Collaborative study sessions centered around TS Inter 1st Year Commerce Model Papers and TS Inter 1st Year Commerce Question Paper March 2018 can enhance peer learning.

TS Inter 1st Year Commerce Question Paper March 2018

Section – A

(2 × 10 = 20)

Answer any two of the following questions in not exceeding 40 lines each.

Question 1.

Define the Co-operative Society. Explain its features.

Answer:

Meaning : The term “co-operation” is derived from the Latin word “co-operari”. The work “Co” means “with” and “operari” means “to work”. Thus the term co-operation means working together. Cooperative society is a voluntary association of persons who work together to promote their economic interest.

Definition : The Indian co-operative societies Act 1932, section (4) defines co-operatives society as “a society which has its objectives for the promotion of economic interests of its members in accordance with co-operative principles”.

Features :

- Voluntary Association: A co-operative society is a voluntary association of persons. That means, persons can join and leave the society when they want.

- Open Membership : The Membership is open to all persons having a common economic interest. Any person can became a member irrespective of his/her caste, creed, religion, colour, sex etc.

- Number of Members : A Minimum of TO’ members are required to form a co-operative Society. In case of multistate co-operative societies, the minimum number of members should be ’50’ from each state.

- State control : Every co-operative society comes under the control and supervision of the Government. Every society has to get its accounts audited from the co-operative Department of the government.

- Capital: The capital of the co-operative society is contributed by its members, it after depends on the loans and grants from state and central Government.

- Democratic set up : The co-operative societies are managed in a democratic manner. The Management of a co-operative society is control by managing committee elected on the basis of “one-man one-vote” irrespective of the member of shares held by any member.

- Service Motive : The primary objective of all co-operative societies is to provide services to its members, rather than to earn profits.

- Return on capital Investment : The members of co-operative society get returns on their capital investment in the form of dividend.

- Distribution of surplus : After giving dividends to the members of the society, the surplus profit is distributed among the members in the form of bonus.

- Registration of the society : In India, co-operative societies are registered under the co-operative Societies Act.

Question 2.

Distinguish between a Private Company and a Public Company.

Answer:

Introduction :

On the basis of Public Interest, companies may be classified into two types. They are

(1) Private company and

(2) Public company

(1) Private company : According to companies Act, private company is a company which is formed with the association of at least two members but not exceed fifty and with minimum paid up capital of one lakh rupees. It is prohibited from issue of share to the public and also transfer of shares.

(2) Public Company : Public company is a company which is formed with the Association of minimum seven members and there is no limit on maximum number of members. Public companies are required to issue a prospecters for inviting people to purchase their shares. Public company minimum paid up capital is five Lakhs rupees.

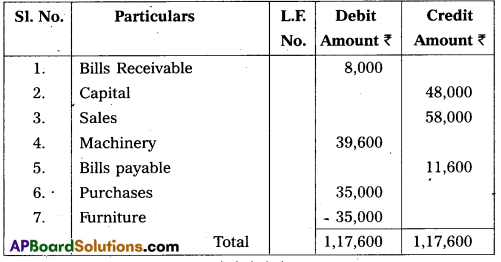

Difference between private company and public company :

![]()

Question 3.

What is Business Finance ? Explain its needs and significance in the business organisations.

Answer:

Meaning : The requirement of funds by business firm to accomplish its various activities is called “Business finance”.

Finance is considered as the life blood of any organization. The success of any organization depends on the availability of adequate finance.

Definition :

According to B.O. Wheeler : “Finance is that business activity which is concerned with the acquisition and conservation of capital funds in meeting the financial needs and overall objectives of a business enterprise”. ,

Need and Significance :

- To meet fixed capital requirement of business : Business requires finance to meet fixed capital requirements such as purchase fixed assets like land and building, plant and Machinery, furniture and fixtures etc.

- To meet working capital requirements : Working capital is used for holding current assets such as purchase of material, payment of wages, transportation expenses, etc. business reequires finance.

- For growth and expansion : For growth and expansion activities, a business requires finance. It may be required increase production, to install more machines, to set up a R & D centre, etc.

- For diversification : Entering into new business and new lines of activities is known as diversification. The Business finance is needed to start any new activity in business.

- For Survival : Without the required finance, organizations can not survive for long time. To carry out the various business operations in continuity, business finance is needed.

- Liabilities : To meet liabilities of business, may be long-term or short, a business requires sufficient finance, e.g. for payment of loan installments, creditors etc.

- For payment of expenses : Business finance is needed for payment of expenses like paying salaries, wages, taxes, rent, advertisements etc.

Section -B

(4 × 5 = 20)

Answer any four of the following questions not exceeding 20 lines each :

Question 4.

What is meant by Industry ? Explain four types of Industries.

Answer:

Industry is a business activity, which is related to the extract producing, processing or manufacturing of goods.

Classification / Types of Industries :

- Primary Industry : Primary Industry is concerned with production of goods with the help of nature and which requires very little human effort. For example : Agriculture ; Farming ; Fishing, etc.

- Genetic Industry : Genetic Industries are engaged, in re-production and multiplication of certain species of plants and animals with, the object of sale to earn profit Eg : plant Nurseries, fish hatcheries, cattle breeding etc.

- Extractive Industry : Extractive Industry is concerned with extraction or drawing out goods from the spil, air or water. Generally products of this industry are in raw form and they are used by manu-facturing and construction Industries.

Eg : Mining Industry, Coal, Mineral, oil ; Iron ore industries etc. - Manufacturing Industry: Manufacturing Industry is engaged in the conversion of raw material into semifinished or finished goods. This industry creates form utility in goods by making them suitable for human use.

Eg : Cement Industry, sugar Industry, Cotton textile industry etc. - Construction Industry : construction Industry engaged in the construction of buildings, bridges, roads, dams, canals, etc. These industries are engaged in the creation of infrastructure for the smooth development of the economy.

- Service Industry : In modem times, service sector plays an important role in the development of the nation and therefore it is named as service Industry.

Eg : Hotel Industry ; Tourism Industry, entertainment industry etc.

Question 5.

State three advantages and two disadvantages of Hindu Undivided Family business.

Answer:

Hindu undivided family business is a form of business where the family members of three successive generations own the business jointly. The head of the family known as “karta” manages the business. The other members are called “co-parceners”. All of them have equal ownership right over the properties of the business.

Advantages :

- Continuity : It is not dissolved by the death of insanity of a coparcener.

- Centralized and efficient management: The management of J.H.E firm is vested in the hands of karta only. This results in the unity of command and disciplined management.

- No limit to membership : By birth every coparcener will automatically became a number in joint hindu family. Hence, there is no limit to membership.

- Better credit : It credit worthiness is better than of sole Trader.

Disadvantages :

- No Direct correlation between Efforts and Rewards: Kartha alone looks after the business; but benefits are shared among all coparceners. There is no rewards for their work.

- Limited managerial ability: In Joint Hindu undivided family business, the kartha alone to manage, so in expansion and growth of business- the management and control becomes difficult.

- Limited capital and Financial Resources : compared with partnership and joint stock company the capital and financial resources of the joint Hindu undivided family firm.

Question 6.

What is Partnership Deed ? Also write its main contents.

Answer:

Partnership deed is a document containing the terms and conditions of a partnership. It is a agreement in writing signed by all the partners duly stamped and registered. The partnership deed defines certain rights, duties and obligations of partners and governs relationship among them in the conduct of business. This deed has to be stamped in accordance with the Indian stamp Act 1899.

The following points are generally be included in the deed.

Contents :

- Name of the firm.

- Nature of the business.

- Name and address of partners.

- Location of business.

- Duration of partnership.

- Amount of capital to be contributed by each partner.

- profit and loss sharing ratio.

- Duties, powers and obligations of partners.

- Salaries and withdrawals of the partners.

- Preparation of accounts and their auditing.

- Procedure for dissolution of the firm.

- Procedure for settlement of disputes.

Question 7.

Explain the’advantages of Equity Shares.

Answer:

Equity shares are also known as “ordinary shares” represent the ownership of a company. A company can raised the capital by issue of equity shares.

Advantages :

- Equity shares do not create any obligation to pay a fixed rate of dividend.

- Equity shares can be issued without creating any charge over the assets of the company.

- It is a permanent source of capital and the company need not to repay it except under liquidation.

- Equity share holders are the real owners of the company who have the voting right.

- Incase of profits, equity shareholders are the real gainers by way of increased dividends and appreciation in the value of shares.

Question 8.

Differentiate between a share and a debenture.

Answer:

The capital of a company is divided into small units called “share”. “Debentures” are important instruments for raising long term debt capital.

The following are the differences between shares and debentures.

Question 9.

Explain the features of MNCs.

Answer:

MNCs means Multinational Corporations. The word “Multinational” is a combination of words “Multi” which refers to many and” national” refers to a country. So multinationals means a company which operates in more than one country. MNC refers to an enterprise whose managerial headquarters are located in one country, while it carries out operations in a number of other countries.

According to Pavid E. Liliental, defines the MNCs as “Corpo-rations which have their home in one country but operate and live under the laws and customs of other countries as well”.

Features of MNCs :

- Giant size : The assets and sale of MNCs are very large. These companies operate on large scale as they trade in more than one country. Some times their sales turnover exceeds the Gross National product (GNP) of developing countries.

- International Operation : A MNC operates and sells their products in different countries. It operates through a network of branches and subsidiaries in host countries.

- Professional Management : A Multinational corporation employees professional experts, specialized people. MNCs try to keep their employees updated by training from time to time to handle the advance in technology effectively.

- Oligo polistic powers : Oligopoly means power in the hands of few companies only. Due to their gaint size, the MNCs occupy dominating position in the market.

- Centralized control : MNC’s will have managerial headquarters in the home country. All the subsidiary and branches work under the supervision, guidance and control of the head office.

- Sophisticated Technology : Multinational companies make use of latest, advanced and innovative technology to produce quality goods.

Section – C

(5 × 2 = 10)

Answer any five of the following questions not exceeding 5 lines each :

Question 10.

What is Employment ?

Answer:

- An employment is a contract of service between employee and employer. An employee works under an agreement as per the rules of service assigned to him by the employer.

- For performing such activities employee receives remuneration from employer in the form of “wage” or salary.

![]()

Question 11.

What is Sole Proprietorship ?

Answer:

- Sole proprietorship is a form of business organisation in which a single individual introduces his own capital; skill in the management and he only responsible for the results of its operations.

- According to kimball and Kimball: “sole proprietorship is a form of business where the individual proprietor is the supreme judge of all matters to his business”.

Question 12.

Define Active Partner.

Answer:

- The partner who actively participate in the day-to-day operations of the business is called as “Active partners”.

- Active partner is also called as “working partner”.

Question 13.

Define M.O.A.

Answer:

- M.O.A. Means memorandum of Association. It is the constitution of the company. It defines the scope of company’s activities as well as its relation with the out siders of the company.

- According to companies Act, “The memorandum of Association of a company as originally framed or as altered from time to time in pursurance of ahy previous company laws or of this Act”.

Question 14.

Define preference shares.

Answer:

1) As per sec 85 of the Indian companies Act 1956, preference shares are those shares which carry special rights over the equity shares.

2) preference shares have the following two rights :

- Right to receive the fixed rate of dividend irrespective of profits.

- Right to get back the capital prior to equity shareholders at the time of company’s liquidation.

Question 15.

Define Service Enterprise.

Answer:

1) The enterprises involve in providing or rendering services are called “service enterprises”.

2) There are 3 types of services enterprises based on Investment in equipment.

a) Micro service enterprise : Investment in equipment does not exceed ₹ 10 lakhs.

b) Small service enterprise : Investment in equipment is more than ₹ 10 lakhs but not exceeds ₹ 2 crore.

c) Medium service Enterprise : Investment and equipment is more than ₹ 2 crore but not exceed ₹ 5 crore.

Question 16.

What is Fixed Capital ?

Answer:

- The capital which is used to acquire fixed assets such as land and buildings, plant and machinery etc., is called “Fixed capital”.

- Business enterprises use fixed capital for longterms requirements.

Question 17.

What is E-Commerce’?

Answer:

- E – Commerce is short for “Electronic commerce”.

- Transacting or facilitating business through Internet is called “E – commerce”.

- Popular examples of E – Commerce revolve around buying and selling online.

Section – D (1 × 20 = 20)

(50 Marks)

Answer the following question :

Question 18.

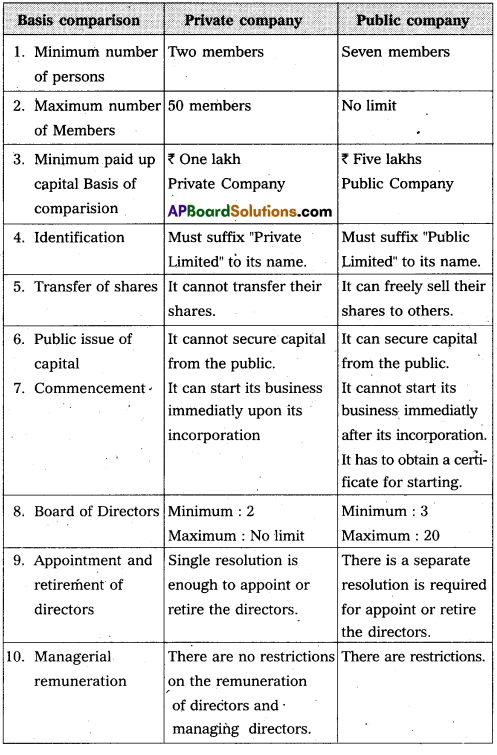

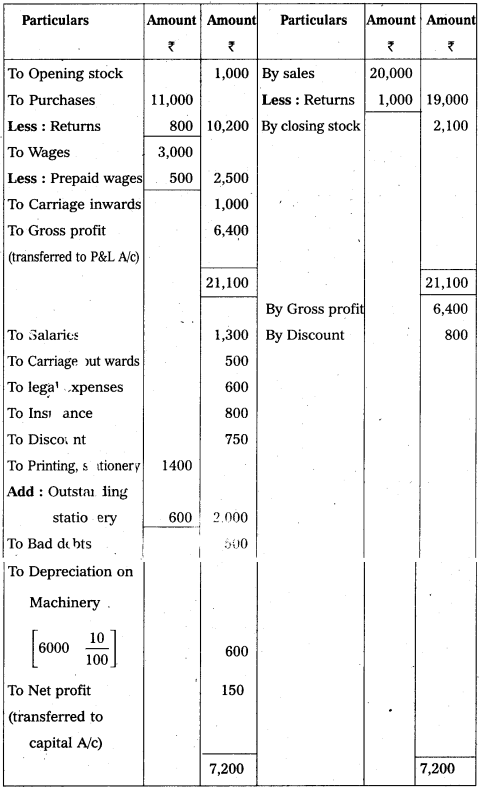

From the following Trial Balance, prepare Final accounts of Sathish as on 31.12.2012.

Trial Balance

Adjustments:

(1) Closing Stock ₹ 2,100.

(2) Outstanding Stationery ₹ 600.

(3) Depreciation on Machinery ₹ 10%.

(4) Bad debts ₹ 500.

(5) Prepaid Wages ₹ 500.

Answer:

Trading and profit & loss Account of sathish for the year ended 31-12-2017

Balance sheet of Sathish as on 31-12-2017

Section – E (1 × 10 = 10)

Answer any one of the following questions.

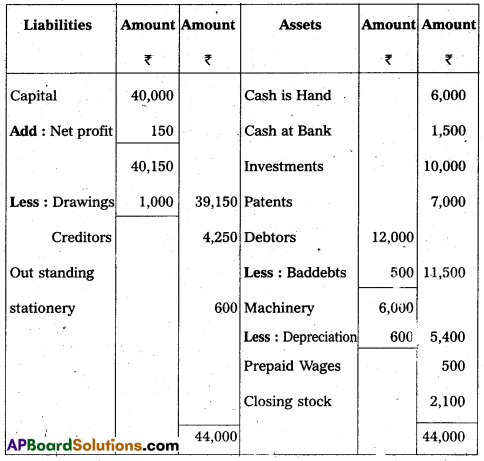

Question 19.

Prepare a three-column cash Book from the following particulars

Answer:

Question 20.

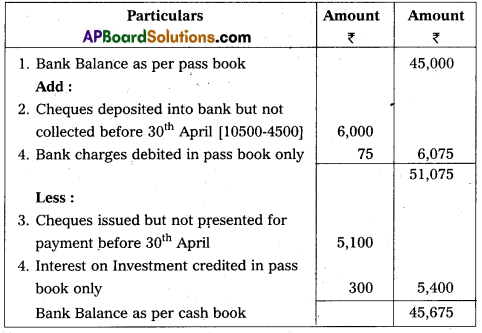

From the following information, prepare a Bank Reconciliation Statement of M/s. Sathish Brothers as on 30th April, 2017 :

(1) Credit balance of Pass Book ₹ 45,000.

(2) Cheque amounting to ₹ 10,500 were deposited in the Bank but only cheques of ₹ 4,500 were cleared upto 30th April.

(3) Cheques amounting ₹ 15,000 were issued but cheques worth ₹ 5,100 not been Presented for payment in the Bank upto 30th April.

(4) In the Pass Book there was a credit ₹ 300 for interest on investments and debit of ₹ 75 for bank charges.

Answer:

Bank reconciliation statement of M/s. Sathish Brothers as on 30th Apr.2017

Section – F (2 × 5 = 10)

Answer any two of the following questions :

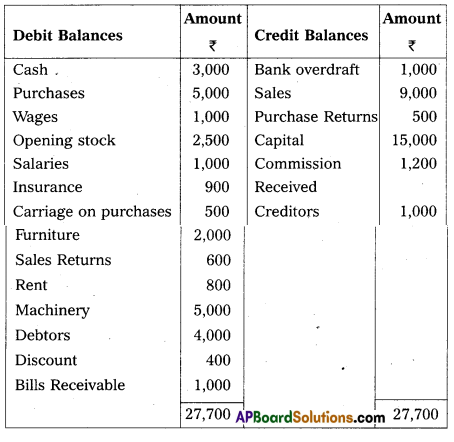

Question 21.

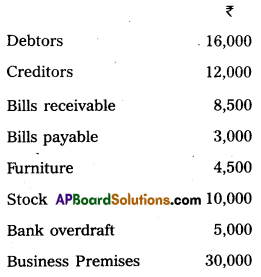

Explain different types of Accounts along with their debit-credit rules.

Answer:

Accounts are classified into 3 types. Which are

1) Personal Accounts

2) Real Accounts and

3) Nominal Accounts.

1) Personal Accounts : The accounts which are related to persons, firms and companies are called “personal accounts”. Ex : Ramu a/c , State Bank of India a/c etc.

Rule : Debit The receiver

Credit the giver.

2) Real Accounts : Accounts related to properties and assets of

business are called “Real accounts”. Ex : Cash a/c, Furniture a/c, land & building a/c ; goodwill a/c etc

Rule : Debit what comes in

Credit what goes out.

3) Nominal Accounts: The accounts related to expenses, losses, incomes and gains are called as “Nominal Accounts”. Ex : Wages a/c , salaries a/c, commission a/c, rent a/c, discount received a/c etc.

Rule : Debit all expenses and losses

Credit all incomes and gains.

![]()

Question 22.

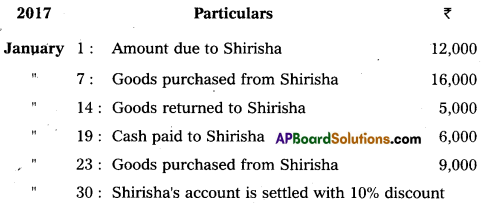

Prepare Shirisha’s account from the following particulars :

Answer:

Question 23.

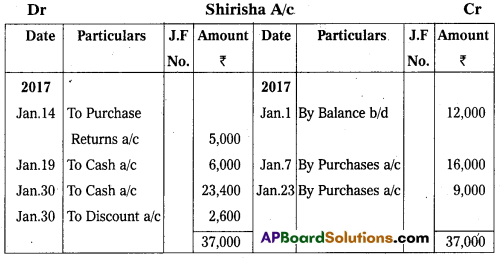

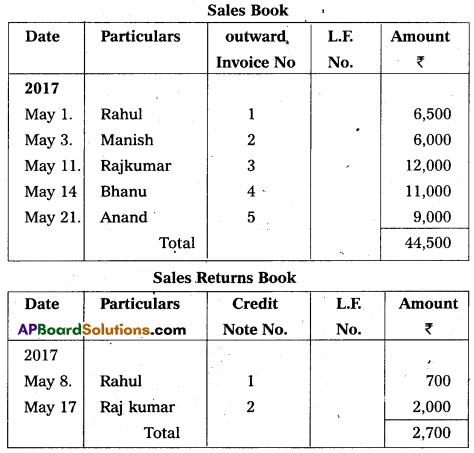

Prepare Sales Book and Sales Return Book from the following :

Answer:

Question 24.

What-are the Errors disclosed by the Trial Balance ?

Answer:

The errors which affect the agreement of Trial Balance are called Errors disclosed by the Trial Balance.

The following are the errors disclosed by Trial Balance :

1) Posting of Transaction to wrong side of an account: Posting of transaction to wrong side of account affect the agreement of Trial Balance.

Eg : Discount allowed posted to credit side of discount account.

2) Posting of wrong amount to an account: Posting of wrong amount affect the agreement of Trial Balance.

Eg : Sales of ₹ 5000 posted as ₹ 500 to sales account.

3) Errors in totaling : Errors in totaling it may be over cast or undercast affects the agreement of trial Balance.

Eg: Sales Returns Book Overcast by ₹ 100.

4) Errors of carrying forward: If a mistake in carrying forward a total of one page to the next page. This error affect the agreement of Trial Balance.

Eg: purchase Book total is carried forward as ₹ 1,500 instead of ₹ 150.

5) Posting of only one aspect of Journal Entry into ledger :

Some times accountant may post only one aspect of entry to the ledger account, it affect the Agreement of Tril Balance. Eg: Sale of goods to Ramesh ₹ 200 Posted to sales book only.

6) Recording one aspect twice :

An accountant may be record one aspect twice it affect the Agreement of Trial Balance.

Eg : Paid salaries ₹ 600 debited twice in salaries account.

Section – G (5 × 2 = 10)

Answer any five of the following questions :

Question 25.

What is an Accounting Cycle ?

Answer:

An Accounting Cycle is a complete sequence of accounting process that begins with the recording of business transactions and ends with the preparation of final accounts.

It involves Journal, ledger, Trial Balance and financial statements such as Trading account, profit and loss account and Balance sheet.

Question 26.

Explain Business Entity Concept.

Answer:

As per this concept, Business organisation are treated as a separated entity which can be distinguished from the “owners” or stakeholders who provide capital to it.

This concept helps in keeping private affairs of the owners and stakeholders separate from the business affairs.

![]()

Question 27.

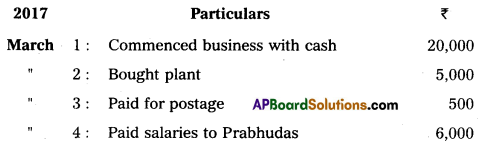

Journalise the following transactions :

Answer:

Journal Entries

Question 28.

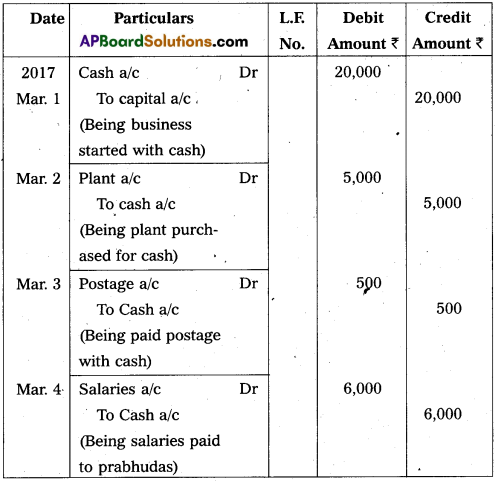

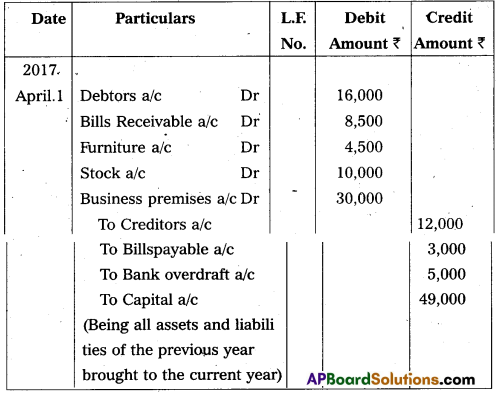

Write opening Journal Entry from the following as on 1st April, 2017 :

Answer:

Opening Entry as on 1st April 2017

Question 29.

What iš Debit Note?

Answer:

Debit Note is a document sent to the supplier while returning the goods purchased on credit from him.

This Debit Note intimating that the supplier account is debited to the extent of goods returned and reasons for returning them.

Question 30.

What is Bank Overdraft’

Answer:

Bank overdraft is an arrangement made by the customer with banker to drawn an excess amount of what the customer has in his bank account balance subject to a specific predetermined limit.

Question 31.

Give the meaning of Bad debts.

Answer:

The debts which are not collected and irrecoverable are knowns as “Bad Debts”.

Baddebts are treated as loss to the business.

Question 32.

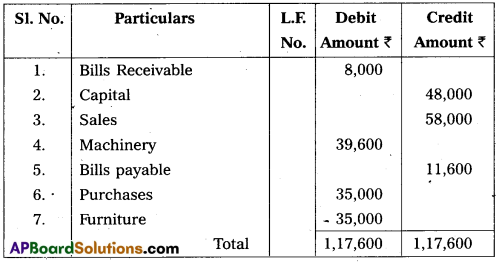

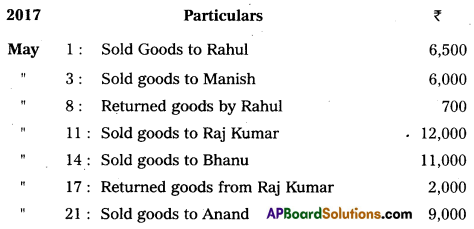

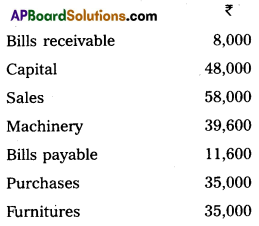

Prepare Trial Balance of Sathish:

Answer:

Trial Balance of Sathish