The strategic use of AP Inter 1st Year Economics Model Papers Set 6 allows students to focus on weaker areas for improvement.

AP Inter 1st Year Economics Model Paper Set 6 with Solutions

Time: 3 Hours

Maximum Marks: 100

Section – A

I. Answer any Three of the following questions in not exceeding 40 lines each. (3 × 10 = 30)

Question 1.

What is price elasticity of demand ? Explain three methods of price elasticity of demand.

Answer:

The concept of elasticity of demand is one of the original contributions of DrMarshall. The concepts of elasticity of demand clearly explains ‘how much’ demand increases due to a certain fall in price and ‘how much’ demand decreases due to certain rise in price. According to Mrs. Joan Robinson, “The elasticity of demand at any price or at any output is the proportional change of amount purchased in response to a small change in price, divided by the proportional change in price”. Methods of measurements of Price Elasticity of demand : The Elasticity of demand can be measured mainly in three ways.

1. Total outlay (or) Expenditure method

2. Point method and

3. Arc method.

1) Total outlay (or) Expenditure method:

This method was introduced by Alfred Marshall. Price elasticity of demand can be measured on the basis of change in the total outlay due to a change in the price of a commodity. This method helps us to compare the total expenditure from a buyer or total revenue from the seller before and after the change in price.

Total outlay = Price × Quantity demanded

According to this method the price elasticity of demand is expressed in three forms, they are elastic demand, unitary elastic and inelastic demand. This can be explained with the help of table.

| 1 Price | Quantity demand | Total expenditure or outlay | Ed nature |

| 6

5 |

100 200 |

600

1000 |

Elastic demand Ed > 1 |

| 4

3 |

300 400 |

1200

1200 |

Unitary demand

Ed = 1 |

| 2

1 |

500

600 |

1000

600 |

Inelastic demand

Ed < 1 |

In this table shows that:

1) If the total expenditure increases due to a fall in price is known as relatively elastic demand.

- If total expenditure remains constant even the price falls is known as unitary elastic demand.

- If the total expenditure decreases due to a fall in price is known as relatively inelastic demand.

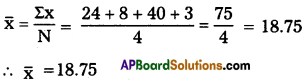

2) Point method:

his method is introduced by Marshall. In this method elasticity of demand is measured at a point on the demand curve. So, this method is also called as “geometrical method”. In this method to measure elasticity at a point on de¬mand curve the following formula is applied.

Ed = \(\frac{The distance from the point to the X – axis}{The distance from the point to the Y – axis}\)

In the below diagram ‘AE’ is straight line demand curve. Which is 10 cm length.

Applying the formula we get

Ed = 1

Ed < 1

Ed = 0

Elasticity at point A, Ed = \(\frac{\mathrm{AE}}{\mathrm{A}}=\frac{10}{0}=0\)

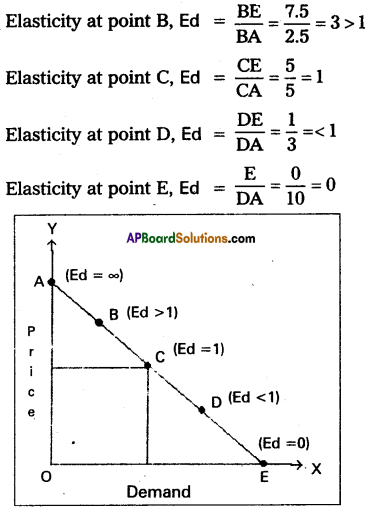

If the demand curve is non-linear. It means if the demand curve is not straight line will be drawn at the point on the de-mand curve where to measure elasticity.

In the diagram at C point’where Elasticity of demand will be equal to \(\frac{\mathrm{CB}}{\mathrm{CA}}\)

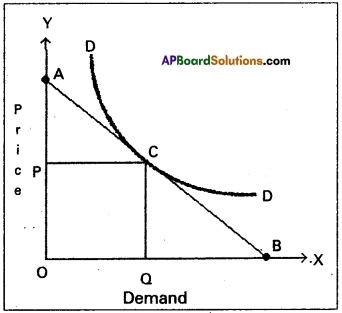

3) Arc method:

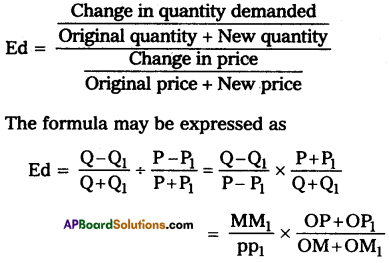

The word ‘Arc’ means a portion or a segment of a demand curve. In this method mid points between the old and new price and quanti-ties demanded are used. This method used to known small changes in price. This method is also known as “Average Elasticity of demand”. This method studies a segment of the demand curve between two points the formula for measuring elasticity is given below.

Suppose we take price of the commodity is ₹ 4/- demand is 300 units. If price falls ₹ 3/- demand increases 400 units.

Then applying above formula Arc elasticity of demand is

Then appiying above formula Arc elasticity of demand is

\(\frac{100}{300+400} \div \frac{1}{4+3}=\frac{100}{700} \div \frac{1}{7}\)

= \(\frac{100}{700} \times \frac{7}{1}=\frac{700}{700}=1\)

∴ Ed = 1

![]()

Question 2.

Elucidate the features of perfect competition.

Answer:

Perfect competitive market is one in which the number of buyers and sellers is very large, all engaged in buying and selling a homogeneous products without any restrictions.

The following are the features of perfect competition :

1) Large number of buyers and sellers: Under perfect com-petition the number of buyers and sellers are large. The share of each seller and buyer in total supply or total demand is small. So no buyer and seller cannot influence the price. The price is deter¬mine only demand and supply. Thus the firm is price taker.

2) Homogeneous product: The commodities produced by all the firm of an industry are homogeneous or identical. The cross elasticity of products of sellers is infinite. As a result, single price .will rule in the industry.

3) Free entry and exit: In this competition there is a free¬dom of free entry and exit. If existing firms are getting profits. New firms enter into the market. But when a firm getting losses, it would leave to the market.

4) Perfect mobility of factors of production : Under perfect competition the factors of production are freely mobile between the firms. This is useful for free entry and exits of firms.

5) Absence of transport cost: There are no transport cost. Due to this, price of the commodity will be the same throughout the market.

6) Perfect knowledge of-the e conomy: All the buyers and sellers have full information regarding the prevailing and future prices and availability of the commodity. Information regarding market conditions is availability of commodity.

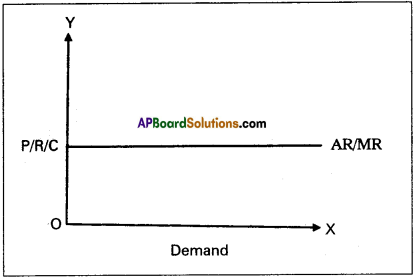

7) Shape of revenue curves: The shape of revenue curves under perfect competition is parallel to the ‘X’ axis.

Question 3.

Define rent and explain Ricardian theory of Rent.

Answer:

David Ricardo was a 19th century economist of England, who propounded a systematic theory of rent. Ricardo defined rent as “that portion of the procedure of earth which is paid to the landlords for the use of the original and indestructible powers of soil”. According to Ricardo, rent arises due. to differential in surplus occurring to agriculturists resulting from the differences in fertility of soil of different grades of land.

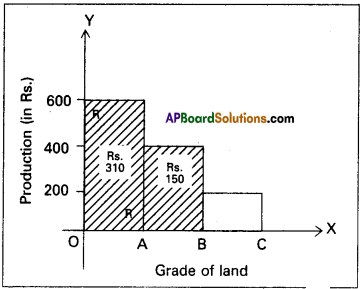

Ricardian theory of rent is based on the principle of demand and supply. It arises in both extensive and intensive cultivation of land. When land is cultivated extensively, rent on superior land equals the excess of its produce over that of the inferior land. This can be explained with the following illustration.

We can imagine that a new island is discovered. Assume a batch of settlers go to that Island. Land in this Island is differ in , fertility and situation. We assume that there are three grades- of land A, B and C. With a given application of labour and capital superior lands will yield more output than others. The difference in fertility will bring about differences in the cost of production, on the different grades of land.

They first settle on A’ grade land for cultivation of com. A’ grade land yields say 20 quintals of com with the investment of ₹ 300. The cost of production per quintal is ₹ 15 (300/20). The price of com in the market has to cover the cost of cultivation. Otherwise the farmer will not produce com. Thus the price in the present case should be atleast ₹ 15 per quintal. As time passes, population increases and demand for land also increases. In such a case people have to cultivate next best land, i.e., ‘B’ grade land. The same amount of ₹ 300 is spent of ‘B’ grade land gives only 15 quintals of com as ‘B’ grade land is less fertile.

The cost of cultivation on ‘B’ grade land risen to ₹ 20 (300/15) per quintal of com. If the price Qf com per quintal in the market is then ₹20, the cultivator of ‘B’ grade and will be not cultivated. Therefore, the price has to be high enough to cover the cost of .cultivation on ‘B’ grade land. Hence the price also rises to ₹ 20. There is no surplus on ‘B’ grade land. But on A grade land. But on A grade land, the surplus is 5 quintals or ₹ 100 (5 x 20).

Further, due to growth of population demand for land and corn increased. This necessitates, the cultivation of ‘C’ grade land with ₹ 300 investment cost. It yields only 10 quintals of com. Therefore the per quintal production cost rises to 30 (300/10). Then the price per quintal must be atleast ₹ 30 to cover the cost of production.

Otherwise ‘C’ grade lar i will be withdrawn from cultivation. At price ₹ 30 ‘C’ grade land yield no surplus or rent. But A grade land yields still layer surplus of 10 quintals or ₹ 300 (10 x 30). But surplus or rent 6’n’B’ grade land has 5 quintals or ₹ 150 (5 x 30). But there is no surplus or rent on ‘C’ grade land. It covers just the cost of cultivation. Hence, ‘C’ grade land is a marginal land which earns no rent or surplus.

This can also be explained with the following table.

| Types of land | Cost of production | Produce (Quintals) | Price | Total Revenue | Rent or surplus | |

| In physical Units | In value form (₹) | |||||

| A | 300 | 20 | 15 | 300

400 600 |

–

5 10 |

–

100 300 |

| B | 300 | 15 | 20 | 300

450 |

–

5 |

–

150 |

| C | 300 | 10 | 30 | 300 | – | – |

The essence of Ricardian theory of rent.

- Rent is a puer surplus

- Rent is differential surplus.

- Rent does not determine or enter into price.

- Diminishing returns applies fo agricultural production.

- Land is put to only one use i.e., for cultivation.

Ricardian theory of rent can be explained with the help of diagram. In the above diagram the shaded area represents the rent or differential surplus. The least fertile land i.e., C does not carry any rent. So it is called marginal land or no rent land.

Question 4.

How does Keynes advocate government expenditure to reduce unemployment? Explain.

Answer:

The role of the state has become almost all pervasive in the economic organisation of the country. Whether it may be devel-oped or underdeveloped country. The activities undertaken by the modem State in the eco-nomic organisation of a country may be discussed under the fol-lowing heads.

1) The State and Industry:

The activities of the State in the industrial sphere may be considered under three groups namely, the regulatory functions, control of monopolies and lastly nationalisation or public ownership. The state is taking an increasing role in regulating the man-ner of forming and operating industrial undertakings. The under-takings will probably have to take out licenses from the govern-ment before they can start operation.

To check the growth of few giant concerns, the state has been forced to adopt measures for fixing prices and other terms of sale of the monopolised products. All the methods of controlling monopolies have ineffective, then the State take over the ownership of the monopolistic concerns.

2) State and Labour:

The modem state has also been forced to take a number of steps for protecting the interests of labour. In this respect the state has passed factory laws prohibiting the em-ployment of children and women under certain circumstances, fix-ing of reasonable hours of work etc.

3) The State and the Social Services:

State has adopted schemes of social insurance according to which qll persons get free medical treatment and cash payments during periods of sick¬ness, receive unemployment benefits if they are out of work, enjoy pensions in their oldage or in case of disablement. The widows and orphans also receive pensions from the State. The purpose behind these schemes is to relieve the poverty of the citizens and to provide security against the various risks of life.

4) The State and Foreign Trade:

The state interferes with the course of foreign trade for the protection of home industries and for curing deficits in the balance of payments. The deficits in balance of payments will be cured by the State through the system of import control and exchange restrictions.

5) State and Inequalities of Income:

It is the duty of the state to take all reasonable steps for the reduction of inequalities of income. Therefore, the state has adopting the system of pro¬gressive taxation of incomes, imposing levy of death duties or in¬herited properties at progressive rates and distributing the pro¬ceeds of the taxes among the poorer sections of the community.

6) The State and War:

The expenses of modem war have forced the state to assume a good deal of control over the eco-nomic life of a country. If the economic system is to be organised fully for the successful prosecution Of the war, it may be necessaiy for the state to exercise an all – round control over the economy of the country.

7) The State and the Trade Cycles:

Both monetary policy and budgetary policy can be utilised by the State to check the course of the trade cycle.

8) The State and Economic Planning:

An economic plan is a method of organising and utilising the available resources of a country for the purpose of fulfilling certain desirable end. The modem state is expected to formulate such an economic plan or plAnswer: It is necessary or desirable for-the state to formulate a plan for rapid economic development especially in underdeveloped economies, to secure a better distribution of the national income among all classes of people, for the development of resources of the community so on to ensure full employment for everybody etc. All these activities of the state will increase the public expenditure.

![]()

Question 5.

Define inflation. Explain the causes of inflation.

Answer:

Inflation means a rise in the general price level over a long period of time. It occur due to the following reasons.

1) Increase in the aggregate demand of commodities.

2) Inadequate supply of commodites.

3) Increase in the cost of production.

- The factors that the effect the increase in demand.

- Heavy pressure of population.

- Increase in economy’s money supply.

- More public expenditure towards various welfare schemes.

- Reduce in rates of direct taxes.

- Increase in the income levels of individuals.

- Deficit financing by government.

- Conspicious spending by the people having black money.

- Production in direct tax rates.

- Factors that increase the cost of production:

- Increase in costs of various factors of production.

- Increase in tax rates.

- Increase in the prices of technology.

- Devaluation of domestic currency.

- Inefficient management and no control on expenditure.

- Lack of optimum allocation of resources.

- Devaluation of domestic currency.

- Factors that cause inadequate supply:

- Irregular monsoons, floods, interior seeds in agriculture.

- Non-availability of scarcity of inputs and raw materials.

- Under-utilisation of productive capacity.

- Shortage of investment due to non-availability of institu-tional credit.

- Artificial scarcity due to black-marketing.

- Exports at the cost of domestic supply.

- Long gestation period of certain industries.

Section – B

II. Answer any Eight of the following questions in not exceeding 20 lines each. (8 × 5 = 40)

Question 6.

Explain the importance of the concept of elasticity of demand.

Answer:

The term elasticity refers to the measure of extent of rela-tionship between two related variable. The elasticity of demand is the measure of responsiveness or sensitiveness of demand for a commodity to the change in it demand. Importance :

1) Useful to monopolist:

Monopolist should study the elas-ticity of demand for his commodity before fixing up the price. Monopolist will fix a higher price when the commodity has inelas-tic demand, but he will fix a lower price when the commodity has elastic demand.

2) Useful to joint products:

It is useful in the price fixation of joint goods like meat and fur. In such case the producer will be guided by elasticity of demand to fix the prices of the joint goods.

3) Useful to the government:

The concept of elasticity can be used in formulating government policies relating public utility

service like Railways, drug industry etc.

4) Useful to international trade:

In calculating the terms of trade both countries have to take into account the mutual elastici-ties of demand for the products.

5) Useful to finance minister:

The concept of elasticity is useful to the Finance Minister in imposing taxes on goods. The finance minister studies the elasticity of commodities before he imposes new taxes or enhances old taxes.

6) Useful to Management:

Before asking for higher wages trade union leaders must know the elasticity of demand of the prod¬uct produced by them. Trade union leaders may demand for higher wages only when the goods produced by them have inelastic demand.

7) Useful to producers:

Volume of goods must be produced in accordance with demand for the commodity. Whenever the de-mand for the commodity is inelastic, the producer will produce more commodities to take advantage of higher price. So, it helps in determining the volume of output.

![]()

Question 7.

What are the determinants of supply?

Answer:

The supply of a commodity means the total quantity of the commodity that sellers offer to sell at different prices from the stock of that commodity existing at any given time. The supply of commodity depends upon the following factors.

Determinants of supply :

- Price of the commodity:

The supply of the commodity depends upon the price of that commodity. When price falls, sup-ply falls and when price rises, supply also rises. Thus price and supply are directly related. - Factor prices:

The cost of production of a commodity depends upon the prices of various factors of production. - Prices of related goods:

The supply of the commodity depends upon the prices of related goods. If the price of a substi-tute good goes up, the producer will be induced to divert their resources. - State of technology:

Technological improvements deter-mine supply of a commodity. Progress in technology leads to re-duction in the cost of production which will increase supply. - Government policy:

Imposition of heavy taxes as a com-modity discourages its production. Hence production decreases.

Question 8.

Define Oligopoly. What are the main features of Oligopoly?

Answer:

The term ‘Oligopoly’ is derived from two Greek word “Oligoi” meaning a few and “Pollein” means to sell. Oligopoly refers to a market situation in which the number of sellers dealing in a ho-mogeneous or differentiated product is small. It is called competition among the few. The main features of oligopoly are the following.

- Few sellers of the product.

- There is interdependence in the determination of price.

- Presence of monopoly power.

- There is existence of price rigidity.

- There is excessive selling cost or advertisement cost.

Question 9.

Explain briefly various theories of wages.

Answer:

Wages are a payment made for the services of labour, either mental or physical.

According to Benham “sum of money paid under contract by an employer to a worker for the services rendered”. Theories of wages:

1. Subsistence theory of wages:

This theory was formu¬lated by a group of French Economics known as Physiocrats. This theory is also termed as “Iron Law of wages”. According to this theory, wages will always be at a level to enable the labourer and his family to fulfill the minimum subsistence level. If the wages are raised above the subsistence level, supply of labour will increase. If wages will decrease to the subsistence level, the supply of labour will decrease. Hence wages will always be at the subsistence level.

2. Wage fund theory:

This theory developed by J.S.Mill. According to this theory every entrepreneur will keep aside a part of the variable capital to pay wages as the labourers cannot wait for their wages till goods are sold. Such part of variable capital is known as “Wages fund” or “Circulating capital”.

Amount of wage fund Average wage rate = Number of labourers

3. Residual claimant theory of wages:

This theory proposed the residual claimant theory of wages. According to Walker is a residual claimant. After paying rent, interest and profit from total revenue, the balance will be paid as wages to labourers. Wages = Total Revenue – (Rent + Interest + Profit)

4. Taussig’s theory of wages:

This theory modified by Taussig. According to Taussig, wages are equal to the discounted marginal product of labour. According to him, the labourer cannot get full value of the marginal productivity. In order to meet the expenditure of labourer in course of production, the employer will have to pay wages in advance. Hence, the employers deducts a certain percentage from the final output inorder to compensate the risk involved in advance payments to the labourers.

5. Modern theory of wages:

This theory proposed by Marshall and J.R.Hicks. According to this theory, the wages of labourers are determined by the demand for and supply of labourers wage is determined at that point where the demand and supply of labourer are equal.

Question 10.

What is the importance of national income estimates?

Answer:

The importance of national income studies is growing because of several reasons.

- The national income estimates are very important for pre-paring economic plAnswer:

- It is very important tools for framing economic policies.

- It is very useful in making budgetary allocations.

- It helps us to compare economic growth with other coun-tries.

- It is essential to calculate percapita incomes in a country and income inequalities.

- It helps the government in macroeconomic policy making.

Question 11.

What are the different types of budget deficits?

Answer:

Budget deficits arises when the total expenditure in the bud¬get exceeds the total receipts. Technically there are four types of deficits with reference to a budget.

1) Revenue deficit: Revenue deficit arises when revenue expenditure exceeds revenue receipts. In the budget estimates of the government India for the year 2013-14 as revenue deficit is ₹ 3,79,838/- crores.

Revenue deficit = Revenue receipts – Revenue expenditure.

2) Budget deficit: Budget deficit is the difference between the total receipts and total expenditure.

Budget deficit = Total receipts – Total expenditure

3) Fiscal deficit: Fiscal deficit is the difference between the total expenditure and total revenue minus the market borrowings.

Fiscal deficit = (Total revenue – Total expenditure) + market borrowings and other liabilities.

4) Primary deficit: Primary deficit is the fiscal deficit minus interest payment.

Primary deficit = Fiscal deficit – Interest payments.

![]()

Question 12.

What is Net Banking? What are the advantages of Net Banking?

Answer:

Net Banking also called internet or online banking. It is the process of conducting banking transactions over the internet. Viewing bank statements and the states of a bank account online comes under the definition of net banking.

Net Banking advantages:

- Available for 24 hours a day, 7 days a week.

- The account can be operated from anywhere all you need is a computer with internet access.

- Easy to apply for a majority of the services such as loans, savings accounts, mortgages etc., online.

- It can be used for paying bills through online which saves both time and money on postage.

- Net Banking is a safe and secure way to handle finances.

- Online banking is environmental friendly, it reduces the paper to use.

Question 13.

State the types of inflation.

Answer:

Inflation means a general rise in prices. Based on the rate of inflation, it may be divided into four types.

- Creeping inflation: When rise in the prices is very slow and small, it is called creeping inflation.

- Walking inflation: This is the second stage of inflation.

- The inflation rate will be between 2% and 4%.

- Running inflation: When the rate of inflation is in the range of 4-10% per annum, it is called running inflation.

- Galloping inflation or hyper inflation: If the inflation rate exceeds 10%, galloping inflation occurs. It may also called hyper inflation.

Question 14.

What do you understand by “lender of last resort”?

Answer:

The central bank serves as a lender of last resort to all the financial institutions i.e., commercial banks, discount houses and other credit institutions. These institutions can also approach the central bank when they face the problem of liquidity. The central bank helps the commercial banks by providing loans and advances against some approved securities and also help to rediscount the commercial banks bills subject to certain terms and conditions.

Question 15.

Explain different kinds of deposits accepted by the commercial banks.

Answer:

Commercial banks pay a very important role in the economic growth of a country. Commercial banks are the most important source of institutional credit in the money market. Banks attract savings from the people and encourage investment in industry, trade and commerce. Bank is a profit seeking business firm dealing in money and credit.

The word bank is derived from the “German” word “bankco” which means joint stock or joint fund. Banking in Britain originated with the lending of money by wealthy individuals to merchants who wished to borrow.

According to ‘Richard Sydney1 sayers – “Banks are institu-tions whose debts usually referred to as “Bank deposits” are com-monly accepted in final settlement of other people’s debts”.

Accepting deposits: The commercial bank just like any other money lender is doing money lending business. Bank receives public money in the form of deposits. The deposits mainly are of the following types.

a) Current deposits: These deposits have two characteristics.

1) There are no restrictions with regard to the amount of withdrawal and number of withdrawls.

2) Banks normally do not pay any interest on current account deposits.

b) Savings deposits: The sole aim of banks in receiving these deposits is to promote the habit of thrift among low income groups. They have the following characteristics:

1) Two or three withdrawals per week are permitted.

2) Banks pay 4% to 5% interest per annum on savings de-posits.

c) Recurring deposits: People will deposit their money in these deposits as monthly installments for a fixed period of time. The bank after expiry of the said period-will return the total amount with interest thereon. The rate of interest will be higher than the saving deposits.

d) Fixed deposits: Deposits are fixed accounts are called fixed or time deposits they are left with the bank for a fixed period. The following are the characteristics.

1) The amount cannot be withdrawn before expiry of fixed period.

2) Bank pay high rate of interest than any deposits.

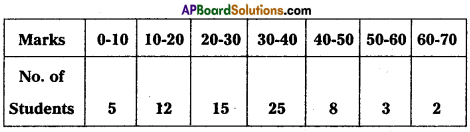

Question 16.

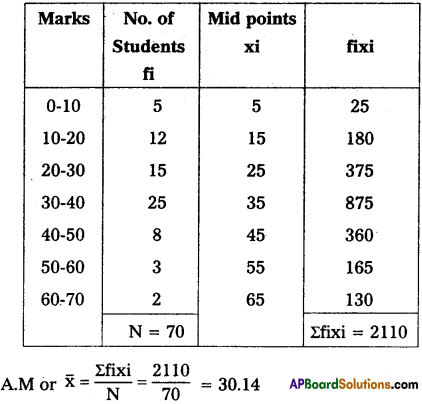

Calculate A.M from the following data through direct method.

Answer:

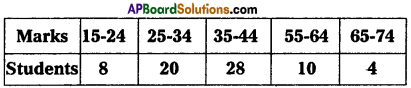

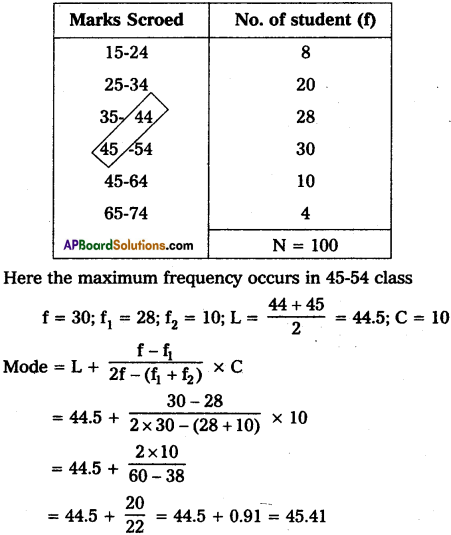

17. The marks scored by 100 students are given below find to Mode.

Answer:

Section – C

III. Answer any fifteen of the following questions in not exceeding 5 lines each. (15 × 2 = 30)

Question 18.

Deductive method

Answer:

The deductive method is also known as the analytical and abstract method. It proceeds from general to the particular or from universal to the individual. This was advocated by classical economists.

Question 19.

General equilibrium

Answer:

This concept was popularised by Walras. General equilibrium analysis takes into account multi market situation. It seeks to explain the effect of a price change of one commodity as the prices of other commodities.

![]()

Question 20.

Relatively elastic demand

Answer:

When a proportionate change in price leads to a more than proportionate change in quantity demand is called relatively elas¬tic demand. In this case Ed > 1.

Question 21.

Market demand

Answer:

A market demand schedule shows the total demand for a good at a particular time at different prices in market. It can be obtained in two ways. 1) By adding up all the individual demand schedules. 2) By taking the demand schedule of a consumer and multiplying it by the toteil number of consumers.

Question 22.

Factors of production

Answer:

There are four factors of production in the economy. They are land, labour, capital and organisation. These are used for pro¬duction process.

Question 23.

Long period

Answer:

The long period market is one which is long enough to change the supply totally for a given change in demand. This period permits to change all the factors of production in changing output. Therefore all factors of production are variable.

Question 24.

Local market

Answer:

A product is said to have local market, when buyers and sellers of the product carry on the business in a particular locality. They cannnot even stored for a larger time. Ex : Vegetables, Milk, Frutis etc.

Question 25.

Equilibrium of firm

Answer:

A firm is said to be in equilibrium when it produces output that yields highest profit and is not interested to change the output. This can be explained in two time periods i.e., short period and long period.

Question 26.

Land

Answer:

Land stands in economics for natural resources. There are nature given resources like soil, earth, water, rainfall etc. All these come under land. Land is the productive equipment given by na¬ture. The remuneration to land is called rent.

Question 27.

Piece wage

Answer:

Piece wage is themount paid for labourers according to volume of work done by them.

Question 28.

Liquidity preference

Answer:

Keynes proposed a monetary explanation of the rate of interest. According to Keynes “Interest is the reward for parting with liquidity for the specified period”.

![]()

Question 29.

Disposable income

Answer:

Personal income totally is not available for spending. Income tax is a payment which must be deducted to obtain disposable income. Disposable income = Personal income – Personal taxes = Consumption + Savings.

Question 30.

Transfer payments

Answer:

Government made payments in the form of pensions unemployment doles etc., are called transfer payments. These payments not included in the National Income.

Question 31.

Market period

Answer:

Market period is also known as very short period. In this > period the supply remains constant. This time period is not enough to change anyone of the factors of production. It may be one day or two days. For Ex : Fish, Vegetables, Flowers etc.

Question 32.

Aggregate demand function

Answer:

The schedule showing aggregate demand price at different levels of employment in the economy is called the aggregate de-mand function.

Question 33.

Call Loan

Answer:

A type of loan given by the commercial banks. It is repay-able on demand without any notice.

Question 34.

Multiple Bar diagram

Answer:

Multiple Bar diagrams are used for comparing two or more set of data.

![]()

Question 35.

Measure of central tendency

Answer:

The measures of central tendency is a way of summarizing the data in the form of typical or representative values. The mea-sures of central tendency are also known as ‘averages’. The three most commonly used averages are:

1. Mean

2. Median

3. Mode

Question 36.

Component bar diagram

Answer:

Thes diagrams are used to represent various parts of the total

Question 37.

Find mean if x values is 24, 8, 40, 3.

Answer: