Thoroughly analyzing AP Inter 2nd Year Commerce Model Papers Set 6 helps students identify their strengths and weaknesses.

AP Inter 2nd Year Commerce Model Paper Set 6 with Solutions

Time: 3 Hours

Maximum Marks: 100

Part – I (50 Marks)

Section – A

(2 × 10 = 20)

Answer any two of the following questions in not exceeding 40 lines each.

Question 1.

Explain the types of entrepreneurs.

Answer:

Entrepreneurs can be found among various sections of society viz., fanners, artisans, workers, etc.’In a study of American Agriculture, Danhof has classified entrepreneurs into four categories. They are:

- Innovating Entrepreneurs

- Adoptive or Initiative Entrepreneurs

- Fabian Entrepreneurs

- Drone Entrepreneurs

(a) Innovating Entrepreneurs:

Schumpeter’s entrepreneur was of this type. He introduces new products, and new methods of production and opens new markets. The entrepreneurs are aggressive. Innovating entrepreneurs experiment and convert attractive possibilities into practice.

(b) Adaptive or Initiative Entrepreneur:

Entrepreneurs of this type are found in underdeveloped countries. This type of entrepreneur instead of innovating new things, just adopt the successful innovations innovated by others. However, some of the innovations made by others, may not suit the needs of underdeveloped countries. In such cases, the initiative innovators may make some changes in the innovations made by innovative entrepreneurs to suit their requirements.

(c) Fabian Entrepreneur:

These entrepreneurs neither fall in the innovative entrepreneur category nor the adoptive entrepreneur category. These are very cautious people. These entrepreneurs are rigid and fundamental in approach. They follow in the footsteps of their successors. They are shy to introduce new methods and ideas. Fabian entrepreneurs are no risk-takers.

(d) Drone Entrepreneur:

Drone entrepreneurs are lazy in adopting new methods, but Drone entrepreneurs are more rigid than Fabian entrepreneurs. They resist changes. They are laggards. They may close down their business but they don’t adapt to changes. Drone entrepreneurs refuse to adopt changes.

Question 2.

Explain the limitations and problems of international trade.

Answer:

The exchange of goods and services between the nations is called international trade. It has certain limitations and problems. The following are the limitations of international trade.

- Economic interdependence is gained from international trade. In case of war or any other political deadlock, it creates a crisis.

- Industrialization of developing countries may be adversely affected by unrestricted imports.

- Foreign trade leads to unhealthy competition among the countries, creating rivalry between them.

- The concept of comparative cost principle which leads to rigid specialization in a few countries may create many difficulties.

- International trade may lead to lopsided or partial development at the cost of neglect of certain sectors of the economy.

Problems of Foreign Trade:

- Currency problems: Payment between the countries creates complications because every country has its own currency. To avoid losses in transactions the rate of exchange has to be carefully determined.

- Legal problems: Laws and customs regulations are affecting the import and export trade because every country has its laws, and customs regulations. These regulations stand in the way of smooth inflow and outflow of goods.

- Credit problems: The exporter has to take special steps to ascertain the creditworthiness of the buyer as there is no direct contact between the exporter and importer.

- Greater risk: In foreign trade goods are to be exported to long distances. So exporting the goods creates greater risk.

- Time gap: In foreign trade, there is a wide gap between the time when the goods are dispatched and the time when the goods are received and paid.

![]()

Question 3.

Define stock exchanges and explain their functions.

Answer:

According to Securities Contracts Act 1956, a stock exchange is defined as “an association, organization, or body of individuals, whether incorporated or not, established to assist, regulate and controlling business in buying, selling and dealing in securities”.

Functions of Stock Exchange:

1. Ready and Continuous Market:

The stock exchange provides a ready and continuous market for securities. The exchange provides a regular market for trading securities.

2. Protection to Investors:

The stock exchange protects the interest of the investors through the enforcement of rules. The rules of the securities contracts (Regulation) Acl, 1956 also govern the dealings on stock exchanges.

3. Provides the information to assess the real worth of the Securities:

The value of securities is made properly on the stock exchange. This is made by taking into consideration various factors such as present and future competition in securities, and financial and general economic conditions. The stock exchange publishes the quotation of different securities on the faith of these quotations every investor knows the worth of his holdings at any time.

4. Provides Liquidity of Investment:

The stock exchange is a market for existing securities. This market is continuously available for the conversion of securities into cash and vice-versa. Persons who do not need hard cash can dispose of their securities easily.

5. Helps in Raising Capital:

There is always a demand for additional capital from the existing concerns. The demand is met through the issue of shares. Stock exchange provides a ready market for such shares.

6. Raising Public Debt:

The increasing government’s role in economic development has necessitated the raising of huge amounts and the stock exchange provides a platform for raising public debt.

7. Listing of Securities:

The company that wants its shares to be traded on the stock exchange should list its securities by applying to the stock exchange authorities giving all the details regarding capital structure, management, etc.

8. Encourage Savings Habit:

Stock exchange creates the habit of saving and investing among the members in the public. It leads to the investment of their funds in corporate and government securities. In this way, it contributes to capital formation.

9. Economic Barometer:

The pulse of the market can be known by its stock indices. The prevailing economic conditions affect the share prices. So, stock exchanges can be called as an economic barometer.

10. Improve the Company’s Performance:

In stock exchanges, only those securities are traded which are listed. The stock exchanges exercise influence over the management of the company.

Section – B

(4 × 5 = 20)

Answer any four of the following questions in not exceeding 20 lines each.

Question 4.

Explain the opportunities for entrepreneurship in drugs and pharmaceuticals and mines and minerals in A.P.

Answer:

1. Drugs and Pharmaceuticals:

The state offers excellent opportunities for the growth of the pharmaceutical industry due to the availability of trained and skilled manpower, good infrastructure as well as research and development facilities. Hyderabad accounts for around one-third of India’s total bulk production and is considered the drug capital of the country. It provides plenty of opportunities for entrepreneurs as govt, decided the establish a pharma city near Visakhapatnam.

2. Mines and Minerals:

Andhra Pradesh is the second largest storehouse of mineral resources in India. It includes vast deposits of coal, limestone, slabs, oil and natural gas, manganese, iron ore, etc. A wide range of these minerals are used in fertilizers, ceramics, abrasives, glass, foundry, oil well drilling filters, and pigments. Besides the state has immense potential for untapped and under-tapped minerals and provides opportunities for entrepreneurs.

Question 5.

Criticism against SEZs.

Answer:

The following are the disadvantages of SEZ.

- Special economic zones are criticized on many grounds. The first major criticism against a special economic zone is the forcible acquisition of agricultural land. This displaces many people from their traditional livelihood and employment sources such as farming, fishing, etc. SEZs are encouraging real estate speculation. Small and marginal farmers, weaving, and livestock-rearing communities are away from their professions due to SEZs.

- The special economic zones are not only dispossessing people of resources but also of democracy and governance. There has been criticism regarding the governance model of special economic zones and their accountability. The problem of the special economic zone is that there would be no democratic local governance institutions.

- Special economic zones are also criticized for payment of meager and inadequate compensation and rehabilitation measures to the displaced. There are several environmental and health problems in the establishment of special economic zones. The SEZ Act is completely on environmental concerns.

- Special economic zones are to be established in backward areas to bring balanced regional development. But it has not happened. The majority of the units are located nearer to larger cities.

![]()

Question 6.

Define Services and Goods.

Answer:

Services are those separately identifiable, essentially intangible, activities that provide the satisfaction of wants and are not necessarily linked to the sale of a product or another service. Services are intangible as they are not seen or touched. Service is inconsistent since there is no standard tangible product. Service is the simultaneous activities of production and consumption. Services cannot be stored for the future. Service is the participation of the customer in the service delivery process. Goods are physical objects and are homogeneous. They are tangible.

- Medicine Different customers get standardized demands fulfilled.

- Mobile phones. There will be a separation of production and consumption.

- Purchasing ice cream from a store. Goods can be kept in stock.

- Train journey ticket. Involvement at the time of delivery is not possible.

- Manufacturing a vehicle.

Question 7.

What are the facets of electronic banking?

Answer:

The following are the different facets of E-Banking.

- ATM: ATM is popularly known as Any Time Money Machine. The customer gets cash fast, withdrawal, transfer, payment of bills, or cash deposit through ATM.

- Tele Banking (Home Banking): Customers can perform several transactions from their telephone such as checking the balance in the accounts, transferring funds from one account to another, paying certain bills ordering statements or checkbooks, etc.

- E-mail Banking: Customers may communicate with the bank by electronic mail or E-mail. The most frequently used service is sending account statements periodically to the client’s mailbox.

- Network Banking or Online Banking: Internet or online banking is a facility provided by banks to enable the user to execute bank-related transactions through the Internet. The people sitting at home can transact business and they need not visit a bank.

- Mobile Banking: The delivery of bank services to a customer through a mobile (cell) phone is called mobile banking.

Question 8.

Briefly explain dematerialization.

Answer:

Dematerialisation:

All trading in securities is now done through computer terminals. Since all systems are computerized, the buying and selling of securities are settled through an electronic book entry form. This is mainly done to eliminate problems like theft, fake/forged transfers, transfer delays, and paperwork associated with share certificates or debentures held in physical form. In this process securities held by the investor in physical form are canceled and the investor is given an electronic entry or number so that he can hold it as an electronic balance in an account. The process of holding securities in an electronic form is called dematerialization. For this, the investor has to open a Demat account with an organization called a depository. Now all initial public offers are issued in dematerialized form.

Question 9.

What is an index? Explain NIFTY.

Answer:

A stock market index is a barometer of market behavior. It measures overall market sentiment through a set of stocks that are representative of the market. It reflects market direction and indicates day-to-day fluctuations in stock prices. An ideal index number must represent changes in the prices of securities and reflect the price movement of typical shares for better market representation. If the index rises, it indicates that the market is doing well, and vice versa. In the Indian market, the BSE – SENSEX and NSE – Nifty are important indices.

NIFTY:

NIFTY is an index of NSE, which is computed from the performance of top stocks from different sectors listed in NSE. NIFTY stands for National Stock Exchanges Fifty. It consists of 50 companies from 24 different sectors. The companies that form an index of nifty may vary from time to time based on many factors considered by the NSE. The base year for the index is 1995-96 with the base value as 1000.

Section – C

(5 × 2 = 10)

Answer any five of the following questions in not exceeding 5 lines each.

Question 10.

Write the types of entrepreneurs.

Answer:

Entrepreneurs are classified into four types. They are:

- Innovating Entrepreneurs

- Initiative Entrepreneurs

- Fabian Entrepreneurs

- Drone Entrepreneurs

Question 11.

Mail order business.

Answer:

Mail order refers to shopping by post. It is a district form of retail business where in orders are accepted and goods are delivered by post. It is a method of non-store, impersonal, and direct selling that eliminates the middlemen. Thus mail order business can be defined as an establishment that receives orders by mail and makes its sales by mail, parcels, etc.

![]()

Question 12.

What is meant by SEZ?

Answer:

Special Economic Zones (SEZ) is a geographical region that has economic laws that are more liberal than the country’s economic laws. The main aim of SEZ is to attract large foreign investments. It is intended to make SEZ engines for economic growth. The SEZ Act was passed by the Parliament in May 2005. An SEZ is specifically described as a duty-free enclave deemed to be a foreign territory for trade operations.

Question 13.

Bill discounting.

Answer:

The holder of a bill or drawer may be in urgent need of cash before the due date. In such circumstances, he can sell or discount the bill to the bank at a lesser amount than the actual.

Question 14.

What is premium?

Answer:

It is the money that is paid periodically by the insured to the insurer in consideration for which the insurer gives protection to the insured.

Question 15.

Treasury bills.

Answer:

A treasury bill is an instrument of short-term borrowing by the Government of India maturing in less than one year. These are issued by RBI on behalf of the Government to meet its short-term requirements. The purchase price is less than face value and at maturity govt, will pay full face value.

Question 16.

SENSEX.

Answer:

BSE Sensex is called BSE-30. Since BSE has been the leading exchange of the Indian secondary market, SENSEX is an important indicator of the Indian Stock Market. SENSEX which was launched in 1986 is made up of 30 of the most actively traded stocks in the market.

Question 17.

State Commission.

Answer:

The state commission settles the consumer dispute at the state level. The state commission is headed by the judge of the High Court and comprised of other members not less than two and not more than such members as prescribed. The state commission is empowered to call for the records and appropriate orders in respect of any consumer dispute within the state jurisdiction. The state commission shall have jurisdiction to entertain consumer complaints where the value of goods and services for which compensation claimed exceeds ₹ 20 lakhs.

Part – II (50 Marks)

Section – D

(1 × 20 = 20)

Answer the following question.

Question 18.

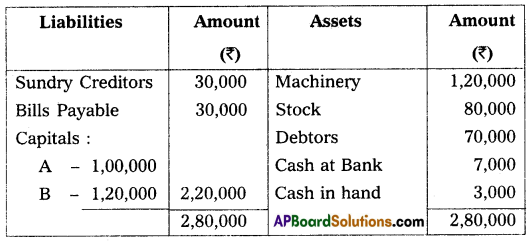

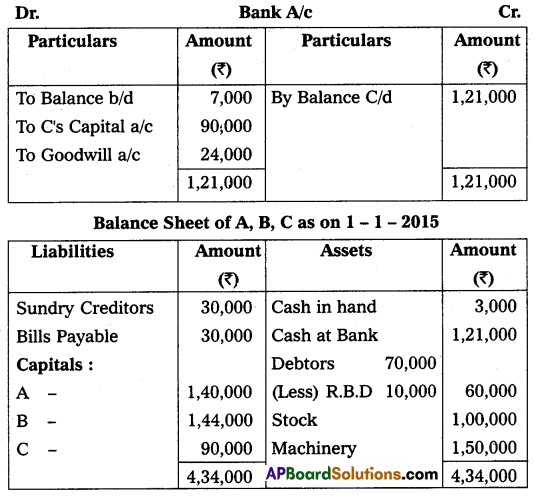

A and B are partners in a firm, sharing profits and losses in the ratio of 5 : 3, on 31st December 2014 their Balance sheet was as under:

On the above date, they decided to admit C as a partner on the following terms:

(a) C will bring ₹ 90,000 as his capital and ₹ 24,000 for his share of goodwill for 1/4th share in the profit.

(b) Machinery is to be valued at ₹ 1,50,000, stock 1,00,000 and provision for bad debts of ₹ 10,000 is to be created.

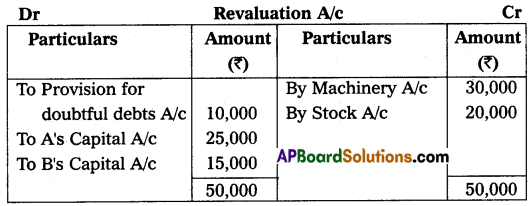

Prepare Revaluation A/c, partners’ capital A/c, and new Balance Sheet.

Answer:

Section – E

(1 × 10 = 10)

Answer any one of the following questions.

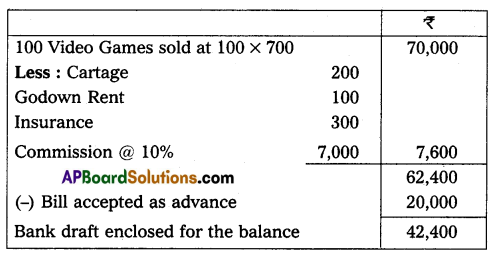

Question 19.

A & Co., of Hyderabad, consigned 100 Video Games to B & Co., of Delhi to be sold on consignment ₹ 500 each. He paid transport ₹ 2,000 warehouse charges ₹ 3,000. B & Co., sent account sales stating that

Prepare necessary ledger accounts in the books of both parties.

Answer:

(or)

Question 20.

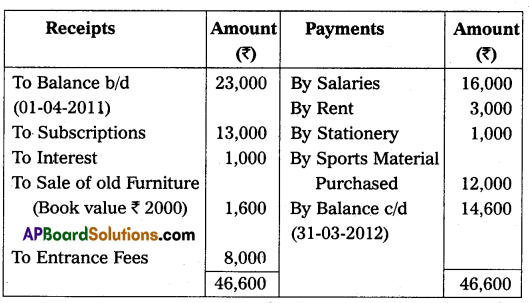

From the following Receipts and Payments of Nethajee Sports Club, prepare income and Expenditure A/c for the year ended on 31-Mar-2012.

Additional Information:

(a) Subscriptions Include ₹ 1,000 Received for the last year.

(b) Rent Includes ₹ 600 paid for the last year.

From the above particulars Prepare Income and Expenditure A/c for the year ending 31-03-2012.

Answer:

Section – F

(2 × 5 = 10)

Answer any two of the following questions.

Question 21.

Explain the categories of share capital.

Answer:

From the accounting point of view, the share capital of the company can be classified as follows:

- Authorized Capital: Authorised capital is the amount of share capital that a company is authorized to issue to the public by the memorandum of association. It is also called nominal or registered capital.

- Issued Capital: Issued capital is part of authorized capital that is issued to the public for subscription. A company may issue its entire authorized capital or may issue in parts from time to time as per the needs of the company.

- Subscribed Capital: It is that part of the issued capital which has been subscribed by the public. This capital can be equal to or less than the issued capital.

- Called-up Capital: It is that part of the subscribed capital that is called up by the company to pay on the allotted shares. The company may decide to call the entire amount or part of the face value of shares.

- Paid-up Capital: That part of the called-up capital that has been paid by the shareholders.

- Reserve Capital: A company may reserve a portion of its uncalled capital to be called only in the event of the winding up of the company, Such an uncalled amount is called the reserve capital of the company.

![]()

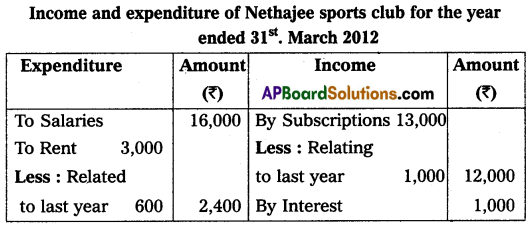

Question 22.

Parvathi sold goods worth ₹ 14,000 to Suneetha on 1st January 2014. Suneetha paid ₹ 4,000 immediately and for the balance, she accepted a bill of exchange drawn upon her by Parvathi payable after 3 months. Parvathi discounted the bill immediately with her bank @ 10% p.a. On the due date, Suneetha dishonored the bill and the bank paid ₹ 30 as noting charges. Pass necessary journal entries in the books of Parvathi.

Answer:

Question 23.

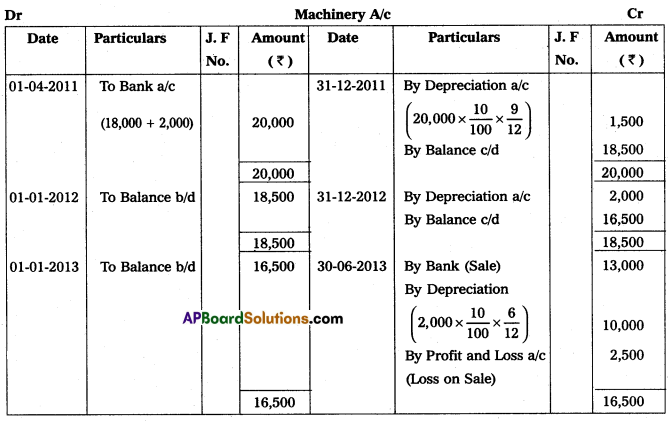

Manoj & Company purchased a secondhand machine for ₹ 18,000 on 1st April 2011 and spent ₹ 2,000 on repairs and installed the same. Depreciation is written off at 10% p.a. on the Straight Line Method. On 30th June 2013, it was sold for ₹ 13,000. Prepare machine accounts assuming that the accounts are closed on 31st December every year.

Answer:

Question 24.

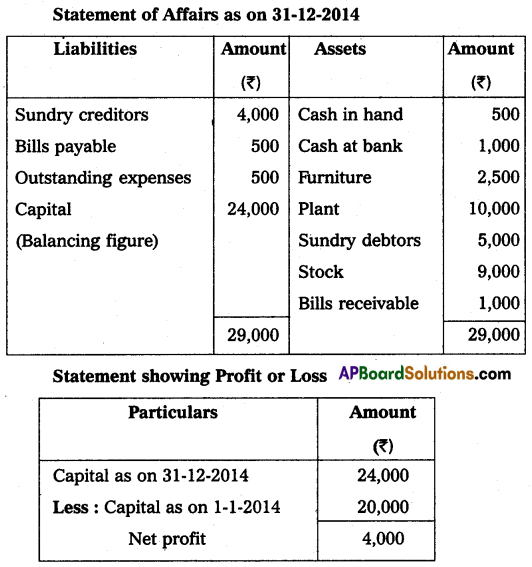

Mr. J. Keeps his books by a single entry. He started the business on 1st January 2014 with ₹ 20,000 on 31st December 2014 his position was as under.

Assets: Cash in hand ₹ 500; Cash at bank ₹ 1,000; Furniture ₹ 2,500; Plant ₹ 10,000; Sundry debtors ₹ 5,000; Stock ₹ 9,000 and Bills receivables ₹ 1,000.

Liabilities: Sunday creditors ₹ 4,000; Bills payable ₹ 500 and Outstanding expenses ₹ 500. Ascertain the profit or loss made by J.

Answer:

Section – G

(5 × 2 = 10)

Answer any Five of the following questions.

Question 25.

What is a bill of exchange?

Answer:

When goods are sold on credit, the buyer promises the seller that he will pay the amount of goods purchased after a certain period. The buyer has to give a promise in writing. The bill of exchange contains an unconditional order to pay a certain amount on an agreed date.

Question 26.

What is obsolescence and depletion?

Answer:

Obsolescence implies an existing asset becoming out of date on account of the availability of a better type of asset due to technological changes or improvements in production methods. Assets of waste in nature such as mines, quarries, etc., get depleted with the extraction of raw materials out of them.

Question 27.

What is an overriding commission?

Answer:

It is an extra commission allowed over the normal commission. This commission is generally offered when an agent is required to work hard either to introduce a new product or to supervise the work of other agents in a particular area.

Question 28.

What is capital income? Give two examples.

Answer:

Any amount received as investment by owners or raised by way of loans and sale of fixed assets is known as capital receipts. These amounts lie in huge amounts. These are non-recurring. All the items of capital receipts are to be shown on the liabilities side of the balance sheet.

Question 29.

Bose is a partner in a firm. He withdraws ₹ 3,000 at the start of each month for 12 months. The books of the firm close on March 31 every year. Calculate interest on drawings at the rate of interest is 10% p.a.

Answer:

When the amount is withdrawn at the beginning of every month:

Total drawings = 3,000 × 12 = ₹ 36,000

Interest on drawings = 36,000 × \(\frac{10}{100} \times \frac{6.5}{12}\) = ₹ 1,950

Question 30.

Sacrificing Ratio.

Answer:

The ratio in which the old partners agree to sacrifice their share of profit in favor of the incoming partner is called the sacrificing ratio.

∴ Sacrificing Ratio = Old Share of Profit – New Share of Profit

![]()

Question 31.

X and Y share profits and losses in the Ratio of 4 : 3, they admit Z with 3/7th share; which he gets 2/7th from X and 1/7th from Y. What is the new profit sharing ratio?

Answer:

New Oartner Z’s Share = \(\frac{3}{7}\) (This acquired \(\frac{2}{7}\) from X and \(\frac{1}{7}\) from Y)

Old Ratio 4 : 3

New Share = Old Share – Sacrificing Ratio

X = \(\frac{4}{7}-\frac{2}{7}=\frac{2}{7}\)

Y = \(\frac{3}{7}-\frac{1}{7}=\frac{2}{7}\)

Z = \(\frac{3}{7}\)

Question 32.

Preference Shares.

Answer:

Shares refer to the units into which the total share capital of the company is divided. Thus, a share is a fractional part of the share capital and forms the basis of ownership interest in the company. The persons who contribute money through shares are all called shareholders. As per section, 86 of the Companies Act a company can issue two types of shares: Preference shares and equity shares.

Preference Shares:

According to section, 85 of the Companies Act, of 1956, a preference share fulfills the following two conditions.

- It carries a preferential right to dividend, to be paid as a fixed amount or an amount calculated by a fixed rate of the nominal value of each share before any dividend is paid to the equity shareholders.

- That concerning capital it carries or will carry, on the winding up of the company, the preferential right to the repayment of capital before anything is paid to equity shareholders.