Collaborative study sessions centered around AP Inter 1st Year Commerce Model Papers Set 5 can enhance peer learning.

AP Inter 1st Year Commerce Model Paper Set 5 with Solutions

Time : 3 Hours

Max. Marks : 100

PART – I (50 MARKS)

(Section – A)

(2 × 10 = 20)

Answer any TWO of the following questions in not exceeding 40 lines each.

Question 1.

Define trade and explain various types of aids to trade.

Answer:

All the human activities engaged in buying and. selling of goods and services comes under trade. Therefore trade includes sale, transfer or exchange of goods and services with the intention of making profit. The object of trade is to make goods available to those who need them and willing to pay for them. Trade is the final stage of business activities and involves transfer of ownership.

Aids to trade : Trade or exchange of goods and services involves several difficulties which can be removed by aids to trade.

Aids to trade refer to those activities which directly or indirectly facilitate smooth exchange of goods and services.

Aids to trade includes transport, warehousing, banking, insurance, advertising and communication.

1) Transport: All the goods are not consumed at the same place where they are produced. Goods are to be moved from the places of production to the places where they are demanded. The activity concerned with the movement of goods is called transportation. It can be done by rail, road, water and air.

2) Warehousing : Goods are produced in anticipation of demand. There is time gap between production and consumption. Hence, it became necessary to make arrangements for storage or warehousing. Agricultural products like wheat and rice are seasonal in nature but they are consumed throughout the year. On the other hand, goods such as umbrellas and woollen cloths are produced throughout the year but they are demanded only during particular season. Therefore, these goods need to be stored in warehouses till they are demanded. Warehousing creates time utility.

3) Insurance; Business is subject to risks and uncertainties. Risks may be due to theft, fire, accident or any other natural calamity. Insurance reduces the problem of risks. Insurance companies who act as risk bearers covers risks.

4) Banking: Producers and traders require money for carrying on production and trade. Banks are the institutions which supply . funds for industries and trade. They pool savings from the public and make them available to industries. So, banking is an important function of commerce.

5) Advertising : Exchange of goods is possible when the consumers have the knowledge about the existance of the product. Through advertisement, producers communicate all information about the goods to prospective consumers. It creates a strong desire to buy the product. Advertising is done through T.V., radio, , newspapers, magazines, hoarding, wall posters etc.

6) Communication : Communication means exchange of information from one person to another. It is necessary to finalise and settle terms such as price, discount, facility of credit etc. Modern means of communication like telephone, telex, e-mail, tele conference etc., play an important role in establishing contact , between businessmen, producers and consumers.

Question 2.

Discuss the merits and demerits of co-operative form of organisation.

Answer:

Merits of co-operative society:

- Easy to form: It is easy to form a co-operative society as the legal formalities are not many. It is economical as it need not pay stamp duty, registration fees.

- Democratic management: The management is done in a democratic way. Every member has one vote irrespective of the number of shares held by him. So, every one has an equal voice in the management.

- Limited liability: The liability of the members is limited. He is not personally liable.

- Perpetual existance: A co-operative society has perpetual existance. It need not be dissolved on the death, lunacy, insolvency of its members.

- Economy in operation: Some of the members may voluntarily offer their free service. Therefore, some of the management expenses are saved.

- Cheaper and better commodities: A co-operative society aims at service rather than profit. The consumers can get goods of better quality at reasonable price.

- Privileges: The government has granted several privileges to co-operative society. The government provide finance .at concessional rates of interest.

- Elimination of middlemen : A co-operative society pur-chases goods directly from the producers and sells directly to its members. Hence, middlemen are eliminated.

- Aim at mutual prosperity: Co-operatives function on the principle of “Each for all and all for each” with the aim of mutual prosperity.

Demerits of co-operative Society:

- Weak and inefficient management: The members of the managing committee are elected persons. Hence inexperience and unscrupulous persons may be elected. This leads to weak and inefficient management.

- Limited resources: Restriction on dividend and the prin-ciple of one man, one vote discourage rich people from joining the society. Due to shortage of funds, there is limited scope for expansion and growth.

- Lack of unity among members: The members are drawn from different sections of the society. There is lack of harmony among them.

- Lack of secrecy: It is very difficult to maintain business secrets which are important for the success of the business.

- Government interference: Co-operative societies have to follow the rules and regulations of the co-operative societies act and government.

- Political interference: Government nominates members to the managing committee. Every government tries to send their own party members to these societies.

- Cash trading : The members need credit facilities. But societies sells goods only for cash. So, the members may go to private traders who extend credit facilities.

- Lack of incentive to work hard : Managing committee members do not take active part as they are not paid for their ser-vices. The loyalty of members may not always assured.

![]()

Question 3.

Define E-business and explain the scope of E-business.

Answer:

The term E-business was first used by IBM in 1997. It is defined E-business as “The transformation of key business processses through the use of internet technologies”. E-business is defined as the application of Information and Communication Technologies (ICT) which support all the activities of the business with customers. It also enables enterprises to link their internal and external data processing systems more efficiently and flexibly and serve better to the needs and expectations of their customers. E-business uses web based technology to improve relationships with customers.

Scope of E-business: E-business can be divided into following are as.

- E-business within the organisation.

- Business-to-Business : It refers to exchange of products and services by one business and another.

- Business-to-Customer : It refers to the exchange of products and services from a business to customer.

- Customer-to-Customer : These transactions are facilitated by websites like Quicker, OLX where customers offer their products online, to be bought by other customers.

- Customer-to-Business : It refers to transactions involve provision of project work by customers on internet to needy persons.

Now-a-days one can buy products online through some sites like Flipkart, Jabong and Amazon. In the age of E-commerce almost everything from gym equipment to laptops are available online. Even people are buying services online. Business consultants, lawyers, doctors are offering their services to the potential clients online.

Electronic business is super set of business cases. E-commerce is one of them. Other important aspects of E-business ape E-auctioning, E-banking, E-marketing, E-trading etc.

i) E-commerce : Electronic commerce is transacting are facilitating business through internet. E-commerce revolve around buying and selling online. Any form of business transaction conducted electronically is E-commerce.

ii) E-auctioning : In E-auctioning the people who want to participate in the auction, visit the website with a click and go through the details of goods offered or kept in auction in concerned web pages and participate in auction.

iii) E-banking : Electronic banking is one of the most successful online business. E-banking allows customers to access their accounts and execute orders through the use of website. Online banking allows customers to get their money from ATM.

iv) E-marketing: Electronic marketing provides a world wide form of buying and selling of goods. The internet allows companies to react to individual customers demand immediately. It does not matter where the customer is located. It can be done by E-mails etc.

v) E-trading: E-trading is also known as “online trading” or E-broking. It is used for buying and selling stocks in stock exchange.

Section – B

(4 × 5 = 20)

Answer any FOUR of the following questions in not exceeding 20 lines each.

Question 4.

Explain the importance of commerce.

Answer:

Commerce involves the process of bringing goods from the place of production to the place of consumption. It makes possible to link producers and customers through middlemen and aid of trade. Thus it tries to satisfy ever increasing human wants. They are able to purchase any product anywhere in the world. When a man consumes more products, his standard of living improves. The growth of commerce, industry and trade cause the growth of agencies of trade such as banking, transport, warehousing, insurance, advertising etc., generates more and more employment opportunities. When production increases, national income also increases.

It helps to earn foreign exchange by way of exports and duties are levied on imports. It encourages international trade and ensures faster economic growth of the country. The under developed countries can import skilled labour and technical know how from advanced countries which paves the way for rapid industrialisation in those countries. During emergencies like floods, earthquakes etc. Commerce helps in reaching essential requirements like food stuff, medicines and relief measures to the affected areas.

Question 5.

Briefly explain duties of partners.

Answer:

The following are the duties of partners.

- Every partner should carry on the business to the greatest common advantage.

- Every partner should work honestly, morally and Confidently in the activities of the firm.

- No partner should undertake undesirable activities.

- The active partner is bound to keep and render true and correct accounts of the business.

- No partner can undertake competing business.

- A partner must indemnify the firm for the loss suffered because of fradulent conduct or wilful neglect.

- No partner can earn secret profits by using the firms assets and name.

- All the partners should share the profits in the agreed ratio.

- Every partner should act within the authority. If he exceeds his authority he is responsible to the firm.

Question 6.

Certificate of commencement of business.

Answer:

A private limited company can start its business immediately after incorporation. But a public company has to wait till it gets the certificate of commencement of business. In order to obtain this certificate, the company has to submit the following :

- The prospectus or statement in lieu of prospectus.

- The shares are allotted to the extent of minimum subscription.

- The directors have paid application and allotment amounts towards qualification shares.

- A statutory declaration by the secretary or director stating that all the formalities are complied with.

The Registrar will then scrutinise all the documents and if satisfied issues certificate of commencement of business.

Question 7.

Explain the classification of sources of finance.

Answer:

Sources of finance can be classified on the basis of period, ownership and generation.

On the basis of period : On the basis of period, sources of funds are divided into long term, medium term and short term finance. Long term sources fulfill the financial requirements for a period exceeding five years and include sources such as shares, debentures and long term borrowings. Medium term finance is required for a period of more than one year and these includes borrowings from commercial banks, public deposits, lease financing. Short term funds are required for a period of less than one year and the sources are trade credit, bank credit, instalment credit, advances, bank overdraft, cash credit and commercial paper.

On the basis of ownership : On the basis of ownership, the sources can be classified into owners funds and borrowed funds. Owners funds are those which are provided by the owners which include issue of shares and retained earnings. Borrowed funds refer to the funds raised through loans or borrowings which include loans from commercial banks, financial institutions, issue of debentures and public deposits.

On the basis of generation: Sources of finance can be generated from internal source or external source. Internal sources of funds are generated within the business such retained earnings, collection of receivables, depreciation fund, disposing surplus stock etc. External sources lie outside the business and include shares, debentures, public deposits, borrowings from banks and financial institutions etc.

![]()

Question 8.

Types of loans from commercial banks.

Answer:

Commercial banks are the most important source of short term capital. They provide a wide variety of loans to suit the needs of the concern. They provide the following types of short term loans.

1) Loans : A loan is a direct advance made in lumpsum against some security. In case of a loan, a specified amount is sanctioned by the bank to the customer. The entire loan amount is paid to the borrower either in cash or by credit to his account. The borrower withdraws the full amount in cash immediately and undertakes to pay in one single instalment or number of instalments. The borrower has to pay interest on the whole amount from the date of sanction.

2) Cash Credits: A cash credit is an arrangement by which bank allow its customer to borrow money upto a certain limit. It is a running account from which the amounts can be withdrawn from ime to time. The borrower can also deposit any surplus amount rith him. The interest is charged on the daily balance and not on he entire amount.

3) Overdrafts : It is agreement with a bank by which a current account holder is allowed to withdraw more than the balance to his credit upto a certain limit. Interest is charged on the amount actually withdrawn and not on the amount sanctioned by the bank.

4) Discounting of bills : Present day commerce is built upon credit. The seller draws a bill of exchange on the buyer of goods on credit. The bank purchases the bills and credit the customers account with the amount of the bill less discount. At the maturity of the bill, the bank presents the bill to the acceptor for payment.

Question 9.

Explain any four merits of MNCs to home country.

Answer:

Merits of Multi National Corporations to the home country:

- Availability of resources : The country can obtain raw materials, land, labour at comparatively low cost.

- Develop exports : They can export commodities and finished products for assembling or for distribution in foreign markets. Thereby market is widened.

- Generate income : They can earn huge income from dividends, licencing fees, royalty and management contracts. They can acquire technical and managerial expertise of foreign markets.

- Provides employment: They can increase job and career opportunities at home and abroad in connection with overseas operations.

Section – C

Answer any FIVE of the following questions in not exceeding 5 lines each.

Question 10.

Transportation

Answer:

There is a vast distance between the centres of production and centres of consumption. Goods are to moved from places of / production to the places where they are needed. The activity which is concerned with such movement of goods is called transportation. Transport creates place utility. There are several kinds of transport such as air, water and land transport.

Question 11.

Partnership deed

Answer:

Partnership deed forms the basis of partnership. It includes all important clauses like nature of business, contribution of capital, share of profits etc. Partnership deed is a document contains all matters according to which mutual rights, duties and liabilities of the partners in the conduct of management of the affairs of the firm is determined.

Question 12.

Liability for mis-statements in prospectus

Answer:

The investors buy shares in good faith believing that the contents in the prospectus are true. So, the company should not make any false statements. Only facts should be given. In case, the company makes any mis-representation and gives false information, the investors may sue for compensation. Consequently the directors and persons responsible for such acts are liable for civil and criminal action.

Question 13.

Internal source of finance

Answer:

Internal sources of funds are those which are generated from within the organisation. The sources are ploughing back of profits, retained earnings, collection of receivables, disposing the surplus inventories and depreciation of funds etc.

Question 14.

Trade credit

Answer:

Trade credit is the credit extended by one trader to another for the purchase of goods and services. Trade credit facilitates the purchase of supplies without immediate payment. Such credit appears in the record of the buyer of the goods as ‘sundry creditors’ or ‘account payable’. The credit is commonly used business concerns as a source of short term financing.

Question 15.

Small Industries Development Bank of India

Answer:

SIDBI was setup by the Government of India in April 1990 as a wholly owned subsidiary of IDBI. It is the principle financial institution for promotion, financing and development of small scale industries. It aims to empower micro, small and medium enterprises sector with a view to contributing to the process of economic growth, employment generation and balanced regional development.

Question 16.

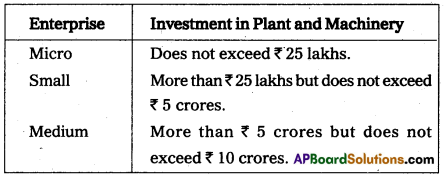

Define Manufacturing Enterprise as per MSMEs Act 2006.

Answer:

Manufacturing enterprises are those business enterprises which are engaged in the manufacture or production of goods and services. The manufacturing enterprises are defined in terms of investment made in Plant and Machinery.

Question 17.

E-Marketing

Answer:

Electronic marketing provides a world wide platform for buying and selling of goods without having any geographical barriers. The internet allows companies to react to the individual customers demands immediately without any loss of time. It does not matter where the customer is located. It can be done by E-mail etc.

PART – II (50 MARKS)

(1 × 20 = 20)

Section – D

Answer the following question.

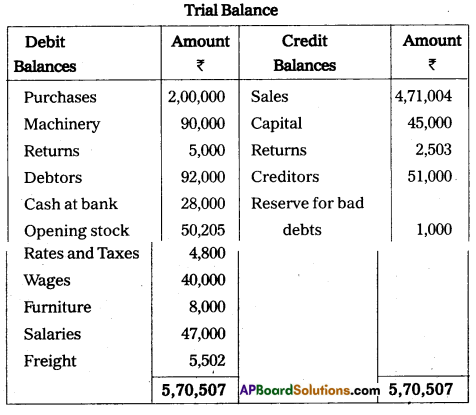

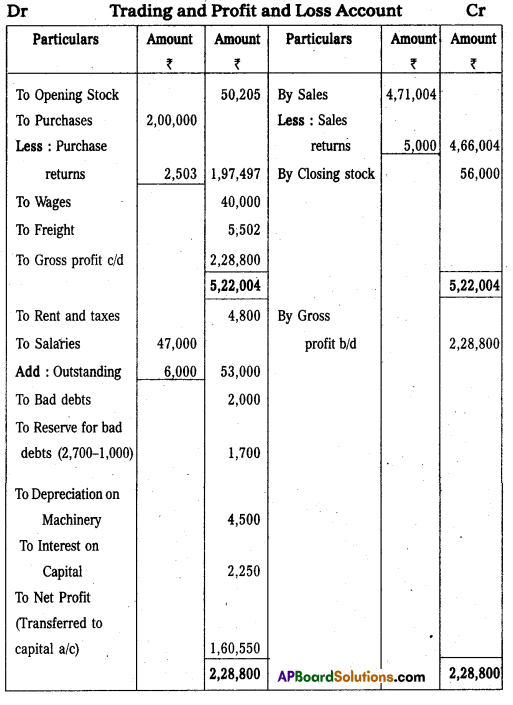

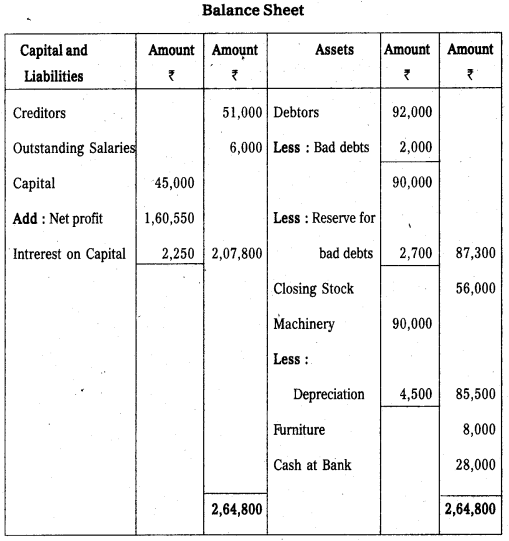

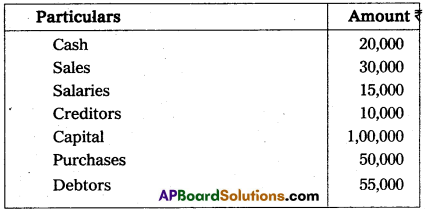

Question 18.

Prepare final accounts.

Adjustments:

1) Closing stock value : ₹ 56,000

2) Outstanding Salaries : ₹ 6,000

3) Bad debts ₹ 2,000 and create reserve for bad debts 3%

4) Depreciation on Machinery 5%

5) Interest on capital 5%

Answer:

Section – E

(1 × 10 = 10)

Answer any ONE of the following questions.

Question 19.

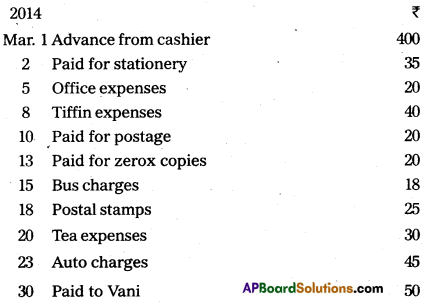

From the following information prepare Analytical Petty Cash Book.

Answer:

Question 20.

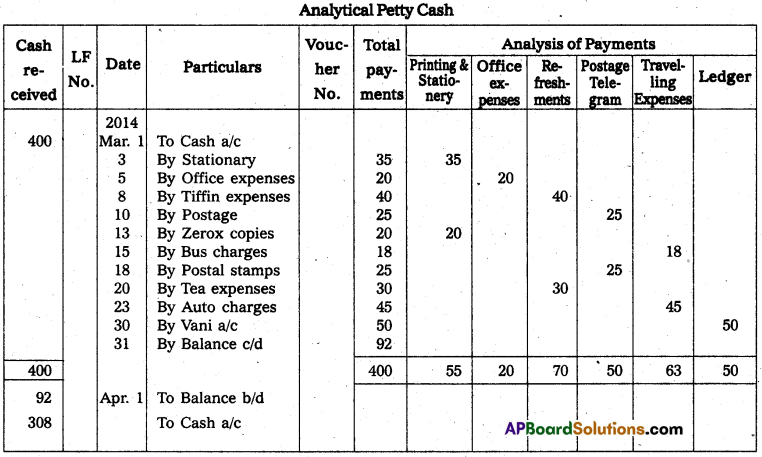

From the following particulars prepare a Bank Reconciliation Statement.

Answer:

Section – F

(2 × 5 = 10)

Answer any TWO of the following questions.

Question 21.

What are accounting conventions ? Explain convention of consistency and convention of conservation.

Answer:

Accounting conventions are customs or traditions guiding the preparation of accounts. They are adopted to make financial statements clear and meaningful.

Convention of consistency: The convention of consistency facilitates comparison of performance of a business unit from one accounting period to another is possible when the accounting principles followed by the firm are consistently applied over the years. Ex. : An organisation should not change the method of depreciation or valuation of closing stock every year.

Convention of conservatism: According to this convention, the principle of “anticipate no profit but provide for all losses” should be applied. The principle of conservatism requires that in the situation of uncertainity and doubt, the business transactions should be recorded in such a manner that the profits and assets are not overstated and the losses and liabilities are not understated.

![]()

Question 22.

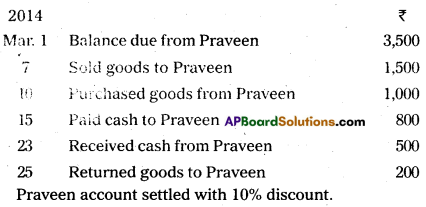

From the following information prepare Praveen’s Account as on 31.03.2014.

Answer:

Question 23.

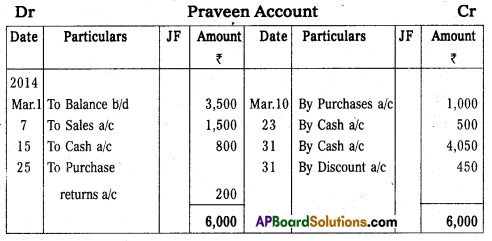

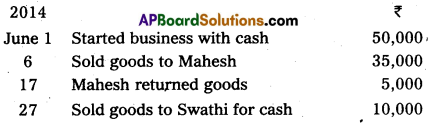

Enter the following transactions in proper subsidiary books.

Answer:

Question 24.

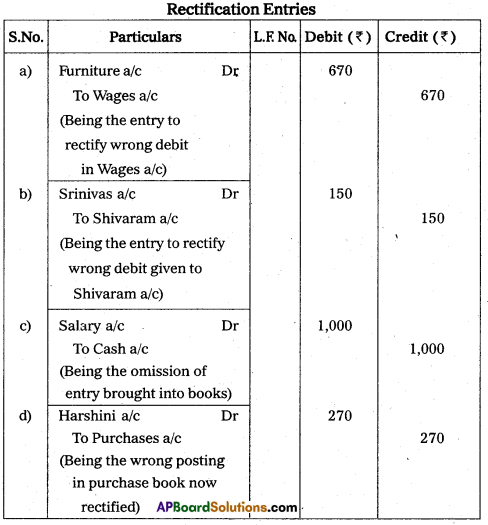

Give the rectification entries for the following errors.

a) Wages payable to Furniture ₹ 670 debited to Wages a/c

b) A credit šale of ₹ 150 to Srinivas debited to Shivaram.

c) Payment of salary to manager ₹ 1,000 was not passed through books at all.

d) A credit purchase of ₹ 140 to Harshini, recorded in the books as ₹ 410.

Answer:

Section – G

Answer any FIVE of the following questions.

Question 25.

Going concern concept

Answer:

The concept relates with the long life of the business. The assumption is that the business will continue to exist for unlimited period unless it is dissolved due to some reason or other. When the final accounts are prepared, recording is made for outstanding expenses and prepaid expenses because of the assumption that the business will continue.

Question 26.

Intangible assets

Answer:

These are the assests having no physical existance but their possession gives rise to some rights and benefits to the owner. It cannot be seen and touched. Goodwill, patents, trade marks are some of the examples for intangible assets.

![]()

Question 27.

What is Journalising ?

Answer:

The process of recording a transaction in the journal is called journalising. For journalising transactions, it is essential to identify the two accounts involved in the’transaction, then apply the rule of debit and credit and make the entry in the journal in their respective columns.

Question 28.

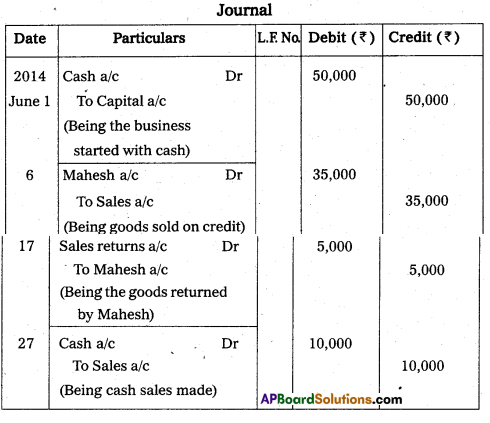

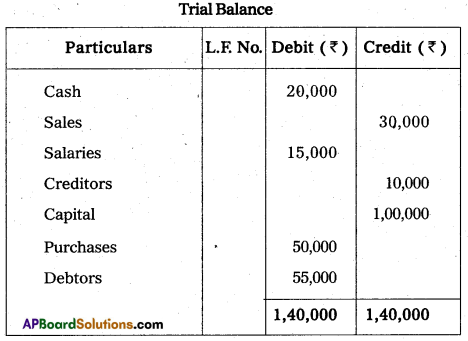

Journalise the following transactions.

Answer:

Question 29.

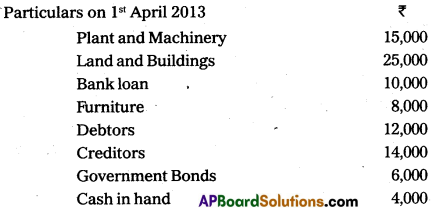

Pass opening Journal entry from the following.

Answer:

Question 30.

Define trial balance.

Answer:

J. R. Batliboi defines trial balance as “A trial balance is a statement prepared with debit and credit balances of ledger accounts to test the arithmetical accuracy of the books”.

According to Spicer and Pegler “A trial balance is a list of all balances standing on the ledger accounts and cash book of the concern on any given date”.

Question 31.

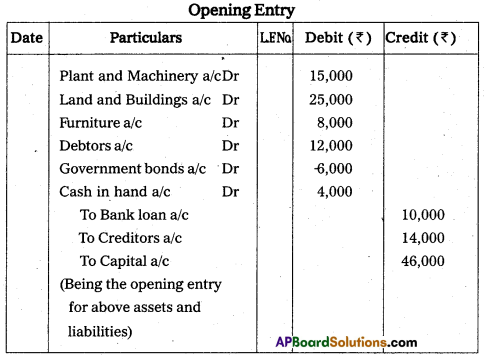

From the following particulars prepare Trial Balance of Manas as on 31.12.2013.

Answer:

Question 32.

Income to be received

Answer:

It is also known as Accrued income. It is the income relating to the current year which is not received but to be received in the next year. These incomes are added to the concerned income in profit and loss account credit side. These incomes are shown as assets in the Balance Sheet.