Thoroughly analyzing AP Inter 2nd Year Commerce Model Papers Set 2 helps students identify their strengths and weaknesses.

AP Inter 2nd Year Commerce Model Paper Set 2 with Solutions

Time: 3 Hours

Maximum Marks: 100

Part – I (50 Marks)

Section – A

(2 × 10 = 20)

Answer any two of the following questions in not exceeding 40 lines each.

Question 1.

What is trade? Explain different types of trade.

Answer:

Trade means the buying and selling of goods or services between two persons two business organisations or two countries. Trade is broadly classified into two types: Domestic trade and Foreign or international trade.

1. Domestic Trade:

Buying and selling of goods takes place between the individuals of the same country. The buyer and seller live in the same country. It is also called Home trade or internal trade based on the scale of operations, internal trade can be classified into two types. They are Wholesale trade and Retail trade.

- Wholesale trade: Buying and selling goods in relatively large quantities is called ‘wholesale trade’. A person who is involved in wholesale trade is called a wholesaler. A wholesaler buys goods in large quantities from the manufacturers and sells in relatively smaller quantities to the retailers. So, he is the connecting link between producers and the retailers.

- Retail trade: Retailing means the sale of goods in small quantities to the consumers: A person engaged in retail trade is called a retailer. Retailers buy goods from wholesalers and sell them in relatively smaller quantities to the final consumers. Retailers established a link between wholesalers and consumers.

2. Foreign Trade or International Trade:

The trade that takes place between nations is international trade. So, goods or services exchanged between the traders of two nations is called foreign trade. Foreign trade can be divided into three types. They are Import trade, Export trade, and Entrepot trade.

- Import trade: The term import is derived from the conceptual meaning as to bring in the goods and services in the port of the country. When purchases are made from another country, goods are said to be imported from that country to the buyer’s country. For example, China has the most modern technology for producing electronic products cheaply. So our country is importing those products.

- Export trade: The term export is derived from the conceptual meaning as to ship goods and services out of the port of the country. When the goods are sold to a trader in another country, goods are said to be exported to that country by the seller country. For example, India is a major exporter of tea to other countries.

- Entrepot trade: When goods are imported into a country, not for consumption in that country, but for exporting them to a third country, it is known as ‘Entrepot trade’. For example, India imports oil seeds from the USA and exports the same to Malaysia.

![]()

Question 2.

Discuss the Principles of Insurance.

Answer:

Insurance means protection against the risk of loss. It provides compensation against any loss or damage due to the happening of an event. It is a contract between the two parties by which one of them undertakes to indemnify the other person against a loss that may arise due to some events.

Principles of Insurance

1. Insurable Interest:

A person cannot enter into a contract of insurance unless he has an insurable interest in the subject matter of insurance. It is an essential feature of insurance. Without this insurable interest, the contract of insurance will be treated as a wager or gambling contract. A person has an insurable interest in his own life or the life of his wife and a creditor has insurable interest in the debtor.

2. Utmost Good Faith:

Insurance is based on the principle of utmost good faith. It means both the parties of the contract must disclose all the facts relating to the subject matter of insurance. If the insured does not disclose all material facts, the contract between them is void. A person who had suffered from T.B. in the past had not disclosed it in the proposal form. Later on, the insurer comes to know of this fact. He may declare the contract as void.

3. Indemnity:

This is the chief principle of insurance. Indemnity means security against the risk of loss. Under this principle, the insured gets only the loss suffered by the insurer but not profits out of the contract of insurance. The principle of indemnity applies to contracts of fire and marine insurance only, but not to life insurance contracts.

4. Contribution:

Sometimes, goods are insured by more than one company. It is double insurance. The insured can get compensation only for the total loss from all insurance companies put together, but not the total loss from each company. The insurance companies will pay the compensation on a pro-rata basis.

5. Subrogation:

According to this principle, the insurer after compensating the loss of the insured, the right of ownership of the damaged goods is shifted from the insured to the insurance company.

Ex: Mr. X owns a scooter worth ₹ 36,000 and it was insured with an insurance company for full value. Later it was met with an accident and damaged beyond repairs. The insurance company paid the full value as compensation. Then all the rights on the scooter will be passed on to the insurance company.

6. Causa Proxima:

According to this principle, if the loss is caused by a nearest and direct factor, then only the insurer will have to bear the loss.

Ex: Biscuits in a ship are insured and are destroyed because of the seawater entered through a hole made by the mouse in the bottom of the ship and water entered into the ship. The nearest and direct cause is seawater. Hence, the insurer will have to bear the loss.

7. Mitigation of Loss:

It is the duty of the insured to take necessary steps to minimize the loss that happened due to some event. He should not act carelessly and negligently at the time of loss to the insured property.

Question 3.

What is a capital market? What is its importance?

Answer:

The term capital market refers to facilities and institutional arrangements through which long-term funds, both debt and equity are raised and invested. It consists of a series of channels through which savings of the community are made available for industrial and commercial enterprises. The capital market consists of development banks, commercial banks, and stock exchanges. The process of economic development is facilitated by the existence of a well-organized capital market. Economic growth can be achieved through the development of the financial system. It is essential that financial institutions are sufficiently developed and that market operations are free, fair, competitive, and transparent.

Importance of Capital Market:

1. Act as a link between Savers and Investors:

The capital market plays an important role in mobilizing the savings and diverting them into productive investment. In this way, it is transferring financial resources from surplus and wasteful areas to deficit and productive areas.

2. Encourage Savings:

In undeveloped countries, there are low savings, and those who can save often invest their savings in unproductive areas and conspicuous consumption in the absence of a capital market. With the development of a capital market, financial institutions provide a wide range of instruments that encourage people to save.

3. Encouragement to Investors:

Various financial assets like shares, bonds etc., encourage people to put their investment in the industry or lend to the government. This can be facilitated by the existence of the capital market.

4. Stability in Prices:

The capital market tends to stabilize the value of stocks and securities. In the process of stabilization, it provides capital to the borrowers at a lower interest rate and discourages investment in speculative and unproductive areas.

5. Promotes Economic Growth:

Balanced economic growth is possible in any country with the proper allocation of resources among the industries. The capital market not only reflects the general condition of the economy but also smoothens and accelerates the process of economic growth.

Section – B

(4 × 5 = 20)

Answer any four of the following questions in not exceeding 20 lines each.

Question 4.

Explain any two characteristics of an entrepreneur.

Answer:

The following are some of the important characteristics that every successful entrepreneur must possess.

1. Innovation:

Innovation is an important characteristic of an entrepreneur in modern business. The entrepreneur makes arrangements for introducing innovations that help in increasing production on the one hand and reducing costs on the other.

2. Risk-taking:

Risk-taking is another feature of an entrepreneur. He has to pay for all the other factors of production in advance. There are chances that he may be rewarded with a. handsome profit or he may suffer a heavy loss. Therefore, risk-bearing is the final responsibility of an entrepreneur.

![]()

Question 5.

What is meant by internal trade?

Answer:

A trade that takes place within the country is known as internal or domestic trade. The buying and selling of goods take place within the boundaries of the same country. Trade goods are carried from one place to another place through railways and roadways. Payment for goods and services is made in the currency of the home country. There is a wide chance of the goods available and it involves transactions between producers, middlemen, and consumers.

Question 6.

What is mobile banking? What services can be obtained through mobile banking?

Answer:

The delivery of bank services to customers through mobile (cell) phones is called mobile banking. When compared to telephone banking the scope of mobile banking is more effective also. Mobile banking can take the form of SMS banking, GSM SIM Toolkit, and WAP.

- SMS Banking: Short messages are sent to the customer’s mobile phones. SMS messages can be used for both passive and active banking operations. A client automatically receives information about his account balance after a certain operation is performed.

- GSM SIM Tool Kit: The GSM SIM Toolkit service can be only be used from a mobile phone supporting this technology. GSM SIM Toolkit is a software that evolves arbitrary Changes in the mobile phone menu. Mobile phones now on the market support a GSM SIM Tool kit after buying a special SIM card and activating the permanent bank branch. The client can use this service.

- WAP (Wireless Application Protocol): WAP is often compared to web pages although it is simplified. Unlike pages appearing on a computer monitor, WAP presents it output on a small mobile phone. WAP Banking is not very popular. Only a few banks are providing this service.

Question 7.

Explain the term insurance and state the functions of insurance.

Answer:

The method of sharing risk through economic cooperation is called insurance. Insurance may described as a social device to reduce or eliminate the risk of loss of life and property. Insurance renders valuable services to commerce as well as to society. Insurance covers many risks and uncertainties in the world of business and acts as a boon to business firms.

Functions of Insurance:

- Providing Certainty: Insurance provides payment of the risk of loss. There are uncertainties of happening of time and amount of loss. Insurance removes these uncertainties and the assured receives payment of loss. The insurer charges a premium for providing certainty.

- Protection: The second function of insurance is to protect probable chances of loss. Insurance cannot stop the happening of a risk or event but can compensate for the losses arising out of it.

- Risk Sharing: On the happening of a risk event, the loss is shared by all the persons exposed to it. The share is obtained from every insured member by way of premiums.

- Assist in Capital Formation: The accumulated funds of the insurer received by way of premium payments made by the insured are invested in various income-generating schemes.

Question 8.

The distinction between primary and secondary markets.

Answer:

The following are the differences between the primary market and the secondary market.

| Primary Market (New Issue Market) | Secondary Market (Stock Exchange) |

| 1. There is the sale of securities to investors by new companies or new issues by existing companies. | 1. There is the trading of existing shares only. |

| 2. Securities are sold by the company to the investor directly or through an intermediary. | 2. Ownership of existing securities is exchanged between investors. The company is not involved at all. |

| 3. The flow of funds is from savers to investors i.e. The primary market directly promotes capital formation. | 3. Enhances encashment (liquidity) of shares i.e. The secondary market indirectly promotes capital formation. |

| 4. Only the buying of securities takes place in the primary market. Securities cannot be sold there. | 4. Both the buying and selling of securities can take place on the stock exchange. |

| 5. Prices of securities are determined and decided by the management of the company. | 5. Prices are determined by the demand and supply of the security. |

| 6. There is no fixed geographical location. | 6. Located at specified places. |

Question 9.

Write briefly about the district Forums.

Answer:

The state government in each district establishes a District forum by notification. The district forum consists of a president nominated by the state government. The forum also comprises two other members who shall have atleast 10 years of experience in dealing with problems of economics, law commerce, and industry. Every member of the form shall have a tenure of 5 years or 65 years whichever is earlier. The District collector acts as the chairman of the District Forum. The District Forum shall have jurisdiction to entertain consumer complaints where the value of goods and services for which the compensation claimed should ₹ 20 lakhs.

Section – C

(5 × 2 = 10)

Answer any five of the following questions in not exceeding 5 lines each.

Question 10.

Explain the meaning of entrepreneur.

Answer:

The word entrepreneur is derived from the French verb ‘entrepredre’, which means to undertake. An entrepreneur may be referred to such a single person or group of persons who promote a new enterprise by collecting various factors of production and bearing the risks arising out of such venture.

![]()

Question 11.

Who is the retailer?

Answer:

A trader who is engaged in retail trade is called a retailer. A retailer is the last link in the chain of distribution of goods. He is an intermediary between the wholesaler and consumers. He purchases goods from wholesalers and sells them in very small quantities to ultimate consumers. His activities are generally confined to the locality in which his shop is located. Big departmental stores, super bazaars, hawkers, and other small shopkeepers are examples of retailers.

Question 12.

Money market.

Answer:

The money market is a market for short-term funds that deals in monetary assets whose period of maturity is up to one year. The market facilitates the raising of short-term funds for meeting temporary shortages of cash and obligations and the deployment of excess funds for earning returns.

Question 13.

OTCEI

Answer:

The Over The Counter Exchange of India (OTCEI) is a company incorporated under the Companies Act, to provide small and medium companies access to the capital market for cost-effectively raising finance. It is also meant to provide investors with a convenient, transparent, and efficient avenue for capital market investment.

Question 14.

Online banking

Answer:

It is also called internet banking. It is a facility provided by banks that enables the user to execute bank-related transactions through the Internet. People sitting at home can transact business.

Question 15.

Double insurance

Answer:

When more than one insurance policy is taken on the same subject matter, it is called double insurance. In life insurance, any number of policies can be taken by the insured upon his life. He can collect the full amount on all the policies. But this is not the case with fire and marine insurance. He is entitled to the compensation of the actual loss only.

Question 16.

Bonded warehouse

Answer:

Bonded warehouses are owned and operated by port trust authorities. It is located near the port. It is a place where importers store goods till customs duties are paid or goods are re-shipped to other destinations without being brought into the country.

Question 17.

Who is a consumer in the opinion of Mahatma Gandhi?

Answer:

Mahatma Gandhi, the father of the nation, attached great importance to what he described as the ‘poor consumer’, who according to him should be the principal beneficiary of the consumer movement. He said A consumer is the most important visitor on our premises. He is not dependent on us, we are on him. He is not an interruption to our work; he is the purpose of it. He is not an outsider to our business; he is a part of it. We are not doing him a favor by serving him; he is doing us a favor by allowing doing so.

Part – II (50 Marks)

Section – D

(1 × 20 = 20)

Answer the following question.

Question 18.

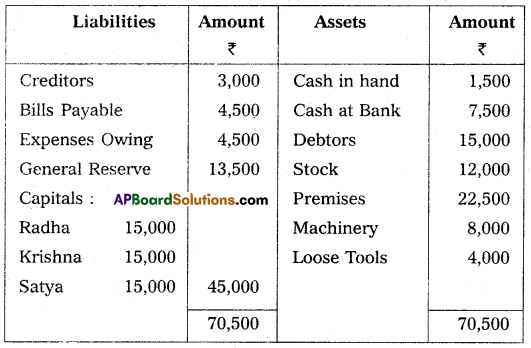

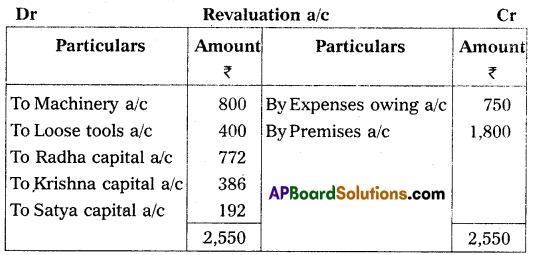

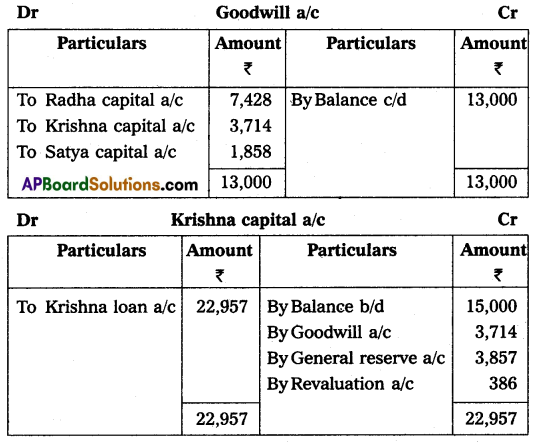

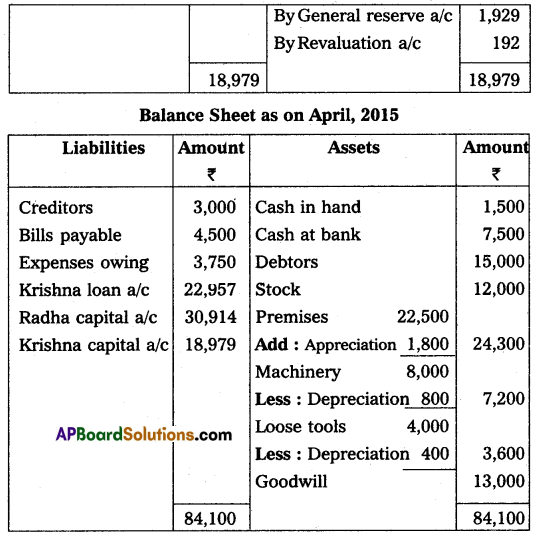

Radha, Krishna arid Satya were in Partnership sharing profits and losses in the ratio of 4 : 2 : 1 in April, 2015, Krishna retired from the firm, and on that date, the balance sheet was as follows:

The terms were:

(a) The goodwill of the firm was valued at ₹ 13,000.

(b) Expenses owing to be brought down to ₹ 3,750.

(c) Machinery and Loose Tools are to be valued at 10% less than their book value.

(d) Factory premises are to be revalued at ₹ 24,300.

Prepare:

1. Revaluation account

2. Partner’s capital accounts and

3. Balance sheet of the firm after the retirement of Krishna

Answer:

Section – E

(1 × 10 = 10)

Answer any one of the following questions.

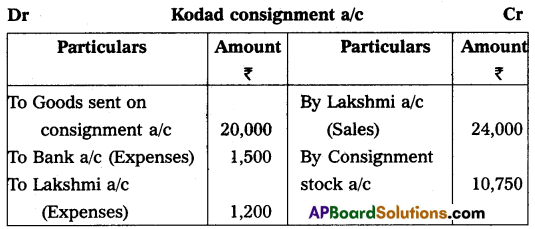

Question 19.

Laxmi of Vijayawada consigned goods worth ₹ 20,000 to his agent Saraswathi of Kodad on consignment. Laxmi spent ₹ 1,000 on transport, and ₹ 500 on insurance: Saraswathi sent ₹ 5,000 as advance. After two months, Laxmi received the account sales as follows:

(a) Half of the goods were sold for ₹ 24,000

(b) Selling expenses were ₹ 1,200

(c) 10% commission on sales

Give ledger accounts in the books of Laxmi.

Answer:

(or)

Question 20.

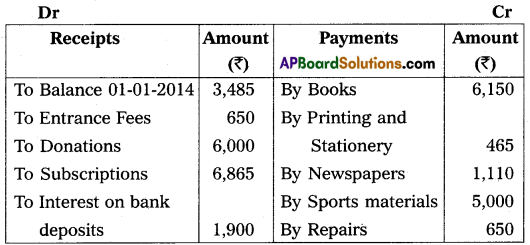

From the following receipts and payments a/c of the Venkateswara Society for the year ended 31-Dec-2014. Prepare income and expenditure a/c for the year ended 31-Dec-2014.

The entrance fees and donations are to be capitalized. Sports materials value ₹ 4,000 as of 31-Dec-2014.

Answer:

Income and expenditure of Venkateswara society for the year ending 31st December 2014.

Section – F

(2 × 5 = 10)

Answer any Five of the following questions.

Question 21.

Write any three differences between manual accounting and computerized accounting.

Answer:

Computerized accounting is a system of accounting in which one can use a computer and different accounting software for a digital record of each transaction. Both manual and computerized accounting aims to record, classify, and summarise accounting transactions. However the following are the differences between manual accounting and computerized accounting.

Differences between Manual and Computerised Accounting Systems

| Basis | Manual Accounting | Computerized Accounting |

| 1. Definition | Manual accounting system in which we keep a physical register of journals and a ledger for keeping the records of each transaction. | In this system of accounting we use computers and different accounting software for digital records of each transaction. |

| 2. Calculation | In manual accounting, all calculations of adding and subtracting are done manually. For example, to find the balance of any ledger account, we will calculate the debit and credit Side and then we will find its difference for showing the balance. | In computerized accounting, we must record the transactions manually in the database. All the calculations are done by a computer system we need not calculate each accounts balance. It is calculated automatically by computerized accounting system. |

| 3. Ledger | In manual accounting, we check the journal and then transfer figures to related accounts debit or credit side through manual post. | The computerized accounting system will automatically process the system and will make all the accounts, and ledgers because we have pass voucher entries under its respected ledger account. |

Question 22.

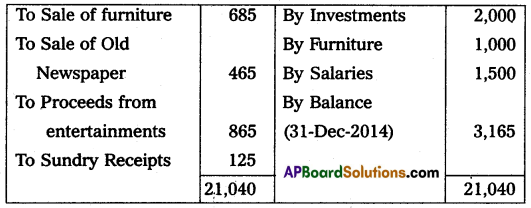

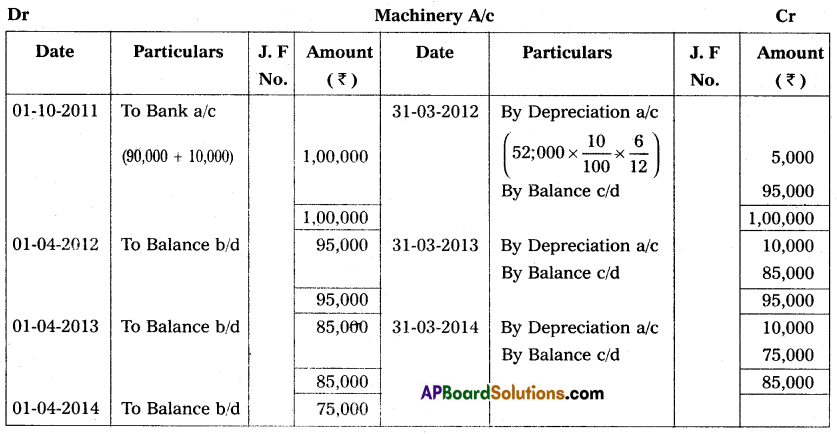

Kotireddy purchased goods worth ₹ 12,000 from Rajareddy on 25th March 2014 and accepted a bill of exchange drawn upon him by Rajareddy payable after two months. On the date of maturity, Kotireddy dishonored the bill. Rajareddy paid ₹ 80 as noting charges. Pass the necessary journal entries in the books of Rajareddy and Kotireddy.

Answer:

Question 23.

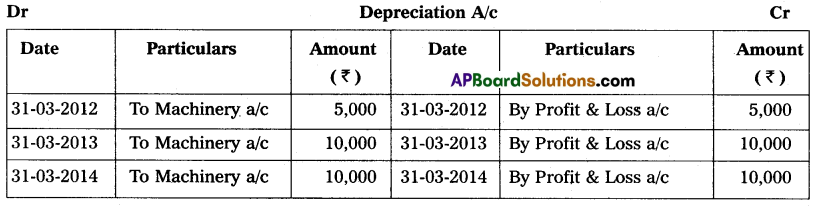

On 1st October 2011, Jagannadham & Sons purchased a machine for ₹ 90,000 and spent ₹ 10,000 for its installation. The books are closed on 31st March every year. The firm writes off depreciation at the rate of 10% on the original cost every year. Prepare Machine Account and Depreciation Account for the first three years.

Answer:

![]()

Question 24.

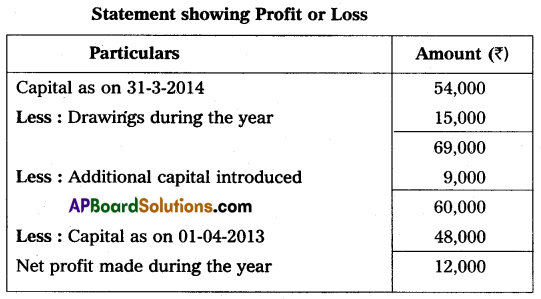

Mr. Jeevan maintains his books in the single entry system he gives the following information.

Capital on 01-04-2013 – ₹ 48,000

Drawings during the year – ₹ 15,000

Capital as on 31-03-2014 – ₹ 54,000

Additional capital introduced during the year – ₹ 9,000

You are requested to prepare a statement of profit or loss for 31-03-2014.

Answer:

Section – G

(5 × 2 = 10)

Answer any Five of the following questions.

Question 25.

What do you mean by noting charges?

Answer:

To obtain the proof of dishonor, the bill is re-sent to the drawee through a legally authorized person called a notary public. Notary public charges a small fee for providing this service known as noting charges. Noting charges are paid to the notary public first by the holder of the bill but are ultimately recovered from the drawee, because he is the responsible person for the dishonor.

Question 26.

What are the causes of depreciation?

Answer:

The main causes of depreciation are:

- Wear and tear

- Physical forces

- Expiration of legal rights

- Obsolescence

- Accidents

- Depletion

Question 27.

What is Delcredre’s commission?

Answer:

The consignee may sell some part of the goods on credit. When goods are sold on credit, there is always a risk of some amount of bad debt. To avoid the risk of bad debts the consignor provides an additional commission known as the Del-Credre commission to the consignee who guarantees for the payment in case of a credit sale. Delcredre commission is paid at a predetermined percentage of gross sale proceeds.

Question 28.

What is legacy?

Answer:

It is the amount that a not-for-profit concern will receive as per the will of a deceased person. It should be capitalized being an item of a non-recurring nature and should be shown on the liabilities side of the balance sheet.

Question 29.

What do you understand by the fluctuating capital of partners?

Answer:

Under the fluctuating capital method, only one account i.e., a capital account is maintained for each partner. All the adjustments such as share of profit/loss, interest on capital, drawings, interest on drawings, salary, etc., are recorded directly in this account. This makes the balance in the capital account fluctuate from time to time that is why it is called as fluctuating capital method.

Question 30.

What is an equity share?

Answer:

The equity shares are also called as ordinary shares. According to section 85 of the Companies Act, 1956 an equity share is a share that is not a preference share. In other words, shares that do not enjoy any preferential right in the payment of dividends or repayment of capital are called equity shares.

![]()

Question 31.

Ready to use accounting software.

Answer:

Ready-to-use accounting software is suited to organizations running small/conventional businesses when the frequency or volume of accounting transactions is very low. This is because the cost of installation is generally low and several users are limited.

Question 32.

Write briefly the salient features of incomplete records.

Answer:

Features of accounts from incomplete records:

- It is not a systematic method of recording transactions.

- It is very common to keep only personal accounts.

- It avoids real and nominal accounts.

- It is very common to keep a cashbook to record cash receipts and cash payments.

- This system lacks uniformity as it differs from firm to firm.

- It is mostly suitable and used by sole traders and partnership concerns.