The strategic use of TS Inter 1st Year Economics Model Papers Set 5 allows students to focus on weaker areas for improvement.

TS Inter 1st Year Economics Model Paper Set 5 with Solutions

Time: 3 Hours

Maximum Marks: 100

Section – A

Note : Answer ANY THREE out of the following five questions in not exceeding 40 lines each. (3 × 10 = 30 )

Question 1.

Examine the wealth and welfare definitions of economics.

Answer:

Wealth Definition :

Adam Smith was the first person to give a precise definition of Economics and separate this study from other social sciences. Adam Smith is considered as ‘Father of Economics’. He defined it in his famous book Wealth of Nations’, as “An enquiry into the nature and causes of wealth of nations”. Most of the economists in the 19th century held this view.

j.B. Say states that “The aim of political economy is to show the way in which wealth is produced, distributed and consumed”. The other economists who supported this definition are J.B. Say, J.S. Mill, Walker and others. The main features of Wealth definition:

- Acquisition of wealth is considered as the main objective of human activity.

- Wealth means material things.

- Human beings are guided by self-interest, whose objec-tive is to accumulate more and more wealth.

- Economics deals with the activities of wealth production, consumption, preservation and increasing.

Criticism : The Wealth definition was severely criticised by many writers due to its defects.

- Economists like Carlyle and Ruskin pointed out that economics must discuss ordinary man’s activities. So they called it as a ‘Dismal Science’.

- In Adam Smith’s definition, wealth was considered to consist of only material things and services are not included. Due to this the scope of economics is limited.

- Marshall pointed out wealth is only a means to an end but not an end in itself.

- This definition concentrated mainly on the production side and neglected distri- bution side.

Welfare definition:

Alfred Marshall tried to remedy the defects of wealth definition in 1890. He shifted emphasis from production of wealth to distribution of wealth. According to Marshall, “Political Economy or Economics is a study of mankind in the ordinary business of life. It examines that part of individual and social action which is most closely connected with the attainment and with the use of material requisites of well-being. Thus, Economics is on one side, a study of wealth and on the other and more important side, a part of study of man”.

Edwin Cannan defined it as ‘The aim of political economy is the explanation of the general causes on which the material welfare of human beings depends”. In the words of Pigou, “The range of enquiry becomes restricted to that part of social welfare that can be brought directly or indirectly into relation with the measuring rod of money”.

The main features of Welfare definition:

- Economics as a social science is concerned with man’s ordinary business of life.

- Economics studies only economic aspects of human life and it has no concern with the social, political and religious aspects of human life. It examines that part of individual and social action which is closely connected with acquisition and use of material wealth for promotion of human welfare.

- According to Marshall, the activities which contribute to material welfare are considered as economic activities.

- He gave primary importance to man and his welfare and to wealth as means for the promotion of human welfare.

Criticism:

- Robbins criticised Marshall’s economics as a ‘social sci-ence’ rather than a human science, which includes the study of actions of every human being.

- Marshall’s definition mainly concentrated on the welfare derived from material things only. But non – materialistic goods which are also very important for the well being of the people. Hence, it is incomplete.

- Critics pointed out that quantitative measurement of welfare is not possible. Welfare is a subjective concept and relative concept and changes according to time, place and persons.

- According to Marshall, economics deals with those ac-tivities which will promote human welfare. But produc-tion of alcohol and drugs do not promote human welfare. Hence, the scope of economics is limited.

- Another important criticism is that it is not concerned with the fundamental problem of scarcity of resources. According to Robbins the economic problem arises due to unlimited wants and limited resources. These factors are ignored in this definition.

![]() .

.

Question 2.

What is a Demand Function ? What are the factors that de-termine the demand for a good ?

Answer:

The functional relationship between the demand for a commodity and its various determinants may be explained mathematically in terms of a demand function.

Dx = f(px, p1 …… Pn< Y, T) .

Where, Dx = Demand for good X;

Px = price of X;

P1 …. Pn = Prices of substitutes and complementaries

Y = Income,

T = Taste of the consumer.

Determinants of demand:

- Price of commodity:

The demand for any good depends on its price, more will be demanded at lower price and vice-versa. - Prices of substitutes and complementaries :

Demand is influenced by changes in price of related goods either substitutes or complementary goods. Ex : Increase in the price of coffee leads an increase in the demand for tea in the case of substitutes positive relation and complementaries negative relationship between price and demand. - Income of the consumer:

Demand always changes with a change in the incomes of the people. When income increases the demand for several commodities increases and vice-versa. - Population:

A change in the size and composition of population will effect the demand for certain goods like food grains, clothes etc. - Taste and preferences:

A change in the taste and the fashions bring about a change in the demand for a commodity. - Technological changes:

Due to economic progress technological changes the quantity the quality of goods available to the consumers increase. Ex: Demand for cell phones reduced the demand for landline phones. - Change in the weather:

Demand for commodity may change due to a change in climatic condition. Ex : During summer demand for cool drinks, in winter demand for woollen clothes. - State of business:

During the period of prosperity, de-mand for commodities will expand and during depression demand will contract.

Question 3.

Describe the internal and external economics.

Answer:

conomies of large scale production can be grouped into two types.

1. Internal economies

2. External economies.

1. Internal Economies:

Internal economies are those which arise from the expansion of the plant, size or from its own growth. These are enjoyed by that firm only. “Internal economies are those which are open to a single factory or a single firm independently of the action of other firms.” Cairncross

i) Technological Economies:

The firm may be running many productive establishments. As the size of the productive establishments increase, some mechanical advantages may be obtained. Economies can be obtained from linking process to another process i.e., paper making and pulp making can be combined. It also uses superior techniques and increased specialization.

ii) Managerial Economies:

Managerial economies arises from specialisation of management and mechanisation of managerial functions. For a large size firm it becomes possible for the management to divide itself into specialised departments under specialised personnel. This increases efficiency of management at all levels. Large firms have the opportunity to use advanced techniques of communication, computers etc. All these things help in saving of time and improve the efficiency of the management.

iii) Marketing Economies:

The large firm can buy raw mate-rials cheaply, because it buys in bulk. It can secure special concession rates from transport agencies. The product can be advertised better. It will be able to sell better.

iv) Financial Economies:

A large firm can arise funds more easily and cheaply than a small one. It can borrow from bankers upon better security.

v) Risk Bearing Economies:

A large firm incurs unrisk and it can also reduce risks. It can spread risks in different ways. It can undertake diversifications of output. It can buy raw materials from several firms.

vi) Labour Economies:

A big firm employs a large number of workers. Each worker is given the kind of job he is fit for.

2. External Economies:

An external economy is one which is available to all the firms in an industry. External econo mies are available as an industry grows in size.

i) Economies of Concentration :

When a number of firms producing an identical product are localised in one place, certain facilities become available to all Ex: Cheap transport facility, availability of skilled labour etc.

ii) Economies of Information:

When the number of firms in an industry increases collective action and co-operative effort becomes possible. Research work can be carried on jointly. Scientific journal can be published. There is a possibility for exchange of ideas.

iii) Economies of Disintegration: When the number of firms increases, the firm may agree to specialise. They may divide among themselves the type of products of stages of production. Ex : Cotton industry. Ex : During summer demand for cool drinks, in winter demand for woollen clothes.

Question 4.

What are the characteristic features of perfect competitions?

Answer:

Perfect competitive market is one in which the number of buyers and sellers is very large, all engaged in buying and selling a homogeneous products without any restrictions.

The following are the features of perfect competition :

1) Large Number of Buyers and Sellers:

Under perfect competition, the number of buyers and sellers is large. The share of each seller and buyer in total supply or total de¬mand is small. So, no buyer and seller cannot influence the price. The price is determined only by demand and supply. Thus, the firm is price taker.

2) Homogeneous Product:

The commodities produced by all the firms of an industry are homogeneous or identical. The cross elasticity of products of sellers is infinite. As a result, single price will rule in the industry.

3) Free Entry and Exit:

In this competition there is a free-dom of free entry and exit. If existing firms are getting profits new firms enter into the market. But when a firm gets losses, it would leave the market.

4) Perfect Mobility of Factors of Production:

Under perfect competition the factors of production are freely mobile between the firms. This is useful for free entry and exit of firms.

5) Absence of Transport Cost: There are no transport cost. Due to this, price of the commodity will be the same throughout the market.

6) Perfect Knowledge of the Economy:

All the buyers and sellers have full information regarding the prevailing and future prices and availability of the commodity. Information regarding market conditions is also available.

![]()

Question 5.

Explain about the gross interest and net interest.

Answer:

The concept of interest are two types namely, gross interest and net interest.

Gross Interest:

The payment which the lender receives from the borrower excluding the principal is gross interest. It comprises the following payments :

Net Interest: It is the payment for the service of capital or money only. This is the interest in economic sense.

Keynes’ Liquidity Preference Theory:

Keynes proposed a monetary explanation of the rate of interest. He said that interest is determined by both the demand for and supply of money. According to J.M. Keynes, “Interest is the reward paid for parting with liquidity for the specified period”.

A. Supply of Money:

Supply of money refers to the total quantity of money in circulation. Though the supply of money is a function, of the rate of interest to a degree, supply of money is fixed or perfectly inelastic at a given point of time. It is determined by the central bank of a country.

B. Demand for Money:

Keynes coined a new term liquidity preference. People demand money for its liquidity. The desire to hold ready cash is liquidity preference. The higher the liquidity preference, the higher will be the rate of interest to be paid to induce them to part with their liquid assets. The lower the liquidity preference, the lower will be the rate of interest that will be paid to the cash holders. People demand money basically for three reasons :

- Transactions motive

- Precautionary motive

- Speculative motive.

1) Transaction Motive:

People desire to keep cash for the current transactions of personal and business exchanges. The amount kept for this purpose depends upon the income and business motives.

2) Precautionary Motive:

People keep cash in reserve to meet unforeseen expenses like illness, accidents, unemployment etc. Businessmen keep cash in reserve to gain from unexpected deals in future. Therefore, both individuals and businessmen keep cash in reserve to meet unexpected needs.

3) Speculative Motive:

Speculative motive for money relates to the desire to hold cash to take advantage of future changes in the rate of interest and bond prices. The price of bonds and the rate of interest are inversely related. If the prices of bonds are expected to rise then the rate of interest is expected to fall, as businessmen will buy bonds to sell them when their prices rise and vice versa. Low bond prices are indicative of high interest rates, and high bond prices reflect low interest rates. The demand for money is inversely related to the rate of interest.

The transaction and precautionary motives are relatively interest inelastic, but are highly income elastic. In the determination of rate of interest, these two motives do not have any role. Only the speculative motive is interest elastic and this plays very important role in determining the rate of interest with the given supply of money. When the demand for money and supply of money are equal, along with the equilibrium, rate of interest also be determined.

Section – B

Question 6.

What is Micro economics ? What is its importance?

Answer:

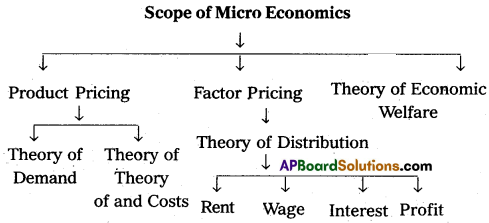

The term ‘Micro Economics’ is derived from the Greek word ‘MIKROS’ which meahs ‘small’. Thus, Micro Economics deals with individual units like individual demand, price, supply etc. It was popularised by Marshall. It is also called as ‘Price Theory’ because it explains pricing in product market as well ‘as factor market.

Importance:

- Micro Economics provides the basis for understanding the working of the economy as a whole.

- This study is useful to the government to frame suitable policies to active economic growth and stability.

- This study is applicable to the field of international trade in the determination of exchange rates.

- Micro Economics provides an analytical tool for evaluating the economic policies of the government.

- It can be used to examine the condition of economic welfare and it suggests ways and means to bring about maximum social welfare.

Question 7.

Explain the concept of indifference curve. Discuss its properties.

Answer:

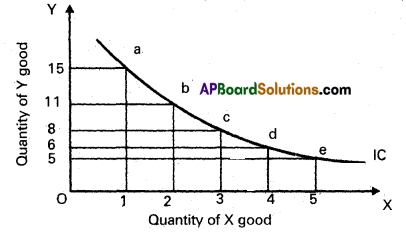

An indifference curve can be defined as the locus of points each representing a different combination of two goods yielding the same utility or level of satisfaction. Therefore, a consumer is indifferent between any two combinations of goods when it comes to making a choice between them. It is also called iso – utility curve or equal utility curve.

Indifference Schedule:

An indifference curve is drawn on the basis of an ‘indifference schedule’. It may be defined as a schedule of various combinations of two goods which yields same level of satisfaction.

| Combinations | Commodity X | Commodity Y |

| 1 | 1 + | 15 |

| 2 | 2 + | 11 |

| 3 | 3 + | 8 |

| 4 | 4 + | 6 |

| 5 | 5 + | 5 |

The table shows five combination of two goods, X and Y, which give the same utility. The consumer’s satisfaction from

1st combination (1 unit of X + 15 units of Y) is the same as that of other combination i.e., 2nd, 3rd, 4th and 5th. Since all

combinations yield the same level of satisfaction, the con- ; sumer is indifferent among these combinations.

In the above figure, good X is measured on the OX – axis. Good Y is measured on OY-axis. Consumer’s utility at point a on the IC with I unit of good X and 15 units of good Y, is equal to the utility at point b with 2 units of X and 11 units of Y or at point C with 3X and 8Y and so on. These combina-tions give him the same level of satisfaction. If we join the r points a, b, c, d and e, we get an indifference curve (IQ and utility as all points on this curve are same. Hence, the con-sumer is indifferent regarding the combinations. When the consumer moves from A to B on IC, he gives up AS of Y (AY).for SB of X (AX).

Properties of Indifference Curves:

Indifference curves have the following basic properties :

1) An indifference curve is negatively sloped towards down. It implies that when the amount of one good in combination is increased, the amount of other good is reduced.

This is essential if the level of satisfaction is to remain the same on an indifference curve. It is neither positively sloped towards up nor horizontal.

2) Indifference curves are always conyex to the origin. The convexity rule implies diminishing marginal rate of substitution. Indifference curves cannot be concave to the origin.

3) Indifference curves can never intersect each other. If two IC curves intersect, it would imply that an indifference curve indicates two different levels of satisfaction. It is not proper.

4) A higher indifference curve represents a higher level of satisfaction than a lower indifference curve. In other words, an IG to the right represents more satisfaction. This is because of combinations lying on a higher IC con¬tain more of either one or both’goods. Similarly, an indifference curve to the left represents less satisfaction.

Question 8.

Discuss the concept of income demand.

Answer:

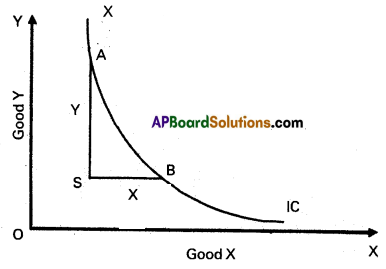

Income demand:

It explains the relationship between consumers income and various quantities of various levels of income assuming other factors like price of goods, related goods, taste etc; remain the same. It means if income increases quantity demand increases and viceversa. This can be shown in the following form.

Dx = f(Y)

The functional relationship between income and demand may be inverse or direct depending on the nature of the commodify. This can be shown in the following table.

| Income | Demand | |

| Superior good | Inferior good | |

| 2000 | 4 | 12 |

| 4000 | 6 | 10 |

| 6000 | 8 | 8 |

| 8000 | 10 | 6 |

| 10,000 | 12 | 4 |

Superior goods:

In case of superio goods quantity de-manded will increase a when there is an increase in the income l

of consumers.

In the diagram ‘X’ axis represents demand, OY axis represents income, YD represents the income demand curve. It is showing positive slope whenever income increased from OY to OY1 the demand of superior or normal goods increases from OQ to OQ1 Demand This may happen in case of Veblen goods.

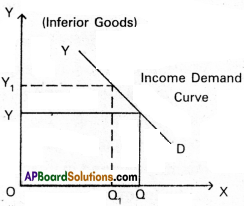

Inferior goods:

On the contrary quantity demanded of inferior goods decreases with the increase in incomes of consumers. In the diagram, on ‘OX’ axis measures demand and OY axis represents income of the consumer. When the consumer income increases from OY to OY1 the demand for a commodity decreases from OQ to OQ1 So the ‘YD’ curve is negative sloping.

Question 9.

Explain the Diminishing Returns.

Answer:

Diminishing Returns: After the stage of increasing returns, stage of diminishing returns will take place. This is known as the law of diminishing returns. Diminishing returns stage starts when the average product is maximum and continues upto the level of zero marginal product and maximum total product. Table shows this stage when the workers are employed from four to seven. From Q to Qj on OX axis shows the diminishing returns stage. In this stage, the total product increases at a diminishing rate and the average and marginal products decline. In this stage TP > AP > MP. Production is profitable only in the stage of diminishing returns.

Question 10.

What is Oligopoly? Explain its characteristics.

Answer:

The term ‘Oligopoly is derived from two Greek word “Oligoi” meaning a few and “Pollein” means to sell. Oligopoly refers to a market situation in which the number of sellers dealing in- a homogeneous or differentiated product is small. It is called competition among the few. The main features of oligopoly are the following.

- Few sellers of the product.

- There is interdependence in the determination of price.

- Presence of monopoly power.

- There is existence of price rigidity.

- There is excessive selling cost or advertisement cost.

![]()

Question 11.

What are the determining factors of real wages?

Answer:

Real wages refer to the purchasing power of money wages received by the labourer. Real wages are expressed in terms of goods and services that a worker can buy with his money wages. The real wage is said to be high when a labourer obtains larger quantity of goods and services with his money income. Factors Determining Real Wages: Real wages depend on the following factors:

1) Price Level:

Purchasing power of money determines the real wage. Purchasing power of money depends on the price level. If price level is high, purchasing power of money will be low. On the contrary, if price level is low, purchasing power of money will be high. Similarly, given the price level, if money wage is high real wage will also increase and when money wage decreases real wage also decreases.

2) Method of Payment:

Besides money wages, labourers get certain additional facilities provided by their management.

Like free housing, free medical facilities, free education facilities to children, free transport etc. If such facilities are high, the real wages of labourers will also be high.

3) Regularity of Employment:

Real wages depend on the regularity of employment. If the job is permanent, his real wage will be high even though his money wage is low. In case of temporary employment, his real wage will be low though his money wage is high. Thus, certainty of job influences real wages,

4) Nature of Work:

Real wages are also determined by the risk and danger involved in the work. If the work is risky real wages of labourer will be low though money wages are’high. For instance, a captain in a submarine, miners etc., always.face danger and risk.

5) Conditions of Work:

The working conditions also determine the real wage of a labourer. Less duration of work, ventilation, light, fresh air, recreation facilities etc., certainly result in the high real wages. If these facilities are lacking, real wages are low even though money, wages are high.

6) Subsidiary Earnings:

If a labourer earns extra income in addition to his wage, his real wage will be higher. For instance, a government doctor may supplement his earnings by undertaking private practice.,

7) Future Prospects :

Real wage is said to be higher in those jobs where there is a possibility of promotions, hike in wage and vice-versa.

8) Timely Payment:

If a labourer receives payment regularly and timely, the real wage of the labourer is high although

t his money wage is pretty less and vice versa.

9) Social Prestige: Although money wages of a bank officer and Judge are equal, the real wage of a Judge is higher than the bank officer due to social status.

10) Period and Expenses of Education: Period and expenses of education also affect real wage. For example, if one person is a graduate and the other is an undergraduate who are working as clerks, the real wage of the undergraduate is high because his period of learning and ex¬penses on education are lower than the graduate labourer.

Question 12.

What are National Income at market prices and National at factor cost?

Answer:

National Income is the value of all the final goods and services produced in a year of a country.

National Product at Market Prices (NNP) : The country’s stock of fixed capital undergoes certain amount of wear and tear in producing goods and services over a period of time.

This ‘user cost’ or depreciation or charges for renewals and repairs must be substracted from the GNP at market prices to obtain net national product at market prices.NNP at market prices = GNP at market prices – Depreciation.

National Product at Factor Cost: It is aslo called as national income. It is the total income received by the four factors of production in the form of rent, wages, interest and profits in an economy during a year. NNP at market prices is hot available for distribution among the factors of production. The amount of indirect taxes (which are included in the prices) are paid by the firms to the government and not to the factors of production. Similarly, the government gives subsidies to firms for production of certain types of goods and services and that part of the production cost is borne by the government. Hence, the goods are sold in the market at a lower price than the actual cost of production. Therefore, this volume of subsidies has to be added to the net national income at market prices. Thus,

NNP at factor cost = NNP at market prices – Indirect taxes + Subsidies.

In another way,

NNP at factor cost = GNP at market prices – Depreciation – Indirect taxes + Subsidies.

Question 13.

Explain the criticism against the classical theory of employ-ment

Answer:

The classical theory of employment came in for severe criticism from J.M. Keynes. The main points of Criticism are as follows :

- The assumption of full employment is unrealistic. It is rare phenomenon and not a normal features.

- The wage cut policy is not a practical policy in modem times. The supply of labour is a function of money wage and not real wage. Trade unions would never accept any reduction in the money wage rate.

- Equilibrium between savings and investment is not brought about by a flexible rate bf interest. Infact, saving is a function of income and not interest.

- The process of equilibrium between supply and demand is not realistic. Keynes commented the self adjusting mechanism doesn’t always operate.

- Long run approach to the problem of unemployment is also not realistic. Keynes commented, “we are all dead in the long run”. He considered unemployment as a short- run problem and offered immediate solution through his employment theory.

- It is not correct to say that money is neutral. Money acts not only as a medium of exchange but also as a store of value. Money influences variables like .consumption, investment and output.

Question 14.

Explain the budget deficits.

Answer:

Generally speaking, budget deficit arises when the total expenditure in the budget exceeds the total receipts (income), Technically there are four types of deficits with reference to a budget:

1) Revenue Deficit:

Revenue deficit arises when revenue expenditure exceeds revenue receipts.

Revenue deficit = revenue receipts – revenue expenditure.

2) Budget Deficit:

Budget deficit is the difference between the total receipts and the total expenditure.

Budget deficit = Total receipts – Total expenditure.

3) Fiscal Deficit: Fiscal deficit is the difference betweeri the total expenditure and the total revenue plus the market borrowings.

Fiscal deficit = (Total revenue – Total expenditure) + Market borrowings & Other liabilities.

(or)

Fiscal deficit = Budget deficit + Market borrowings and Other liabilities.

4) Primary Deficit:

Primary deficit is the fiscal deficit minus interest payments.

Primary deficit = Fiscal deficit – Interest payments. Modem governments have been resorting to deficit budgets in order to meet the growing expenditure needs to finance for economic development. But it is not desirable to have large deficits, particularly fiscal deficit as it would have adverse effects on the economy.

![]()

Question 15.

What is Barter system? What are its dificulties?

Answer:

Barter system means exchange of goods. This system was followed in olden days. But the population and its require-ments are increasing, the system became very complicated. The difficulties of barter system are :

1) Lack of coincidence of wants:

Under the barter system, the buyer must be .willing to accept the commodity which the seller is willing to offer in exchange. The wants of both the buyer and the seller just coincide. This is called

double coincidence of wants. Suppose the seller has a good and he is willing to exchange it for rice. Then the buyer – must have rice and he must be willing to exchange rice for goat. If there is no such coincidence direct exchange between the buyer and the seller is not possible.

2) Lack of store value:

Some commodities are perishables. They perish within a short time. It is not possible to store the value of such commodities in their original form un¬der the barter system. They should be exchanged before they actually perish.

3) Lack of divisibility of commodities:

Depending upon its quantity and value, it may become necessary to divide a commodity into small units and exchange one or more units for other commodity. But all commodities are not divisible.

4) Lack of common measure of value:

Under the barter system, there was no common measure value. To make exchange possible, it is necessary to determine the value of every commodity interms of every other cpmmodity.

5) Difficulty is making deferred payments:

Under barter system future payments for present transaction was not possible, because future exchange involved some difficulties. For example suppose it is agreed to sell specific quantity of rice in exchange for a goat on a future date keeping in view the recent value of the goat. But the value of goat may decrease or increase by that date.

Question 16.

Distinguish between different types of money.

Answer:

Money can be grouped into various items based on the value, material used and the legal status. They are :

1) Commodity money and representative money:

Money is classified into commodity money and representative money on the basis of the intrinsic value it possess. If the intrinsic value is equal to the face value of coin is called commodity money and if the value is less than the face value, it is called representative money.

2) Legal tender money and optional money:

On the basis of legality money is divided into legal tender money and optional money. If money is accepted as per law by every one is called legal tender money. If the acceptance is optional and not according to law is called optional money. Ex: Cheques.

3) Metallic money and paper money:

Based on the material used money can be divided into metallic and paper money. If money is made up of metals such as silver, nickel, steel etc., all coins are metallic money and if money is printed on papers is called paper money.

4) Standard money and token money:

If the face value and intrinsic value are same, then the money is called standard money and if the face value is higher than the intrinsic value is called token money.

5) Credit money:

It is also called as bank money. This is created by commercial banks. This refers to the bank deposits that are repayable on demand and can be transferred from one person to other through cheques.

Question 17.

What is median? What are it’s merits and drawbacks?

Answer:

Median (M) : Median is the middle element when the data set is arranged in order of the magnitude. Median is that positional value of the variable which divides the distribution ‘into two equal parts. In the ungrouped data, the median is computed as follows:

i) The values of the variate are arranged either in ascending or in descending order.

ii) The middle – most value is taken as the median. If the number of values ‘n’ in the raw data is odd, then the Median will be the \(\left(\frac{\mathrm{n}+1}{2}\right)^{\mathrm{th}}\) value arranged in order of magnitude. In this case, there will be one and only one value of Median. On the other hand, if n is even, and when the data arranged in order of magnitude, there will be two middle

most values, \(\left(\frac{\mathrm{n}}{2}\right)^{\mathrm{th}}\) and \(\left(\frac{\mathrm{n}}{2}+1\right)^{\text {th }}\) values. Median is the average of the

\(\frac{\mathrm{n}^{\text {th }}}{2} \text { and }\left(\frac{\mathrm{n}}{2}+1\right)^{\text {th }}\)values

Merits and Drawbacks of Median:

- Merits of Median:

- It is rigidly defined.

- Even if the value of extreme item is much different from other values, it is hot much affected by these values.

- It can be located graphically.

- It can be easily calculated and is also easy to understand.

- Drawbacks of Median:

- Even if the value of extreme items is too large, it does not affect too much, due to this reason, sometimes median does not remain the representative of the series.

- Median cannot be used for further algebraic treatment.

- In a continuous series it has to be interpolated.

- If the number of series is even, we can only make its estimate; as the A.M. of two middle terms is taken as Median.

Section – C

Question 18.

Discuss the importance of statistics for the study of econo-mics.

Answer:

Statistical analysis render valuable assistance in the understanding of the economic problems and the formulation of economic policy. Economic problems are capable of being expressed numerically. The nature of many economic problems like poverty, unemployment, rise in prices, volume of trade, output of manufacturing, mining, agriculture etc.’, cannot be analysed without the help of statistics.

Question 19.

Compute median for the following data. 5, 7, 7, 8, 9, 10, 12, 15 and 21

Answer:

Here N =

Median = \(\frac{N+1}{2}=\frac{9+1}{2}=\frac{10}{2}\)

5th value is 9.

Hence, Median (Q2) = 9.

Question 20.

What is currency?

Answer:

Currency is the form in which money is circulated in the .economy by the monetary authority. Currency includes coins and paper notes. It is only one component of money.

Question 21.

Which Bank is called as bankers bank and why?

Answer:

Banker’s Bank: Reserve Bank serves as a banker not only to the government but also to the banks. According to Banking Regulation Act, 1934 all the scheduled banks are bound by the law to maintain with the Reserve Bank of India a part of their total deposit amount as cash balances. This ratio is called the Cash Reserve Ratio (CRR). Reserve Bank provides financial assistance to the commercial banks in times of their financial stringency by giving loans or rediscounting the bills of exchange. It acts as clearing house for settlement of inter-bank accounts.

![]()

Question 22.

Write about Fifteenth Finance Commission.

Answer:

Fifteenth Finance Commission : The Government of India

appointed the Fifteenth Finance Commission on November 27,2017 with N.K. Singh as Chairman. The recommendations of the Commission will cover the five year period 2020 – 25. The Commission has been asked to submit its report by October 30,2019.

The Commission has been instructed to use the population data of 2011 census as the base for calculating the expen-diture needs of various states. This is the first Commission which is required to present its recommandations in the post GST era.

Question 23.

What is meant by primary deficit?

Answer:

Primary deficit is the fiscal deficit minus the interest payments.

Question 24.

What is the importance of National income estimations?

Answer:

Importance of national income estimations:

- The national income estimates or statistics are very important for preparing economic plans and for framing national economic policies.

- The national income data are useful in research and distribution of income in the country. .

- It enables us to assess the performance of each sector in the economy and inter-relationship among the sectors.?

- It is more useful in making budgetary allocations.

- It gives us an idea of the standard of living in the country.

Question 25.

What is Personal Income?

Answer:

It is the total of income received by all persons in a year before payment of all direct taxes. The whole of National Income is not availabe to them. Corporate taxes have to be paid by firms. Firms, may keep a part of its profits for expansion. Salaried employees may make contributions for social security. Hence,

PI = NI(NNP at factor cost) – (Undistributed corporate profits + Corporate taxes + Social security payments) + Transfer earnings

Question 26.

What is Economic rent?

Answer:

The ordinary use of the term ‘rent’ means any periodic payment for the hire of anything such as garriages, buildings etc. Economic rent is the pure rent payable as a reward for utilising the productivity of land. It is derived by subtracting the elements like interest, wages, profits and depreciation from the gross rent or contract rent. To David Ricardo, it is surplus over costs or expenses of cultivation.

Question 27.

What are Money wages?

Answer:

Money wages are the remuneration received by the labourer in the form of money for the physical and mental service rendered by him or her in the production process. Ex : If a labourer is paid ₹ 30/- per day. ₹ 30/- is the money wage.

![]()

Question 28.

Explain equilibrium price.

Answer:

Equilibrium price is that price where demand and supply are equal in the market.

Question 29.

What is perfect competition?

Answer:

In this market there are large number of buyers and sellers . who promote competition. In this market goods arc homogeneous. There is no transport fares and publicity costs. So price is uniform of any market.

Question 30.

What is Capital Accumlation?

Answer:

Capital accumulation typically refers to an increase in assets from investment or profits. Individuals and complanies can accumulate capital through investment. Investment assets usually earn profit they contributes to a capital base.

Question 31.

What is the Importance of capital?

Answer:

Importance of Capital: The importance of capital in brief:

- Capital plays a very vital role in the modem productive system. Production without capital is almost impossible.

- The productivity of workforce depends upon the amount of capital available per worker. The greater the capital per worker, the greater the efficiency and productivity of the worker.

- Capital occupies a central position in the process of eco-nomic development.

- It promotes the technological progress.

- It helps in the creation of employment opportunities.

Question 32.

Define Inferior Goods.

Answer:

The goods whose income elasticity of demand is negative for levels of income are termed as inferior goods. In case of inferior goods if income increases demand decreases and vice- versa. The income emand for inferior goods has a negative slope.

Question 33.

What are the types of price elasticity of demand?

Answer:

If the price of a commodity increases, its quantity demanded will fall. The rate of change in demand is not always propor-tionate to the rate of change in price. For some commodities a smaller change in price leads to a greater change demand, here the demand is elastic. A greater change in price many lead to only a smaller change in quantity demanded, here the demand is inelastic. The following are the types of elasticity of demand.

a) Perfectly elastic demand,

b) Perfectly inelastic demand.

c) unitary elastic demand.

d) Relatively elastic dejmand.

e) Relatively inelastic demand.

Question 34.

Explain Law of equtanainal utility.

Answer:

The law states that a consumer having a fixed incpme and facing given market prices of goods will achieve niaximum satisfaction when the marginal utility pf the last rupee spent on each good is exactly the same as the marginal utility of the last rupee spent on any other good. Equalisation of marginal utilities will maximize the consumer’s satisfaction and consumer attains equilibrium. The fundamental condition for consumer’s maximum satisfaction and equilibrium of the consumer.

![]()

Question 35.

Explain the relation ship between total utility and marginal utility.

Answer:

The relationship between total utility and marginal utility is explained in three ways. They are :

- When total utility increases at a diminishing rate, marginal utility falls.

- When total utility is maximum, marginal utility becomes zero.

- When total utility decreases, marginal utility becomes negative.

Question 36.

Explain the Gonsumer Goods.

Answer:

Consumer good is an economic good or commodity purchased by househ?olds for final consumption. Thus, consumer goods are those goods which directly satisfy human wants. For Ex: Fruits, Milk, Pen, Clothes etc. Consumer goods are divided into two types.

a) Perishable goods : Which loose their value in single use, Ex : Milk, fruits etc.

b) Durable goods : Which yields service over time. Ex: TVs & Computers.

Question 37.

What is Positive Economics?

Answer:

A positive science is defined as a body of systematised knowledge concerning ‘what it is’. The classical school economists were of the opinion that economics is purely a positive science which had no right to comment upon the rightness or wrongness of economic policy. Here, economists cannot give any final judgement on any matter.