Thoroughly analyzing AP Inter 2nd Year Commerce Model Papers and AP Inter 2nd Year Commerce Question Paper March 2017 helps students identify their strengths and weaknesses.

AP Inter 2nd Year Commerce Question Paper March 2017 with Solutions

Time: 3 Hours

Maximum Marks: 100

Part – I (50 Marks)

Section – A

(2 × 10 = 20)

Note: Answer any two of the following questions in not exceeding 40 lines each:

Question 1.

Discuss the principles of Insurance.

Answer:

Insurance means protection against the risk of loss. It provides compensation against any loss or damage due to the happening of an event. It is a contract between the two parties by which one of them undertakes to indemnify the other person against a loss that may arise due to some events.

Principles of Insurance

1. Insurable Interest:

A person cannot enter into a contract of insurance unless he has an insurable interest in the subject matter of insurance. It is an essential feature of insurance. Without this insurable interest, the contract of insurance will be treated as a wager or gambling contract. A person has an insurable interest in his own life or the life of his wife and a creditor has insurable interest in the debtor.

2. Utmost Good Faith:

Insurance is based on the principle of utmost good faith. It means both the parties of the contract must disclose all the facts relating to the subject matter of insurance. If the insured does not disclose all material facts, the contract between them is void. A person who had suffered from T.B. in the past had not disclosed it in the proposal form. Later on, the insurer comes to know of this fact. He may declare the contract as void.

3. Indemnity:

This is the chief principle of insurance. Indemnity means security against the risk of loss. Under this principle, the insured gets only the loss suffered by the insurer but not profits out of the contract of insurance. The principle of indemnity applies to contracts of fire and marine insurance only, but not to life insurance contracts.

4. Contribution:

Sometimes, goods are insured by more than one company. It is double insurance. The insured can get compensation only for the total loss from all insurance companies put together, but not the total loss from each company. The insurance companies will pay the compensation on a pro-rata basis.

5. Subrogation:

According to this principle, the insurer after compensating the loss of the insured, the right of ownership of the damaged goods is shifted from the insured to the insurance company.

Ex: Mr. X owns a scooter worth ₹ 36,000 and it was insured with an insurance company for full value. Later it was met with an accident and damaged beyond repairs. The insurance company paid the full value as compensation. Then all the rights on the scooter will be passed on to the insurance company.

6. Causa Proxima:

According to this principle, if the nearest and direct factor causes the loss, then only the insurer will have to bear the loss.

Ex: Biscuits in a ship are insured and are destroyed because of the seawater entered through a hole made by the mouse in the bottom of the ship and water entered into the ship. The nearest and direct cause is seawater. Hence, the insurer will have to bear the loss.

7. Mitigation of Loss:

It is the duty of the insured to take necessary steps to minimize the loss that happened due to some event. He should not act carelessly and negligently at the time of loss to the insured property.

![]()

Question 2.

Define Stock Exchanges and explain their functions.

Answer:

According to Securities Contracts Act 1956, a stock exchange is defined as “an association, organization, or body of individuals, whether incorporated or not, established to assist, regulate and controlling business in buying, selling and dealing in securities”.

Functions of Stock Exchange

1. Ready and Continuous Market:

The stock exchange provides a ready and continuous market for securities. The exchange provides a regular market for trading securities.

2. Protection to Investors:

The stock exchange protects the interest of the investors through the enforcement of rules. The rules of the securities contracts (Regulation) Acl, 1956 also govern the dealings on stock exchanges.

3. Provides the information to assess the real worth of the securities:

The value of securities is made properly on the stock exchange. This is made by taking into consideration various factors such as present and future competition in securities, and financial and general economic conditions. The stock exchange publishes the quotation of different securities on the faith of these quotations every investor knows the worth of his holdings at any time.

4. Provides Liquidity of Investment:

The stock exchange is a market for existing securities. This market is continuously available for the conversion of securities into cash and vice-versa. Persons who do not need hard cash can dispose of their securities easily.

5. Helps in Raising Capital:

There is always a demand for additional capital from the existing concerns. The demand is met through the issue of shares. Stock exchange provides a ready market for such shares.

6. Raising Public Debt:

The increasing government’s role in economic development has necessitated the raising of huge amounts and the stock exchange provides a platform for raising public debt.

7. Listing of Securities:

The company that wants its shares to be traded on the stock exchange should list its securities by applying to the stock exchange authorities giving all the details regarding capital structure, management, etc.

8. Encourage Savings Habit:

Stock exchange creates the habit of saving and investing among the members of the public. It leads to the investment of their funds in corporate and government securities. In this way, it contributes to capital formation.

9. Economic Barometer:

The pulse of the market can be known by its stock indices. The prevailing economic conditions affect the share prices. So, stock exchanges can be called as an economic barometer.

10. Improve the Company’s Performance:

In stock exchanges, only those securities are traded which are listed. The stock exchanges exercise influence over the management of the company.

Question 3.

Explain the Redressal Mechanism available to consumers under the Consumer Protection Act 1986.

Answer:

The judicial machinery set up under the Consumer Protection Act (C.P.A) 1986 consists of consumer courts (Forums) at the District, State, and National levels. These are known as the District Forum, State Consumer Disputes Redressal Commission (State Commission), and National Consumer Disputes Redressal Commission (National Commission).

1. District Forum:

This is established by the state government in each of its districts.

- Composition: The district forum consists of a chairman and two other members one of whom shall be a woman. The district forms are headed by the person of the rank of a District Judge.

- Jurisdiction: A written complaint can be filed before the district forum where the value of goods or services and the compensation claimed does not exceed ₹ 20 lakhs.

- Appeal: If a consumer is not satisfied with the decision of the District Forum, he can challenge the same before the state commission, within 30 days of the order.

2. State Commission:

This is established by the state governments in their respective states.

- Composition: The state commission consists of a president and not less than two and not more such number of members as may be prescribed, one of whom shall be a woman. The commission is headed by a person of the rank of High Court Judge.

- Jurisdiction: A written complaint can be filed before the state commission where the value of goods or services and the compensation claimed exceeds ₹ 20 lakhs but does not exceed ₹1 Crore.

- Appeal: In case the aggrieved party is not satisfied with the order of the state commission he can appeal to the National Commission within 30 days of passing the order.

3. National Commission:

The National Commission was constituted in 1988 by the central government. It is the apex body in the three-tier judicial machinery set up by the government for the redressal of consumer grievances. Its office is situated at Janpath Bhawan in New Delhi.

- Composition: It consists of a president and not less than four and not more than such members as may be prescribed, one of whom shall be a woman. The National Commission is headed by a sitting or retired judge of the Supreme Court.

- Jurisdiction: All complaints about those goods or services and compensation whose value is more than ₹ 1 Crore can be filed directly before the National Commission.

- Appeal: An appeal can be filed against the order of the National Commission to the Supreme Court within 30 days from the date of the order passed.

Section – B

(4 × 5 = 20)

Note: Answer any four of the following questions in not exceeding 20 lines each:

Question 4.

Explain any five functions of Entrepreneurs.

Answer:

An entrepreneur performs all the functions necessary right from the generation of an idea and upto setting up an enterprise. The following are the functions of an entrepreneur.

1. Formation of a new producing organization:

The function of an entrepreneur is to rationally combine the factors of production into a new producing organization.

2. Decision making:

An entrepreneur as a decision maker makes various decisions regarding ascertaining the objective of the enterprise, sources of finance, product mix, pricing policies, promotion strategies, appropriate technology, or new equipment.

3. Innovation:

Innovation is the main function of an entrepreneur. Innovation means doing new things or doing things that are already being done in a new way. An entrepreneur puts science and technology to economic use. Innovative entrepreneurs are essential for rapid industrialization and economic development.

4. Management:

An entrepreneur performs managerial functions such as formulation of production plans, providing raw materials, physical facilities, and production facilities, and organizing and managing sales.

5. Risk bearing:

An entrepreneur undertakes the responsibility for loss that may arise due to unforeseen contingencies in the future. He guarantees interest to creditors, wages to labor, and rent to landholders.

6. Supervision, Control and Direction:

J.S.Mill mentions superintendence, control, and direction as entrepreneurial functions. Supervision involves assembling the means, turning maximum output at minimum cost, and supervising the work. The entrepreneur has to regulate and control the flow of goods, the use of finance and machinery. He also has to control and direct the activities of the employees.

7. Planning:

Planning is the first step in the direction of setting up an enterprise. The entrepreneur prepares a scheme for the proposed project in a formal systematic approach. The authorities, if satisfied fully with the requirements, grant legal sanction for the project.

According to Kilby, an entrepreneur performs the following major four functions.

- Exchange functions

- Administrative function

- Management and control functions

- Technological functions

![]()

Question 5.

Explain the relationship between Entrepreneur and Entrepreneurship.

Answer:

Entrepreneur is the person, entrepreneurship is the process and enterprise is the creation of the person and output of the process. Though the term entrepreneur is often used interchangeably with entrepreneurship, they are conceptually different. The relationship between the two is just like the two sides of the same coin. The following points highlight the relationship between entrepreneurs and entrepreneurship.

- An entrepreneur is a person: Entrepreneurship is a process.

- Entrepreneur is organizer: Entrepreneurship is the organization.

- Entrepreneur is an innovator: Entrepreneurship is innovation.

- An entrepreneur is a risk bearer: Entrepreneurship is risk-bearing.

- Entrepreneur is motivator: Entrepreneurship is motivation.

- Entrepreneur is the creator: Entrepreneurship is the creation.

- Entrepreneur is visualizer: Entrepreneurship is vision.

- Entrepreneur is the leader: Entrepreneurship is leadership.

- Entrepreneur is imitator: Entrepreneurship is imitation.

Question 6.

What is International Trade? Explain various types of International Trade.

Answer:

The trade that takes place between nations is international trade. The exchange of goods and services between the traders of two nations is international trade. International trade involves the exchange of not only goods but also currencies between nations. International trade is the process of transferring goods produced by one country for the consumers in another country. The international trade can be divided into three types. They are:

- Import trade

- Export trade

- Entrepot trade

1. Import trade:

The term import is derived from the conceptual meaning as to bring in goods and services into the port city of the country. When purchases are made from another country, goods are said to be imported from that country to the buyer’s country. For example, Japan has the most modern technology for producing electronic products cheaply, so we import these products into our country.

2. Export trade:

The term export is derived from the conceptual meaning as to ship goods and services out of the port of the country. When goods are sold to a trader in another country, goods are exported to that country by the seller’s country. For example, India is a major exporter of tea because of the fertile land in Assam and Darjeeling, so we export tea products to other countries.

3. Entrepot trade:

When goods are imported into a country, not for consumption in that country, but for exporting them to a third country, it is known as ‘Entrepot trade’.

e.g.: India importing wheat from the U.S. and exporting the same to Sri Lanka.

Question 7.

Explain the main advantages of SEZs.

Answer:

The following major benefits can be attributed to Special Economic Zones (SEZ).

- Employment generation: Special Economic Zones are considered to be highly effective tools for job creation.

- Economic development: India can be made as a transformed economy if special economic zones are implemented properly because special economic zones are engines for economic development.

- Growth of labor-intensive manufacturing industry: The establishment of special economic zones may lead to faster growth of the labor-intensive manufacturing and service industry in the country.

- Balanced regional development: Special economic zones are beautifully crafted initiatives for achieving balanced regional development.

- Capacity building: Special economic zones are necessary for stronger capacity building.

- Export promotion: Special economic zones induce dynamism in the export performance of a country by eliminating

- Distortions resulting from tariffs and other trade barriers.

- The corporate tax system and excessive bureaucracy.

Question 8.

Explain the kinds of roads in India.

Answer:

Indian roads are classified into three types – National highways, State highways, District and Rural Roads.

(a) National Highway:

These roads are meant for interstate transport and the movement of defensemen. These also connect the state capitals and major cities. The National Highway Authority of India (NHAT) has the responsibility for the development, maintenance, and operation of national highways. The national highways have a road length of about 65,000 kms or 2% of the length of the total road system but they carry nearly 40% of goods and passenger traffic.

(b) State Highways:

These are constructed and maintained by the state government. They connect the state capital with district headquarters and other important towns. State highways constitute 4% of the total road length in the country.

(c) District Roads:

These roads are the connecting link between the district headquarters and the other important roads of the district. They account for 14 % of the total road length of the country.

(d) Rural Roads:

These roads provide a link to the rural areas. There are about 80% of the total length in India is categorized as rural roads.

(e) Boarder Roads:

These roads are in the northern and northern-eastern boundary of the country. The Boarder Road organization constructs and maintains border roads. They construct roads in high-altitude areas and undertake snow clearance.

(f) International Highways:

They are meant to promote a harmonious relationship with the neighboring countries by providing effective links with India.

![]()

Question 9.

Distinguish between primary and secondary markets.

Answer:

The following are the differences between the primary market and the secondary market.

| Primary Market (New Issue Market) |

Secondary Market (Stock Exchange) |

| 1. There is the sale of securities to investors by new companies or new issues by existing companies. | 1. There is the trading of existing shares only. |

| 2. Securities are sold by the company to the investor directly or through an intermediary. | 2. Ownership of existing securities is exchanged between investors. The company is not involved at all. |

| 3. The flow of funds is from savers to investors i.e. The primary market directly promotes capital formation. | 3. Enhances encashment (liquidity) of shares i.e. The secondary market indirectly promotes capital formation. |

| 4. Only the buying of securities takes place in the primary market. Securities cannot be sold there. | 4. Both the buying and selling of securities can take place on the stock exchange. |

| 5. Prices of securities are determined and decided by the management of the company. | 5. Prices are determined by the demand and supply of the security. |

| 6. There is no fixed geographical location. | 6. Located at specified places. |

Section – C

(5 × 2 = 10)

Note: Answer any five of the following questions in not exceeding 5 lines each:

Question 10.

Explain any one characteristic of an entrepreneur.

Answer:

The following are some of the important characteristics that every successful entrepreneur must possess.

1. Innovation:

Innovation is an important characteristic of an entrepreneur in modern business. The entrepreneur makes arrangements for introducing innovations that help in increasing production on the one hand and reducing costs on the other.

2. Risk-taking:

Risk-taking is another feature of an entrepreneur. He has to pay for all the other factors of production in advance. There are chances that he may be rewarded with a handsome profit or he may suffer a heavy loss. Therefore, the risk-bearing is the final responsibility of an entrepreneur.

Question 11.

Write two types of entrepreneurs.

Answer:

Entrepreneurs are classified into four types. They are:

- Innovating Entrepreneurs

- Initiative Entrepreneurs

- Fabian Entrepreneurs

- Drone Entrepreneurs

Question 12.

Define Wholesaler.

Answer:

Wholesale trade means buying and selling the goods in relatively large quantities or in bulk and the traders who engage in the wholesale trade are called wholesalers. A wholesaler buys goods in large quantities from manufacturers and sells them in small lots to retailers or industrial users. A wholesaler is the first intermediary and serves as a link between producers and retailers.

Question 13.

Define Mobile Banking.

Answer:

This type of service is provided free of cost to all the customers. Under this, the customer can access his bank account on the mobile screen for services such as checking the balance, ordering a demand draft, stopping payment, or viewing the last five transactions. To avail of this facility the customer is required to have a mobile phone with a WAN facility.

Question 14.

Define Pipelines.

Answer:

Pipeline transport is used for the movement of liquid commodities. Crude oil, natural gas, and other petroleum products are transported through pipelines. Pipelines offer continuous movement at a relatively low cost. The fuel is efficient, dependable, and involves less losses and damage. It can be operated all around the clock (24 × 7).

Question 15.

Dematerialization.

Answer:

It is a process where securities held by investors in the physical form are canceled and the investor is given an electronic entry so that he can hold it as an electronic balance, in an account. This process of holding securities in an electronic form is called dematerialization.

Question 16.

SENSEX

Answer:

BSE Sensex is called BSE-30. Since BSE has been the leading exchange of the Indian secondary market, SENSEX is an important indicator of the Indian Stock Market. SENSEX which was launched in 1986 is made up of 30 of the most actively traded stocks in the market.

![]()

Question 17.

Give the meaning of Consumer.

Answer:

Under the Consumer Protection Act 1986, The word consumer has been defined separately for goods and services. For goods, a consumer buys any goods for consideration and any user of such goods other than the person who buys it, provided such use is made with the approval of the buyer. For services, a consumer has any service or services for consideration and any beneficiary of such services provided the service is availed with the approval of the person who had hired the service for consideration.

Part – II (50 Marks)

Section – D

(1 × 20 = 20)

Note: Answer the following question.

Question 18.

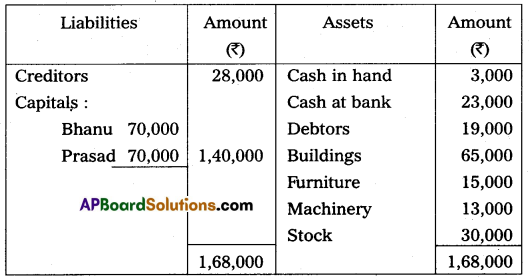

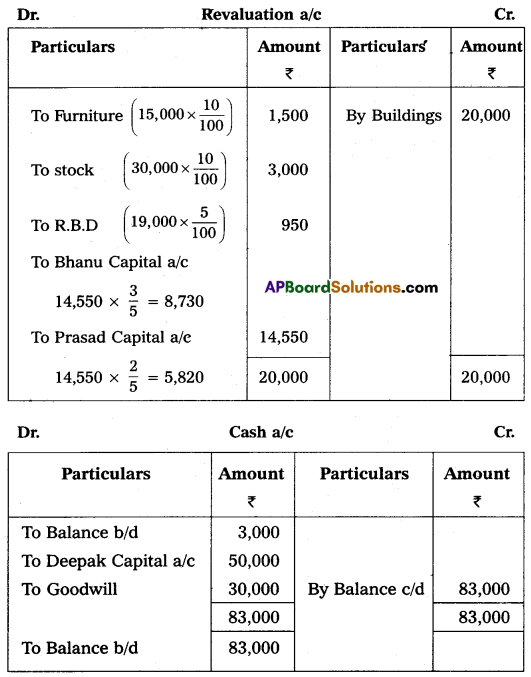

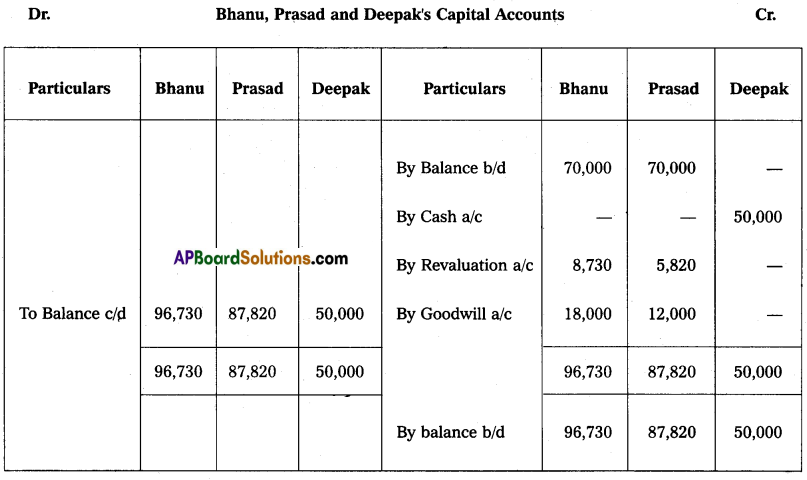

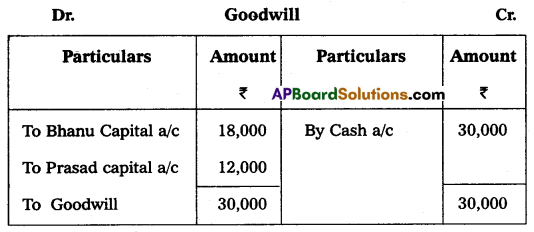

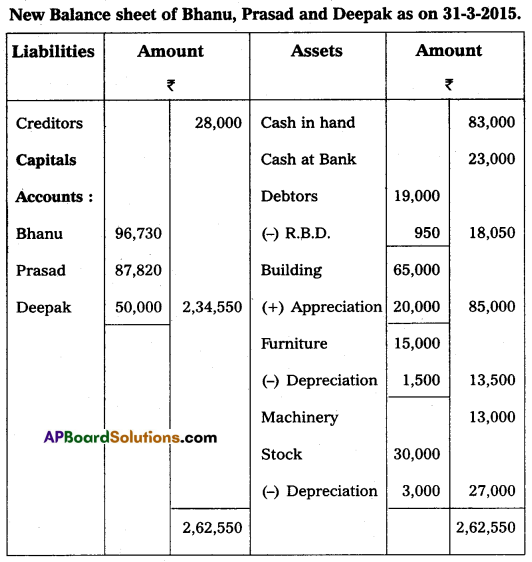

Bhanu and Prasad are partners sharing profits and losses in the ratio of 3 : 2 respectively. Their Balance Sheet as of March 31, 2015, was as under:

On that date, they admit Deepak into partnership for 1/3 share in future profit on the following terms:

(i) Furniture and stock are to be depreciated by 10%.

(ii) The building is appreciated by ₹ 20,000.

(iii) A 5% provision is to be created by debtors for doubtful debts.

(iv) Deepak is to bring in ₹ 50,000 as his capital and ₹ 30,000 as goodwill.

Make necessary Ledger Account and Balance Sheet of the new firm.

Answer:

Section – E

(1 × 10 = 10)

Note: Answer any one of the following questions.

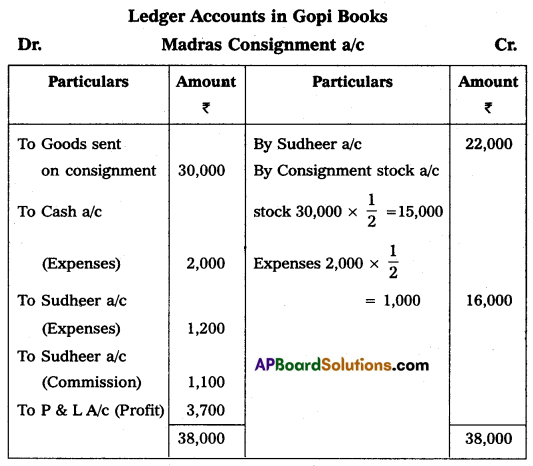

Question 19.

On 1st January 2012, Gopi of Hyderabad consigned goods valued at ₹ 30,000 to Sudheer of Madras. Gopi paid cartage and other expenses ₹ 2,000. On 1st April 2012, Sudheer sent the account sales with the following information:

(a) 50% of the goods sold for ₹ 22,000.

(b) Sudheer incurred expenses amounting to ₹ 1,200.

(c) Sudheer is entitled to receive commission @ 5% on sales. A bank draft was enclosed for the balance due. Prepare the necessary Ledger Accounts in the books of Gopi.

Answer:

Question 20.

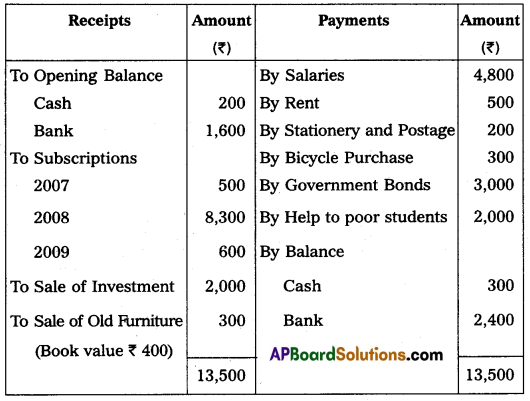

From the following Receipts and Payments a/c. of Balaji Trust, prepare Income and Expenditure a/c. for the year ending 31st December 2008.

Adjustments:

1. Subscriptions for the year 2008 still receivable – ₹ 700.

2. Interest due on Government Bonds – ₹ 100

3. Rent Outstanding – ₹ 60

Answer:

Section – F

(2 × 5 = 10)

Note: Answer any two of the following questions.

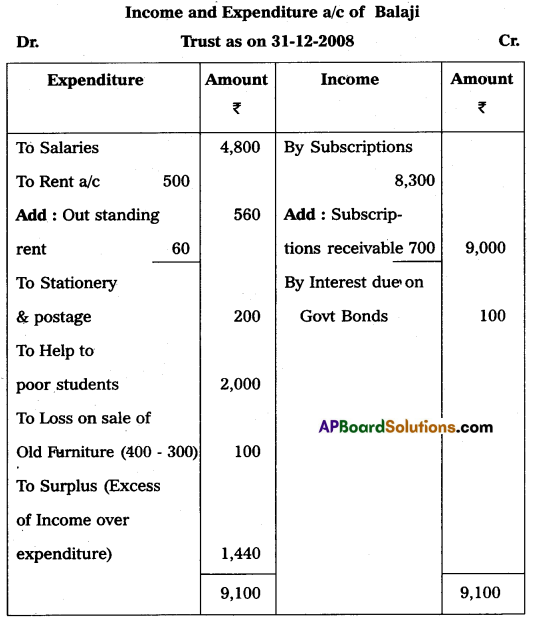

Question 21.

Sandhya sold goods for ₹ 14,000 to Rajeswari on 1st March 2014 and drew upon her a bill of exchange payable after 2 months. Rajeswari accepted the bill and handed over the same to Sandhya. Sandhya immediately discounted the bill with her bank @ 12%p.a., on the due date Rajeswari met her acceptance. Pass necessary Journal Entries in the books of Sandhya.

Answer:

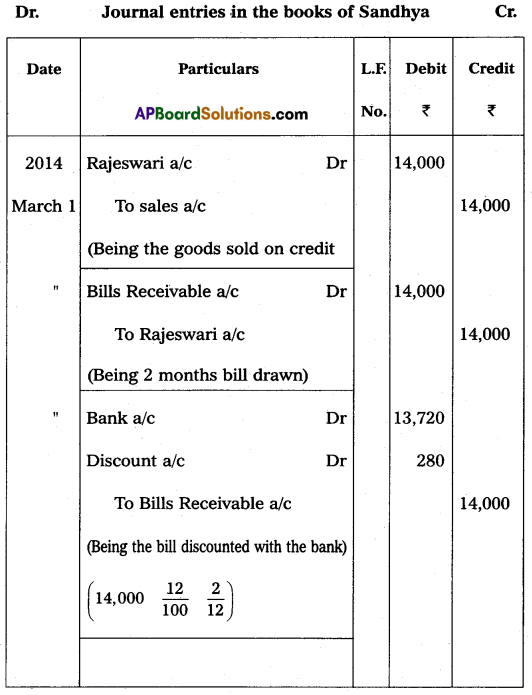

Question 22.

Suneetha traders purchased a secondhand machine for ₹ 72,000 on 1st January 2011 and spent ₹ 8,000 on its repairs and installed the same. Depreciation is written off at 10% p.a on the straight-line method. On 30th June, 2013 the machine was sold for ₹ 50,000. Prepare Machinery Account assuming that the accounts are closed on 31st December every year.

Answer:

Question 23.

Explain the types of issue of Shares.

Answer:

When a company issues its shares at their face value, the shares are known to have been issued at par.

- Example 1: The face value of the share is ₹ 100 and it is issued for ₹ 100. When a company issues its, shares at a price higher than the face value, it is said to have been issued at a premium. The money collected more than the face value is called the premium.

- Example 2: If the face value of a share is ₹ 100 it is issued for ₹ 110. When the company issues its shares at a price less than the face value, it is said to be an issue at a discount. The difference between the face value and issue price is called ‘Discount’.

- Example 3: If the face value of the share is ₹ 100 and it is issued at ₹ 90.

![]()

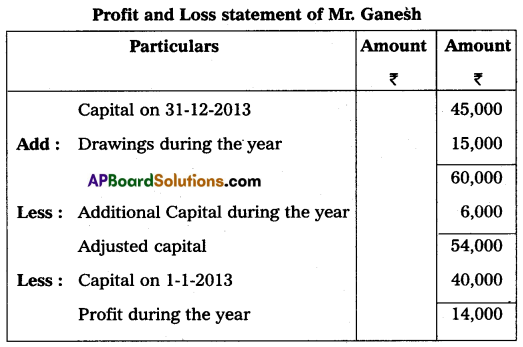

Question 24.

Mr. Ganesh maintains his Books on the single-entry Entry Method. He gives you the following information.

Capital on 01-01-2013 – ₹ 40,000

Drawings during the year – ₹ 15,000

Capital on 31-12-2013 – ₹ 45,000

Fresh capital during the year – ₹ 6,000

Prepare the Statement of Profit or Loss.

Answer:

Section – G

(5 × 2 = 10)

Note: Answer any five of the following questions.

Question 25.

What do you mean by Noting Charges?

Answer:

To obtain the proof of dishonor, the bill is re-sent to the drawee through a legally authorized person called a notary public. Notary public charges a small fee for this service known as noting charges. Noting charges are paid to the notary public first by the holder of the bill but are ultimately recovered from the drawee, because he is the responsible person for the dishonor.

Question 26.

Explain any two causes of Depreciation.

Answer:

The main causes of depreciation are:

- Wear and tear

- Physical forces

- Expiration of legal rights

- Obsolescence

- Accidents

- Depletion

Question 27.

What is Account Sales?

Answer:

Account sales is a document sent by the consignee to the consignor showing the details of the gross sale proceeds, the various expenses incurred by him, the commission amount due, any advance payment to the consignor which is deducted from the total amount due, and the net amount payable is shown.

Question 28.

What do you mean by Revenue Expenditure? Give examples.

Answer:

Any amount spent to earn revenue or profits is called revenue expenditure. These expenses are recurring in nature. Its useful life also would be less them one year.

e.g. salaries, rent, wages, insurance, etc.

Question 29.

M and N are partners sharing profits and losses in the ratio 1 : 2. They have decided to admit ‘O’ by giving him 1/4 share in future profits. Calculate the new profits sharing ratio.

Answer:

If we assume the total share is 1

The new partners share is a \(\frac{1}{4}\)

Remaining share = 1 – \(\frac{1}{4}\) = \(\frac{3}{4}\)

Old Ratio = 1 : 2

New Share = Rest of the Share × Old Ratio

M new share = \(\frac{3}{4} \times \frac{1}{3}=\frac{3}{12}\)

N new share = \(\frac{3}{4} \times \frac{2}{3}=\frac{6}{12}\)

O’s Share \(\frac{1}{4}\) or \(\frac{3}{12}\)

New Share = 1 : 2 : 1

Question 30.

What is Authorized Capital?

Answer:

Authorized capital is the amount of share capital that a company is authorized to issue to the public by the memorandum of association. It is also called Nominal or Registered capital.

![]()

Question 31.

Ready to use Accounting Software.

Answer:

Ready-to-use accounting software is suited to organizations running small/conventional businesses when the frequency or volume of accounting transactions is very low. This is because the cost of installation is generally low and several users are limited.

Question 32.

Write any two differences between a Double Entry System and a Single Entry System.

Answer:

| Basis | Double Entry System | Single Entry System |

| 1. Type | It is a perfect and complete system of bookkeeping. | It is an incomplete system and a crude method. |

| 2. Nature | This system is scientific and follows certain accounting principles. | This system is unscientific and does not follow accounting principles. |