Telangana & Andhra Pradesh BIEAP TS AP Intermediate Inter 2nd Year Accountancy Study Material Textbook Solutions Guide PDF Free Download, TS AP Inter 2nd Year Accountancy Blue Print Weightage 2022-2023, Telugu Academy Intermediate 2nd Year Accountancy Textbook Pdf Download, Questions and Answers Solutions in English Medium and Telugu Medium are part of AP Inter 2nd Year Study Material Pdf.

Students can also read AP Inter 2nd Year Accountancy Syllabus & AP Inter 2nd Year Accountancy Important Questions for exam preparation. Students can also go through AP Inter 2nd Year Accountancy Notes to understand and remember the concepts easily.

AP Intermediate 2nd Year Accountancy Study Material Pdf Download | Sr Inter 2nd Year Accountancy Textbook Solutions

AP Inter 2nd Year Accountancy Study Material in English Medium

- Chapter 1 Bills of Exchange

- Chapter 2 Depreciation

- Chapter 3 Consignment

- Chapter 4 Not-for-Profit Organizations

- Chapter 5 Partnership Accounts

- Chapter 6 Admission of a Partner

- Chapter 7 Retirement / Death of a Partner

- Chapter 8 Company Accounts

- Chapter 9 Computerised Accounting System

- Chapter 10 Accounts from Incomplete Records

AP Inter 2nd Year Accountancy Study Material in Telugu Medium

- Chapter 1 వినిమయ బిల్లులు

- Chapter 2 తరుగుదల

- Chapter 3 కన్సైన్మెంటు

- Chapter 4 వ్యాపారేతర సంస్థల ఖాతాలు

- Chapter 5 భాగస్వామ్య ఖాతాలు

- Chapter 6 భాగస్తుని ప్రవేశం

- Chapter 7 భాగస్తుని విరమణ / మరణము

- Chapter 8 కంపెనీ ఖాతాలు

- Chapter 9 కంప్యూటరైజ్డ్ అకౌంటింగ్

- Chapter 10 అసంపూర్తి రికార్డుల నుంచి ఖాతాలు (ఒంటి పద్దు విధానం)

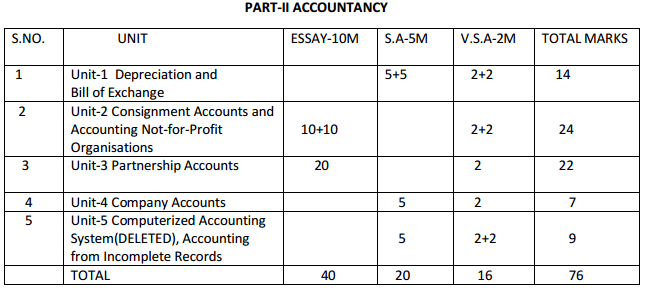

TS AP Inter 2nd Year Accountancy Weightage Blue Print 2022-2023

TS AP Inter 2nd Year Accountancy Weightage 2022-2023 | TS AP Inter 2nd Year Accountancy Blue Print 2022

Intermediate 2nd Year Accountancy Syllabus

TS AP Inter 2nd Year Accountancy Syllabus

Chapter 1 BILLS OF EXCHANGE

Meaning and Definition – Features of a Bill of Exchange – Parties to a Bill of Exchange – Advantages of a Bill of Exchange-Types of Bills of Exchange (Time and Demand Bills – Trade and Accommodation Bills – Inland and Foreign Bills)- Difference between a Bill and a Promissory Note – Difference between a Bill and a Cheque – Important Terminology – Accounting Treatment for Bills of Exchange (Methods of Dealing with a Bill of Exchange by Drawer))- Honour of Bills of Exchange – Dishonour of Bills of Exchange – Renewal of a Bill – Retiring a Bill under Rebate – Insolvency of Drawee.

Chapter 2 DEPRECIATION

Meaning and Definition – Need for Depreciation – Causes of Depreciation – Accounting Treatment (Purchase of Asset – Use of Asset – Sale of Asset)- Methods of Providing Depreciation – Straight Line Method – Reducing Balance Method (Difference between Straight Line Method and Reducing Balance Method).

Chapter 3 CONSIGNMENT

Introduction – Characteristics / Features of Consignment – Difference between Consignment and Sale – Important Documents (Proforma Invoice – Account Sales) – Commission (Ordinary Commission – Del Credere Commission – Over-Riding Commission) – Accounting Treatment in the Books of Consignor (Consignment Account – Consignee Personal Account – Goods Sent on Consignment Account) Accounting Treatment in the Books of Consignee (Proforma of Consignors Account) – Valuation of Unsold Stock – Loss of Stock – Types (Normal Loss).

Chapter 4 NOT-FOR-PROFIT ORGANIZATION

Introduction – Characteristics – Capital and Revenue Transactions – Distinction Between Profitable and Not-for-Profit Organizations – Formation of Not-for-Profit Organizations – Accounting Records to be maintained in Not-for-Profit Organizations (During the Accounting Period – At the end of the Accounting Year) – Preparation of Receipts and Payments Account (Distinction between Receipts and Payments Account and Cash Book – Features of Receipts & Payment Account – Steps in Preparation of Receipts & Payments A/C) – Preparation of Income and Expenditure Account (Features of Income and Expenditure Account – Distinction between Receipts and Payments Account and Income and Expenditure Account – Proforma of Income and Expenditure Account – Conversion of Receipts and Payments Account into Income and Expenditure Account) – Treatment of Important Items – Balance Sheet.

Chapter 5 PARTNERSHIP ACCOUNTS

Introduction – Meaning and Definition – Features of Partnership Firm – Partnership Deed (Rules Applicable in the Absence of an Agreement) – Distribution of Profit/Loss among Partners (Profit and Loss Appropriation Account) – Maintenance of Capital Accounts of Partners – Interest on Partner’s Loan – Interest on Capital – Interest on Drawings.

Chapter 6 ADMISSION OF A PARTNER

Introduction – New Profit Sharing Ratio (Sacrificing Ratio) – Revaluation of Assets and Liabilities – Adjustments of Reserves and Accumulated Profit or Losses – Goodwill (Methods of Valuation of Goodwill – Treatment of Goodwill) – Adjustment of Partners’ Capital.

Chapter 7 RETIREMENT / DEATH OF A PARTNER

Introduction – New Profit Sharing Ratio (Gaining Ratio) – Revaluation of Assets and Liabilities – Adjustment of Accumulated Profits and Losses – Treatment of Goodwill – Adjustment of Capitals – Disposal of Amount Due to Retiring Partner – Share of Profits/Losses up to Date of Deceased Partner.

Chapter 8 COMPANY ACCOUNTS

Introduction – Categories of Share Capital (Categories of Share Capital – Types of Shares) – Issues of Shares (Shares Issued at Par of Face Value – Shares Issued at Premium (Section 52 – Shares Issued at Discount (Section 53)).

Chapter 9 COMPUTERISED ACCOUNTING SYSTEM

Introduction – Computers in Accounting – Process of Computerised Accounting System – Driving Forces for Computerised Accounting – Comparison of Manual and Computerized Accounting System – Advantages of Computerised Accounting System – Limitations of Computerised Accounting System – Sourcing of Accounting Software – Accounting Packages.

Chapter 10 ACCOUNTS FROM INCOMPLETE RECORDS (SINGLE ENTRY SYSTEM)

Introduction – Meaning and Definition – Features of Accounts from Incomplete Records – Uses if Accounts from Incomplete Records – Limitations of Accounts from Incomplete Records – Differences between Single Entry System and Double Entry System – Preparing Statement of Affairs – Difference between Statement of Affairs and Balance Sheet – Ascertainment of Profit or Loss of Business – Application of Single Entry System to Partnership Firms.

We hope that this Telangana & Andhra Pradesh BIEAP TS AP Intermediate Inter 2nd Year Accountancy Study Material Textbook Solutions Guide PDF Free Download 2022-2023 in English Medium and Telugu Medium helps the student to come out successful with flying colors in this examination. This Sr Inter 2nd Year Accountancy Study Material will help students to gain the right knowledge to tackle any type of questions that can be asked during the exams.