The strategic use of AP Inter 1st Year Economics Model Papers Set 3 allows students to focus on weaker areas for improvement.

AP Inter 1st Year Economics Model Paper Set 3 with Solutions

Time: 3 Hours

Maximum Marks: 100

Section – A

I. Answer any Three of the following questions in not exceeding 40 lines each. (3 × 10 = 30)

Question 1.

Explain the consumer’s equilibrium using indifference curve.

Answer:

The point where the consumer gets maximum possible satisfaction, where the budget line is tangent to the indifference curve and the MRS is equal to the price ratio of the two goods will be defined as equilibrium of the consumer.

Assumptions :

- Consumer scale of preferences must remain constant.

- Money income of the consumer must remain constant.

- The price of two goods must remain unchanged.

- There should be no change in the tastes and habits of the consumer.

- The consumer is rational and thus maximises his satis-faction.

Conditions of equilibrium:

There are two conditions that must be satisfied for the consumer to be in equilibrium. They are:

- At the point of equilibrium, the budget / price line must be tangent to the indifference curve.

- At the point of equilibrium, the consumer’s MRSxy and the price ratio must be equal.

i.e., MRSxy = \(\frac{P_x}{P_y}\) This can be shown in the following diagram.

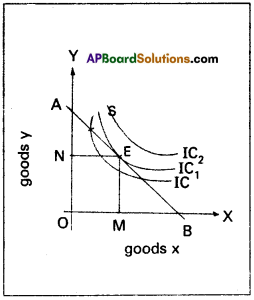

In the diagram ‘AB’ is consumer’s budget or price line.

IC, IC1 IC2 are indifference curves. In the diagram the consumer is equilibrium OM of x and ON of y. At point ’E’ the price line touches to and IC1 At point ‘S’ consumer will be on ‘O’ lower in-difference curve IC and will be getting less satisfaction than at E on IC. IC2 is beyond the capacity of consumer. So it is outside to the budget line.

![]()

Question 2.

Explain law of returns to scale.

Answer:

The law of returns to scale relate to long run production function. In the long run it is possible to alter the quantities of all the factors of production. If all factors of production are increased in given proportion the total output has to increase in the same proportion.

Ex : The amounts of all the factors are doubled, the total output has to be doubled increasing all factors in the same proportion is increasing the scale of operation. When all inputs are changed in a given proportion, then the output is changed in the same proportion. We have constant returns to scale and finally arises diminishing returns. Hence as a result of change in the scale of production, total product increases at increasing rate, then at a constant rate and finally at a diminishing rate.

Assumptions :

1. All inputs are variable.

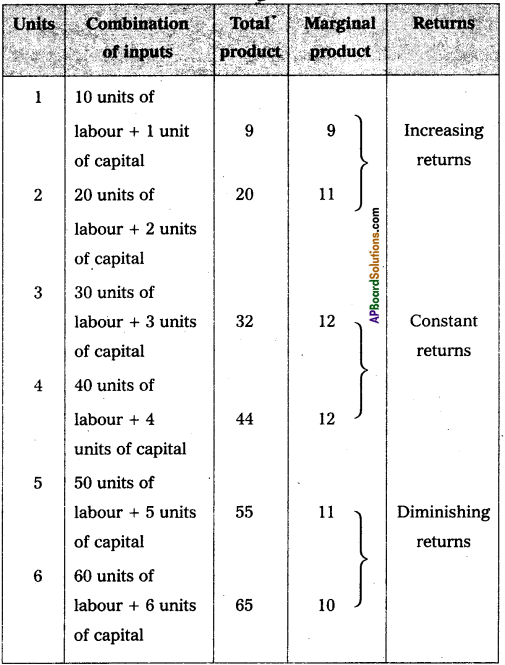

2. It assumes that state of technology remain the same. The returns to .scale can be shown in the following table.

The above table reveals the three patterns of returns to scale. In the 1st place, when the scale is expanded upto 3. units, the returns are increasing. Later and upto 4 units, it remains constant and finally from 5th onwards the returns go on diminishing.

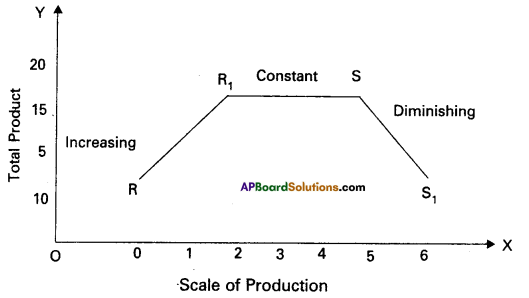

In the diagram on ‘OX’ axis shown scale of production,-on ‘OY’ axis shown total product. RR1 represents increasing returns R1S – Constant returns; SS1 represents diminishing returns.

Question 3.

Explain the classification of markets.

Answer:

Market is commonly thought of as a place where commodities are bought and sold and where buyers and sellers meet. But in economics, the word market does not refer to any particular place. It refers to a region. “Market implies the whole area over which buyers and sellers are in such touch with each other, direction or through middlemen, that the price of the commodity in one part influences it in other parts of it”.

According to Benham’s:

Market means “any area over which buyers and seller are in such close touch with one another, either directly or through dealers, that the prices obtainable in one part of the market affect the price period in other parts”. According to ‘Mac millari – market means “generally any context in which sale and purchase of goods and services takes place. There need be no physical entity corresponding to a market. It may, for example, consist of network at telecommunications across the world on which, say shares are traded”.

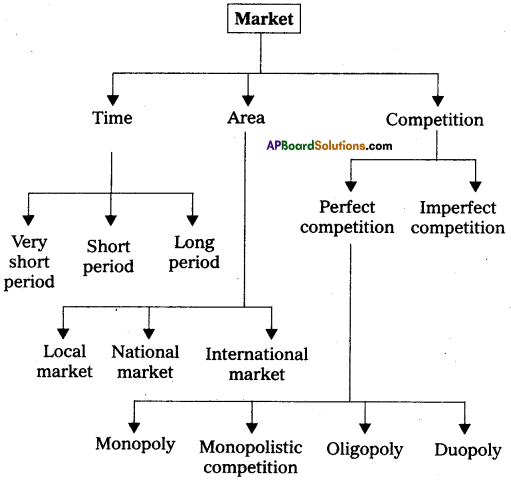

Classification of markets:

‘Markets can be classified on the basis of

1) area covered

2) time and

3) degree of competition.

1) On the basis of area

2) On the basis of time

3) On the basis of competition.

I. On the basis of area: According to the area, markets can be of three types.

- Local market:

When a commodity is sold at particular locality. It is called a local market. Ex: Vegetables, flowers, fruits etc. - National market:

When a commodity is demanded and supplied throughout the country is called national market. Ex : Wheat, rice etc. - International market:

When a commodity is demanded and supplied all over the world is called international market.Ex : Gold, silver etc.

II. On the basis of time: It can be further classified into three types.

- Market period or very short period:

In this period where producer cannot make any changes in supply of a commodity Here supply remains constant. Ex : Perishable goods. - Short period:

In this period supply can be change to some extent by changing the variable factors of production. - Long period:

In this period supply can be adjusted in according change in demand. In long run all factors will become variable.

III. On the basis of competition: This can be classified into two types.

- Perfect market:

A perfect market is one in which the number of buyers and sellers is very large, all engaged in buying and selling a homogeneous products without any restrictions. - Imperfect market:

In this market, competition is imperfect among the buyers and sellers. These markets are divided into- Monopoly

- Duopoly

- Oligopoly

- Mono polistic competition.

![]()

Question 4.

Describe the components of national income.

Answer:

The total quantity of goods and services produced in the economy in a year is the national income. The various components of the national income are :

- Consumption (C)

- Gross domestic investment (I)

- Government expenditure (G)

- Net foreign investment (x – m)

1) Consumption:

By consumption, we mean the expenditure made on goods and services which directly satisfy our wants.

Ex : Cloth, food products, educafiQn and health services etc. A major portion of the national inc6me comprises only consumption goods and services. Consumption expenditure depends on the level of income. Consumption and savings are the two parts of disposable income.

Income which is left after consumption is the saving. Consumption goods can be perishable or durable. Perishable goods are single use goods. Ex : Food. Durable goods can be used more than once for a longer time. Ex : Vehicles, fans etc.

2) Gross domestic investment:

The expenditure made on producer goods by the firms to produce goods and services is the investment expenditure. Ex : Machinery and tools etc. They satisfy wants indirectly. For instance, the plough used for producing rice cannot give us satisfaction directly. Producer goods are most essential for the growth in national income.

3) Government expenditure:

The expenditure incurred on various goods and services by the government is the public expen-diture. This is what is meant by government consumption. Gov-ernment provides roads, schools, medical facilities, irrigation, elec-tricity, infrastructure facilities etc., to the society. It also provides administrative services, defence services etc. The public expenditure is determined by the nature of economic system.

4) Net foreign investment:

Some goods produced in the economy are exported to other countries. In the same way, some goods which are required in the economy are imported into the country. If the value of exports is more than the value of imports, other countries are indebted to our country. So, it must be added to national income. If the value of imports is more than exports, that difference must be deducted from national income.

Exports – Imports = Net foreign investment

National Income = C + I + G+(x – m)

Question 5.

Discuss how Keynesian theory is an improvement over the classical theory of employment.

Answer:

Classical theory of employment was stated by Adam Smith, David Ricardo, Robert Malthus etc. It is based on the Say’s law of market According to this law “Supply creates its own demand”. The classical theory of employment assumed that there is always full employment of labour and other resources.

Infact full – employment is considered to be the normal situ-ation and any lapses from full employment are considered to be abnormal. Even if at any time there is not actual full employment. The classical theory asserts that there is always a tendency to¬wards full employment.

The free play of economic resources itself bring about the fuller utilization of economic resources including labour. Any in-terference of government in economic activities shall fail to bring about full employment.

Criticism on classical theory:

J. M Keynes criticized the basic assumptions of classical.theory. According to him the assumptions of classical theory are far from reality.

1) Full employment:

According to classicals full employ-ment is a general condition in the economy but for Keynes full

employment is a special situation and not a general situation. The 1930’s economic depression proved that the classical assumption of full employment equilibrium was wrong.

2) Automatic adjustment:

Classicals believed that the economic forces automatically adjust by them self without interference of the government. But automatic adjustment mechanism faild to restore. Full employment during the period of economic depression.

3) Money is neutral:

J.M Keynes denounced the classical assumption that money is neutral. He integrated monetary variables with real variable through rate of interest and successfully demonstrated the effect of changes in money supply on real variables.

4) Wage-cut-policy:

Classicals suggested the wage cut policy to solve the problem of involuntary unemployment. But according to Keynes it is impossible to cut money wage. The trade unions al¬ways fight for a hike in money wage and never accept a cut in money wage.

5) Savings and investment:

According to classicals the sav¬ing and investment are the function of interest rate. But Keynes argued that savings is a function of level of income rather than that the rate of interest.

6) Labour supply:

The supply of labour depends upon the money wage rate and not on real wage rate because workers suffer from money illusion i.e., they are interested in the amount of money they receive rather than its purchasing power.

7) Long run analysis:

Keynes also criticized the long run analysis of classical by saying that we are all dead in the long run. He emphasised the need for the analysis of short fun problems and providing solution for them.

8) According to Keynes existence of perfect competition is also wrong.

Having made such a frontal attract on the classical theory. Keynes offered his own theory in its place. So his theory is treated as an improvement over the classical theory of employment.

Section – B

II. Answer any Eight of the following questions in not exceeding 20 lines each. (8 × 5 = 40)

Question 6.

Explain Robbin’s scarcity definition.

Answer:

Lionel Robbins in his book “An essay on the nature and significance of Economic science gave more analytical definition to economics”. According to Robbins “Economics is the science which studies human behaviour as a relationship between ends and scarce means which have alternative uses”. This definition given by Robbins has the following main features.

1) Unlimited wants or ends:

Economic ends are unlimited. As one want is satisfied, may other*crop up. It is impossible to satisfy all of man’s wants as human wants are unlimited, one is required to choose between the more urgent and lesswants. So economics is called a science of choice.

2). Scarce mens:

Most of the means or resources which can be used to satisfy wants are limited in supply. Man’s wants are unlimited. Therefore, we are forced to postpone the satisfaction of many of our wants.

3) Means have alternative uses:

Most of the economic resources have a large number of uses. Man is always faced with the problem of allocation of limited resources.

4) Problem of choice:

According to Robbins choice making is really an economic activity. Every man is faced with the scarcity of means and as such is forced to make a choice in his present and future satisfaction of wants and in his allocation of resources. The choice problem is the central problem of economics.

Thus according to Robbins definition Economics is the . science of choice”.

Question 7.

What are the various types of utility?

Answer:

The want satisfying capacity of a commodity at a point of time is known as utility.

Types of utility:

- Form utility :

Form utilities are created by changing the shape, size and colour etc. of a commodity so as to

increase its want satisfying power. Ex : Conversion of a wooden log into a chair. - Place utility:

By changing the place some goods acquire utility. Ex: Sand on the sea shore has no utility. If it is brought out and transported to market, it gains utility. This is place utility. - Time utility:

Time utilities^are created by storage facility. Ex : Business men store food grains in the stock points in the off season and releases them to markets to meet high demand and obtained super normal profits. - Service utility:

Services also have the capacity to satisfy human wants. Ex : Services of Lawyer, Teacher, Doctor etc. These services directly satisfy human wants. Hence they are called as service utilities.

Question 8.

What are the differences between cardinal and Ordinal utility?

Answer:

The concept of utility was introduced by Benham in 1789. Utility means want satisfying power of a commodity. It is a psychological phenomenon. The measurement of utility, there are two different approaches 1) Cardinal utility 2) Ordinal utility.

1) Cardinal utility:

This approach was developed by Alfred Marshall, According to him utility is phychological concept, so it can be measured util. The numbers 1, 2, 3, 4 ….. etc., are cardinal numbers. According to this analysis the utilities derived from consumption of different commodities can be measured in terms of arbitary units, such as 1, 2, 3 ect….. and so on.

2) Ordinal utility:

This approach was developed by R.J.D. Allex and J.R. Hicks. According to them utility is psychological concept. So we cannot measure in numerically much less compared. The numbers 1st, 2nd, 3rd, 4th etc., are ordinal numbers. The ordinal numbers are ranked. It means the utilities obtained by the consumer from different goods can be arranged in a serial order such as 1st, 2nd, 3rd, 4th etc.

![]()

Question 9.

What are the factors that determine demand?

Answer:

The functional relationship between the demand for a commodity and its various determinants may be explained mathematically in terms of demand function.

Dx – f(px, p1…. pn, y,T)

Determinants of demand :

- The demand for any good depends an its price. More will be demanded at a lower price and vice-versa.

- A change in the tastes, fashions etc., bring about a change in the demand for a commodity.

- A change in the size and composition of population will effect the demand for certain goods.

- Demand always changes with a change in the incomes of the people. When income increases the demand for several commodities increases and vice-versa.

- Demand is also influenced by changes in the price of related goods either substitutes or complementary goods.

- Expectation with regard to future price is another reason for a change in demand of a commodity.

- Demand always changes with a change in weather or climate even though price remains unchanged.

- Due to economic progress and technological changes, the quantity and quality of goods available to the consumers increase.

Question 10.

Explain the importance of concept of elasticity of demand.

Answer:

The term Elasticity refers to the measure of extent of t relationship between two related variables. The elasticity of demand is the measure of responsiveness or sensitiveness of demand for a commodity to the change in it demand.

Importance :

1) Useful to monopolist:

Monopolist should study the elasticity of demand for his commodity before fixing up the price. Monopolist will fix higher price when the commodity has inelastic demand. But he will fix a lower price when the commodity has elastic demand.

2) Useful to the government:

The concept of elasticity can be used in formulating government policies relating public utility service like railways, drug industry etc.

3) Useful to international trade:

In calculating the terms of trade both countries have to take into account the mutual elasticities of demand for the products.

4) Useful to finance minister:

The concept of elasticity is useful to the finance minister in imposing taxes on goods. The finance minister studies the elasticity of commodities before he imposes new taxes or enhances old taxes.

5) Useful to management:

Before asking for higher wages trade union leaders must know the elasticity of demand of the product produced by them. Trade union leaders may demand for higher wages only when the goods produced by them have inelastic demand.

Question 11.

Explain the concept of quasi rent.

Answer:

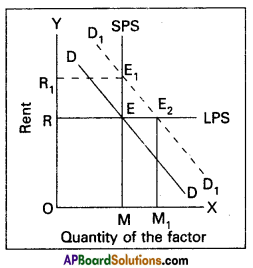

The concept of Quasi Rent was first introduced by Marshall. According to Marshall, Quasi Rent is the income derived from machines and other man made appliances of production. Whose supply is inelastic in the short run in relation to their demand. If the demand for these factors increases, their prices will also increase due to their inelasticity of supply in the short period. The rent or surplus above the factor price will disappear in the long run.

In the above diagram man made appliances are shown in ‘OX’ axis and ‘OY axis shown rent. SPS in short period supply curve. LPS is long period supply curve. In the above diagram it is observed that rent will disappear in the long run.

Question 12.

Mention any three definitions of national income.

Answer:

National Income is the total market value of all goods and services produced in a country during a given period of time. Several economists have defined National Income as follows.

Pigou’s definition :

According Pigou “National Income is that part of the objective income of the community including of course income derived from abroad which can be measured in money”.

Fisher’s definition:

The national dividend or income consists of sole by of services received by ultimate consumers, whether from their material or from their human environment.

Marshall’s definition:

The labour and capital of country acting on its natural resources, produce annually a certain net aggregate of commodities, material and immaterial including services of all kinds. This is the net annual income or revenue of a country.

Kuznet definition:

According to Kuznet’s, “National Income is the net output of commodities and services flowing during the year from the country’s productive system into the hands of ultimate consumers or into the net additional to country’s capital goods”.

![]()

Question 13.

Explain wage cut policy.

Answer:

Wage cut policy is one of the assumption of classical theory of employment which was started by “AC Pigou” who defended the classical theory of and its full employment assumption. To Pigou and others the wage fund is given. The wage rate determined by dividing the wage .fund with the number of workers. Pigou advocated a general cut in money wages in times of depression to restore full employment.

If there is a problem of unemployment in the economy. It is possible to solve this problem by reducing the money wages of the workers. This is known as “wage cut policy”. The given wage fund can offer more employment at a lower wage rate. The classicals believe that involuntary unemployment all involuntary unemployment would disappear.

According to classical theory of the labour supply and its demand depends as real wage rate. Real wage rate indicates the purchasing power of labourers. Because of existence of perfect

competition in labour market r6al wage rate always equals to marginal productivity of labour. Labour supply is positively related to real wage rate and the demand for labour is inversely related to real wage rate.

Question 14.

Enumerate the assumptions of classical theory of employment.

Answer:

The classical theory of employment is based on the Say’s law of markets. The famous law of markets, propounded by the J.B. Say states that “supply creates its own demand”.

Assumptions : The Say’s law is based on the following assumption.

- There is a free enterprise economy.

- There is perfect competition in the economy.

- There is no government interference in the functioning of the economy.

- The equilibrium process is considered from the long term point of view.

- All savings are automatically invested.

- The interest rate is flexible.

- The wage rate is flexible.

- There are no limits to the expansion of the market.

- Money acts as medium of exchange.

Question 15.

Examine the difficulties of barter system.

Answer:

Barter system means exchange of goods. This system was followed in old days. But the population and its requirements are increasing, the system became very complicated. The difficulties of barter system are :

1) Lack of coincidence of wants:

Under the barter system, the buyer must be willing to accept the commodity which the seller is willing to offer in exchange. The wants of both the buyer and the seller just coincide. This is called double coincidence of wants.

Suppose the seller has a good and hb is willing a exchange it for rice. Then the buyer must have rice and he must be willing to exchange rice for goat. If there is no such coincidence direct exchange between the buyer and the seller is not possible.

2) Lack of store value:

Some commodities and perishables. They perish with in a short time. It is not possible to store the value of such commodities in their original form under the barter system. They should be exchanged before they actually perish.

3) Lack of divisibility of commodities:

Depending upon its quantity and value, it may become necessary to divide a commodity into small units and exchange one or more units for other commodity. But all commodities are not divisible.

4) Lack of common measure of value:

Under the barter system, there was no common measure value. To make exchange possible, it was necessary to determine the value of every commodity interms every other commodity.

5) Difficulty is making deferred payments:

Under barter system future payments for present transaction, was not possible, because future exchange involved^ some difficulties. For example suppose it is agreed to sell specific quantity of rice in exchange for a goat on a future date keeping in view the recent value of the goat. But the value of goat may decrease or increase by that date.

Question 16.

Distinguish between demand pull and cost push inflation.

Answer:

It refers to a persistent upward movement in the general price level rather than once for all rise in it. If results in a decline of the purchasing power. There is no generally accepted definition to inflation. According to “Hawtrey” is “issue of too much currency”. According to “Dalton” as “too much money chasing too few goods”.

Demand – pull inflation:

The most common cause of inflation is pressure of even increasing aggregate demand for goods and services compared to the rise of aggregate supply. If aggregate demand for goods and services exceeds aggregate supply of goods and services prices rise. This is called “demand – pull inflation”.

Cost – push inflation:

As the result of rise in the cost of production of goods and services, prices. This is called cost – push inflation. It is caused by increase in wage enforced by trade unions through strikes or increase in other factor costs.

On this two types of inflations – cost – push inflation is much more difficult to control than demand pull inflation the reason is obvious. Any attempt to cutdown wages by the authorities will be met by stiff resistance on the part of the workers.

Question 17.

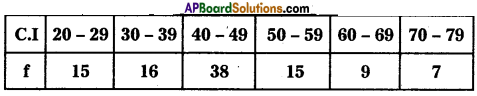

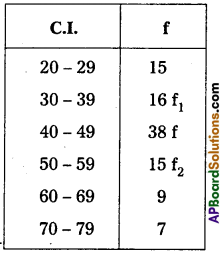

Calculate made for the following data.

Answer:

Here maximum frequency occurs in 40 – 49 class.

L = \(\frac{39+40}{2}=\frac{79}{2}\) = 39. 5 (Lower boundary of models class)

f = 38,

f1 = 16

f2 = 15

c = 10

Mode = L + \(\left[\frac{\mathbf{f}-\mathrm{f}_1}{2 f-f_1+\mathrm{f}_2}\right] \times \mathbf{c}\)

= 39.5 + 0.48 × 10 = 39.5 + 4.8

= 44.38

Section – C

III. Answer any fifteen of the following questions in not exceeding 5 lines each. (15 × 2 = 30)

Question 18.

Capital goods

Answer:

Goods which are used in the production of other goods are called producer or capital goods. They satisfy human wants in directly. Ex : Machines, tools, buildings etc.

Question 19.

Income

Answer:

Income is a flow of satisfaction from wealth per unit of time. In every economy income flows from households to firms and vice versa. Income can be expressed in two types.

1) Money income which is in terms of money.

2) Real income which is in terms of goods and services.

Question 20.

Scale of preferences.

Answer:

Guides the consumer in his purchases. It reflects his tastes and preferences.

![]()

Question 21.

Cross demand

Answer:

Cross demand refers to the relationship between any two goods which are either complementary to each other or substitute of each other at different prices. Dx = f(Py).

Question 22.

Veblen goods

Answer:

This is associated with the name of T. Veblen costly goods like diamonds and cars are called Veblen goods generally rich people purchase those goods for the sake of prestige. Hence rich people may buy more such goods when their prises rise.

Question 23.

Variable factors

Answer:

The factors of production which are possible to change in relation to a change in output is known as variable factors in the long run all factors of production are variable. Ex : Labour, Raw materials.

Question 24.

Supply function

Answer:

Supply of a commodity depends upon a number of factors, the important among these can be presented in the form of a supply function as follows.

Qx = f(Px, Py> F, T, G)Where

Qx = Quantity of good X supplied

Px = Price of good X

Py = Price of related good

F = Price of factors of production

T = Technical knowhow

G = Goal of the producer/seller

f = Functional relationship

Question 25.

Perfect competition

Answer:

In this market large number of buyers and sellers who promote competition. In this market goods are homogeneous. There is no transport fares and publicity costs. So price is uniform of any market.

Question 26.

Scarcity of rent

Answer:

Prof. Marshall explained the concept of scarcity rent on the basis of demand and supply. Scarcity rent is the surplus earned by land which has inelastic supply. In general land has indirect demand or derived demand. If there is an explosion of population, demand for land increases resulting in a rise in its price. The surplus earned by land above its price is called scarcity rent.

Question 27.

Innovation

Answer:

Concept of innovation was introduced by Joseph. A Schumpeter says that profits are the reward for the unique function of innovations made by the entrepreneurs. The innovations are of five types. They are inventing new goods, new source of resources, new production method, new techniques and new markets. The innovations improves the growth rate of the economy.

Question 28.

National income

Answer:

The total value of all final goods and services produced in the economy in a year.

![]()

Question 29.

Fiscal deficit

Answer:

It is the difference between the total revenue and the total expenditure plus the market borrowings.

Fiscal deficit = (Total revenue – Total expenditure + other borrowing and liabilities).

Question 30.

Vote on Account

Answer:

It is an interium budget presented for a few months pending presentation of regular budget.

Question 31.

Net Banking

Answer:

Net banking also called internet or online banking. It is the process of conducting banking transactions over the internet. Viewing bank statements and the status of a bank account online comes under the definition of net banking.

Question 32.

Token Money

Answer:

It is the money or unit of currency whose face value is higher than the intrinsic value. It is not convertible it facilitates transactions and accepted by the public as medium of exchange.

Question 33.

Consumer price index

Answer:

This is the index of prices of a given basket of commodities which are brought by the representative consumer. CPI is expressed in percentage terms.

Question 34.

Hyper inflation

Answer:

It is also known as galloping inflation. If the inflation rates exceeds 10% per annum is called hyper inflation.

![]()

Question 35.

What is median?

Answer:

Median is the middle element when the data set is arranged in order of the magnitude. Median is that positional value of the variable which divides the distribution into two equal parts.

Question 36.

What is a simple Bar diagram?

Answer:

Bar diagram comprising a group of equi-spaced and equi- width rectangular bars for each class of data.

Question 37.

Find the mode for the data 17, 6, 19, 14, 8, 6, 12, 15, 6, 16

Answer:

Mode is ‘6’ because it is occurring in many times i.e. 3.