The strategic use of TS Inter 1st Year Economics Model Papers Set 4 allows students to focus on weaker areas for improvement.

TS Inter 1st Year Economics Model Paper Set 4 with Solutions

Time: 3 Hours

Maximum Marks: 100

Section – A

Note : Answer ANY THREE out of the following five questions in not exceeding 40 lines each. (3 × 10 = 30 )

Question 1.

Explain the concepts of Cardinal Utility, Ordinal Utility, Total Utility and Marginal Utility.

Answer:

The concept of utility was introduced in economic thought by Jevans in 1871. In a general sense, utility is the ‘want satisfying power’ of a commodity or service. In economic sense, utility is a psychological phenomenon.

1) Cardinal utility:

Utility is cardinal in the sense that utility is measurable in terms of units called utils. According to the concept of cardinal utility, the utility derived from the consumption of a good can be expressed in terms of numbers such as 1, 2, 3, 4 and so on. For example, a person can say that he derives utility equal to 10 utils from the consumption of one unit of commodify A and 5 utils from the consumption of one unit of commodity B. He can compare different commodities and express which commodity gives him more utility or satisfaction and by how much. Alfred Marshall fol-lowed this approach. The law of diminishing marginal utility and the law of equi-marginal utility are based on cardinal utility approach.

2) Ordinal utility:

Utility is ordinal in the sense that utilities derived from the consumption of commodities cannot be measured quantitatively but can be compared by giving ranks. It means that the utilities obtained by the consumer from different commodities can be arranged in a serial order such as 1st, 2nd, 3rd, 4th etc. These numbers tell us that the second number is more than the first number. But, it is not possible to tell how much, because they are not measurable. J.R. Hicks and R.J.D. Allen have used the ordinal approach. The indifference curve analysis is based on ordinal utility approach.

3) Total Utility and Marginal Utility :

a) Total Utility : Total utility is the total amount of satisfaction which a person gets from the consumption of all units of the commodity. Let us assume that a consumer consumed 3 apples and first apple gave him 20 utils of utility, second one 15 utils and the third one 10 utils of utility. By adding these utilities we get the total utility, ie., 20 + 15 + 10 = 45. When the quantity of consumption increases total utility also increases but at a diminishing rate. The total utility is a function of total quantity.

TUn = f(Qn)

Where TUn = Total utility of n commodity,

f = functional relationship, and

Qn = Quantity of n commodity.

b) Marginal Utility:

Marginal utility is the addition made to the total utility by consuming one more unit of the commodity. Let us assume that one apple gives 20 utils of utility and 2 apples gives 35 utils of utility. It means that the additional utility from the second apple is 15 utils i.e., 35 – 20 = 15. This is called marginal utility.’It can be expressed as

MUn = TUn – TUn-1

where, MUn = Marginal utility of nth unit,

TUn = Total utility of nth Units, and

TUn-1 = Total utility of n – 1 units.

In the example, marginal utility of the second unit is equal toMU2 = TU2-TU1 = 35 – 20 = 15

Marginal utility can also be expressed in the following way:

MU = \(\frac{\Delta \mathrm{TU}}{\Delta \mathrm{C}}\) = \(\frac{Change in total utility }{Change in quantity consumed}\) = \(\frac{15}{1}\) = 15

By adding all the marginal utilities of different units of the commodity, we get total utility.

Question 2.

Explain the law of returns to scale.

Answer:

The law of returns to scale relate to long run production function. In the long run it is possible to alter the quantities of all the factors of production. If all factors of production are increased in given .proportion the total output has to increase in the same proportion. Ex : The amounts of all the factors are doubled, the total output has to be doubled, increasing all factors in the same proportion is increasing the scale of operation. When all inputs are changed in a given proportion, then the output is changed in the same proportion. We have constant returns to scale and finally arises diminishing returns. Hence, as a result of change in the scale of production, total product increases at increasing rate, then at a constant rate and finally at a diminishing rate.

Assumptions :

1. All inputs are variable.

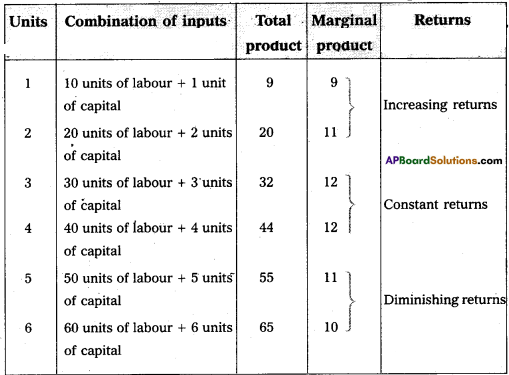

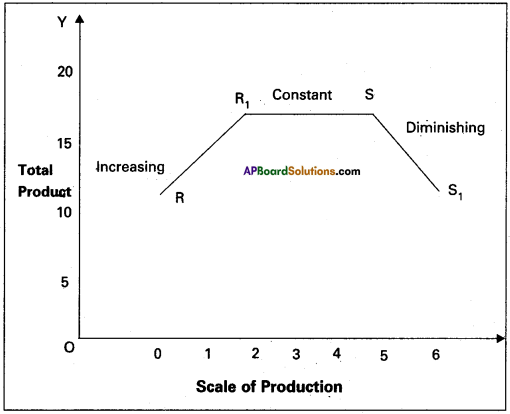

2. It assumes that state of technology remains the same. The returns to scale can be shown in the following table.

The above table reveals the three patterns of returns to scale. In the 1st place, when the scale is expanded upto 3 units, the returns are increasing. Later and upto 4th units, it remains constant and finally from 5th onwards the returns go on diminishing.

In the diagram, on ‘OX’ axis shown scale of production, on ‘OY’ axis shown total product. RR1 represents increasing returns R1S – Constant returns; SS1 represents diminishing returns.

Question 3.

What is meant by real wages ? What are the factors that determine real wages?

Answer:

The amount of goods and services that can be purchased with the money wages at any particular time is called real wage. Thus, real wage is the amount of purchasing power received by worker through his money wage.

Factors Determining the Real Wage:

1. Methods of Form of Payment:

Besides money wages, normally the labourers get some additional facilities provided by their management. Ex : Free housing, free medical facilities etc. As a result, this real wage of the worker will be high.

2. Purchasing Power of Money:

An important factor which determines the real wage is the purchasing power of money which depends upon the general price level. A rise in general price level will mean a full in the purchasing power of money, causes decline in real wages.

3. Nature of Work:

The working conditions also determine the real wages of labourer. Less duration of work, ventilation, fresh air etc., result in high real wages, lack of these facilities then the real wages are low even though if money wages are high.

4. Future Prospects:

Real wage is said to be higher in those jobs where there is possibility of promotions, hike in wages and vice-versa.

5. Nature of Work:

Real wages are also determined by the risk and danger involved in the work. If work is risky wages of labourer will be low though money wages are high. Ex : Captain in a submarine.

6. Timely Payment:

If a labourer receives payment regularly and timely the real wages of the labourer is high although his money wage is pretty less and vice-versa.

7. Social Prestige:

Real wage depends on social prestige. The money wages of Bank officer and judge are equal, but the real wage of a judge is higher than bank officer.

8. Period and Expenses of Education: Period and expenses of training also affect real wages.

Question 4.

Explain equilibrium of the firm in the shortrun and longrun under perfect competition.

Ans:

Perfect competition is a market structure characterized by a complete absence of rivalry among the individual firms. Thus, perfect competition in economic theory has a meaning diametrically opposite to the everyday use of this term. In practice, businessmen use the word competiton as synonymous to rivalry. In theory, perfect competition implies no rivalry among firms. Perfect competition may be defined as that market situation, in which there are large number of firms producing homogeneous product, there is free entry and free exit, perfect knowledge on the part of buyer, perfect mobility of factors of production and no transportation cost at all.

Equilibrium of a Firm:

We have learnt that the price of a commodity is determined by the market demand and market supply under perfect competition. An increase in price of a product acts as an incentive in increasing production. As a firm aims at maximizing profit, it chooses that output which maximizes its profits. When the firm is in equilibrium, it has no desire to change its output.

Equilibrium output is explained with the help of cost and revenue curves of a firm. In perfect competition, average and marginal cost curves are ‘U’ shaped one and average revenue and marginal revenue curves are parallel to OX axis. Since AR = MR, both these curves will merge into a single line.

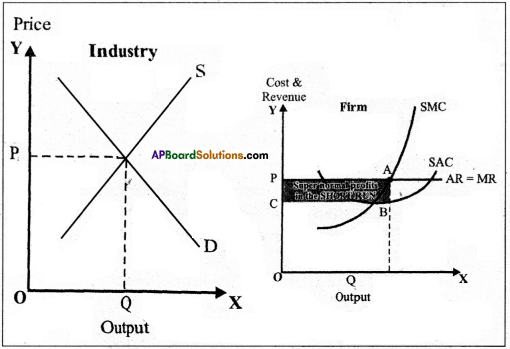

1) Short Period Equilibrium:

Firms are in business to maximize profits. During short period, a firm cannot change fixed factors like machinery , buildings etc. However, it produces more output by increasing variable factors. Equilibrium output is produced in the short period where short period marginal cost (SMC) is equal to short period marginal revenue (SMR). The firm will be in equilibrium, when marginal cost curve cuts marginal revenue curve from below. During short period, a firm may get super normal, normal profits or losses. Two conditions are necessary for firm s equilibrium. They are : i) MC = MR and ii) MC curve should cut MR curve from below. The figure shows the firm’s short period equilibrium.

In the figure quantity demanded and supplied are shown on OX axis and price of the commodity on OY axis. The diagram shows that the equilibrium price OP is determined by the industry at point E where the industry demand is equal to industry supply. The price, so, determined by the industry is passed on to the firm. This is shown by the horizontal dernand curve of the firm.

This line is also known as the price line. Since, competition is perfect, the AR curve (demand curve) of the firm is also the MR curve of the firm. The firm’s SAC curve and SMC curve are also shown respectively. The profits of the firm are maximum at the output where MC = MR, that is, at output OQ, SMC = MR. At any output than OQ, MR exceeds MC, which would mean that if the production is more its profits will increase. At any output more than OQ, MR becomes less than MC, which would mean a loss to the firm. Thus, OQ is output of maximum profits. At the equilibrium point ‘E’, the price is equal to OP or AQ, while AC per unit equals QB, profit per unit is equal to B. Total supernormal profits will be equal to PABC, i.e., BA x OQ.

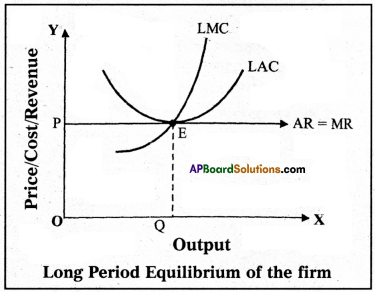

2) Long Period Equilibrium:

We have seen that under short period, a firm can adjust its output, within limits, by varying the factors of production. But in the long period the firm can adjust its output to any extent because it can vary all the factors of production. Thus, it is certain that the firm will not incur losses in the long period. In the long period, the free entry of the new firms into the industry will wipe out the supernormal profits of the firm. Hence, in the long period, the frim wil be at optimum size where there is no profit – no loss. Firm gets only normal profits which are included in the long period average cost. In other words, under perfect competition, the individual firm at equilibrium earns normal profits only.

Therefore, AR = MR = LAC = LMC

The figure illustrates the long period equilibrium of the firm. The quantity of a good is depicted on OX axis and price, costs and revenues are on OY axis in the diagram.

The point of equilibrium will be established at which the firm’s MR curve touches its LAC curve at its minimum point. At this point LMC = LAC. Thus, when a firm is in long period equilibrium the following conditions exist:

At point E;P = AR = MR = LMC = LAC.

Question 5.

Describe the concept, components and types of budget.

Answer:

Budget is an annual statement showing the estimated receipts (revenue) and expenditure of a government for a financial year (April – March). The governments present to the legislature an annual budget every year for its approval. The budget is presented by the finance minister. The government cannotincur any expenditure unless it has the prior approval of the legislature.

Sometimes a vote on account budget is presented by the government when it is not possible to present the full budget. It is an interim budget for a few months. This will facilitate the government to incur expenditure pending approval of the regular budget.

Objectives:

The main purpose of the budget is to obtain approval of the legislature for the tax proposals and allocation of resources to various government activities. The government utilizes the occasion to state its policies and programmes.

Budget Estimates:

In the budget, budget estimates for the ensuing financial year are shown along with’”the actual expenditure of the preceding financial year, and budget estimates and revised estimates for the current financial year. For a clear understanding of these estimates, budget at a glance for the year 2013-14.

Components of the Budget: The budget consists of both receipts (income) and expenditure of the government. The budget of the Government of India consists of two main components :

- Budget Receipts:

- Revenue Receipts: This consists of tax revenue and non-tax revenue and

- Capital Receipts: This consists of recoveries of loans, other receipts and borrowings and other liabilities.

- Budget Expenditure:

In the Union budget of India, the budget expenditure is classified into plan expenditure and non-plan expenditure. Each category is further divided into revenue account and capital account. Let us enlist them as hereunder:- Plan Expenditure:

- a) Plan expenditure on revenue account.

- b) Plan expenditure on capital account.

- Non-plan Expenditure:

- a) Non-Plan expenditure on revenue account.

- b) Non-Plan expenditure on capital account.

- Plan Expenditure:

Again the plan expenditure and the non-plan expenditure is summed up and shown as revenue expenditure and capital expenditure. Types of Budget: There are three types of budgets based on the difference between the receipts and expenditure:

- Surplus Budget:

This refers to the budget in which the total revenue is more than the total expenditure (R>E). - Deficit Budget:

This refers to the budget in which the total expenditure exceeds the total revenue (R<E). - Balanced Budget:

This refers to the budget in which the total expenditure and the total revenue are equal (R = E).

Section – B

Question 6.

Examine the welfare definition of economics.

Answer:

Alfred Marshall raised economics to a dignified status by advancing a new definition in 1890. He shifted emphasis from production of wealth to distribution of wealth (welfare). In the words of Marshall, “political economy or economics is a study of mankind in the ordinary business of life; it exam¬ines that part of individual and social action which is most closely connected with the attainment and with the use of the material requisites of well – being. Thus, it is on the one side, a study of wealth and on the other and more important side, a part of the study of man”.

I. Important Features of Welfare Definition:

1) Marshall used the term “Economics” for “Political economy” to make it similar to physics. He assumed that economics must be a science even though it deals with the ever changing forces of human nature.

2) Economics studies only economic aspects of human life and it has no concern with the political, social and reli¬gious aspects of life. It examines that part of individual and social action which is closely connected with acquisi¬tion and use of material wealth which promotes human welfare.

3) Marshall’s definitions considered those human activities which increased welfare.

4) This definition has given importance to man and his welfare and recognised wealth as a mean for the promotion of human welfare.

II. Criticism:

Marshall’s definition is not free from critics. Robbins in his “Essay on the Nature and Significance of Economic Science” finds fault with the welfare definition of economics.

1) Economics is a human science rather than a social science. The fundamental laws of economics apply to all human beings and therefore, economics should be treated as a human science and not as a social science.

2) Lionel Robbins criticized it as classificatory. It distinguishes between materialistic and non materialistic goods and not given any importance to non-materialistic goods which are also very important. Therefore, it is incomplete.

3) Another serious objection is about the quantitative mea-surement of welfare. Welfare is a subjective concept and changes according to time, place and persons.

4) Marshall includes only those activities which promote hu¬man welfare. But the production of alcohol and drugs do not promote human welfare. Yet economics deals with the production and consumption of those goods.

5) Robbins has taken serious objection for not considering ‘scarcity of resources’. According to Robbins’ economic problem arises due to limited resources which are to be used to satisfy unlimited wants.

Question 7.

Define the law of diminishing Marginal Utility. State its assumptions.

Answer:

The law of diminishing marginal utility was originally ex-plained by Hermann Heinrich Gossen in 1854. Jevans called it as Gossen’s first law. But Alfred Marshall popularised this law and analysed it in a scientific manner.

Definitions of the law:

“The additional benefit which a per-son derives from a given increase of his stock of a thing di-minishes with every increase in stock that he already has” – Alfred Marshall. Assumptions : The law is based on the following assump-tions :

- Rationality: The consumer is a rational human being in the sense that he seeks to maximize his satisfaction.

- Cardinal Measurement of Utility : Utility is a cardinal concept, i.e. utility is measurable quantitatively. It can be measured in cardinal numbers.

- Independent Utility: The utility of any commodity de-pends on its own quantity, i.e. utility of goods are inde-pendent.

- Constant Marginal Utility of Money : The marginal util¬ity of money remains constant.

- Homogeneous Goods: Goods are homogeneous in the sense that they are alike both quantitatively and qualita-tively.

- Uniform Size of Goods: Goods should be of suitable size, i.e. neither too big nor too small. They should be identical.

- No Time Lag: There is no time lag between the consump¬tion of one unit to another unit.

- Divisible Commodity: Commodity is divisible.

- No Change in Consumer Behaviour: The income, tastes and preference of the consumer should remain constant.

- Full Knowledge of the Market: Consumer will have full knowledge of market.

Question 8.

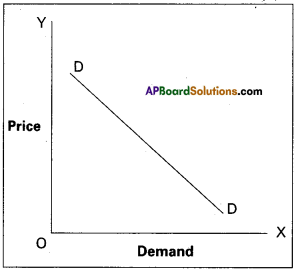

Illustrate the reasons for negative sloping demand curve.

Answer:

According to Marshall, “The amount demanded increases with a fall in price and diminishes with a rise in price when other things remain the same”.

The law of demand explains inverse relationship between the price and quantity demanded of a commodity. Therefore, the demand curve slopes downward from left to right. There are some other reasons also responsible for down¬ward sloping demand curve.

1) Old and New Buyers:

If the price of a good falls, the real income of the old buyers will increase. Hence, the de¬mand for the good will increase. In the same way, the fall in price attracts new buyers and will be able to built after a fall in its price. So the demand curve slopes downwards from left to right.

2) Income Effect:

Fall in price of commodity the real income of its consumers increase. The increase in real income encourages demand for the commodity with reduced price. The increase in demand on account of increased in real income is known as income effect.

3) Substitution Effect:

When the price of commodity falls, it will become relatively cheaper than its substitutes. The increase in demand on account of increase in real income is known as income effect.

4) Law of Diminishing Marginal Utility :

According to this law, if consumer goes on consuming more units of the commodity, the additional utility goes on diminishing. Therefore, the consumer prefers to buy at a lower price. As a result the demand curve has a negative slope.

Question 9.

Discuss about the changes in supply.

Answer:

The supply function explains the relationship between the determinants of supply of a commodity and the supply of that commodity. Supply of a commodity depends upon its price, the prices of related goods, the prices of factors of production, the state of technology, the goals of firm and polity of the government. These can be written in the form a supply function as :

Qx = f(Px>Pr.PfT,Gf,Gp)

Where, Qx = quantity of good X supplied, Px = price of good X, Pr = prices of related goods (substitutes, comple- mentaries), Pf = prices of factors of production, T = technical knowhow, Gf = goal of the firm / seller, Gp = government policy, f = functional relationship.

In the above equation, supply of commodity is a depen¬dent variable on many aspects. Change even in one variable of the determinants of supply brings a change in the supply. In determining the supply of a good, price of this good is more important among all the determinants. Hence, if we assume all other aspects will not change, then the supply function will be as:

Img-1

Determinants of Supply:

Supply function explains the rela¬tionship between supply of a commodity and its determi¬nants. Let’s discuss about the determinants of supply,

i) Price of a Good:

In determining the supply of a good, price of this good is more important and this price deter¬mines the profit of the firm. Other things being constant, the supply of commodity increases with an increase in its price and vice versa. Thus, there exist a positive relation¬ship between price and supply,

ii) Prices of its Related Goods:

Goods comprise substitutes and complementaries. Any change in the prices of these goods exerts influence on production of the good in consideration. For instance, if the price of a substitute good goes up, the producers may try to produce that substitute good or demand for the substitute good which has higher price may decrease and therefore, producer may increase supply of the good which he was producing initially. Similarly, producer may decide the supply of his product on the basis of the prices of complementaries and demand for them.

iii) Prices of Factors of Production:

Increase in the prices of factors of production would lead to an increase in the cost of production. As a result, supply of the commodity may decline. The reverse will happen in the case of a fall in the prices of factors of production.

iv) State of Technology:

New and improved methods of production, inventions and innovations help to save factors, costs and time and thus, technology contributes to increase the supply of goods.

v) Goals of producer and other determinants: Goals of producer, means of transport and communication and natural factor etc., will equally influence the supply of a commodity

vi) Government policy:

Imposition of heavy taxes on a commodity discourages the production of goods and as a result supply diminishes in goods are given, supply of goods will increase.

Question 10.

What are the characteristics of monopolistic competition ?

Answer:

It is a market with many sellers for a product but the products are different in certain respects. It is mid way of monopoly and perfect competition. Prof. E.H. Chamberlin and Mrs. Joan Robinson pioneered this market analysis.

Characteristics of Monopolistic Competition:

- Relatively Small Number of Firms: The number of firms in this market are less than that of perfect competition. No one can control the output in the market as a result of high competition.

- Product Differentiation:

One of the features of monopo-listic competition is product differentiation. It takes the

form of brand names, trade marks etc. Its cross elasticity of demand is very high. - Entry and Exit:

Entry into the industry is unrestricted. New firms are able to commence production of very close substitutes for the existing brands of the product. - Selling Cost: Advertisement or sales promotion technique is the important feature of Monopolistic competition. Such costs are called selling costs.

- More Elastic Demand:

Under this competition the de-mand curve slopes downwards from left to the right. It is highly elastic.

Question 11.

What are the factors that determine the factor prices?

Answer:

The demand and supply of a factor of production determine its price. The demand for a factor of production depends on the following.

- It depends on the demand for the goods produced by it.

- Price of the factor determines its demand.

- Prices of other factors or co-operative factors determine the demand for a factor.

- Technological changes determine the demand for a factor.

- The demand for a factor increases due to increase in its production.

Factors that determine the supply of a factor of production :

- The size of the population and it’s age composition.

- Mobility of the factor of production.

- Efficiency of the factor of production.

- Geographical conditions.

- Wage also determines the supply of this factor.

- Income.

Question 12.

What are the various methods of calculating national income? Explain them.

Answer:

There are three methods of measuring National Income.

- Output method or Product method.

- Expenditure method.

- Income method.

‘Carin cross’ says, National Income can be looked in any one of the three ways. As the national income measured by adding up everybody’s income by adding up everybody’s output and by adding up the value of all things that people buy and adding in their savings.

1) Output Method (Product Method):

The market value of total goods and services produced in an economy in a year is considered for estimating National Income. In order to arrive at the value of the product services, the total goods and services produced are multiplied with their market prices.

Then, National Income = (P1Q1 + P2Q2 + ….. PnQn) – Depreciation – Indirect taxes + Net income from abroad.

Where P = Price

Q = Quantity

1,2, 3 n = Commodities & Services

There is a possibility of double counting. Care must be taken to avoid this. Only final goods and services are taken to compute National Income but not the raw materials or intermediary goods. Estimation of the National Income through this method will indicate the contribution of different sectors, the growth trends in each sector and the sectors which are lagging behind.

2) Expenditure Method:

In this method, we add the personal consumption expenditure of households, expenditure of the firms, government purchase of goods and services net exports plus net income from abroad.

NI = EH + EF + EG + Net exports + Net income from abroad.

Here, National Income = Private final consumption expenditure + Government final consumption expenditure + Net domestic capital formation + Net exports + Net income from abroad

EH = Expenditure of households

EF = Expenditure of firms

EG = Expenditure of Government.

Care should be taken to include spending or expenditure made on final goods and services only.

3) Income Method:

In this method, the income earned by all factors of production is aggregated to arrive at the National Income of a country. The four factors of production receives income in the form of wages, rent, interest and profits. This is also national income at factor cost.

NI = W + I + R + P

Net income from abroad

Where, NI = National income

W = Wages

I = Interest

R = Rent

P = Profits

This method gives us National Income according to distribution of shares.

Question 13.

Enumerate the assumptions and major aspects of classical theory of employment.

Answer:

The classical theory of employment is based on the Say’s law of markets. The famous law of markets, propounded by the J.B Say states that “Supply creates its own demand”. Assumptions : The Say’s law is based on the following assumptions.

- There is a free enterprise economy.

- There is perfect competition in the economy.

- There is no government interference in the functioning of the economy.

- The equilibrium process is considered from the long term point of view.

- All savings are automatically invested.

- The interest rate is flexible.

- The wage rate is flexible.

- There are no limits to the expansion of the market.

- Money acts as medium of exchange.

Aspects of Classical Theory: The classical theory of employment can be discussed with three dimensions.

A) Goods Market Equilibrium:

The classical theory of employmet is based on the Say’s Law of Markets. The first part of Say’s market law explains the goods market equilibrium. The famous law of markets, propounded by the J.B. Say states that, “Supply creates its own demand”.

B) Money Market Equilibrium (Saving Investment Equi-librium):

The goods market equilibrium leads to bring equilibrium of both money and labour markets. In goods market, it is assumed that the total income is spent. The classical economists agree that part of the income may be saved, but the savings is gradually spent on capital goods. The expenditure on capital goods is called investment. It is assumed that equality between savings and investment (S = 1) is brought by the flexible rate of interest.

C) Labour Market Equilibrium: Pigou’s Wage Cut Policy:

According to the classical economists, unemployment may occur in the short run. This is not because the demand is not sufficient but due to increase in the wages forced by the trade unions or the interference of government. A.C. Pigou suggested that reduction in the wages will remove unemployment. This is called wage – cut policy. A reduction in the wage rate results in the increase in employment.

Question 14.

List out various items of public expenditure.

Answer:

Public expenditure is an important constituent of public finance. Modern governments spend money from various welfare activities. The expenditure incurred by the govern-ment on various economic activities is called public expenditure. Governments incur expenditure on the following heads of accounts.

- Defence

- Internal security

- Economic services

- Social services

- Other general services

- Pensions

- Subsidies

- Grants to state governments

- Grants to foreign governments

- Loans to state governments

- Loans to public enterprises

- Loans to foreign governments

- Repayment of loans

- Assistance to states on natural calamities etc.

Question 15.

Point out the agency and general utility functions of commercial banks.

Answer:

The following are agency functions and general utility functions.

Agency Function:

Commercial banks perform certain agency functions also. On certain occasions they act as agents of the customers. Some of the important agency functions are :

a) Collection of cheques, drafts, bills of exchange etc., of their customers from other banks.

b) Collection of dividends and interest from business and industrial firms.

c) Purchase and sale of securities, shares, debentures, government securities on behalf of the customers.

d) Acting as trustees and keeping their funds in safe custody.

e) Making payments such as insurance premium, income tax, subscriptions etc., on behalf of their customers as per their request.

General Utility Functions:

Besides the agency functions, commercial banks provide certain utility services to their customers. They are:

a) Provision of locker facility for the safe custody of the silver, gold ornaments and important and valuable documents for which service rent is collected.

b) Transfer of money of the customers from one bank to the other by way of demand drafts, mail transfer by collecting commission from them.

c) Provision of online transfer facility of money from one bank to the other.

d) Issue of letters of credit to enable the customers to purchase commodities on the basic of credit.

e) Endorsing and providing guarantee to the shares issued by the joint stock companies.

f) Issue of traveler’s cheques to customers to avoid the risk of carrying of cash.

g) Providing foreign exchange to the customers for exports and imports in connection with their business.

h) Conveying information on behalf of their customers to the businessmen operating in other places and also collecting information of such businessmen and provide it to the customers. Thus they act as referees’.

Question 16.

State the contingent, static and dynamic functions of money.

Answer:

Money plays a vital role in modem economy.

According to Waker’ – “Money is what money does”. According to ‘Robertson’ – “Anything which is widely accepted in payment for goods discharge of other kinds of business obligations”.

Contingent functions :

a) Measurement and distribution of National income:

National income of a country be measured in money by aggregating the value of all commodities. This is not possible in a barter system similarly national income can be distributed to different factors of production by making payment then in money.

b) Money equalizes marginal utilises / productivities:

The consumers can equalize marginal utilities of different commodities purchased by them with the help of money. We know how consumers equalize the marginal utility of the taste rupee they speed on each commodity. Similarly firms can also equalize the marginal productivities of different factors of production and maximize profits.

c) Basis of credit:

Credit is created by banks from out of the primary deposits of money supply of credit, in an economy is dependent on the supply of nominal money.

d) Liquidity:

Money is the most important liquid asset. Interms of liquidity it is superior than other assets. Money is cent percent liquid. Static and Dynamic Functions of money : Paul Engig classified functions of money as static and dynamic functions.

i) Static Functions:

We have learnt the medium of exchange, measure of value, store of value and standard of deferred payment are the traditional or technical functions of money. Engig called them static functions. These functions facilitate emergence of price mechanism. They do not show any effect on the economic development,

ii) Dynamic Functions :

The functions of money which influence output, consumption, distribution and general price level are called dynamic functions. They make the entire economy dynamic. The functions shown as contingent functions come under dynamic functions.

Question 17.

What is mode? What are its merits and demerits?

Answer:

Mode (Z) : Mode is the most frequently observed value in the data or an observation with the highest frequency is called the mode of the data. Mode is defined as that value in series which occurs most frequently. Mode is a point of maximum concentration on a scale of values, i.e., it is the most typical or most fashionable value of series.

Merits and Drawbacks of Mode: i) Merits or uses of Mode:

- Mode is the term that occur most in the series hence, it is neither an isolated value like Median nor it is a value like mean that may not be there in the series.

- It is not affected by extreme values hence, is a good representative of the series.

- It can be found graphically also.

- For open end intervals it is not necessary to know the length of open intervals.

- It can also be used in case of quantitative phenomenon.

- With only just a single glance on data we can find its value. It is simplest.

- It is the most used average in day-to-day life, such as average marks of a class, average number of students in a section, average size of shoes, etc.

ii) Drawbacks of mode:

- Mode cannot be determined if the series is bimodal or multimodal.

- Mode is based only on concentrated values; other values are not taken into account inspite of their big difference with the mode. In continuous series only the lengths of class intervals are considered.

- Mode is most affected by fluctuations of sampling.

- Mode is not so rigidly defined. Solving the problem by different methods we won’t get the same results as in case of mean.

- It is not capable of further algebraic treatment. It is impossible to find the combined mode of some series as in case of Mean.

- If the number of terms is too large, only then we can call it as the representative value.

Section – C

Question 18.

Compute Harmonic means for 4, 6 and 12.

Answer:

Harmonic mean for 4, 6, 12

| N | X |

| 1 | 4 |

| 2 | 6 |

| 3 | 12 |

Question 19.

Explain the drawback of Mode.

Answer:

Drawbacks of mode :

- Mode cannot be determined if the series is bimodal or multimodal.

- Mode is based only on concentrated values; other values are not taken into account inspite of their big difference with the mode. In continuous series only the lengths of class intervals are considered.

- Mode is most affected by fluctuation of sampling.

- Mode is not so rigidly defined. Solving the problem by different methods we won’t get the same results as in case of mean.

- It is not capable of further algebraic treatment. It is impossible to find the combined mode of some series as in case of Mean.

- If the number of terms is too large, only then we can call it as the representative value.

Question 20.

What is token money?

Answer:

Token money is money or unit of currency whose face value is higher then the intrinsic value. Ex. 1,2 and 5 rupees coins, etc.

Question 21.

What are the uses of overdrafts?

Answer:

Overdraft: This is a facility allowed by the bank to the current account holders. They are allowed to withdraw money, with or without security, in excess of the balance available in their account, up to a limit. This facility is available as a temporary measure to the borrowers to meet their short needs in case of shortage of regular funds. Interest is charged on the amount of actual withdrawal.

Question 22.

What is budget?

Answer:

Budget is the annual statement showing the estimated receipts and expenditure of tne government for a financial year in the budget. The budget estimates and revised estimates of the current financial year and actual expenditure of the preceding financial year are shown.

Question 23.

What is Fiscal deficit?

Answer:

Fiscal deficit is the difference between total revenue and total expenditure plus the market borrowings.

Fiscal deficit = (Total revenue – total expenditure) + Other borrowing and other liabilities.

Question 24.

WTiat is Depreciation?

Answer:

Firms use continuously machines and tools for the production of goods and services. This results in a loss of value due to wear and tear of fixed capital. This loss suffered by fixed capital is called depreciation.

Question 25.

Explain the concept of GNP (Gross National Product).

Answer:

It is the total value of all final goods and services produced in the economy in one year.

GNP = C + I + G + (x-m) where,

C = Consumption

I = Gross National Investment

G = Government Expenditure

X = Exports

M = Imports

x – m = Net foreign trade.

Question 26.

What is Gross interest?

Answer:

The payment which the lender receives from the borrower excluding the principal is gross interest.

Gross interest = Net interest + [Reward for risk taking + Reward for Inconvenience + Reward for management]

Question 27.

What are the determining factors of the demand for a factor?

Answer:

- The demand for the factors of production is derived demand. It depends on the demand for the goods produced by it.

- Price of the factor determines its demand.

- Prices of other factors which will help in the production also determine the demand for a factor.

- Technology determines the demand for the factors. For instance, increase in technology reduces the demand for labourers.

- Returns to scale will determine the demand for the factors of production. The demand for the factors increases due to increasing returns in the production.

Question 28.

Give a note on the Time Raised Markets.

Answer:

Supply of a good can be adjusted depending on time factor. On the basis of time, markets are divided into three types, i.e., very short period, short period and long period.

a) Market Period or Very Short Period:

This is a period where producer cannot make any changes in the supply of a good. Hence, the supply is fixed. As we know supply can be changed by making changes in inputs. Inputs cannot be changed in the very short period. Supply remains constant in this period. Perishable goods will have this kind of markets.

b) Short Period:

It is a period in which supply can be changed to a little extent. It is possible by changing certain variable inputs like labour.

c) Long Period:

The market in which the supply can be changed to meet the increased demand, producer can make changes in all inputs depending upon the demand in the long period. It is possible to make adjustments in supply in long period.

Question 29.

Define Oligopoly.

Answer:

A market with a small number of producers is called oligopoly. The product may be homogeneous or may be differences. This market exists in automobiles, electricals etc.

Question 30.

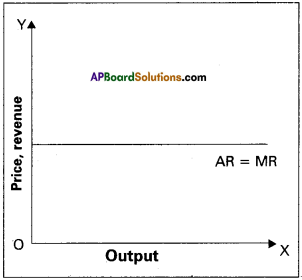

Explain the nature of AR and MR curves in perfect competition.

Answer:

Under perfect competition, there exist large number of sell-ers and large number of buyers. In this market neither sell-ers nor buyers have any control on the price of the product. The seller can sell any amout of the good and buyers can buy any amount of the good at the ruling market price. Here the goods are sold at single price under perfect competition therefore, additional units are also sold at the same price. Hence, under perfect competition the AR = MR, because of this P = AR – – MR. Since P = At = MR, the AR and MR curves will be parallel to OX axis as shown in the following diagram.

Question 31.

Explain the Characteristics of land.

Answer:

Land means not only earth’s surface alone but also refers to all free gits of nature which include soil, water, air, natural vegetation etc. Characteristics of Land – The following are the characteristics of land as a factor of production

a) Free gift of nature.

b) Supply of land is perfectly inelastic.

c) Cannot be shifted from one place to another place.

d) Land provides infinite variation of degree of fertility.

Question 32.

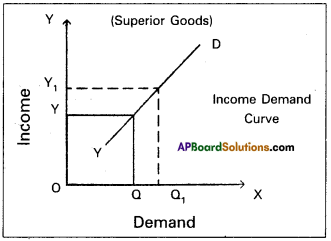

Define Superior goods.

Answer:

In case of superior or normal goods, quantity demanded in-creases when there is an increase in the income of consumers. Income demand for superior goods exhibits a positive relationship between the income and quantity demanded. In such a case, the demand curve slopes upwards from left to right.

In figure OX-axis represents quantity demanded for su-perior goods and OY-axis represents the income of the consumer. YD represents the income demand curve showing a positive slope. Whenever income increases from ‘OY’ to OY1 the quantity demanded of superior or normal goods increases from OQ to OQ1 This may happen in case of Veblen goods.

Question 33.

What is Income Demand?

Answer:

It shows the direct relationship between the income of the consumer and quantity demanded when the other factors remain constant. There is direct relationship between income and demand for superior goods. Inverse relationship between income and demand for inferior goods.

Dx = f(Y)

Question 34.

Define Marginal utility.

Answer:

Marginal utility is the additional utility obtained from the consumption of additional unit of the commodity.

MUn = TUn – TU(n-1)

(or)

MU = \(\frac{\Delta \mathrm{TU}}{\Delta \mathrm{Q}}\)

Question 35.

Write in brief, about properties of indifferences curves.

Answer:

It represents the satisfaction of a consumers from two goods of various combinations. It is drawn an the assumption that for all possible combinations of the two goods on an indifference curve, the satisfaction level remains the same.

Question 36.

What is Macro Economics?

Answer:

The word Macro’ is derived from Greek work ‘Makros’ which means ‘Large’. It was developed by J.M. Keynes. It studies aggregates or economy as a whole like national income, employment, general price level etc. It is also called “Income and Employment” theory.

Question 37.

What is Income concept?

Answer:

Income is a flow of satisfaction from wealth per unit of time. In every economy income flows from households to firms and vice versa. Income can be expressd in two types.

- Money income which is in terms of money.

- Real income which is in terms of goods and services.