Collaborative study sessions centered around AP Inter 1st Year Commerce Model Papers Set 10 can enhance peer learning.

AP Inter 1st Year Commerce Model Paper Set 10 with Solutions

Time : 3 Hours

Max. Marks : 100

PART – I (50 MARKS)

(Section – A)

(2 × 10 = 20)

Answer any TWO of the following questions in not exceeding 40 lines each.

Question 1.

What is meant by Industry ? Explain various types of Industries with suitable examples.

Answer:

Industry is concerned with the making or manufacturing of goods. It is that part of the production which is involved in changing the form of goods at any stage from raw material to the finished product. Ex. : Weaving woollen yarn into cloth. Thus industry imparts form utility of goods.

The goods may be consumer goods or producer goods. Consumer goods are the goods, which are used finally by consumers. Ex: Food grains, textiles, cosmetics. Producer goods are the goods used by the manufacturers for producing some other goods. Ex : Machinery, tools and equipment etc.

Classification or types of industries : The industries may be classified as follows.

1) Primary industry : Primary industry is concerned with production of goods with th§ help of nature. It is nature-oriented industry, which requires very little human effort. Ex : Agriculture, farming, fishing, horticulture etc.

2) Genetic industry : Genetic industry is related to the reproducing and multiplying certain species of animals and plants with the object of earning profits from their sale. Ex : Nurseries, cattle breeding poultry, fish hatcheries etc.

3) Extractive industry : It is engaged in raising some form of wealth from the soil, climate, air, water or from beneath the surface of the earth. Generally the products of extractive industries comes in raw form and they are used by manufacturing and construction industries for producing finished products. Ex: Mining, coal, mineral, iron ore, oil industry, extraction of timber and rubber from forests.

4) Construction industry : The industry is engaged in the creation of infrastructure for the smooth development of the economy. It is concerned with the construction, erection or fabrication of products. These industries are engaged in the construction of buildings, roads, dams, bridges and canals.

5) Manufacturing industry: This industry is engaged in the conversion of raw material into finished or semifinished goods. This industry creates form utility in goods by making them suitable for human needs or uses. Ex Cement industry, sugar industry, cotton textile industry, iron and steel industry, fertiliser industry etc.

6) Service industry : In modem times, service sector plays an important role in the development of the nation and therefore it is named as service industry. These are engaged in the provision of essential services to the community. Ex : Banking, transport, insurance etc.

Question 2.

List out and briefly explain different types of companies.

Answer:

Companies are classified as follows :

1) Chartered Companies : These companies are started under a special charter issued by king or head of the state. The special charter contains rules and regulations governing the formation, management and winding up of the company. Under the charter certain exclusive rights and privileges are granted to the company. Ex : East India Company, Bank of England.

2) Statutory Companies : These companies are established by Special Act of Parliament or State Legislature are called Statutory Companies. Ex : Reserve Bank of India, LIC of India, Unit Trust of India.

3) Government Companies : A Company in which not less than 51 % of paid up share capital is held by the Central Government or any State Government or partly by Central Government and partly by any State Government is called government company. Ex : Hindustan Machine tools, ONGC, NTPC.

4) Registered Companies: Companies which are registered under the Companies Act, 1956 are called Registered Companies.

5) Private Companies : A Private Company is one which by its articles of association

- Limits the number of members to 50

- Restricts the right of transfer of shares and

- Prohibits any invitation to public to subscribe for its shares and debentures.

6) Public Companies : According to the Companies Act, all those companies other than private companies are considered as public companies.

7) Companies limited by shares : In these companies the liability of the shareholders is limited to the face value of shares held by them.

8) Companies limited by guarantee : In these companies, there is a stipulation in the memorandum clause that members are guaranteed to pay certain sum in the event of winding up of the company.

9) Unlimited Companies : These companies are registered without limiting the liability of its members.

10) Holding Company : When a company controls the management of another company by owning more than 51% of share capital, such company is called Holding Company.

11) Subsidiary Company: When one company controls the management of another company, such company so controlled is called Subsidiary Company.

12) Indian Company : A company registered in India and having a place of business in India is called Indian Company.

13) Foreign Company : If a company incorporated outside India and having place of business in India are called Foreign Companies.

14) National Companies : Such companies confine their operations with in the boundaries of the country.

15) Multi National Company: Such companies extend their area of operations beyond the country in which they are registered.

![]()

Question 3.

What is Globalisation ? Explain the necessity of globalisation.

Answer:

Globalisation refers to the increasing integration of markets and production includes the mobility of resources like capital, labour, organisation and knowvedge.

Necessity of Globalisation: The world is moving away from self contained national economies to an inter dependent, integrated global economic system. Globalisation refers to shift towards a more integrated and inter dependent world economy. Globalisation has two facets. They are globalisation of markets and globalisation of production.

Globalisation of markets : Globalisation of markets refers to merging of historically distinct and separate national markets into one huge global market. It removes trade barriers so that it is easy to sell goods internationally. The tastes and preferences of consumers are now converging into some global norm and firms helps to create global market by offering some basic products world wide.

Globalisation of production: The globalisation of production refers to getting goods and services from locations around the globe to take advantage of national difference in cost and quantity of factors of productions like land, labour and capital. Companies can compete more effectively by lowering their cost structure or by improving the quality or functionality of their product.

There are two major factors that underline the trend towards globalisation are

i) Low trade barriers

ii) Technological change.

i) Low trade barriers : Lowering the barriers in trade and investment mean that the firms can view to the world rather than a single country as their market and the firms can base their production in the best suited location. The decline in the barriers to free flow of goods, services and capital taken place at the end of the second world war and advanced countries made a committment to lower barriers to trade and investment.

ii) Technological change : Technological change has made the globalisation of markets a reality. Important technological changes occured in microprocessors and tele-communications, the internet and world wide web, transportation technology. These technological changes lowered the transportation costs and enable the firms to disperse production to economical, geographically separate locations. These changes also lowered the information processing and communication costs. It enabled the firms to create and manage globally dispersed production centres.

Section – B

(4 × 5 = 20)

Answer any FOUR of the following questions in not exceeding 20 lines each.

Question 4.

Briefly describe the categories of manufacturing industry.

Answer:

Manufacturing industries may be classified as follows.

1) Analytical industry : One product is analysed and many products are received as final products is called analytical industry. In the processing of crude oil, we will get kerosene, petrol, gas and diesel etc.

2) Synthetic industry: In this industry many raw materials are brought together in manufacturing process to make a final product. In manufacturing cement, rocks, gypsum, coal etc., are re-quired.

3) Processing industry : In this type of industry a product

passes through several processes to become a final product. The finished product of one process becomes the raw material for the next process till the final process produced the finished product. Cotton textiles, sugar and paper industries are examples of these industries.

4) Assembling industry : In this industry various types of products already manufactured by other industries are assembled to form a new product. T.V, watches, cars, scooters etc., are ex-amples of assembling industry.

Question 5.

Explain the features of sole proprietor.

Answer:

The following are the features of sole proprietorship.

- One man ownership : The ownership lies with one person only. He invests his own money or borrow from his friends and relatives.

- No separation of ownership and management: The owner himself manages the business. The separation of ownership from management is not present in the form of organisation.

- No legal formalities : No legal formalities are required to start sole trading business. However, in some cases, a licence may be required.

- No separate entity : The business does not have any entity separate from the owner. The owner and the business are one and the same.

- Sharing of profits : One person is the sole owner of the business. He takes all profits and bears all losses. There is direct relationship between efforts and rewards.

- Unlimited liability : The liability of the sole trader is unlimited. In case of loss, if the business assets are not enough to pay the business liabilities, his personal assets can be utilised to pay the liabilities.

- Secrecy: All important decisions are taken by the owner himself. He keeps all business secrets only to himself.

Question 6.

Differences between preference shares and equity shares.

Answer:

Differences between preferences shares and equity shares.

| Preference shares | Equity shares |

| 1. Issue of these shares are optional. | 1. Issue of these shares are compulsory. |

| 2. Dividend is paid before payment of dividend to equity shares. | 2. Dividend is paid after the payment of dividend to preference shares. |

| 3. The rate of dividend is fixed. | 3.’The rate of dividend is not fixed. |

| 4. Incase of winding up capital is refunded before payment to equity shares. | 4. Incase of winding up capital is refunded after the payment of preference shares. |

| 5. These shares do not carry any voting rights. | 5. Equity shareholders are the real owners of the company who have the voting rights. |

| 6. It is less risky as compared to equity shares. | 6. It is highly risky as compared to preference shares. |

| 7. No scope for speculation. | 7. Scope for speculation. |

| 8. Bonus shares are not offered to preference shareholders. | 8. Bonus shares are offered to equity shareholders. |

Question 7.

Merits and limitations of public deposits.

Answer:

Merits of public deposits :

- The interest payable on public deposits is lower than the Interest charged by banks and specialised financial institutions.

- There has been a good public response for public deposits because the rate of interest is higher than the rate offered by banks.

- During the periods of credit squeeze public deposits have been easier method of moblising the funds.

- There is no need to prove its credit worthiness in case of public deposits.

- Companies are attracted more towards public deposits because they are unsecured.

- Legal formalities are low when compared to other types of securities.

- As the rate of interest payable on public deposits is fixed, the company can derive the benefits of trading on equity.

Limitations of public deposits :

- The payment of interest will be burden to the company.

- If there is sudden withdrawals of deposits may create financial problems.

- The professional investors may not go for public deposits.

- Eventhough the rate of interest on public deposits in low but other expenses like commission and brokerage make them uneconomical.

- Depositors do not get any security for the investment.

- Public deposits may not be able to make best use of funds or may indulge in speculative practices.

Question 8.

Features of Joint Hindu Family Business.

Answer:

The following features are Joint Hindu Family Business :

- The joint hindu family business is created by the operation of Hindu law. There must be atleast two members having some ancestral property.

- There are two types of members in a joint hindu family business viz. The Karta who is the male head of the family and the co-parceners who are the male members of the family

- The liability of Karta is unlimited whereas the liabilities of co-parceners is limited to their interest in the joint hindu family business.

- The right of management is vested with Karta other members have no right to participate in the management even or inspect the books of accounts.

- All co-parceners have equal share in the profits of the business.

- Death of any co-parcener or even Karta does not effect the continuity of the business.

- A joint hindu family firm do not enjoy a separate legal status. It is not separate from the members who constituted it.

![]()

Question 9.

State any five differences between partnership and co-operative society.

Answer:

Distinction between co-operative society and partnership.

| Co-operative society | Partnership |

| 1. It is registered under cooperative societies Act. 1912 or other state co-operative Acts. | 1. It is formed under Indian partnership Act, 1932. |

| 2. The minimum number of members is 10 and maximum is unlimited. | 2. Minimum number of members is 2. Maximum number is 10 in banking business and 20 in other busineses. |

| 3. Liability of the members is limited. | 3. Liability of partners is unlimited, joint arid several. |

| 4. It is managed on democratic lines, it is based on service motto. | 4. It is managed and controlled by the partners and it is profit motto. |

| 5. It can enjoy several exemptions and privileges on payment of stamp duty, income tax etc. | 5. No such exemptions and privileges for partnership firms. |

Section – C

Answer any FIVE of the following questions in not exceeding 5 lines each.

Question 10.

Construction industry.

Answer:

This industry is engaged in the creation of infrastructure for the smooth development of the economy. It is concerned with the construction, erection or fabrication of products. These industries are engaged in the construction of buildings, roads, dams, bridges and canals.

Question 11.

Advertising

Answer:

Exchange of goods is possible only when the consumers have the knowledge about the existance of a product. Through advertisement, producers communicate all information about the goods to the prospective consumers. Advertisement can be is done through T.V, radio, newspapers, magazines, hoardings, wall posters etc.

Question 12.

Wholesale trade

Answer:

In wholesale trade goods are purchased in large quantities and are sold to retailers. A wholesaler is a link between the producer and the retailer. This helps the producer in making bulk production and selling in large quantities to traders. A wholesaler does not come into direct contact with the customer.

Question 13.

Banking

Answer:

Producers and traders require money for carrying production and trade. Banks are the institutions which supply funds for industry and trade. They pool savings from the public and make them available to industry. So, banking is an important function of commerce.

Question 14.

Sleeping partner

Answer:

A sleeping partner or dormant partner is who contributes capital, share profits and losses but does not take part in the working of the concern. He is not known to the public. So, he is also called as secret partner.

Question 15.

Capital subscription

Answer:

After going through the incorporation stage, the next step will be to raise funds. A public company cannot commence business unless minimum subscription as stated in the prospectus has been subscribed. The amount stated for allotment should be duly received in cash and allotment has been properly made.

Question 16.

Commercial banks

Answer:

Commercial banks occupy a vital position as they provide funds for different purposes as well as for different periods. Banks extends loans to firms of all sizes in many ways like cash credits, overdrafts, purchase/ discounting of bills and issue of letters of credit. The loan is repaid in lumpsum or in instalments. The borrower is required to provide some security or create a charge before the loan is sanctioned.

Question 17.

Global depositary receipt.

Answer:

GDR is a bank certificate issued in more than one country for shares in a foreign company. There are more than 900 GDRs listed on exchange worldwide. GDRs are mainly list in Frankfurt stock exchange, Luxembourg stock exchange and London stock exchange. Global depository receipt facilitate trade of shares. Several international banks like Citigroup, J.R Morgan’ Bank of New York etc., issue GDRs. A holder of GDR can convert into number of shares that it represents.

Part – II (50 Marks)

Section – D

Answer the following question.

Question 18.

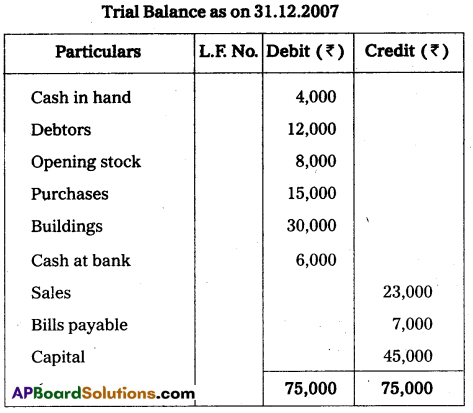

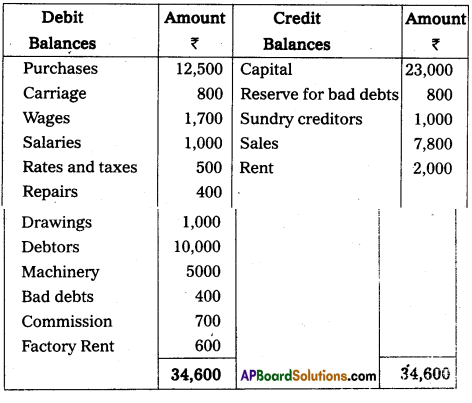

Prepare the final accounts of Deepti Traders for the year ending 31-03-2014.

Adjustments:

- Closing Stock : ₹ 5,000

- Reserve for Bad debts : 5%

- Interest on Capital: 10% .

- Interest on Drawings : 10%

- Depreciation on Machinery : 5%

Answer:

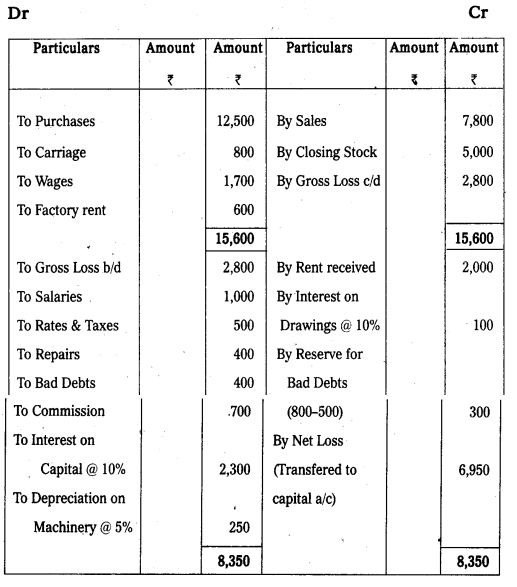

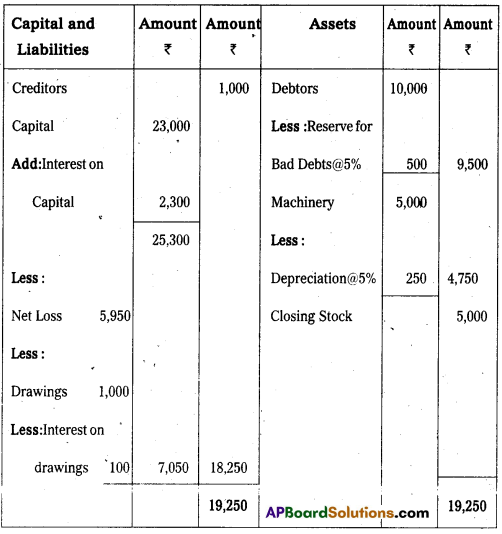

Trading and Profit and Loss Account of Deepti traders of the year ended 31-03-2014

Balance Sheet of Deepti Traders as on 31-03-2014.

Section – E

(1 × 10 = 10)

Answer any ONE of the following questions.

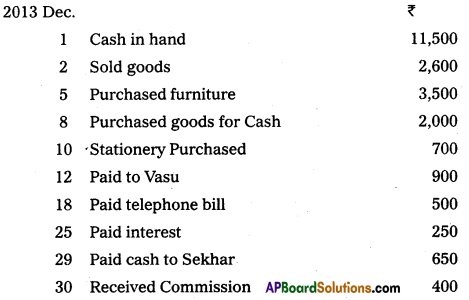

Question 19.

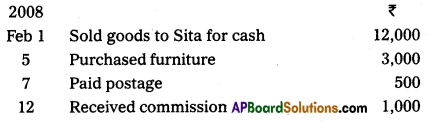

Enter the following transactions in single column cash book.

Answer:

![]()

Question 20.

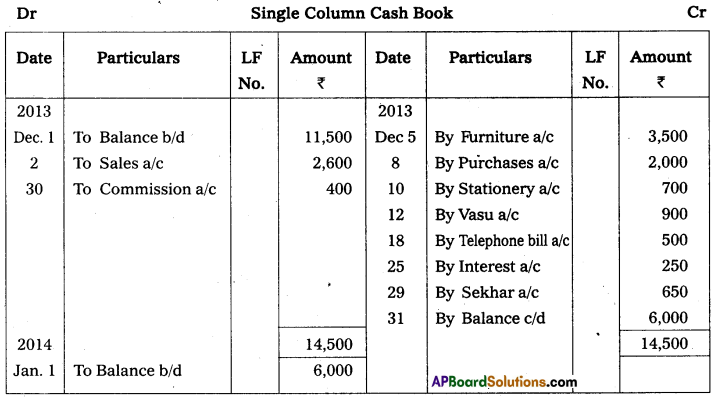

The Bank Pass book of M/s Murali showed an overdraft of ₹ 17,000 on 30th November, 2013 and on the same date the Cash Book showed a different balance. You are required to prepare a Bank Reconciliation Statement from the following particulars.

a) Two cheques worth of ₹ 5,000 each were deposited in the bank but the proceeds were credited only on 2nd December.

b) Three cheques for ₹ 3,000, ₹ 1,500 and ₹ 500 were issued but the same were not encashed at the bank upto 30th November.

c) Bank charged ₹ 500 being collection charges on some cheques but was not recorded in Cash Book.

d) A cheque for ₹ 2,000 received and recorded in the cash book but not sent to bank.

e) The bank credited ₹ 200 on account of interest received on a bill sent for collection but no intimation was sent.

f) Two cheques for ₹ 2,000 each were earlier depostied in the bank and the same were dishonoured for which the bank debited the amount in the Pass Book but not entered in Cash Book.

Answer:

Bank Reconciliation statement of M/s.Murali as on 30.11.2013

Section – F

(2 × 5 = 10)

Answer any TWO of the following questions.

Question 21.

Explain briefly any three accounting concepts.

Answer:

The term concept means an idea or thought. Basic accounting concepts are the fundamental ideas or basic assumptions underlying the theory and practice of financial accounting. These concepts are termed as generally accepted accounting prin

1. Cost Concept : According to this concept, an asset is recorded at cost i.e., the price which is paid at the time of acquiring it. In balance sheet, these assets appear not at cost price but depreciation is deducted and they at the amount which is cost less depreciation. Under this concept, all such events are ignored which affect the business but no cost. Ex : Death of a director.

2. Accounting Period Concept: Every business man wants to know the result of his investment and efforts after a certain period. Usually one year period is regarded as ideal for this purpose. It may be 6 months or 2 years also. This period is called accounting period. It depends on the nature of business and object of the proprietor of business. From taxation point of view one year period is necessary as income tax is payable every year.

3. Duel Aspect Concept : Under this concept, every transaction has got two fold aspect,

- Receiving the benefit and

- Giving of that benefit.

For instance, when a firm acquires an asset, (receiving the benefit) it must pay cash (giving of that benefit). Therefore, two accounts are to be passed in the books of accounts, one for receiving the benefit and other for giving the benefit. Thus, there will be a double entry for every transaction – debit for receiving the benefit and credit for giving the benefit.

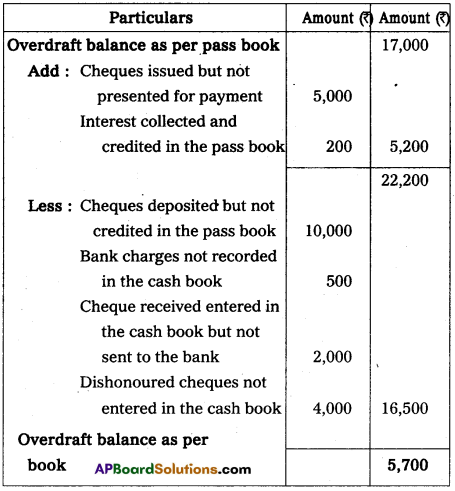

Question 22.

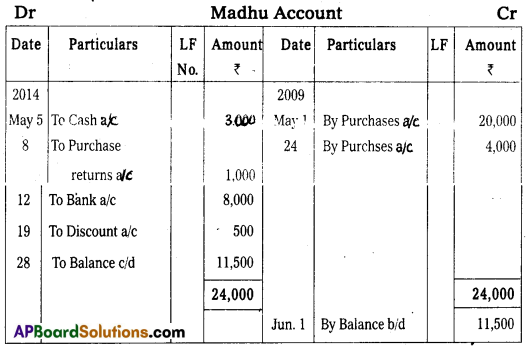

From the following information prepare Madhu Account.

Answer:

Question 23.

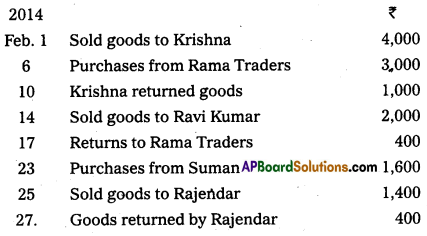

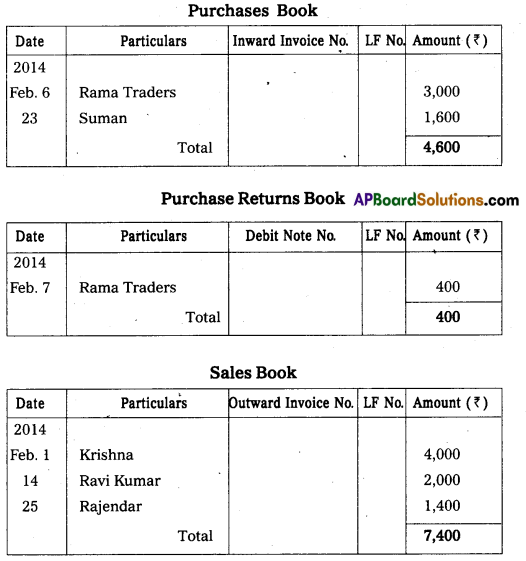

Record the following transactions in proper subsidiary books.

Answer:

Question 24.

What is imprest system of cash book ?

Answer:

Imprest system: Under this system, the petty cashier receives from the head cashier at the begining of the month a certain sum of money called the ‘Float’ or ‘Petty cash imprest’. The petty cashier makes payments out of the petty expenses as instructed and enters them in the petty cash book. At the end of the month, he balances his book and gets it checked initiated by the head cashier as a token on its correctness. Then the head cashier advances the exact amount which he has spent so that he has with him the same amount at the begining of the previous month. Under this system, the total cash with the petty cashier never exceeds the imprest.

Section – G

(5 × 2 = 10)

Answer any FIVE of the following questions.

Question 25.

Personal accounts.

Answer:

The accounts which relate to the persons, group of persons or institutions are called personal accounts. Ex: Rama’s a/c, Andhra Bank a/c., Infosys Ltd a/c. The rule in personal accounts is “Debit the receiver and credit the giver”. According to this, benefit receives account is debited and benefit given account is credited.

Question 26.

Balancing of an account.

Answer:

Balancing is the process of finding the difference between the total debits and total credits of an account. When posting is done, many accounts may have entries on the debit side as well as on the credit side. The net result of such debits and credits in an account is the balance.

Question 27.

Charactersitics of cash book.

Answer:

The following are the characteristics of cash book:

- The cash book can also be treated as subsidiary book.

- Only cash transactions are recorded.

- It serves as a cash discount.

- It records all cash receipts on the debit side and cash payments on the credit side.

- Cash book will show debit balance only.

Question 28.

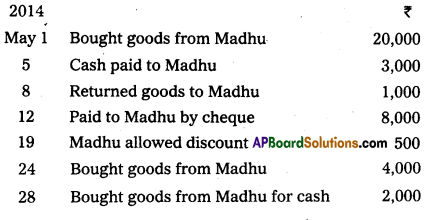

Bank Reconciliation statement.

Answer:

The statement prepared for reconciling the balance of cash book and pass book is known as Bank Reconciliation Statement. Kohler explains it as “A statement displaying the items of difference between the balance of an account reported by a bank and the account appearing on the books of bank customer”. Bank Reconciliation Statement may be defined as “a statement prepared with uncommon adjustments of cash book and pass book to find out the reasons of difference in the balance as shown by traders cash book and bankers pass book”.

![]()

Question 29.

Meaning of Bad debts.

Answer:

The trader sells the goods on credit to some of the customers. The customer who has taken the credit may not pay the amount. These debts which are not collected and irrecoverable are known as bad debts. Bad debts is a loss to the business.

Question 30.

Journalise the following transactions.

Answer:

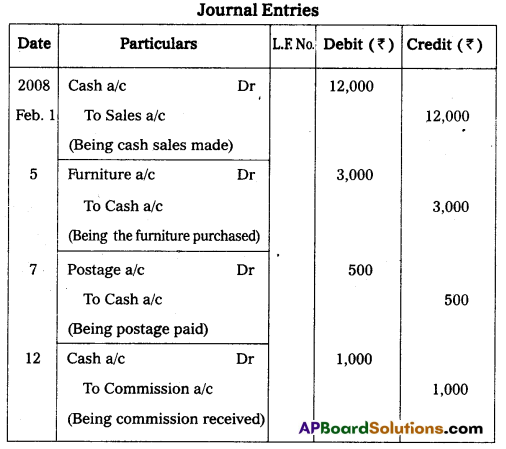

Question 31.

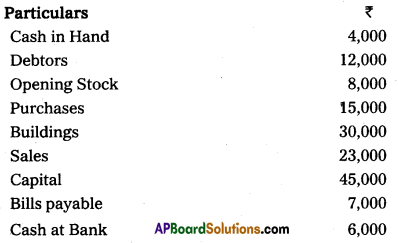

Pass the opening entry from the following.

Answer:

Question 32.

Prepare Trial Balance as on 31.12.2007 from the following.

Answer: