Collaborative study sessions centered around AP Inter 1st Year Commerce Model Papers and AP Inter 1st Year Commerce Question Paper March 2019 can enhance peer learning.

AP Inter 1st Year Commerce Question Paper March 2019

Time : 3 Hours

Max. Marks : 100

Part – I (50 Marks)

Section – A

Answer any TWO of the following questions in not exceeding 40 lines each.

Question 1.

Define the Co-operative Society. Explain its features.

Answer:

Co – operative society is a voluntary association of persons started with the objective of service but not profit. It encourages self-help, mutual help and thrift among members.

The Indian Co-operative Societies Act 1932 defines co-op-eratives in Section 4 as “a society which has its objectives for the pro-motion of economic interests of its members in accordance with co-operative principle”.

According to H.C. Calvert, a co-operative society is “a form of organisation where in persons voluntarily associate together as human beings on the basis of equality for the promotion of economic interest of themselves”.

Features :

1) Voluntary membership : A co-operative society is a volun-tary association of persons. Everyone is at liberty to enter of leave the co-operative society as and when he likes. Any person can become a member irrespective of his/her caste, creed, religion, colour, sex etc.

2) Democracy and equality : It is organised on the basis of democracy and equality. Every member has the same right to partici-pate in the management. Every member has only one vote.

3) State control: A co-operative society is subject to the con-trol and supervision. In India, all co-operative societies are registered under Indian co-operative societies Act or respective state co-opera-tive laws.

4) Service motto : The primary objective of co-operative soci-eties is to provide service to the members. The aim is not to earn profits. The societies earn small amount of profits to cover adminis-tration expenses.

5) Knowledge of the principles of co-operation: Every person joining a co-operative society must be familiar with the fundamentals of co-operation. The important aim is to serve the common man. The spirit is “Each for all and all for each”.

6) Distribution of surplus : The entire surplus at the end of the year is not distributed among the members. Some portion is trans-ferred to reserve, welfare fund, bonus to members. A certain percent-age is paid in the form of dividend.

7) Cash trading: A co-operative society should aim at transacting the business on cash basis. It is necessary to maintain stability and liquidity. It eliminates bad debts and collection expenses.

8) Number of members : Atleast 10 persons are required to form a co-operative society. The maximum number is unlimited.

9) Capital : The capital is procured from its members in the form of share capital. It can raise funds by way of loans from government and apex co-operative institutions or by way of assistance from the government.

Question 2.

Distinguish between a Private Company and a Public Company.

Answer:

The following are the differences between Private Company and a Public Company.

| Private Company | Public Company |

| 1. To form a Private Company the minimum number of members is 2 and maximum number of members is 50. | 1. Minimum number of members is 7 and maximum number of members is unlimited. |

| 2. It cannot issue prospectus. | 2. Public Company can issue prospectus. |

| 3. The transferability of shares is generally restricted by its articles. | 3. The shareholders can freely transfer their shares. |

| 4. It can commence its business as soon as it obtains certificate of incorporation from the Registrar. | 4. The business can be started only after getting the certificate of commencement of the business. |

| 5. It need not conduct statutory meeting and file copy of statutory report to the Registrar of Joint Stock Companies. | 5. A statutory meeting must be held within 6 months from the date of receiving the certificate of commencement of business. Statutory report is to be submitted to the Registrar. |

| 6. A Private Company can proceed with the allotment of shares before minimum subscription is received. | 6. Shares cannot be allotted before minimum subscription is received. |

| 7. The word private limited at the end of the name. | 7. The word Limited at the end of the name. |

| 8. The minimum number of directors is 2. The maximum number of directors is no limit. | 8. The minimum number of directors is 3. The maximum number of directors is 20. |

| 9. The directors need not take qualification shares. | 9. Qualification shares are necessary to become a director. |

| 10. The directors need not retire by rotation. | 10. 1/3 of the directors must retire by rotation every year. |

| 11. There is no age limit to become a director. | 11. Age limit for the directors is 65 years. |

| 12. The directors need not sent their consent to act as directors. | 12. The directors must send their consent to act as directors. |

| 13. There is no restriction on the remuneration to the directors and managing directors. | 13. The remuneration payable to the directors and others shall not exceed 11% of the net profits. |

| 14. It can grant loans to the directors without the consent of the central government. | 14. Permission from the central government is necessary to grant loans to the directors. |

| 15. Quorum for the meeting is 2. | 15. Quorum for the meeting is 5. |

| 16. All the directors can be appointed by single resolution. | 16. A separate resolution is required for the appointment of every director. |

![]()

Question 3.

Examine the advantages and disadvantages of raising funds by issuing equity shares.

Answer:

Issue of shares : The capital of the company is divided into number of equal parts known as shares. A company can issue different types of shares to get funds from the investors to suit their requirement. Some investors prefer regular income though it may be low, others may prefer higher returns and they will be prepared to take risk. Under the companies act, 1956, a company can issue only two types of shares.

1) Preference shares

2) Equity shares.

1) Preference shares : As the name suggests, these shares have certain preferences as compared to equity shares. There is a preference for payment of dividend and also repayment of capital at the time of liquidation. When the company has distributable profits, the dividend is first paid to preference shares. In the event of liquidation of the company, after the payment of outside creditors, preference share capital is returned. Because of these preferences they are called preference shares. These shares are furthur divided into cumulative, non-cumulative, participating, redeemable, irredeemable, convertable and non-convertable preference shares.

Advantages :

- Rate of return is guaranteed to those investors who prefer safety and want to earn income certainly.

- These shares are helpful in raising long term capital of the company.

- Redeemable preference shares have the added advantage of repayment of capital whenever there is surplus in the company.

- As fixed rate of dividend is payable, this enable the company to adopt trading on equity.

- There is no need to mortgage assets for the issue of shares.

Disadvantages :

- Fixed rate, of dividend is paid on these share. This is a permanent burdent to the company.

- These shares does not carry any voting right and cannot participate in the management of the company.

- Compared to other types of securities such as debentures, usually cost of raising capital is high.

2) Equity shares : They are also known as ordinary shares. Equity shareholders are the real owners of the company as these shares carry voting rights. Equity shareholders are paid dividend after paying to the preference shares. The rate of dividend depends on the profits of the company. There may be a higher rate of dividend or they may not get anything. These shareholders take more risk as compared to preference shareholders. Equity capital is returned after meeting all other claims including preference shares.

Advantages :

- Equity shares do not create any obligation to pay fixed rate of dividend.

- They can be issued with creating any charge over the assets of the company.

- It is a permanent source of capital and the company need not repay it except under liquidation.

- Equity shareholders are the real owners of the company.

- In case of profits, these shareholders can get higher dividends and appreciation in the value of shares.

Disadvantages :

- If only equity shares are issued the company cannot take the advantage of trading on equity.

- There is danger of over capitalisation in case of excess issue of these shares.

- These shareholders can put obstacles in management.

- In case of higher profits, increase in the value of shares may lead to speculation in the market.

Section – B (4 × 5 = 20)

Answer any four of the following questions not exceeding 20 lines each :

Question 4.

Explain the characteristics of Business.

Answer:

In the words of L.H.Haney “Business may be defined as human activities directed towards providing or acquiring wealth through buy-ing and selling of goods”. According to Wheeler “Business is an institution organised and operated to provide goods and services to the society under the incentive of private gain”. Spriegal considers all activities concerned with production and sale of goods are business activities.

An analysis of the above definitions brings out the following characteristics of business.

1) Economic activities : All those activities relating to the pro-duction and distribution of goods and services are called economic activities. Business is carried on with a profit motive. Any activity undertaken without economic considerations will not be part of busi-ness.

2) Deals with goods and services: Every business concern pro-duces or purchases goods and services with a view to selling them for profit. Goods may be consumer goods or producer goods. Consumer

goods like coffee, bread or shoes are meant for direct use by the con-sumers. Producer goods are used for the production of consumer or capital goods like raw materials, machinery etc. Services like trans-port, warehousing etc., may be considered as intangible and invisible goods.

3) Exchange of goods and services : A business must involve exchange of goods and services with a profit motive. Production or purchasing of goods and services for personal consumption do not constitute business. The purchase of goods should be to sell them again. If a person cooks his food at home, it is not business, but if the same person cooks at a restaurant it is business because he exchanges his services for money.

4) Continuity of transactions : In business only those transac-tions are included which have regularity and continuity. An isolated transaction will not be called business, even if the person earns profit from the deal. A person builds a house for himself but later on sells it for a profit, it is not business. On the other hand, if a house building society builds houses and sells them, this will be called business.

5) Profit motive : The profit motive is an important element of business. Profits are essential for the survival as well as the growth. Profit must, however, be earned through legal and fair means. Busi-ness should never exploit society to make money.

6) Risk and uncertainly : The business involves a large element of risk and uncertainity. The factors on which business depends are never certain, so the business opportunities will also be uncertain. There may be shift in demand, strike by employees, floods, war, fall in prices etc. A business man can reduce risks through correct forecasting and insurance. But all risks cannot be eliminated.

7) Creation of utility : Business creates various types of utilities in goods so that consumers may use them. The utility may be form utility, place utility and time utility. When rato materials are converted into finished goods it creates form utility. When the goods are transported from the places of production to the ultimate consumers, it creates place utility. The process of storing goods when they are not required and supplying them at a time when they are needed is called creation of time utility.

8) Art as well as science: Business is an art because it requires personal skills and experience. It is also a science because it is based on certain principles and laws.

Question 5.

Explain any five types of partners.

Answer:

There are different types of partners in a partnership firm. They are :

1) Active Partner : An active partner is one who takes active part in the day-to-day working of the business. He may act in various capacities as manager, advisor or organisor. He is also known as work-ing partner or managing partner.

2) Sleeping Partner : A sleeping partner or dormant, partner is one who contribute capital, share profits and losses but does not take part in the working of the concern. He is not known to the public. So, he is also called as secret partner.

3) Nominal Partner: A nominal partner is who lends his to the firm. He does neither contribute any capital nor does he shares profits of the business. They do not participate in the management of the business. But they are liable to third parties for all acts of the firm.

4) Partners in Profits : He is a partner who shares in the profits of the firm but not losses. But he is liable to third parties like any other partner. He is not allowed to take part in the management of the business.

5) Partner by Estoppel : When a person is not a partner, but posses himself as partner, either by words or in writing or by his acts, he is called partner by estoppel. He neither contributes the capital nor participate in profits and losses. But he is liable to any creditor like any other partner.

6) Partner by Holding out: If a person is considered by outsider as partner in the firm and he does not disclaim it, he is called partner by holding out. He neither contributes the capital to the firm nor participate in profits and losses. But he is liable to third parties for the debts of the firm.

7) Limited Partner : The liability of limited partners is limited to the extent of their capital contribution. This type of partners found in limited partnership.

8) General Partners: The partners having unlimited liability are called general partners.

9) Minor Partner: A minor is a person who has not yet attained the age of majority i.e., 18 years. According to Indian contract Act, a minor cannot enter into a contract. A minor may be admitted to the benefits of existing partnership with the consent of all partners. The minor is not personally liable for liabilities of the firm.

![]()

Question 6.

Explain the classification of sources of finance.

Answer:

Sources of finance can be classified on the basis of period, own-ership and generation.

On the basis of period: On the basis of period, sources of funds are divided into long term, medium term and short term finance. Long term sources fulfill the financial requirements for period exceeding five years and include sources such as shares and debentures, longterm borrowings and loans from financial institutions. Medium term finance is required for a period of more than one year and these include borrowings from commercial banks, public deposits, lease financing and loans from financial institutions. Short term funds are require for a period of less than one year and the sources are trade credit, bank credit, installment credit, advances, bank overdrafts, cash credit and commercial paper.

On the basis of ownership : On the basis of ownership, the sources can be classified into owners funds and borrowed funds. Owners funds are those which are provided by the owners which in-clude issue of equity shares and retained earnings. Borrowed funds refer to the funds raised through loans or borrowings. The sources include loans from commercial banks, loans from financial institu-tions, issue of debentures, public deposits and trade credit.

On the basis of generation : Sources of finance can be gener-ated from internal source or external source. Internal sources of funds are generated from within the business such as ploughing back of profits, retained earnings, collection of receivables, disposing of sur-plus inventories, depreciation fund etc. External source of funds lie outside the organisation and include shares, debentures, public de-posits, borrowings from commercial bank and financial institutions, suppliers, lendors and investors.

Question 7.

Differentiate between a Share and a Debenture.

Answer:

The following are the differences between shares and Deben-tures.

| Shares | Debentures |

| 1. A share is a part of owned capital. | 1. A Debenture is an acknowledge of debt. |

| 2. Share holders are paid dividend on the shares held by them. | 2. Debenture holders are paid interest on debentures. |

| 3. The rate of dividend depends upon the amount of divisible profits and policy of the company. | 3. A fixed rate of interest is paid on debentures irrespective of profit or loss. |

| 4. Dividend on shares is a charge against profit and loss Appropriation account. | 4. Interest on debenture is a charge against profit and Loss account. |

| 5. Share holders have voting rights. They have control over the management of the company. | 5. Debenture holders are only creditors of the company. They cannot participate in management. |

| 6. Shares are not redeemable except redeemable prefe-rence shares during the life time of the company. | 6. The debentures are redeemed after a certain period. |

| 7. At the time of liquidation of the company, share capital is payable after meeting all out side liabilities. | 7. Debentures are payable in priority over share capital at the time of liquidation of the company. |

Question 8.

Explain any five merits of MNCs to host country.

Answer:

Merits of MNCs to host countries :

- Provide capital : MNCs bring in much needed capital for the development of industries. These corporations make direct foreign investment and speedup the process of economic development.

- Transfer of technology: Developing countries are technically backward. They lack resources to carry research and development. MNCs serve as a vehicles for the transfer of advanced technology.

- Generate employment : It creates large scale employment opportunities in host countries. They offer excellent pay scales and career opportunities to managers technical and clerical staff.

- Foreign exchange: MNCs help the host countries to increase their exports. They reduce their dependence on imports. MNCs enable host countries to improve their balance of payments position.

Question 9.

Define E-business. What are the benefits of e-business to cus-tomers ?

Answer:

E-business : The scope of E-Business can be studied in the following areas :

- E-Business with in the organisation

- Business – to – Business

- Business – to – Customer

- Customer- to – Customer

- Customer- to – Business

In second and third category there is exchange of goods and services from one business to another business and business to customer. In fourth and fifth category the transactions are facilitated by one customer to another customer and customer to business through internet.

Now-a-days one can buy products online through some sites like Flipkart, Jabong and Amazon. In the age of E-Commerce, almost everything from gym equipment to laptops are available online. Even people are buying services online. Business consultants, lawyers, doctors offering their services to the potential clients online.

E-business is a super set of business cases. It includes E-Trading, E-Engineering, E-Franchising, E-Mailing, E-Operational resource management.

E-Business to Customers : The following are the benefits of E-Business to consumers.

- Purchasing made easy : E-Business enables consumers to shop or to do any other transaction 24 hours a day, round the year from any location.

- Wide choice : Customers will have more choices as more alternative products and services are available.

- Saving in prices : E-Business provides customers with less expensive products and services which allows them to shop in many places and conduct quick comparisons. E-business facilitates compe-tition, which results in substantial discounts.

- Exchange of information : E-Business allows customers to interact with each other and exchange their opinions and experiences on the products purchased by them.

Section – C (5 × 2 = 10)

Answer any five of the following questions not exceeding 5 lines each

Question 10.

Entrepot Trade.

Answer:

When goods are imported from one country and the same are exported to another country, such trade is called entrepot trade.

E.g.: India importing wheat from U.S. and exporting the same to Srilanka.

Question 11.

Genetic industries.

Answer:

Genetic industry is related to the reproducing and multiplying certain species of animals and plants with the object of earning profit from their sale. E.g. : Nurseries, cattle breeding, poultry farm, fish hatcheries etc.

Question 12.

What is sole proprietorship ?

Answer:

Sole trade is the oldest and most commonly used form of business organisation. It is also known as sole proprietorship, individual partnership single entrepreneurship. In sole trade concern a single individual introduces his own capital, skill and intelligence in the management of its affairs and is solely responsible for the results of its operations.

It is the easiest to form and is also the simplest in organisation. All that is required is that the individual concerned should decide to carry on particular business and find the necessary capital. For this purpose, he may depend mostly on his own savings or he may borrow part or whole from his friends or relatives. He can start business in his own house or on rented premises. He may run the business on his own or may obtain the assistance of his family members or paid employees.

A sole trader is a person who setsup the business with his own resources, manages the business himself by employing persons for his help and alone bears all gains and risks of the business.

Question 13.

Mitakshara.

Answer:

This school of Hindu law prevails in entire India except in Assam and West Bengal. Family members of male line and their wives, unmarried daughters are its members. By birth, a member gets a share in common property, it continues till his death. In this way shares in the property gets fluctuates in accordance with the number of coparceners.

Question 14.

What is a Government Company ?

Answer:

A company in which not less than 51 % of the paidup share capital is held by the central government or any state government or partly by central government and partly by any state government is called Government Company. Ex : Hindustan Machines tools, oil and natu-ral gas commission, NTPC etc.

Question 15.

Minimum subscription.

Answer:

The minimum amount of capital to be collected by the company before the allotment of shares is known as minimum subscription. A public company cannot commence business unless the minimum sub-scription has been subscribed. It is fixed by taking into account the following requirements.

- Amount required for the purchase of property.

- Amount need for payment of preliminary expenses.

- Amount required for working capital.

- Amount need for any expenditure in the formation of the company.

Question 16.

Fixed capital.

Answer:

The capital which is used to acquire fixed assets such as land and buildings, plant and machinery etc., is called fixed capital. Capital used by the business organisations to meet the long term requirements is called fixed capital or block capital. The amount of fixed capital required by the business concern depends on the size and nature of business.

Question 17.

Define manufacturing enterprises.

Answer:

Manufacturing Enterprise :

| Enterprise | Investment in Plant and Machinery |

| Micro

Small Medium |

Does not exceed ₹ 25 lakhs.

More than ₹ 25 lakhs but does not exceed ₹ 5 crores. More than ₹ 5 crores but does not exceed ₹ 10 crores. |

Section-D (1 × 20 = 20)

(50 Marks)

Answer the following question :

Question 18.

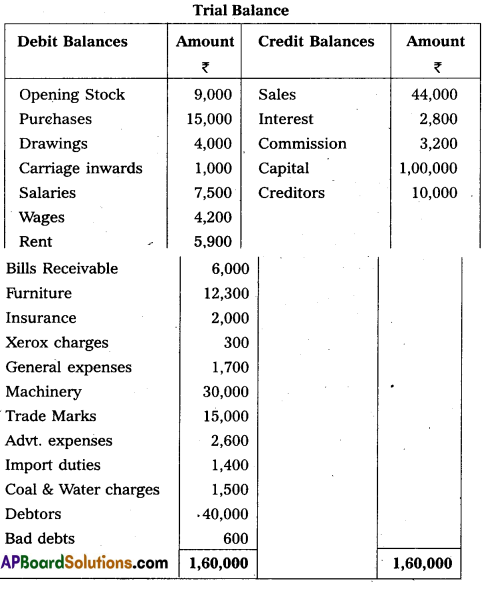

From the following Trial Balance of Mr. Reddy, Traders, prepare Trading, P & L A/c and Balance Sheet for the year ended 31.12.2017 :

Adjustments :

(1) Closing Stock value ₹ 7,500.

(2) Depreciation on Machinery – 10%.

(3) Commission received in advance – ₹ 1,200.

(4) Interest receivable – ₹ 1,500.

(5) Further bad debts – ₹ 400.

(6) Prepaid Insurance – ₹ 500.

Answer:

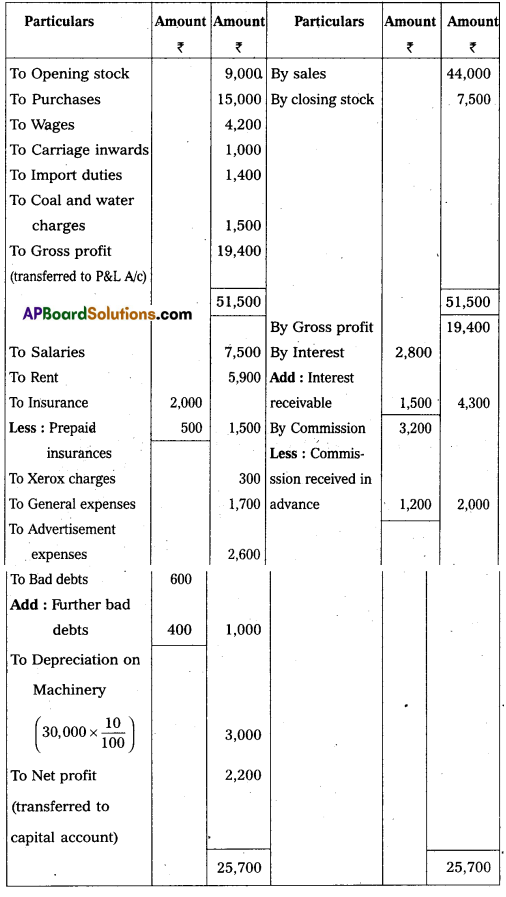

Trading, Profit & Loss Account of Mr. Reddy Traders for the year ended 31-12-2017

Balance sheet of Mr. Reddy Traders as on 31-12-2017

section – E

Answer any one of the following questions.

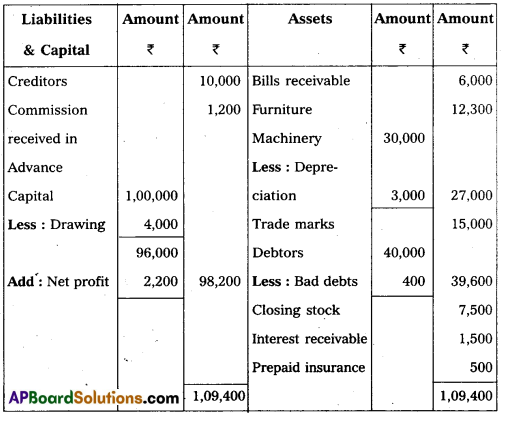

Question 19.

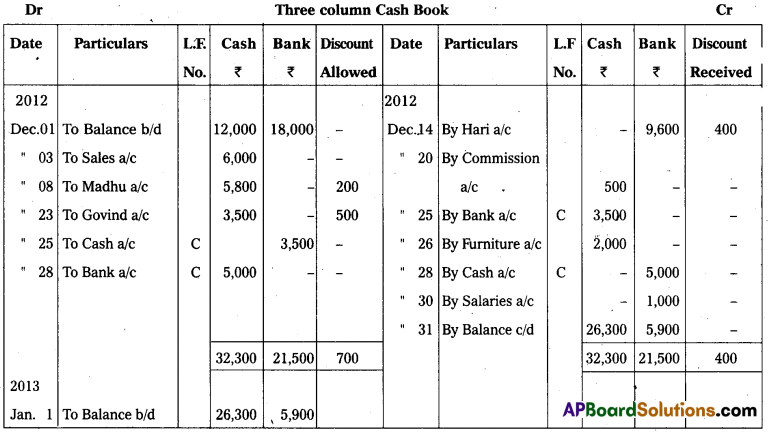

Prepare Three Column Cash Book :

Answer:

Question 20.

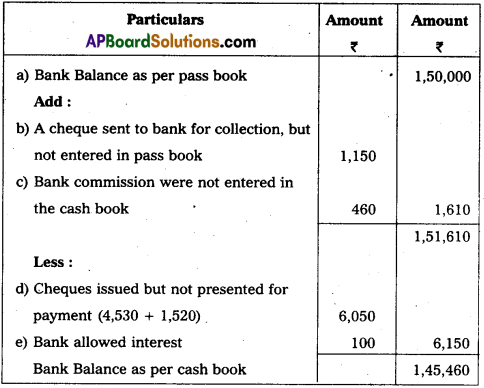

Prepare Bank Reconciliation Statement of Kavitha Stores as on 30th June, 2018 from the following particulars :

(a) Balance as per Pass Book ₹ 1,50,000.

(b) Two cheques for ₹ 4,530 and ₹ 1,520 issued on 25th June were presented for payment at Bank in July.

(c) A cheque for ₹ 1,150 sent to bank for collection, was not entered in the pass book till 30th June.

(d) By the bank allowed interest – ₹ 100.

(e) Bank commission ₹ 460 were not entered in the cash book.

Answer:

Bank Reconciliation statement of Kavitha Stores as on 30th June, 2018.

Section – F

(2 × 5 = 10)

Answer any two of the following questions :

Question 21.

Explain different types of accounts along with their debit, credit rules.

Answer:

Accounts are classified into 3 types. Which are :

1) Personal Accounts

2) Real Accounts and

3) Nominal Accounts.

1) Personal Accounts : The accounts which are related to persons, films and companies are called “personal accounts”.

Ex : Ramu a/c, State Bank of India a/c etc.

Rule : Debit The receiver

Credit the giver.

2) Real Accounts : Accounts related to properties and assets of business are called “Real accounts”. Ex: Cash a/c, Furniture a/c, land & building a/c ; goodwill a/c etc

Rule : Debit what comes in

Credit what goes out.

3) Nominal Accounts: The accounts related to expenses, losses, incomes and gains are called as “Nominal Accounts”.

Ex : Wages a/c , salaries a/c, commission a/c, rent a/c, discount received a/c etc.

Rule :

Debit all expenses and losses

Credit all incomes and gains.

![]()

Question 22.

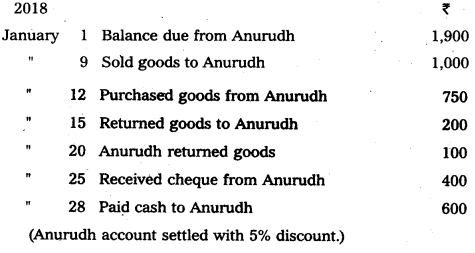

Prepare Anurudh’s Account from the following :

Answer:

Note: Balance due from Anurudh is 2450 Settled with 5% discount i.e. 2,450 × \(\frac{5}{100}\) = 122.5

We take 122.5 as 123.

Question 23.

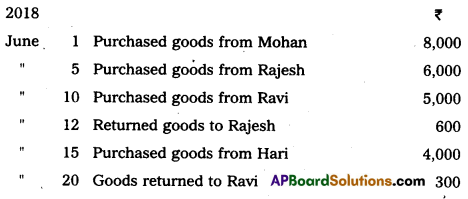

Enter the following in Purchase Book and Purchase Return Book.

Answer:

Question 24.

What are the errors disclosed by Trial Balance with examples ?

Answer:

Errors may be classified as

1. Errors not disclosed by Trial Bal-ance

2. Errors disclosed by Trial Balance

1. Errors not disclosed by Trial Balance : This type of errors cannot be traced out in the preparation of trial balance, because these errors cannot affect the agreement of the trial balance.

- Errors of principle, Ex : Repairs to machinery debited to machinery a/c.

- Errors of omission, Ex : Sales made are not recorded in the sales book.

- Errors of commission, Ex: Purchase Book overcast by ₹ 1000.

- Compensating errors, Ex : Amount paid to Ram ₹ 5,000 re-corded as ₹ 5,500 and amount received from Shyam ₹ 10,000 recorded as ₹ 9,500.

- Posting wrong entry in the subsidiary books.

- Posting to correct side in a wrong account.

- Recording a transaction in books of account in twice.

2. Errors disclosed by Trial Balance : The errors which are revealed by trial balance are known as Errors disclosed by trial bal-ance

- Posting a transaction to wrong side of an account. Ex : Dis-count allowed posted to credit side discount account.

- Posting a wrong amount in account. Ex: Sales ₹ 25,000 posted to sales a/c as ₹ 2,500.

- Errors in totally Ex: Sales return book is overcast by ₹ 100.

- Errors made in carrying forward. Ex: Purchases book total is carried forward ₹ 1,500 instead of ₹ 150.

- Omission to post an amount from the subsidiary book to ledger. Ex : Sold goods to Hari ₹ 1,000 not entered in Hari’s account.

- Recording one aspect twice. Ex : Paid salaries ₹ 1,000 deb-ited to salaries account twice.

- Omission to enter a balance or wrong balancing in ledger account.

Section-G

(5 × 2 = 10)

Answer any five of the following questions :

Question 25.

Define Accounting.

Answer:

The American Institute of Public Accountant defined accounting as “The art of recording, classifying and summerising in a significant manner and interms of money transactions and events which in part, atleast of a financial character and interpreting the results there of’.

![]()

Question 26.

Dual Aspect concept.

Answer:

- Under this concept, every transaction has two aspects, i.e. receiving aspect and giving aspect.

- Receiving aspect is called “Debit” and giving aspect is called “Credit”.

Question 27.

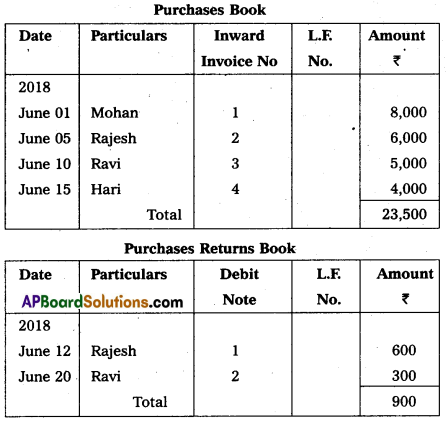

Journalize the following transactions :

Answer:

Question 28.

Debit note.

Answer:

- Debit Note is a document sent to the supplier while returning the goods purchased on credit from him.

- This debit note intimating that the supplier account is debited to the extent of goods returned and reasons for returning the goods.

Question 29.

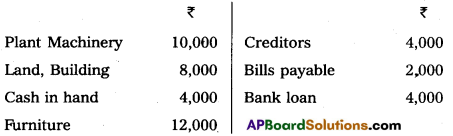

Write the opening entry from the following particulars on 1st January, 2016 :

Answer:

Opening Entry as on 1st January, 2016.

![]()

Question 30.

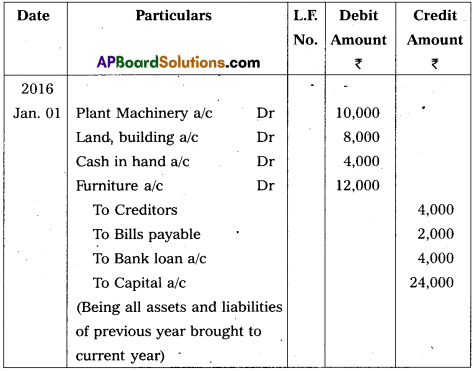

Prepare the Trial Balance of Kavitha from the following balances :

Answer:

Trial Balance of Kavitha

Question 31.

What is meany by suspense account ?

Answer:

When trial balance is not tally, the difference between debit and credit totals should be transferred to a separate account called ‘Suspense Account”.

Suspense account is an imaginary and temporary account which is opened to make the two sides of trial balance agree.

Question 32.

Capital income.

Answer:

- Any amount received as investment by the owners, raised by way of loans and income received on sale of fixed assets is called “Capital Income’.

- For Example : Capital, Sale of machinery etc.

- Capital incomes are recorded as liabilities in the balance sheet.