Students must practice these AP Inter 2nd Year Commerce Important Questions 4th Lesson Financial Markets to boost their exam preparation.

AP Inter 2nd Year Commerce Important Questions 4th Lesson Financial Markets

Long Answer Questions

Question 1.

What is meant by Financial Market? Briefly explain functions and classification of financial market.

Answer:

A Market is a place for buying and selling of goods. Financial market means any market place where buyers and sellers participate in the trade of financial assets such as equities, bonds, currencies and derivatives. The lender of funds or investor is the buyer of the financial asset and the borrower of funds is the seller of financial asset or issuer of the security. Thus, a financial market helps to link the savers and investors by mobilizing funds between them.

Functions:

Financial markets play an important role in the allocation of scarce resources in an economy by performing the following four important functions:

1. Mobilisation of savings and channelling them into the most productive uses: A financial market facilitates the transfer of savings from savers to investors. It gives savers the choice of different investments and thus helps to channelise surplus funds into the most productive use.

2. Facilitating price discovery: In the financial market, the households are suppliers of funds and business firms represent the demand. The interaction between them helps to establish a price for the financial asset which is being traded in that particular market.

3. Providing liquidity to financial assets: Financial markets provide liquidity to financial assets, so that they can be easily converted into cash whenever required. Thus, holders of assets can readily sell their financial assets through the mechanism of the financial markets.

4. Reducing the cost of transactions: Financial market helps to save time, effort, and money that both buyers and sellers of a financial asset by providing valuable information about securities being traded in the market. Thus, financial market is a common platform where buyers and sellers can meet for fulfilment of their individual needs.

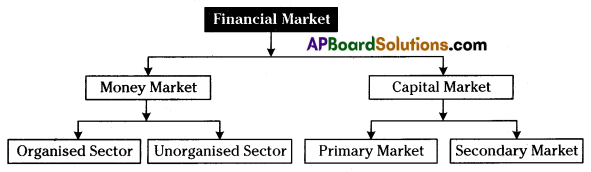

Classification of financial market: Financial markets are classified into two types on the basis of the maturity of financial instruments traded in them. They are 1) Money market and 2) Capital market.

1. Money Market: Money market is a market for short term funds which deals in monetary assets whose period of maturity is up to one year. Treasury bill, commercial paper, commercial bill, call money, certificate of deposit, etc. are the short – term securities or instruments traded in the money market. Those instruments are close substitutes for money.

The Indian money market is divided into two categories of financial agencies. They are 1) Organised and 2) Unorganised.

The organised sector contains well established, scientifically managed financial institutions. They comprise the RBI, The State Bank of India, and its associate banks, development banks, etc. The RBI is the supreme monetary banking author¬ity in the country, which has responsibility to control the banking system in the country. It keeps the reserves of all commercial banks, hence it is known as the “Reserve Bank”. The organised sector of money market is well developed.

The unorganised sector contains agencies which have diverse policies, lack of uniformity and consistency in the lending business. The unorganised sector in- eludes indigenous banks, money-lenders, chit funds, etc. This sector is unorganised because its activities are not controlled and co-ordinated by Reserve Bank of India.

2. Capital Market: Capital market is the market where securities with maturities of more than one year are bought and sold. Both debt and equity are raised and invested in capital market. Equity shares, preference shares, debentures are the long term securities traded in the capital market. The capital market consists of commercial bank, development banks, and stock exchanges.

Capital market is divided into two types. They are 1) Primary market and 2) Secondary Market.

The market mechanism for the buying and selling of new issues of securities is known as “Primary Market”. This market is also known as “New issues market” because it deals with new securities being issued for the first time.

The secondary market represents the stock market where existing shares and debentures are traded. This market is also known as the “Stock Market” or “Stock Exchange”. It helps existing investors to disinvest and fresh investors to enter the market. In this market securities are traded, cleared and settled within the regulatory framework prescribed by SEBI.

Question 2.

What is capital market? What is its importance?

Answer:

Capital market is the market where securities with maturities of more than one year are bought and sold. Both debt, and equity are raised and invested in capital market. Equity shares, preference shares, debentures are the long term securities traded in the capital market. The capital market consists of commercial banks, development banks, and stock exchanges. The process of economic development is facilitated by existence of a well functioning capital market, because it is the necessary condition for economic growth.

![]()

Importance:

An efficient capital market is an essential pre-requisite for industrial and commercial development of a country. The importance of capital market in the process of economic development of a country can be described as below.

1. Link between Savers and Investors: The capital market acts as a bridge between savers and investors. It mobilises savings and diverts them into productive investment. Hence, the capital market plays an important role in transferring financial resources from surplus and wasteful areas to deficit and productive areas.

2. Encouragement of Savings: Savings are the backbone of any nation’s economic development With the development of capital market, the financial institutions provide vast range of instruments which encourage people to save them.

3. Encouragement of Investments: Various financial assets like shares, bonds, etc. encourage savers to lend to the government or to invest in industry. Thus, the capital market facilitates lending to the businessmen and also to the government.

4. Stability in Prices: In case of a developed capital market, the experts in banking and non-banking intermediaries put in every effort in stabilising the value or price of stocks and securities. This process is facilitated by providing capital to the needy at a lower rate of interest and by cutting down the speculative and unproductive activities.

5. Promotes Economic Growth: The balanced economic growth is possible in any country with the proper allocation of resources among the industries. The capital market not only reflects the general conditions of the economy, but also smoothens and accelerates the process of economic growth.

Thus, it is clear that the capital market is the life blood of economic development of a country. If the capital market is not developed, it will lead to misuse of financial resources. The capital market plays a significant role in diverting the wrongful use of resources to their rightful use.

Question 3.

Distinguish between capital and money market.

Answer:

Capital Market: Capital market is the market where securities with maturities of more than one year are bought and sold. Both debt and equity are raised and invested in capital market. Equity shares, preference shares, debentures are the long term securities traded in capital market. The capital market consists of commercial banks, development banks, and stock exchanges.

Money Market: Money market is a market for short term funds which deals in monetary assets whose period of maturity is up to one year. Treasury bill, commercial paper, commercial bill, call money, certificate of deposit, etc. are the short-term securities or instruments traded in the money market. Those instruments are close substitutes for money.

Distinction between Capital Market and Money Market:

| Point of Distinction | Capital Market | Money Market |

| 1. Maturity Period | Capital market deals with long term funds more than one year. | Money market deals with short term funds for period not exceeding one year. |

| 2. Participants | The participants in the capital market are development banks, stock exchanges, and investment companies. | The main participants in money market are central bank, commercial banks, acceptance houses, non-banking financial institutions, bill brokers, etc. |

| 3. Credit Instruments | The main instruments traded in capital market are equility shares, preference shares, debentures, bonds, etc. | The main instruments traded in money market are trade bills, promissory notes, commercial paper, treasury bill, and certificates of deposit. |

| 4. Investment Outlay | Investment in the capital market does not necessarily require a high financial outlay. | In the money market, transactions entail huge sums of money as the instruments are quite expensive. |

| 5. Liquidity | Capital market securities are considered liquid investments but the degree of liquidity is less than the money market. | Money market instruments enjoy a higher degree of liquidity as there is formal arrangement for this. |

| 6. Safety | Capital market instruments are riskier both with respect to returns and principal repayment due to long duration of investment. | Money market is generally much safer with a minimum risk of default. This is due to shorter durations of investment and also to financial soundness of the issuers. |

| 7. Expected Return | Capital market provides higher return for the investors who invest in capital markets instruments than the money market instruments. | The returns in money market investments are low when compared to capital markets. |

| 8. Regulator | In capital market SEBI regulates the institutions and procedures. | In money market Reserve Bank of India (RBI) regulates the market. |

| 9. Purpose of Loans | The capital market provides the funds for long term needs of the industrialists and provides fixed capital to buy land, machinery, etc. | The money market provides the short term credit for working capital needs of the industrialists. |

Question 4.

Define the stock exchange and explain its function.

Answer:

Stock exchange is a financial barometer of the country, which deals in long term finance. A stock exchange is an institution which provides a platform for buying and selling of existing or “second hand” listed securities. So stock exchange is also called “Stock Market” or “Secondary Market”. It provides a connecting link between people who want to dispose of their investment because they need cash and people who wish to invest because they have surplus cash available.

Definition:

The Securities Contracts (Regulation) Act, 1956 defined stock exchange as “an association, organization or body of individuals, whether incorporated or not, established for the purpose of assisting, regulating and controlling business in buying, selling and dealing in securities.

Functions of a stock exchange:

The stock exchanges provide many useful services to the corporate sector and the investor. The following are some of the important functions of a stock exchange.

1. Providing liquidity and marketability to existing securities: The primary function of the stock exchange is the creation of a continuous market where securities are bought and sold. It gives investors the chance to disinvest and reinvest. This provides both liquidity and easy marketability to already existing securities in the market.

2. Pricing of securities: In stock exchange, share price is determined by the forces of demand and supply. These prices are communicated openly to the public and are known as market quotation which provides important information to both buyers and sellers in the market.

3. Safety of transaction: The membership of a stock exchange is well regulated and its dealings are well defined according to the existing legal framework and follows rules of the Securities Contracts (Regulation) Act, 1956. And SBI also directly controls the day to day activities of the stock exchange. This ensures that the investing public gets a safe and fair deal on the market.

4. Contributes to economic growth: In stock exchange, the existing securities are resold or traded. Through this process of disinvestment and reinvestment savings get channelised into their most productive investment avenues. This leads to capital formation and economic growth.

5. Spreading of equity cult: The stock exchange can play an important role in ensuring wider share ownership by regulating new issues, better trading practices and taking effective steps in educating the public about investments.

6. Providing scope for speculation: Certain degree of speculations is necessary to ensure liquidity and price continuity in the stock market. The stock exchange provides sufficient scope for speculation within the provisions of law, in a restricted and controlled manner.

7. Listing of securities: The important function of stock exchange is listing of securities. Only listed securities can be traded on Stock Exchange. A company which is desirous of listing its securities will apply to the Stock Exchange authorities. The listing is allowed only after a critical examination of all the affairs of a company.

8. Provides liquidity of investment: Stock exchange provides liquidity to the listed securities. Buyers and sellers of securities exchange their securities in stock exchange. In this way stock exchange provides a ready market for converting the securities into cash and vice versa.

![]()

Question 5.

Explain the objectives and functions of SEBI.

Answer:

The Securities and Exchange Board of India (SEBI) was established by Government of India in April 1988, to protect the interests of investors and regulate the working of stock exchanges. It was to function under the overall administrative control of the Ministry of Finance of the Government of India. The statutory status was conferred to SEBI in January 1992. Its headquarters is located in Mumbai Stock Exchange.

Objectives of SEBI:

The overall objective of SEBI is to protect the interests of investors and to promote the development and regulate the securities market. This may be given below:

- To regulate stock exchanges and the securities industry to promote their orderly functioning.

- To protect the rights and interest of investors, particularly individual investors and to guide and educate them.

- To prevent trading malpractices and achieve a balance between self-regulation by the securities industry and its statutory regulation.

- To regulate and develop a code of conduct and fair practices by intermediaries like brokers, merchant bankers, etc. with a view to making them competitive and professional.

Functions of SEBI:

In order to control and regulate capital market (securities market) SEBI has been assigned regulatory, development and protective functions.

A) Regulatory Functions:

- Registration of brokers, sub-brokers and other players in the market.

- Registration of collective investment schemes and mutual funds.

- Regulation of stock brokers, portfolio exchanges, underwriters and merchant bank¬ers and the business in stock exchanges and any other securities market.

- Regulation of takeover bids by companies.

- Calling for information by undertaking inspection, conducting enquiries and audits of stock exchanges and intermediaries.

- Levying fee or other charges for carrying out the purpose of the Act.

- Performing and exercising such powers under Securities Contracts (Regulation) Act, 1956, as may be delegated by Government of India.

B) Development Functions:

- Training for intermediaries of the securities market.

- Conducting research and publishing information useful to all market participants.

- Undertaking measures to develop the capital markets by adapting a flexible approach.

C) Protective Functions:

- Prohibition of fraudulent and unfair trade practices like making misleading state-ments, manipulations, price rigging, etc.

- Controlling insider trading and imposing penalties for such practices.

In this way SEBI plays very important role in regulating Indian capital market because Government of India can only take decision to open new stock exchange in India after getting advice from SEBI. If SEBI thinks that it will be against its rules and regulations, SEBI can ban on any stock exchange to trade in shares and stocks.

Short Answer Questions

Question 1.

What are the different components of money market?

Answer:

Money market is a market for short term funds which deals in monetary assets whose period of maturity is up to one year. Treasury bill, commercial paper, commercial bill, call money, certificate of deposit, etc. are the short term securities or instruments traded in the money market. Those instruments are close substitutes for money. Call money market, acceptance market, bill market and collateral loan market are the various components of money market.

Components of Money Market: The basic components of money market are given below.

1. Call Money Market: The market for extremely short period loans is referred as the “Call Money Market”. It is an important submarket of Indian money market. This market is also known as “Money at call” and “Money at short notice”. It deals in call loans or call money given for a very short duration from few hours to 14 days. The participants in the call money market are mostly banks, so it is also called “Inter bank call money market” or “Inter bank loan market”. The rate at which money is made available is called “call rate” which is fixed by demand and supply of money. This type of markets are located in the industrial and commercial locations such as Mumbai, Delhi, Kolkata, etc.

2. Acceptance Market: Acceptance market deals with banker’s acceptances, which arise out of commercial transactions both within the country as well as abroad. The market where banker’s acceptances can be easily sold or discounted is called “Acceptance Market”. This market is typically used by exporters in getting paid more quickly for their exported goods.

3. BUI Market: The bill market is also called “Discount Market”. A bill market is a market in which short term papers or bills are bought and sold. It includes commercial bill market and treasury bill market. Commercial bills are used for trading purpose or for raising short term funds where treasury bills are government papers which are sold by the Central Bank on behalf of the Government.

4. Collateral Loan Market: When loans are offered against collateral securities like Government securities, stocks, gold, silver, merchandise, etc. the collateral loans are given for a short period lasting for a few months. The collateral security is returned to the borrower when he repays the loan. If the borrower fails to repay the loan, then collateral becomes the property of the lender.

Question 2.

Explain the various money market instruments. [May ’17(AP)]

Answer:

Money market is a market for short term funds which deals with monetary assets whose period of maturity is up to one year. Call money market, Bill market, Acceptance market and Collateral loan market are the various components of money market.

Instruments:

Instruments of money market are close substitutes for money. Some of the important instruments which are traded in money market are given below.

1. Treasury bill: A treasury bill is an instrument of short-term borrowing by the Government of India maturing in less than one year. They are also known as “Zero Coupon Bonds”, issued by the RBI on behalf of the Central Government to meet its short term requirement of funds. The purchase price is less them the face value. At the time of maturity the Government will pay full of face value.

2. Commercial paper: The Commercial Paper (CP) is a short term unsecured, negotiable and transferable money market instrument. It has been introduced by the RBI in 1989. It usually has a fixed maturity period of 15 days to one year. The main purpose of commercial paper was to provide short term funds for seasonal and working capital needs. Companies use C.P. for bridge financing, i.e. for the cost associated with issue such as brokerage, commission, printing of applications and advertising, etc.

3. Call money: Call money is short term finance repayable on demand, with a maturity period of one day to fourteen days, used for inter-bank transactions. Call money is a method by which banks borrow from each other to be able to maintain the cash reserve ratio. The interest rate paid on call money loans is known as the “Call rate”. It is a highly volatile rate that varies from day to day and sometimes even from hour to hour also.

4. Certificate of deposit: Certificates of Deposit (CD) are unsecured, negotiable, short-term money market instruments issued by commercial banks and developed financial institutions. They help to mobilise a large amount of money for short periods which has been introduced by the RBI. The RBI prescribes a limit to each bank for funds raised under the certificate of deposits scheme. The return on the CD is higher than the treasury bill because it assumes a higher level of risk.

5. Commercial bill: A commercial bill is a bill of exchange used to finance the working capital requirements of business firms. It is a short term, negotiable, self – liquidating instrument which is used to finance the credit sales of firms. The credit seller (drawer) of the goods draws the bill and buyer (drawee) accepts it. On being accepted, the bill becomes a marketable instrument and is called a trade bill. These bills can be discounted with a bank if sellers need funds before matures the bill. When trade bill is accepted by a commercial bank it is known as commercial bill.

6. Collateral loan: The loans and advances covered by collaborates like government securities, government bonds, gold, silver, stocks of corporations, etc. are called collateral loans. Commercial banks provide this type of loans against the government securities and bonds.

![]()

Question 3.

Explain the capital market instruments.

Answer:

Capital market is a market where securities with maturities of more than one year are traded. Both debt and equity are raised and invested in capital market. Equity shares, preference shares, debentures are the long term securities traded in the capital market. The capital market consists of commercial banks, development banks, and stock exchanges.

Instruments: The following are the instruments traded in capital market.

1. Secured Premium Notes (SPN): It is a secured debenture redeemable at premium issued along with a detachable warrant, redeemable after a notice period, say four to seven years. The warrants attached to SPN gives the holder his right to apply and get allotted equity shares, provided the SPN is fully paid.

2. Deep Discount Bonds: A bond that sells at a significant discount and redeemable at par value at the time of maturity. They are designed to meet the long term funds requirements of the issuer and investors who are not looking for immediate return and can be sold with a long maturity of 25-30 years.

3. Equity Shares with Detachable Warrants: A warrant is issued by company entitling the holder to buy a given number of shares at a stipulated price during a specified period. These warrants are separately registered with the stock exchanges and traded separately.

4. Fully Convertible Debentures with Interest: This type of debt instrument is fully converted into equity shares after specific period. When the instrument is a pure debt instrument, interest is paid to the investor. After conversion, interest payments cease on the portion that is converted.

5. Sweat Equity Shares: Sweat equity shares are those equity shares which are issued by the company to employees or directors for recognition of their work. Those shares are usually in the form of giving options to employees to buy shares of the company, so they become part owners and participate in the profits, apart from earning salary.

6. Disaster Bonds: Disaster Bond is a high-yield debt instrument that is usually insurance linked and meant to raise money in case of a catastrophe (sudden great disaster). So it is also called Catastrophe or CAT bond. It has a special condition that states that if the issuer (Insurance company or Reinsurance company) suffers a loss from a particular pre-defined catastrophe, then the issuer’s obligation to pay interest and repay the principal after some time or completely forgiven.

7. Foreign Currency Convertible Bonds: A convertible bond is a mix between a debt and equity instrument. It is a bond having regular coupon and principal payments and also able to take advantages of any large price appreciation in the company’s stock, due to the equity side of the bond.

8. Derivatives: A derivative is a financial instrument whose characteristics and value depend upon the characteristics and value of some underlying asset typically commodity, bond, equity, currency, index, etc.

Question 4.

Distinction between primary and secondary market.

Answer:

Primary Market: The market which deals with buying and selling of new issues of securities is called primary market. This market is also called the “New Issue Market”, because it deeds with new securities being issued for the first time. A company can raise capital through the primary market in the form of equity shares, preference shares, debentures, loans and deposits.

Secondary Market: Secondary market represents the stock market where existing shares and debentures are traded. It is also known as the “Stock Market” or “Stock Exchange”. It helps the existing investors to disinvest and fresh investors to enter the market. Securities are traded, cleared and settled within the regulatory framework prescribed by SEBI.

Distinction between Primary Market and Secondary Market:

| Primary Market (New Issue Market) | Secondary Market (Stock Exchange) |

| 1. There is sale of securities to investors by new companies or new issues by existing companies. | 1. There is trading of existing shares only. |

| 2. Securities are sold by the company to the investors directly or through an intermediary. | 2. Ownership of existing securities is exchanged between investors. The company is not involved at all. |

| 3. In this market the flow of funds is from savers to investors, i.e. the primary market directly promotes capital formation. | 3. Secondary market enhances (provides) liquidity of shares, i.e. it indirectly promotes capital formation. |

| 4. In primary market only buying of securities takes place but securities cannot be sold there. | 4. Both buying and selling of securities can take place on the stock market. |

| 5. Prices of securities are determined and decided by the management of the company. | 5. In secondary market prices are determined by demand and supply of the securities. |

| 6. There is no fixed geographical location for primary market. | 6. Secondary markets are located at specified places for trading activities. |

![]()

Question 5.

What do you know about BSE and NSE? [May ’22; Mar. ’20]

Answer:

1. BSE: BSE stands for “Bombay Stock Exchange”. The first exchange in India was established as “Native Shares and Stock Brokers Association” at Bombay in 1875, later it has transformed into the present “Bombay Stock Exchange (BSE)”. BSE is located in Dalal Street, Mumbai, which is Asia’s first Stock Exchange and one of India’s leading exchange groups.

Over the past 140 years, BSE has facilitated the growth of the Indian corporate sector by providing it an efficient capital-raising platform. In 1956, the BSE became the first stock exchange to be recognized by the Indian Government under the Securities Contracts Regulation Act, 1956. Subsidiaries companies of 13. regional exchanges now serve as sub-brokers of BSE.

BSE is the 4th largest stock exchange in Asia and the 9th largest in the world. More than 5000 companies are listed on BSE making it world’s No. 1 exchange in terms of listed members. According to Asian Development Bank’s 2010 Report, BSE is the 2nd most profitable stock exchange of the world.

2. NSE: NSE stands for “National Stock Exchange”. The most important development in Indian stock market was the establishment of the National Stock Exchange (NSE). It is the latest and most modern technology driven exchange.

National Stock Exchange was incorporated on 27th November 1992 and it was recognised as a stock exchange in April 1993. It started operations in 1994, with trading on the wholesale debt market segment. Subsequently, it launched the capital market in November 1994. In 2000 it started trading of various derivative instruments like options, futures, etc.

NSE has set up a nation-wide fully automated screen trading system with a high degree of transparency and equal access to investors irrespective Of geographical location.

Question 6.

Briefly explain about depository and dematerialization.

Answer:

Depository:

Depository means keeping or holding securities of investors in electronic form and providing services related to transactions of securities. In the depository a securities account can be opened, all shares can be deposited, they can be withdrawn or sold at any time and instruction to deliver or receive shares on behalf of the investor can be given.

Depository is a technology driven electronic storage system. It has no paper work related to share certificates, transfer, forms, etc. In India there are two depositories namely 1) National Securities Depositories Limited (NSDL) and 2) Centred Depository Services Limited (CDSL).

National Securities Depositories Limited is the first and largest depository presently operated in India. It was promoted as a joint venture of the IDBI, UTI and National Stock Exchange whereas CDSL is the second depository to commence operations and was promoted by the Bombay Stock Exchange and Bank of India.

Dematerialisation:

The process of converting investor’s securities held in physical form (certificates) to an equivalent number of securities in electronic form and crediting the same to investor’s demat account is known as “Dematerialisation”. For this, the investor has to open a Demat Account (Dematerialised Account) with an organisation called a depository.

At the time of issue of new securities by a company, the securities allotted to an investor can be directly credited to his demat account. SEBI has made it mandatory for the settlement of procedures to take place in demat form (mode) for trading above 500 shares.

Question 7.

What is index? Explain any two popular indices in our country.

Answer:

Stock market index is a barometer of market behaviour. It measures overall market sentiment through a set of the stocks that are representative of the market. It reflects market direction and indicates day-to-day fluctuations in stock prices. If the index rises, it indicates the market is doing well and vice-versa. In the Indian markets the BSE-SENSEX & NSE -NIFTY are important indices.

1. SENSEX: SENSEX is the benchmark index of the BSE. The BSE-SENSEX (Sensitive Index) is also called the “BSE – 30”. The SENSEX has been an important indicator of the Indian stock market which is the most frequently used indicator. The SENSEX, launched in 1986 is made up with 30 of the most actively traded stocks in the market. They represent 13 sectors of the economy and are the leaders in their respective industries. The index with a base year of 1978-79, the value of base year was 100.

[Benchmark = Standard against which others can be measured or judged]

2. NIFTY: NIFTY is an index of NSE (National Stock Exchange). NIFTY stands for National Stock Exchanges fifty, which consists of top 50 companies stocks from 24 different sectors listed on NSE. The companies which form index of nifty may vary from time to time based on many factors considered by NSE. The base year for the NIFTY index is 1995-96, with the base value as 1000.

![]()

Very Short Answer Questions

Question 1.

Financial Market:

Answer:

Financial market means any market place where buyers and sellers participate in the trade of financial assets, such as equities, bonds, currencies and derivatives. The lender of funds or investor is the buyer of the financial asset and the borrower of funds is the seller of financial asset or issuer of the security. Thus, a financial market helps to link the savers and investors by mobilizing funds between them.

Question 2.

Classification of Financial Market:

Answer:

Financial market is the market in which financial assets are created and transferred. Financial markets are classified into two types, on the basis of maturity of financial instruments traded in them. They are 1) Money Market and 2) Capital Market. The financial instruments with a maturity of less than one year are traded in the money market and with longer maturity are traded in capital market.

Further money market is classified into call money market, acceptance market, bill market, collateral loan market, whereas capital market may be classified as primary market and secondary market.

Question 3.

Money Market:

Answer:

Money market is a market for short term funds which deals in monetary assets whose period of maturity is up to one year. Treasury bill, commercial paper, commercial bill, call money, certificate of deposit, etc. are the short term securities or instruments traded in the money market. Those instruments are close substitutes for money. Call money market, acceptance market, bill market and collateral loan market are the various components of money market.

Question 4.

Capital Market: [Mar. 2020,’19; May ’17(AP)]

Answer:

Capital market is the market where securities with maturities of more than one year are bought and sold. Both debt and equity are raised and invested in capital market. Equity shares, preference shares, debentures are the long term securities traded in the capital market. The capital market consists of commercial banks, development banks, and stock exchanges. The process of economic development is facilitated by the existence of a well functioning capital market, because it is the necessary condition for economic growth.

Question 5.

Primary Market:

Answer:

The market mechanism for the buying and selling of new issues of securities is known as “Primary Market”. This market is also known as the “New Issue Market”, because it deals with new securities being issued for the first time. The prime function of the new issues market is to facilitate the transfer of funds from the savers or willing investors to the entrepreneurs for setting up new projects, new corporate enterprises, expansion, diversification, modernisation of existing projects, mergers, and take overs, etc. A company can raise capital through the primary market in the form of equity shares, preference shares, debentures, loans and deposits.

Question 6.

Secondary Market:

Answer:

Secondary market represents the stock market where existing shares and debentures are traded. It is also known as the “Stock Market” or “Stock Exchange”. It helps the existing investors to disinvest and fresh investors to enter the market. It also provides liquidity and marketability to existing securities. Securities are traded, cleared and settled within the regulatory framework prescribed by SEBI. Nowadays, with the help of advanced information technology we can trade securities from anywhere in the country through trading terminals.

![]()

Question 7.

Treasury Bill: [May ’22; Mar. ’20]

Answer:

A treasury bill is an instrument of short term borrowing by the Government of India maturing in less than one year. They are also known as “Zero Coupon Bonds”, issued by the RBI on behalf of the Central Government to meet its short term requirement of funds. The purchase price is less than the face value. At the time of maturity the Government will pay full of face value.

Question 8.

Commercial Paper:

Answer:

The Commercial Paper (CP) is a short term unsecured, negotiable and transferable money market instrument. It has been introduced by the Reserve Bank of India (RBI) in 1989. It usually has a fixed maturity period of 15 days to one year. The main purpose of commercial paper was to provide short term funds for seasonal and working capital needs. Companies use C.P. for bridge financing, i.e. for the cost associated with issue such as brokerage, commission, printing of applications and advertising, etc.

Question 9.

Certificate of Deposit:

Answer:

Certificates of Deposit (CD) are unsecured, negotiable, short-term money market instruments issued by commercial banks and developed financial institutions. They help to mobilise a large amount of money for short periods which has been introduced by the RBI. The RBI prescribes a limit to each bank for funds raised under the certificate of deposits scheme. The return on the certificate of deposit is higher than the treasury bill because it assumes a higher level of risk.

Question 10.

OTCEI

Answer:

The “Over The Counter Exchange of India (OTCEI)” is a company incorporated under the Companies Act 1956, and recognised as a stock exchange under the Securities Contracts (Regulation) Act, 1956. It is fully computerised, transparent, single window exchange which commenced trading in 1992. It was set up to facilitate small and medium companies to raise funds from the capital market in a cost effective manner, as it does not involve any flatation cost. This exchange is established on the lines of NASDAQ, the OTC exchange in USA, and has been promoted by UTI, ICICI, IDBI, LIC, GIC, SBI capital markets and Can Bank Finance Services.

Question 11.

Dematerialisation: [Mar. ’17(AP)]

Answer:

The process of converting investor’s securities held in physical form (certificates) to an equivalent number of securities in electronic form and crediting the same to investor’s demat account is known as “Dematerialisation”. For this, the investor has to open a Demat Account (Dematerialised Account) with an organisation called depository. At the time of issue of new securities by a company, the securities allotted to an investor can be directly credited to his demat account. SEBI has made it mandatory for the settlement of procedures to take place in demat form (mode) for trading above 500 shares.

Question 12.

Depository:

Answer:

Depository means keeping or holding securities of investors in electronic form and providing services related to transactions of securities. In the depository a securities account can be opened, all shares can be deposited, they can be withdrawn or sold at any time and instruction to deliver or receive shares on behalf of the investor can be given.

It is a technology driven electronic storage system. It has no paper work related to share certificates/transfer, forms, etc. In India there are two depositories namely 1) National Securities Depositories Limited (NSDL) and 2) Central Depository Services Limited (CDSL).

![]()

Question 13.

SENSEX: [May ’22; Mar. ’19,’18,’17 (AP)]

Answer:

SENSEX is the benchmark index of the BSE. The BSE-SENSEX (Sensitive Index) is also called the “BSE – 30”. The SENSEX has been an important indicator of the Indian stock market which is the most frequently used indicator. The SENSEX, launched in 1986 is made up with 30 of the most actively traded stocks in the market. They represent 13 sectors of the economy and are the leaders in their respective industries. The index with a base year of 1978-79, the value of base year was 100.

[Benchmark = Standard against which others can be measured or judged]

Question 14.

NIFTY: [May 2022]

Answer:

NIFTY is an index of NSE (National Stock Exchange). NIFTY stands for National Stock Exchanges fifty, which consists of top 50 companies stocks from 24 different sectors listed on NSE. The companies which form index of nifty may vary from time to time based on many factors considered by NSE. The base year for the NIFTY index is 1995-96, with the base value as 1000.