Collaborative study sessions centered around AP Inter 1st Year Commerce Model Papers and AP Inter 1st Year Commerce Question Paper May 2016 can enhance peer learning.

AP Inter 1st Year Commerce Question Paper May 2016

Time : 3 Hours

Max. Marks : 100

Part – I (50 Marks)

Section – A

Answer any TWO of the following questions in not exceeding 40 lines each.

Question 1.

Define Sole proprietorship and discuss its any five merits and demerits.

Answer:

In this organization only one individual is at the helm of all affairs of business. He makes all the investments. He bears all risks and takes all profits. He manages and control the business himself. The business is run with the help of his family members or paid employees. His liability is unlimited. The sole trader is the sole organizer, manager, controller and master of the business.

Merits :

- Easy to form: It is very easy and simple to form a sole trading business. The capital required is small. There are no legal formalities for starting the business.

- Prompt decisions and quick action : The sole trader is the sole dictator of his business. There is no need to consult any body while taking decisions. So decisions can be taken quickly.

- Incentive to work hard : The sole trader takes all the profits. There is a direct connection between the effort and reward. So, it is an incentive for him to work hard. He manages the business to best of his ability.

- Flexibility in operation : Changes in the business are necessary. The sole trading concern is dynamic in its nature. The nature of the business can be easily changed according to changing market conditions.

- Business secrecy : Since the whole business in handled by the proprietor, his business secrets are known to him only. He need not publish annual accounts and there is no need to disclose the information to others. So he can maintain business secrets.

- Contact with customers : It is easy to maintain personal contact with the customers. He can easily known their tastes, likes and dislikes and adjust his operations accordingly. This results in increase of sales.

Demerits :

- Limited resources : The resources of sole trader are limited- He has only two sources of securing capital, personal savings and borrowing on personal security. Hence he can raise very limited amount of capital.

- Instability: It has no separate legal status. The business and the owner are inseparable from pne another. The business comes to an end on the insolvency, insanity or death of a sole trader.

- Unlimited liability : The liability of the sole trader is unlimited. The creditors can recover the loan amounts not only from business assets but also from his private property.

- Not suitable for large scale operations : The resources are limited. Therefore, it is suitable only for small business and not large scale operations.

- Limited managerial skill: The managerial ability is limited. A person may not be an expert in all matters. Sometimes, wrong decisions may be taken.

Question 2.

What are the features of Joint Stock Company ?

Answer:

“A Company is an association of persons who contribute money or money’s worth to a common stock and employ it in some trade or business and share the profits or losses arising there from”.

– L.J. Lindley

A Joint Stock Company is a voluntary association of individuals for profit having a capital divided into transferable shares, the ownership of which is the condition of membership”.

From the above definitions, the features of Joint Stock Company is as given below.

Features :

1) Association of persons : A company is an association of persons join hands with a common motive earning profits through business.

2) Separate legal entity : The company is created by law. It has a separate legal entity apart from its members. Eventhough it is invisible and intangible having no body or soul, it can act just like any other human being. It can enter into contracts, purchase and sell goods, conduct lawful business in its own name. It can sue and can be sued in a court of law.

3) Perpetual existence : The company has a perpetual existence. The shareholders may come or may go but the company will go on forever. The continuity of the company is not affected by death, lunacy or insolvency of shareholders.

4) Common seal: A company being an artificial person cannot put its signature. The law requires every company to have a seal and get its name engraved on it. The seal of the company is affixed on all important documents and contracts signature.

5) Limited liability : The liability of shareholders is limited to the value of the shares they have purchased.

6) Transferability of shares : The shareholders of the public company is free to transfer their shares. They do not need the con-sent of other shareholders.

7) Separation of Ownership and Management : The shareholders are the owners of the company. But they are too many. They are widely scattered and cannot take part in the day-to-day affairs of the company. The management is entrusted to Board of Directors who are elected by the shareholders. So, the ownership is separated from management.

8) Membership : To form a Joint Stock Company minimum two members are required in the case of private company and seven members in the case of public company. The maximum member-ship is fifty in private companies and unlimited in public compa-nies.

9) Formation: The Company comes into existence only when it is registered under the Indian Companies Act, 1956.

10) Submitting annual statements : A Joint Stock Company is required to file annual statements with the Registrar of companies at the end of the financial year. These statements are available for inspection in the office of the Registrar.

![]()

Question 3.

What is Business Finance ? Explain its need and significance in the Business Organization.

Answer:

The requirement of funds by business firm to accomplish its various activities is called business finance.

R.C. Osborn defines business finance as “The process of acquiring and utilising funds by business”.

Need and Significance of business finance :

- To commence a new business : Money is needed to Start a new business and to procure fixed assets like land and buildings etc., working capital is required to meet the day – to – day expenses and holding current assets like cash, stock-in-trade etc.

- To expand the business : Huge amount of funds are required for purchasing sophisticated machinery and for employing technically skilled labour. The quality of the product can be improved and cost per unit can be reduced by adopting new technology.

- To develop and market new products : Business needs money to spend on developing and marketing new products.

- To enter new markets : Creation of new markets leads attracting new customers. Business spend money on advertisement and retail shops in busy areas.

- To take over another business : In order to overcome competition an enterprise may decide to take over another business.

- To more to new premises : Sometimes a business may be forced to shift the business in another place.

- Day-to-day running : A business needs money to meet the day – to – day requirements like wages, taxes etc.

Section – B

Answer any FOUR of the following questions in not exceeding 20 lines each.

Question 4.

Explain the classification of Industries.

Answer:

The industries may be classified as follows.

1) Primary industry : Primary industry is concerned with production of goods with the help of nature. It is a nature-oriented industry, which requires very little human effort.

E.g : Farming, Fishing, Horticulture etc.

2) Genetic industry : Genetic industry is related to the reproducing and multiplying of certain species of animals and plants with the object of earning profits from their sale.

E.g : Nurseries, cattle breeding poultry etc.

3) Extractive industry : It is engaged in raising some form of wealth from the soil, climate, air, water or from beneath the surface of the earth. Generally the products of extractive industries comes in raw form and they are used by manufacturing and construction industries for producing finished products.

E.g : Mining, coal, mineral, iron ore, oil industry.

4) Construction industry : The industry is engaged in the creation of infrastructure for the smooth development of the economy. It is concerned with the construction, erection or fabrication of products. These industries are engaged in the construction of buildings, roads, bridges, dams etc.

5) Manufacturing industry : This industry is engaged in the conversion of raw material into finished or semifinished goods.

This industry creates form utility in goods by making them suitable for human needs or uses. E.g : Cement industry, Sugar industry, cotton textile industry.

6) Service industry : These industries are engaged in the provision of essential services to the community. E.g. : Banking, transport, insurance etc.

Question 5.

Discuss five types of Partners.

Answer:

There are different types of partners in a partnership firm. They are:

1) Active Partner: An active partner is one who takes active part in the day-to-day working of the business. He may act in vari-ous capacities as manager, advisor and organisor. He is also known as working partner or managing partner.

2) Sleeping Partner: A sleeping partner or dormant partner is one who contributes capital, share profits and losses but does not take part in the working of the concern. He is not known to the public. So, he is also called as secret partner.

3) Nominal Partner : A nominal partner is one who lends his name to the firm. He does neither contributes any capital nor does he shares profits of the business. They do not participate in the management of the business. But they are liable to third parties for all acts of firm.

4) Partner by Estoppel: When a person is not a partner, but posses himself as partner, either by words or in writing or by his acts, he is called partner by estoppel. He neither contribute capital nor share the profits, but liable to third parties like any other partner.

5) Partner by Holding out: If a person is considered by an outsider as partner in the firm and does not disclaim it, he is called partner by holding out. He neither contributes the capital to the firm nor participates in profits and losses. But he is liable to third parties for the debts of the firm.

Question 6.

Explain the classification of sources of Business Finance.

Answer:

Sources of finance can be classified on the basis of period, ownership and generation.

On the basis of period : On the basis of period, sources of funds are divided into long term, medium term and short term finance. Long term sources fulfill the financial requirements for a period exceeding five years and include sources such as shares, debentures and long term borrowings. Medium term finance is required for a period of more than one year and these includes borrowings from commercial banks, public deposits, lease financing. Short term funds are required for a period of less than one year and the sources are trade credit, bank credit, instalment credit, advances, bank overdraft, cash credit and commercial paper.

On the basis of ownership : On the basis of ownership, the sources can be classified into owners funds and borrowed funds. Owners funds are those which are provided by the owners which include issue of shares and retained earnings. Borrowed funds refer to the funds raised through loans or borrowings which include loans from commercial banks, financial institutions, issue of debentures and public deposits.

On the basis of generation : Sources of finance can be generated from internal source or external source. Internal sources of funds are generated within the business such retained earnings, collection of receivables, depreciation fund, disposing surplus stock etc. External sources lie outside the business and include shares, debentures, public deposits, borrowings from banks and financial institutions etc.

![]()

Question 7.

What are the differences between Shares and Debentures ?

Answer:

The following are the differences between shares and debentures

| Shares | Debentures |

| 1. A share is a part of owned capital. | 1. A debenture is an acknowledgement of debt. |

| 2. Shareholders are paid dividend on the shares held by them. | 2. Debentureholders are paid interest on debentures. |

| 3. The rate of dividend depends upon the amount of divisible profits and policy of the company. | 3. A fixed rate of interest is paid on debentures irrespective of profit or loss. |

| 4. Dividend on shares is a charge against profit and loss appropriation account. | 4. Interest on debentures is a charge against profit and loss account. |

| 5. Shareholders have voting rights. They have control over the management of the company. | 5. Debenture holders are only creditors of the company. They cannot participate in management. |

| 6. Shares are not redeemable except redeemable preference shares during the life time of the company. | 6. The debentures are redeemed after a certain period. |

| 7. At the time of liquidation of the company, share capital is payable after meeting all outside liabilities. | 7. Debentures are payable in priority over share capital. |

Question 8.

What are the features of MNCs ?

Answer:

Features of Multi NationalCorporations :

- Global Operations : Multi National Corporations carry production and marketing operations in different countries of the world. They possess all the infrastructural facilities in all the countries of their operations.

- Giant Size : The assets and sales of MNC are quite large. The sales turnover of some MNCs extend the gross national product of several developing countries.

- Centralised Control : It has its head office in home country. It exercises control over all branches and subsidiaries.

- Dominant Position and Status : They occupy a dominant position in the market due to their giant size. They also takeover the firms to acquire huge economic power.

- Internationalised Research and Development: These are intended to capture the quality and serve according to the requirements of the host nation.

- Sophisticated Technology : MNC has advanced technology so as to provide world class products and services. It employs capital intensive technology in manufacturing, marketing and other areas of business.

- Professional Management: A MNC employs professional managers to integrate and manage world wide operations.

Question 9.

What is E-Business ? What are the benefits of E-Business to consumer ?

Answer:

The term E-business was first used by IBM in 1997. It is defined E-business as “The transformation of key business processses through the use of internet technologies”. E-business is defined as the application of Information and Communication Technologies (ICT) which support all the activities of business with customers. It also enables enterprises to link their internal and external data processing systems more efficiently and flexibly and serve better to the needs and expectations of their customers. E-business uses web based technology to improve relationships with customers.

I. Benefits of E ∙ business of customers :

- Purchasing made easy : E-Business enables the consumers to shop or to do any other transaction 24 hours a day, round the year from any location.

- Wide choice : Customers will have more choice as more alternative products and services are available.

- Saving in prices : E-Business provides customers with less expensive products and services which allows them to shop in many places and conduct quick comparisons. E-Business facilitates competition, which results in substantial discounts.

- Exchange of information : E-Business allows customers to interact with each other customers and exchange their opinions and experiences on the products purchased by them.

Section – C

(5 × 2 = 10)

Answer any FIVE of the following questions in not exceeding 5 lines each.

Question 10.

What are the types of Economic Activities ?

Answer:

Economic Activities are broadly divided into three types. They are

A) Business

B) Profession

C) Employment.

A) Business : The business is an activity which is primarily pursued with the object of earning profits.

B) Profession : Profession is an occupation involving the provision of personal services of a special and expert nature.

C) Employment: Employment involves working under a con-tract of employment for or under some one known as employer in return for a salary.

Question 11.

Entrepo-trade.

Answer:

When the goods are imported from one country and the same is exported to another country, such trade is called entrepo trade. E.g.: India importing Wheat from U.S.A. and exporting the same to Srilanka.

Question 12.

Karta.

Answer:

The senior most male member of the family is Karta. All the affairs of the Joint Hindu Family are controlled and managed by one person. He is known as Karta or Manager. The liability of the Karta is unlimited. He acts on behalf of the other members of the family. He is not accountable to anyone. He is the great master of the grand show.

Question 13.

Partnership Deed.

Answer:

Partnership deed forms the basis of partnership. It includes all important clauses like nature of business, contribution of capital, share of profits mode of management etc. Partnership deed is a document containing all matters according to which mutual rights, duties and liabilities of the partners in the conduct of management of the affairs of the firm is determined.

Question 14.

What is a Government Company ?

Answer:

A Company in which not less than 51% of paid up share capital is held by the Central Government or State Government or partly by Central Government and partly by any State Government is called government company.

Ex : Hindustan Machine tools, ONGC, NTPC.

Question 15.

Promotion.

Answer:

A promoter conceives an idea for setting up a particular business at a given place and performs various formalities required for starting a company. He is an individual, or a firm or association of persons or a company.

Question 16.

Working Capital.

Answer:

The capital required by business enterprise to run its day- to-day operations such as purchase of raw materials, payment of wages and holding current assets like stock of raw materials, bills receivable is called working capital. The amount of working capital required varies from business to business. Generally trading concerns require more working capital as compared to manufac-turing concerns.

![]()

Question 17.

E-Commerce.

Answer:

Transacting or facilitating business through internet is called E-Commerce. E-Commerce revolve around buying and selling online. But the E-Commerce universe contains other types of activities as well. Any form of business transaction conducted electronically is E-commerce.

Part – II (50 Marks)

Section -D

Answer the following question.

Question 18.

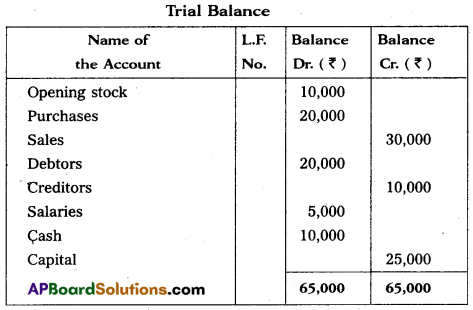

From the following Trial Balance of M/s. Rama Traders, Prepare Trading Account, Profit & Loss Account, Balance Sheet for the year ended on 31-03-2014 :

Trial Balance

Adjustments:

1. Value of Closing stock ₹ 4,500.

2. Prepaid wages ₹ 200.

3. Outstanding Rent ₹ 200.

4. Depreciation on Machinery 10% and on Furniture 5%.

Answer:

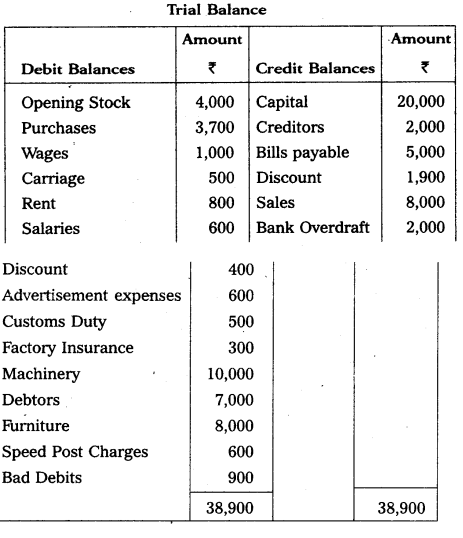

Trading and Profit and Loss A/c of M/S Rama Traders as on 31 – 3 – 2014.

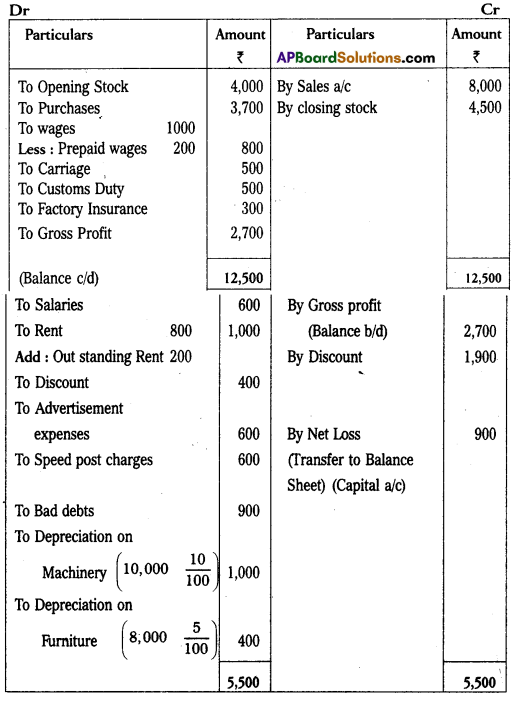

Balance Sheet of M/s Rama traders as on 31.03.2014.

Section – E

Answer any ONE of the following questions.

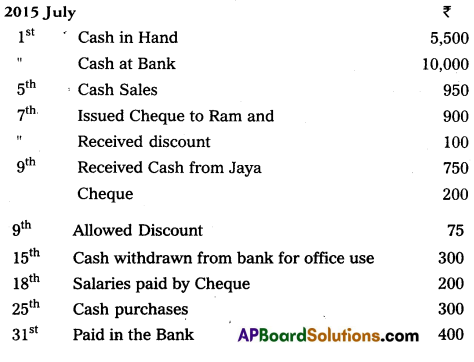

Question 19.

Prepare three column cash book from the following particulars.

Answer:

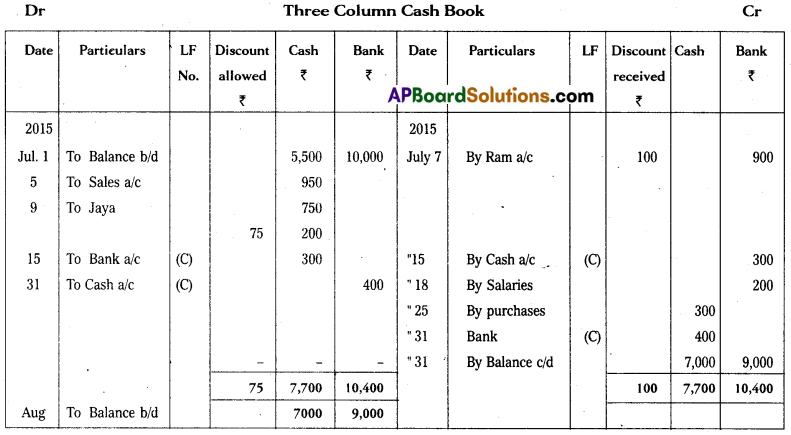

Question 20.

From the following information, prepare a Bank Reconcilia-tion Statement of M/s Geetha Traders as on 31-12-2014 :

1. Balance as per Cash Book ₹ 25,000.

2. Cheques issued but not presented for payment ₹ 9,500.

3. Cheques deposited into Bank but not credited upto 31-12-2014 ₹ 5,300.

4. Bank credited ₹ 3,500 for receiving dividend through Electronic Clearing System.

5. Bank charges debited by Bank ₹ 200.

Answer:

Bank Reconciliation Statement of M/s Geetha Traders as on 31-12-2014.

Section – F

(2 × 5 = 10)

Answer any TWO of the following questions.

Question 21.

Explain the principles of Debit and Credit of different Accounts.

Answer:

Accounts are broadly divided into three types.

- Personal Accounts : These accounts relate to persons or firms. Ex. : Rama’s a/c, Gopal’s a/c, Andhra Bank a/c. The rule in personal accounts is “Debit the receiver and credit the giver”.

- Real Accounts : These accounts relate to assets and properties. Ex.: Cash a/c, Stock a/c, Buildings a/c.

The rule in real accounts is “Debit what comes in and credit what goes out”. - Nominal Accounts : These accounts relate to expenses, losses, incomes and gains. Ex. : Salary a/c, Rent a/c, Interest received a/c. The rule in nominal accounts is “Debit all expenses and losses and credit all incomes and gains”.

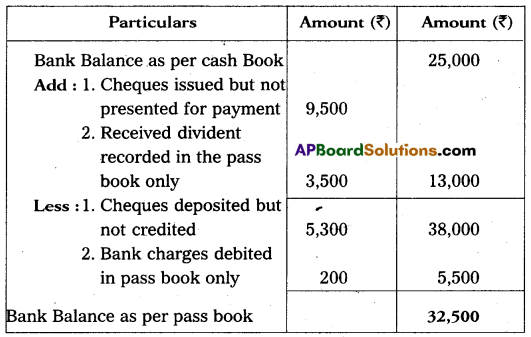

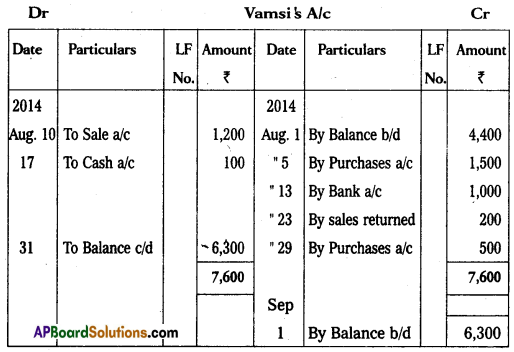

Question 22.

Prepare Vamsi’s Account from the following :

Answer:

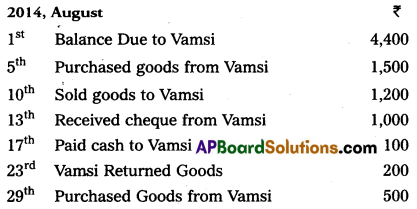

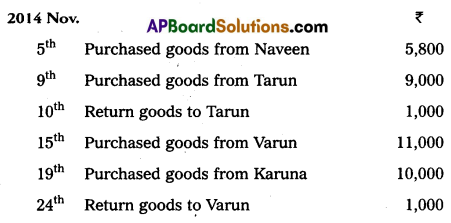

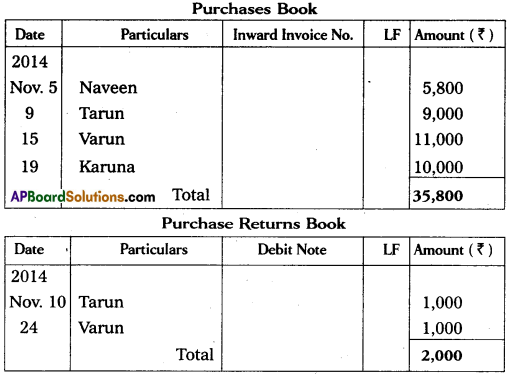

Question 23.

Enter the following transactions in proper Subsidiary books.

Answer:

![]()

Question 24.

Explain the various kinds of Errors.

Answer:

Errors are classified into two types.

1) Error of principle

2) Clerical errors

1) Error of principle: Error of principle occurs where errors are made due to defective knowledge of accounting principles. These may arise, when distinction is not made between capital and revenue nature items.

2) Clerical errors : When mistake is committed while recording them in the books of original entry or posting them in the ledger is called clerical errors. They are again divided into following types of errors.

a) Errors of omission : These errors occur due to omission of some transactions in any subsidiary books.

b) Errors of commission : These errors arises because of mistakes in calculations, totalling, carry forward or balancing.

c) Compensating errors: These errors arise when one error is compensated by other error or errors.

Section – G

(5 × 2 = 10)

Answer any FIVE of the following questions.

Question 25.

Accounting.

Answer:

The American Institute of Public Accountants defined accounting as “the art of recording, classifying and summarising in significant manner and interms of money transactions and events which are in part, atleast of financial character and interpreting results thereof’.

Question 26.

Ledger.

Answer:

Ledger is a book which facilitates recording of all type of transactions related to personal, real and nominal accounts separately. According to Cropper “The book which contains a classified and permanent record of all the transactions of a business is called ledger”.

Question 27.

Cost Concept.

Answer:

According to this concept, an asset is recorded at cost i.e., the price which is paid at the time of acquiring it. In balance sheet, these assets appear not at cost price but depreciation is deducted and they at the amount which is cost less depreciation.

Question 28.

What is Revenue Income ?

Answer:

Revenue income is regular or routine or recurring in nature then it is known as revenue income or revenue receipt.

Question 29.

Give two examples of error of Omission.

Answer:

These errors arise in the books due to omission of some transactions in any subsidiary books or posting into ledger.

Ex: When no entry is made for a transaction in any subsidiary book or journal.

Omission of posting an entry in ledger.

Question 30.

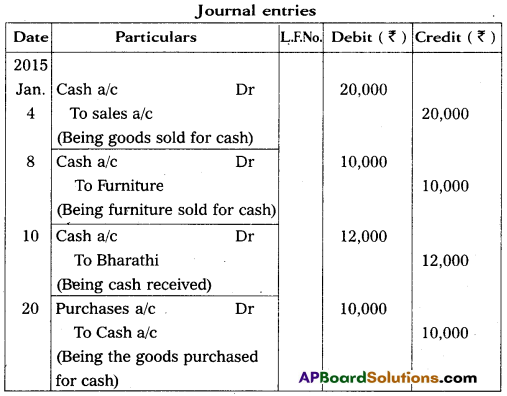

Journalize the following transactions in the books of Krishna.

Answer:

![]()

Question 31.

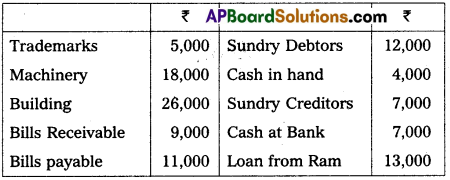

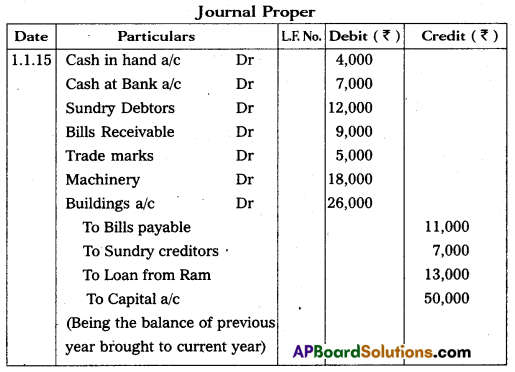

Write the opening Journal Entry from the following particulars on 1-1-2015 :

Answer:

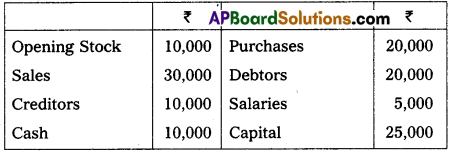

Question 32.

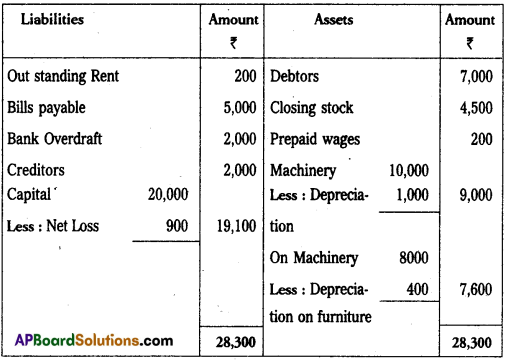

Prepare Trial Balance from the following particulars :

Answer: