Thoroughly analyzing AP Inter 2nd Year Commerce Model Papers and AP Inter 2nd Year Commerce Question Paper May 2017 helps students identify their strengths and weaknesses.

AP Inter 2nd Year Commerce Question Paper May 2017 with Solutions

Time: 3 Hours

Maximum Marks: 100

Part – I (50 Marks)

Section – A

(2 × 10 = 20)

Answer any two of the following questions not exceeding 40 lines each.

Question 1.

Define banking. Explain the functions of the banking.

Answer:

The word Bank is derived from the French word ‘Bancus’ which means a bench. According to the Banking Regulation Act of 1949, banking is defined as “Accepting for lending or investment of deposits of money from the public, repayable on demand or otherwise and withdrawable by cheque, draft, order or otherwise”.

The basic functions of banks are classified as primary functions and secondary functions.

(A) Primary Functions:

(i) Accepting Deposits:

The Bank accepts various types of deposits, such as

- Fixed deposits: Fixed deposits are also called time deposits or term deposits. In this deposit amount cannot be withdrawn until maturity. The interest rate is also high.

- Current Deposits: Current accounts bear no interest companies, institutions, governments, and businessmen hold the current account. The greatest advantage of having a current account is that there is no restriction on withdrawals.

- Savings Deposits: These accounts aim to encourage small Savings from the public. Certain restrictions are imposed on the depositors regarding the number of withdrawals and the amount to be withdrawn in a given period.

- Recurring Deposits: The purpose of these accounts is to encourage regular savings, particularly by the fixed-income group. Generally, money is deposited in these accounts in monthly installments for a fixed period. It is repaid to the depositors along with interest on maturity.

(ii) Advancing of Loans:

Lending is carried out purely on profit motive. Banks lend the amount which is mobilized through the deposits. The different forms of lending are

- Loans: A specified amount sanctioned by the bank is called a ‘Loan’. A loan is granted against the security of property or personal security. The loan may be repaid in a lump sum or installments. The loan may be classified into (i) Demand loan and (ii) Term loan. A demand loan is repayable on demand. It is repayable at short notice. Medium and long-term loans are called term loans. It is granted for more than a year and repayment is done on a longer period.

- Cash Credit: Cash credit is an arrangement where the bank agrees to lend money to the borrower upto a certain limit. The amount is credited to the borrower’s account. The borrower draws the money as and when he needs it. Interest will be charged only on the amount drawn. Banks may impose commitment charges on unutilized portion.

- Overdraft: Banks grant overdraft to current account holders by which he is allowed to draw an amount over the balance held in their account. Interest is charged on the overdrawn amount.

- Discounting of Bills of Exchange: A holder of a bill of exchange may be in urgent need of cash before the due date. He may sell or discount the bill with the bank. He will receive a lesser amount than the actual amount. On maturity, the bank gets its payment from the debtor.

(B) Secondary Functions:

These services include agency services and general utility services.

1. Agency Services:

Banks perform some agency services on behalf of their customers.

- Banks help their customers in transferring funds from one place to another place through cheques, drafts, etc.

- Banks collect and pay various credit instruments like cheques, bills of exchange, promissory notes, etc.

- Banks undertake to purchase and sale of various securities like shares, bonds, debentures, etc., on behalf of their customers.

- Banks preserve the wills of their customers and execute them after death.

2. General Utility Services:

These services are

- Letters of credit are issued by the banks to their customers certifying their creditworthiness.

- Banks issue traveler’s cheques to help to travel without fear of theft or loss of money.

- Banks provide safe deposit locker facilities to the public at selected branches.

- Accepting or collecting foreign bills of exchange.

![]()

Question 2.

Define Stock Exchange. Explain its functions.

Answer:

According to Securities Contracts Act 1956, a stock exchange is defined as “an association, organization, or body of individuals, whether incorporated or not, established to assist, regulate and controlling business in buying, selling and dealing in securities”.

Functions of Stock Exchange:

1. Ready and Continuous Market:

The stock exchange provides a ready and continuous market for securities. The exchange provides a regular market for trading securities.

2. Protection to Investors:

The stock exchange protects the interest of the investors through the enforcement of rules. The rules of the Securities Contracts (Regulation) Act, of 1956 also govern the dealings on stock exchanges.

3. Provides the Information to assess the real worth of the securities:

The value of securities is made properly on the stock exchange. This is made by taking into consideration various factors such as present and future competition in securities, and financial and general economic conditions. The stock exchange publishes the quotation of different securities on the faith of these quotations every investor knows the worth of his holdings at any time.

4. Provides Liquidity of Investment:

The stock exchange is a market for existing securities. This market is continuously available for the conversion of securities into cash and vice-versa. Persons who do not need hard cash can dispose of their securities easily.

5. Helps in Raising Capital:

There is always a demand for additional capital from the existing concerns. The demand is met through the issue of shares. Stock exchange provides a ready market for such shares.

6. Raising Public Debt:

The increasing government’s role in economic development has necessitated the raising of huge amounts and the stock exchange provides a platform for raising public debt.

7. Listing of Securities:

The company that wants its shares to be traded on the stock exchange should list its securities by applying to the stock exchange authorities giving all the details regarding capital structure, management, etc.

8. Encourage Savings Habit:

Stock exchange creates the habit of saving and investing among the members of the public. It leads to the investment of their funds in corporate and government securities. In this way, it contributes to capital formation.

9. Economic Barometer:

The pulse of the market can be known by its stock indices. The prevailing economic conditions affect the share prices. So, stock exchanges can be called as an economic barometer.

10. Improve the Company’s Performance:

In stock exchanges, only those securities are traded which are listed. The stock exchanges exercise influence over the management of the company.

Question 3.

Describe the rights of a Consumer as per CPA 1986.

Answer:

Although business man is aware of their social responsibilities even then we come across many cases of consumer protection. Hence Government of India provided the following six rights to all Consumers under the Consumer Protection Act.

1. Right to Safety:

According to this right, the consumers have the right to be protected against the marketing of goods and services that are hazardous to life and property. The right is important for a safe and secure life.

2. Right to Information:

According to this right, the consumer has the right to get information about the quality, quantity, purity standard, and piece of goods or services. The producer must supply all the relevant information at a suitable place.

3. Right to Choice:

According to this right, every consumer has a right to choose the goods or services of his or her liking. The supplier should not force the consumer to buy a particular brand only. Consumers should be free to choose the most suitable product from their viewpoint.

4. Right to Consumer Education:

According to this right, it is the right of the consumer to acquire knowledge and skills to be informed to the customer. It is easier for the literate consumers to know their rights and take action.

5. Right to Seek Redressal:

According to this right, the consumer has the right to get compensation or seek redressal against unfair trade practices or any other exploitation. The right assures justice to consumers against exploitation.

6. Right to Heard/Right to Represent:

According to this right, the consumer has the right to represent himself or to be heard or the right to advocate his interest. In case a consumer has been exploited or has any complaint against the product or service then he has a right to be heard.

Section – B

(4 × 5 = 20)

Answer any four of the following questions not exceeding 20 lines each.

Question 4.

Explain the characteristics of entrepreneurs.

Answer:

The following are some of the important characteristics that every successful entrepreneur must possess.

1. Innovation:

Innovation is an important characteristic of an entrepreneur in modem business. The entrepreneur makes arrangements for introducing innovations that help in increasing production on the one hand and reducing costs on the other.

2. Risk-taking:

Risk-taking is another feature of an entrepreneur. He has to pay for all the other factors of production in advance. There are chances that he may be rewarded with a handsome profit or he may suffer a heavy loss. Therefore, the risk-bearing is the final responsibility of an entrepreneur.

3. Decision Making:

An entrepreneur has to make decisions about the establishment of a business its management and coordination of various resources. Every activity of the business requires decision-making. The entrepreneur has to make decisions everyday which have an impact on the working of the enterprise.

4. Leadership:

An entrepreneur has to be a leader because he is such a person who organizes directly and controls the functions of the organization. His personality will influence the working of his subordinates who can praise and appreciate him. An entrepreneur in his role as a leader, not only guides and counsels his people but he motivates them to achieve goals quickly and efficiently.

5. Organisation of Production:

An entrepreneur procures various factors of production like land, labor, capital, raw materials, etc. For manufacturing a product or bringing out a service. He assesses the viability of different production processes and selects one which is most suitable.

![]()

Question 5.

Explain the relationship between entrepreneur and entrepreneurship.

Answer:

Entrepreneur is the person, entrepreneurship is the process and enterprise is the creation of the person and output of the process. Though the term entrepreneur is often used interchangeably with entrepreneurship, they are conceptually different. The relationship between the two is just like the two sides of the same coin. The following points highlight the relationship between entrepreneurs and entrepreneurship.

- An entrepreneur is a person: Entrepreneurship is a process.

- Entrepreneur is organizer: Entrepreneurship is the organization.

- Entrepreneur is an innovator: Entrepreneurship is innovation.

- An entrepreneur is a risk bearer: Entrepreneurship is risk-bearing.

- Entrepreneur is motivator: Entrepreneurship is motivation.

- Entrepreneur is the creator: Entrepreneurship is the creation.

- Entrepreneur is visualizer: Entrepreneurship is vision.

- Entrepreneur is the leader: Entrepreneurship is leadership.

- Entrepreneur is imitator: Entrepreneurship is imitation.

Question 6.

What is International Trade? Explain its importance.

Answer:

The trade that takes place between the countries is called international trade. The exchange of goods and services between the traders of two countries is international trade. International trade involves not only the exchange of goods but also currencies between nations. International trade is the process of transferring goods produced in one country to the consumers of another country. This is also called Foreign trade or External trade. Due to globalization development of means of communication and transport, international trade has opened the way to huge imports and exports.

Importance of International Trade:

Foreign trade becomes necessary for every country because no country is capable of producing everything for the consumption of its people and the development of its economy. Hence foreign trade is necessary on the following grounds.

- Different countries of the world have different natural resources. However, some countries may not possess such mineral wealth. Therefore, one country has to depend on another country for natural resources which results in the need for foreign trade.

- Some countries are more suitably placed to produce some goods more economically due to the availability of raw materials, labor, technical know-how, etc. Then the other countries. In such cases, foreign trade is needed to import goods from those countries where they can be produced cheaply instead of producing goods at a higher cost.

- No country can produce all its needs. Production of different commodities requires different climatic conditions. For example Cuba can produce sugar, Egypt can produce cotton etc. Foreign trade among these countries helps all these countries to get all their requirements.

- International trade has reduced inequalities and facilitated the growth of the economy in different countries.

- International trade lowers the prices of goods and services all over the world.

- International trade promotes increased international understanding, exchange of ideas and culture, and world peace.

- In the era of globalization, no economy in the world can remain cut off from the rest of the world. Therefore, every country has to depend upon some other country or other.

Question 7.

What is SEZ? Explain their objectives.

Answer:

Special Economic Zones (SEZ) is a geographical region that has economic laws that are more liberal than a country’s economic laws. The main aim of the SEZ is to attract larger foreign investments. It is intended to make SEZ engines for economic growth. The SEZ Act was passed by parliament in May 2005. An SEZ Act is specifically described as a duty-free enclave deemed to be a foreign territory for trade operations.

Objectives of SEZ:

The following are the objectives of special economic zones.

- To create employment opportunities.

- To generate additional economic activity.

- To promote the export of goods and services.

- To develop infrastructural facilities.

- To promote investment from domestic and foreign sources.

- To import capital goods and raw materials duty-free.

- To create a foreign territory for trade operations and tariffs.

- To allow 100% foreign direct investment for developing township.

- To exempt import duties and service tax.

- To get a wide range of income tax benefits.

Question 8.

Explain the terms Insurance. Explain the functions of Insurance.

Answer:

The method of sharing risk through economic cooperation is called insurance. Insurance may described as a social device to reduce or eliminate the risk of loss of life and property. Insurance renders valuable services to commerce as well as to society. Insurance covers many risks and uncertainties in the world of business and acts as a boon to business firms.

Functions of Insurance:

- Providing Certainty: Insurance provides payment of the risk of loss. There are uncertainties of happening of time and amount of loss. Insurance removes these uncertainties and the assured receives payment of loss. The insurer charges a premium for providing certainty.

- Protection: The second function of insurance is to protect probable chances of loss. Insurance cannot stop the happening of a risk or event but can compensate for the losses arising out of it.

- Risk Sharing: On the happening of a risk event, the loss is shared by all the persons exposed to it. The share is obtained from every insured member by way of premiums.

- Assist in Capital Formation: The accumulated funds of the insurer received by way of premium payments made by the insured are invested in various income-generating schemes.

Question 9.

Explain the various money market instruments.

Answer:

The following are some of the important money market instruments.

1. Treasury Bills:

A treasury bill is an instrument of short-term borrowings by the Government of India maturing in less than one year. They are also known as zero coupon bonds issued by RBI on behalf of the Central Government to meet its short-term requirements of funds. The purchase price is less than the face value. At maturity, the government will pay full face value.

2. Commercial Paper:

Commercial paper is a short-term unsecured promissory note, negotiable and transferable by endorsement and delivery with a fixed maturity period. It is issued by large and credit-worthy companies to raise short-term funds at lower rates of interest than market rates. It usually has a maturity period of 15 days to one year. It is sold at a discount and redeemable at par. The original purpose of commercial paper was to provide short-term funds for seasonal and working capital needs. Companies use this instrument for purposes such as bridge financing.

3. Call Money:

Call money is a short-term finance repayable on demand, with a maturity period of one day to fifteen days, used for inter-bank transactions. Commercial banks have to maintain a minimum cash balance known as a cash reserve ratio. Call money is a method by which banks borrow from each other to be able to maintain the cash reserve ratio. The interest rate paid on call money loans is known as the call rate. It is a highly volatile rate that varies from day to day and sometimes even from hour to hour.

4. Certificate of Deposit:

Certificates of deposit are unsecured, negotiable, short-term instruments in bearer form, issued by commercial banks and developed financial institutions. They can be issued to individuals, corporations, and companies during periods of tight liquidity when the deposit growth of banks is slow but the demand for credit is high. They help to mobilize a large amount of money for short periods. The return on the certificate is higher than the treasury bills because it assumes a higher level of risk.

5. Commercial Bill:

A commercial bill is a bill of exchange used to finance the working capital requirements of business firms. It is a short, negotiable, self-liquidating instrument that is used to finance the credit sales of firms. The seller draws a bill on the buyer. When it is accepted, it is called a trade bill and becomes a marketable instrument. These bills can be discounted with a bank if the seller needs funds before the bill matures. When a trade bill is accepted by a commercial bank, it is known as a commercial bill.

6. Collateral Loan:

Commercial banks provide loans against government securities and bonds.

Section – C

(5 × 2 = 10)

Answer any five of the following questions not exceeding 5 lines each.

Question 10.

Write the definition of an entrepreneur.

Answer:

According to Peter F. Drucker an entrepreneur is one who “searches for change, responds to it and exploits opportunities and the innovation is the specified tool of an entrepreneur”.

Question 11.

Explain any one function of an entrepreneur.

Answer:

An entrepreneur performs all the functions necessary right from the generation of an idea and upto setting up an enterprise. The following are the functions of an entrepreneur.

Decision Making:

An entrepreneur as a decision maker takes various decisions regarding the following:

- Ascertaining the objective of the enterprise

- Sources of finance

- Product mix

- Pricing policies

- Promotion strategies

- Appropriate technology or new equipment etc.

![]()

Question 12.

Who is a Retailer?

Answer:

A trader who is engaged in retail trade is called a retailer. A retailer is the last link in the chain of distribution of goods. He is an intermediary between the wholesaler and consumers. He purchases goods from wholesalers and sells them in very small quantities to ultimate consumers. His activities are generally confined to the locality in which his shop is located. Big departmental stores, super bazaars, hawkers, and other small shopkeepers are examples of retailers.

Question 13.

Write a short note on A.T.M.

Answer:

ATM means Automatic Teller Machine. An ATM is an unmanned device located on or off the bank premises. The operation mechanism is that an ATM is inserted into the ATM, and the terminal reads and transmits the tape data to a processor which activates the account. It works 24 hours a day, 7 days a week. ATMs are being used to withdraw, deposit, and transfer funds.

Question 14.

Write a short note on Reinsurance.

Answer:

The insurance company undertakes the risk according to its capacity. If a company undertakes more risks than its capacity, then it tries to share the risks with some other insurance company. When an insurance company insurer completes part of the risk with another insurance company, then it is called re-insurance.

Question 15.

Write a short note on the Capital Market.

Answer:

The term capital market refers to facilities and institutional arrangements through which long-term funds, both debt and equity are raised and invested. It consists of a series of channels. Through this savings of the community are made available for industrial and commercial purposes.

Question 16.

Write a short note on the Financial Market.

Answer:

A financial market is a broad term describing any marketplace where buyers and sellers participate in the trade of financial assets such as equities, bonds, currencies, and derivatives.

Question 17.

Write a short note on District Forums.

Answer:

- District Forum: This is established by the state government in each of its districts.

- Composition: The district forum consists of a chairman and two other members one of whom shall be a woman. The district forms are headed by the person of the rank of a District Judge.

- Jurisdiction: A written complaint can be filed before the district forum where the value of goods or services and the compensation claimed does not exceed ₹ 20 lakhs.

- Appeal: If a consumer is not satisfied by the decision of the District Forum, he can challenge the same before the state commission, within 30 days of the order.

Part – II (50 Marks)

Section – D

(1 × 20 = 20)

Answer the following question.

Question 18.

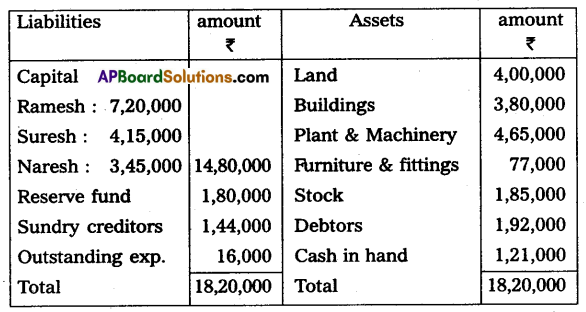

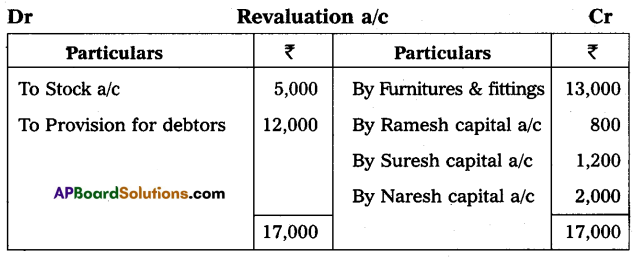

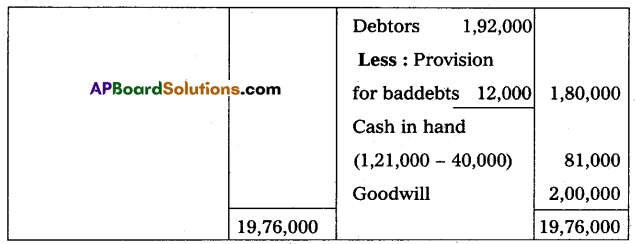

Ramesh, Suresh, and Naresh were sharing profits in the ratio of 2 : 3 : 5. The Balance sheet of Ramesh, Suresh, and Naresh on 31st March 2016:

Suresh retires on the above date and the following adjustments are agreed upon his retirement:

(i) Stock was valued at ₹ 1,80,000.

(ii) Furniture and fittings were valued at ₹ 90,000.

(iii) An amount of ₹ 12,000 was doubtful and a provision for the same was required.

(iv) Goodwill of the firm was valued at ₹ 2,00,000.

(v) Suresh was paid Rs. 40,000 immediately on retirement and the balance was transferred to his loan account.

(vi) Ramesh and Naresh were to share future profits in the ratio of 3 : 2.

Prepare Revaluation Account, Capital Account, and Balance Sheet of the reconstituted firm.

Answer:

Section – E

(1 × 10 = 10)

Answer any one of the following questions.

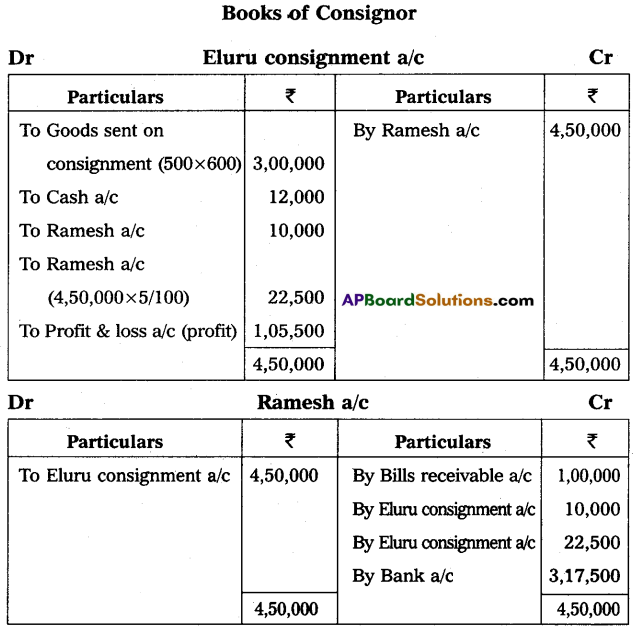

Question 19.

Vijay of Vijayawada consigned 500 Radio sets each at ₹ 600 to Ramesh of Eluru. On consignment, Vijay paid of ₹ 12,000 as freight and insurance in transit. Vijay drew a bill on Ramesh for three months for ₹ 1,00,000. Ramesh sent account sales which show the following particulars.

(a) Gross sale proceeds are ₹ 4,50,000.

(b) Unloading and godown rent ₹ 10,000.

(c) Commission 5% on gross sales.

Ramesh sends a bank draft for the balance due to Vijay. You are required to prepare necessary Ledger Accounts in the books of the Consignor.

Answer:

![]()

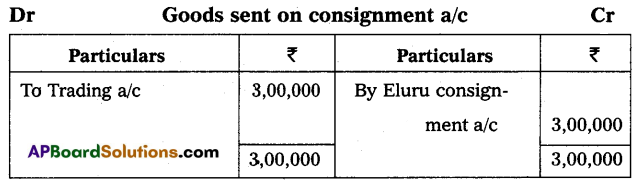

Question 20.

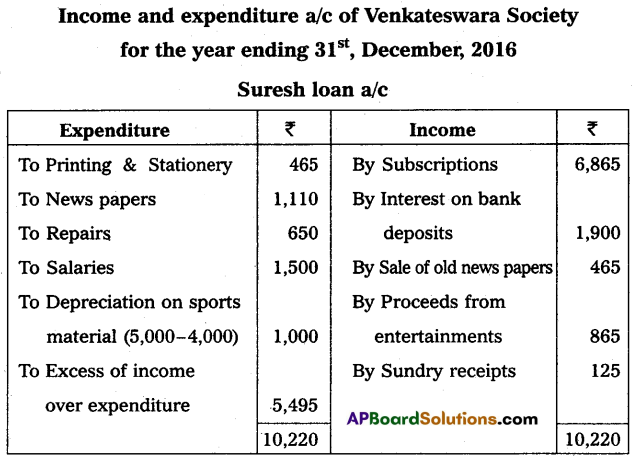

From the following Receipts and Payments account of the Venkateswara Society for the year ended 31st December 2016. Prepare Income and Expenditure account for the Year ended 31st December 2016.

The entrance fees and donations are to be capitalized. Sports materials value ₹ 4,000 as of 31st December 2016.

Answer:

Section – F

(2 × 5 = 10)

Answer any two of the following questions.

Question 21.

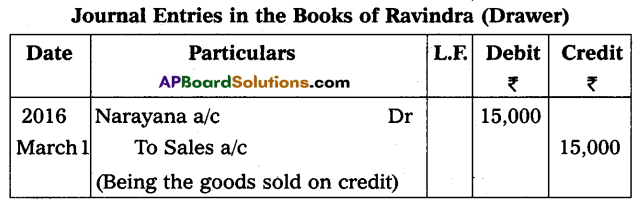

Narayana purchased goods for ₹ 15,000 from Ravindra on 1st March 2016. Ravindra drew upon Narayana a bill of exchange for the same amount payable after two months. The bill was immediately discounted by Ravindra with his bank @ 6% p.a. On the due date, the bill was dishonored and the bank paid ₹ 100 as noting charges. Pass the necessary journal entries in the books of Ravindra.

Answer:

Question 22.

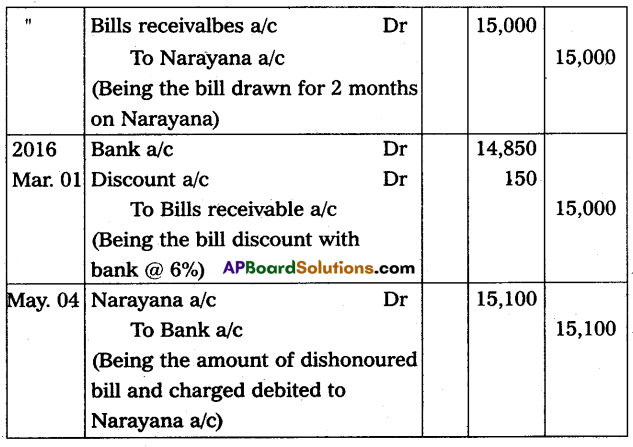

Lakshmi traders purchased a Machine for ₹ 50,000 on 1.1.2016. Another Machine was bought on 1.1.2017 for ₹ 60,000 and used from 1st July 2017 onwards. The depreciation is provided at 10% per annum, under the straight-line method. The books are closed on 31st December every year. Prepare the Machinery account for 3 years.

Answer:

Question 23.

Explain the categories of share capital.

Answer:

From the accounting point of view, the share capital of the company can be classified as follows:

- Authorized Capital: Authorised capital is the amount of share capital that a company is authorized to issue to the public by the memorandum of association. It is also called nominal or registered capital.

- Issued Capital: Issued capital is that part of authorized capital that is issued to the public for subscription. A company may issue its entire authorized capital or may issue in parts from time to time as per the needs of the company.

- Subscribed Capital: It is that part of the issued capital which has been subscribed by the public. This capital can be equal to or less than the issued capital.

- Called-up Capital: It is that part of the subscribed capital that is called up by the company to pay on the allotted shares. The company may decide to call the entire amount or part of the face value of shares.

- Paid-up Capital: That part of the called-up capital that has been paid by the shareholders.

- Reserve Capital: A company may reserve a portion of its uncalled capital to be called only in the event of the winding up of the company. Such an uncalled amount is called the reserve capital of the company.

Question 24.

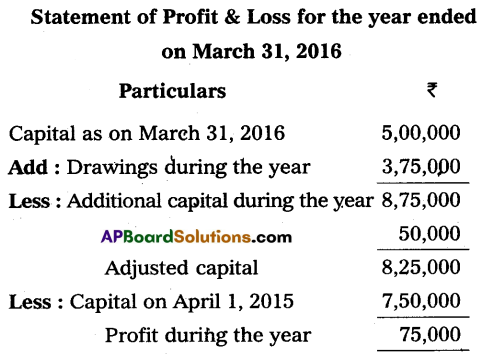

The following information is given below. Prepare the statement of Profit or Loss.

Capital April 01, 2015 – ₹ 7,50,000

Capital 31st March 2016 – ₹ 5,00,000

Capital brought in by the proprietor during the year – ₹ 50,000

Drawings during the year – ₹ 3,75,000

Answer:

Section – G

(5 × 2 = 10)

Answer any five of the following questions.

Question 25.

What is meant by the dishonor of a bill?

Answer:

When the drawee or acceptor of the bill fails to make payment of the bill on the date of maturity it is called ‘Dishonour of the bill’.

Question 26.

What is the reducing balance method?

Answer:

This method is also known as written down value method. Under this method, depreciation is charged at a fixed percentage on the book value of the asset. Since the book value keeps on reducing by the annual charge of depreciation, it is known as the reducing balance method.

Question 27.

What is Del Credere Commission?

Answer:

The consignee may sell some part of the goods on credit. When goods are sold on credit, there is always a risk of some amount of bad debt. To avoid the risk of bad debts the consignor provides an additional commission known as the Del-Credre commission to the consignee which guarantees the payment in case of a credit sale. Del create commission is paid at a predetermined percentage of gross sale proceeds.

Question 28.

What is Legacy?

Answer:

It is the amount that a not-for-profit concern will receive as per will of a deceased person. It should be capitalised being an item of non-recurring nature and should be shown on the liabilities side of the balance sheet.

Question 29.

Explain the sacrificing ratio.

Answer:

The ratio in which the old partners agree to sacrifice their share of profit in favor of the incoming partner is called the sacrificing ratio.

Sacrificing Ratio = Old share of Profit – New share of Profit.

Question 30.

What is an equity share?

Answer:

The equity shares are also called as ordinary shares. According to section 85 of the Companies Act, of 1956 an equity share is a share that is not a preference share. In other words, shares that do not enjoy any preferential right in the payment of dividends or repayment of capital is called equity shares.

![]()

Question 31.

Define a single entry system.

Answer:

According to R.N. Carter, single entry cannot be termed as a system, as it is not based on any scientific system like a double entry system, for this purpose, a single entry is nowadays known as the preparation of accounts from incomplete records.

Question 32.

What is Tailored?

Answer:

Accounting software is generally tailored in large business organizations with multi-users and geographically scattered locations. This software requires specialized training for the users. The tailored software is designed to meet the specific requirements of the users and forms an important part of the organizational MIS.