Collaborative study sessions centered around AP Inter 1st Year Commerce Model Papers and AP Inter 1st Year Commerce Question Paper May 2017 can enhance peer learning.

AP Inter 1st Year Commerce Question Paper May 2017

Time : 3 Hours

Max. Marks : 100

Part – I (50 Marks)

Section – A

Answer any TWO of the following questions in not exceeding 40 lines each.

Question 1.

Define Sole Proprietorship. Discuss its merits and demerits.

Answer:

In this organisation only one individual is at the helm of all affairs of business. He makes all the investments. He bears all risks and takes all profits. He manages and controls the business himself. The business is run with the help of his family members or paid employees. His liability is unlimited. The sole trader is the sole organiser, manager, controller and master of his business.

Kimball and Kimball defines “Sole Proprietorship is a form of business where the individual proprietor is the supreme judge of all matters pertaining to his business”.

Merits :

- Easy to form : It is very easy and simple to form a sole trading business. The capital required is small. There are no legal formalities for starting the business.

- Prompt decisions and quick action : The sole trader is the sole dictator of his business. There is no need to consult any body while taking decisions. So, decisions can be taken quickly.

- Incentive to work hard: The sole trader takes all the profits. There is a direct connection between the effort and reward. So, it is an incentive for him to work hard. He manages the business to the best of his ability.

- Flexibility in operation: Changes in the business are necessary. The sole trading concern is dynamic in its nature. The na-ture of the business can be easily changed according to charging market conditions.

- Business secrecy : Since the whole business is handled by the proprietor, his business secrets are known to him only. He need not publish annual accounts and there is no need to disclose the information to outsiders. So, he can maintain business secrets.

- Contact with customers : It is easy to maintain personal contact with the customers. He can easily know their tastes, likes and dislikes and adjust his operations accordingly. This results in increase of sales.

Demerits :

- Limited resources : The resources of sole trader are limited. He has only two sources of securing capital, personal savings and borrowing on personal security. Hence, he can raise very limited amount of capital.

- Instability : It has no separate legal status. The business and the owner are inseparable from one another. The business comes to an end on the insolvency, insanity or death of the sole trader.

- Unlimited liability: The liability of a sole trader is unlimited. The creditors can recover the loan amounts not only from the business assets but also from his private property.

- Not suitable for large scale operations : The resources are limited. Therefore, it is suitable only for small business and not large scale operations.

- Limited managerial skill: The managerial ability is limited. A person may not be an expert in all matters. Sometimes, wrong decisions may be taken.

Question 2.

What is Memorandum of Association ? Explain its clauses.

Answer:

The Memorandum of Association is the most important document of the company. It is to be filed with the Registrar for obtaining the certificate of incorporation. It is the charter of the company. It forms the foundation on which the super structure of the company is based. It establishes the relationship between the company and the outside world. The contents of the Memorandum cannot be altered at the option of directors or even the shareholders. It is to be altered only with the central governments approval and court approval in many cases.

The Memorandum has to be divided into paragraphs, con-secutively numbered and has to be printed. It should be signed by seven members in the case of public company and by two mem-bers in the case of Private company.

Memorandum of Association contains the following clauses.

1) Name clause : In this clause, the name of the company should be stated. The company is free to adopt any name it likes. But it should not resemble the name of another registered com-pany. It should not any words pertaining to Government or local government, such as royal, crown, state etc. The name of the company must end with the word ‘Limited’ if it is a public company or with the words ‘Private Limited’ if it is a private company.

2) Situation clause : The place and the state in which the registered office is to be situated must be mentioned in this clause.

3) Objects clause : This is the most important Clause of the Memorandum. This gives out the various objects for which the company is formed. The objects of the company must be legal and be very clearly defined. A company has power to carry on only those types of business which are included in the objects clause. Any action beyond the express powers of the company is ultravirus

i. e., beyond the scope of the memorandum. Therefore, it should be carefully drafted.

4) Liability clause : This clause clearly states that the liabil-ity of members is limited to the extent of the face value of the shares purchased by them.

5) Capital clause : The amount of capital required by the company is stated in this clause. This is called authorised or nominal or registered capital. This capital is divided into small units called as shares. The company must mention the number and kinds of shares and the value of each share.

6) Association and subscription clause: This clause contains the names of the persons who signed in the memorandum. The memorandum must be signed by atleast seven persons in case of public company and atleast two persons in the case of private company. Each subscriber must take atleast one share in the company. The subscribers declare that they agree to incorporate the company and agree to take the shares stated against their name. The signatures of the subscribers are attested by atleast one witness each. The addresses and occupations of subscribers and the witnesses are also given.

![]()

Question 3.

What is Business Finance ? Explain its need and significance in the Business Organization.

Answer:

The requirement of funds by business firm to accomplish its various activities is called Business Finance. R.C. Osborn defines business finance as “The process of acquiring and utilising funds by business”.

B.O. Wheeler defined business finance as follows: “Finance is that business activity which is concerned with the acquisition and conservation of capital funds in meeting the financial needs and overall objectives of a business enterprise.”

Need for business finance :

1. To start a new business : Money is needed to start a business and to procure fixed assets like buildings, plant and machinery, furniture and fixtures etc., working capital is required for holding current assets such as stock of materials, transportation expenses etc. The amount of finance to be procured depends on the type of business, nature of business and usage of technology.

2. To expand the business : Huge amount of funds are required for purchasing sophisticated machinery and for employing technically skilled labour. The quality of the product can be improved and cost per unit can be reduced by adopting new technology.

3. To develop and market new products : Business needs money to spend on developing and marketing new products. Invention and innovation of products should be given much priority to sustain in the market. Marketing research needs more funds.

4. To enter new markets : Creation of new markets leads attracting new customers. Business spend money on advertisement and retail shops in busy areas.

5. To take over another business : Business needs money to overcome competition or to get strengthened. An enterprise may decide to take over another business.

6. To move to new premises: A business unit may be forced to shift the business to new premises according to directions of the government. In such case, finance is needed for expenses like transport, packaging, installation of machinery etc.

7. Pay for the day-to-day running of the business : A business enterprise needs money to meet the day – to – day expenses like wages, taxes advertisement, rent etc. If also needs to meet liabilities like repayment of loan installments creditors etc.

Section – B (4 × 5 = 20)

Answer any four of the following questions in not exceeding 20 lines each :

Question 4.

Explain the classification of Industries.

Answer:

Classification or types of industries : The industries may be classified as follows.

1) Primary industry : Primary industry is concerned with production of goods with the help of nature. It is nature-oriented industry, which requires very little human effort. E.g. : Agricul-ture, Farming, Fishing, Horticulture etc.

2) Genetic industry : Genetic industry is related to the re-producing and multiplying of certain species of animals and plants with the object of earning profits from their sale. E.g. : Nurseries, cattle breeding poultry, fish hatcheries etc.

3) Extractive industry : It is engaged in raising some form of wealth from the soil, climate, air, water or from beneath the surface of the earth. Generally the products of extractive industries comes in raw farm and they are used by manufacturing and construction industries for producing finished products. E.g.: Mining, coal, mineral, iron ore, oil industry, extraction of timber and rubber from forests.

4) Construction industry : The industry is engaged in the creation of infrastructure for the smooth development of the economy. It is concerned with the construction, erection or fabri-cation of products. These industries are engaged in the construc-tion of buildings, roads, dams, bridges and canals.

5) Manufacturing industry: This industry is engaged in the conversion of raw material into semifinished or finished goods. This industry creates form utility in goods by making them suit-able for human uses. E.g. : Cement industry, Sugar industry, Cot-ton textile industry, Iron and steel industry, Fertiliser industry etc.

6) Service industry : In modem times, service sector plays an important role in the development of the nation and therefore it is named as service industry. These are engaged in the provision of essential services to the community. E.g. : Banking, transport, insurance etc.

Question 5.

Write about any five types of Partners.

Answer:

There are different types of partners in a partnership firm. They are :

1) Active Partner: An active partner is one who takes active part in the day-to-day working of the business. He may act in various capacities as manager, advisor and organisor. He is also known as working partner or managing partner.

2) Sleeping Partner: A sleeping partner or dormant partner is one who contributes capital, share profits and losses but does not take part in the working of the concern. He is not known to the public. So, he is also called as secret partner.

3) Nominal Partner : A nominal partner is one who lends his name to the firm. He does neither contributes any capital nor does he shares profits of the business. They do not participate in the management of the business. But they are liable to third parties for all acts of firm.

4) Partner by Estoppel: When a person is not a partner, but posses himself as partner, either by words or in writing or by his acts, he is called partner by estoppel. He neither contribute capital nor share the profits, but liable to third parties like any other partner.

5) Partner by Holding out: If a person is considered by an outsider as partner in the firm and does not disclaim it, he is called partner by holding out. He neither contributes the capital to the firm nor participates in profits and losses. But he is liable to third parties for the debts of the firm.

Question 6.

Explain the differences between Shares and Debentures.

Answer:

The following are the differences between shares and Debentures.

| Shares | Debentures |

| 1. A share is a part of owned capital. | 1. A debenture is an acknowledge of debt. |

| 2. Shareholders are paid dividend on the shares held by them. | 2. Debentureholders are paid interest on debentures. |

| 3. The rate of dividend depends upon the amount of divisible profits and policy of the company. | 3. A fixed rate of interest is paid on debentures irrespective of profit or loss. |

| 4. Dividend on shares is a charge against profit and loss appropriation account. | 4. Interest on debentures is a charge against profit and loss account. |

| 5. Shareholders have voting rights. They have control over the management of the company. | 5. Debenture holders are only creditors of the company. They cannot participate in management. |

| 6. Shares are not redeemable except redeemable preference shares) during the life time of the company. | 6. The debentures are redeemed after a certain period. |

| 7. At the time of liquidation of the company, share capital is payable after meeting all outside liabilities. | 7. Debentures are payable in priority over share capital. |

Question 7.

Write about nature of Business Finance.

Answer:

The requirement of funds by business firm to accomplish its various activities is called business finance.

R.C. Osborn defines business finance as “The process of acquiring and utilising funds by business”.

Nature of Business Finance :

- It includes all type of funds used in business

E.g.: Owners funds and borrowed funds. - It is necessary for all types of business.

- It is required for manufacturing as well as for trading business.

- It depends on the size of business

E.g.: small size less finance is required and for large scale business more finance is required. - The amount of business finance varies from time to time.

Question 8.

Briefly explain the registration process of MSMEs.

Answer:

The following are the registration requirements under MSMED Act, 2006.

As per the act, any person intend to establish a micro or small enterprise may do so at his discretion.

Any person intending to establish a medium enterprise, engaged in providing or rendering of services, may do so at his discretion.

Any person intending to establish a medium enterprise engaged in the manufacture or production of goods pertaining to any industry specified in the First Schedule to the industries (Development and Regulation) Act, 1951, shall file the memorandum of medium enterprise with authority specified by the State Government or the Central Government.

![]()

Question 9.

Explain the scope of E-Business.

Answer:

The scope of E-Business can be studied in the following areas:

- E-Business with in the organisation

- Business – to – Business

- Business – to – Customer

- Customer – to – Customer

- Customer – to – Business

In second and third category there is exchange of goods and services from one business to another business and business to customer. In fourth and fifth category the transactions are facilitated by one customer to another customer and customer to business through internet.

Now-a-days one can buy products online through some sites like Flipkart, Jabong and Amazon. In the age of E-Commerce, almost everything from gym equipment to laptops are available online. Even people are buying services online. Business consul-tants, lawyers, doctors offering their services to the potential clients online.

E-business is a super set of business cases . It includes E- Trading, E-Engineering,

E-Franchising, E-Mailing, E-Operational resource management.

Section – C

(5 × 2 = 10)

Answer any five of the following questions in not exceeding 5 lines each :

Question 10.

What is meant by Business ?

Answer:

The word business literally means a state of being busy. In the words of Haney “Business may be defined as human activities directed towards providing or acquiring wealth through buying and selling of goods”. According to Wheeler “Business is an institution organised and operated to provide goods and services to the society under the incentive of private gain”.

Question 11.

What do you mean by Commerce ?

Answer:

Commerce is concerned with exchange of goods. It includes all those activities which are related to transfer of goods from the places of production to the ultimate consumer. Commerce enables all these processes which help to break the barriers between producers and consumers. It is such of those processes which are engaged in the removal of hindrances of persons, place and time in exchange.

Question 12.

Who is Kartha ?

Answer:

The senior most male member of the family is Karta. All the affairs of the Joint Hindu Family are controlled and managed by one person. He is known as Karta or Manager. The liability of the Karta is unlimited. He acts on behalf of the other members of the family. He is not accountable to anyone. He is the great master of the grandshow.

Question 13.

What is Partnership Deed ?

Answer:

Partnership deed forms the basis of partnership. It includes all important clauses like nature of business, contribution of capital, share of profits etc. Partnership deed is a document contains all matters according to which mutual rights, duties and liabilities of the partners in the conduct of management of the affairs of the firm is determined.

Question 14.

Define Company.

Answer:

According to Lord Justice Lindley “Joint Stock Company is a voluntary association or organisation of many persons who contribute money or moneys worth to a common stock and employ it in some trade and who share profit or loss arising therefrom”.

Section 566 Companies Act, defines a company is an artificial person created by law with prepetual succession and a common seal.

Question 15.

What is meant by Certificate of Commencement of Business ?

Answer:

A private limited company can start its business immediately after incorporation. But a public company has to wait till it gets the certificate of commencement of business. In order to obtain this certificate, the company has to submit the following :

- The prospectus or statement in lieu of prospect is.

- The shares of allotted to the extent of minimum subscription.

- The directors have paid application and allotment amount towards qualification shares.

- A statutory declaration by the secretary or director stat-ing that all the formalities are complied with.

The Registrar will then scrutinise all the documents and if satisfied issues “Certificate of commencement of business”.

Question 16.

Fixed Capital.

Answer:

The capital which is used to acquire fixed assets such land and buildings and plant and machinery etc., is called fixed capital. Capital utilised by the business for the long term requirements is called fixed or block capital. The amount of fixed capital required depends on the size and nature of business.

Question 17.

Define MNC.

Answer:

According to International Labour Organisation report, Multi National Corporation refers to an enterprise whose managerial head quarters are located in one country, while it carried out operations in number of other countries as well. According to Prof. Vernon MNC is defined as ‘a cluster of operations of diverse of nationality joined together by common management strategy’.

Part – II (50 Marks)

Section – D (1 × 20 = 20)

Answer the following question :

Question 18.

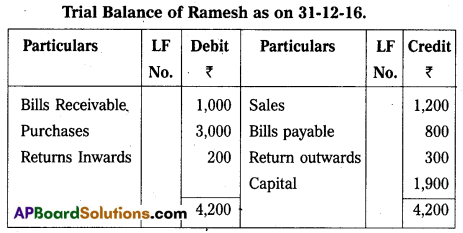

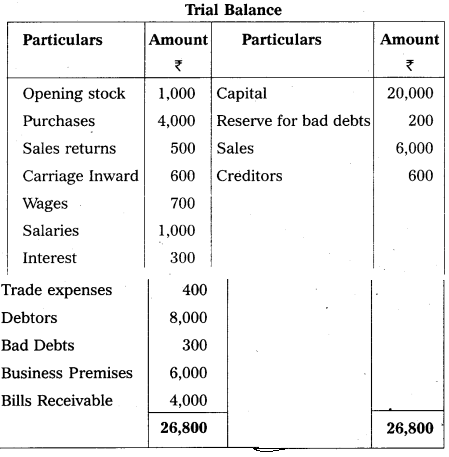

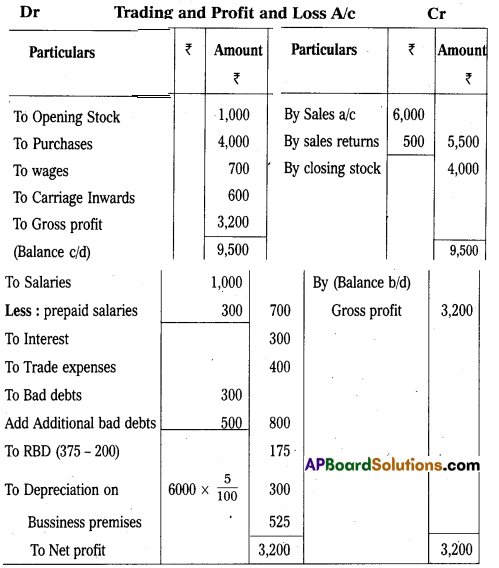

From the following Trial Balance, prepare the Final Accounts :

Additional Informations :

(1) Closing Stock : ₹ 4,000

(2) Prepaid Salaries : ₹ 300

(3) Bad Debts : ₹ 500

(4) Reserve for bad debts : 5%

(5) Depreciation on Premises 5%

Answer:

Balance Sheet

Section – E

(1 × 10 = 10)

Answer any one of the following questions :

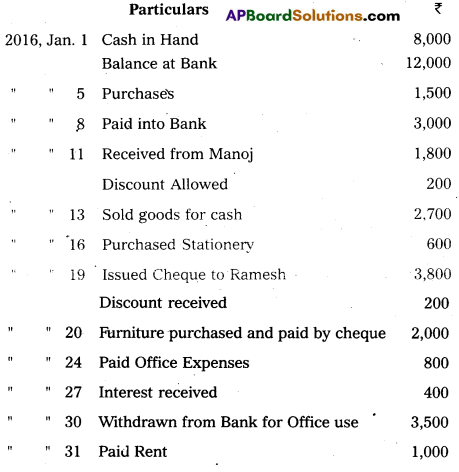

Question 19.

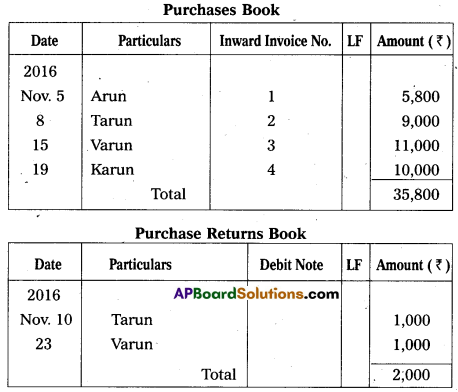

Prepare a Three-Column Cash Book from the following :

Answer:

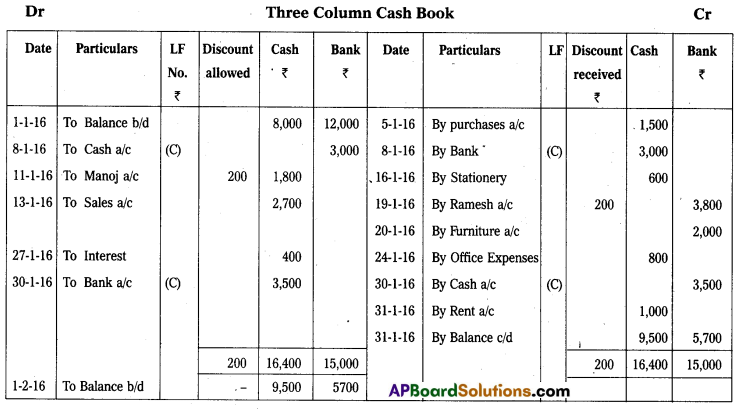

Question 20.

On 30th April, 2016, the pass book of Mr. Vijaykumar traders showed a credit balance of ₹ 45,000.

(a) Cheques amounting to ₹ 10,500 were deposited in the bank but only cheques of ₹ 4,500 were cleared upto 30th April.

(b) Cheques amounting to ₹ 15,000 were issued but cheques worth ₹ 5,100 not been presented for payment in the bank upto 30th April.

(c) In the pass book there was a credit of ₹ 300 for interest on Investments and debit of ₹ 75 for bank charges.

Prepare a bank reconciliation statement showing the balance as per cash book.

Answer:

Bank Reconciliation Statement of Mr. Vijay Kumar Traders as on 30-04-2016.

Section – F

(2 × 5 = 10)

Answer any two of the following questions :

Question 21.

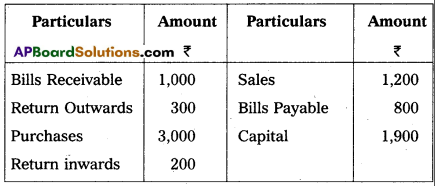

Explain different types of Accounts along with their debit, credit rules.

Answer:

Accounts are broadly divided into three types.

- Personal Accounts : These accounts relate to persons or firms. Ex.: Rama’s a/c, Gopal’s a/c, Andhra Bank a/c. The rule in personal accounts is “Debit the receiver and credit the giver”.

- Real Accounts : These accounts relate to assets and properties. Ex.: Cash a/c, Stock a/c, Buildings a/c.

The rule in real accounts is “Debit what comes in and credit what goes out”. - Nominal Accounts : These accounts relate to expenses losses, incomes and gains. Ex. : Salary a/c, Rent a/c, Interest received a/c. The rule in nominal accounts is “Debit all expenses and losses and credit all incomes and gains”.

![]()

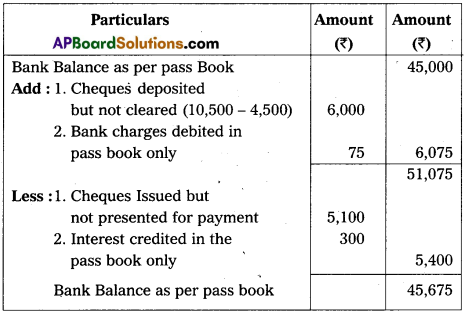

Question 22.

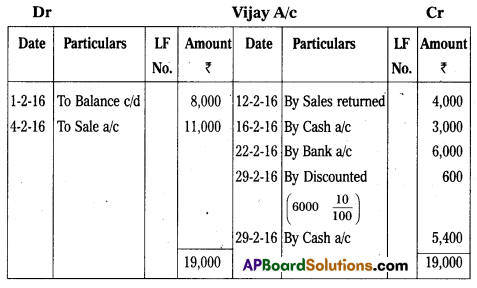

Prepare Vijay Account from the following :

Answer:

Question 23.

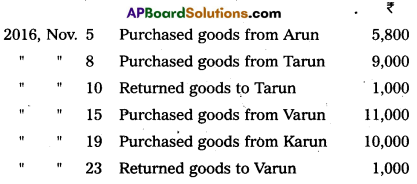

Enter the following transactions in proper Subsidiary books.

Answer:

Question 24.

Explain the various types of errors.

Answer:

Errors are classified into two types.

1) Error of principle

2) Clerical errors

1) Error of principle: Error of principle occurs where errors are made due to defective knowledge of accounting principles. These may arise, when distinction is not made between capital and revenue nature items.

2) Clerical errors : When mistake is committed while recording them in the books of original entry or posting them in the ledger is called clerical errors. They are again divided into following types of errors.

a) Errors of omission : These errors occur due to omission of some transactions in any subsidiary books.

b) Errors of commission : These errors arises because of mistakes in calculations, totalling, carry forward or balancing.

c) Compensating errors: These errors arise when one error is compensated by other error or errors.

Section – G (5 × 2 = 10)

Answer any five of the following questions.

Question 25.

What is Book Keeping ?

Answer:

Book-keeping is the art of recording business transactions in regular and systematic manner. According to Carter “Book-keeping is the science and art of correctly recording books of accounts all those business transactions that result in transfer of money or money’s worth.

Question 26.

Define Double Entry System.

Answer:

Refer Q.No. 31 in May 2015 Question Paper in Model Paper

Question 27.

Prepaid Expenses.

Answer:

Prepaid expenses are the expenses relating to the next year but paid during the year. Ex : Insurance or taxes paid for the next year. These expenses are deducted from the concerned expenditure either in trading or profit and loss a/c debit side. They are shown as assets in the balance sheet.

Question 28.

What is Journal Proper ?

Answer:

All business transactions are recorded in different subsidiary books according to their nature. For example, credit purchases are recorded in purchases book, credit sales are recorded in sales book, purchases returns are recorded in purchase returns book, sales returns are recorded in sales returns book, cash transactions are recorded in cash book etc. But there are certain transactions which occassionally happen and these are not recorded in any of the subsidiary books. However, they are recorded in a special book known as ‘Journal Proper’. That is, the transactions which are not recorded in the respective subsidiary books are recorded in the journal proper.

Question 29.

Suspense Account.

Answer:

Suspense account is an imaginary account, opened and used as a temporary measure to make the two side of the trial balance agree. As and when the errors which causes the disagreement in trial balance is detected, rectification entries should be passed through suspense account. Detection and rectification of all the errors will result in automatic closure of suspense account.

![]()

Question 30.

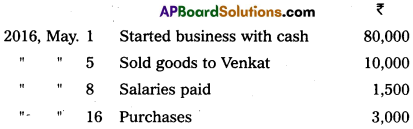

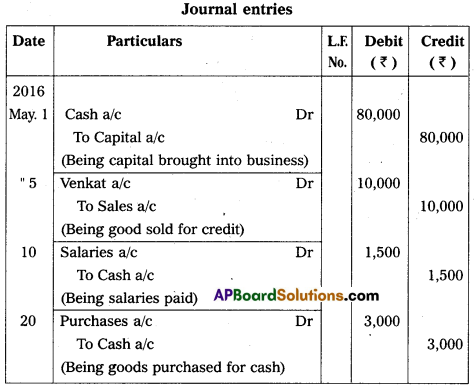

Journalize the following transactions :

Answer:

Question 31.

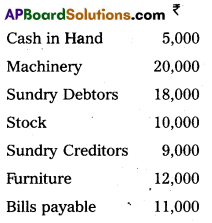

Record the opening entry from the following particulars on 1st April, 2016 :

Answer:

Question 32.

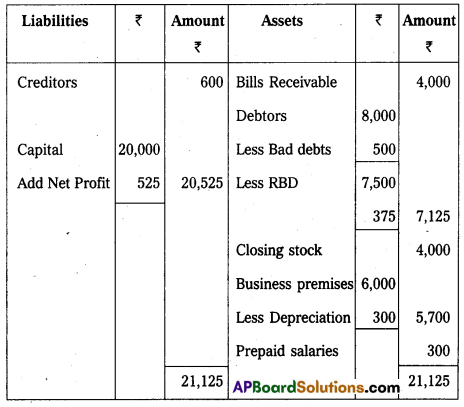

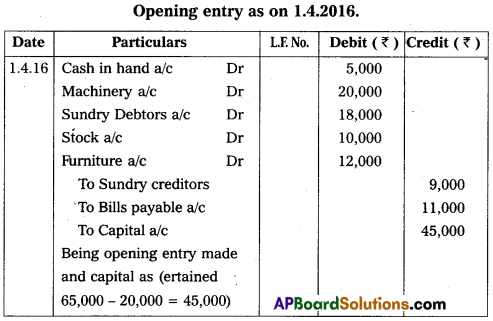

Prepare Trial Balance of Ramesh as on 31-12-16 :

Answer: