Telangana SCERT 8th Class Social Study Material Telangana Pdf 7th Lesson Money and Banking Textbook Questions and Answers.

TS 8th Class Social 6th Lesson Questions and Answers – Money and Banking

Improve Your Learning

Question 1.

Can there be any difficulties or disadvantages in keeping money in a bank? Think and write.

Answer:

There are some difficulties in keeping money in a hank.

- Some people are illiterate. Hence such people have to depend on others for depositing/withdrawing money from the hank.

- Bank branches may be away from the residing area. Sometimes it may become difficult to get done in short time.

- There are restrictions on withdrawals in savings account.

- Most of the banks insist for minimum balance otherwise penalty will be levied.

- The rate of interest offered by the banks are nominal when compared with inflation.

- There are too many conditions and rules like TDS, KYC which sometimes give a lot of trouble to an ordinary man.

Question 2.

In what ways have cheques made exchange of money more convenient? (or) How did the cheques make the money transaction easy? Explain in your own words. (Conceptual /understanding)

Answer:

- When we want to send money to some one who lives in a different place. we will send a cheque to them by post.

- We can use our cheque to transfer money electronically into the other person’s account through a bank.

- For business purposes. where money is frequently received and paid, cheques are very important as a medium tor transactions,

Question 3.

Only a part of the total deposits is kept as cash in the bank-safe. Why is this so and how does this benefit the bank? (Conceptual/understanding)

Answer:

- A hank is a business enterprise and it will trade with people’s money.

- Deposits are the way through which money saved by people comes into the bank and the banks require only a small proportion of the deposits as cash so that they can always keep to the promise of payment on demand.

- Banks give loans to individuals I institutions and to the government and earn interest. This is the main source of revenue to the bank. I fence it is beneficial to the hank to keep only a certain portion of cash in its safe.

![]()

Question 4.

If many loans are written off (that k, borrowers are not required to pay back the money), how will this affect the working of the bank f (Conceptual understanding)

Answer:

- Many loans are written of means banks will become bankrupt and it may lead to the closure of the bank.

- If loans are written off like this, the government has to reimburse the amount to the bank or financial support is to be extended to the bank.

Question 5.

Read the paragraphs under the heading “Types of Loans and answer the following question. What sort of loans are more common in your area?

Types of Loans

Banks give loans and advances to different sections of the public like traders, Industrialists, students (educational loans), furnaces, artisans, etc. Let us examine sonic of them.

Rahim, is a small farmer who grows paddy on his 4 acres of land. he needed ‘money for fertilizers and seeds at the time of sowing. So he look a loan of (Rs 10,000. He mortagaged (gave as security) his harvest, After selling the harvest, Rahim will return the loan to the bank along with interest, within on year.

Leela wants to tiny a flat She lakes a housing loan from a bank for Rs. 8 lakhs by mortgaging her fiat. A certain amount is deducted from her salary every month atul paid to the bank. She will recover the ownership papers of the lier flat, after idly paying off her bank loan.

Shanta is a member of the Self-Help Group (SHG). She has taken a loan for her house repair front the bank. She does not have lo keep any assets as security. The group will ensure That loans are paid back by its members.

Answer:

Ours is a rural area and after observing the pattern of loans, the following loans were more.

- Agricultural / crop loans

- Gold loans

- House loans

- Business loans

Question 6.

Suppose, this year the rainfall is poor and the crop yield is only half as much as was originally expected. Some people argue that if this happens, the farmers should be asked to pay back only half the amount they have taken as loans, However. other people say that full amount should be repaid, keeping in view the next year’s crop. In your opinion what should the bank do and why? (Reflection n contemporary issues and questioning)

Answer:

- Whatever the situation, normally banks ask for full payment of loan.

- When there is crop failure or less yield, farmers are unable to repay their Loans.

- In such situations, banks have to reschedule the repayment procedure and has to provide crop loans to the farmers for the next season.

- Government shall support the farmers by waiving interest components and directing the banks to provide necessary loans for the next crop.

Question 7.

People have to pay a higher interest on loans than the interest they receive on a fixed deposit for the same time period. Why do you think this is so? (Conceptual understanding)

Answer:

Banks trade with money. Fixed deposits means money that is to be kept with the bank for agreed and specified period. When one has to disturb this arrangement, he has to pay penalty for the same. Hence banks charge more interest on FD loans than what they give. Another important aspect is discouraging loans on fixed deposits.

Question 8.

Do you feel that the loans taken from SHGs are helpful to the members How?

(or)

Are there any Self Help Groups in your allege? Do you think the members of Self Help Group benefit really? Analyse with reasons. (Appreciation and Sensitivity)

Answer:

There are Self Help Groups in our village. The members of Self Help Group get benefits really.

- The very concept of SHG is to encourage saving and thrift among its members.

- As ait individual one may get difficult in obtaining loan from government financial institutions.

- As a member of SHG one can get loan very easily without any security and even at lower rate of interest.

- As the member of SHGs are very conscious about their responsibilities they will utilise these loans for productive purpose and get maximum benefit from it.

Classroom Activity

Imagine that you need Rs. 2,000. Write a cheque and give it to your friend and send her to get the money in cash. (Conceptual understanding)

Answer:

I will write a cheque for Rs. 2,000/- on my friend’s name and ask her to get cash from the hands I will give her instructions where to hand over the cheque in the bank and how to receive cash in counter.

![]()

Discussion:

Invite the local postmaster postman to your class and conduct the interaction on different saving schemes.

Answer:

We invited the local postmaster of Mariapuram village to our school. The postmaster explained us different saving schemes available through post offices.

Postmaster: Post Offices offer different savings schemes like

- Post Office Savings Account

- 5-year Post Office Recurring Deposit Account (RD)

- Post Office Time Deposit Account (TD)

- Pact Office Monthly Income Scheme Account (MIS)

- Senior Citizen Savings Scheme (SC)

- 15 ear Public Provident Fund Account (PPF)

- National Savings Certificate (NSC)

- Kisan Vikas Patra (KVP)

- Sukanva Samridhi Accounts

We: Why are there many schemes?

Postmaster: Depending on the needs of the people, different schemes are implemented. Some offer good rate of interest, some offer pension benefits, some offer tax saving schemes.

We : What is Sukanva Samridhi Account?

Postmaster: This scheme is mainly intended for girl children. The rate of interest is 8.5% per annum A legal guardian or natural guardian can open an account in the name of girl child. Partial withdrawal of 50% of balance can be taken after Account holders attaining age of 18 years. Account can be closed after completion of 21 ears.

We : Please tell us about scheme Kisan Vikas Patra.

Postmaster: In this scheme amount invested doubles up in 112 months i.e., 9 years and 4 months. certificate can be taken on behalf of a minor or by two adults. it can be purchased from any Departmental Postal Office. Certificate can be encashed after 2 and 2 years from the date of issue.

We: Thank you sir for providing us valuable information regarding different postal schemes.

Project

Question 1.

Visit a bank or invite a bank employee to the school and find out:

(a) How to open a savings account in your name (Opening a Savings Account)

Answer:

- The simplest form of deposit account is the savings bank account.

- It can be opened by an individual in his own name or joint names of two or more individuals with following information.

- Documentary evidence in support of identification with proof of residential address.

- Two passport-size photographs.

- Proper introduction regarding the identity of the individual by the existing account holder.

(b) How are cheques cleared by the banks?

Answer:

- Cheques deposited into a bank account enables one to transfer the money into another account

- In many towns and cities representatives of all banks meet on each day to settle what each bank has to pay to the other and receive from the other.

- Cheques that have been verified are handed over to each other.

- One of the banks works as the clearing bank where all the banks have all accounts.

- The payments and receipts between banks are done by this clearing bank.

(c) How do banks make NEFT/RTGS/IMPS/UPI/MMID Transfers?

Answer:

- National Electronic Fund Transfer is a scheme introduced by Reserve Bank of India to help banks offering their customers money transfer service from account to account of any bank branch to any other bank branch in places where the Electronic Fund Transfer Services are available.

- NEFT is safe, secure, efficient and less expensive than cheque payments and collections.

- Bank branch needs the information i.e. name of the customer whom money to be sent, his account number and type of account, name of the bank, and name of the branch and its code etc.

- After instructing the bank with the above details money will be transferred within no time.

(d) What security precautions are necessary for an ATM to work?

Answer:

- ATM Centre must be located at a strategic place where the customer can enter easily.

- The main security tv precautions are the CC camera and the Pin number.

- The computer-connected camera located inside the ATM machine will recognize the face and iris.

- Pin number ensures that it is genuine customer that is withdrawing money.

(e) Apart from cheques, people can also exchange money through Bank Drafts I Online

transactions etc. Find out more about the different modes of exchange.

Answer:

- Yes, I came to know that people can exchange through Bank drafts and on Online.

- Bank drafts are useful where online banking facilities are not available.

- Online transactions are convenient, not bound by operational timings. There are no geographical barriers and the services can be offered at minimum cost.

- One can pay electricity, telephone bills, credit card, and insurance premiums, fund transfers, payment of taxes online.

(f) For the person receiving the money, what is the advantage of online transactions compared to a cheque?

Answer:

- Cheque collection takes time besides one has to pay collection charges, service charges, etc.

- Whereas online transaction ensures speed transaction and within minutes one can receive money and that too without any expenditure.

(g) Find out the following interest rates:

Answer:

| Interest rates on savings deposits | 3.5% to 4% |

| Interest rate on faked deposits | 8% to 8.5% |

| Interest rate for loans given to farmers 10% (Actually it works out to 7% as 3% will be paid by the government.) | |

| Interest rate in loans given to housing | 10.25% |

| Interest rate for loans given to education | 11 to 12% |

All these figures were obtained from State Rank of India and there may be slight variations in the rates charged by different banks at different times. These rates will change as and when there is a change in the monetary policy of Reserve Bank of India.

Question 2.

Please visit www.rbi.org. in and read comics on financial inclusion and financial literacy themes.

Answer:

Student Activity

Intext Questions

Text Book Page No. 75

Question 1.

Are you aware of any exchanges that are done without money? (CU.)

Answer:

I observed that in our village people used to give paddy for purchasing vegetables. fruits and ether small items of consumption.

Question 2.

You may have bought things in exchange of old clothes, plastic, newspapers, hair, paddy etc. Discuss the transadion. (Conceptual understanding)

Answer:

this is more or less primitive type of Barter where goods will be exchanged for goods.

- People exchange old clothes for steel and aluminum tins and bowls, plastics, iron, and newspapers to get onions.

- Where people bought large quantities of paddy they will exchange this with oil, soaps. clothes and other essential commodities of consumption particularly from village fairs.

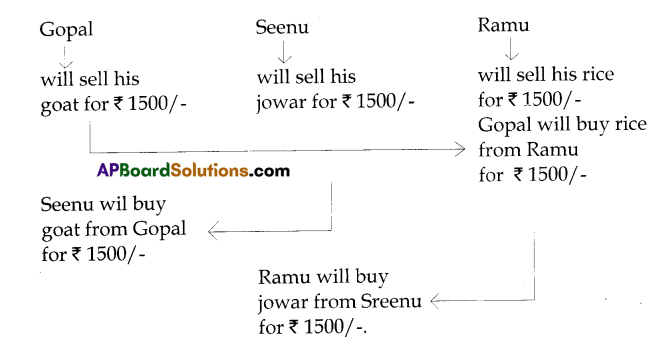

![]()

Text Book Page No. 75

Question 3.

Complete the following table: (Information skills)

| Gopal | Seenu | Ramu |

| Wishes to buy |

||

| Wishes to sell |

Answer:

| Gopal | Seenu | Ramu | |

| Wishes to buy | rice | goat | jowar |

| Wishes to sell | goat | jowar | rice |

a. What can we conclude from the above table?

Answer:

- Gopal has a goat and he wants to exchange it for rice. Ramu has rice but he wants to exchange his rice for Jowar but not for goat.

- Seenu has jowar and he wants a goat whereas Copal wants to exchange his goat for rice hut not to jowar.

- Ramu has rice and he wants to buy jowar hut not want to exchange his rice for the goat.

From the above table it is clear that there is no double coincidence of wants. Hence exchange among them directly is not possible.

b. Explain in your own words why exchange is not possible between Gopal and Seenu.

Answer:

Gepal has a goat and he wants to exchange it for rice

Seenu wants a goat but he has jowar but not rice.

So here exchange is not possible between Gopal and Seenu because of lack of coincidence of wants.

c. Will the use of money hip?

Answer:

Yes. Money acts as a medium of exchange. The value of goat is expressed in terms of money and similarly, the value of jowar can be converted into money value. Then it is very easy for Copal to sell goat and purchase rice and also to Seenu to sell his jowar the market rate to purchase goat.

Fill in the blanks:

Answer:

Gopal exchanges his goat with Seenu for money, then uses this money to buy rice from Ramu. Now Ramu can use this money to buy Jowar from Seenu.

d. Ask your parents how washerman, barbers, neeti kaavalikaru were paid foc their work in villages and towns.

Answer:

Our parents told that they were paving the washerman, barbers, neeti kaavalikaru in kind i.e. grains as per existing practices.

Text Book Page No. 76

Question 1.

How can money be used in the transactions between Gopal, Seenu and Ramu? Explain with the help of a flow chart. (Conceptual understanding)

Answer:

Question 2.

If the role of money, as described above, was stated as a medium of exchange, would you agree? Explain. (Appreciation and Sensitivity)

Answer:

Yes, I fully agree that money acts as a medium of exchange.

- Here the values of rice, goat, jowar can be converted into money by expressing in terms of rupees.

- As the price of rice and jowar are expressed in terms of rupees per kilogram and total value of goat is expressed in terms of rupees.

- As a result fair values were given in the above transaction and all are satisfied with this agreement.

Question 3.

In a Barter system, how do you pay to a person who cuts your hair? Discuss. (C.U.)

Answer:

In typical Indian villages it is an old-age practice that barbers are paid in kind i.e. grains, clothes, groceries etc. So the barber is paid 1 kg of grains or some vegetables or grocery items as accepted by both barber and customer.

Question 4.

For how much rice should Copal exchange his goat? (CU)

Answer:

Here we have to take into account of price of both the things in rupees i.e. total value of goat is 3000/- and the value of rice is 30 per kilogram. So here Gopal will exchange his goat for 100 Kgs. of rice to ensure fair price.

![]()

Question 5.

Look at the following conversation. (Conceptual understanding)

Gopal: How mans’ bags of rice will you give for this goat?

Seetaiah: Four bag.s.

Gopal: I need two bags of rice. Will you give wheat for the remaining two bags of rice?

Seetaiah: I don’t have wheat, if you want, I can give you edible oil, pulses.

Gopal: 1 don’t require pulses, I want sugar

Copal: ………………. will give

Seetaiah : ………………… will give

In the above example, complete the conversation so that they are able to trade.

Answer:

Gopal: If you give 2 bags of rice and I bag of sugar, I will give mv goat.

Seetaiah: O.K. 1 will give 2 bags of rice I bag of sugar. Please give your goat.

Question 6.

If money was not used by you or any of the traders in your sandals or weekly market, imagine what would happen Describe the situation in a paragraph. (Appreciation and Sensitivity)

Answer:

Money acts as a medium of exchange. If there is no money it is very difficult to undertake fair and just trade in the santalu or local market.

- There will not be double coincidence of wants between goods and services.

- It is very difficult to store perishable commodities like vegetables, milk, etc.

Text Book Page No. 77

Question 7.

Do you think money can act as a measure of value of the goods and services? Explain. (Conceptual understanding)

Answer:

Money acts as a measure of value. All the values of goods and services can be expressed in terms of money. Examples are:

- Rice ₹ 35 per kg., oil ₹ 85 per liter, cloth ₹ 220 per meter etc. are measurements

of goods in money. - All the wages say daily wage of a casual labourer ₹ 300 per day, ₹ 200 fee for consultation of a doctor, ₹ 5,000 for advocate fee, etc., are measurements of services in money.

Question 8.

Why were metal preferred for use as money? (Conceptual understanding)

Answer:

People in the early ages preferred scarce and attractive metals like copper, bronze, silver, and gold as money because

- these are durable,

- these can be divided into parts,

- these can be carried around,

- since these are scarce and no value erosion, were accepted by all.

Question 9.

Do you think minting of coins was a good idea? (Conceptual understanding)

Answer:

In those days it was a good idea because coins do not lose value as it could happen with grains or cattle. But now – a – days, using plastic currency like debit card, credit card are better than minting coins.

Question 10.

In what ways would minting of coins benefit the rulers? Can you think of three different reasons. (Conceptual understanding)

Answer:

Minting of coins benefit the rulers because

- they are of standard size.

- it is not necessary to weigh each time.

- there was greater assurance of purity from royal mint.

- it is very easy to carry these coins.

Question 11.

Do you think the plastic or polymer material used for money affects the value of it’ (Conceptual understanding)

Answer:

No. It is the Reserve Bank of India which is responsible for issuing current arid guarantees the value of money irrespective of the material used for printing of currency.

Question 12.

Have you ever been inside a bank? What are the names of some banks you know? (Information skills)

Answer:

I went to bank with my brother. Some of the banks which I know are

- State Bank of India

- Andhra Bank

- Canara Bank

- Syndicate Bank

- Punjab National Bank

- Indian Bank

- State Bank of Hyderabad

- Federal Bank

![]()

Question 13.

If you step inside a Bank, you will find some employees sitting at different counters with their computers! ledgers and dealing with the customers. You can also observe people depositing money at some counters and withdrawing money at some other counters. There is one cabin where the manager sits. What do these bank employees do? (Information skills)

Answer:

Bank employees attend to their daily routine work in a branch. Employees are accepting cash deposits from the public, paving money to the customers for their withdrawals. One will be issuing drafts /cheques etc. One will be attending loan processing and another posting entries in the passbook. Manager will be coordinating the activities of all the employees besides attending important policy matters.

Question 14.

why do the receipts of the goldsmith work as money? (C.U)

Answer:

Goldsmith is known to all and is trusted for always paying up the receipts easily. Because of the trust created by the goldsmith, their receipts began to work as a form of money.

Question 15.

Can you think of situations when this trust of the Goldsmith could break? (C.U)

Answer:

Yes, sometimes it may happen. When the goldsmith is overconfident and issues too many receipts without gold backing, it may lead to breakdown in the system.

Question 16.

What was the problem faced by the traders in Amsterdam and how did they find a way out? (Conceptual understanding)

Answer:

- In 1606. there were 846 silver and gold coins recognized by the government that could be accepted for exchange in Amsterdam.

- Traders were always suspicious of each other – everyone would doubt the purity and weight of these coins.

- To solve this problem they created a bank owned by the city. The bank operated honestly and trusted by all traders.

Question 17.

After two centuries this bank collapsed. Can you guess what could have been the reasons for this? Discuss. (Conceptual understanding)

Answer:

As far as my knowledge goes, following may be reasons for the collapse of the bank.

- Overdrawing by the members.

- Large loans to government/municipal/individuals which were not recovered,

- Large loans of big/large industrial houses which were not recovered.

Question 18.

Read the promise on paper notes used today. Who is making the promise and to whom? Why is this important? Discuss.

Answer:

- Notes are issued by the Reserve Bank of India. It is Governor of Reserve Bank of India who promises to pay the bearer the sum of the rupees of the value of the note.

- This is important because the value of note is guaranteed by the Reserve Bank

/Government. - It creates confidence among the public regarding paper notes issued by the Central Bank of the country.

Question 19.

How would Geeta withdraw the money from an ATM? (C.U.)

Answer:

- Geeta will enter into ATM cabin and swipe or insert the ATM card.

- After inserting ATM card, the computer will ask to enter the PIN number. Then Geeta will enter her PIN number.

- After entering correct pin number computer will display various options

- After Geeta pressed withdraw button computer asks to enter the amount.

- Once the amount is entered computer will ask if it is correct or not?

- Geeta presses the button “Correct”, and wait. She will receive the required amount from the cash slot in a few seconds.

- After collecting the money’, she will count it and get a balance statement from the machine.

![]()

Question 20.

What would Geeta do if she went to her bank branch? (C.U.)

Answer:

- After going to bank branch she will fill a withdrawal slip for required amount and gives it in the concerned desk and receive a token.

- She will go to payments counter and when her turn comes, she will hand over the token in the counter and collect the amount.

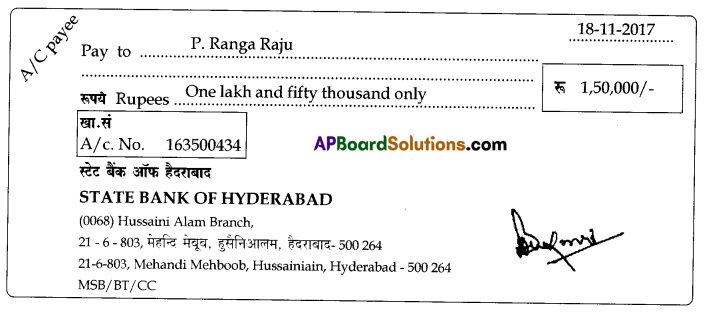

Question 21.

Draw the picture of a bank cheque in your notebook and pay Rs.1,50,000 to your friend sitting neat to you. (Conceptual understanding)

Answer:

Question 22.

Why is a crossed cheque safe? Discuss. (Reflection on contemporary issues and questioning)

Answer:

- Open cheque is subject to risk or theft. It is not safe to issue such cheques.

- This risk can be avoided by issuing Crossed Cheques’ whose payment is not made over the counter at the bank.

- It is only credited to the bank account of the payee. Hence no danger of misuse or fraudulent encashment.

Question 23.

If Suresh Babu wants to deposit 1,75,000 electronically into Kancharla Sujatha’s account through his bank, how can this be dones What more information would he require’ Visit a bank and find out. (Information Skills)

Answer:

- Electronic fund transfer provides for electronic payments and collections.

- It is safe, secure, efficient, and less expensive than cheque payments and collections.

- This system presently covers all the branches of the 27 public sector banks and 55 scheduled commercial banks.

- 4. On a visit to the bank I found the above information. The following are required by Chandra to send money electronically to Kancharla Sujatha’s Account.

A) Name of the Bank and Branch location where Sujatha is having her account.

B) Sujatha’s type of Account and Account number.

C) IFSC code of that Branch and MICR code number,

Electronic Fund Transfer is of two types

1. NEFT

2. RTGS

NEFF: National Electronic Fund Transfer.

(Through this we can send upto ₹ 2,00,000/-)

RTGS: Real Time Gross Settlement.

(It is used for the transfer of above ₹2,00,000/- through electronic fund transfer).

Question 24.

Discuss and make a list o4 the different payments that people make electronically without using a cheque.

Answer:

- E-banking facilitates the payment f electricity bills, telephone bills, credit cards and insurance premiums.

- Transfer of amount from one account to another of the same or any other hank.

- A customer can pay various taxes online including Income Tax, Service Tax. Direct Tax etc.

Question 25.

What are the differences between a savings account and a current account? (C.U.)

Answer:

| Savings Account | Current Account |

| 1. The simplest form of deposit account which can be opened by an individual or two or more individuals. | 1. Professionals, business enterprises and others engaged in commercial activities require current accounts. |

| 2. There is a limit on the number of withdrawals permitted from the account. |

2. These accounts permit any’ number of transactions during any given day without restrictions on deposits and withdrawals. |

| 3. There is also the requirement of minimum balance to be maintained in the savings account. |

3. Minimum balance is insisted upon. Penalties are levied in case the balance drops below the permissible minimum. |

| 4. Interest is paid on savings account. | 4. There is no provision of payment of interest. |

| 5. These accounts are meant to inculcate a banking habit and savings discipline. |

5. Business is generated through collection of cheques and documentary hills of exchange. issue of drafts, grant of overdrafts, opening of letters of credit, bank guarantees etc. |

Text Book Page No. 84

Question 26.

Match the statements in column A with the word(s)/terms in column B. (CU.)

Answer:

Column A Column B

a) The banking facility that helps us to make payments out of our bank account without actually carrying money with us. ( IV ) (I) ATM

b) The banking facility enabling us to deposit or withdraw cash 24 hours a day. ( I ) (ii) Phone Banking

c) The facility that helps us to perform banking transactions over the Internet. ( V ) (III) Credit Card

d) We can get information about the balance in our bank account over the mobile phone using this facility. ( II ) (IV) Debit Card

e) The facility that enables us to make payments for purchases. ( III ) (V) Net Banking

Question 27.

When should one opt for fixed deposits for savings? (Conceptual understanding)

Answer:

- These are deposits given to the bank for a fixed period i.e. 7davs to 120 months.

- Savings of the customers which they can afford to keep with the bank for a

particular duration to earn interest constitute such deposits. - Interest is payable on fixed deposits as per the duration of the deposit.

Question 28.

How much money will Manaswini get from her Fixed in five years if the rate of interest is 8% (Conceptual understanding)

Answer:

Manaswini will get ₹14,000 from her Fixed Deposit after five years at the rate of interest of 8%. \(\frac{1000 \times 5 \times 8}{100}\) = 4000/-

10000+4000 = 14000/-

Question 29.

Suppose she needs the money urgently for some medical treatment. Can she (Manaswini)

withdraw it from the Fixed Deposit at the bank? What will happen? (Conceptual understanding)

Answer:

Fixed Deposits can be encashed prematurely before the date of maturity if there is urgent requirement. However, the rate of interest will be lower, besides penalties sometimes.

Question 30.

Will the same rate of interest be charged for all types of borrowers from a bank? (Conceptual understanding)

Answer:

No. Interest rates will differ based on the nature of the loan. For eg. agricultural loans will be given at lower rate of interest and loans for commerce and trade at higher rate of interest.

Question 31.

What will happen if some borrowers do not repay the bank loan? (Reflection on contemporary issues and questioning)

Answer:

Generally, banks give loans on collateral and surety by third party. If the borrowers do not repay, the banks will dispose the collateral and get their money back. Sometimes the surety is forced to pay the loan Bank’s profitability will decline, if again and again, the borrowers do not repay. If more and more borrowers do not pay back to the bank, the bank may collapse.

Text Book Page No. 85

Question 32.

Why do banks ask for security while lending?

Answer:

- Execution of documents by the borrower is an admin ion of debt and an undertaking to repay the amount of dept on demand on as per terms and conditions specified and agreed.

- These are the basics which establish the liability of the borrower and are thus known as the personal security.

Banks ask for security while lending,

- as security to collect or the amount lent in case the borrower fails to repay.

- If one is not able to repay the loan, then bank will put his security in action to get back the amount.

Question 33.

Which is a better source of loans – Banks or Money lenders? Why? (Reflection on contemporary issues and questioning)

Answer:

Bank is a better source of loans because of the following differences.

| Bank | Money lender |

| 1. Adopts standard procedures | 1. Adopts debious standards. Differ from person to person. |

| 2. Interest rates are moderate. | 2. Higher interest rates. |

| 3. Convenient installments. | 3. Inconvenient repayment conditions. |

| 4. Transparent transaction. | 4. Secrecy in transaction and humiliation if the repayment is delayed. |

| 5. Flexibility in repayment schedule. | 5. Rigidity with physical forcing. |

![]()

Question 34.

How is an SHG loan different from an individual loan? (C.U)

Answer:

- A self-help group is a voluntary association of the poor people, especially women who belong to the same socio-economic background.

- The SHG promotes small savings among its members which are kept with a bank.

- Unlike an individual loan, a member of self-help group can take loan from the bank and they need not keep any asset as security.

- They will get loans at lower rate of interest.

- The self-help group will ensure that loans are paid back by its members, Thus it is very easy to get subsidised loan from a bank to a SHG member than an individual loan.

Question 35.

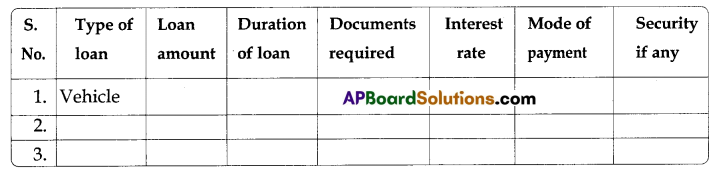

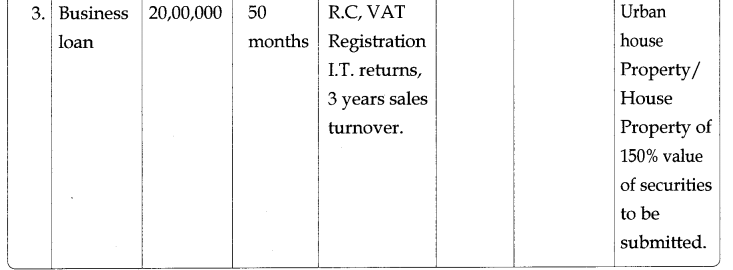

Visit a commercial bank which is near to your locality and fill up the following table (Information skills)

Answer:

Reading the Text (given), understanding and interpretation

Nowadays cheques are widely used for making payments and receiving money. When

you uint to give money to someone, you write a cheque on that person’s name. ken you

want to send money to someone who lines in a different place, you can send a cheque to the person by post.

You can also use your cheque to transfer money electronically into the other person s account through a bank. For business purposes, where money is frequently received and paid, cheques are very important as a medium for transactions.” Read the above paragraph “Nowadays cheques ……… for transactions” and answer the following questions.

Cheques- a convenient way to exchange money “How?

Answer:

These days cheques are widely used for both making payments and receiving money. Not only can you withdraw money from your account with cheques,you can also give cheques to others. When you want to give money to someone, you can write a cheque with that person’s name on it. When you want to send money to someone who lives in a different place, you can write a cheque and send it by post.

For business purposes, where money is frequently received and paid, the cheque is a very important medium for money transactions.

Question 2.

‘Banking is a business activity where money deposits are collected from the public, and these deposits can be transferred from one person to another. Banks also give loans to businessmen. industrialists, farmers, and individuals. Such banks are called Commercial Banks. Let us examine both these aspects.’ Read the above paragraph “Banking is a business both these aspects” and answer the following question.

What are the functions of Banking?

Answer:

- A bank has two major functions one, to accept deposits into different types of accounts, and two, to give loans to people who need them.

- The borrowers return loans along with the interest. It is from this interest that

the bank earns money needed for its work. - The bank keeps depositors’ money safe and pays back cash whenever the depositors want.

Information Skills

Question 1.

“Now’ a day’s computers and internets are used everywhere. In most banks, human and

manual teller counters are being replaced by the Automated Teller Machines (ATM).

Banking activity is being done with computers with internet and other electronic means of communication which is called as electronic banking or Internet banking, Most of the

banks are providing debit card, credit card, net banking, phone banking for their customers to use the banking services online.”

1. What are the cards provided by banks to their customers?

Answer:

Debit cards and Credit cards.

2. Expand ATM?

Answer:

Automated Teller Machine.

3. What is electronic banking?

Answer:

Banking activity is being done with computers. Internet and other electronic means of communication which is called as electronic banking.

![]()

4. Is ‘phone banking’ is an online service?

Answer:

Yes. Phone banking is an online service.

Question 2.

‘In 1606, Amsterdam was a major trading centre in Europe. Here there were 846 types of silver and gold coins recognised by the government that could be accepted for exchange. However, traders were always suspicious of each other everyone would

doubt the purity and weight of these coins. The merchants of Amsterdam got together

and solved this problem in a unique manner.

They created a hank owned by the city. A merchant would take his coins and the bank would weigh raid find out the amount of pure metal and give him reciept for this and open an account. Whenever required Ire could ask for the pure metal. He could also transfer soase of this to another person if required. This was convenient for traders,”.

1. In which year Amsterdam was a major trading center in Europe?

Answer:

1606.

2. How many gold and silver coins are recognized by the government?

Answer:

846

3. What type of solution found by Amsterdam workers about purity and weight of coins?

Answer:

Amsterdam workers created a bank owned by the city.

4. ‘Amsterdam’ is the capital city of which country?

Answer:

Netherlands.

One Mark Questions

Question 1.

Expand A.T.M.

Answer:

Automated Teller Machine.

Question 2.

What is Barter system?

Answer:

The old system of trade where goods were exchanged.

Question 3.

Which was the major trading center in Europe in 1606?

Answer:

Amsterdam.

Question 4.

Name some of various kinds of deposits.

Answer:

Fixed deposit and savings deposit.

Question 5.

Expand S.G.H and write its importance.

Answer:

S.G.H means Self Help Groups. It was formed by women in rural areas for the development.

Question 6.

Name some of the public sector banks.

Answer:

State Bank of India, Indian Bank, Syndicate Bank.

Question 7.

Name some of the private sector banks.

Answer:

ICICI, HÐFC, IDBI, and HSBC.

Question 8.

Which is responsible for printing and distributing money in India?

Answer:

Reserve Bank of India.

![]()

Question 9.

Which banks give loans to businessmen?

Answer:

Commercial Banks.

Question 10.

Who were early bankers in India?

Answer:

Jagatseths of Bengal, Shahs of Patna, Arunji Nathji of Surat and Chethars of Madras.

Objective Type Questions

Question 1.

Any commodity or service can be exchanged for ( )

A) service

B) rice

C) goat

D) money

Answer:

D) money

Question 2.

In very early ages people used as money are ( )

A) cattle

B) sheep

C) grains

D) all the above

Answer:

D) all the above

Question 3.

Which is not attractive metal? ( )

A) Aluminium

B) Bronze

C) Silver

D) Gold

Answer:

B) Bronze

Question 4.

Besant” belonged to ( )

A) Maurvan Period

B) Aryan Period

C) Roman Period

D) Dravidian Period

Answer:

D) Dravidian Period

Question 5.

In 1606 major trading center in Europe is ( )

A) London

B) Amsterdam

C) Paris

D) Rome

Answer:

B) Amsterdam

Question 6.

Which is not a deposit of the bank? ( )

A) Savings Deposit

B) Credit Card

C) Fixed Deposit

D) Current Deposit

Answer:

D) Current Deposit

![]()

Question 7.

‘Pana’ was the standard currency in …………….. period. ( )

A) Mauryan

B) Mughal

C) Aryan

D) Sindhu

Answer:

A) Mauryan

Question 8.

Amsterdam’ was a major trading center in …………… continent. ( )

A) Asia

B) Europe

C) Africa

D) Australia

Answer:

B) Europe

Question 9.

………………. is responsible for printing and circulating the money in India ( )

A) S.B.I.

B) I.D.B.I

C) R.B.I.

D) BOB

Answer:

C) R.B.I.

Question 10.

Find the correct one ( )

A) Jagatseths – Surat

B) Shahs – Bengal

C) Chettiars – Madras

D) Arunji Nathji – Patria

Answer:

A) Jagatseths – Bengal

B) Shahs – Surat

C) Chettiars – Madras

D) Arunji Nathji – Patria

Question 11.

……………………. currency is easy to handle ( )

A) Plastic

B) Polymer

C) A and B

D) None of these

Answer:

Question 12.

Now a days are widely used for making payments. ( )

A) hundreds

B) cheques

C) drafts

D) bonds

Answer:

B) cheques

Question 13.

……………………… Metal was used as a medium of exchange in ancient days ( )

A) Copper

B) Silver

C) Gold

D) All of these

Answer:

D) All of these

Question 14.

…………………… dynasty was a famous for silver coin ( )

A) Moghal

B) hodis

C) Mauryan

D) Satsvahanas

Answer:

C) Mauryan

![]()

Question 15.

Hundis’ means …………………… . ( )

A) paper money

B) plastic money

C) coin money

D) B and C

Answer:

A) paper money