Andhra Pradesh BIEAP AP Inter 2nd Year Accountancy Study Material 2nd Lesson Depreciation Textbook Questions and Answers.

AP Inter 2nd Year Accountancy Study Material 2nd Lesson Depreciation

Essay Questions

Question 1.

Define depreciation. What are the main causes of depreciation?

Answer:

Spicer and Pegler define depreciation as follows ‘Depreciation is the measure of exhaustion of the effective life of an asset from any cause during a given period. Depreciation means a decline in the value of fixed assets due to use, the passage of time, obsolescence, or any other cause.

Causes of depreciation: The main causes of depreciation include the following:

- Wear and tear: When fixed assets are put to use in business operations for earning revenue, the value of such assets may decrease. Such a decrease in the value of assets is said to be due to wear and tear.

- Physical forces: When the assets are exposed to the forces of nature like weather, winds, rains, etc. The value of such assets may decrease even if they are not being put to use.

- Expiration of legal rights: When the use of the assets like patents, copyrights, leases, etc., is governed by a time-bound agreement, the value of such assets may decrease with the passage of time.

- Obsolescence: Obsolescence implies an existing asset becoming out of date on account of the availability of a better type of asset due to technological changes or improvements in production methods.

- Accidents: A decline in the usefulness of the asset may be caused by accidents due to fire, earthquakes, floods, etc. Accidental loss is permanent.

- Depletion: Assets of wasting character such as mines, quarries, oil wells, etc., get depleted with the extraction of raw materials them.

![]()

Question 2.

Define depreciation. Explain the need of providing depreciation.

Answer:

“Depreciation is the diminution in the intrinsic value of the asset due to use and or the lapse of time”.

So, depreciation is a permanent, continuous, and gradual decrease in the book value of an asset due to various causes.

Need for Depreciation:

- To ascertain true profit or loss: The true profit or loss can be ascertained only when the depreciation is debited to the profit and loss account along with other revenue expenses like salaries, postage, etc. Which are incurred for the purpose of earning revenue.

- To disclose true and fair financial position: If reasonable depreciation is not deducted from the value of assets, the balance sheet will not reflect the true and fair financial position of business concerns. Hence depreciation should be provided every year to present a true and fair financial position.

- To have funds for the replacement of assets: A portion of profits is set aside in the form of depreciation every year. The amount accumulates and is available for replacement of the asset at the end of its life or when it is discarded.

- To ascertain the true cost of production: For ascertaining the cost of production, it is necessary to charge depreciation as an item of cost of production. If the depreciation is not charged, the cost records would not present the true cost of production.

- To fulfill legal requirements: In the case of joint stock companies, it is compulsory to provide depreciation on fixed assets. Without providing depreciation dividends cannot be declared.

Question 3.

Explain the meaning, merits, and demerits of the Straight Line Method.

Answer:

The straight-line method is the simplest and one of the most widely used methods of providing depreciation. This method is called as Fixed Instalment Method or Equal Instalment Method or Original Cost Method. Under this method, depreciation is calculated at a fixed percentage of the original value of the asset every year. Thus the amount of annual depreciation is uniform throughout the year.

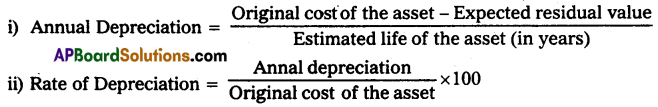

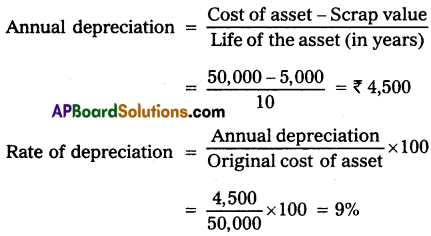

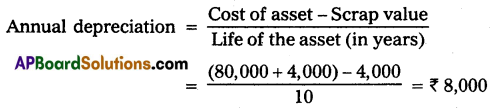

The annual depreciation amount and rate of depreciation is calculated as follows.

Merits of straight-line method:

- It is veiy easy to understand.

- It is very simple to calculate depreciation.

- Assets can be depreciated up to net scrap value or zero value.

- This method is suitable for those assets whose estimated life can be estimated accurately.

- Depreciation will remain the same throughout the life of the asset.

Demerits of straight-line method:

- In this method, the depreciation amount will remain the same throughout the life of the asset.

- But in reality depreciation and repairs will be less in the earlier years and gradually increase in the later part of the life of the asset.

- It becomes difficult to ascertain the amount of depreciation if additions are made during the year.

- This method is not recognized by the income tax authorities.

- No provision is made for interest on the amount invested in the asset.

- It is very difficult to estimate the life of the asset.

![]()

Question 4.

Explain the meaning, merits, and demerits of the Reducing Balance Method.

Answer:

This method is known as Diminishing Balance Method or Written Down Value Method. Under this method, depreciation is charged at a fixed percentage on the book value of the asset. Since the book value keeps on reducing by the annual charge of depreciation, it is known as the reducing balance method.

The amount of depreciation decreases year after year. Depreciation is calculated on the diminishing value of the asset. Under this method, the amount of depreciation is larger in the earlier years than in the later years.

Merits:

- The total charge i.e., depreciation and repairs remain uniform year after year. In the earlier years, the amount of depreciation is more and the amount of repairs is less, whereas in later years, the depreciation amount is less and the amount of repairs is more.

- This method is logical in the sense that as an asset grows older, the amount of depreciation also goes on decreasing.

- Income Tax Act, 1961 accept this method for tax purpose.

- This method can be used where obsolescence is high.

- This method is suitable for those assets which have a longer life.

Demerits:

- It is difficult to calculate depreciation.

- The book value of the asset doesn’t become zero.

- It doesn’t take into account the interest on the amount invested in the asset.

- It doesn’t provide for the replacement of assets on the expiry of its life.

Question 5.

What are the differences between the Straight Line Method and the Reducing balance method?

Answer:

| Basis of difference | Straight line method | Reducing balance method |

| 1. Basis of calculation | Depreciation is calculated on the original cost. | Depreciation is calculated on the book value (i.e., original cost – depreciation charged till date). |

| 2. Amount of depreciation | The amount of depreciation remains constant. | The amount of depreciation decreases year after year. |

| 3. Total change against Profit and Loss a/c in respect of depreciation and repairs | The total charge against the Profit and Loss account in respect of depreciation and repairs expenses in later years under this method. | The depreciation charge declined in later years. Therefore total depreciation and repair expenses remain similar or equal every year. |

| 4. Recognition by Income Tax Law | This method is not recognized by Income Tax Act. | This method is recognized by Income Tax Act. |

| 5. Suitability | This method is suitable for assets in which repair charges are more, and the possibility of obsolescence is low. | This method is suitable for assets that are affected by technological changes and more repair expenses with the passage of time. |

Short Answer Questions

Question 1.

What is depreciation?

Answer:

Depreciation is the gradual reduction or loss in the value of fixed assets like building plants, furniture, etc. If a company purchases a plant for ₹ 1,00,000 with an estimated life of 10 years, the plant will lose a value of ₹ 10,000 every year. This reduction loss is called depreciation.

Question 2.

What are the causes of depreciation?

Answer:

The main causes of depreciation are:

- Wear and tear

- Physical forces

- Expiration of legal rights

- Obsolescence

- Accidents

- Depletion

Question 3.

What is obsolescence?

Answer:

Obsolescence implies an existing asset becoming out of date on account of the availability of a better type of asset due to technological changes or improvements in production methods.

Question 4.

What is depletion?

Answer:

Assets of wasting in nature such as mines, quarries, etc., get depleted with the extraction of raw materials them.

![]()

Question 5.

Write different methods of providing depreciation.

Answer:

The following are the different methods of providing depreciation.

- Straight line method

- Reducing balance method

- Annuity method

- Depreciation fund method

- Insurance policy method

- Revaluation method

- Depletion method

- Machine hour rate method

Question 6.

What is the Straight Line Method?

Answer:

The straight-line method is the simple and widely used method of providing depreciation. Under this method, depreciation is calculated at a fixed percentage of the original cost of the asset every year.

Question 7.

What is the Reducing Balance Method?

Answer:

This method is also known as the written down value method. Under this method, depreciation is charged at a fixed percentage on the book value of the asset. Since the book value keeps on reducing by the annual charge of depreciation, it is known as the reducing balance method.

Textual Exercises

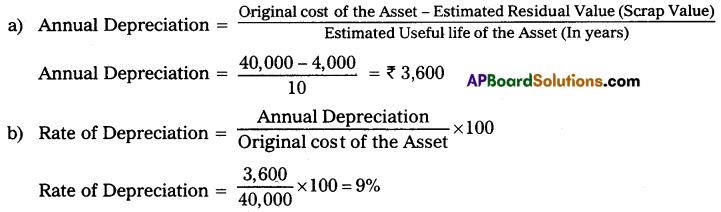

Question 1.

Praveen traders purchased a machine for ₹ 80,000. The life of the machine is estimated at 10 years and the residual value is ₹ 10,000. Calculate the annual amount of depreciation according to the Straight Line Method.

Solution:

Question 2.

A machine is purchased for ₹ 40,000. It is estimated that the useful life of the machine is 9 years and the residual value is ₹ 4,000. You are required to find out the annual amount of depreciation and the rate of depreciation under the Straight Line Method.

Solution:

Question 3.

A truck is purchased for ₹ 50,000. It is estimated that the useful life of the truck is 10 years and the residual value is ₹ 5,000. Calculate the annual amount of depreciation and the rate of depreciation under the Straight Line method.

Solution:

![]()

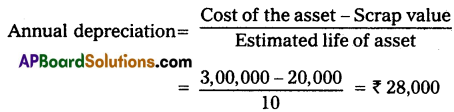

Question 4.

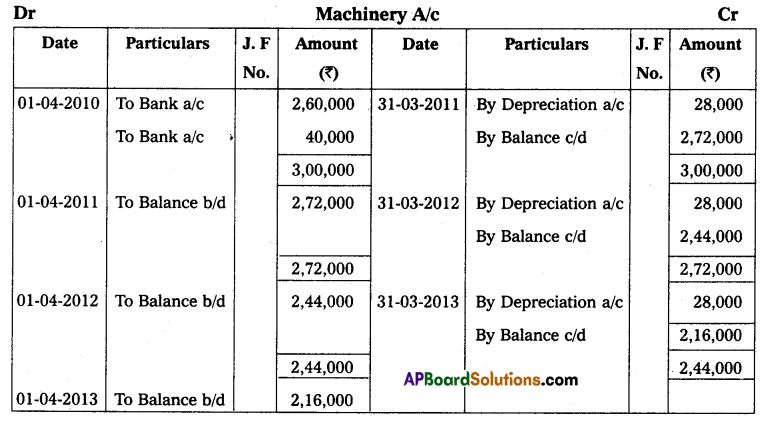

On 1st April 2010, Anand traders purchased a machine for ₹ 2,60,000 and spent ₹ 40,000 on its installation. It is estimated that working life is 10 years and after 10 years its scrap value will be ₹ 20,000. Books are closed on 31st March every year.

Write necessary journal entries and prepare machine accounts for the first three years in the books of Anand traders according to the Straight Line Method.

Solution:

Original cost = Purchase price + Installation expenses

= 2,60,000 + 40,000

= ₹ 3,00,000

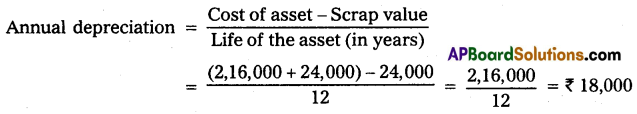

Question 5.

On 1st July 2011, Neeharika & Co purchased a printing machine for ₹ 2,16,000 and spent ₹ 24,000 on its installation. It was estimated that the effective useful life of the printing machine will be 12 years and its scrap value will be ₹ 24,000. The books are closed on 31st December every year.

Prepare printing machine account and depreciation account for the first three years according to the Straight Line Method.

Solution:

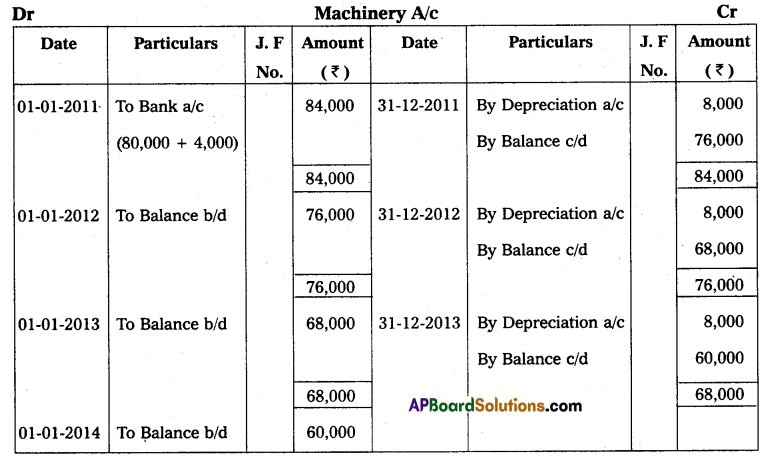

Question 6.

Madan & Company purchased machinery on 1st January 2011 for ₹ 80,000 and spent ₹ 4,000 for its installation. The estimated life of the machinery is 10 years with a scrap value of ₹ 4,000. Books are closed on 31st December every year.

Calculate the amount of annual depreciation under the Straight Line Method and prepare the machinery account for the first three years.

Solution:

Note: 2 and 3 entries are to be passed for another three years.

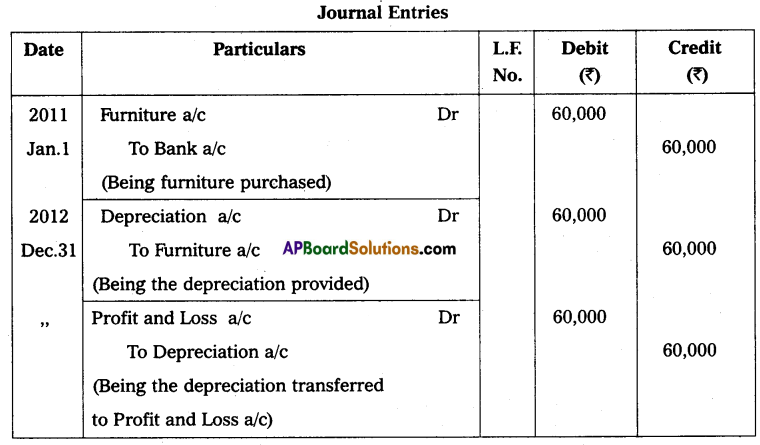

Question 7.

On 1st January 2011, Raghavendra traders purchased Furniture for ₹ 60,000. Depreciation is to be calculated at the rate of 10% p.a. on Straight Line method. The books are closed on 31st December every year. Write necessary journal entries and prepare Furniture Account for the first four years.

Solution:

![]()

Question 8.

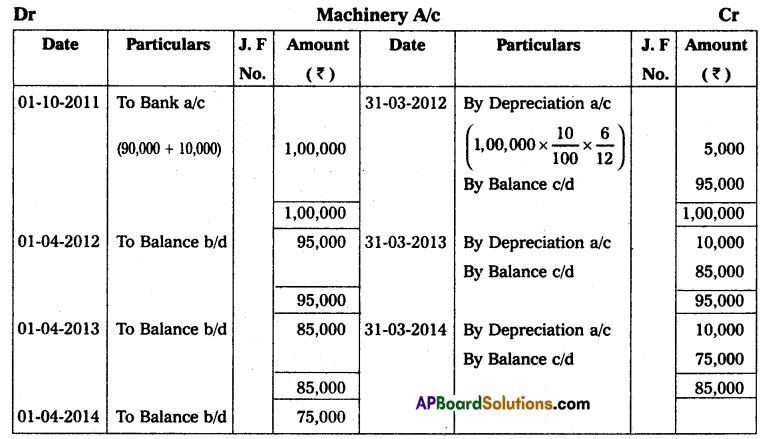

On 1st October 2011 Jagannadham & Sons purchased a machine for ₹ 90,000 and spent ₹ 10,000 for its installation. The books are closed on 31st March every year. The firm writes off depreciation at the rate of 10% on the original cost every year.

Prepare Machine Account and Depreciation Account for the first three years.

Solution:

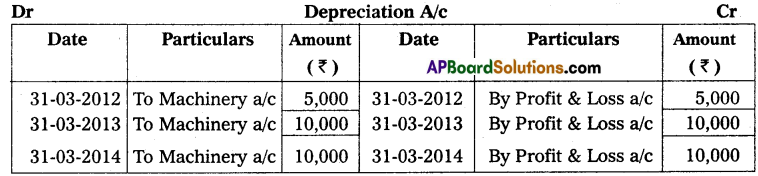

Question 9.

Venugopal traders limited purchased machinery on 1st July 2010 for ₹ 50,000 and spent ₹ 2,000 on its installation. Depreciation is to be provided at @10% p.a. under the Straight Line Method. Books of account are closed on 31st December every year.

Show the machinery account for the first three years.

Solution:

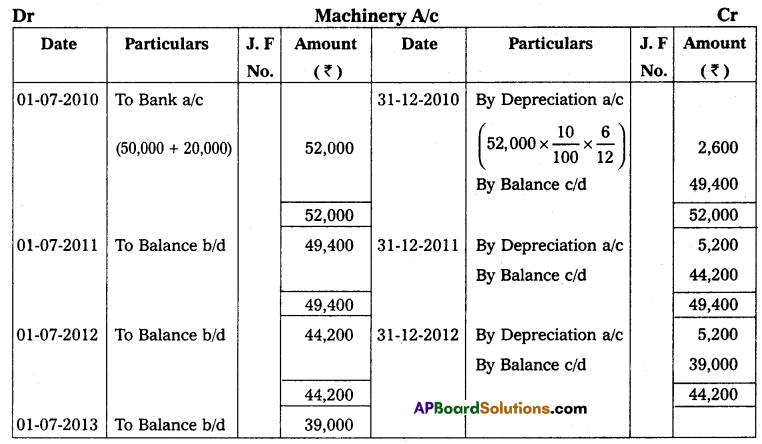

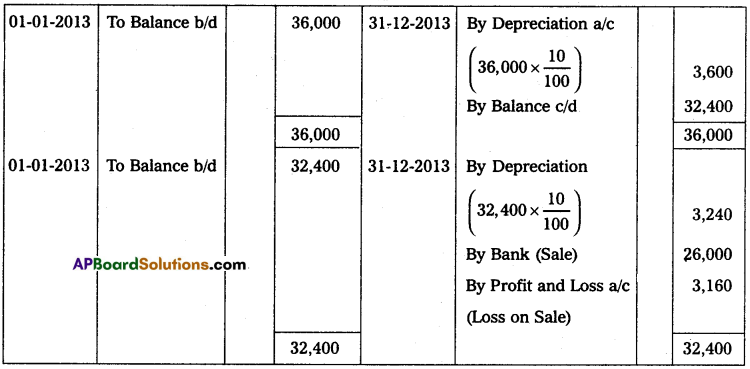

Question 10.

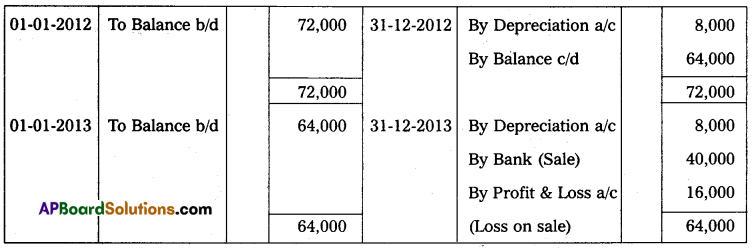

On 1st January 2011 Suma purchased Furniture for ₹ 80,000. Depreciation is to be provided annually at 10% under the Straight Line Method. On 31st December 2013 furniture was sold for ₹ 40,000.

Show the Furniture Account assuming that the books are closed on 31st December every year.

Solution:

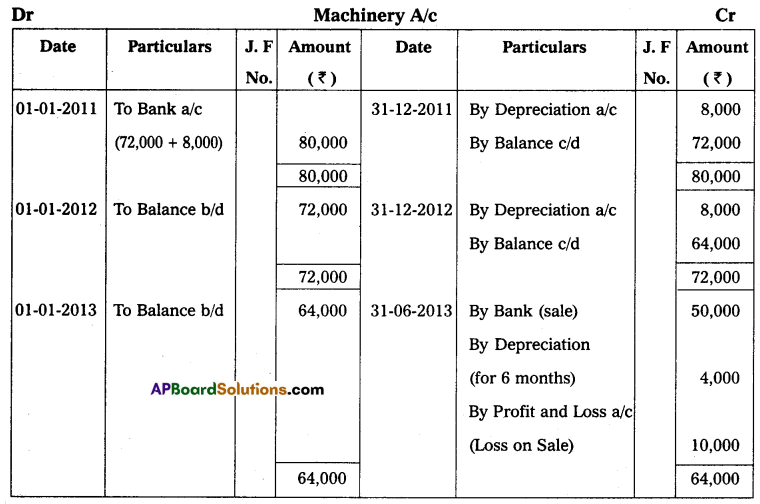

Question 11.

Suneetha traders purchased a second-hand machine for ₹ 72,000 on 1st January 2011 and spent ₹ 8,000 on repairs and installed the same. Depreciation is written off at 10% p.a.on the Straight Line Method. On 30th June 2013, the machine was sold for ₹ 50,000.

Prepare machinery accounts assuming that the accounts are closed on 31st December every year.

Solution:

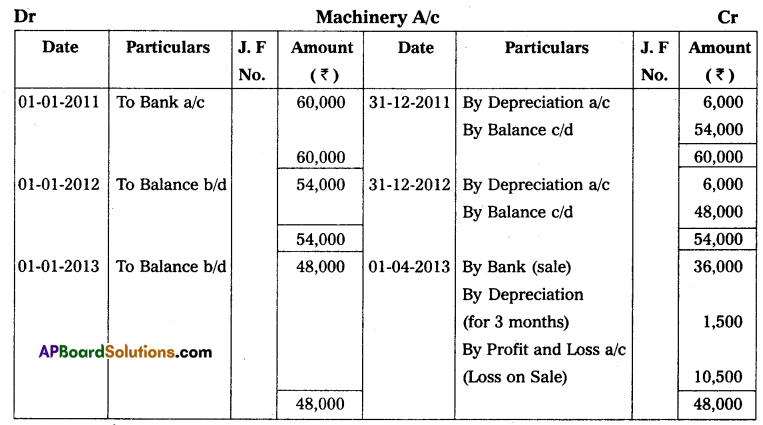

Question 12.

Ranadheer & Co purchased a machine for ₹ 60,000 on 1st January 2011. Depreciation is calculated at @10% on the Straight Line Method. On 1st April 2013, the company sold the machine for ₹ 36,000.

Prepare machine accounts assuming that the accounts are closed on 31st December every year.

Solution:

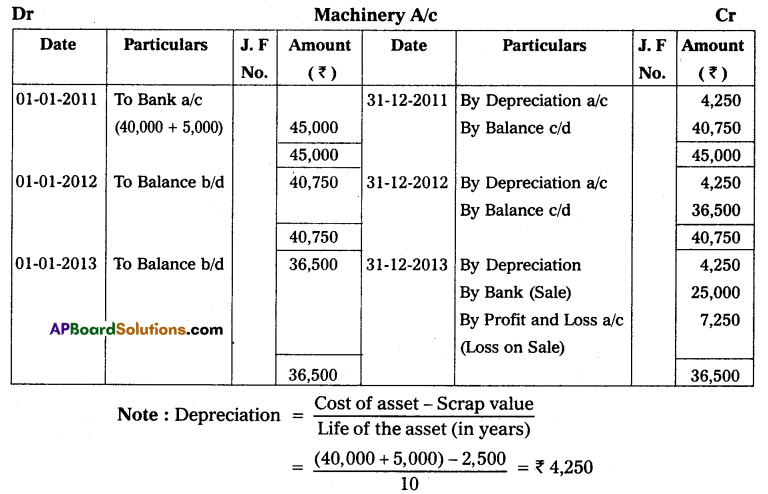

Question 13.

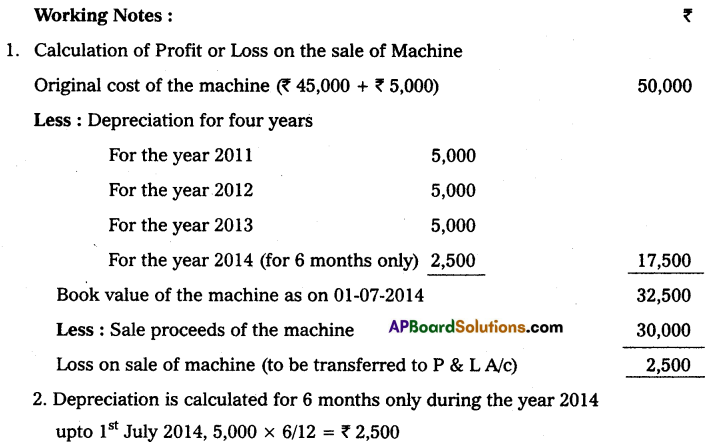

On 1st January 2011, Siva traders purchased a second-hand machine for ₹ 40,000 and spent ₹ 5,000 on repairs and installed the same. It is estimated that the working life of the machine is 10 years and the scrap value is ₹ 2,500. On 31st December 2013, the machine was sold for ₹ 25,000. Prepare machine account assuming that the books are closed on 31st December every year according to the Straight Line Method.

Solution:

![]()

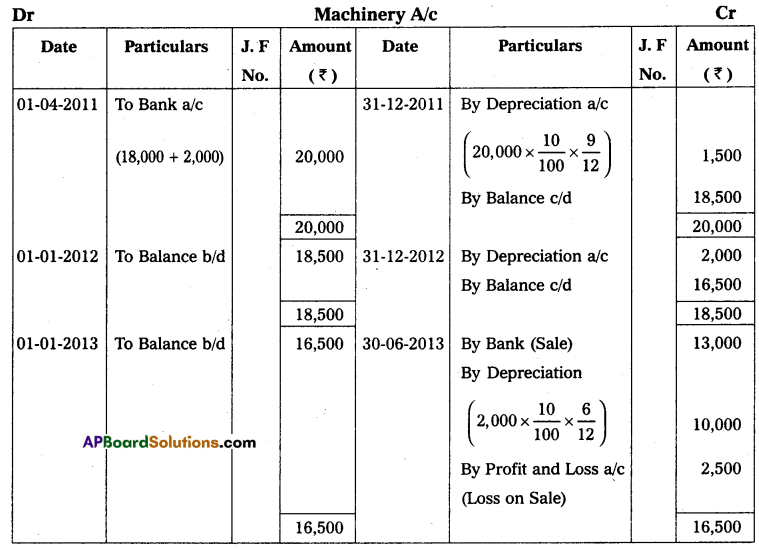

Question 14.

Manoj & Company purchased a second-hand machine for ₹ 18,000 on 1st April 2011 and spent ₹ 2,000 on repairs and installed the same. Depreciation is written off at 10% p.a. on the Straight Line Method. On 30th June 2013, it was sold for ₹ 13,000.

Prepare machine accounts assuming that the accounts are closed on 31st December every year.

Solution:

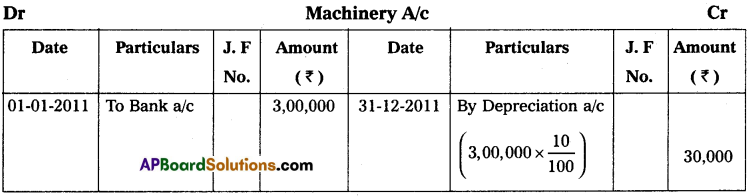

Question 15.

Ramesh & Co purchased machinery on 1st January 2011 for ₹ 3,00,000. On 1st September 2011, another machine was purchased for ₹ 4,20,000. Depreciation is provided on machinery at 10% p.a. on the Straight Line Method. Books are closed on 31st December every year.

Prepare machinery account for three years.

Solution:

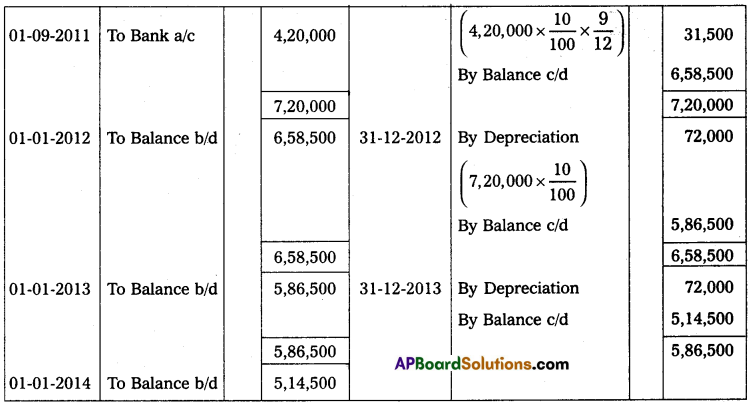

Question 16.

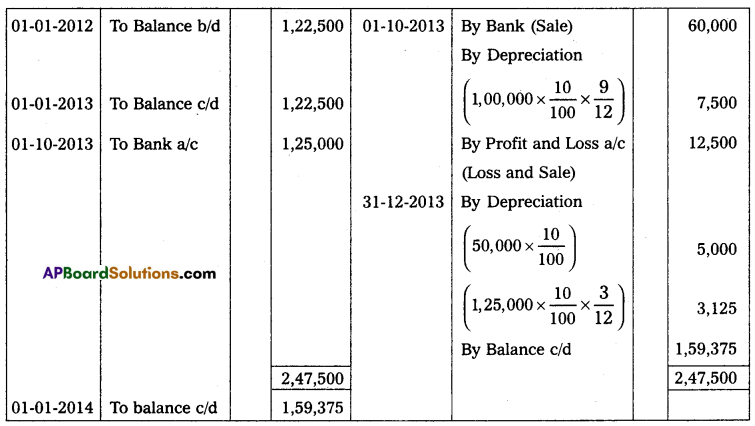

Andhra sugars Ltd. purchased a plant for ₹ 1,00,000 on 1st January 2011. On 1st July of the same year, an additional plant was purchased for ₹ 50,000. On 1st October 2013, the plant purchased on 1st January 2011 has become obsolete and was sold for ₹ 60,000. On the same date, a fresh plant was purchased for ₹ 1,25,000. Depreciation is provided at 10% p.a. on the Straight Line Method.

Prepare plant account for the years assuming that the accounts are closed on 31st December every year.

Solution:

Question 17.

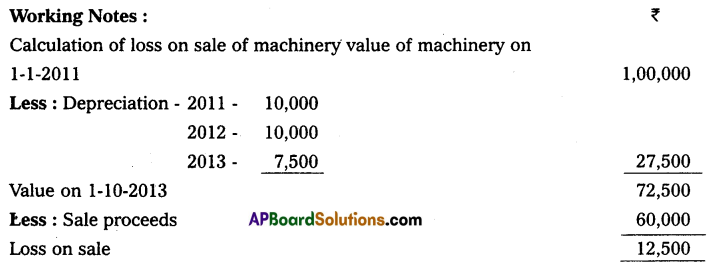

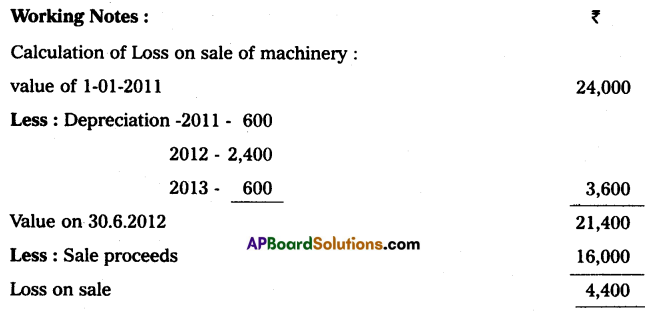

On 1st July 2010 Ganga & Co purchased a secondhand machine for ₹ 40,000 and spent ₹ 6,000 on repairs. On 1st January 2011, a new machine was purchased for ₹ 24,000. On 30th June 2012 the machine purchased on 1st January 2011 was sold for ₹ 16,000 and another machine was installed at a cost of ₹ 30,000. The company writes off depreciation @ 10% p.a. on the original cost every year on 31st March.

Show the machinery account for three years.

Solution:

Question 18.

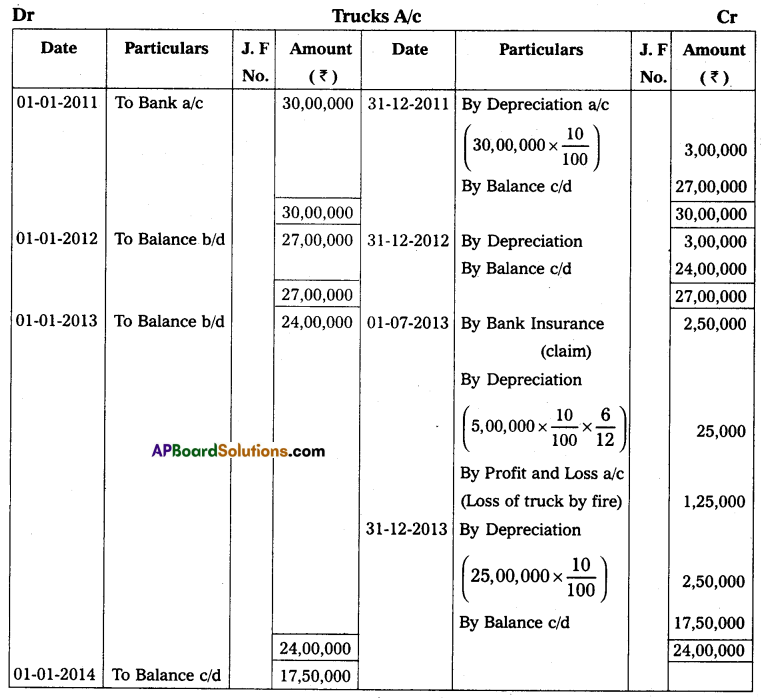

Rama transport company purchased 6 trucks at ₹ 5,00,000 each on 1st January 2011. The company writes off the depreciation of @10% p.a. on the original cost. The books of account are closed on 31st December every year. On 1st July 2013, one of the trucks is involved in an accident and completely destroyed. A sum of ₹ 2,50,000 is received from the insurance company in full settlement. Prepare Trucks Account for the first three years.

Solution:

Reducing Balance Method

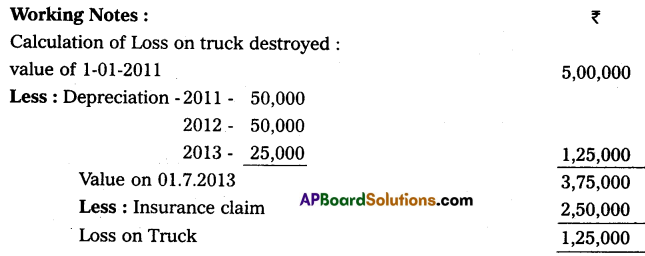

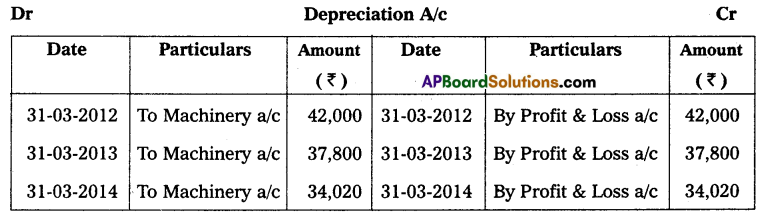

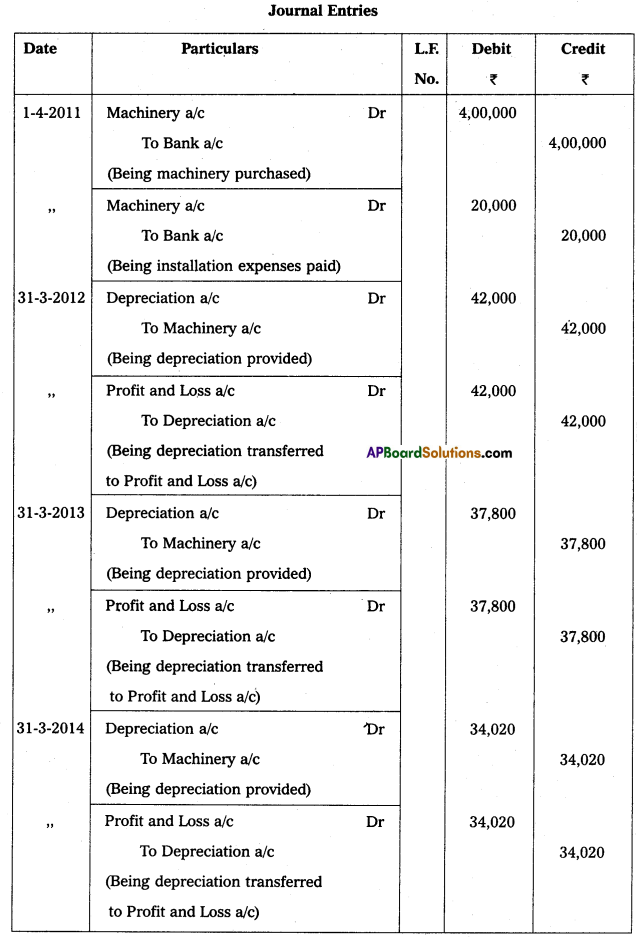

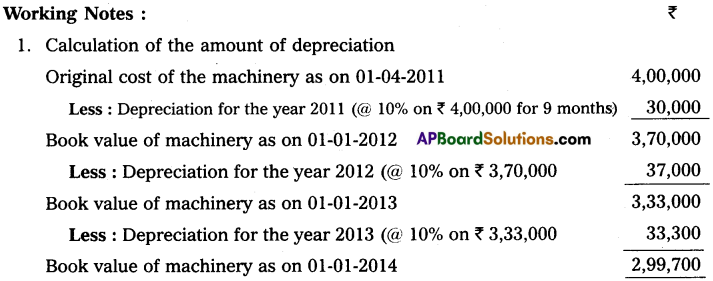

Question 19.

Kushal textile mills purchased machinery on 1st April 2011 for ₹ 4,00,000 and spent ₹ 20,000 for its installation. Depreciation is provided at @ 10% p.a. on the Reducing Balance Method. Books are closed on 31st March every year.

Write necessary journal entries and prepare Machinery Account and Depreciation Account for the first three years.

Solution:

![]()

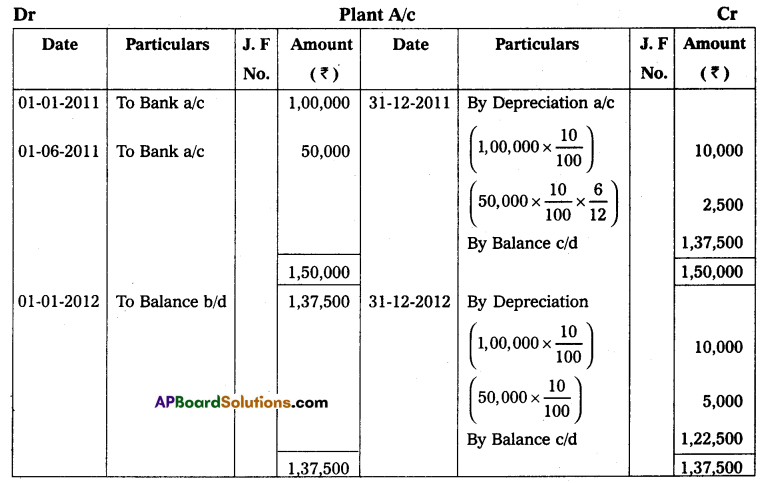

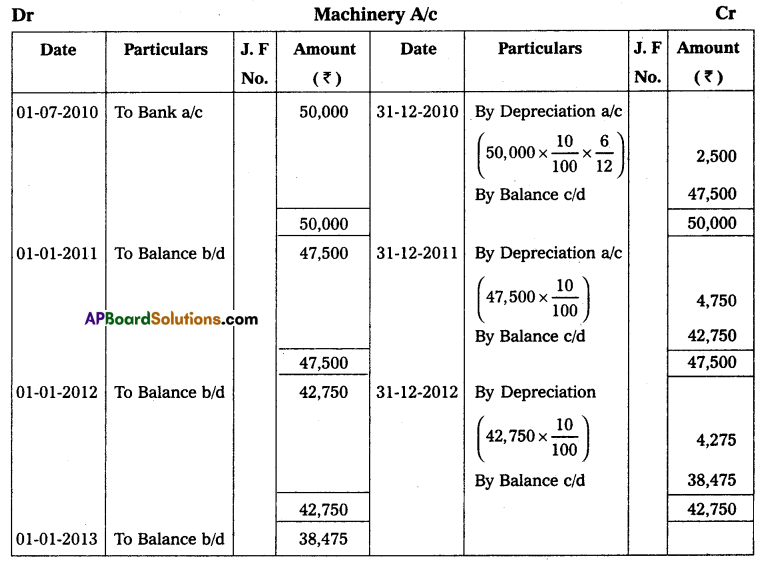

Question 20.

On 1st July 2010, Pradeep & Co purchased machinery for ₹ 50,000. Depreciation is written off at the rate of 10% p.a. under the Reducing Balance Method. Show the Machinery Account for 3 years assuming that the books are closed on 31st December every year.

Solution:

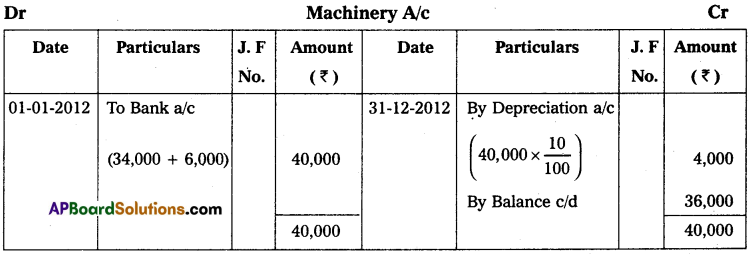

Question 21.

On 1st January 2012, Siva & Co purchased second-hand machinery for ₹ 34,000 and spent ₹ 6,000 on its repairs and installed the same. On 31st December 2014, the machinery was sold for ₹ 26,000. The books are closed on 31st December every year. Depreciation is provided @ 10% p.a. on the Reducing Balance Method. Show the Machinery Account.

Solution:

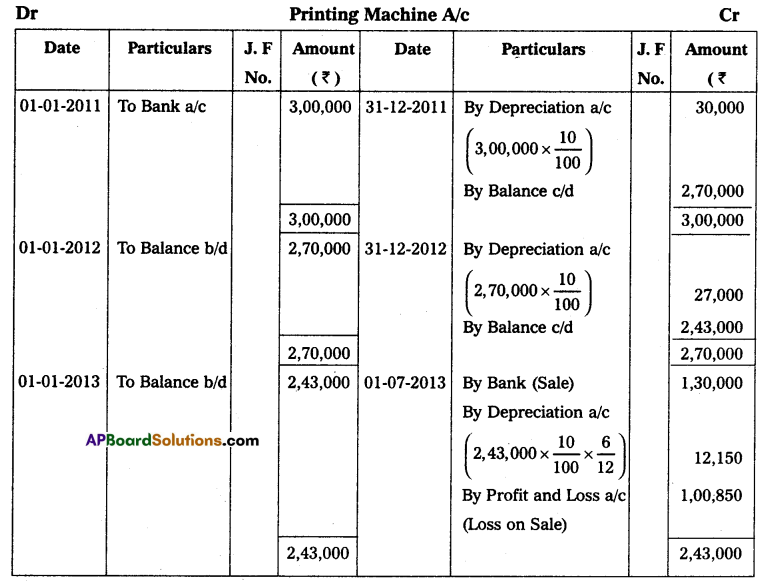

Question 22.

On 1st January 2011, Geetha traders purchased a printing machine for ₹ 3,00,000. On 1st July 2013, the printing machine was sold for ₹ 1,30,000. Depreciation is provided @ 10% p.a. on the Reducing Balance Method. The books are closed on 31st December every year.

Prepare Printing Machine Account.

Solution:

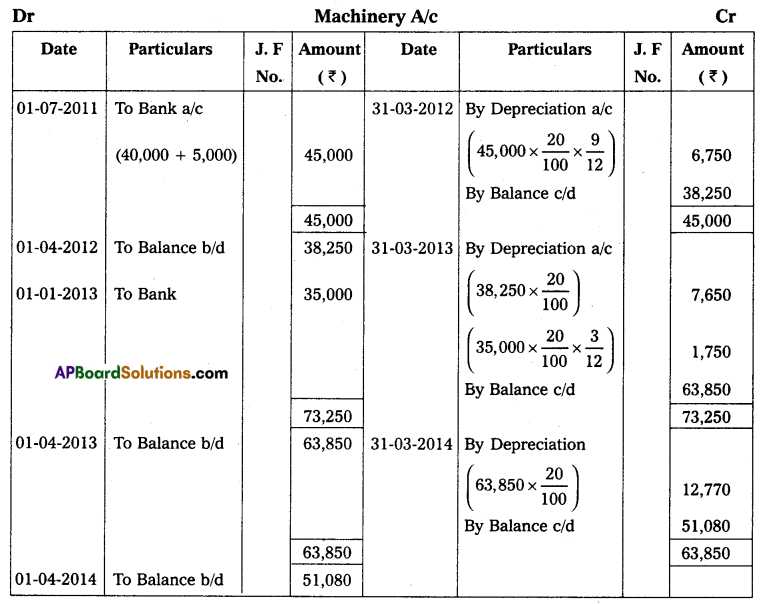

Question 23.

Sravanthi enterprises purchased a machine for ₹ 40,000 on 1st July 2011 and spent ₹ 5,000 on its installation. Another Machine for ₹ 35,000 was purchased on 1st January 2013. Depreciation is charged @ 20% p.a. on the Reducing Balance Method. Books are closed on 31st March every year. Prepare Machinery Account for three years.

Solution:

![]()

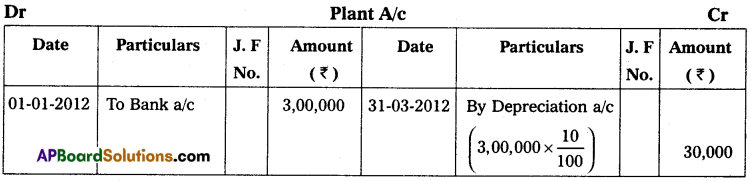

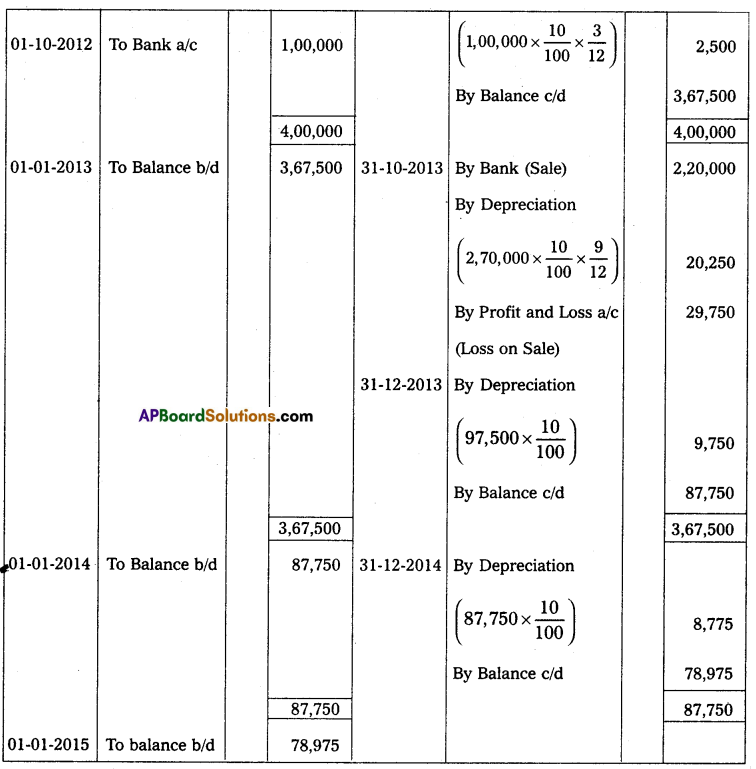

Question 24.

On 1st January 2012, Swathi & Co purchased the plant for ₹ 3,00,000. On 1st October 2012, another plant was purchased for ₹ 1,00,000. Depreciation is charged @10% p.a. on the Reducing Balance Method. On 1st October 2013, the first plant was Sold for ₹ 2,20,000.

Prepare plant account for three years assuming that the accounts are closed on 31st December every year.

Solution:

Textual Examples

Illustrations of Straight Line Method

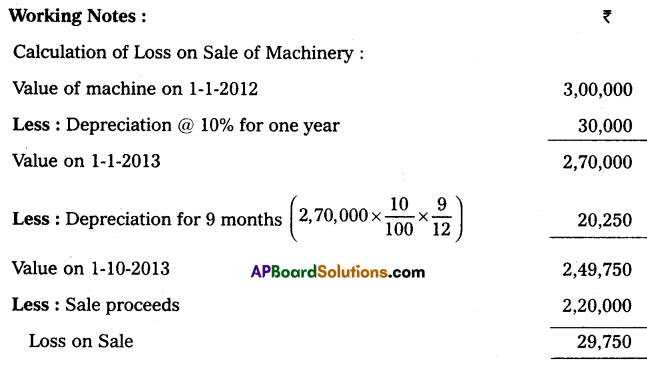

Question 1.

An Asset is purchased for ₹ 40,000. The useful life of the asset is 10 years and the residual value is ₹ 4,000. Find out the annual depreciation and the rate of depreciation under the straight-line method.

Solution:

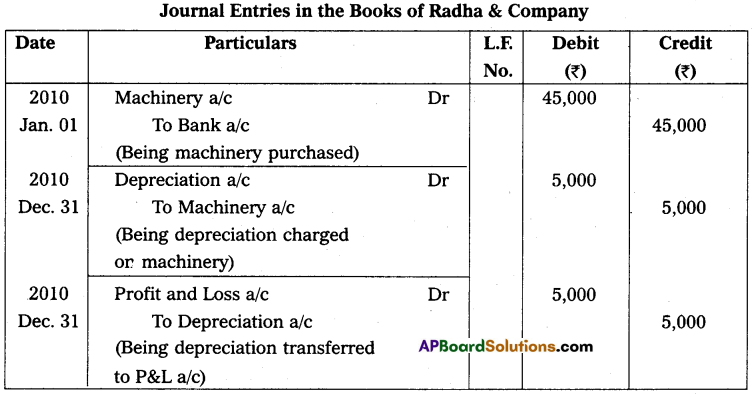

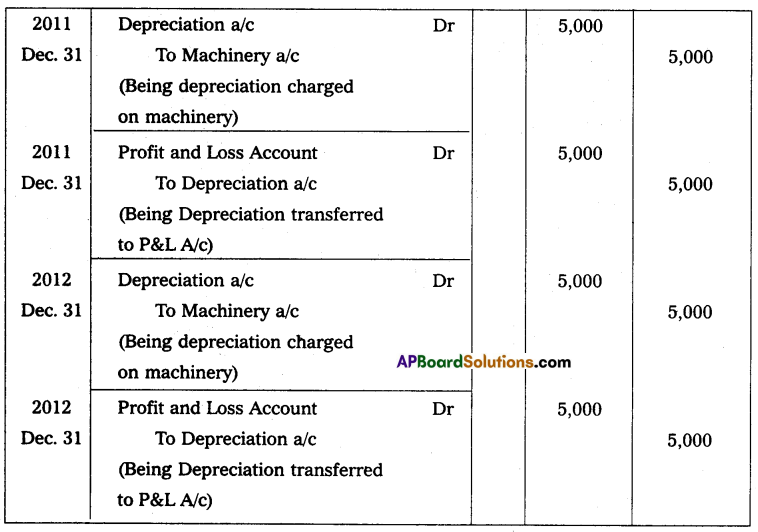

Question 2.

Radha & Company purchased machinery for ₹ 45,000 on 1st Jan 2010. The estimated life of the machinery is 8 years and the residual value at the end of its life period is ₹ 5,000. The books are closed on 31st December every year.

Write journal entries and show the Machinery Account and Depreciation Account for 3 years on the Straight Line Method.

Solution:

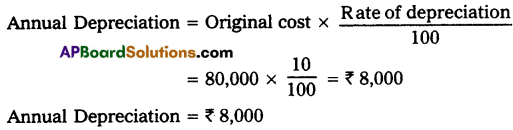

Question 3.

Vasavi & Co purchased machinery for ₹ 80,000 on 1st January 2011. Depreciation is provided annually at 10% on the original cost every year. Die books are closed on 31st December every year.

Prepare Machinery Account for the first 3 years.

Solution:

![]()

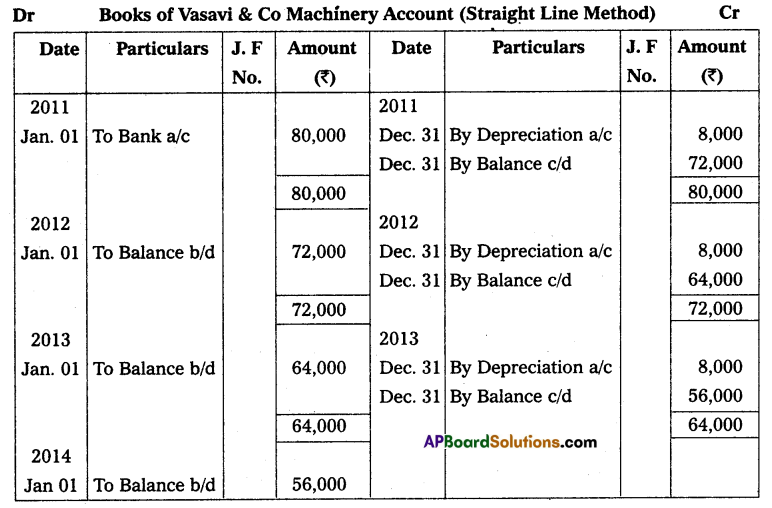

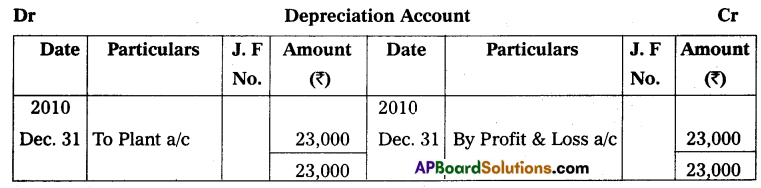

Question 4.

Narayana and Bros purchased a plant for ₹ 2,00,000 on 1st January 2010 and spent ₹ 50,000 for its installation. The salvage value of the plant after its useful life of 10 years is estimated to be ₹ 20,000. The Books are closed on 31st December every year.

Prepare Plant account and Depreciation Account for the first 3 years using the Straight Line Method.

Solution:

The original cost of Plant = Purchase price + Installation expenses

= 2,00,000 + 50,000

= ₹ 2,50,000

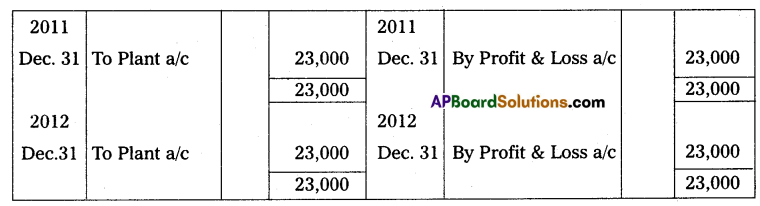

Question 5.

Rama Rao and his sons purchased a machine for ₹ 1,40,000 on 1st July 2011 and spent ₹ 10,000 for its installation. The firm writes off depreciation at the rate of 10% on the original cost every year. The books are closed on December 31st every year.

Prepare Machine Account and Depreciation Account for the three years.

Solution:

1. Original cost of Machine = Purchase price + Installation expenses

= 1,40,000 + 10,000

= ₹ 1,50,000

2. Annual depreciation = 1,50,000 × \(\frac{10}{100}\) = ₹ 15,000

3. Depreciation for the year 2011 = the Asset is used only 6 months from 01-07-2011.

Depreciation shall be provided only for 6 months i.e. ₹ 7,500

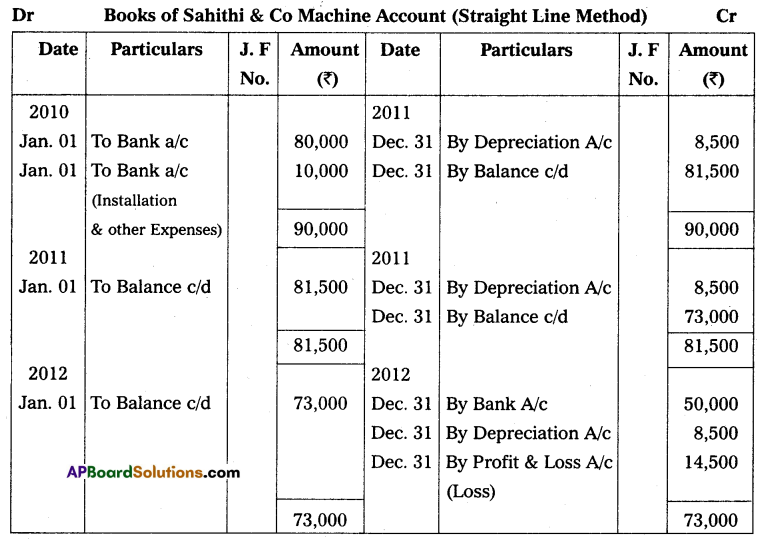

Question 6.

On 1st January 2010, Sahithi & Co purchased a second-hand machine for ₹ 80,000 and spent ₹ 4,000 on carriage inwards, ₹ 40,000 as repair charges, and ₹ 2,000 on installation expenses. It is estimated that the machine will have a scrap value of ₹ 5,000 at end of its useful life which is 10 years. On 31st December 2012, the machine was sold for ₹ 50,000. The books are closed on 31st December every year.

Prepare Machine Account.

Solution:

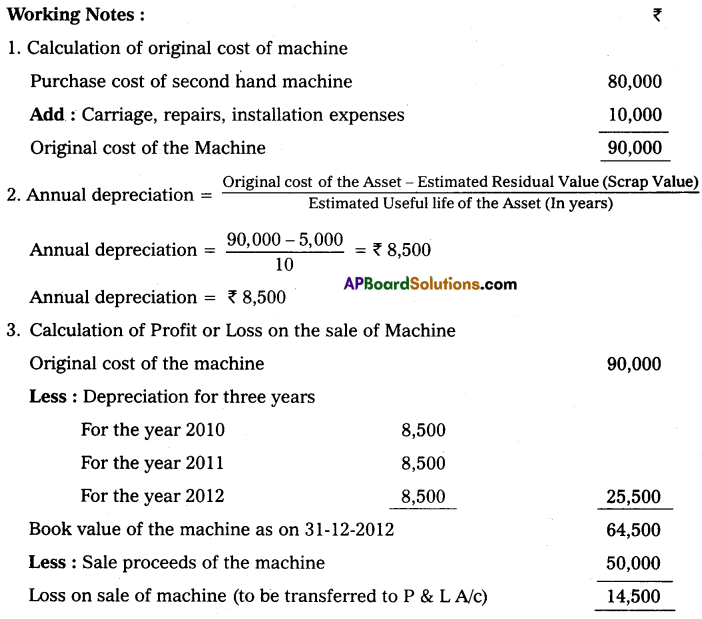

Question 7.

Nagaraju & Co purchased a second-hand machine on 1st January 2011, for ₹ 45,000 and spent ₹ 5,000 on repairs and installed the same. Depreciation is provided at the rate of 10% p.a. under the Straight Line Method. On 1st July 2014, the machine was sold for ₹ 30,000. The books are closed on 31st December every year.

Prepare the Machine Account.

Solution:

![]()

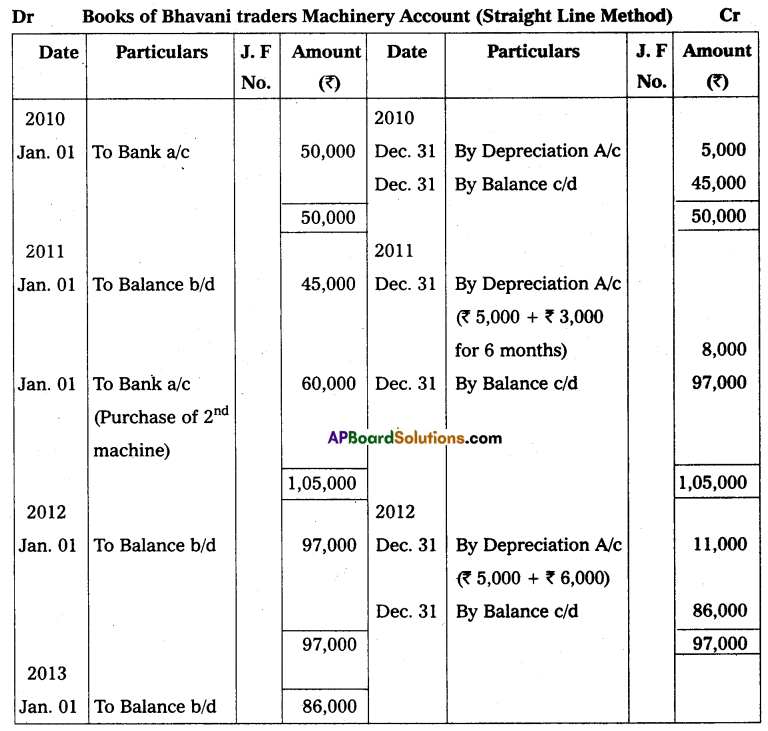

Question 8.

Bhavani traders purchased a machine for ₹ 50,000 on 01-01-2010. Another machine was bought on 01-01-2011 for ₹ 60,000 and used from 1st July 2011 onwards. The depreciation is provided at 10% per annum under the Straight Line Method. The books are closed on 31st December every year.

Prepare the machinery account for 3 years.

Solution:

Working Notes:

1. Annual depreciation is calculated as under.

1st Machine = 50,000 × \(\frac{10}{100}\) = ₹ 5,000

2nd Machine = 60,000 × \(\frac{10}{100}\) = ₹ 6,000

2. The Second machine was purchased on 1st January 2011, but started working from 1st July 2011. Hence the depreciation is calculated for 6 months only, i.e. from the date of use to the closing date of the year 2011.

Depreciation on 2nd machine for 6 months = 60,000 × \(\frac{6}{12}\) = ₹ 3,000

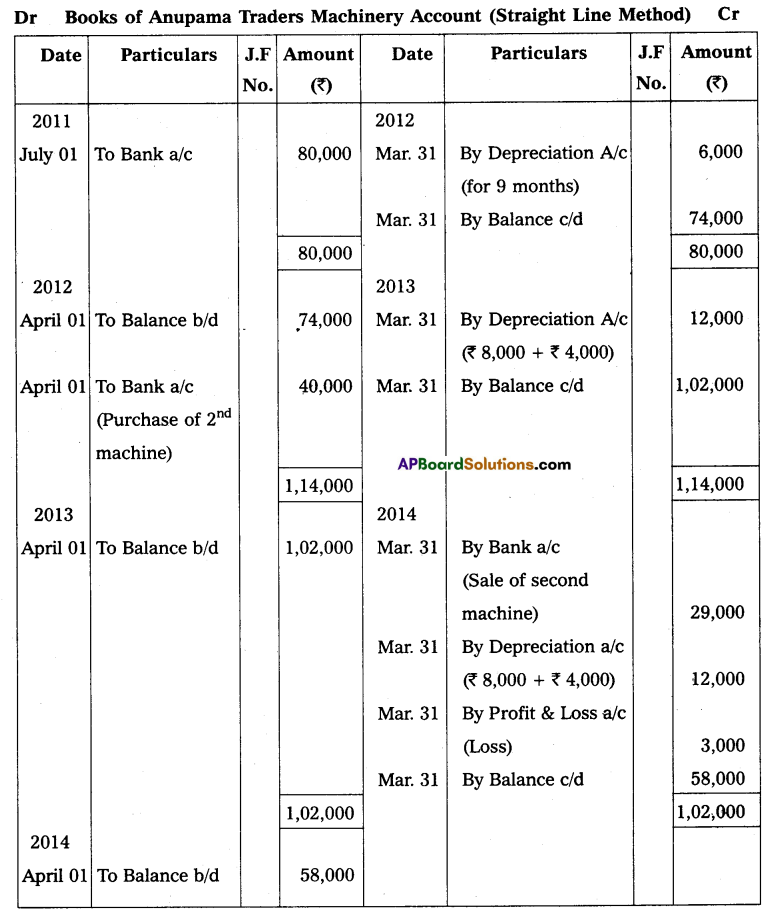

Question 9.

On 1st July 2011, Anupama Traders purchased a machine for ₹ 80,000. On 1st April 2012, the firm purchased another machine for ₹ 40,000. on 31st March 2014, the machine which was purchased on 1st April 2012 was sold for ₹ 29,000. The firm writes off 10% depreciation on the original cost. The books are closed on 31st March every year.

Show the machinery account for three years.

Solution:

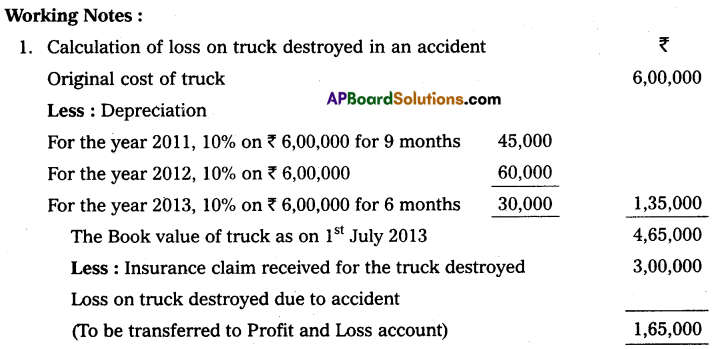

Question 10.

On 1st April 2011 Rajesh transport company purchased 4 trucks at ₹ 6,00,000 each. The company writes off depreciation @ 10% per annum on the original cost. On 1st July 2013, one of the trucks is involved in an accident and completely destroyed. Insurance company paid ₹ 3,00,000 in full settlement of the claim. The books are closed on 31st December every year.

Prepare trucks to account for three years.

Solution:

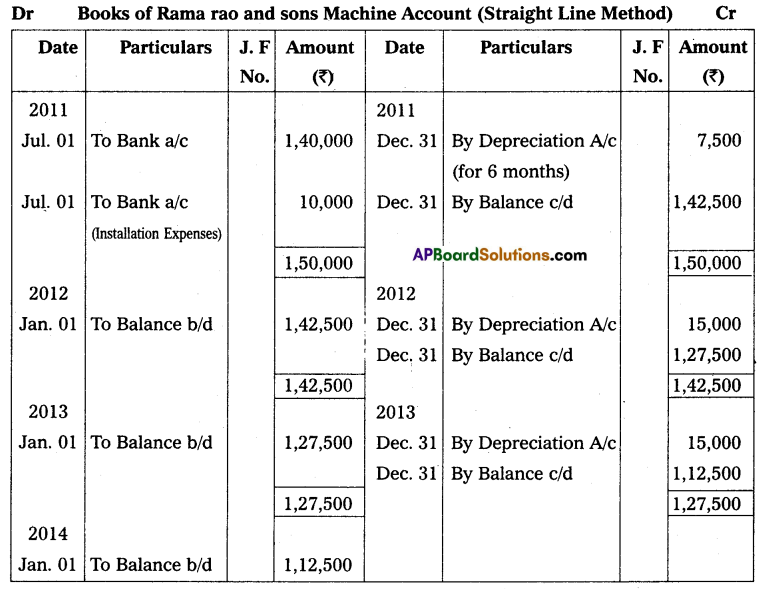

Difference between Straight Line Method and Reducing Balance Method

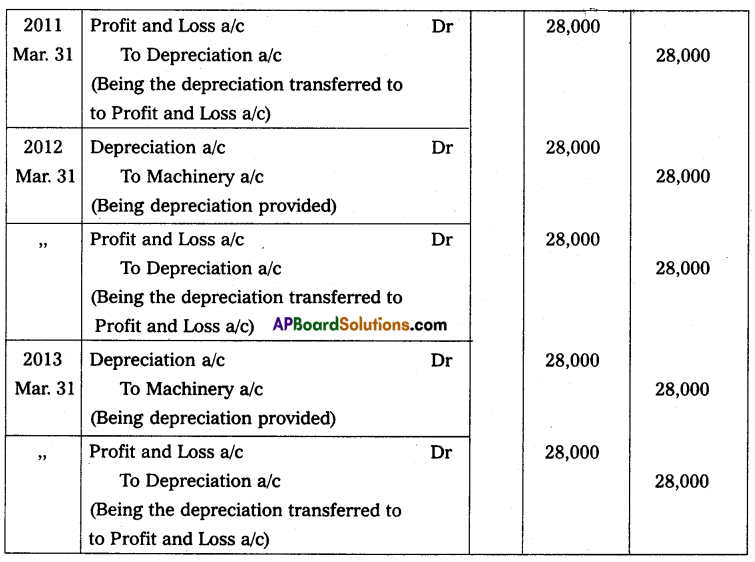

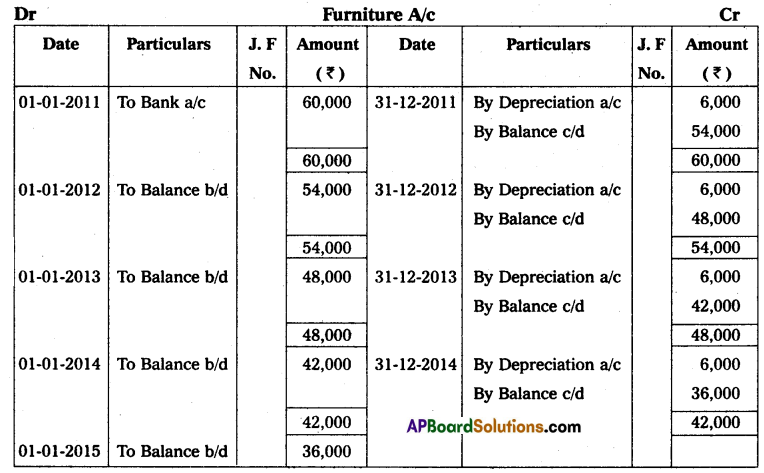

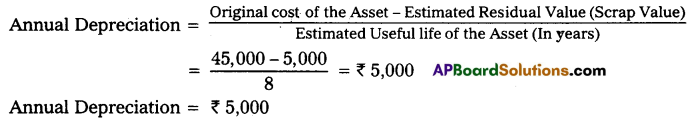

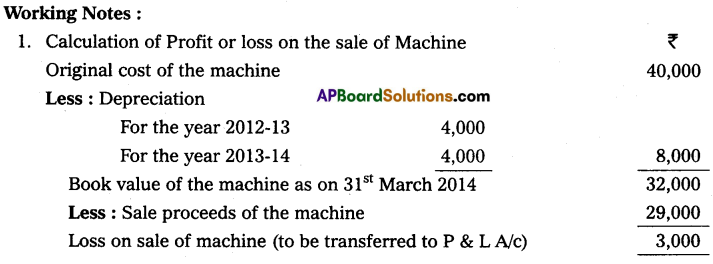

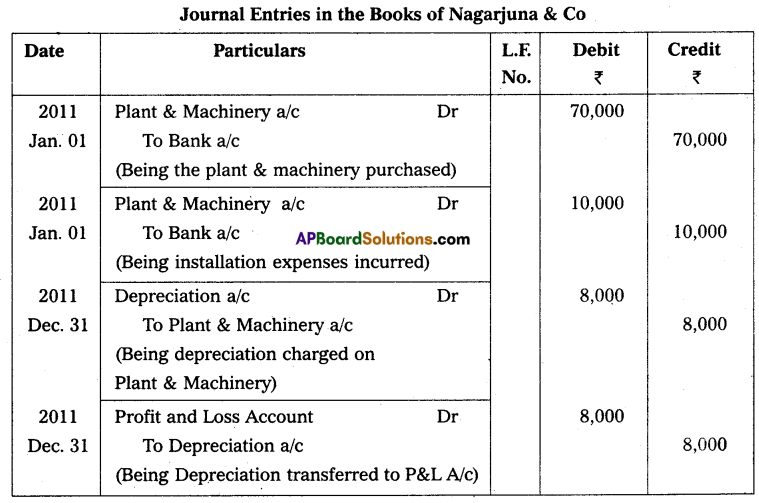

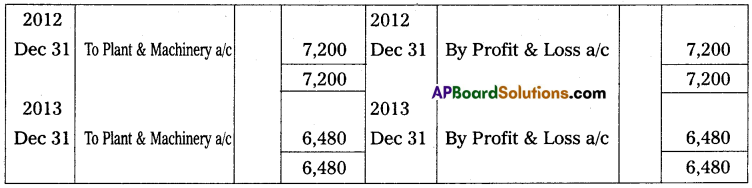

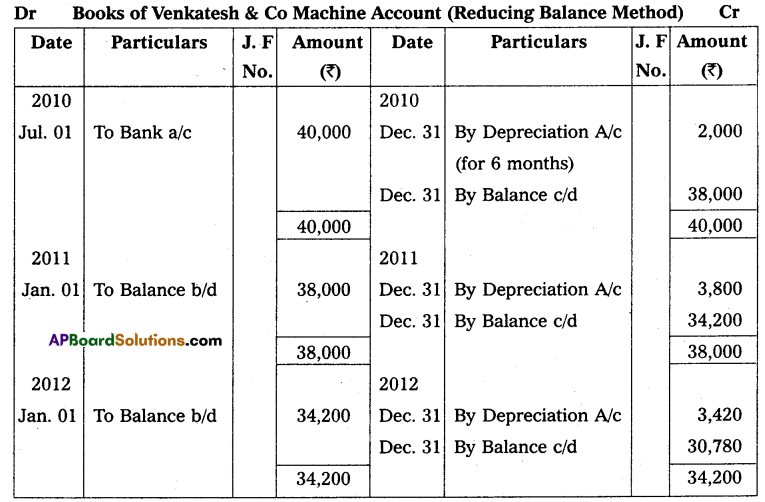

Question 11.

Nagarjuna & Co purchased plant and machinery for ₹ 70,000 on 1st January 2011 and spent ₹ 10,000. for installation expenses. Depreciation is to be provided at 10% on the Reducing Balance Method. Books are closed on 31st December every year.

Write the necessary journal entries and prepare the Plant and Machinery Account and Depreciation Account for three years.

Solution:

Journal Entries in the Books of Nagarjuna & Co

![]()

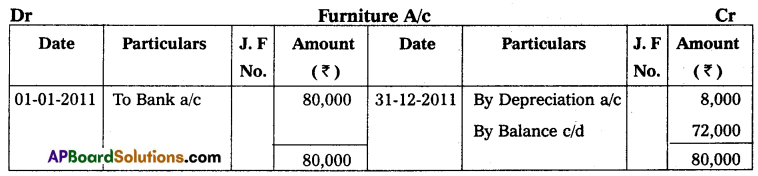

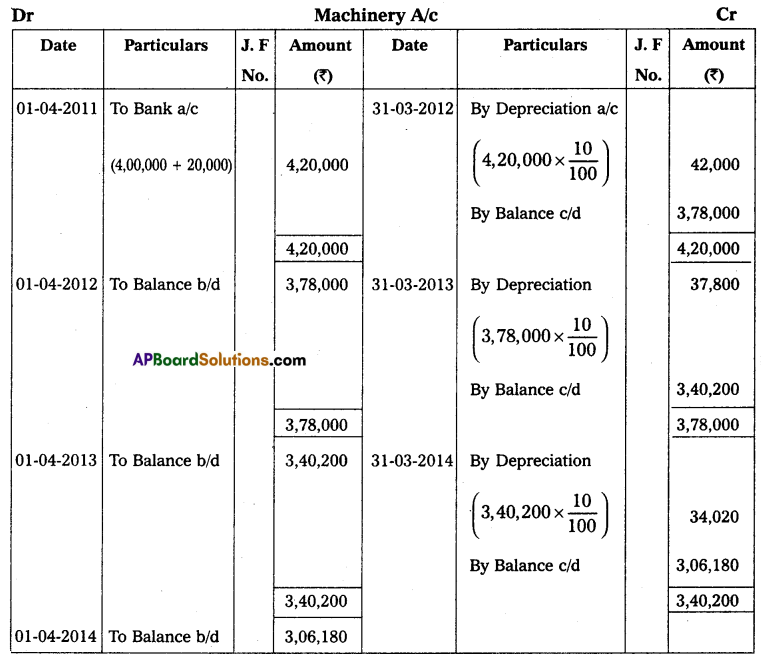

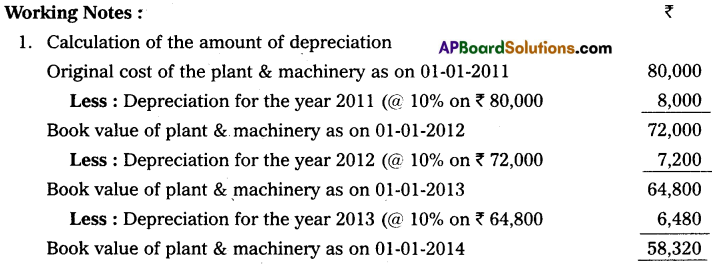

Question 12.

Sujatha enterprises purchased machinery on 1st April 2011 for ₹ 4,00,000. Depreciation is calculated @ 10% per annum on the Reducing Balance Method. Books are closed on 31st December every year.

Prepare Machinery Account for the first three years.

Solution:

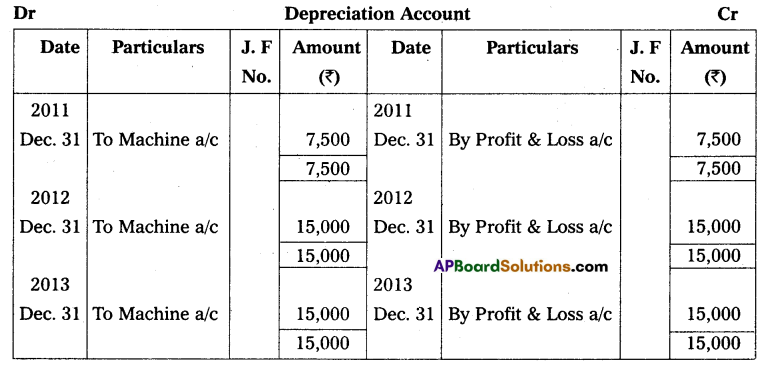

Question 13.

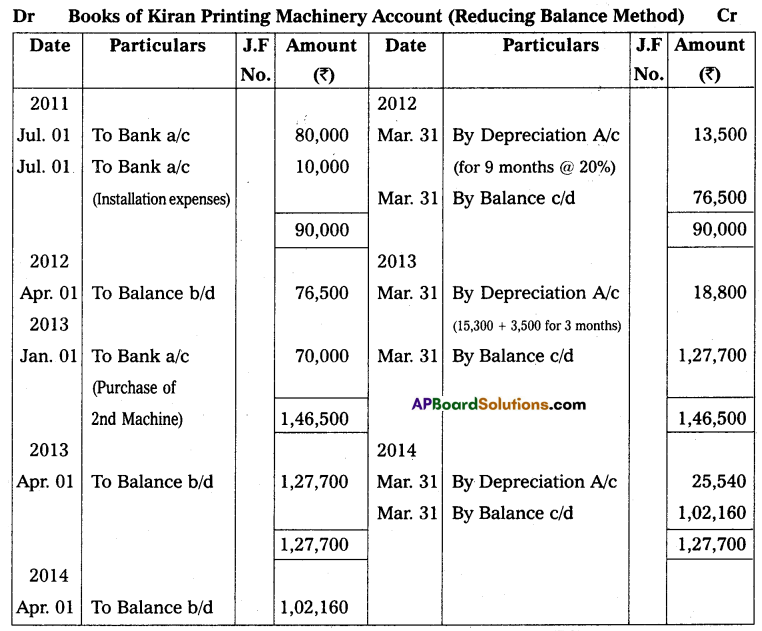

Kiran enterprises purchased a printing machine for ₹ 80,000 on 1st July 2011 and spent ₹ 10,000 on its transport and installation expenses. Another machine for ₹ 70,000 was purchased on 1st January 2013. Depreciation is charged at the rate of 20% on the Reducing Balance Method. Books are closed on 31st March every year.

Prepare printing Machine Account for three years.

Solution:

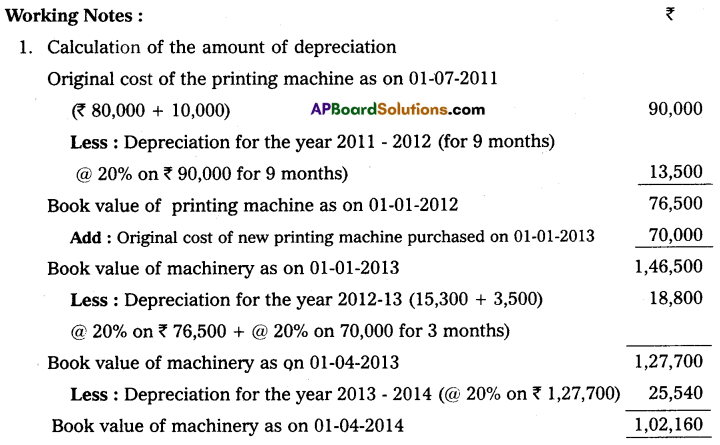

Question 14.

On 1st July 2010, Venkatesh & Co purchased a machine for ₹ 40,000. On 30th June 2013, the machine was disposed of for ₹ 26,000. The books are closed on 31st December every year. Depreciation is to be calculated @ 10% per annum on the Reducing Balance Method.

Show the Machine Account.

Solution:

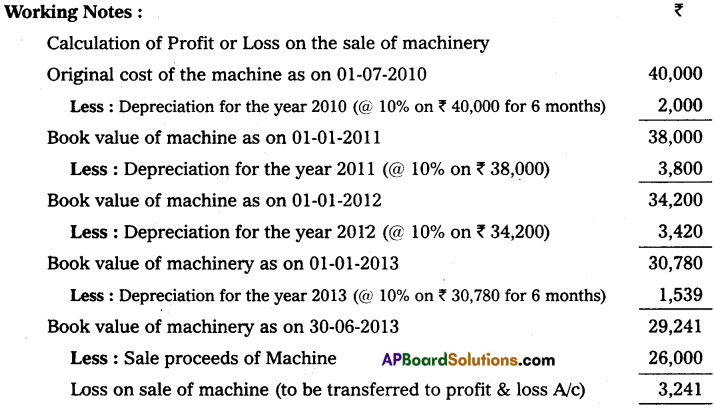

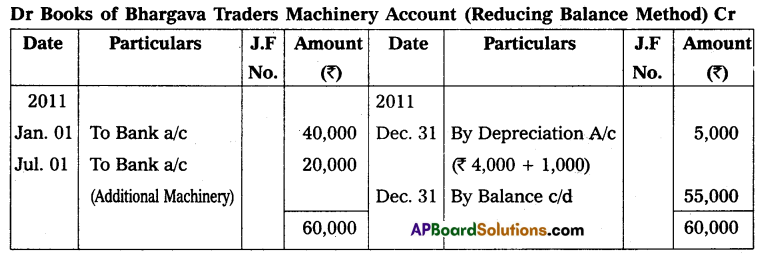

Question 15.

On 1st January 2011, Bhargava traders purchased machinery for ₹ 40,000. On 1st July of the same year, the firm purchased additional machinery for ₹ 20,000. On 1st July 2013, the machinery purchased on 1st January 2011 has become obsolete, it was sold for ₹ 32,000. The books are closed on 31st December every year.

Prepare Machinery Account for three years providing depreciation @ 10% p.a. on Reducing Balance Method.

Solution:

![]()

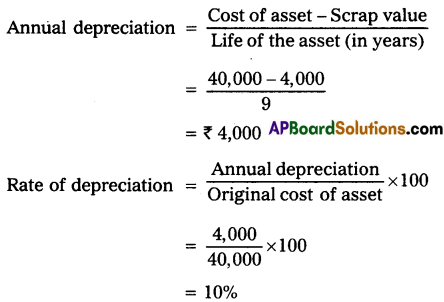

Question 16.

On 1st January 2010, Manjula & Co purchased a plant for ₹ 30,000. The company purchased another plant on 1st January 2011 for ₹ 28,000 and spent ₹ 2,000 on installation expenses. The books are closed on 31st December every year.

Show the plant account for the first three years providing depreciation at 10% on the first plant and 15% on the second plant on the Reducing Balance Method.

Solution: