Thoroughly analyzing AP Inter 2nd Year Commerce Model Papers Set 7 helps students identify their strengths and weaknesses.

AP Inter 2nd Year Commerce Model Paper Set 7 with Solutions

Time: 3 Hours

Maximum Marks: 100

Part – I (50 Marks)

Section – A

(2 × 10 = 20)

Answer any two of the following questions in not exceeding 40 lines each.

Question 1.

Describe road transportation. Explain the kinds of roads in India.

Answer:

Road transport is the oldest form of transport. The Indian road network is one of the largest in the world. Road transport plays an important role in trade and commerce. Road transport is very good for short distances. Door-to-door collection and delivery are possible in road transport. It is most suitable for perishable goods. In road transport, both men and animals are used to carry goods and people. Modes of road transport are bullock carts, Tonga, rickshaws, and motor vehicles such as jeeps, buses, motor vans, trucks, and other vehicles. Road transport is suitable for goods such as paper goods, clothing, computers, livestock, cement, etc. Indian roads are classified into three types – National highways, State highways, District and Rural roads.

(a) National Highway:

These roads are meant for interstate transport and the movement of defensemen. These also connect the state capitals and major cities. The National Highway Authority of India (NHAI) has the responsibility for the development, maintenance, and operation of national highways. The national highways have a road length of about 65,000 kms or 2% of the length of the total road system but they carry nearly 40% of goods and passenger traffic.

(b) State Highways:

These are constructed and maintained by the state government. They connect the state capital with district headquarters and other important towns. State highways constitute 4% of the total road length in the country.

(c) District Roads:

These roads are the connecting link between the district headquarters and the other important roads of the district. They account for 14 % of the total road length of the country.

(d) Rural Roads:

These roads provide a link to the rural areas. There are about 80% of the total length in India is categorized as rural roads.

(e) Boarder Roads:

These roads are in the northern and northern – eastern boundary of the country. The Boarder Road organization constructs and maintains border roads. They construct roads in high-altitude areas and undertake snow clearance.

(f) International Highways:

These are meant to promote harmonious relationships with the neighboring countries by providing effective links with India.

![]()

Question 2.

What is SEZ? Explain their objectives.

Answer:

Special Economic Zones (SEZ) is a geographical region that has economic laws that are more liberal than a country’s economic laws. The main aim of the SEZ is to attract larger foreign investments. It is intended to make SEZ engines for economic growth. The SEZ Act was passed by parliament in May 2005. An SEZ Act is specifically described as a duty-free enclave deemed to be a foreign territory for trade operations.

Objectives:

The following are the objectives of special economic zones.

- To create employment opportunities.

- To generate additional economic activity.

- To promote the export of goods and services.

- To develop infrastructural facilities.

- To promote investment from domestic and foreign sources.

- To import capital goods and raw materials duty-free.

- To create a foreign territory for trade operations and tariffs.

- To allow 100% foreign direct investment for developing townships.

- To exempt import duties and service tax.

- To get a wide range of income tax benefits.

Question 3.

Explain the objectives and functions of SEBI.

Answer:

The Securities Exchange Board of India (SEBI) was established by the Government of India in April 1988 as an interim administrative body to promote orderly and healthy growth of the securities market and for investors’ protection. The SEBI was given a statutory status in 1992 Jan through an ordinance.

Objectives of SEBI:

The following are the objectives of SEBI.

- To regulate stock exchanges and the securities market to promote their orderly functioning.

- To protect the rights and interests of the investors, particularly individual investors by guiding and educating them.

- To prevent trading malpractices and achieve a balance between self-regulation by the securities industry and its statutory regulation.

- To regulate and develop a code of conduct and fair practices by intermediaries like brokers, merchant bankers, etc. to make them competitive and professional.

Functions of SEBI:

SEBI was entrusted with the twin task of both regulation and development of the securities market. It has certain protective functions.

A. Regulatory Functions:

- Registration of brokers, sub-brokers, and other players in the market.

- Registration of collective investment schemes and mutual funds.

- Regulation of stock brokers, portfolio exchanges, underwriters, and merchant bankers, and the business of stock exchange and any other securities market.

- Regulation of takeover bids by companies.

- Calling for information by undertaking inspections, conducting inquiries, and audits of stock exchanges and intermediaries.

- Levying fee or other charges for carrying out the purposes of the Act.

- Performing and exercising such power under the Securities Contracts (Regulation) Act 1956, as may be delegated by the Government of India.

B. Development Functions:

- Training for intermediaries of the securities market.

- Conducting research and publishing information useful to all market participants.

- Undertaking measures to develop the capital markets by adopting a flexible approach.

C. Protective Functions:

- Prohibition of fraudulent and unfair practices like making misleading statements, manipulations, price rigging, etc.

- Controlling insider trading and imposing penalties for such practices.

Section – B

(4 × 5 = 20)

Answer any four of the following questions in not exceeding 20 lines each.

Question 4.

Explain the opportunities for entrepreneurs in Agriculture and Forestry, Tourism, and Fisheries in A.P.

Answer:

Agriculture and Forestry:

Agriculture is the main occupation for the people in A.P. Rice js the major crop in the state. Other important crops are lower bajra, pulses, clusters, etc. Entrepreneurs may have many opportunities to establish units based on these products. Entrepreneurs make use of the recently announced industrial policy of A.P. and explore the possibilities of establishing agro-based units.

Tourism:

A.P. is truly a land of beauty and it represents Indian culture and heritage: Beaches, wildlife, forests, forts, historical monuments, national parks, holy temples with architectural beauty. It provides many opportunities for entrepreneurs to start ventures related to tourism services.

Fisheries:

The state stretches over the coastal area of the Bay of Bengal. A vast coastal area is the main reason for seafood. The aquaculture around the coast proved to be a rich source of seafood, which occupies a major share in exports from the state. The entrepreneurs may examine the various opportunities and explore the possibilities of setting units based on the sea foods and exporting the same.

Question 5.

Describe the classification of the home trade.

Answer:

Domestic Trade:

Buying and selling of goods takes place between the individuals of the same country. The buyer and seller live in the same country. It is also called Home trade or internal trade based on the scale of operations, internal trade can be classified into two types. They are (i) Wholesale trade and (ii) Retail trade.

Wholesale Trade:

Buying and selling goods in relatively large quantities is called ‘wholesale trade’. A person who is involved in wholesale trade is called a wholesaler. A wholesaler buys goods in large quantities from the manufacturers and sells in relatively smaller quantities to the retailers. So, he is the connecting link between producers and the retailers.

Retail Trade:

Retailing means the sale of goods in small quantities to consumers. A person engaged in retail trade is called a retailer. Retailers buy goods from wholesalers and sell them in relatively smaller quantities to the final consumers. Retailers established a link between wholesalers and consumers.

![]()

Question 6.

What are the advantages of life Assurance policies?

Answer:

In a life insurance contract, the policy amount is definitely, it is a question of time. The policy may mature during the lifetime of the assured or it may be paid on his death.

Advantages of Life Assurance Policies:

- Encourages savings: The insured has to pay a premium to the insurance company every year. Otherwise, the policy will be canceled. So, the insurance helps create the habit of saving money.

- Exemption from income tax: The amount paid as a premium on a life insurance policy is allowed as a deduction from income for calculating income tax.

- Protection: Life insurance protects the family members if the policyholder dies suddenly. Life insurance builds a fund for the benefit of the dependents.

- Credit facilities: Insured can get loans against their policies to meet emergency needs. Life Insurance Corporation itself gives a loan against the policy to the insured at a lower rate of interest.

- Surrender: The life insurance company can surrender the life policy if the insured is unable to continue it. The insurance company can return some- premium known as ‘surrender value’.

- Meets future needs: An insurance policy can help provide funds for the marriage and educational needs of insured children.

Question 7.

Disadvantages of Air transportation.

Answer:

- It is the costliest means of transport. The fares of air transport are so high that it is beyond the reach of the common man.

- Its carrying capacity is very small and not suitable to carry cheap and bulky goods.

- Air transport is uncertain and uncontrollable as it is controlled to a great extent by weather conditions.

- The chances of breakdown are high as compared to other modes of transport.

- It requires a large amount of capital investment in the construction and maintenance of airplanes.

- Air transport requires specialized skills and a high degree of training for its operation.

Question 8.

Briefly explain treasury bills, commercial paper, and collateral loans.

Answer:

The following are some of the important money market instruments.

1. Treasury Bills:

A treasury bill is an instrument of short-term borrowings by the Government of India maturing in less than one year. They are also known as zero coupon bonds issued by RBI on behalf of the Central Government to meet its short-term requirements of funds. The purchase price is less than the face value. At maturity, the government will pay full face value.

2. Commercial Paper:

Commercial paper is a short-term unsecured promissory note, negotiable and transferable by endorsement and delivery with a fixed maturity period. It is issued by large and credit-worthy companies to raise short-term funds at lower rates of interest than market rates. It is usually has a maturity period of 15 days to one year. It is sold at a discount and redeemable at par. The original purpose of commercial paper was to provide short-term funds for seasonal and working capital needs. Companies use this instrument for purposes such as bridge financing.

3. Collateral Loan:

Commercial banks provide loans against government securities and bonds.

Question 9.

National Commission.

Answer:

National commission operates at the National level. It settles the consumer disputes in the country. The National Commission has a President, who should be a serving or retained Supreme Court Judge the commission also comprises other members of not less than four. The president and all the members of the commission are appointed by the central government. The National Commission shall have jurisdiction to entertain consumer complaints where the value of goods and services and compensation exceeds ₹ 1 crore.

Section – C

(5 × 2 = 10)

Answer any five of the following questions in not exceeding 5 lines each.

Question 10.

Initiative entrepreneur.

Answer:

Adaptive or Initiative Entrepreneur:

Entrepreneurs of this type are found in underdeveloped countries. This type of entrepreneur instead of innovating new things, just adopt the successful innovations innovated by others. However, some of the innovations made by others, may not suit the needs of underdeveloped countries. In such cases, the initiative innovators may make some changes in the innovations made by innovative entrepreneurs to suit their requirements.

Question 11.

Domestic trade.

Answer:

Domestic trade: Buying and selling of goods takes place between the individuals of the same country. The buyer and seller live in the same country. It is also called Home trade or internal trade based on the scale of operations, internal trade can be classified into two types. They are (i) Wholesale trade and (ii) Retail trade.

![]()

Question 12.

Differentiate insurer and insured.

Answer:

The party who agrees to pay money for the happening of an event is called the insurer. The party who seeks protection against the risk by paying a premium is called the insured.

Question 13.

What is subrogation?

Answer:

According to this principle, the insurer after compensating the loss of the insured, the right of ownership on damaged goods is shifted from the insured to the insurer, i.e., the insurance company.

Question 14.

Capital market.

Answer:

The term capital market refers to facilities and institutional arrangements through which long-term funds, both debt and equity are raised and invested. It consists of a series of channels. Through this savings of the community are made available for industrial and commercial purposes.

Question 15.

Depository.

Answer:

Just like a bank keeps money in safe custody for customers, a depository keeps securities in electronic form on behalf of investors. In the depository a securities account is opened and all shares are deposited and sold at any time, an instruction to deliver and receive shares on behalf of investors is given.

Question 16.

District Forums.

Answer:

- District Forum: This is established by the state government in each of its districts.

- Composition: The district forum consists of a chairman and two other members one of whom shall be a woman. The district forms are headed by the person of the rank of a District Judge.

- Jurisdiction: A written complaint can be filed before the district forum where the value of goods or services and the compensation claimed does not exceed ₹ 20 lakhs.

- Appeal: If a consumer is not satisfied by the decision of the District Forum, he can challenge the same before the state commission, within 30 days of the order.

Question 17.

Development Functions of SEBI.

Answer:

- Training for intermediaries of the securities market.

- Conducting research and publishing information useful to all market participants.

- Undertaking treasures to develop the capital markets by adopting a flexible approach.

Part – II (50 Marks)

Section – D

(1 × 20 = 20)

Answer the following question.

Question 18.

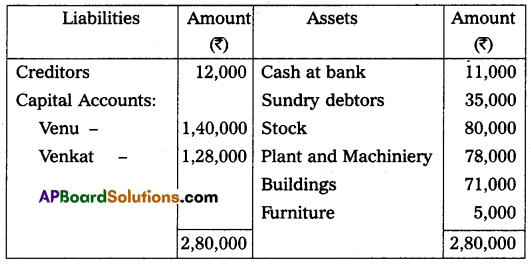

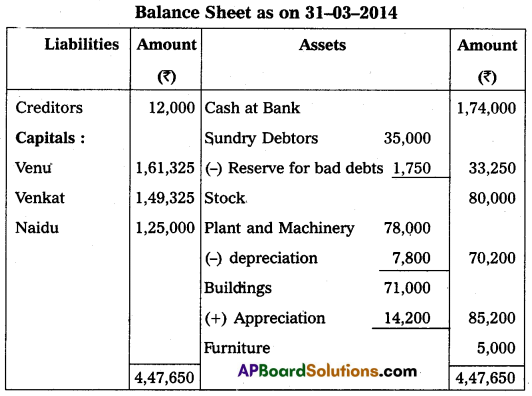

Venu and Venkat are partners sharing profits and losses equally. Their Balance sheet on 31-12-2014 stood as follows:

They decided to admit Naidu into the firm on 1st April 2014 on the following terms and conditions.

(a) Naidu has to pay ₹ 1,25,000/- for 1/4 share in furture profits.

(b) Naidu has to pay ₹ 38,000/- for goodwill.

(c) Plant and Machinery to be depreciated by 10%.

(d) Buildings to be appreciated by 20%.

(e) 5% reserve for doubtful debts to be created on debtors. Prepare necessary accounts in the firm’s books after Naidu’s admission with a new Balance Sheet.

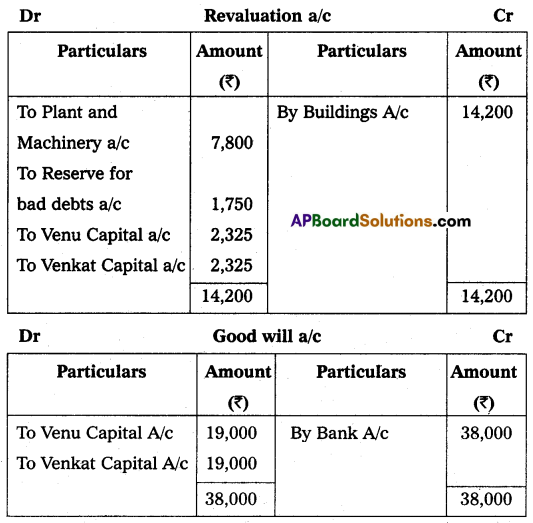

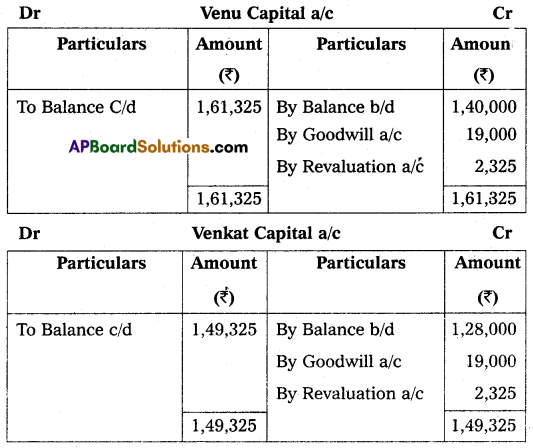

Answer:

Section – E

(1 × 10 = 10)

Answer any one of the following questions.

Question 19.

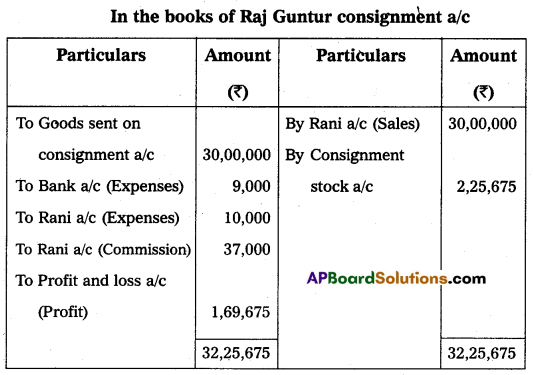

Raj of Bandar sends 200 T.V. sets each costing ₹ 15,000 to Rani of Guntur to be sold on a consignment basis. He incurred the following expenses. Freight ₹ 2,000; Loading and unloading charges ₹ 2,000 and Insurance ₹ 5,000. Rani sold 185 TVs for ₹ 30,00,000 and paid ₹ 10,000 as shop rent which is to be borne by Raj as per the terms and conditions of the consignment. The consignee is entitled to a commission of ₹ 200 per TV sold. Assuming that Rani settled the account by sending a bank draft to Raj. Prepare the necessary Ledger Accounts in the books of Raj.

Answer:

(or)

Question 20.

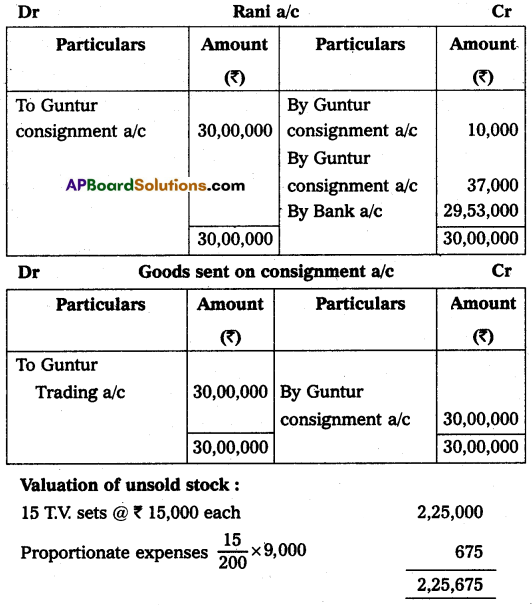

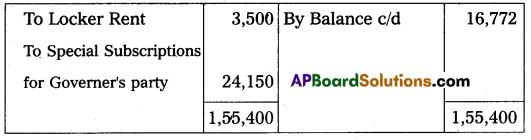

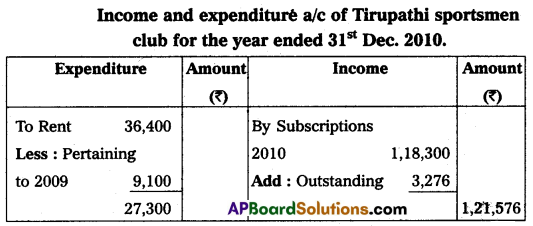

From the following, Prepare income and expenditure A/c of Tirupathi Sports Men Club for the year ended 31-Dec-2010.

Adjustments:

Locker rent ₹ 420 about 2009 and ₹ 630 is still owed. Rent ₹ 9,100 About 2009 and ₹ 9,100 is still due. Stationery expenses ₹ 2,184 relating to 2009 and ₹ 2,548 is still owing, Subscriptions receivable for the year 2010 ₹ 3,276.

Answer:

Section – F

(2 × 5 = 10)

Answer any two of the following questions.

Question 21.

Explain any three limitations of the computerized accounts system.

Answer:

The following are the limitations of the computerized accounting system.

1. Cost of Training:

The sophisticated computerized accounting packages generally require specialized staff personnel. As a result, a huge training cost is incurred to understand the use of hardware and software continuously because newer types of hardware and software are acquired to ensure efficient and effective use of computerized accounting systems.

2. Staff Opposition:

Whenever the accounting system is computerized, there is a significant degree of resistance from the existing staff, partly because of the fear that they shall be made redundant and largely because of the perception that they shall be less important to the organization.

3. Disruption:

The accounting processes suffer a significant loss of work time when an organization switches over to a computerized accounting system. This is due to changes in the working environment that require accounting staff to adapt to new systems and procedures.

![]()

Question 22.

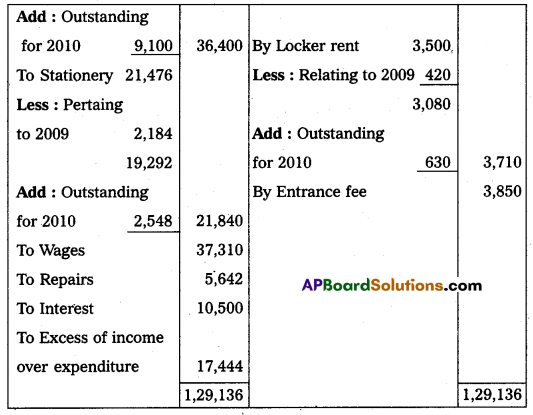

Manga purchased goods for ₹ 20,000 from Ganga on 1st February 2013 and accepted a bill of exchange drawn by Ganga for the same amount payable after 2 months. On 20th February 2013 Ganga sent the bill to her bank for collection. On the due date, Manga dishonored the bill and the bank paid ₹ 100 as noting charges. Pass the necessary journal entries in the books of Ganga and Manga.

Answer:

Question 23.

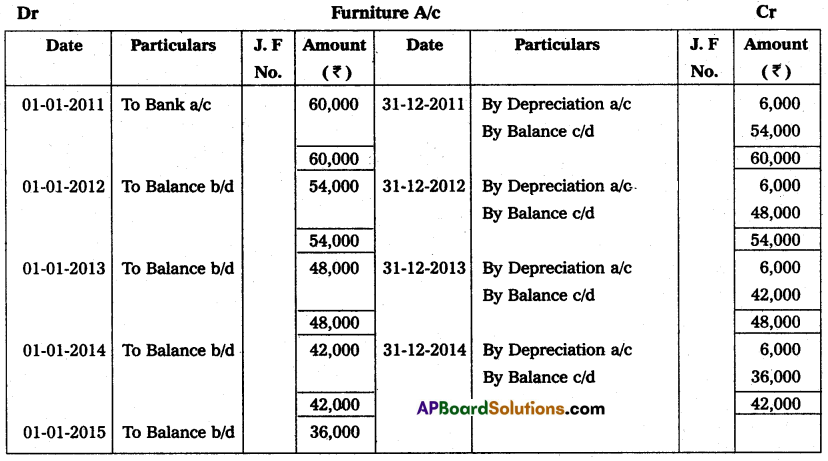

On 1st January 2011, Raghavendra traders purchased Furniture for ₹ 60,000. Depreciation is to be calculated at the rate of 10% p.a. on the Straight Line method. The books are closed on 31st December every year. Prepare a Furniture Account for the first four years.

Answer:

Question 24.

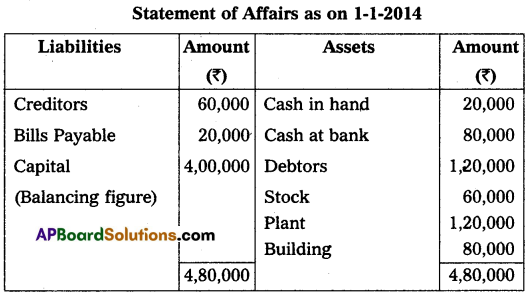

From the following details, ascertain Raju’s capital as of 01-01-2014.

Cash in hand – ₹ 20,000

Building – ₹ 80,000

Cash at Bank – ₹ 80,000

Plant – ₹ 1,20,000

Debtors – ₹ 1,20,000

Creditors – ₹ 60,000

Stock – ₹ 60,000

Bills Payable – ₹ 20,000

Answer:

Section – G

(5 × 2 = 10)

Answer any five of the following questions.

Question 25.

What do you mean by the renewal of the bill of exchange?

Answer:

Sometimes the drawee of a bill finds himself unable to meet the bill on the due date. To avoid dishonoring the bill, he may request the holder of the bill to cancel the original bill and draw a new bill in place of the old one. If the holder agrees, the old bill is canceled and a new bill with new terms is drawn on the drawee and also accepted by him. This is called ‘Renewal of a bill’.

Question 26.

Explain any three differences between the straight-line method and the Reducing balance method.

Answer:

| Basis of Difference | Straight Line Method | Reducing Balance Method |

| 1. Basis of Calculation | Depreciation is calculated on the original cost. | Depreciation is calculated on the book value (i.e., original cost depreciation charged to date). |

| 2. Amount of Depreciation | The amount of depreciation remains constant. | The amount of depreciation decreases year after year. |

| 3. Total change against Profit and Loss a/c in respect of depreciation and repairs | The total charge against the Profit and Loss account in respect of depreciation and repairs expenses in later years under this method. | Depreciation charges decline in later years. Therefore total depreciation and repair expenses remain similar or equal every year. |

| 4. Recognition by Income Tax Law | This method is not recognized by the Income Tax Act. | This method is recognized by the Income Tax Act. |

| 5. Suitability | This method is suitable for assets in which repair charges are more, and the possibility of obsolescence is low. | This method is suitable for assets that are affected by technological changes and more repair expenses with time. |

Question 27.

What do you mean by consignment?

Answer:

The word consignment originated from the French word ‘consigner’ which means to handover or transmit. To consign means ‘to send’ and therefore consignment means sending goods to another person. In the case of consignment, goods are sent by the owner of the goods to the agent for sale. The ownership of the goods remains with the sender. The agent sells the goods on behalf of the sender, according to his instructions. The sender of the goods is known as consignor and the agent is known as consignee.

Question 28.

What is revenue income? Give two examples.

Answer:

Any amount received in the normal course of the business is called revenue receipts, which are recurring in nature, e.g. sales, interest, discounts, commission, rent received, etc.

Question 29.

Vishnu’s monthly drawings are 2,000. Interest on drawings is to be charged @ 10% p.a. Calculate interest on drawings for the year 2014 assuming that money is withdrawn in the middle of every month.

Answer:

Interest on drawings = 24,000 × \(\frac{10}{100} \times \frac{6}{12}\) = ₹ 1200

Question 30.

Revaluation Account.

Answer:

For the revaluation of assets and liabilities at the time of admission of a new partner, an account called a revaluation account is opened. It is a nominal account. The account is credited with all increases in the value of assets and decreases in the value of liabilities. Similarly, it is debited with a decrease in the value of assets and an increase in the value of liabilities. The balance of this account is again or loss on revaluation which is transferred to old partners’ capital accounts in the old profit-sharing ratio.

![]()

Question 31.

X and Y are partners sharing profits and losses in the ratio of 5 : 3. Z the new partner gets 1/5 of X’s share and 1/3rd of Y’s share. Calculate the new ratio.

Answer:

Z gets \(\frac{1}{5}\) share from X and \(\frac{1}{3}\) share from Y.

Old ratio = 5 : 3

New ratio = Old ratio – Sacrificing ratio

X share = \(\frac{5}{8}-\frac{1}{5}\) = \(\frac{25}{40}-\frac{8}{40}=\frac{17}{40}\)

Y share = \(\frac{3}{8}-\frac{1}{3}=\frac{9}{24}-\frac{8}{24}=\frac{1}{24}\)

Z share = \(\frac{1}{5}+\frac{1}{3}\) = \(\frac{3}{15}+\frac{5}{15}=\frac{8}{15}\)

Question 32.

Equity Shares.

Answer:

According to Sec 85 of the Companies Act 1956, an equity share is a share that is not a preference share. In other words, shares that do not enjoy any preferential night in the payment of dividends or repayment of capital are called equity or ordinary shares.