Thoroughly analyzing AP Inter 2nd Year Commerce Model Papers and AP Inter 2nd Year Commerce Question Paper May 2016 helps students identify their strengths and weaknesses.

AP Inter 2nd Year Commerce Question Paper May 2016 with Solutions

Time: 3 Hours

Maximum Marks: 100

Part – I (50 Marks)

Section – A

(2 × 10 = 20)

Answer any two of the following questions not exceeding 40 lines each.

Question 1.

Discuss the principles of Insurance.

Answer:

Insurance means protection against the risk of loss. It provides compensation against any loss or damage due to the happening of an event. It is a contract between the two parties by which one of them undertakes to indemnity the other person against a loss that may arise due to some events.

Principles of Insurance

1. Insurable Interest:

A person cannot enter into a contract of insurance unless he has an insurable interest in the subject matter of insurance. It is an essential feature of insurance. Without this insurable interest, the contract of insurance will be treated as a wager or gambling contract. A person has an insurable interest in his own life or the life of his wife and a creditor has insurable interest in the debtor.

2. Utmost Good Faith:

Insurance is based on the principle of utmost good faith. It means both the parties of the contract must disclose all the facts relating to the subject matter of insurance. If the insured does not disclose all material facts, the contract between them is void. A person who had suffered from T.B. in the past had not disclosed it in the proposal form. Later on, the insurer comes to know of this fact. He may declare the contract as void.

3. Indemnity:

This is the chief principle of insurance. Indemnity means security against the risk of loss. Under this principle, the insured gets only the loss suffered by the insurer but not profits out of the contract of insurance. The principle of indemnity applies to contracts of fire and marine insurance only, but not to life insurance contracts.

4. Contribution:

Sometimes, goods are insured by more than one company. It is double insurance. The insured can get compensation only for the total loss from all insurance companies put together, but not the total loss from each company. The insurance companies will pay the compensation on a pro-rata basis.

5. Subrogation:

According to this principle, the insurer after compensating the loss of the insured, the right of ownership of the damaged goods is shifted from the insured to the insurance company.

Ex: Mr. X owns a scooter worth ₹ 36,000 and it was insured with an insurance company for full value. Later it was met with an accident and damaged beyond repairs. The insurance company paid the full value as compensation. Then all the rights on the scooter will be passed on to the insurance company.

6. Causa Proxima:

According to this principle, if a nearest and direct factor causes the loss, then only the insurer will have to bear the loss.

Ex: Biscuits in a ship are insured and are destroyed because of the seawater entered through a hole made by the mouse in the bottom of the ship and water entered into the ship. The nearest and direct cause is seawater. Hence, the insurer will have to bear the loss.

7. Mitigation of Loss:

It is the duty of the insured to take necessary steps to minimize the loss that happened due to some event. He should not act carelessly and negligently at the time of loss to the insured property.

![]()

Question 2.

Define Stock Exchange. Explain its functions.

Answer:

According to Securities Contracts Act 1956, a stock exchange is defined as “an association, organization, or body of individuals, whether incorporated or not, established to assist, regulate and controlling business in buying, selling and dealing in securities”.

Functions of Stock Exchange

1. Ready and Continuous Market:

The stock exchange provides a ready and continuous market for securities. The exchange provides a regular market for trading securities.

2. Protection to Investors:

The stock exchange protects the interest of the investors through the enforcement of rules. The rules of the Securities Contracts (Regulation) Act, of 1956 also govern the dealings on stock exchanges.

3. Provides the information to assess the real worth of the securities:

The value of securities is made properly on the. stock exchange. This is made by taking into consideration various factors such as present and future competition in securities, and financial and general economic conditions. The stock exchange publishes the quotation of different securities on the faith of these quotations every investor knows the worth of his holdings at any time.

4. Provides Liquidity of Investment:

The stock exchange is a market for existing securities. This market is continuously available for the conversion of securities into cash and vice-versa. Persons who do not need hard cash can dispose of their securities easily.

5. Helps in Raising Capital:

There is always a demand for additional capital from the existing concerns. The demand is met through the issue of shares. Stock exchange provides a ready market for such shares.

6. Raising Public Debt:

The increasing government’s role in economic development has necessitated the raising of huge amounts and the stock exchange provides a platform for raising public debt.

7. Listing of Securities:

The company that wants its shares to be traded on the stock exchange should list its securities by applying to the stock exchange authorities giving all the details regarding capital structure, management, etc.

8. Encourage Savings Habit:

Stock exchange creates the habit of saving and investing among the members of the public. It leads to the investment of their funds in corporate and government securities. In this way, it contributes to capital formation.

9. Economic Barometer:

The pulse of the market can be known by its stock indices. The prevailing economic conditions affect the share prices. So, stock exchanges can be called as an economic barometer.

10. Improve the Company’s Performance:

In stock exchanges, only those securities are traded which are listed. The stock exchanges exercise influence over the management of the company.

Question 3.

Give the meaning of consumer. Explain the redressal mechanism available to consumers under the Consumer Protection Act, of 1986.

Answer:

Under the Consumer Protection Act 1986, The word consumer has been defined separately for goods and services. For goods, a consumer buys any goods for consideration and any user of such goods other than the person who buys it, provided such use is made with the approval of the buyer. For services, a consumer has any service or services for consideration; and any beneficiary of such services provided the service is availed with the approval of the person who Had hired the service for a consideration. The judicial machinery set up under the Consumer Protection Act (C.P.A) 1986 consists of consumer courts (Forums) at the District, State, and National levels. These are known as the District Forum, State Consumer Disputes Redressal Commission (State Commission), and National Consumer Disputes Redressal Commission (National Commission).

1. District Forum:

This is established by the state government in each of its districts.

- Composition: The district forum consists of a chairman and two other members one of whom shall be a woman. The district forms are headed by the person of the rank of a District Judge.

- Jurisdiction: A written complaint can be filed before the district forum where the value of goods or services and the compensation claimed does not exceed ₹ 20 lakhs.

- Appeal: If a consumer is not satisfied by the decision of the District Forum, he can challenge the same before the state commission, within 30 days of the order.

2. State Commission:

This is established by the state governments in their respective states.

- Composition: The state commission consists of a president and not less than two and not more such number of members as may be prescribed, one of whom shall be a woman. The commission is headed by a person of the rank of High Court Judge.

- Jurisdiction: A written complaint can be filed before the state commission where the value of goods or services and the compensation claimed exceeds ₹ 20 lakhs but does not exceed ₹ 1 Crore.

- Appeal: In case the aggrieved party is not satisfied with the order of the state commission he can appeal to the National Commission within 30 days of passing the order.

3. National Commission:

The National Commission was constituted in 1988 by the central government. It is the apex body in the three-tier judicial machinery set up by the government for the redressal of consumer grievances. Its office is situated at Janpath Bhawan in New Delhi.

- Composition: It consists of a president and not less than four and not more than such members as may be prescribed, one of whom shall be a woman. The National Commission is headed by a sitting or retired judge of the supreme court.

- Jurisdiction: All complaints about those goods or services and compensation whose value is more than ₹ 1 Crore can be filed directly before the National Commission.

- Appeal: An appeal can be filed against the order of the National Commission to the Supreme Court within 30 days from the date of the order passed.

Section – B

(4 × 5 = 20)

Answer any four of the following questions not exceeding 20 lines each.

Question 4.

Explain any five characteristics of entrepreneurs.

Answer:

The following are some of the important characteristics that every successful entrepreneur must possess.

1. Innovation:

Innovation is an important characteristic of an entrepreneur in modern business. The entrepreneur makes arrangements for introducing innovations that help in increasing production on the one hand and reducing costs on the other.

2. Risk-taking:

Risk-taking is another feature of an entrepreneur. He has to pay for all the other factors of production in advance. There are chances that he may be rewarded with a handsome profit or he may suffer a heavy loss. Therefore, risk-bearing is the final responsibility of an entrepreneur.

3. Decision Making:

An entrepreneur has to make decisions about the establishment of a business its management and the coordination of various resources. Every activity of the business requires decision-making. The entrepreneur has to make decisions every day which have an impact on the working of the enterprise.

4. Leadership:

An entrepreneur has to be a leader because he is such a person who organizes directly and controls the functions of the organization. His personality will influence the working of his subordinates who can praise and appreciate him. An entrepreneur in his role as a leader, not only guides and counsels his people but he motivates them to achieve goals quickly and efficiently.

5. Organisation of Production:

An entrepreneur procures various factors of production like land, labor, capital, raw materials, etc. For manufacturing a product or bringing out a service. He assesses the viability of different production processes and selects one which is most suitable.

![]()

Question 5.

Explain the role of entrepreneurship in economic development.

Answer:

- Entrepreneurship promotes capital formation by mobilizing the idle savings of the public.

- It provides large-scale employment and helps to reduce the unemployment problem.

- Entrepreneurship promotes balanced regional development.

- It helps to reduce the concentration of economic power.

- Entrepreneurship stimulates the equitable distribution of wealth, income, and even political power in the interest of the country.

- Entrepreneurship encourages effective resource mobilization of capital and skill which might otherwise remain unutilized and idle.

- It also induces backward and forward linkages which stimulate the process of economic development.

- Entrepreneurship also promotes the country’s export trade. It is an important ingredient to economic development.

Question 6.

Distinguish between home trade and foreign trade.

Answer:

The following are the differences between Home trade and Foreign trade.

| Home Trade | Foreign Trade | |

| 1. Trade | Trade carries within the country. | Trade carried with other countries. |

| 2. Currency | It does not involve any exchange of currency. | It involves the exchange of currencies. |

| 3. Restrictions | It is not subjected to any restrictions. | It is subject to many restrictions. |

| 4. Risk | Transport costs and risks are less. | Transport costs and risks are higher. |

| 5. Nature | It consists of sales, transfer, or exchange of goods within the country. | It involves the import and export of goods. |

| 6. Transport of Goods | The movement of goods depends on the internal transport system. e.g.: Roads and railways. | The movement of goods takes place usually by sea wherever possible. |

| 7. Specialisation | It helps to derive benefits of specialization within the country. | It helps all trading countries to derive the benefits of specialization. |

Question 7.

Explain the main advantages of SEZs.

Answer:

The following major benefits can be attributed to Special Economic Zones (SEZ).

- Employment generation: Special Economic Zones are considered to be highly effective tools for job creation.

- Economic development: India can be made a transformed economy if special economic zones are implemented properly because special economic zones are engines for economic development.

- Growth of labor-intensive manufacturing industry: The establishment of special economic zones may lead to faster growth of the labor-intensive manufacturing and service

- industry in the country.

- Balanced regional development: Special economic zones are beautifully crafted initiatives for achieving balanced regional development.

- Capacity building: Special economic zones are necessary for stronger capacity building.

- Export promotion: Special economic zones induce dynamism in the export performance of a country by eliminating

- Distortions resulting from tariffs and other trade barriers.

- The corporate tax system and excessive bureaucracy.

Question 8.

What are the advantages of e-banking?

Answer:

E-banking brings certain advantages.

- It reduces costs: The cost of banking transactions is considerably reduced. It increases the profitability of the banks.

- Prompt in Services: There is a high degree of personalization and fast and flexible execution. Thus E-Banking prompt service and there is greater customer satisfaction.

- Anywhere and any time banking: It is 24 24-hour in a day and 7 days in a weekly banking service. Bank accounts can be accessed from anywhere. So the customer can obtain information on his account and conduct transactions from his home or office.

- Cashless Banking: Handling of cash is not necessary in E-Banking.

- Global Coverage: It provides global network coverage of bank services. NRIs can monitor their bank account in Indian banks, from abroad.

- Central database: The database of each branch is centralized. Customers can deposit, withdraw, or remit money from any branch of their bank.

Question 9.

Briefly explain the importance of the capital market.

Answer:

Importance of Capital Market:

1. Act as a link between Savers and Investors:

The capital market plays an important role in mobilizing the savings and diverting them into productive investment. In this way, it is transferring financial resources from surplus and wasteful areas to deficit and productive areas.

2. Encourage Savings:

In undeveloped countries, there are low savings, and those who can save often invest their savings in unproductive areas and conspicuous consumption in the absence of a capital market. With the development of a capital market, financial institutions provide a wide range of instruments that encourage people to save.

3. Encouragement to Investors:

Various financial assets like shares, bonds, etc., encourage people to put their investment in the industry or lend to the government. This can be facilitated by the existence of the capital market.

4. Stability in Prices:

The capital market tends to stabilize the value of stocks and securities. In the process of stabilization, it provides capital to the borrowers at a lower interest rate and discourages investment in speculative and unproductive areas.

5. Promotes Economic Growth:

Balanced economic growth is possible in any country with the proper allocation of resources among the industries. The capital market not only reflects the general condition of the economy but also smoothens and accelerates the process of economic growth.

Section – C

(5 × 2 = 10)

Answer any five of the following questions not exceeding 5 lines each.

Question 10.

Write the definition of an entrepreneur.

Answer:

According to Peter F. Drucker an entrepreneur is one who “searches for change, responds to it and exploits opportunities and the innovation is the specified tool of an entrepreneur”.

Question 11.

Explain any one function of an entrepreneur.

Answer:

Decision Making:

An entrepreneur as a decision maker takes various decisions regarding the following:

- Ascertaining the objective of the enterprise

- Sources of finance

- Product mix

- Pricing policies

- Promotion strategies

- Appropriate technology or new equipment etc.

Question 12.

Define wholesaler.

Answer:

Wholesale trade means buying and selling the goods in relatively large quantities or in bulk and the traders who engage in the wholesale trade are called wholesalers. A wholesaler buys goods in large quantities from manufacturers and sells them in small lots to retailers or industrial users. A wholesaler is the first intermediary and serves as a link between producers and retailers.

![]()

Question 13.

Write a short note on bonded warehouses.

Answer:

Bonded warehouses are owned and operated by port trust authorities. It is located near the port. It is a place where importers store goods till customs duties are paid or goods are reshipped to other destinations without being brought into the country.

Question 14.

Write a short note on the national highway.

Answer:

National highways are meant for internal transport. These roads also connect state capitals, major cities, etc. The National Highway Authority has the responsibility for the development, maintenance, and operation of the national highways. These roads encompass a road length of about 65,000 kms.

Question 15.

Write a short note on SENSEX.

Answer:

BSE Sensex is called BSE-30. Since BSE has been the leading exchange of the Indian secondary market, SENSEX is an important indicator of the Indian Stock Market. SENSEX which was launched in 1986 is made up of 30 of the most actively traded stocks in the market.

Question 16.

Write a short note on NIFTY.

Answer:

NIFTY is an index of NSE, which is computed from the performance of top stocks from different sectors listed in NSE. NIFTY stands for National Stock Exchanges Fifty. It consists of 50 companies from 24 different sectors. The companies that form an index of nifty may vary from time to time based on many factors considered by the NSE. The base year for the index is 1995-96 with the base value as 1000.

Question 17.

Explain any two rights of the consumer.

Answer:

1. Right to Consumer Education:

According to this right, it is the right of the consumer to acquire knowledge and skills to be informed to the customer. It is easier for literate consumers to know their rights and take action.

2. Right to Seek Redressal:

According to this right, the consumer has the right to get compensation or seek redressal against unfair trade practices or any other exploitation. The right assures justice to consumers against exploitation.

Part – II (50 Marks)

Section – D

(1 × 20 = 20)

Answer the following question.

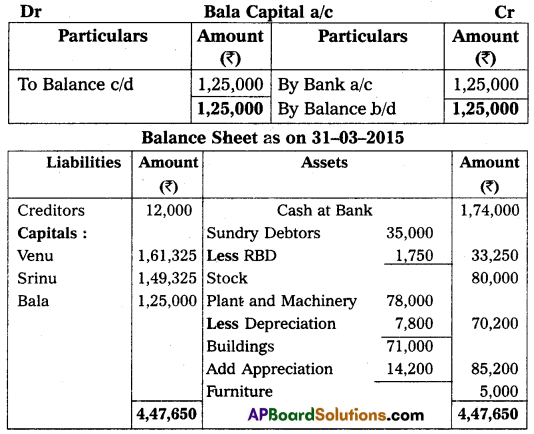

Question 18.

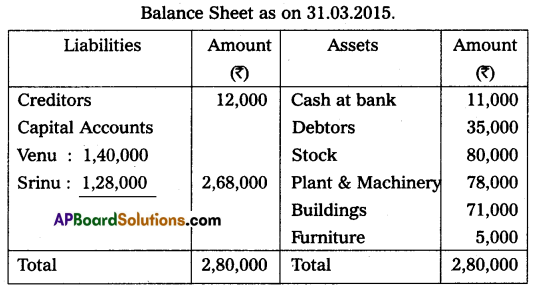

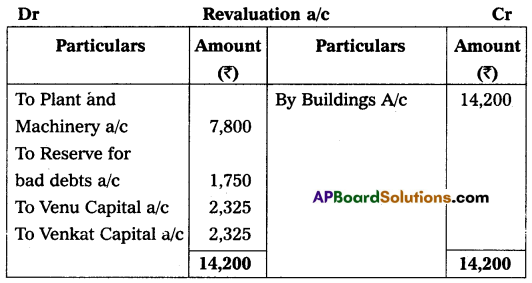

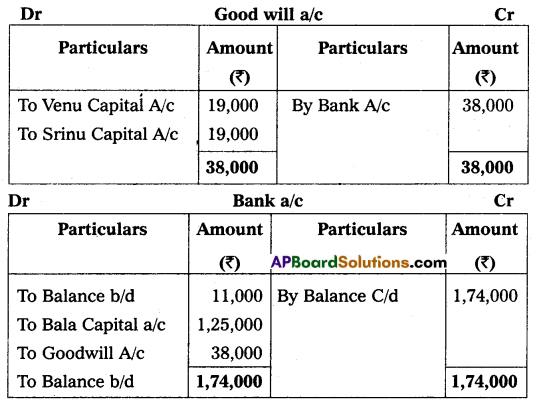

Venu and Srinu are partners in a business sharing profits and losses equally. Their Balance Sheet as on 31st March 2015 was under:

They decided to admit Bala into a firm on 1st April 2015 on the following terms and conditions:

(i) Bala has to pay ₹ 1,25,000 for 1/4th share m future profits.

(ii) Bala has to pay ₹ 38,000 for goodwill.

(iii) Plant and machinery to be depreciated by 10%.

(iv) Buildings to be appreciated by 20%.

(v) 5% reserve for doubtful debts to be created on debtors.

Prepare the necessary accounts in the books of the firm after the admission of Bala with the new balance sheet.

Answer:

Section – E

(1 × 10 = 10)

Answer any one of the following questions.

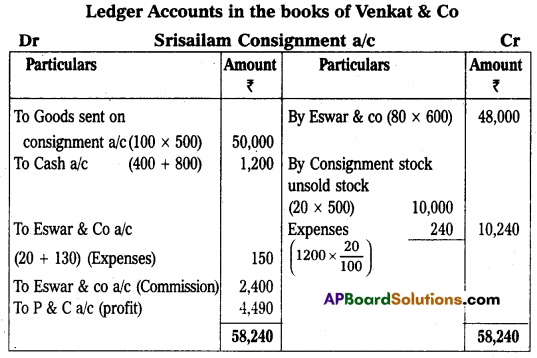

Question 19.

Venkat & Co., Tirupathi, consigned 100 watches to Eswar & Co., Srisailam. The cost of each watch was ₹ 500. Venkat & Co., paid insurance ₹ 400, carriage ₹ 800. Account sales were received from Eswar & Co., showing the sale of 80 watches at ₹ 600 each. The following expenses were deducted by him.

(a) Carriage ₹ 20.

(b) Selling expenses ₹ 130.

(c) Commission ₹ 2,400.

Venkat & Co. received a Bank draft for the balance due. Prepare important ledger accounts in the books of Venkat & Co.

Answer:

![]()

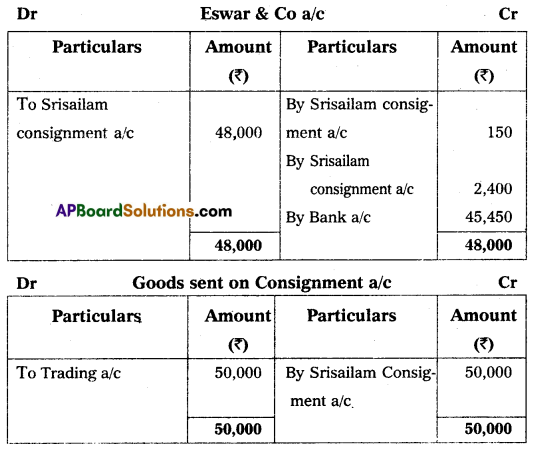

Question 20.

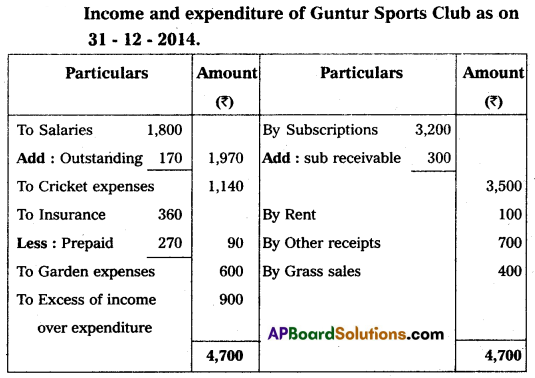

The following Receipts and Payments account belongs to Guntur Sports Club as of 31st December 2014. Prepare Income and Expenditure accounts.

Additional information:

(i) Subscriptions receivable for the year 2014 – ₹ 300.

(ii) Salaries unpaid – ₹ 170.

(iii) Entrance fees are to be capitalized.

(iv) Prepaid insurance premium – ₹ 270.

Answer:

Section – F

(2 × 5 = 10)

Answer any two of the following questions.

Question 21.

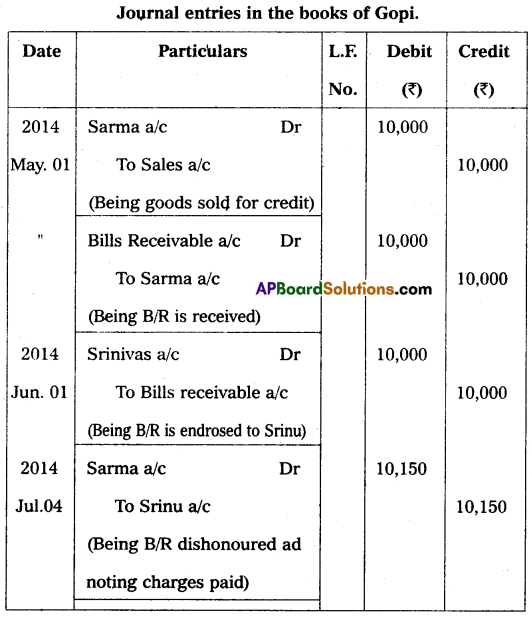

Gopi sold goods of Sarma on 1st May 2014 for ₹ 10,000 on credit drawn up on him. A bill for the same amount is payable after 2 months. Sarma accepted the bill and returned it to Gopi. Gopi endorsed the bill favoring his creditor Srinu on 1st June 2014. On the date of maturity, Sarma failed to make payment of the bill. Srinu paid no charges of ₹ 150. Pass the necessary journal entries in the books of Gopi.

Answer:

Question 22.

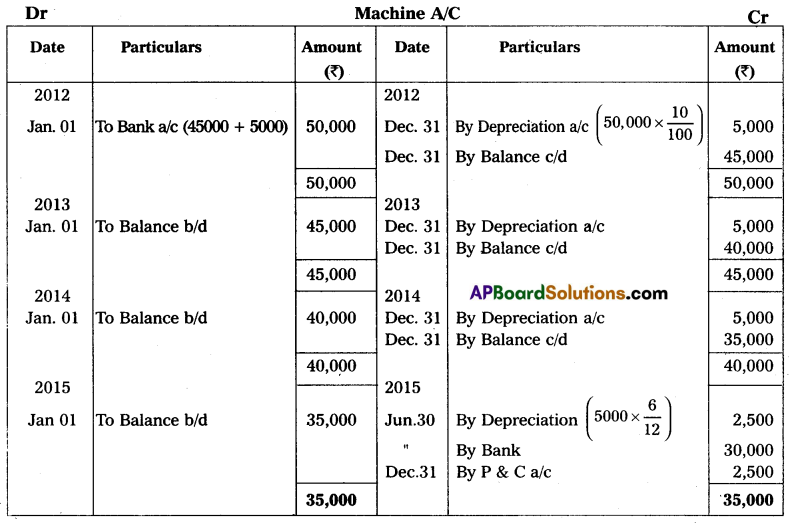

Rao & Co. purchased a second-hand Machine on 1st January 2012 for ₹ 45,000 and spent ₹ 5,000 on repairs. Depreciation is provided at the rate of 10% p.a. under the straight-line method. On 1st July 2015 the machine sold for ₹ 30,000. The books are closed on 31st December every year. Prepare Machine account.

Answer:

Question 23.

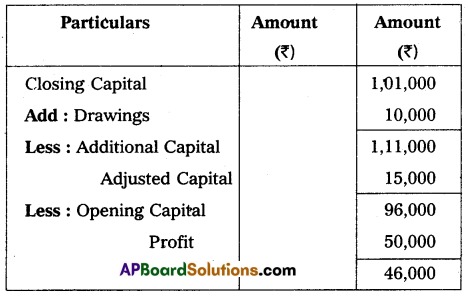

Mr. Sateesh started a business on 1st April 2014 with a capital of ₹ 50,000. He did not maintain his books according to the double entry system. During the year he introduced fresh capital of ₹ 15,000. He withdrew ₹ 10,000 for personal use. On 31st March 2015, his total assets were ₹ 1,75,500 total liabilities were ₹ 74,500. Find the profit earned by Mr. Sateesh by using the statement of affairs method.

Answer:

Mr. Sateesh Closing Capital = Assets – Liabilities

Closing Capital = 1,75,500 – 74,500 = 1,01,000

Profit & Loss Statement of Mr. Sateesh as of 31-3-2015.

Question 24.

Briefly explain the categories of share capital.

Answer:

From the accounting point of view, the share capital of the company can be classified as follows:

- Authorized capital: Authorised capital is the amount of share capital that a company is authorized to issue to the public by the memorandum of association. It is also called nominal or registered capital.

- Issued capital: Issued capital is part of authorized capital that is issued to the public for subscription. A company may issue its entire authorized capital or may issue in parts from time to time as per the needs of the company.

- Subscribed capital: It is that part of the issued capital which has been subscribed by the public. This capital can be equal to or less than the issued capital.

- Called-up capital: It is that part of the subscribed capital that is called up by the company to pay on the allotted shares. The company may decide to call the entire amount or part of the face value of shares.

- Paid-up capital: That part of the called-up capital has been paid by the shareholders.

- Reserve capital: A company may reserve a portion of its uncalled capital to be called only in the event of the winding up of the company. Such an uncalled amount is called the reserve capital of the company.

Section – G

(5 × 2 = 10)

Answer any five of the following questions.

Question 25.

Write a short note on noting charges.

Answer:

To obtain the proof of dishonor, the bill is re-sent to the drawee through a legally authorized person called a notary public. Notary public charges a small fee for this service known as noting charges. Noting charges are paid to the notary public first by the holder of the bill but are ultimately recovered from the drawee, because he is the responsible person for the dishonor.

Question 26.

Write a short note on the reducing balance method.

Answer:

This method is also known as written down value method. Under this method, depreciation is charged at a fixed percentage on the book value of the asset. Since the book value keeps on reducing by the annual charge of depreciation, it is known as the reducing balance method.

Question 27.

What is Del credere commission?

Answer:

The consignee may sell some part of the goods on credit. When goods are sold on credit, there is always a risk of some amount of bad debt. To avoid the risk of bad debts the consignor provides an additional commission known as the Del-Credre commission to the consignee which guarantees the payment in case of a credit sale. Del create commission is paid at a predetermined percentage of gross sale proceeds.

Question 28.

What are Legacies?

Answer:

It is the amount that a not-for-profit concern will receive as per the will of a deceased person. It should be capitalized being an item of a non-recurring nature and should be shown on the liabilities side of the balance sheet.

Question 29.

Supriya and Sravanthi are partners sharing profits in the ratio of 3 : 2. They admitted Srilatha as a partner for 1/5th share in the future profits of the firm. Calculate the new profit-sharing ratio of Supriya, Sravanthi, and Srilatha.

Answer:

Old Ratio of Supriya & Sravanthi = 3 : 2

Srilatha New Share = \(\frac{1}{5}\)

Remaining Profit = 1 – \(\frac{1}{5}\) = \(\frac{4}{5}\)

New profit sharing ratio of Supnya = \(\frac{4}{5} \times \frac{3}{5}=\frac{12}{25}\)

New profit sharing ratio of Sravanthi = \(\frac{4}{5} \times \frac{2}{5}=\frac{8}{25}\)

New profit sharing ratio of Srilatha = \(\frac{1}{5} \times \frac{5}{5}=\frac{5}{25}\)

New ratio of Supriya, Sravanthi & Srilatha = \(\frac{12}{25}\) : \(\frac{8}{25}\) : \(\frac{5}{25}\) (or) 12 : 8 : 5

Question 30.

What is an equity share?

Answer:

The equity shares are also called as ordinary shares. According to section 85 of the Companies Act, of 1956 an equity share is a share that is not a preference share. In other words, shares that do not enjoy any preferential right in the payment of dividends or repayment of capital are called equity shares.

![]()

Question 31.

Discuss any two advantages of the computerized accounting system.

Answer:

1. Speed:

Accounting data is processed faster by using a computerized accounting system than it is achieved through manual efforts.

2. Accuracy:

The possibility of error is eliminated in a computerized accounting system because the primary accounting data is entered for all the subsequent usage and the process is preparing the accounting reports.

Question 32.

Write a short note on ready-to-use accounting software.

Answer:

Ready-to-use accounting software is suited to organizations running small/conventional businesses when the frequency or volume of accounting transactions is very low. This is because the cost of installation is generally low and several users is limited.