Collaborative study sessions centered around AP Inter 1st Year Commerce Model Papers Set 2 can enhance peer learning.

AP Inter 1st Year Commerce Model Paper Set 2 with Solutions

Time : 3 Hours

Max. Marks : 100

PART – I (50 MARKS)

(Section – A)

(2 × 10 = 20)

Answer any TWO of the following questions in not exceeding 40 lines each.

Question 1.

Explain the merits and demerits of the sole trading concern.

Answer:

In this organisation only one individual is at the helm of all affairs of business. He makes all the investments. He bears all risks and takes all profits. He manages and control the business himself. The business is run with the help of his family members or paid employees. His liability is unlimited. The sole trader is the sole organiser, manager, controller and master of the business.

Merits:

- Easy to form: It is very easy and simple to form a sole trading business. The capital required is small. There are no legal formalities for starting the business.

- Prompt decisions and quick action : The sole trader is the sole dictator of his business. There is no need to consult any body while taking decisions. So decisions can be taken quickly.

- Incentive to work hard: The sole trader takes all the profits. There is a direct connection between the effort and reward. So, it is an incentive for him to work hard. He manages the business to best of his ability.

- Flexibility in operation: Changes in the business are necessary. The sole trading concern is dynamic in its nature. The nature of the business can be easily changed according to changing market conditions.

- Business secrecy: Since the whole business in handled by the proprietor, his business secrets are known to him only. He need not publish annual accounts and there is no need to disclose the information to others. So he can maintain business secrets.

- Contact with customers : It is easy to maintain personal contact with the customers. He can easily known their tastes, likes and dislikes and adjust his operations accordingly. This results in increase of sales.

Demerits:

- Limited resources : The resources of sole trader are limited. He has only two sources of securing capital, personal savings and borrowing on personal security. Hence he can raise very limited amount of capital.

- Instability: It has no separate legal status. The business and the owner are inseparable from one another. The business comes to an end on the insolvency, insanity or death of a sole trader.

- Unlimited liability: The liability of the sole trader is unlimited. The creditors can recover the loan amounts not only from business assets but also from his private property.

- Not suitable for large scale operations : The resources are limited. Therefore, it is suitable only for small business and not large scale operations.

- Limited managerial skill: The managerial ability is limited. A person may not be an expert in all matters. Sometimes, wrong decisions may be taken.

Question 2.

What do you mean by prospectus ? State the contents of prospectus.

Answer:

A public limited company soon after incorporation issues a prospectus. It is a circular inviting the public to subscribe to the shares of the company. It is issued by the public company with a view to raising necessary funds from the investors. It will be in the form of appeal describing the prospectus of the company. Section 2(36) of the Companies Act, defines prospectus as “any notice, circular, advertisement or other invitation offering to the public for subscription or purchase of any shares or debentures of body corporate”.

The objects of issue of prospectus is to bring to the notice of the public that a new company has been formed, it is able and competent board of directors and to create confidence in the public about the company and its profitability.

The prospectus should be dated and signed by the directors. A copy of the prospectus must be filed with the Registrar on or before the date of publication. No copy of the prospectus should be issued until a copy has been filed with the Registrar.

Every prospectus contains an application form on which the intending investors can apply for the purchase of shares and de-bentures. A public company must get minimum subscription within 120 days from the date of issue of prospectus. If it fails to get minimum subscription, it has to return the amount already collected.

Contents:

- The main objects of the company.

- Names, addresses, occupation of signatories of memorandum and the number of shares subscribed by them.

- The total share capital and debenture capital, classes of shares and the amount payable on application, allotment and calls.

- The rights of each class of shareholders with regard to dividend repayment of capital, voting etc.

- Names, addresses and occupation of directors, their qualification, shares, powers and remuneration.

- Minimum subscription required for allotment of shares.

- An estimate of preliminary expenses.

- Names and addresses of auditors.

- Names and addresses of vendors and purchase price paid to them.

- Underwriters and their commission.

- Brokerage and commission.

- Addresses of brokers and bankers.

- Particulars of reserves.

- The period of which the subscription list is kept open.

- The amount payable to promoters for their services in floating the company.

![]()

Question 3.

Explain the different types of preference shares.

Answer:

Preference shares can be divided into eight categories basing on the features of right to get dividends, redeemability, conver-tibility and right to participate in the surplus.

I. Based on right to dividend:

1) Cumulative preference shares: Cumulative preference only have the right to get arrears of dividend. These shares get usual profits. The claim of profits on these shares accumulated when there no sufficient profits for the company. The arrears of profits will be paid in those years when the company makes sufficient profits. Preference shares are cumulative unless otherwise stated in the Articles of Association.

2) Non-cumulative preference shares: These shareholders have no claim for the arrears of dividend. These shares also get usual profits. The right of dividend on those shares cannot be carried forward to the next year. They will stand next to the cumulative preference shares and prior to ordinary shares.

II. Based on redeemability:

1) Redeemable preference shares : Redeemable preference shares are to be repaid after the completion of a specified period. Normally, the capital of the company is repaid only at the time of liquidation. However, the company can issue redeemable preference shares if the Articles of Association allow such issue. The company has a right to return redeemable preference share capital after a certain period. The Companies Act has provided certain restrictions on the return of this capital.

2) Non- redeemable preference shares : These shares which cannot be redeemed unless the company is liquidated are known as irredeemable preference shares.

III. Based on convertibility:

1) Convertible preference shares: Convertible preference shares can be converted into equity shares either partially or fully after the expiry of a specified period. The right of conversion must be authorised by Articles of Association.

2) Non-convertible preference shares: The shares which cannot be converted into equity shares are called as non-convertible preference shares.

IV Based on right to participate in the surplus:

1) Participating preference shares : Participating preference shares have right to get share in the surplus profits along with the equity shares. The holders of these shares participate in the surplus profits of the company. They are paid a fixed rate of dividend and then reasonable rate of dividend is paid on equity shares. If some profits remain after paying both these dividends, then preference shareholders participate in the surplus profits.

2) Non-participating preference shares: Holders of these shares get a fixed rate of dividend. They do not carry the additional right of sharing the surplus profits.

Section – B

(4 × 5 = 20)

Answer any FOUR of the following questions in not exceeding 20 lines each.

Question 4.

Role of profit in business.

Answer:

The profit motive is an important element of business. Any activity undertaken without profit motive is not business. A business man tries to earn more and more profits out of his business activities. The incentive of earning profits keeps a person in business and also necessary for the continuity of the business. Profits are needed to face various uncertainities like trade cycle, charge in demand pattern, fluctuations in money market etc. A business rqan needs profits not only for its existence but also for expansion and diversification.

The investors want an adequate return on their investments, workers want higher wages and entrepreneur needs money for re-investing. All these demands will be met only when some profits are made. The profit motive does not mean that the business man should start exploiting the consumers by charging higher prices and selling low quality goods. If profits becomes the sole objective of business, it will hamper healthy relations between the business man and the customers. The business should charge reasonable price and it will be beneficial to both of them.

Question 5.

Give the classification of any five kinds of partners with suitable examples.

Answer:

There are different types of partners in a partnership firm. They are:

1) Active Partner: An active partner is one who takes active part in the day-to-day working of the business. He may act in various capacities as manager, advisor and organisor. He is also known as working partner or managing partner.

2) Sleeping Partner: A sleeping partner or dormant partner is one who contributes capital, share profits and losses but does not take part in the working of the concern. He is not known to the public. So, he is also called as secret partner.

3) Nominal Partner : A nominal partner is one who lends his name to the firm. He does neither contributes any capital nor does he shares profits of the business. They do not participate in the management of the business. But they are liable to third parties for all acts of firm.

4) Partner by Estoppel : When a person is not a partner, but posses himself as partner, either by words or in writing or by his acts, he is called partner by estoppel. He neither contribute capital nor share the profits, but liable to third parties like any other partner.

5) Partner by Holding out: If a person is considered by an outsider as partner in the firm and does not disclaim it, he is called partner by holding out. He neither contributes the capital to the firm nor participates in profits and losses. But he is liable to third parties for the debts of the firm.

Question 6.

What is long-term finance and state the sources of long term finance.

Answer:

The funds raised for a period exceeding five years is known as long-term finance. Long-term finance is essential for investing in fixed assets like land and buildings, plant and machinery etc. Requirement of long term finance depends on the size of the business, nature of business and level of technology used. Sources of long term finance :

i) Issue of shares : A company is able to get large amount of money primarily by issue of shares. It issues different types like preference shares and equity shares and object of issuing different types of shares to appeal the investors with different temperment. It is important method of raising long term finance because the share capital remain in the company till winding up.

ii) Issue of debentures : A company in order to secure long term finance for development purposes and to suppliment its capital may issue debentures. Debentures is an acknowledge of debt by a company, issued and under common seal, secured by fixed or floating charge on the assets of the company. Money raised through debentures remain in the company for a longer period.

iii) Retained earnings : The ploughing back of earnings is an important source of financing the business. Instead of distributing entire profits, some portion of profits are retained which are used to finance long term needs of the company.

Question 7.

Lease financing.

Answer:

A lease is a contractual agreement whereby one party i.e., the owner of the asset grants the other party the right to use the asset in return for a periodic payment. In other words, it is a renting of an asset for some specified period. The owner of the asset is called lessor while the other party that uses the asset is called as lessee.

The lessee pays a fixed periodic amount called lease rental to the lessor for the use of the asset. The terms and conditions regulating the lease agreements are given in the lease contract. At the end of the lease period, the asset goes back to the lessor. Lease finance provides an important means of modernisation and diversification of the firm. Such type of financing is more prevalent in the acquisition of such assets as computers and electronic equipment which become obsolete quicker because of the fast changing technological developments. While making the leasing decision, the cost of leasing an asset must be compared with the cost of owning the asset.

Question 8.

State the demerits of Multi National Corporations to host country.

Answer:

The following are the demerits of Multi National Corporations to the host country.

- Monopolise the markets : In order to monopolise the markets, MNCs may join hands with big business units in the host country and dictate the prices of goods and services. This ultimately leads to concentration of economic power.

- Disregard host countries priorities: MNCs invest in most profitable ventures. They disregard the goals and priorities of host countries. They create relatively few jobs and fail to solve the chronic problem like unemployment.

- Transfer of outdated technology: MNCs often transfer outdated technology to their collaborators in the host countries. It many cases technology transferred was unsuitable causing waste of share capital.

- Threat to sovereignty : MNCs pose a danger to the independence of host countries. These corporations tend to interfere in the political affairs of the host nation.

- Depletion in natural resources : MNCs cause rapid depletion in some of natural resources of host countries.

- Spread of foreign culture : MNCs tend to vitiate the cultural heritage of local people. They propagate their own culture to sell their products.

![]()

Question 9.

What are the benefits of E-business to customers.

Answer:

The following are the benefits of E-business to consumers.

- Purchasing made easy : E – business enables consumers to shop or to do any other transaction 24 hours a day, round the year from any location.

- Wide choice : Consumers will have more choices as more alternative products and services are available.

- Saving in prices : E-business provides customers with less expensive products and services which allows them to shop in many places and conduct quick comparisons. E-business facilitates competition, which results in substantial discounts.

- Exchange of information: E-business allows Customers to interact with each other and exchange their opinions and experiences on the products purchased by them.

Section – C

(5 × 2 = 10)

Answer any FIVE of the following questions in not exceeding 5 lines each.

Question 10.

Explain the term profession.

Answer:

Profession is an occupation involving the provision of personal services of a specialised and expert nature. The service is based on professional education, knowledge, training etc. The specified service is provided for a professional fees charged from the clients. For example, a doctor helps his patients though his expert knowledge of science of medicine and charges a fee for the service.

Question 11.

Define the term Entrepot trade.

Answer:

When the goods are imported from one country and the same is exported to another country, such trade is called entrepot trade.

E.g. : India importing Wheat from U.S.A. and exporting the same to Srilanka.

Question 12.

Define the term Kartha.

Answer:

The senior most male member of the family is Karta. All the affairs of Joint Hindu Family are controlled and managed by one person. He is known as Karta or Manager. The liability of Karta is unlimited. He acts on behalf of other members of the family. He is not accountable to anyone.

Question 13.

Chartered company.

Answer:

These companies are established under a special charter issued by king or head of the state. The special charter contains rules and regulations governing the formation, management and winding up of the company under the charter certain exclusive rights and privileges are granted to the company.

e.g. : East India Company, Bank of England.

Question 14.

Certificate of incorporation.

Answer:

A company in order to obtain certificate of incorporation has to submit the following documents along with application form.

- Memorandum of Association

- Articles of Association

- List of directors

- Consent of directors and statement of qualification shares

- Notice of registered office

- Statutory declaration

Along with the above documents, the company has to pay stamp duty, registration fees etc. The Registrar will scrutinise the documents. If he is satisfied, he will enter the name of the company in the register and issues a certificate called certificate of incorporation.

Question 15.

What is Memorandum of Association ?

Answer:

The Memorandum of Association is the constiution of the company. It is the charter of the company. It provides the foundation on which the company structure is built. It defines the scope of companies activities as well as relation with the outside world. The purpose of memorandum is to enable the shareholders, creditors and those who deal with the company to know the permitted range of activities of the company.

Question 16.

Define Micro enterprise.

Answer:

In case of manufacturing enterprises, a micro enterprise is an enterprise where the investment in plant and machinery does hot exceed ₹ 25 lakhs. In case of service enterprises, a Micro Enterprise is an enterprise where the investment in equipment does not exceed ₹ 10 lakhs.

Question 17.

E-Commerce.

Answer:

Transacting or facilitating business through internet is called E-Commerce. E-Commerce revolve around buying and selling online. But the E-Commerce universe contains other types of activities as well. Any form of business transaction conducted electronically is E-Commerce.

Part – II

(Section – D)

(50 Marks)

Answer the following question.

Question 18.

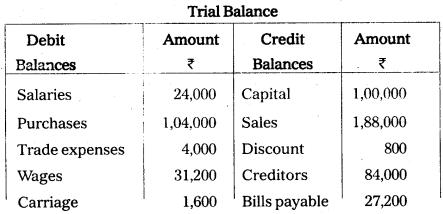

From the following Trial balance of Balu, prepare Trading, Profit and Loss account and Balance Sheet for the year ending 31.12.2010.

Adjustments:

- Closing stock : ₹ 44,000

- Outstanding wages : ₹ 8,000

- Prepaid Insurance : ₹ 200

- Provide bad debts reserve at 5%.

- Depreciation on Machinery and Furniture by 5%.

Answer:

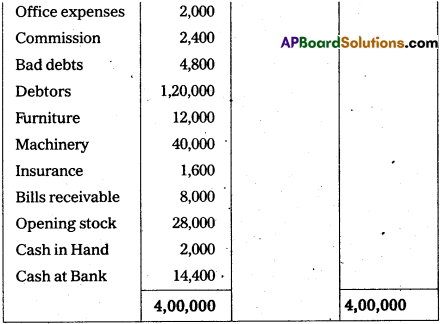

Trading and Profit and Loss A/c of Mr. Balu for the year ended 31-12-2010.

Balance Sheet of Mr. Balu as on 31-12-2010

Section – E

Answer any ONE of the following questions.

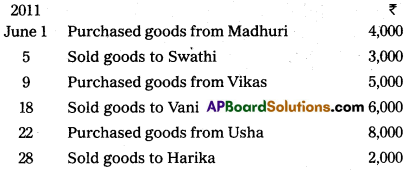

Question 19.

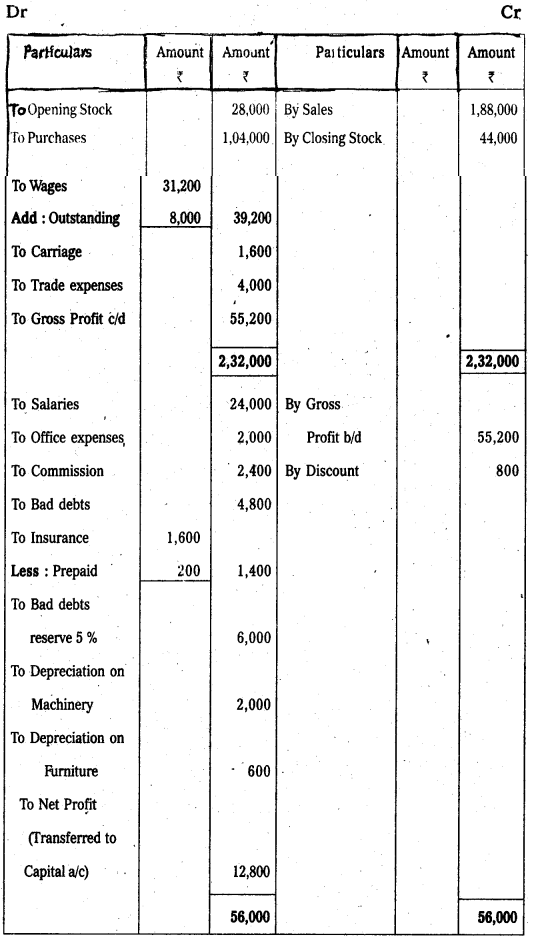

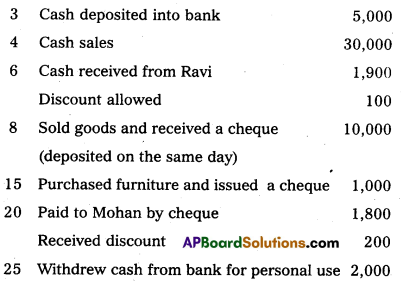

Prepare three column cash book from the following particulars.

Answer:

![]()

Question 20.

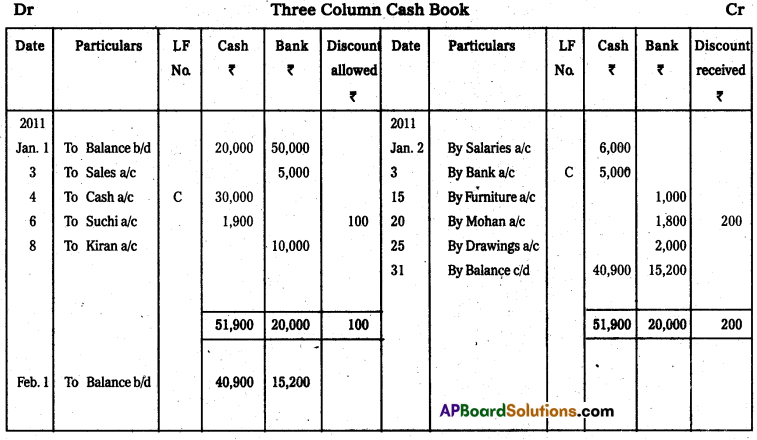

Mr. Raju, a trader found ₹ 18,000 overdraft balance in his passbook on 31.12.2010. Prepare a Bank Reconciliation Statement from the following particulars.

Answer:

Bank Reconciliation statement of Mr. Raju as on 31.12.2010

Section – F

(2 × 5 = 10)

Answer any TWO of the following questions.

Question 21.

Explain different types of accounts along with their debit and credit rules.

Answer:

Accounts are broadly divided into three types.

- Personal Accounts : These accounts relate to persons or firms. Ex.: Rama’s a/c, Gopal’s a/c, Andhra Bank a/c. The rule in personal accounts is “Debit the receiver and credit the giver”.

- Real Accounts : These accounts relate to assets and properties. Ex.: Cash a/c, Stock a/c, Buildings a/c.

The rule in real accounts is “Debit what comes in and credit what goes out”. - Nominal Accounts : These accounts relate to expenses losses, incomes and gains. Ex. : Salary a/c, Rent a/c, Interest received a/c. The rule in nominal accounts is “Debit all expenses and losses and credit all incomes and gains”.

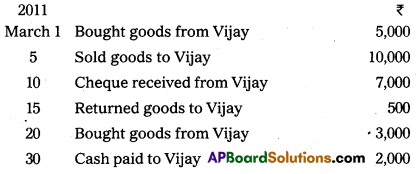

Question 22.

Prepare Vijay account from the following transactions.

Answer:

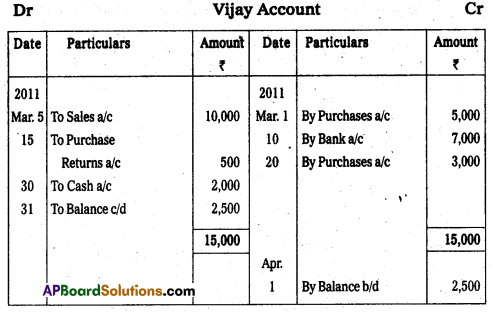

Question 23.

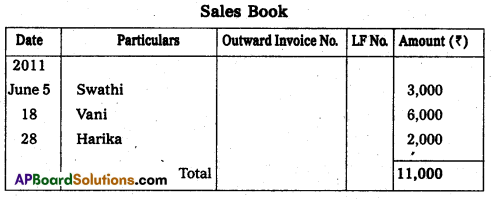

Record the following transactions in proper subsidiary books.

Answer:

Question 24.

Errors disclosed by trial balance.

Answer:

The following errors are disclosed by trial balance.

- Posting a transaction to the wrong side of an account.

Ex : Discount allowed posted to credit side of the discount account. - Posting wrong amount in account.

Ex: Sales ₹ 25,000 posted to the Sales a/c as ₹ 2,500 - Errors in totalling.

Ex: Sales return book is overcast by ₹ 100. - Errors made in carrying forward.

Ex : Purchases book total is carried forward ₹ 1,500 instead of ₹ 150. - Omission to post an amount from the subsidiary book to ledger.

Ex : Sold goods to Hari ₹ 1,000 was not entered in Hari’s account. - Recording one aspect twice.

Ex : Salaries account for ₹ 1,000 debited twice. - Omission to enter a balance or wrong balancing in ledger account.

Section – G

(5 × 2 = 10)

Answer any FIVE of the following questions.

Question 25.

What is book-keeping ?

Answer:

Book-keeping is the art of recording business transactions in regular and systematic manner. According to Carter “Bookkeeping is the science and art of correctly recording books of accounts all those business transactions that result in transfer of money or money’s worth.

Question 26.

Define capital.

Answer:

Capital is the amount invested in business. This amount is increased by the amount of profits earned and the amount of additional capital introduced. It is decreased by the amount of losses incurred and the amounts withdrawn.

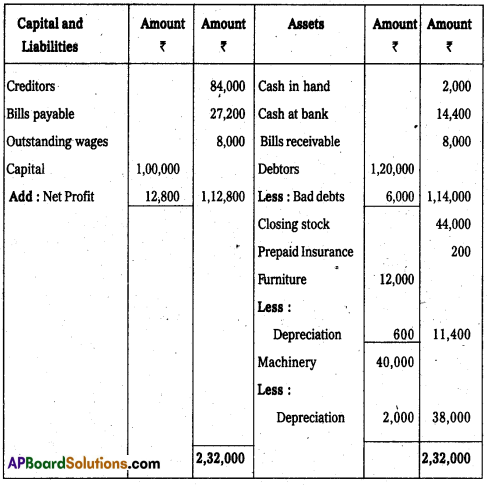

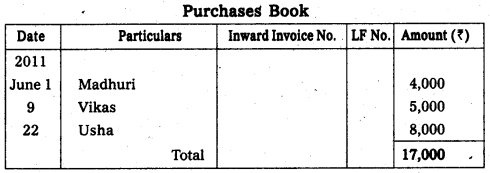

![]()

Question 27.

What is ledger ?

Answer:

Ledger , is a book which facilitates recording of all type of transactions related to personal, real and nominal accounts separately. According to Cropper “The book which contains a classified and permanent record of all the transactions of a business is called ledger”.

Question 28.

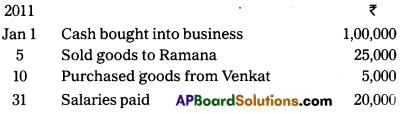

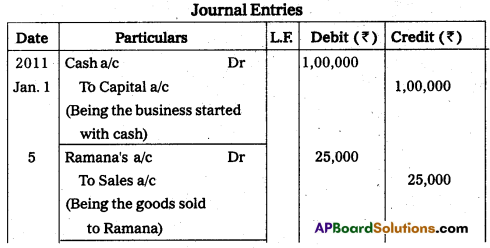

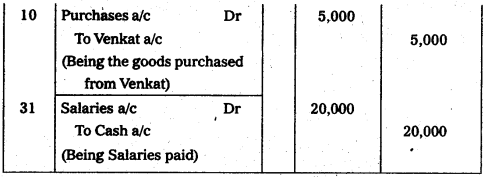

Record the following transactions into Journal.

Answer:

Question 29.

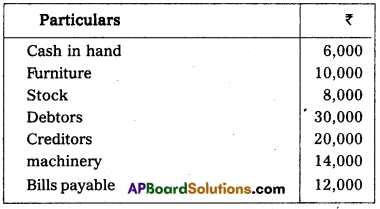

Record the opening journal entry from the following particulars.

Answer:

Journal Proper :

Question 30.

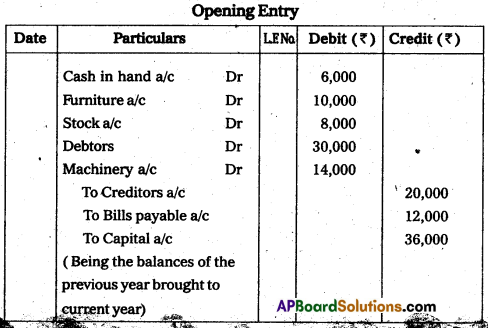

Rectify the following errors through suspense a/c.

i) Sales book was overcast by ₹ 300.

ii) Purchases book was undercast by ₹ 2,000

iii) Expenses ₹ 15 was posted in the ledger as ₹ 150

Answer:

Question 31.

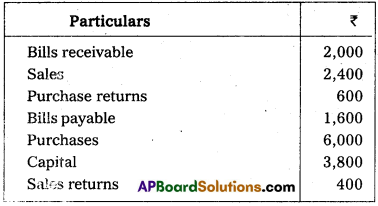

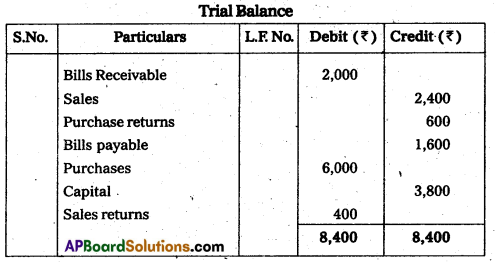

Prepare a trial balance from the following balances bills receivable.

Answer:

Question 32.

Explain prepaid expenses.

Answer:

Prepaid expenses are the expenses relating to the next year but paid during the years. Ex : Insurance or taxes paid for the next year. These expenses are deducted from the concerned expenditure either in trading or profit and loss a/c debit side. They are shown as assets in the balance sheet.