Andhra Pradesh BIEAP AP Inter 2nd Year Accountancy Study Material 8th Lesson Company Accounts Textbook Questions and Answers.

AP Inter 2nd Year Accountancy Study Material 8th Lesson Company Accounts

Essay Questions

Question 1.

Explain the categories of share capital.

Answer:

From the accounting point of view the share capital of the company can be classified as follows:

1. Authorised capital: Authorised capital is the amount of share capital that a company is authorized to issue to the public by the memorandum of association. It is also called nominal or registered capital.

2. Issued capital: Issued capital is that part of authorised capital which is actually issued to the public for subscription. A company may issue its entire authorised capital or may issue in parts from time to time as per the needs of the company.

3. Subscribed capital: It is that part of the issued capital which has been actually subscribed by the public. This capital can be equal to or less than the issued capital.

4. Called-up capital: It is that part of the subscribed capital which is called up by the company to pay on the allotted shares. The company may decide to call the entire amount or part of the face value of shares.

5. Paid-up capital: That part of the called-up capital has been actually paid by the shareholders.

6. Reserve capital: A company may reserve a portion of its uncalled capital to be called only in the event of winding up of the company. Such an uncalled amount is called the reserve capital of the company.

![]()

Question 2.

Explain the classes of shares.

Answer:

Shares refer to the units into which the total share capital of the company is divided. Thus, a share is a fractional part of the share capital and forms the bases of ownership interest in the company. The persons who contribute money through shares are all called shareholders.

As per section, 86 of the Companies Act a company can issue two types of shares 1. Preference shares, 2. Equity shares.

1. Preference shares: According to section, 85 of the Companies Act, 1956, a preference share is one that fulfills the following two conditions.

- That it carries a preferential right to dividend, to be paid as a fixed amount or an amount calculated by a fixed rate of the nominal value of each share before any dividend is paid to the equity shareholders.

- With respect to the capital, it carries or will carry, on the winding up of the company, the preferential right to the repayment of capital before anything is paid to equity shareholders.

2. Equity shares: Equity shares are also called ordinary shares. According to section 85 of the Companies Act, of 1956, an equity share is a share that is not a preference share. In other words, shares that do not enjoy any preferential right in the payment of dividends or repayment of capital are called as equity shares. The equity shareholders are entitled to share the distributable profits of the company after satisfying the dividend rights of preference shareholders. The dividend on equity shares is not fixed and it varies from time to time depending upon the profits available for distribution.

Question 3.

Explain the types of issues of shares.

Answer:

A salient feature of the share capital of a company is that the amount on its shares can be gradually collected in easy installments spread over a period of time depending upon its growing financial requirement. The first installment is collected along with the application and is known as application money. The second installment is termed allotment money and the remaining money is collected in installments are termed a first call, second call, and final call. The word final is suffixed to the last installment. However, this in no way prevents a company from calling the full amount on shares right at the time of application.

Short Answer Questions

Question 1.

What is authorised capital?

Answer:

Authorised capital is the amount of share capital that a company is authorised to issue to the public by the memorandum of association. It is also called Nominal or Registered capital.

Question 2.

What is a preference share?

Answer:

A preference share is a share that carries preferential rights regarding the payment of dividends by a fixed rate and repayment of capital at the time of winding up the company.

![]()

Question 3.

What is an Equity share?

Answer:

Equity shares are also called ordinary shares. According to section 85 of the Companies Act, of 1956 an equity share is a share that is not a preference share. In other words, shares that do not enjoy any preferential right in the payment of dividend or repayment of capital is called equity share.

Question 4.

Explain the issue of shares at par.

Answer:

When a company issues its shares at their face value, the shares are known to have been issued at par.

Ex: The face value of the share is ₹ 100 and it is issued for ₹ 100.

Question 5.

Explain the issue of shares at a premium.

Answer:

When a company issues its shares at a price than the face value, it is said to have been issued at a premium. The money collected more than the face value is called the premium.

Ex: If the face value of a share is ₹ 100 and it is issued for ₹ 110.

Question 6.

Explain the issue of shares at a discount.

Answer:

When the company issues its shares at a price less than the face value, it is said to be an issue at a discount. The difference between the face value and the issue price is called ‘Discount’.

Ex: If the face value of the share is ₹ 100 and it is issued at ₹ 90.

Textual Exercises

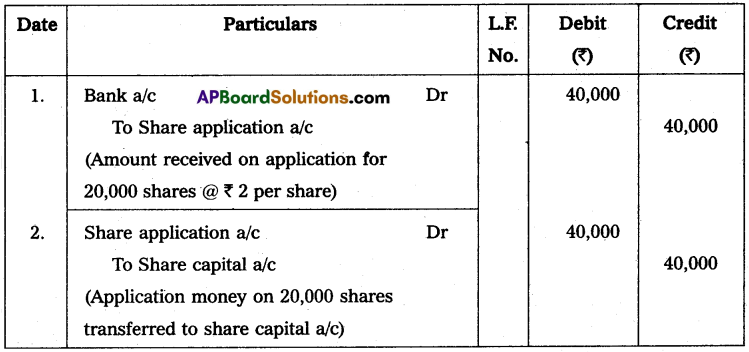

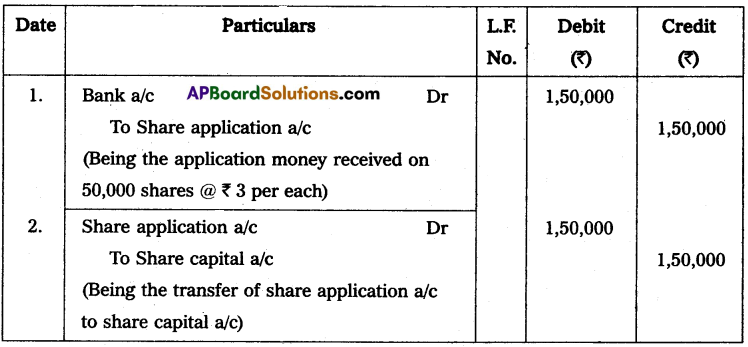

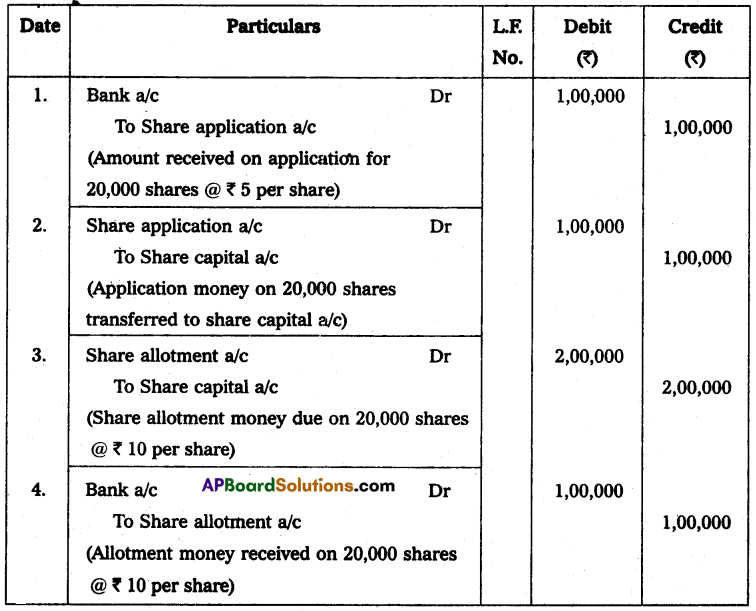

Question 1.

Dhana Ltd. issued 20,000 shares of ₹ 100 each for the subscription. Payable at ₹ 40 per share on application, ₹ 40 per share on the allotment, and the balance ₹ 20 on the first and final call. All the amounts were duly received. Make journal entries in the books of the company.

Solution:

Journal entries in the books

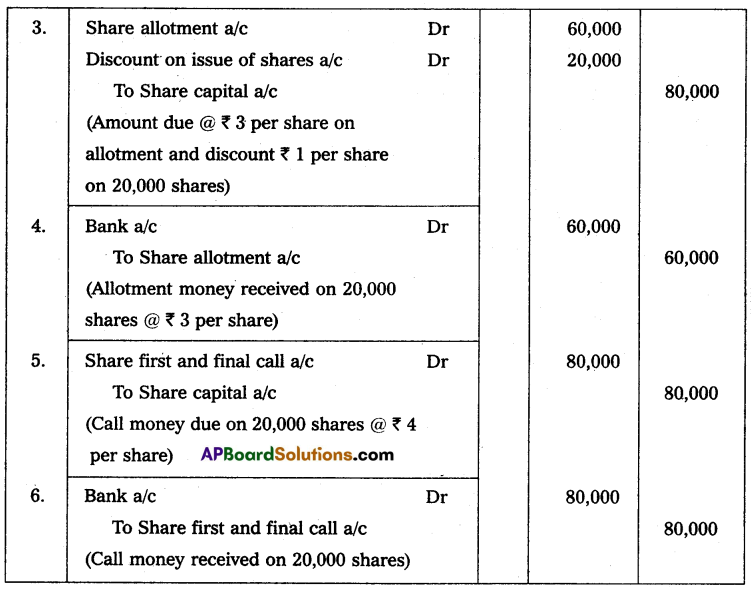

Question 2.

Charan Ltd. decided to issue 10,000 shares of ₹ 200 each for the subscription. Payable at ₹ 50 per share on application, ₹ 100 per share on the allotment, and the balance ₹ 50 on the first and final call. All the money was duly received. Write journal entries in the books of the company.

Solution:

Journal entries in the books of Charan Ltd.

![]()

Question 3.

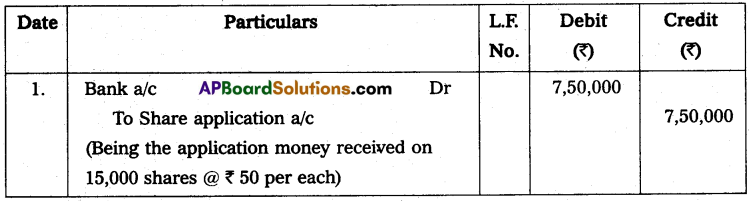

Gayatri cloths Ltd. issued 15,000 shares of ₹ 150 each, payable at ₹ 50 per share on the application, ₹ 50 per share on the allotment, and the balance of ₹ 20 on the first call, ₹ 20 on the second call, and ₹ 10 final calls. All the money was duly received. Prepare journal entries in the books of the company.

Solution:

Journal entries in the books of Gayatri Cloths Ltd.

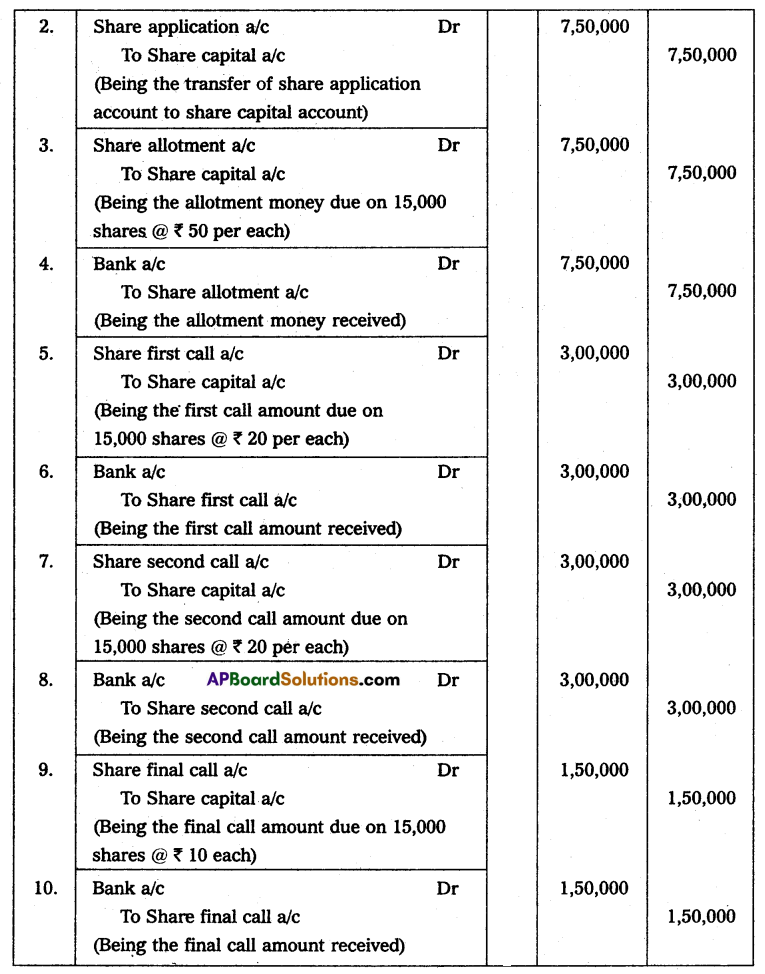

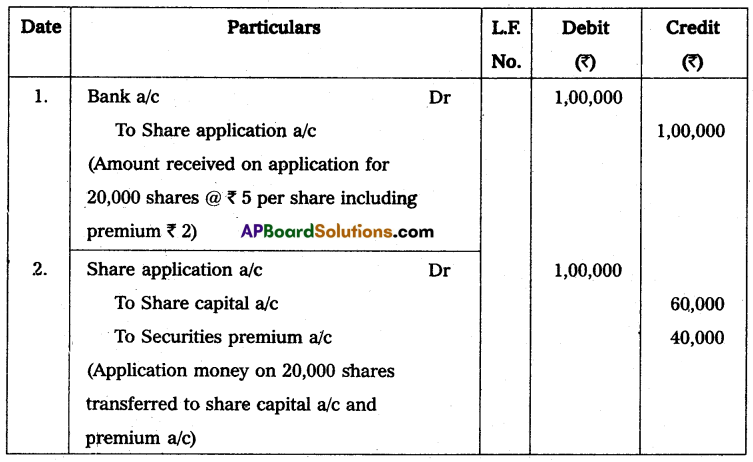

Question 4.

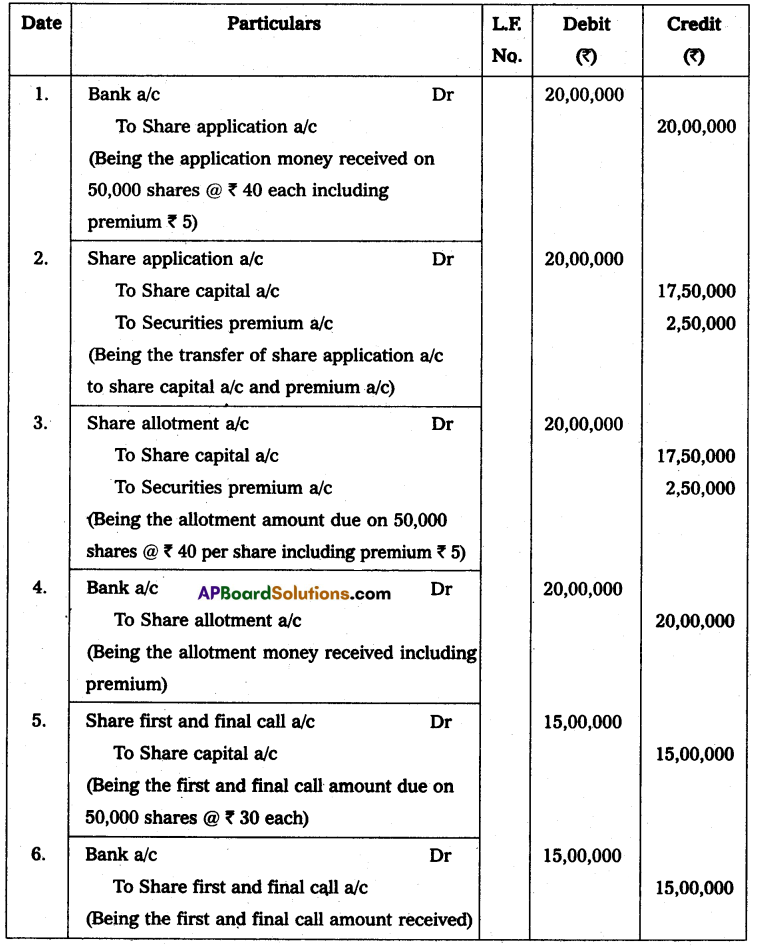

Jayaram Furniture’s Ltd. issued 20,000shares of ₹ 100 each at a premium of ₹ 10 per share payable as follows, on application ₹ 40 (including premium per share), on allotment ₹ 40 (including premium ₹ 5 per share) the remaining balance ₹ 30 on first and final call, the Issue was hilly subscribed. All the money was duly received. Make the Journal entries in the books of the company.

Solution:

Journal entries in the books of Jayaram Furniture Ltd.

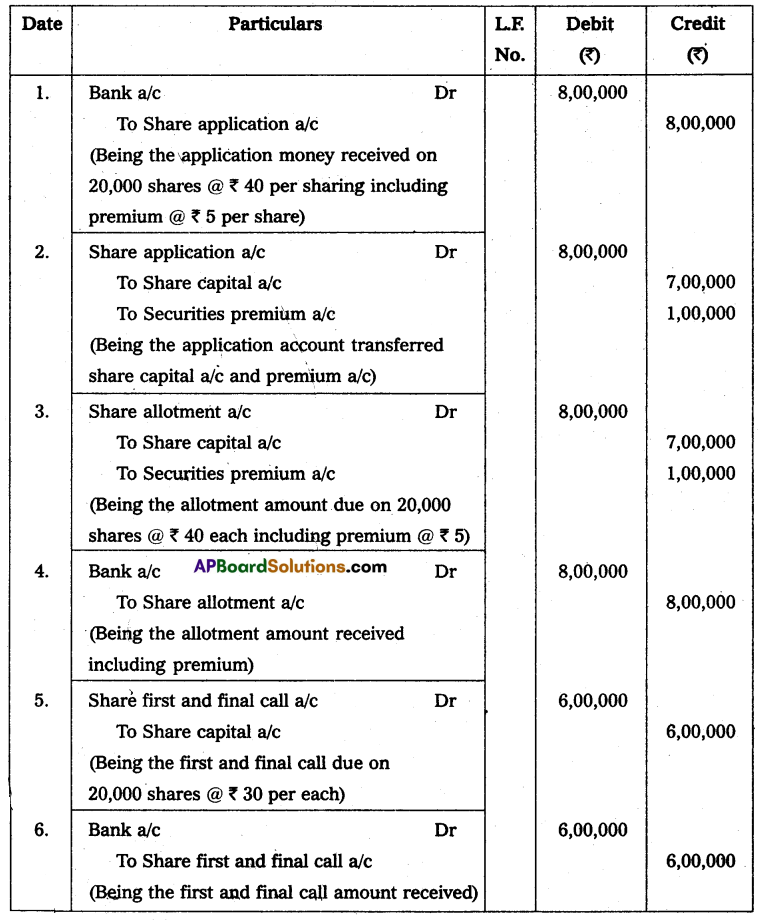

Question 5.

Anusha Ltd. has an authorized capital of ₹ 1,00,00,000 in shares of 10 each issued 10,000 at a premium of ₹ 2 per share payable at ₹ 4 on application (including premium ₹ 1 per share), ₹ 5 on the allotment (including premium ₹ 1 per share) the remaining balance is ₹ 3 on first and final call, the issue was fully subscribed. All the money was duly received. Prepare the Journal entries in the books of the company.

Solution:

Journal entries in the books of Anusha Ltd.

Question 6.

Karthik Ltd. issued 50,000 shares of ₹ 100 at a premium of ₹ 10 per share, payable at ₹ 40 on the application including premium ₹ 5 per share), ₹ 40 on allotment 0ncluding a premium of ₹ 5 per share) the remaining balance of ₹ 30 on the first and final call, the issue was fully subscribed. All the money was duly received. Record the Journal entries in the books of the company.

Solution:

Journal entries in the books of Karthik Ltd.

![]()

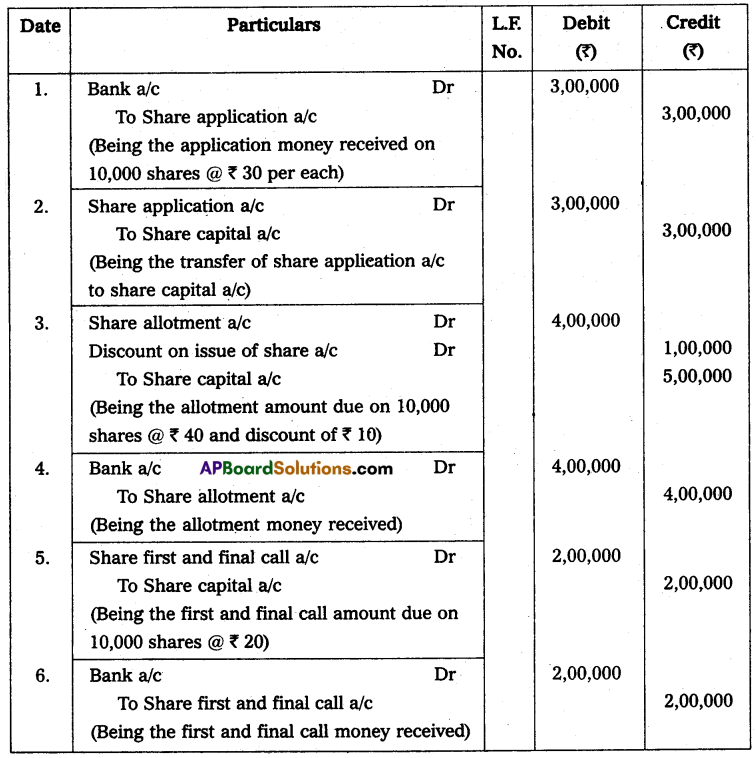

Question 7.

Padmavati Ltd. issued to the public for the subscription of 10,000 shares of ₹ 100 each at a discount of 10% per share, payable at ₹ 30 on application, ₹ 40 on the allotment, and ₹ 20 on the first and final call, the issue was fully subscribed. All the money was duly received. Write the Journal entries in the books of the company.

Solution:

Journal entries in the books of Padmavathi Ltd.

Question 8.

Abishek Ltd. issued 20,000 shares of ₹ 100 each at a discount of 10% per share, the shares were payable at ₹ 40 on application, ₹ 30 on the allotment, and ₹ 20 on the first and final call, the issue was fully subscribed. All the money was duly received. Record the Journal entries in the books of the company.

Solution:

Journal entries in the books of Abishek Ltd.

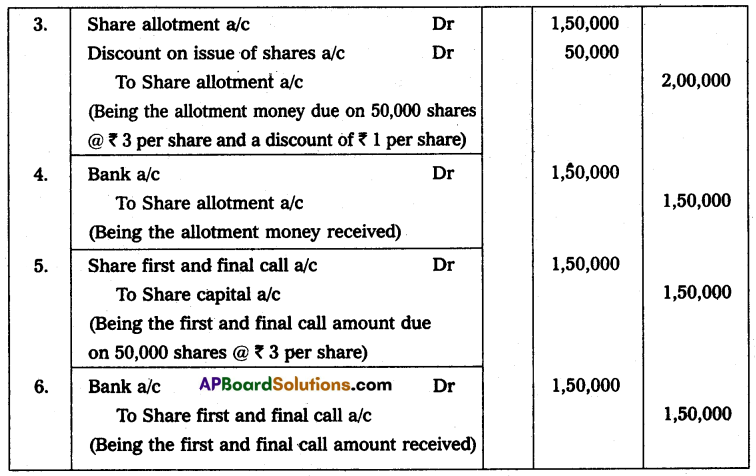

Question 9.

Venkat Ltd. issued 50,000 shares of ₹ 10 each at a discount of 10% per share, the shares were payable at ₹ 3 on application, ₹ 3 on an allotment, and ₹ 3 on the first and final call, and the issue was fully subscribed. All the money was duly received. Give Journal entries in the books of the company.

Solution:

Journal entries in the books of Venkat Ltd.

Textual Examples

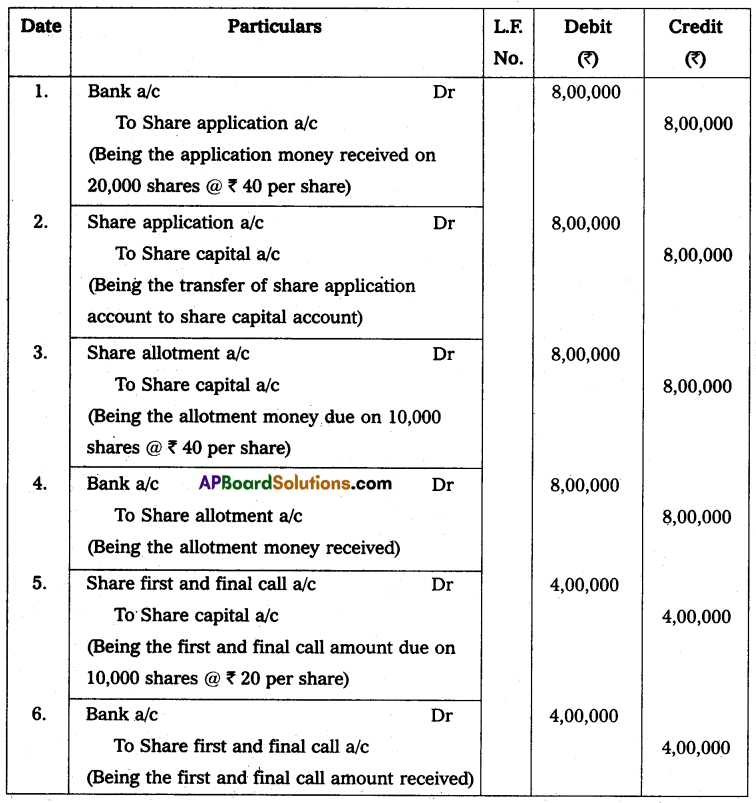

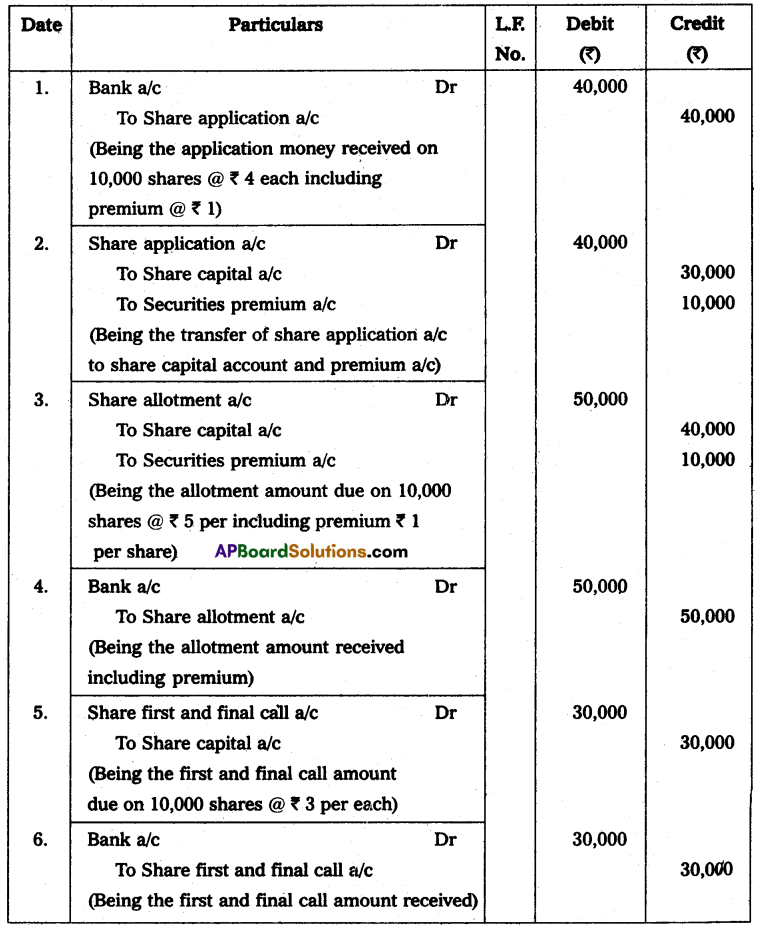

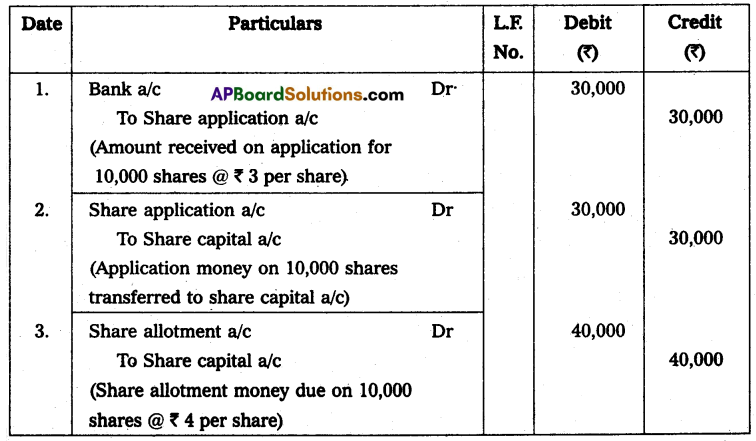

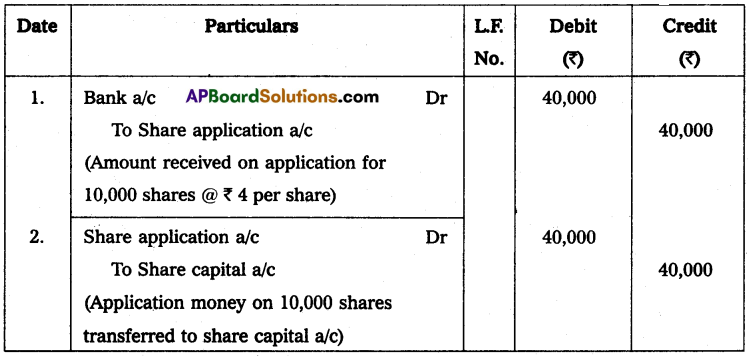

Question 1.

Pavithra Ltd. issued 10,000 shares of ₹ 10 each for the subscription. Payable at ₹ 3 per share on application, ₹ 4 per share on the allotment, and the balance on the first and final call. All the amounts were duly received. Make journal entries in the books of the company.

Solution:

Books of Pavithra Ltd. Journal

![]()

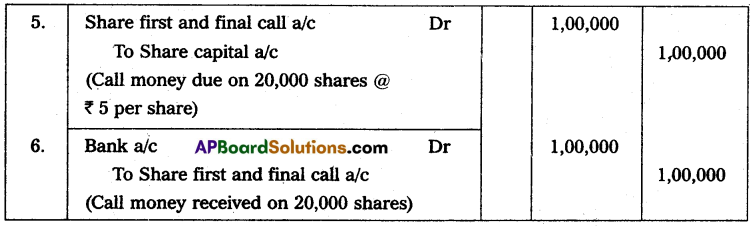

Question 2.

Bhavani Ltd. issued 20,000 shares of ₹ 20 each to the public for subscription as follows, payable ₹ 5 on application, ₹ 10 on the allotment, and the remaining balance on the first and final call.

Give the Journal entries in the books of the company.

Solution:

Books of Bhavani Ltd. Journal

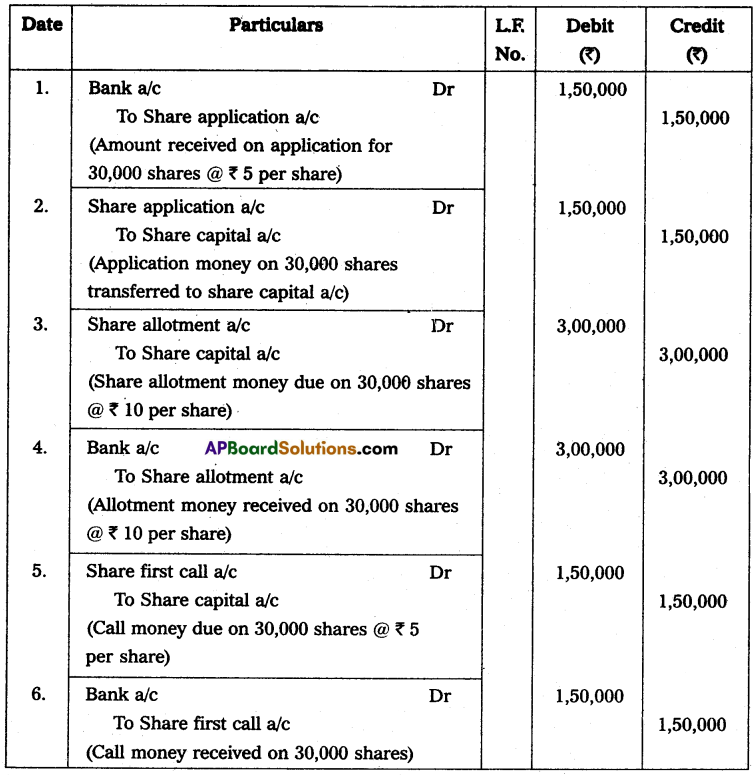

Question 3.

Siva Ltd. issued 30,000 shares of ₹ 30 each to the public for subscription as follows, payable ₹ 5 on application, ₹ 10 on the allotment, and the remaining balance on the first call ₹ 5, second call ₹ 5, and final call ₹ 5. Give the journal entries in the books of the company.

Solution:

Books of Siva Ltd. Journal

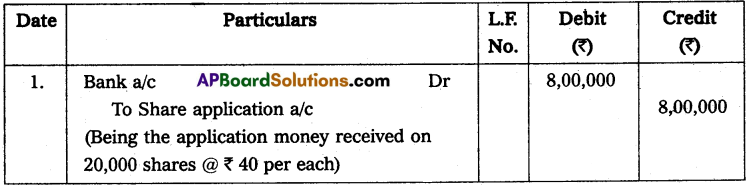

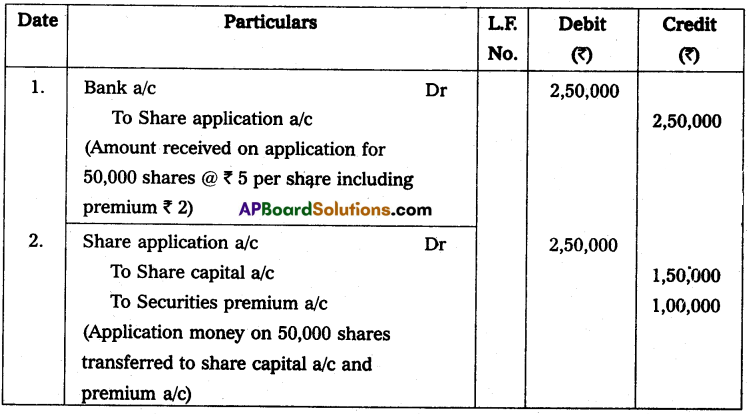

Question 4.

Sarojanamma Ltd. issued 20,000 shares of ₹ 10 each at a premium of ₹ 5 per share, payable as follows, on application, ₹ 5 (including ₹ 2 premium) per share, on allotment ₹ 7 (including premium ₹ 3) per share, and the balance on first and final call ₹ 3. Applications were received for 20,000 shares and allotment was made to all, to make journal entries.

Solution:

Books of Sarojanamma Ltd. Journal

![]()

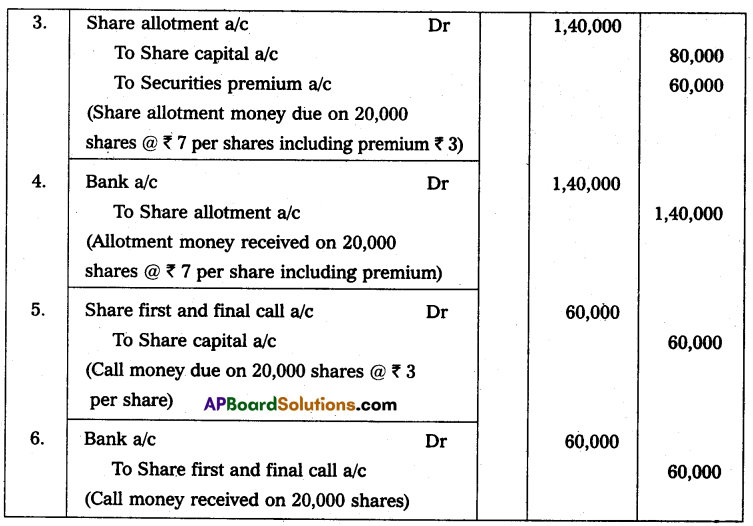

Question 5.

Ramaiah Ltd. issued 50,000 shares of ₹ 10 each at a premium of ₹ 5 per share, payable as follows, on application ₹ 5 (including premium ₹ 2) per share, on allotment ₹ 6 (including premium ₹ 3) per share, the remaining balance ₹ 4 on first and final call, the issue was fully subscribed. All the money was duly received. Make Journal entries.

Solution:

Books of Ramaiah Ltd. Journal

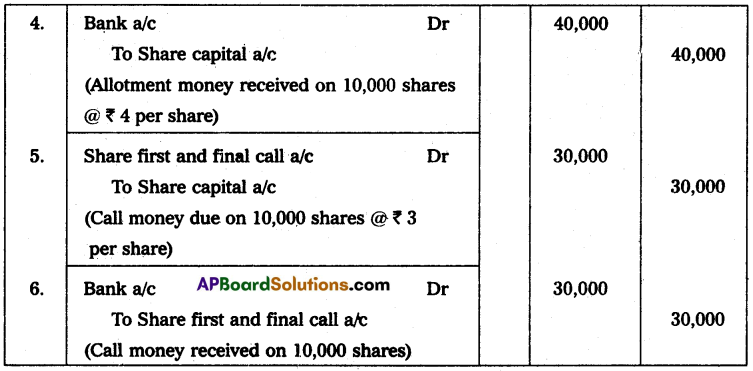

Question 6.

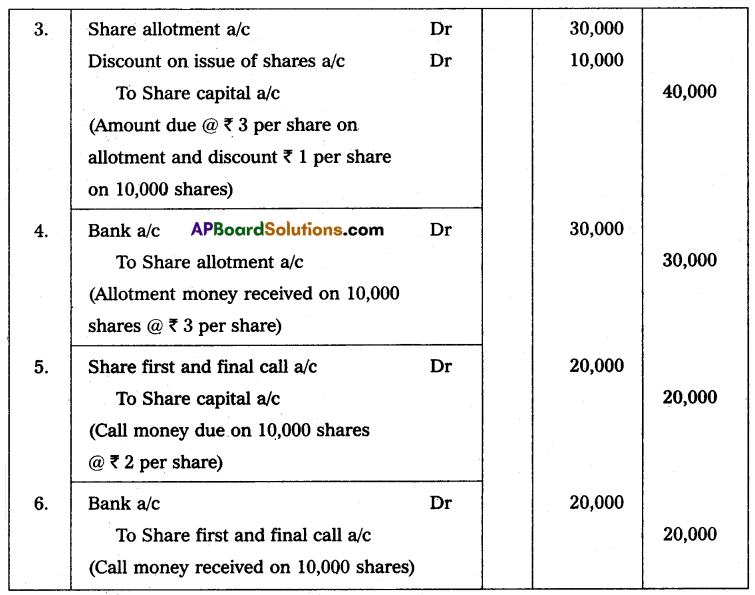

Suguna Motors Ltd. issued to the public for the subscription of 10,000 shares of ₹ 10 each at a discount of 10% per share, payable at ₹ 4 on the application, ₹ 3 on the allotment, and ₹ 2 on the first and final call, the issue was fully subscribed. All the money was duly received. Write the Journal entries in the books of Suguna Motors Ltd.

Solution:

In the books of Suguna Motors Ltd. Journal Entries

![]()

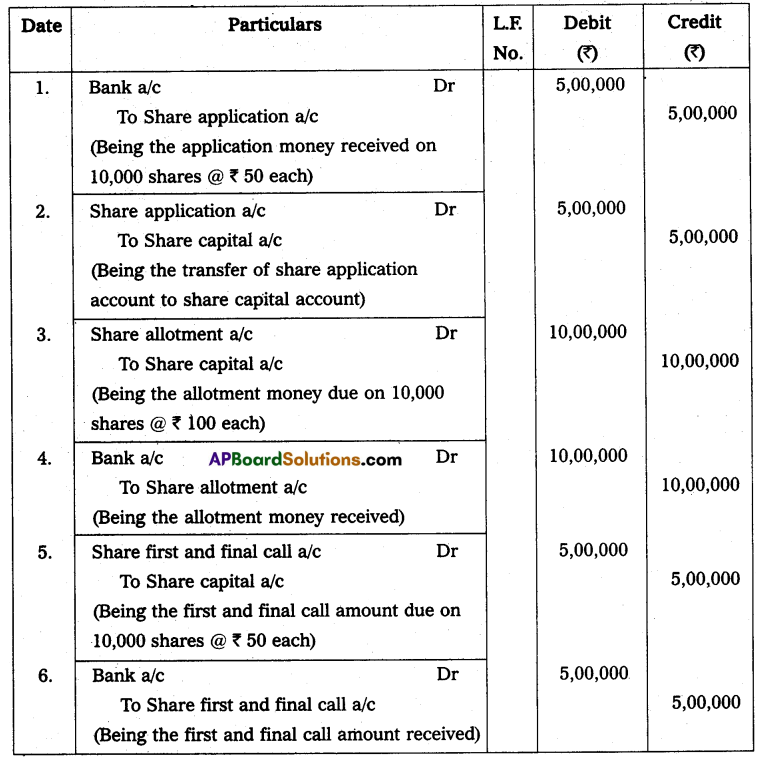

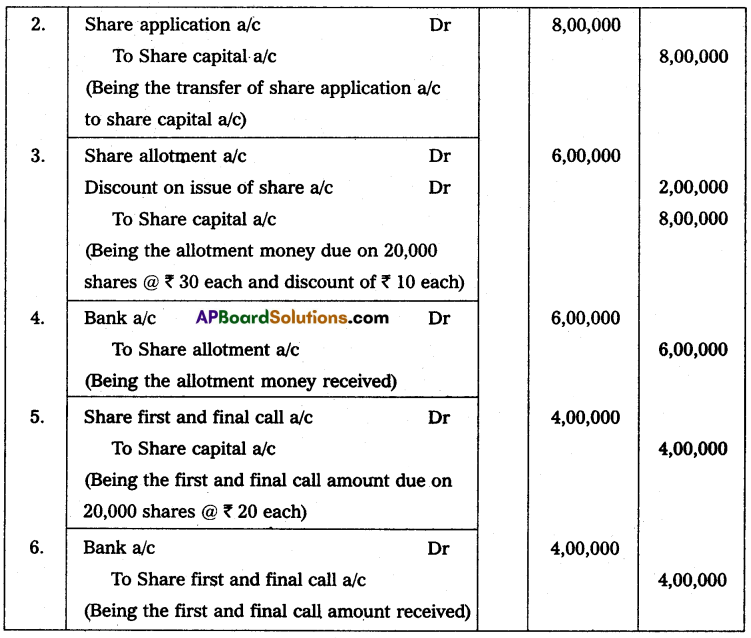

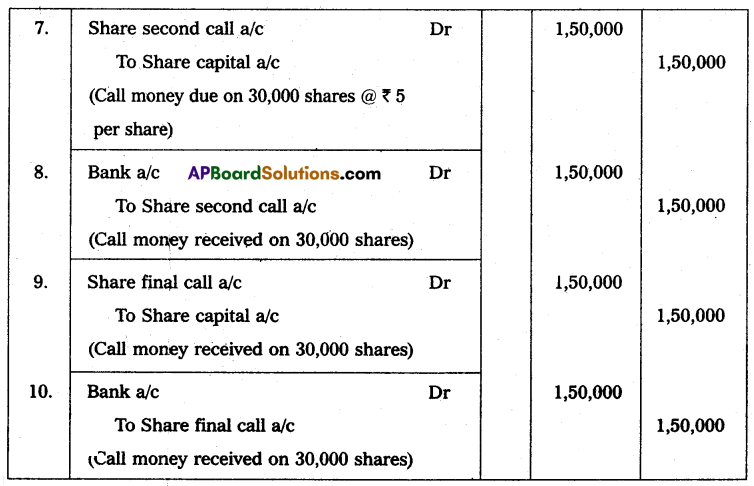

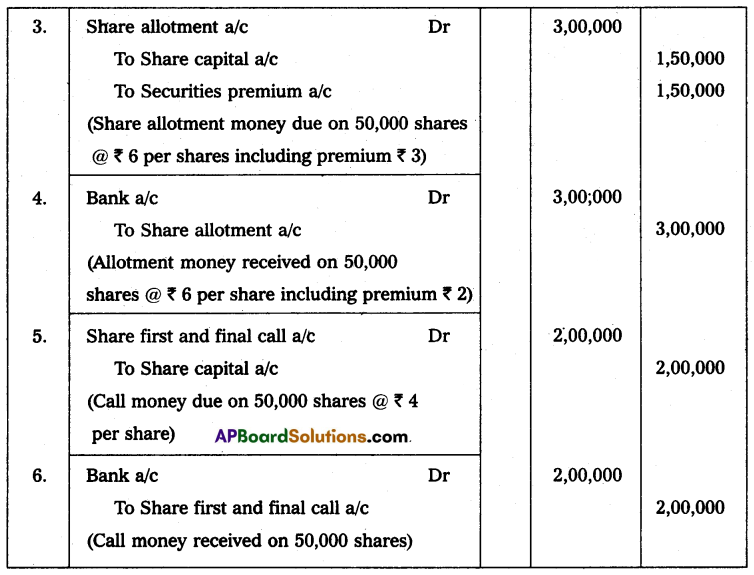

Question 7.

Ravi Tractor Ltd. issued to the public for the subscription of 20,000 shares of ₹ 10 each at a discount of 10% per share, payable at ₹ 2 on application, ₹ 3 on the allotment, and ₹ 4 on the first and final call, the issue was fully subscribed. All the money was duly received. Prepare the Journal entries in the books of the company.

Solution:

In the books of Ravi Tractor Ltd. Journal Entries