price”.

The concept of elasticity of demand explains how much or to what extent a change in any one of the independent variables leads to a change in the dependent variable. There are three kinds of elasticity of demand.

1. Price Elasticity of demand

2. Income,Elasticity of demand

3. Cross Elasticity of demand.

Question 9.

What are the merits and demerits of Divisions?

Answer:

It is an important feature of modem industrial organization. It refers to scheme of dividing the given activity among workers in such away that each worker is supposed to do one activity or only a limited and narrow segment of an activity. Thus, division of labour increases output per worker on account of higher efficiency and specialized skill.

| Advantages: | Disadvantages: |

| i) Increase in productivity, | i) Leads to monotony, |

| ii) Inventions are facilitated, | ii) Retards human development, |

| iii) Saving in time, | iii) Loss of skill, |

| iv) Diversity of employment, | iv) Possibility of unemploy-ment, |

| v) Mechanization is possible, | v) Hindrance to mobility of labour. |

| vi) Increase in dexterity and skills, | |

| vii) Large scale production is possible, | |

| v) Mechanization is possible, |

Question 10.

Explain the concept of duopoly and its characteristics.

Answer:

Duopoly (from greek duoayi (two) + polein(to sell)) is a specific type of oligopoly where only two producers exist in one market. In reality, this definition is generally used where only two firms have dominance over a market.

It is also called as a limited form of oligopoly. The goods produced by the producers may be homogeneous or differentiated. As there are only two producers, both are aware that the decisions of one will affect the other. Rivalry and collusion of the producers are both possible in this market

situation. In the market both firms have noteworthy control. In the field of industrial organization, it is the most commonly studied form of oligopoly due to its simplicity.

The earliest duopoly model was developed in 1838 by the French economist Augustin Cournot. Cournot illustrated his model with the example of two firms. According to this . model, the two sellers will have a naive behaviours and they never learn from past patterns of reaction of rivalry. As a result each firm produces one third of the output. Together they cover two-thirds of the total market. Each firm maximizes its profits but industry profit will not be maximized. This happens due to non recognition of their interdependence. Characteristics of Duopoly:

a) There will be two sellers.

b) Homogeneous product.

c) Zero production cost.

Question 11.

How the per capita income in calculated ? What is the relationship between population and per capita income?

Answer:

The per capita income is the average income of the people in a country in a particular year. It is calculated, by dividing national income at current prices by population of the country in that year.

Per capita income for 2010 -11 =

\(\frac{\text { National Income (at current prices) for } 2010-11}{\text { Population in } 2010-11}\)

This refers to the measurement of per capita income at current prices. This concept is a good indicator of the average income and the standard of living in a country. But it is not reliable because actual income may be more or may be less when compared to the average income. This per capita income will also be measured at constant prices and so we get real per capita income. By dividing real

national income in a particular year by population of that year we will get real per capita income for that year.

Per Capita Income = \(\frac{\text { Real National Income }}{\text { Population }}\)

Relationship Between Per Capita Income and Population:

There is a close relationship between national income and population. These two together determine the per capita income. If rate of growth of national income is 6% and rate of growth of population is 3% the rate of growth of per capita income will be 3% and it can be expressed as follows:

gpc = gni – gp

where,

gpc = Growth rate of per capita income

gni = Growth rate of national income

gp = Growth rate of population

A rise in the per capita income indicates a rise in standard of living. The rise in per capita income is possible only when the rate of growth of population is less than the rate of growth of that national income.

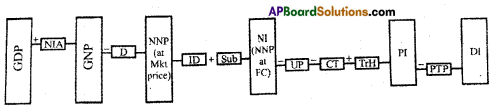

NIA – Net Income from Abroad

D = Depreciation

ID = Indirect Taxes

Sub = Subsidies

UP = Undistributed Profits

CT = Corporate Taxes

TrH = Transfers received by Households

PTP = Personal Tax Payments

GDP = Gross Domestic Product

GNP = Gross National Product

In fig. we have presented the relation between the various concepts of national income.

Question 12.

Explain the concept’s of gross profits.

Answer:

Gross profit is considered as a difference between total revenue and cost of production. The following are the components of gross profit:

- The rent payable to his own land or buildings includes gross profit.

- The interest payable to his own business capital.

- The wage payable to the entrepreneur for his management includes gross profit.

- Depreciation charges or user cost of production and insurance charges are included in gross profit.

Net profits : Net profits are reward paid for the organiser’s entrepreneurial skills.

Components:

- Reward for Risk Bearing : Net profit is the reward for bearing uninsurable risks and uncertainties.

- Reward for Co-ordination : It is the reward paid for co-ordinating the factors of production in right proportion in the process of production.

- Reward for Marketing Services : It is the profit paid to the entrepreneur for his ability to purchase the services of factors of production.

- Reward for Innovations : It is the reward paid for innovations of new products and alternative uses to natural resources.

- Wind Fall Gains : These gains arise as a result of natural calamities, wars and artificial scarcity are also included in net profits.

Question 13.

Discuss the concept of public finance. Describe the sources of public revenue.

Answer:

Public finance deals with the income and expenditure of public authorities (government). The word public is used to denote state or government: central, state and local bodies. According to Prof. Hugh Dalton “it is concerned with the income and expenditure of public authorities and with the adjustment of one to another”.

Modern governments play a major role in creating eco-nomic and social infrastructure. They spend lots of money on construction of roads, railways, on creating communica- . tion systems, education and health, on providing irrigation facilities and electricity etc. Of late modem governments have been spending huge amounts on various welfare measures to ameliorate the difficulties of poor and downtrodden sections of their population.

Public Revenue:

As explained in the previous paragraphs, a modern gov-ernment has many functions to perform. It needs huge rev-enue for the performance of all its functions efficiently. There¬fore it collects revenue by imposing taxes and also receives money from the people in many other forms. Revenue received by the government from different sources is called public revenue. Public revenue is broadly classified into two kinds:

1) Tax revenue and

2. Non-Tax revenue.

1) Tax Revenue:

Revenue received through collection of taxes from the public is called tax revenue. Both the central and state governments collect taxes as per their allocation in the Constitution. Broadly taxes are divided into two categories : a) direct taxes, b) indirect taxes.

a) Direct Taxes:

i) Taxes imposed on individuals and companies based on income and expenditure. Ex : Personal income tax, corporate tax, interest tax and expenditure tax.

ii) Taxes imposed on property and capital assets of individuals and companies. Ex : Wealth tax, gift tax, estate duty.

b) Indirect Taxes : Taxes levied on goods and services. Ex : Excise duty, customs duty, service tax.

2) Non – Tax Revenue : Government receives revenue from sources other than taxes and such revenue is called the non-tax revenue. The sources of non-tax revenues are as follows:

a) Administrative Revenue: Government receives money for certain administrative services. Ex : License fee, Tuition fee, Penalty etc.

b) Commercial Revenue : Modem governments establish public sector units to manufacture certain goods and offer certain services. The goods and services are exchanged for the price. So such units earn revenue by way of selling their products.

Some of the examples of the public sector units are Indian Oil Corporation, Bharath Sanchar Nigam Ltd, Bharath Heavy Electricals, Indian Railways, State Road Transport Corporations, Air India etc.

c) Loans and Advances:

When the revenue received by the government from taxes and from non-tax sources is not sufficient to meet the needs of government expenditure, it may receive loans from the financial institutions operating within the country and also from the public. Modern government can also obtain loans from foreign government and international financial institutions.

d) Grants-in-Aid:

Grants are amounts received without any condition of repayment. They are not repaid. State governments receive such grants from the central govern¬ment. The central government may receive such grants from foreign governments or any international funding agency.

Grants are of two types :

1. General Grants: When a grant is given to meet shortage of funds in general without specifying a purpose, it is called general grant.

2. Specific Grants:

When a grant is given for a specific purpose it is called a specific grant. It cannot be spent on any other purpose. Ex : education grant and family planning grant etc.

Question 14.

Explain different kinds of deposits accepted by the commercial banks.

Answer:

Commercial banks pay a very important role in the economic growth of a country. Commercial banks are the most impor- . tant’source of institutional credit in the money market. Banks attract savings from the people and encourage investment in .industry, trade and commerce. Bank is a profit seeking busi-ness firm dealing in money and credit.

The word bank is derived from the “German” word “bankco” which means joint stock or joint fund. Banking in Britain originated with the lending of money by wealthy individuals to merchants who wished to borrow.

According to ’Richard Sydney’ sayers – “Banks are institu¬tions whose debts usually referred to as “Bank deposits” are commonly accepted in final settlement of other people’s debts”.

Accepting deposits: The commercial bank just like any other money lender is doing money lending business . Bank receives public money in the form of deposits. The deposits mainly are of the following types.

a) Current deposits: These deposits have two characteristics.

1) There are no restrictions with regard to the amount of withdrawal and number of withdrawals.

2) Banks normally do not pay any interest on current account deposits.

b) Savings deposits: The sole aim of banks in receiving these deposits is to promote the habit of thrift among low income groups.

They have the following characteristics :

1) Two or three withdrawals per week are permitted.

2) Banks pay 4% to 5% interest per annum on savings deposits.

c) Recurring deposits:

People will deposit their money in these deposits as monthly installments for a fixed period of time. The bank after expiry of the said period will return the total amount with interest thereon. The rate of interest will be higher than the saving deposits.

d) Fixed deposits:

Deposits of fixed accounts are called fixed or time deposits they are left with the bank for a fixed period. The following are the characteristics.

1) The amount cannot be withdrawn before expiry of fixed period.

2) Bank pay high rate of interest than any deposits.

Question 15.

Identify the causes of Inflation.

Answer:

In a broader sense, the term inflation refers to persistent rise in the general price level over a long period of time. Some of the important definitions are given below :

According to Pigou, “inflation exists when money income is expanding more than in proportion to increase in earning activity”. Crowther defined inflation as, “a state in which the value of money is falling, that is the prices are rising.

Causes of Inflation:

Broadly speaking, inflation may occur due to the following reasons. Inflation is caused either by excess demand or supply shortage or increased cost of production.

- Factors Causing Increase in the Aggregate Demand of Commodities:

- High rate of population growth.

- Increase in non-plan and plan expenditure of the government.

- Rise in the per capita income of the people due to economic development.

- Increased spending by the government on employment programmes and welfare schemes.

- Heavy investment on development projects with long gestation period.

- Increase in the money supply in the economy.

- Liberal availability of credit for unproductive economic activities.

- Deficit financing by the government.

- Conspicuous spending by the people having bjack money.

- Reduction in direct tax rates.

- Factors that Increase the Cost of Production:

- Increase in costs of lands, rents, wage rates and interest rates.

- Rise in the price of capital equipment and raw materials due to their shortage.

- Increase in indirect tax rates.

- Excessive wear and tear of machinery and lack of modernization.

- Import of machinery and equipment at higher prices.

- Lack of optimum allocation of resources.

- Devaluation of domestic currency.

- Inefficiency in management and lack of control over wasteful expenditure. actors Causing Inadequate Supply:

- Failure of monsoons, floods, pests, use of spurious seeds etc., in agriculture.

- Shortage of investment due to inadequate availability of institutional credit.

- Non-availability or inadequate availability of inputs and raw materials.

- Underutilization of productive capacity due to power shortage, labour unrest etc.

- Long gestation period of certain industries.

- Exports at the cost of domestic supply.

- Artificial scarcity due to black-marketing.

Question 16.

Enumerate the assumptions and major aspects of classical theory of employment.

Answer:

The classical theory of employment is based on the Say’s law of markets. The famous law of markets, propounded by the J.B Say states that “Supply creates its own demand”. Assumptions : The Say’s law is based on the following assumptions.

- There is a free enterprise economy.

- There is perfect competition in the economy.

- There is no government interference in the functioning of the economy.

- The equilibrium process is considered from the long term point of view.

- All savings are automatically invested.

- The interest rate is flexible. .

- The wage rate is flexible.

- There are no limits to the expansion of the market.

- Money acts as medium of exchange.

Aspects of Classical Theoiy:

The classical theory of employment can be discussed with three dimensions.

A) Goods Market Equilibrium :

The classical theory of employmet is based on the Say’s Law of Markets. The first part of Say’s market law explains the goods market equilibrium. The famous law of markets, propounded by the J.B. Say states that, “Supply creates its own demand”.

B) Money Market Equilibrium (Saving Investment Equilibrium):

The goods market equilibrium leads to bring equilibrium of both money and labour markets. In goods market, it is assumed that the total income is spent. The classical economists agree that part of the income may be saved, but the savings is gradually spent on capital goods. The expenditure on capital goods is called investment. It is assuiried that equality between savings and investment (S=I) is brought by the flexible rate of interest.

C) Labour Market Equilibrium :

Pigou’s Wage Cut Policy : . According to the classical economists, unemployment may

occur in the short run. This is not because the demand is not sufficient but due to increase in the wages forced by the trade unions or the interference of government. A.C. Pigou suggested that reduction in the wages will remove unemployment. This is called wage – cut policy. A reduction in the wage rate results in the increase in employment.

Question 17.

What is median?

What are it’s merits and drawbacks?

Answer:

Median (M) : Median is the middle element when the data set is arranged in order of the magnitude. Median is that positional value of the variable which divides the distribution into two equal parts. In the ungrouped data, the median is computed as follows :

i) The values of the variate are arranged either in ascending or in descending order.

ii) The middle – most value is taken as the median. If the number of values ‘n’ in the raw data is odd, then the Merits and Drawbacks of Median:

- Merits of Median:

- It is rigidly defined.

- Even if the value of extreme item is much different from other values, it is not much affected by these values.

- It can be located graphically.

- It can be easily calculated and is also easy to under-stand.

- Drawbacks of Median:

- Even if the value of extreme items is too large, it does not affect too much, due to this reason, sometimes median does not remain the representative of the series.

- Median cannot be used for further algebraic treatment.

- In a continuous series it has to be interpolated.

- If the number of series is even, we can only make its estimate; as the AM. of two middle terms is taken as Median.

Section – C

Question 18.

Explain the merits of mode.

Answer:

Merits :

- Mode is the term that occur most in the series hence, it is neither an isolated value like Median nor it is a value like mean that may not be there in the series.

- It is not affecteed by extreme values hence is a good representative of the series.

- It can be found graphically also.

- For open end intervals it is not necessary to know the length of open intervals.

- It can also be used in case of quantitative phenomenon.

- With only just a single glance on data we can find its value. It is simplest.

- It is the most used average in day-to-day life, such as average marks of a class, average number of students in a section, average size of shoes, etc.

Question 19.

What are the uses of Arithmetic mean?

Answer:

Uses of A.M.

- It can be easily calculated; and can be easily understood.

- As every item is taken into calculation, it is affected by every item.

- As the mathematical formula is rigid one, therefore, the result remains the same.

- It is useful for further algebraic treatment.

- It is mostly used for comparing the various issues.

Question 20.

What are the dynamic functions of money?

Answer:

The function of money which influence output consumption, distribution and the given price level are known as dynamic functions. They make the entire economy into dynamic. The contingent function explained about under the perview of dynamic functions.

Question 21.

What is meant by discounting of bills of exchange?

Answer:

Bills of exchange are undertakings written by the buyers and . given to sellers when the transaction is made on credit basis. The buyer undertakes to make payment after a specified period or on a specified future date. The traders who posses such bills of exchange with them may approach the banks for discounting of the bills of exchange when they need money. The commercial banks pay advances by discounting the bills of exchange with or without security.

Question 22.

What is the significance of vote on account budget?

Answer:

Vote on account is an interim budget presented for a few months pending presentation at the regular budget.

Question 23.

Distinguish between revenue account and capital account.

Answer:

Revenue account consists of the current transactions and in-cludes value of transactions relating to export import travel expenses, insurance, investment, income etc. The capital ac¬count refers to the transactions of capital nature such as borrowing and lending of capital repayment of capital sale and purchase of shares and securities etc.

Question 24.

How National Income is estimated in India?

Answer:

After independence the Government of India appointed a National Income Estimates Committee in the year 1949, Under the chairmanship of Sri PC. Mahalanobis to claculate the national income of India. At present the Central Statistical Organization (CSO) has been entrusted with the responsibility of preparing national income estimates. The CSO has divided the Indian economy into 13 sectors and grouped them under five heads. They are

- Primary Sector.

- Secondry Sector.

- Transport, Communication and Trade.

- Finance and Real Estate.

- Community and Personal Services.

Question 25.

Mention the factors that determine National Income.

Answer:

There are many factors that influence and determine the size of national income in a country. These factors are responsible for the differences in national income of various countries,

a) Natural Resources:

The availability of natural resources in a country, its climatic conditions, geographical features, fertility of soil, mines and fuel resources etc., influence the size of national income.

b) Quality and Quantity of Factors of Production:

The national income of a country is largely influenced by the •quality and quantity of a country’s stock of factors of production. For example, the quantity of agricultural production and hence, the size of National income.

c) State of Technology:

Output and national income are influenced by the level of technical progress achieved by the country. Advanced techniques of production help in optimum utilization of a country’s natural resources.

d) Political Will and Stability:

Political will and stability in a country helps for planned economic development for a faster growth of national income.

Question 26.

What is Contract rent?

Answer:

It is the hire charges for any durable good. Ex : Cycle, rent, room rent etc. fit is a periodic payment made for the use of any material good. The amount paid by the tenant cultivator to the landlord annually may be also called contract rent. Ex. : The rent that a tenant pays to the house owner monthly as per an agreement made earlier or the hiring charges of a cycle ? 10 per hour is also contract rent.

Question 27.

What are piece wages ?

Answer:

Piece wage is the amount paid for labourers according to volume of work, done by them.

Question 28.

Give a note on the Competitions based market.

Answer:

Based on the nature of the competition, markets are classified into two perfect competition and imperfect competition.

a) Perfect Competition:

A perfectly competitive market is one in which the number of buyers and sellers is very ‘ large, all engaged in buying and selling a homogeneous product without any artificial restrictions. Hence, there is absence of rivalry among the individual firms in perfect competition.

b) Imperfect Competition:

It is a market situation where competition is not perfect either amongst the buyers or amongst the sellers. Hence, there will be a different price for the same product. These markets are divided into monopoly, monopolistic competition, oligopoly and duopoly.

Question 29.

Define monopoly.

Answer:

Mono means single, Poly means seller. In this market single seller and there is no close substitutes. The monopolist is a price maker.

Question 30.

Explain the nature of AR and MR curve in Monopoly.

Answer:

Under monopoly, there is a single seller. The commodity offered by a monoplist may be or may not be homogenous. Monopolist can control price and output of the commodity, but he can’t determine both simultaneously due to existance of left to right downward sloping demand curve in the market. He can sell more quantity at lower pric e and less quantity at higher price. The relationship between TR, AR and MR is shown in table.

| Output | Price | Total Revenue PQ | Average Revenue = TR/Output | Marginal Revenue |

| 1 | 10 | 10 | 10 | 10 |

| 2 | 9 | 18 | 9 | 8 |

| 3 | 8 | 24 | 8 | 6 |

| 4 | 7 | 28 | 7 | 4 |

| 5 | 6 | 30 | 6 | 2 |

The table reveals that as price falls, sales may improve and total revenue also increases but average revenue (AR) and marginal revenue falls continuously. Here, MR declines at faster rate than that of AR. Thus, MR curve lies below the AR as shown in the figure.

Question 31.

Define Law of Supply.

Answer:

The law of supply explains the functional relationship between price of a commodity and its quantity supplied. The law of supply can be stated as follows “Other things remaining the same, as the price of a Commodity rises its supply is extended and as the price falls its supply is contracted”.

Question 32.

Explain Relatively Inelastic Demand.

Answer:

When the proportionate change in price leads to a less than proportionate change in quantity demanded is called relatively inelastic demand.

Question 33.

What is Cross Demand?

Answer:

Cross demand refers to the relationship between any two goods which are either complementary to each other or substitute of each other at different prices. Dx = f(Py)

Question 34.

Explain Law of diminishing marginal utility.

Answer:

The law of diminishing marginal utility is based on the fact that though human wants are unlimited, but any particular want is satisfiable. This law analyses consumers’ behaviour in case of a single good. If a person goes on consuming more and more units of a commodity, the additional utility he derives from the additional units of the commodity goes on diminishing. This phenomenon of human behaviour is explained by this law. The law of diminishing marginal utility explains the relationship between the quantity of goods cqnsumed and the utility derived.

Question 35.

What is scale of preference?

Answer:

Guides the consumer in his purchases.

Question 36.

What is Income Concept?

Answer:

Income is a flow of satisfaction from wealth per unit of time. In every economy income flows from households to firms and vice versa. Income can be expressd in two types.

- Money income which is in terms of money.

- Real income which is in terms of goods and services.

Question 37.

Explain the wealth definition.

Answer:

Wealth means stock of assets held by an individual or institution that yields has the potential for yielding income in some form. Wealth includes money, shares of companies, land etc. Wealth has three properties.

- Utility

- Scarcity

- Transferability.