Thoroughly analyzing AP Inter 2nd Year Commerce Model Papers Set 8 helps students identify their strengths and weaknesses.

AP Inter 2nd Year Commerce Model Paper Set 8 with Solutions

Time: 3 Hours

Maximum Marks: 100

Part – I (50 Marks)

Section – A

(2 × 10 = 20)

Answer any two of the following questions in not exceeding 40 lines each.

Question 1.

Explain the various money market instruments.

Answer:

The following are some of the important money market instruments.

1. Treasury Bills:

A treasury bill is an instrument of short-term borrowings by the Government of India maturing in less than one year. They are also known as zero coupon bonds issued by RBI on behalf of the Central Government to meet its short-term requirements of funds. The purchase price is less than the face value. At maturity, the government will pay full face value.

2. Commercial Paper:

Commercial paper is a short-term unsecured promissory note, negotiable and transferable by endorsement and delivery with a fixed maturity period. It is issued by large and credit-worthy companies to raise short-term funds at lower rates of interest than market rates. It is usually has a maturity period of 15 days to one year. It is sold at a discount and redeemable at par. The original purpose of commercial paper was to provide short-term funds for seasonal and working capital needs. Companies use this instrument for purposes such as bridge financing.

3. Call Money:

Call money is a short-term finance repayable on demand, with a maturity period of one day to fifteen days, used for inter-bank transactions. Commercial banks have to maintain a minimum cash balance known as a cash reserve ratio, Call money is a method by which banks borrow from each other to be able to maintain the cash reserve ratio. The interest rate paid on call money loans is known as the call rate. It is a highly volatile rate that varies from day to day and sometimes even from hour to hour.

4. Certificate of Deposit:

Certificates of deposit are unsecured, negotiable, short-term instruments in bearer form, issued by commercial banks and developed financial institutions. They can be issued to individuals, corporations, and companies during periods of tight liquidity when the deposit growth of banks is slow but the demand for credit is high. They help to mobilize a large amount of money for short periods. The return on the certificate is higher than the treasury bills because it assumes a higher level of risk.

5. Commercial Bill:

A commercial bill is a bill of exchange used to finance the working capital requirements of business firms. It is a short, negotiable, self-liquidating instrument that is used to finance the credit sales of firms. The seller draws a bill on the buyer. When it is accepted, it is called a trade bill and becomes a marketable instrument. These bills can be discounted with a bank if the seller needs funds before the bill matures. When a trade bill is accepted by a commercial bank, it is known as a commercial bill.

6. Collateral Loan:

Commercial banks provide loans against government securities and bonds.

![]()

Question 2.

Explain the concept of a warehouse and its significance.

Answer:

The term warehousing is a combination of two terms, ‘ware’ and ‘housing’. The word ware refers to goods. Therefore, warehousing can be defined as the place suitable for preserving the goods and warehousing is the activity involving storage of goods. In common parlance, a warehouse means a godown. Warehousing facilitates other marketing functions such as assembling, grading, and transportation. Warehousing performs two important functions regarding finished goods. They are the movement function and storage function. Movement function refers to the receipt of the products from the manufacturing plant, their transfer into the warehouse, and transferring them to common carriers on their way to consumers. The storage function is performed by storing products in the warehouse until they are sold because production and consumption cycles differ. Warehousing functions create time utility at minimum cost.

Significance:

- Some commodities are produced in a particular season only. To ensure their off-season availability, warehousing is needed.

- Some products are produced throughout the year but their demand is seasonal. Warehousing is important in such cases.

- For companies that opt for large-scale production and bulk supply, warehousing is an unavoidable factor.

- Warehousing helps companies to ensure a quick supply of goods in demand.

- Production of goods and their movement of goods are important for the companies for continuous production of goods.

- Warehousing is also important for price stabilization. For necessary goods, the Government stores them in the warehouse and controls its supply in the market as per the price fluctuations.

- Another important need for warehousing is for bulk breaking.

Question 3.

Explain the redressal mechanism available to consumers under the Consumer Protection Act, of 1986.

Answer:

The judicial machinery set up under the Consumer Protection Act (C.P.A) 1986 consists of consumer courts (Forums) at the District, State, and National levels. These are known as the District Forum, State Consumer Disputes Redressal Commission (State Commission), and National Consumer Disputes Redressal Commission (National Commission).

1. District Forum:

This is established by the state government in each of its districts.

- Composition: The district forum consists of a chairman and two other members one of whom shall be a woman. The district forms are headed by the person of the rank of a District Judge.

- Jurisdiction: A written complaint can be filed before the district forum where the value of goods or services and the compensation claimed does not exceed ₹ 20 lakhs.

- Appeal: If a consumer is not satisfied by the decision of the District Forum, he can challenge the same before the state commission, within 30 days of the order.

2. State Commission:

This is established by the state governments in their respective states.

- Composition: The state commission consists of a president and not less than two and not more such number of members as may be prescribed, one of whom shall be a woman. The commission is headed by a person of the rank of High Court Judge.

- Jurisdiction: A written complaint can be filed before the state commission where the value of goods or services and the compensation claimed exceeds ₹ 20 lakhs but does not exceed ₹ 1 Crore.

- Appeal: In case the aggrieved party is not satisfied with the order of the state commission he can appeal to the National Commission within 30 days of passing the order.

3. National Commission:

The National Commission was constituted in 1988 by the central government. It is the apex body in the three-tier judicial machinery set up by the government for the redressal of consumer grievances. Its office is situated at Janpath Bhawan in New Delhi.

- Composition: It consists of a president and not less than four and not more than such members as may be prescribed, one of whom shall be a woman. The National Commission is headed by a sitting or retired judge of the Supreme Court.

- Jurisdiction: All complaints about those goods or services and compensation whose value is more than ₹ 1 Crore can be filed directly before the National Commission.

- Appeal: An appeal can be filed against the order of the National Commission to the Supreme Court within 30 days from the date of the order passed.

Section – B

(4 × 5 = 20)

Answer any four of the following questions in not exceeding 20 lines each.

Question 4.

Types of foreign trade.

Answer:

Foreign trade or International trade: The trade that takes place between nations is international trade. So, goods or services exchanged between the traders of two nations is called foreign trade. Foreign trade can be divided into three types. They are:

- Import trade

- Export trade

- Entrepot trade

(i) Import trade:

The term import is derived from the conceptual meaning as to bring in the goods and services in the port of the country. When purchases are made from another country, goods are said to be imported from that country to the buyer’s country. For example, China has the most modem technology for producing electronic products cheaply. So our country is importing those products.

(ii) Export trade:

The term export is derived from the conceptual meaning as to ship goods and services out of the port of the country. When the goods are sold to a trader in another country, goods are said to be exported to that country by the seller country. For example, India is a major exporter of tea to other countries.

(iii) Entrepot trade:

When goods are imported into a country, not for consumption in that country, but for exporting them to a third country, it is known as ‘Entrepot trade’. For example, India imports oil seeds from the USA and exports the same to Malaysia.

![]()

Question 5.

Services of wholesalers to manufacturers.

Answer:

Services of wholesalers to manufacturers:

- Wholesaler helps the manufacturer to concentrate on the manufacturing operations.

- The wholesaler buys in large quantities. Thus he enables the manufacturer to get the benefit of large-scale production.

- The wholesaler collects orders from a large number of retailers and supplies them from the stock of goods supplied in bulk by the manufacturer.

- By stocking products of a seasonal nature, he makes it possible for the manufacturer of such products to continue production.

- The wholesaler helps the manufacturer to regulate his production to the changing requirements of the market.

- The wholesaler enables the manufacturer to make better use of his capital for production by relieving him of the necessity of carrying large stocks.

- Wholesaler helps in price stabilization. They stock the goods during the slack season and sell them during the periods of peak demand.

Question 6.

Define Banking.

Answer:

A bank is an institution which deals with money and credit. It accepts deposits from the public, makes the funds available to those who need them and helps in the remittance of money from one place to another. According to Crow ther, a bank is a financial institution that collects money from those who have it to spare or who are saving it out of their incomes and lends this money to those who require it. According to the Indian Banking Regulation Act, of 1949 banking is defined as “accepting for lending or investment of deposits of money from the public, repayable on demand or otherwise, and withdrawable by cheque, draft, order or otherwise”.

Question 7.

Explain the characteristics of marine insurance.

Answer:

Marine insurance is a contract whereby the insurer agrees to indemnify the insured against marine losses. The following are the characteristics of Marine Insurance.

- Fundamentals of general contract: Marine insurance must have the fundamentals of general insurance i.e. insurable interest, utmost good faith, indemnity, subrogation, contribution, warranties, causa proximal, etc.

- Consideration: Marine insurance is a contract between the insured and the insurer. Hence, the insured is under an obligation to pay a certain amount periodically to the insurer in consideration of accepting risk.

- Insurance coverage: In marine insurance, cargo ship, and freight can be insured. It covers a large number of risks such as sinking of the ship, burning of the ship, standing of the ship, collision of ships, sea decoits, etc.

- Mode of insurance: In marine insurance, the insurance may be for a single journey, or number of journeys, or a specific period. Insurance must be renewed once the specific condition is lapsed.

- Indemnify the losses: In marine insurance, the insurers guarantee to indemnify the losses caused by sea perils only.

- Condition for compensation: In marine insurance the insured is compensated only when the loss is occurred to the ship or cargo. It also includes third-party insurance.

Question 8.

Importance of capital market.

Answer:

Importance of Capital Market:

1. Act as a link between Savers and Investors:

The capital market plays an important role in mobilizing the savings and diverting them into productive investment. In this way, it is a transfer of financial resources from surplus and wasteful areas to deficit and productive areas.

2. Encourage Savings:

In undeveloped countries, there are low savings, and those who can save often invest their savings in unproductive areas and conspicuous consumption in the absence of a capital market. With the development of a capital market, financial institutions provide a wide range of instruments that encourage people to save.

3. Encouragement to Investors:

Various financial assets like shares, bonds, etc., encourage people to put their investment in the industry or lend to the government. This can be facilitated by the existence of the capital market.

4. Stability in Prices:

The capital market tends to stabilize the value of stocks and securities. In the process of stabilization, it provides capital to the borrowers at a lower interest rate and discourages investment in speculative and unproductive areas.

5. Promotes Economic Growth:

Balanced economic growth is possible in any country with the proper allocation of resources among the industries. The capital market not only reflects the general condition of the economy but also smoothens and accelerates the process of economic growth.

![]()

Question 9.

Common business malpractices.

Answer:

The most common business malpractices leading to consumer exploitation are:

- Sale of adulterated goods.

- Selling spurious goods.

- Sale of sub-standard goods.

- Sale of duplicate goods.

- Use of false weights and measures leading to underweight.

- Hoarding and black marketing lead to scarcity and a price rise.

- Charging more than the maximum retail price fixed for the product.

- Misleading advertisements.

- Supply of inferior services.

Section – C

(5 × 2 = 10)

Answer any five of the following questions in not exceeding 5 lines each.

Question 10.

Fabian entrepreneur.

Answer:

Fabian Entrepreneur:

These entrepreneurs neither fall in the innovative entrepreneur category nor the adoptive entrepreneur category. These are very cautious people. These entrepreneurs are rigid and fundamental in approach. They follow in the footsteps of their successors. They are shy to introduce new methods and ideas. Fabian entrepreneurs are no risk-takers.

Question 11.

Multiple shops.

Answer:

The multiple shop system is a network of branches located at different places in the city or country. All these branches are under central ownership, management, and control.

Question 12.

Wholesale trade.

Answer:

Buying and selling goods in relatively large quantities is called wholesale trade. A person who is involved in wholesale trade is called a wholesaler. A wholesaler buys goods in large quantities from the manufacturers and sells them in relatively small quantities to the retailers.

Question 13.

What is insurable interest?

Answer:

A person cannot enter into a contract of insurance unless he has insurable interest. It is an essential feature of insurance. Without the insurable interest the contract of insurance will be treated as a gambling contract. A person has an insurable interest in their own life or the life of his wife.

Question 14.

Name the subject matter of marine insurance.

Answer:

The subject matter of marine insurance are

- Cargo or the goods on transshipment

- Hull

- Freight

Question 15.

Define stock exchange.

Answer:

According to the Securities Contract Act 1956, a stock exchange is defined as “an association, organization, body of individuals, whether incorporated or not, established to assist, regulate and controlling business in buying, selling and dealing in securities”.

Question 16.

Sweat equity shares.

Answer:

These equity shares are issued by the company to employees or directors on favorable terms, in recognition of their services. Sweat equity usually takes the form of giving options to employees to buy the shares of the company, so that they become part owners and participate in the profits apart from earning salary.

![]()

Question 17.

The Consumer Protection Act 1986.

Answer:

The enactment of the Consumer Protection Act of 1986 was one of the most important steps taken to protect the interests of consumers. The Act comes into force from July 1, 1987. The main features of the act:

- This Act provides various rights and responsibilities to Consumers.

- It provides a safeguard to consumers against defective goods, deficient services, and other forms of exploitation.

Part – II (50 Marks)

Section – D

(1 × 20 = 20)

Answer the following question.

Question 18.

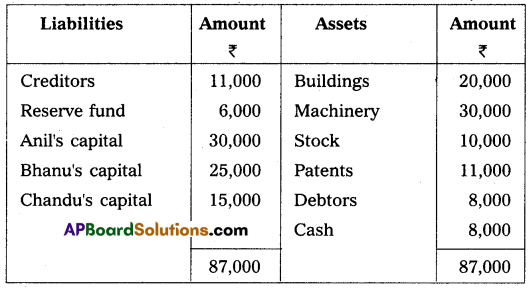

Anil, Bhanu, and Chandu were partners in a firm sharing profits in the ratio of 5 : 3 : 2 on March 31, 2014, their Balance Sheet was as under:

Anil died on October 1, 2014. It was agreed between his executors and the remaining partners that:

(a) Goodwill to be valued at 2\(\frac{1}{2}\) years’ purchase of the average profits of the previous four years which were:

2010-11 – ₹ 13,000

2011-12 – ₹ 12,000

2012-13 – ₹ 20,000

2013-14 – ₹ 15,000

(b) Patents be valued at ₹ 8,000; Machinery at ₹ 28,000; and Buildings at ₹ 25,000.

(c) Profit for the year 2014-15 to be taken as having accrued at the same rate as that of the previous year.

(d) Interest on capital provided at 10% p.a.

(e) Half of the amount due to Anil is to be paid immediately.

Prepare Anil’s capital account and Anil’s executor’s account as of October 1, 2014.

Answer:

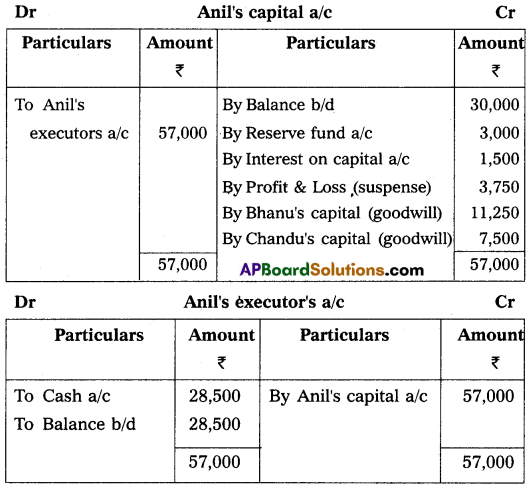

Working Notes:

1. Goodwill = Average Profit × 2\(\frac{1}{2}\) year’s purchase

Average profit for 4 years = ₹ 60,000 ÷ 4 = ₹ 15,000

Goodwill = 15,000 × \(\frac{5}{2}\) = ₹ 37,500

Anil’s share of goodwill = 37,500 × \(\frac{5}{10}\) = ₹ 18,750

This goodwill amount will adjust with 3 : 2 ratio between Bhanu and Chandu.

2. Profit from the date of the last balance sheet to the date of death (April 1, 2014, to October 1, 2014) = 6 months.

Profit for 6 months = ₹ 15,000 × \(\frac{6}{12}\) = ₹ 7,500

Anil’s share of profit = ₹ 7,500 × \(\frac{5}{10}\) = ₹ 3,750

3. Interest on Anil’s capital (April 1, 2014 to October 1, 2014) = ₹ 30,000 × \(\frac{10}{100}\) × \(\frac{6}{12}\) = ₹ 1,500

Section – E

(1 × 10 = 10)

Answer any one of the following questions.

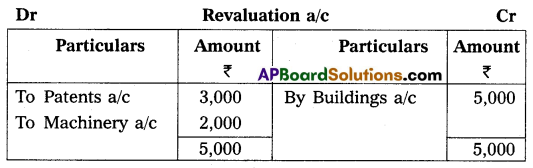

Question 19.

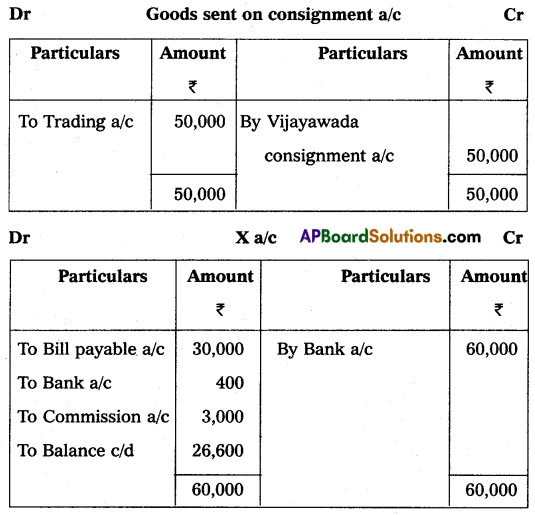

X of Chirala consigned 200 bales of Tobacco @ 250 per bale to V of Vijayawada. X paid cartage and freight ₹ 1,250. X draws a bill on V for 3 months for ₹ 30,000. V sold the entire consignment and rendered account sales showing that the goods realized ₹ 60,000 out of which he deducted his charges amounted to ₹ 400 and commission at 5% on sales. Prepare necessary ledger accounts in the books of X.

Answer:

(or)

Question 20.

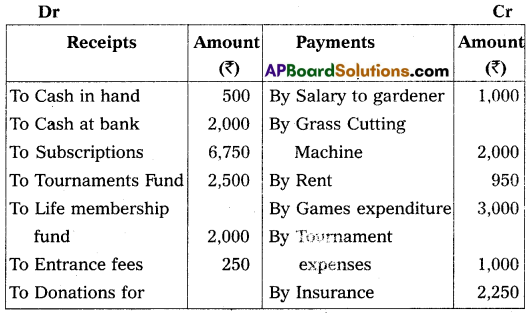

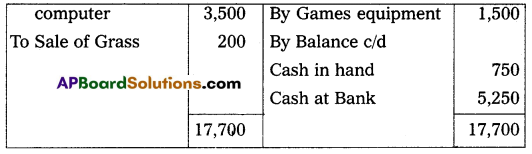

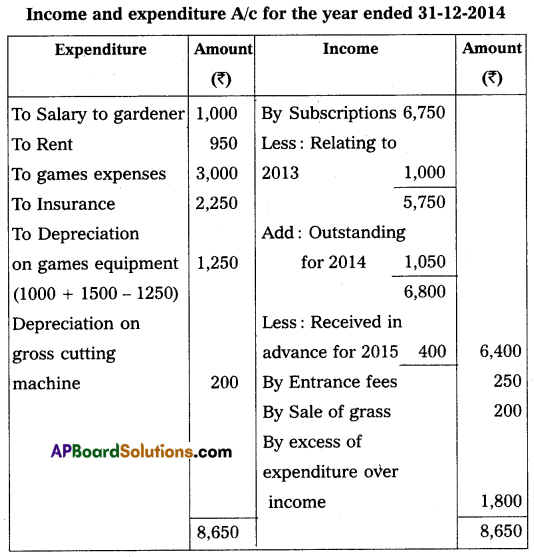

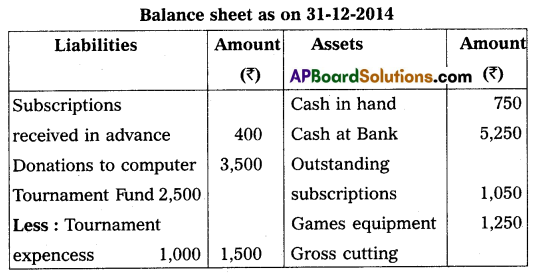

Sri Hari Sports Club’s, Ongole receipts and payments for the year ending 31-Dec-2014. Is given below.

Additional Information:

(a) Subscription receivable for 2013 were ₹ 1,000 and for 2014 ₹ 1,050. Subscription already received including ₹ 400 for the year 2015.

(b) Games equipment in the beginning was ₹ 1,000 and at the end ₹ 1,250.

(c) Provide depreciation @ 10% for the Grass cutting machine.

Prepare income and expenditure accounts for the year ending 31 December 2014. And opening, and closing balance sheets.

Answer:

Section – F

(2 × 5 = 10)

Answer any two of the following questions.

Question 21.

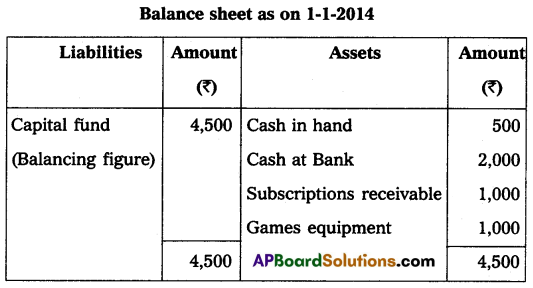

Explain the basic features of income and expenditure accounts.

Answer:

The following are the features of income and expenditure.

- It is a nominal account.

- It is similar to a profit and loss account.

- Expenditure and losses are recorded on the debit side and incomes are recorded on the credit side.

- Only revenue incomes and expenditures are recorded.

- Expenses and incomes relating to the current year are only taken into consideration.

- Adjustments for prepaid, outstanding, provisions are made in this account.

- The difference between the two sides will show either a surplus or deficit and it is transferred to the capital fund on the liabilities side of the balance sheet.

![]()

Question 22.

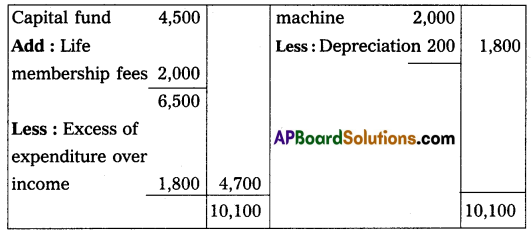

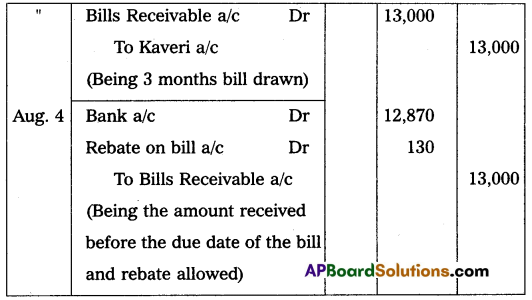

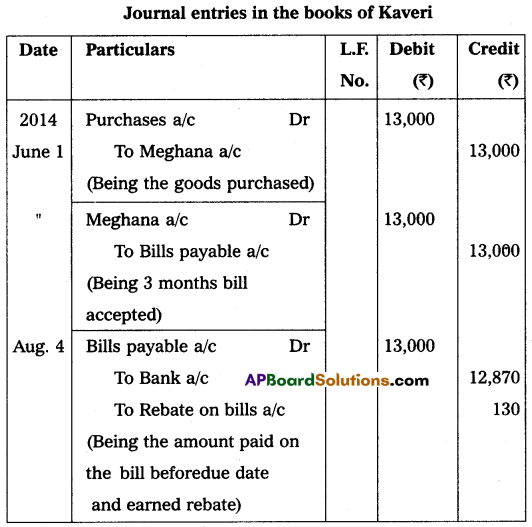

On 1st June 2014 Meghana sold goods for ₹ 13,000 to Kaveri and drew upon her a bill of exchange payable after 3 months. Kaveri accepted the bill and returned it to Meghana. One month before the maturity of the bill Kaveri approached Meghana to accept the payment against the bill under a rebate of 12% p.a. Meghana agreed to the request of Kaveri and retired the bill under the agreed rate of rebate the bill. Pass the necessary journal entries in the books of Meghana and Kaveri.

Answer:

Question 23.

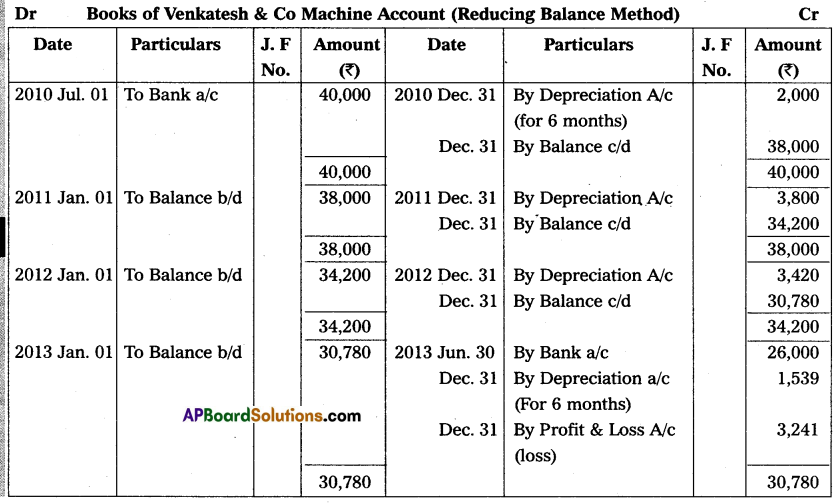

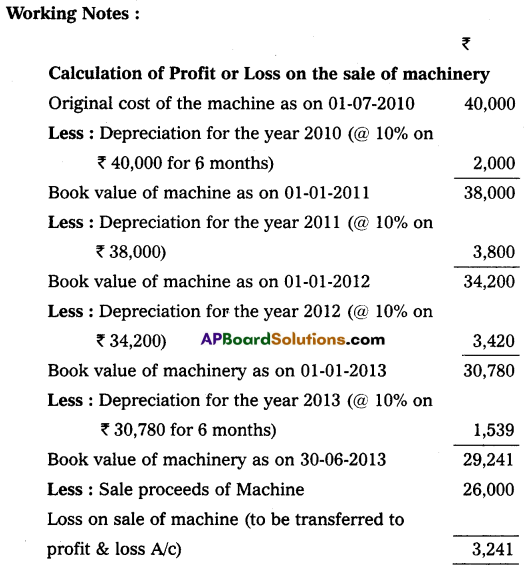

On 1st July 2010, Venkatesh & Co purchased a machine for ₹ 40,000. On 30th June 2013, the machine was disposed of for ₹ 26,000. The books are closed on 31st December every year. Depreciation is to be calculated @ 10% per annum on the Reducing Balance Method. Show the Machine Account.

Answer:

Question 24.

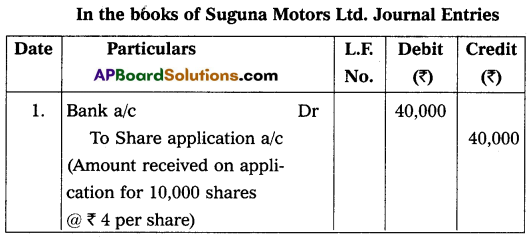

Suguna Motors Ltd. issued to the public for the subscription of 10,000 shares of ₹ 10 each at a discount of 10% per share, payable at ₹ 4 on application, ₹ 3 on the allotment, and ₹ 2 on the first and final call. The issue was fully subscribed. All the money was duly received. Write the Journal entries in the books of Suguna Motors Ltd.

Answer:

Section – G

(5 × 2 = 10)

Answer any Five of the following questions.

Question 25.

What is a promissory note?

Answer:

A promissory note is an instrument in writing (not being a bank note or currency note) containing an unconditional undertaking signed by the maker, to pay a certain sum of money only to or to the order of a certain person or to the bearer of the instrument.

Question 26.

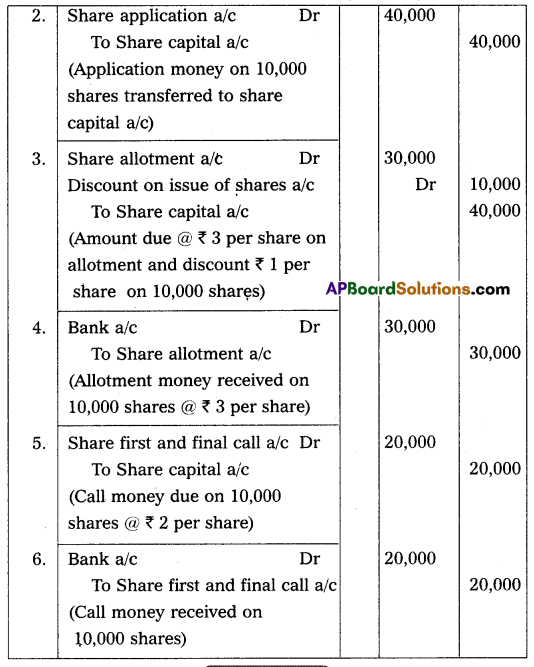

State the formula for the calculation of annual depreciation and rate of depreciation under a fixed installment system.

Answer:

Question 27.

Who is the consignor and consignee?

Answer:

Consignor:

The person who sends the goods is known as consignor. In other words, the consignor is the person who consigns the goods. He is the owner of the goods. He sends goods where the physical delivery is delivered to the receiver without transfer of ownership.

Consignee:

The person who receives the goods sent by the consignor is known as the consignee. In other words, the consignee is the person who acts as an agent of the consignor. He receives the goods on behalf of the consignor, stores them, incurs expenses, and sells the goods as per the specifications of the consignor for a consideration called ‘commission’.

![]()

Question 28.

What are the characteristics of Receipts and Payment Accounts?

Answer:

Features of Receipts and Payment Account:

- It is a summary of the cash book.

- All the amounts of receipts and payments irrespective of the period are recorded.

- Irrespective of capital or revenue nature all the receipts and payments are recorded.

- Noncash items like depreciation, and outstanding expenses are not shown in this account.

- It begins with the opening balance of cash in hand and cash at bank or bank overdraft and closes with the year-end balance of cash in hand/cash at bank or bank overdraft.

Question 29.

Capitalisation method?

Answer:

Capitalization Method:

Under the capitalization method, the capitalized value of the business is determined by capitalizing the average profits by the normal rate of return. Out of the value so determined, the value of net assets/capital employed is deducted, and the balance amount is the value of goodwill.

Question 30.

P and Q are partners sharing profits in the ratio of 2 : 3. They admit R for 1/4th share and he gets equally from P and Q. Calculate the new ratio.

Answer:

New partner R share \(\frac{1}{4}\)

He gets this equally from P and Q. That is \(\frac{1}{4} \times \frac{1}{2}=\frac{1}{8}\)

Old Ratio = 2 : 3

New Share = Old Share – Sacrificing Ratio

P = \(\frac{2}{5}-\frac{1}{8}=\frac{16}{40}-\frac{5}{40}=\frac{11}{40}\)

Q = \(\frac{3}{5}-\frac{1}{8}=\frac{24}{40}-\frac{5}{40}=\frac{19}{40}\)

R = \(\frac{1}{4}\) or \(\frac{10}{40}\)

Question 31.

Interest on Capital.

Answer:

Interest on Capital:

The interest on partner capital is not allowed unless it is specifically mentioned in the partnership deed. It should be calculated on a time basis after considering additional capital or withdrawal of capital.

![]()

Question 32.

How to ascertain profit under incomplete records?

Answer:

Under a single-entry system, net profit Is ascertained by calculating capital at the end and capital at the beginning by preparing two statements of affairs. Then the capital at the end will be added by drawings during the year and subtracting additional capital brought in. The difference between the adjusted capital and capital at the beginning is either net profit or net loss.