Students must practice these AP Inter 1st Year Accountancy Important Questions 8th Lesson Cash Book to boost their exam preparation.

AP Inter 1st Year Accountancy Important Questions 8th Lesson Cash Book

Long Answer Questions

Question 1.

Describe the meaning and importance of cash book.

Answer:

Among the entire subsidiary books cash book is one of the important books. In this book we record cash receipts and cash payments. The main objective of cash book is to know the balance of cash at any given time. The person who maintains cash book is known as cashier. Business transactions are mainly two kinds.

- Cash Transactions

- Credit Transactions

All cash transactions are two types:

- Cash receipts

- Cash payments

Cash receipts should be recorded on debit side and cash payments are on the credit side. Generally cash book shows debit balance, because a business unit cannot pay more than its receipts.

![]()

Question 2.

Briefly explain the different types of cash books.

Answer:

The form of the cash book depends on the need, nature and scope of activities of a business firm.

They are as follows :

- Simple cash book

- Double column cash book

i) With cash and discount columns

ii) With bank and discount columns - Triple column cash book

- Analytical petty cash book

1) Simple Cash Book: The simple cash book is maintained by small business concern. Only cash transactions are recorded in this book. Cash receipts are to be recorded on the debit side and cash payments are on credit side. After entering all the transactions, the balance is ascertained like other accounts.

2) Double Column Cash Book:

a) Cash Book with Cash and Discount Columns : The transactions pertaining to cash and cash discounts are also recorded. To record the discount involved in any transactions one additional column on both sides of the cash book is provided. Discount column on the debit side should be named as discount allowed, and on the credit side discount received. They should not be balanced.

b) Cash Book with Bank and Discount Columns : Modern business organisations carry their transactions in the form of cheques through banks. The receipts and payments of the business are made through cheques. They maintain bank column in the cash book. The traders deposit money and cheques into bank account and make payments by cheques. The traders’ deposit through bank is having advantages of safety and convenience.

3) Triple Column Cash Book: This book also known as cash book with cash discount and bank columns. It contains three columns on both the sides. Three column cash book is used by big trading organisations, to record large number of cash and bank transactions of different nature.

4) Analytical Petty Cash Book: In large scale business organisation cash is paid and received through banks, but every day the organisation has to pay various small payments. It is not possible to pay small payments through cheques and enter in the cash book. Hence all petty payments of the business are recorded in a separate cash book which is called a Petty Cash Book,

Question 3.

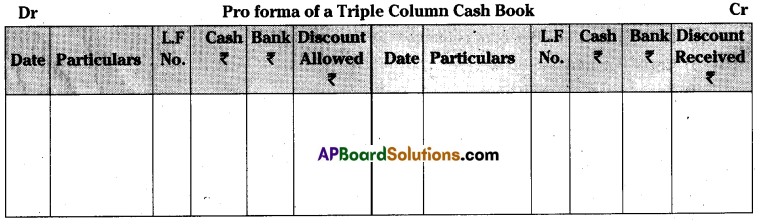

Write the importance of Triple column cash book and draw its pro forma.

Answer:

Triple column cash book contains three columns on both sides (debit and credit) in addition to date, particulars and L.F columns. Three column cash book is very useful to the big trading organisations for the following reasons.

- It helps to record cash Receipts and also Receipts through cheques.

- It is useful to record Cash Payments and also Payments by Cheques.

- It helps to record large number of cash and bank transactions of different nature.

- It is useful to record Contra Entries.

Question 4.

Explain the important points to be followed in the preparation of three column cash book.

Answer:

The following points are to be noted carefully while preparing three column cash book.

1) Opening cash and bank balances are recorded on the debit side of the cash and bank column as “To Balance b/d” in the particulars column.

2) If the overdraft is given as opening bank balance, it should be recorded on the credit side of Bank column.

3) All cash receipts should be recorded on the debit side cash column and cash payments are recorded in the cash column on the credit side.

4) If any cheque is received from customers and if it was not deposited in the bank on the same day, it should be debited to cash column.

5) If cheque is received and sent to bank on the same day, it should be debited to bank column.

6) Any payment made through cheque, should be credited to bank column on the credit side.

7) If discount amounts are involved either in cash or in bank transactions, discount allowed should be recorded on the debit side and discount received should be recorded on the credit side in the discount column.

8) If the cheques sent to bank for collection are dishonoured, it should be recorded in the bank column on debit side.

9) The transaction which is passed on both sides of the cash book is called ‘Contra Entry’. While opening bank a/c, cash deposited in bank, cash withdrawn from bank for personal use and cheque received on one day but deposited on another day. Contra entries will appear on both sides. It is denoted by “C”.

![]()

Short Answer Questions

Question 1.

Explain the advantages of cash book.

Answer:

Advantages of Cash Book:

- It helps to know the amount of cash received and the amount of cash paid by the Business Unit.

- It gives the Cash and Bank balances of a business unit at any given period.

- Mistakes or Fraud can be detected by verifying the closing balance of cash book with the actual amount of cash in hand.

- As cash book acts as Cash A/c, preparation of a separate Cash A/c (ledger) is not required.

Question 2.

Give the characteristics of cash book.

Answer:

Characteristics of Cash Book:

- Cash book is a Subsidiary Book.

- It records only Cash Transactions.

- Cash book serves as Cash Account.

- It records cash receipts on the debit side and cash payments on the credit side.

- Cash book will show Debit Balance only.

Very Short Answer Questions

Question 1.

Cash Discount [Mar ’17 (TS)]

Answer:

It is given for prompt and early payment. If a debtor pays the amount to the creditor on or before the due date, he may receive discount in the form of cash. It is known as cash discount. It is discount received for the debtor and discount allowed for the creditor. The discount column is maintained on both sides of the cash book.

Question 2.

Discount Allowed

Answer:

Discount given or allowed by the creditor is known as discount allowed. It is a loss for the creditor. This was allowed to the debtor for prompt payment.

Question 3.

Discount Received

Answer:

If a debtor pays the amount on or before the due date, he may receive discount in the form of cash. It is gain for the debtor. It is called discount received.

Question 4.

Contra entry [May. 2019; May ’17-T.S.; Mar. 2018]

Answer:

The transaction which is recorded on both sides of Triple column cash book i.e. Cash and Bank on the opposite sides is called contra entry. Contra means opposite side. It should be denoted by “C” in the L.F column on both sides of Triple Column Cash Book.

![]()

Question 5.

Imprest System

Answer:

In this system petty cash payments for a period is estimated and that amount is given to the petty cashier as advance. The cashier makes payments from this amount and records them in petty cash book. At the end of a particular period the petty cashier submits petty cash book to the Head Cashier. The Head Cashier scrutinizes the petty payments and issues a fresh cheque equal to the amount of petty expenses paid. This system of book keeping is called Imprest System.

Problems

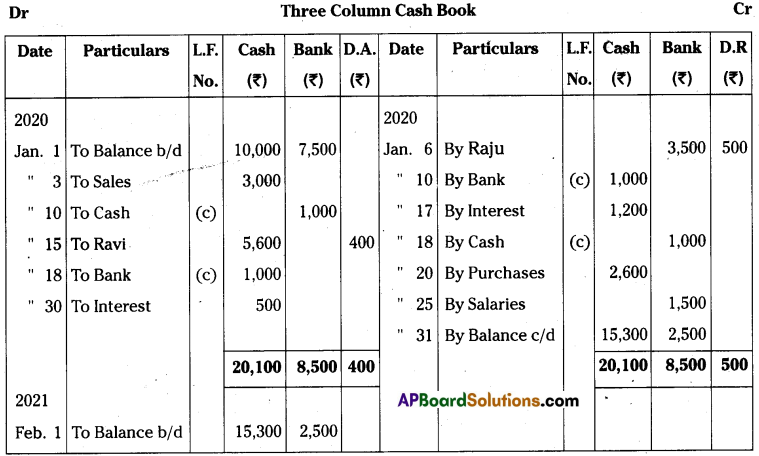

Question 2.

Enter the following transactions in single column cash book of Farma traders

2013 — Rs.

Dec. 1 — Cash in hand — 11,500

2 — Sold goods — 2,600

5 — Purchased furniture — 3,500

8 — Purchased goods for Cash — 2,000

10 — Stationery Purchased — 700

12 — PaId to Vasu — 900

15 — Purchased goods from Sekhar — 650

18 — Paid telephone bill — 500

20 — Sold goods to Han — 800

25 — Paid Interest — 250

29 — Paid cash to Sekhar — 650

30 — Received Commission — 400

Answer:

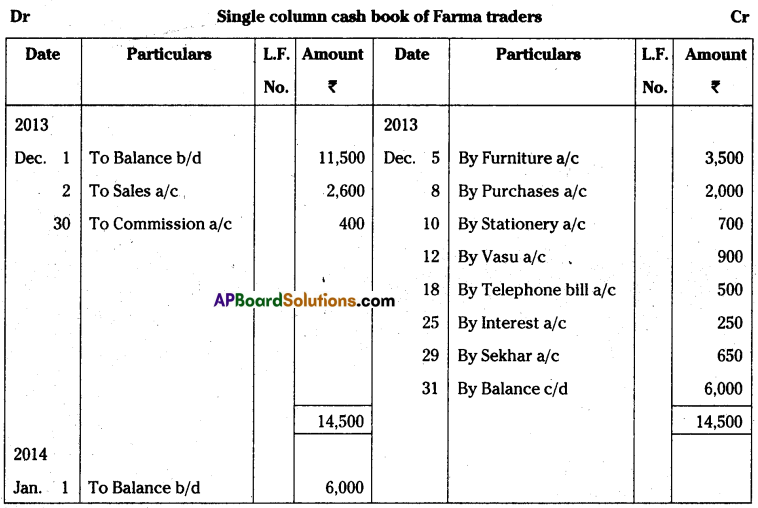

Question 3.

Prepare Simple Cash Book as on 31.3.2014.

2014 — Rs.

March 1 — Started Business with — 10,000

4 — Purchases — 2,000

6 — Deposited cash into bank — 3,000

8 — Sales — 1,200

10 — Purchased goods from Ramesh on Cash — 500

14 — Paid Managers Salary — 800

16 — Paid Office Expenses — 300

17 — Purchased Stationary — 350

21 — Sold old Machine — 900

23 — Drawings — 700

25 — Paid Rent — 1,500

29 — Received Interest — 550

31 — Paid travelling expenses — 825

Answer:

![]()

Question 4.

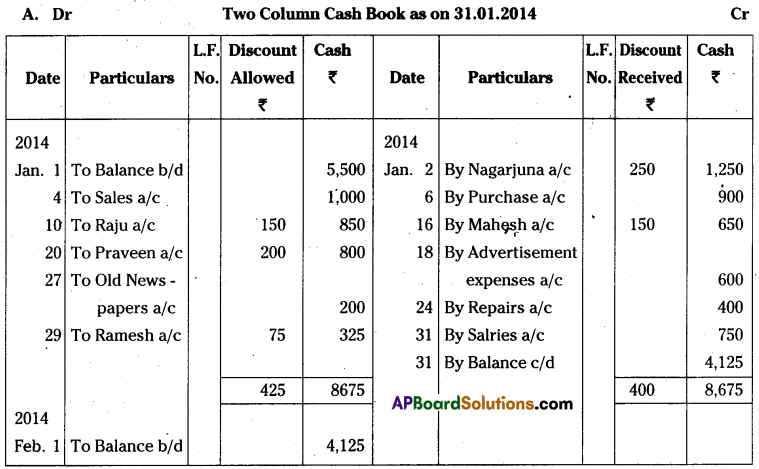

Record following transactions in Two Column Cash book as on 31.1.2014:

2014 — Rs.

Jan 1 — Balance of cash — 5,500

2 — Paid to Nagarjuna — 1250

Discount received — 250

4 — Cash Sales — 1000

6 — Cash Purchases — 900

10 — Received Cash from Raju — 850

Discount allowed — 150

16 — Paid Cash to Mahesh — 650

Discount received — 150

18 — Paid Advertisements expenses — 600

20 — Received cash from Praveen — 800

Discount allowed — 200

24 — Paid for Repairs — 400

27 — Sold old newspapers — 200

29 — Received Cash from Ram — 325

Discount allowed — 75

31 — Paid Salaries — 750

Answer:

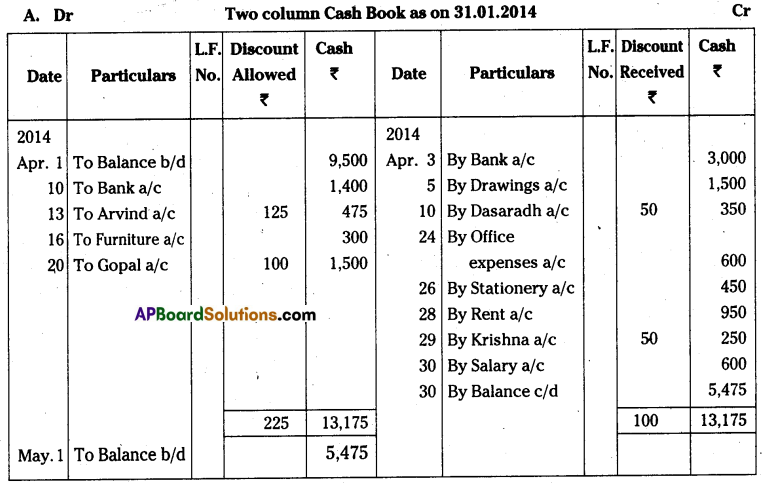

Question 5.

Prepare Double Column Cash Book with Cash and Discount Columhs:

2014 — Rs.

April 1 — Cash in hand — 9500

3 — Deposited cash into bank — 3000

5 — Drawings — 1500

10 — Withdrawn Cash from bank — 1400

12 — Paid Cash to Dasarath — 350

Discount received — 50

13 — Received Cash from Arvind — 475

Discount allowed — 125

16 — Sold old furniture — 300

20 — Cash Received from Gopal — 1500

Discount allowed — 100

24 — Paid office expenses — 600

26 — Paid for stationery — 450

28 — Rent paid — 950

29 — Paid cash to Krishna — 250

Discount received — 50

30 — Paid Salary — 600

Answer:

![]()

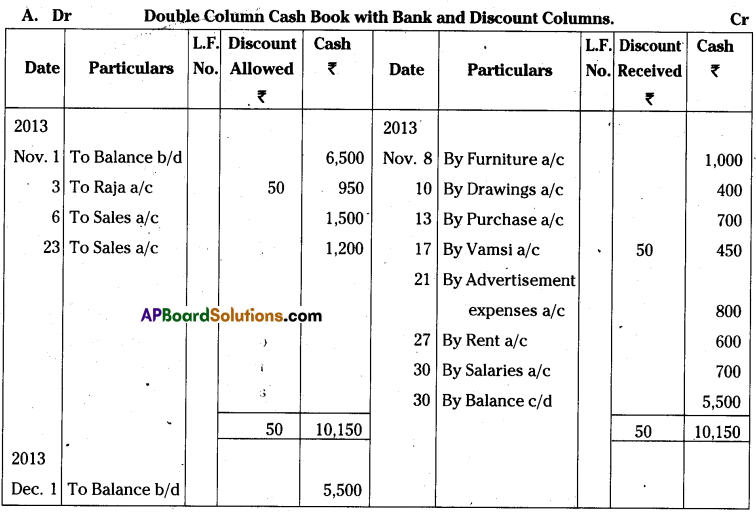

Question 6.

Prepare Double Column Cash Book from the following.:

2014 — Rs.

Feb 1 — Cash in hand — 13000

4 — Paid to Charan — 1800

Discount received — 200

5 — Deposited into Bank — 4000

8 — Drawings — 400

10 — Paid cash to Chandu — 500

Discount received — 100

13 — Cash Sales — 450

15 — Received cash from Reddy Traders — 700

Discount allowed — 200

17 — Cash Purchases — 550

20 — Goods sold to Sripathi — 1000

23 — Wages paid — 250

25 — Received cash from Bhasha — 450

Allowed him discount — 50

27 — Paid cash to Madhu — 370

Discount received — 30

28 — Paid for carriage — 200

Answer:

Hint: Transaction dated 20th is a credit Transaction.

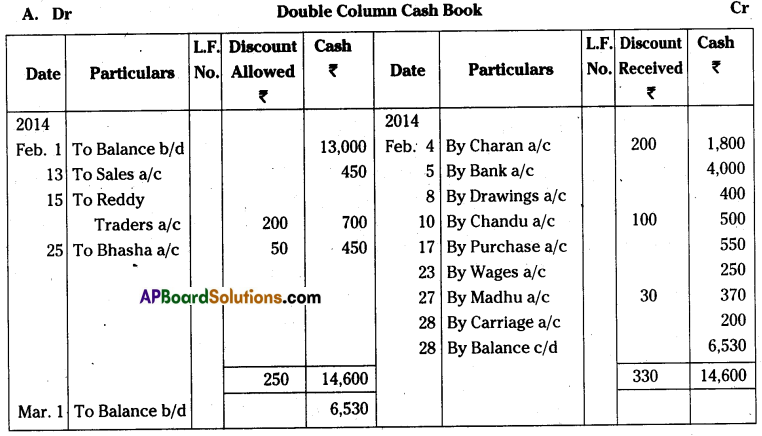

Question 7.

Prepare Two column cash book with Bank and Discount columns from the following:

2013 — Rs.

Nov. 1 — Opening Balance — 6500

3 — Received cheque from Raj — 950

Discount allowed — 50

6 — Sales — 1500

8 — Furniture purchased and paid by cheque — 1000

10 — Withdrawn from bank for personal use — 400

13 — Purchases — 700

17 — Paid to Vamsi by cheque — 450

In settlement of his account — 500

21 — Advertisement expenses — 800

23 — Sold goods to Ramana and received Cheque — 1200

27 — Paid rent to landlord — 600

30 — Salaries paid — 700

Answer:

Question 8.

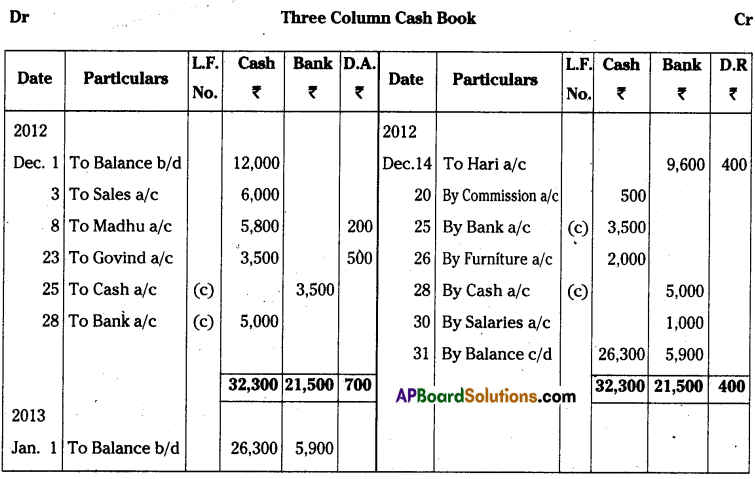

Prepare Three Column Cash Book.

2012 — Rs.

Dec. 1 — Cash in hand — 12000

Cash at bank — 18000

3 — Cash Sales — 6000

8 — Received Cash from Madhu — 5800

Discount allowed — 200

14 — Issued Cheque to Hari — 9600

Discount received — 400

20 — Paid Commission — 500

23 — A Cheque Received from Govind — 3500

allowed him discount — 500

25 — Govind cheque deposited into Bank

26 — Bought furniture — 2000

28 — Withdrew from bank for office use — 5000

30 — Salaries paid by Cheque — 1000

(Hint: Transactions dated 25th and 28th are Contra entries.)

Answer:

![]()

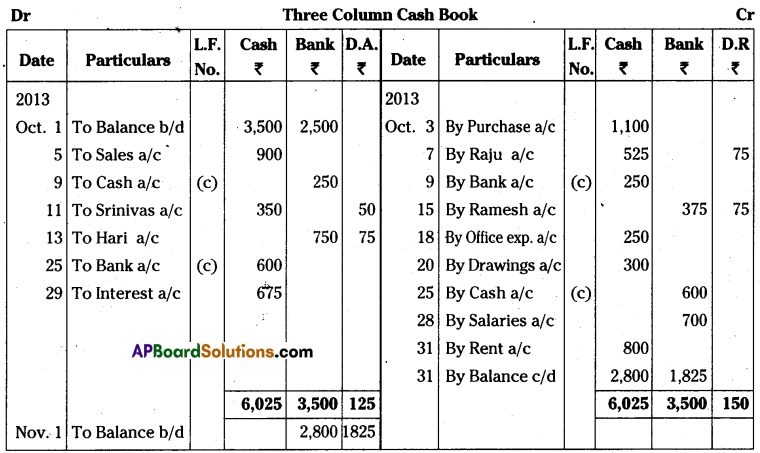

Question 9.

Prepare three column cash book from the following particulars:

2013 — Rs.

Oct. 1 — Cash in Hand — 3500

Balance at Bank — 2500

3 — Purchases — 1100

5 — Sold goods for Cash — 900

7 — Paid cash to Raju — 525

Discount received — 75

9 — Deposited cash into Bank — 250

11 — Received cash from Srinivas — 350

Discount received — 50

13 — Received cheque from Hari and — 750

Discount received — 75

Hari cheque deposited into bank

15 — Paid to Ramesh by Cheque — 375

Discount received — 75

18 — Paid office expenses — 250

20 — Drawings — 300

25 — Withdrawn cash from bank for office use — 600

28 — Paid Salaries through cheque — 700

29 — Received Interest — 675

31 — Paid Rent — 800

Answer:

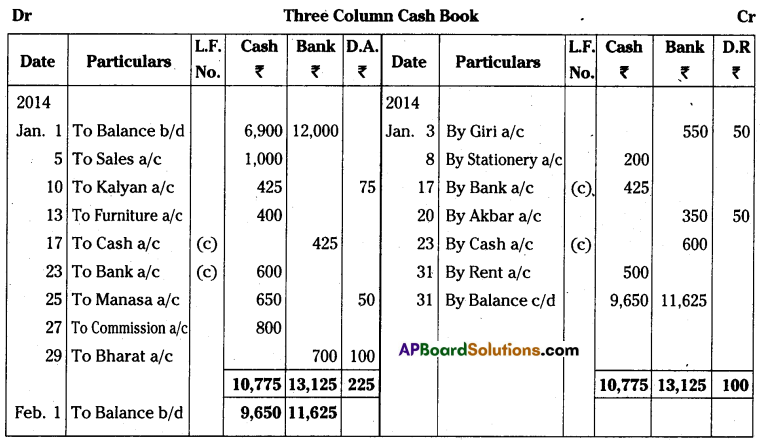

Question 10.

Prepare Triple Column Cash Book from the following:

2014 — Rs.

Jan 1 — Cash in Hand — 6900

Cash at Bank — 12000

3 — Issued cheque to Giri — 550

Discount received — 50

5 — Cash Sales — 1000

8 — Paid for Stationery — 200

10 — Received cheque from Kalyan — 425

Discount received — 75

13 — Sold old furniture — 400

15 — Purchased goods from Manasa — 700

17 — Deposited Kalyan cheque into Bank

20 — Paid to Akbar by cheque — 350

Discount received — 50

23 — Taken cash from bank for office use — 600

25 — Received cash from Manasa — 650

Discount received — 50

27 — Received commission — 800

29 — Received cheque from Bharath — 700

Discount received — 100

Bharath cheque sent to bank

31 — Paid rent 500

Answer:

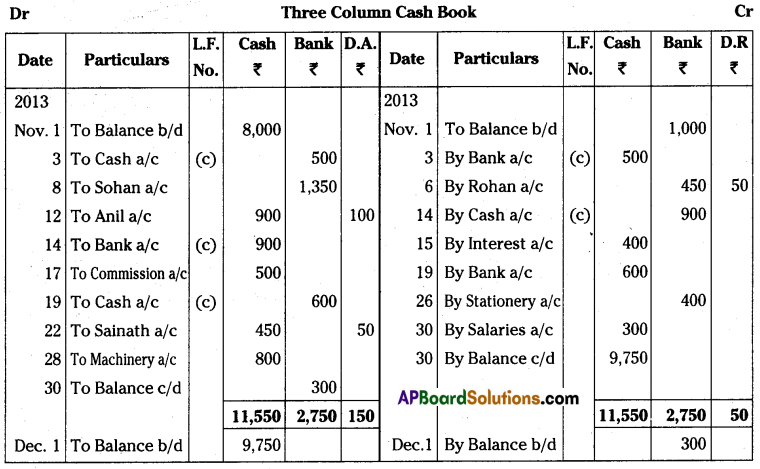

Question 11.

Record the following transactions in Cash, Bank, and Discount Columns Cash Book

2013 — Rs.

Nov 1 — Cash balance — 8000

Bank Overdraft — 1000

3 — Deposited cash into bank — 500

6 — Cheque issued to Rohan — 450

Discount received — 50

8 — Received cheque from Sohan — 1350

And cheque is deposited into bank

12 — Cash received from Anil — 900

in full settlement of his account — 1000

14 — Withdrawn cash from bank — 900

15 — Paid interest — 400

17 — Commission received — 500

19 — Paid cash into Bank — 600

22 — Cash received from Sainath — 450

Discount received — 50

26 — Purchased stationery and paid by cheque — 400

28 — Sold old machinery — 800

30 — Salaries paid — 300

Answer:

![]()

Question 12.

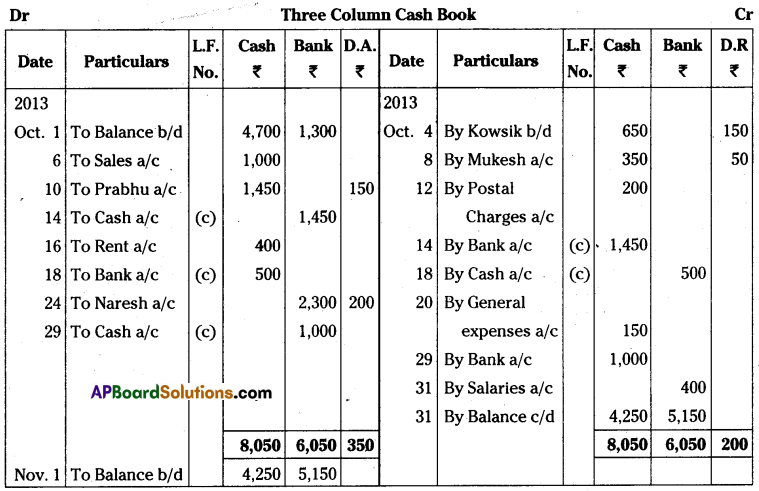

From the following particulars, prepare three column cash book:

2013 — Rs.

Oct 1 — Cash in Hand — 4700

Cash at Bank — 1300

4 — Paid to Kowsik — 650

Discount received — 150

6 — Cash sales — 1000

8 — Paid cash to Mukesh — 350

Discount received — 50

10 — Received cheque from Prabhu — 1450

Discount received — 150

12 — Postal charges — 200

14 — Prabhu cheque deposited into Bank

16 — Received rent — 400

18 — Drew from bank for office use — 500

20 — Paid general expenses — 150

24 — Received cheque from Naresh — 2300

Discount received — 200

Naresh cheque sent to bank

29 — Paid into bank — 1000

31 — Salaries paid by cheque — 400

Answer:

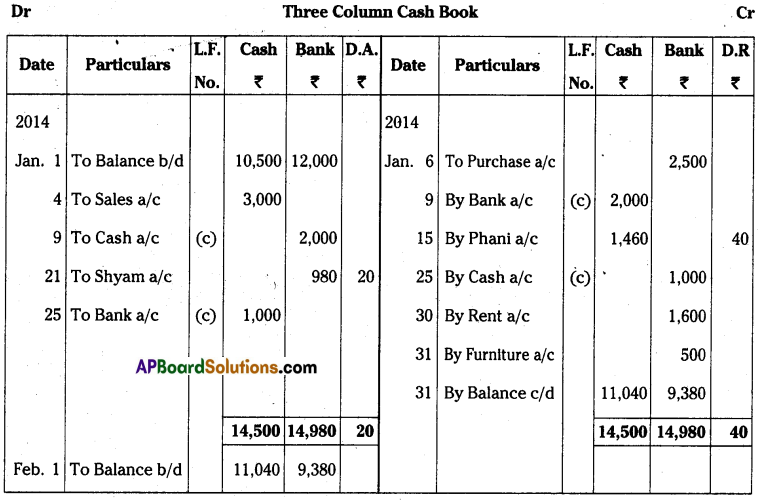

Question 13.

Prepare triple column cash book from the following information: [Mar. ’20 – A.P; May ’17 – T.S.]

2014 (2019) — Rs.

Jan. 1 — Cash Balance — 10500

Bank Balance — 12000

4 — Cash sales — 3000

6 — Purchased goods from Ashok and paid by cheque — 2500

9 — Paid into Bank — 2000

15 — Paid to Phani — 1460

Discount received — 40

21 — Received from Syam a cheque — 980

Discount received — 20

(Syam cheque sent to bank)

25 — Cash withdrawn from bank for office use — 1000

30 — Paid rent by cheque — 1600

31 — Furniture bought by cheque — 500

Answer:

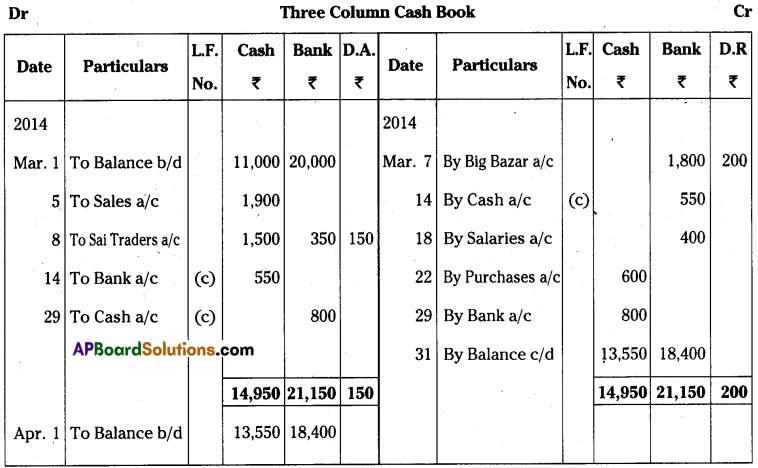

Question 14.

Prepare triple column cash book from the following particulars: ]

2014 — Rs.

March 1 — Cash in Hand — 11000

Cash at Bank * — 20000

5 — Cash Sales — 1900

7 — Issued cheque to Big Bazar — 1800

Discount received — 200

8 — Received cash from Sai Traders — 1500

Cheque — 350

Discount received — 150

(Cheque deposited into Bank)

14 — Cash withdrawn from Bank for office use — 550

18 — Salaries paid by cheque * — 400

22 — Cash purchases — 600

29 — Paid into bank — 800

Answer:

![]()

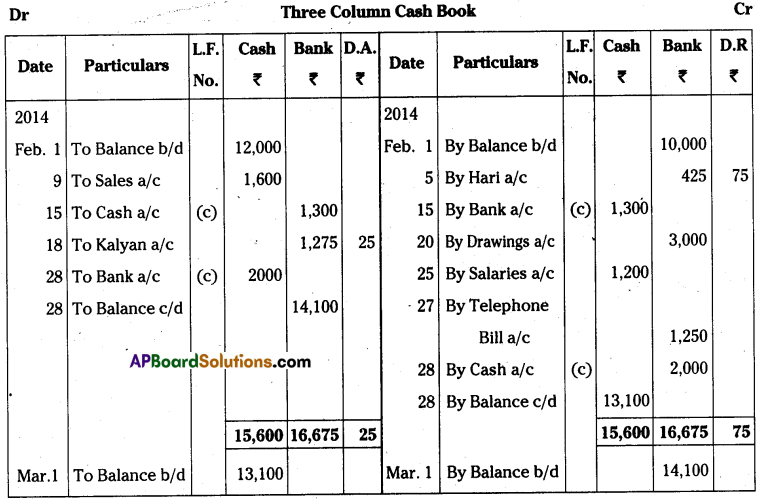

Question 15.

Prepare Three Column Cash Book from the following: [Mar. 2018 -A.P.]

2014 — Rs.

1 — Cash in Hand — 12000

Bank Balance (Credit) — 10000

5 — Paid to Hari by cheque — 425

Discount received — 75

9 — Sales — 1600

15 — Deposited Cash into Bank — 1300

18 — Received cheque from Kalyan — 1275

Discount received — 25

Kalayan cheque deposited into bank

20 — Taken cash from bank for personal use — 3000

25 — Paid salaries — 1200

27 — Telephone bill paid by cheque — 1250

28 — Drawn from bank for office use — 2000

Answer:

Question 16.

Prepare Three Column Cash Book from the following:

2014 — Rs.

March 1 — Cash balance — 4200

Bank balance — 1500

7 — Deposited cash into Bank — 1000

10 — Paid to Anil — 350

Discount received — 50

15 — Sales through Credit Card — 250

20 — Received Cheque from Srinivas — 850

Discount received — 150

Srinivas cheque sent to bank

25 — Cash withdrawn from Bank — 200

30 — Sales through Debit Card — 500

31 — Paid salaries — 300

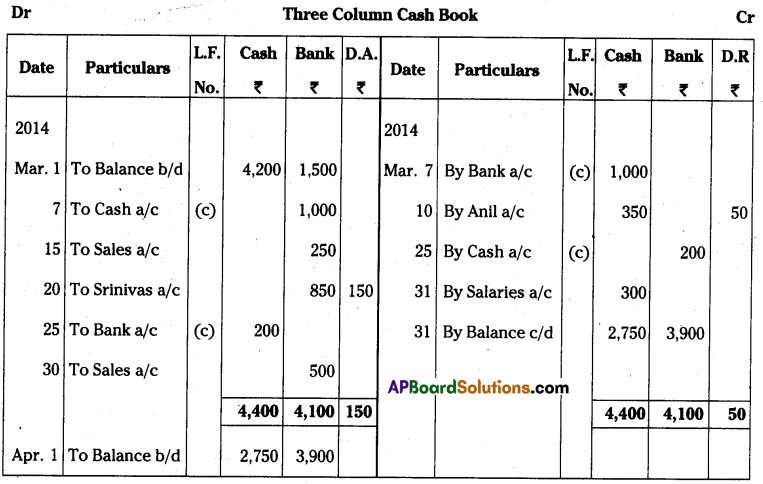

Answer:

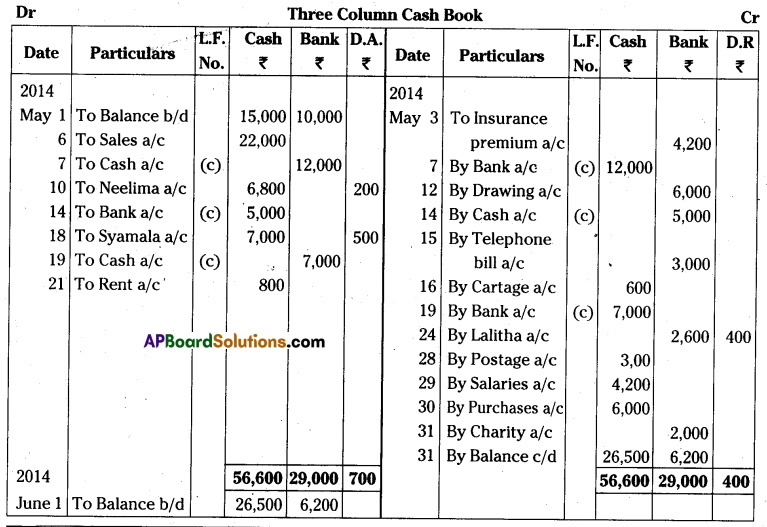

Question 17.

Prepare Three Column Cash book from the following particulars.

2014 — Rs.

May 1 — Cash Balance — 15000

1 — Bank Balance — 10000

3 — Paid Insurance premium by cheque — 4200

6 — Sold goods — 22000

7 — Cash deposited into Bank — 12000

10 — Received cash from Neelima — 6800

Discount allowed — 200

12 — Withdrawn from Bank for personal use — 6000

14 — Withdrawn from Bank for office use — 5000

15 — Telephone bill paid by cheque — 3000

16 — Cartage paid — 600

18 — Cheque received from Syamala — 7000

Discount allowed — 500

19 — Deposited Syamala cheque into bank

21 — Received rent — 800

24 — Cheque issued to Lalitha — 2600

Discount received — 400

28 — Paid for postage — 300

29 — Salaries paid — 4200

30 — Cash purchases — 6000

31 — Paid for charity by cheque — 2000

Answer:

![]()

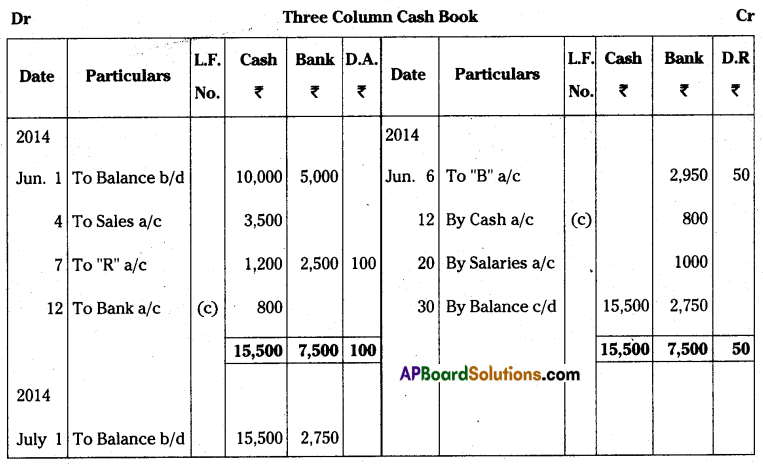

Question 18.

Prepare Three Column Cash book ofMr.Stephen from the following particulars.

2004 — Rs.

June 1 — Cash in Hand — 10,000

Cash at Bank — 5,000

4 — Cash Sales — 3,500

6 — Issued cheque to ‘B’ — 2,950

Discount — 50

7 — Received cash from’R’ — 1,200

Cheque — 2,500

Discount — 100

(Cheque deposited with bank)

12 — Cash withdrawn from bank for office use — 800

20 — Paid salaries by cheque — 1,000

Answer:

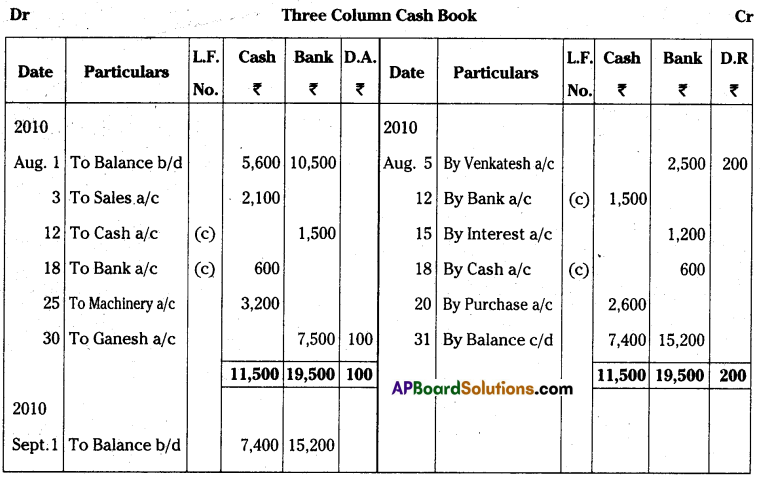

Question 19.

Prepare Three Column Cash book of Mrs. Vijaya from the following particulars

2010 — Rs.

August 1 — Cash in Hand — 5,600

Cash at Bank — 10,500

3 — Cash Sales — 2,100

5 — Issued cheque to Venkatesh — 2,500

Discount receIved 200

12 — Cash deposited Into the bank — 1,500

15 — Paid interest through cheque — 1,200

18 — Withdrew cash from bank for office use — 600

20 — Cash purchases 2,600

25 — Sold old machinery 3,200

30 — Received a cheque from Ganesh and

deposited it in the bank — 7,500

Discount allowed — 100

Answer:

Question 20.

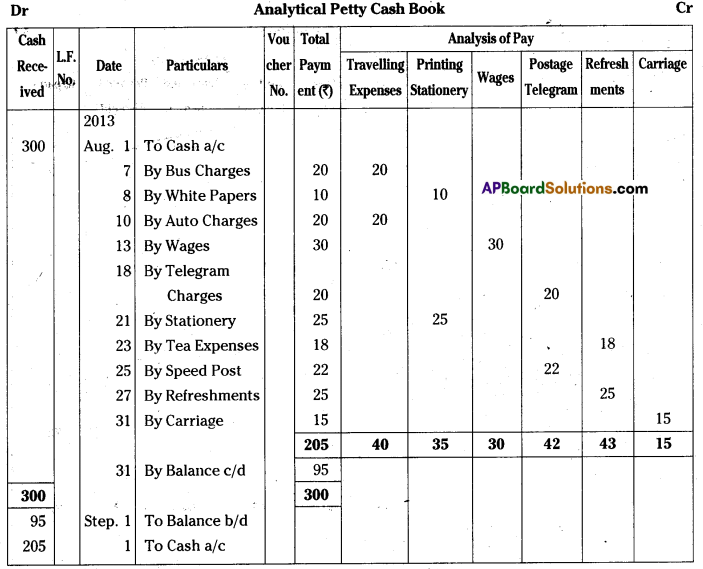

Prepare Analytical Petty Cash from the following particulars:

2013 — Rs.

August 1 — Received advance from Head Cashier — 300

7 — Paid for bus charges — 20

8 — Purchased white papers — 10

10 — Paid auto charges — 20

15 — Paid wages — 30

18 — Telegram charges — 20

21 — Purchased stationery — 25

23 — Tea expenses — 18

25 — Paid for speed post — 22

27 — Refreshments — 25

31 — Paid for carriage — 15

Answer:

![]()

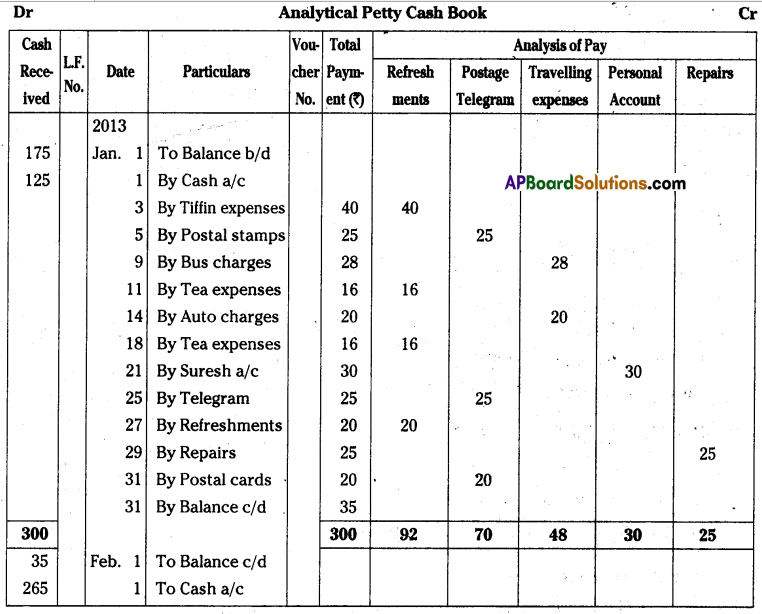

Question 21.

Prepare Analytical Petty Cash Book.

Jan. 1 — Balance of cash — 175

Received advance from Cashier — 125

3 — Tiffin expenses — 40

5 — Postal stamps — 25

9 — Bus charges — 28

11 — Tea expenses — 16

14 — Auto charges — 20

18 — Tea expenses — 16

21 — Paid to Suresh — 30

25 — Sent telegram to Mumbai — 25

27 — Refreshments to guests — 20

29 — Paid Repairing charges — 25

31 — Postal cards and covers — 20

Answer:

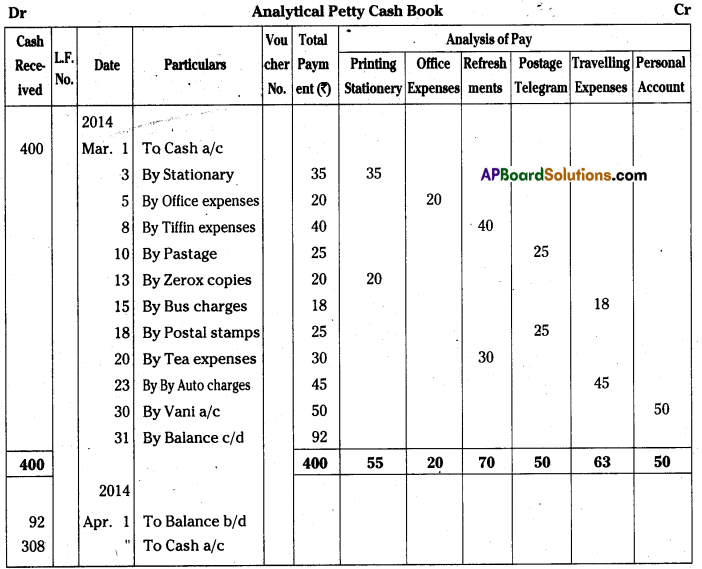

Question 22.

From the following information, prepare Analytical Petty Cash Book and also prepare ledger:

2014 — Rs.

March 1 — Advance from cashier — 400

3 — Paid from stationery — 35

5 — Office expenses — 20

8 — Tiff I n Expenses — 40

10 — Paid for postage — 25

13 — Paid Zerox copies — 20

15 — Bus charges — 18

18 — Postal stamps — 25

20 — Tea expenses — 30

23 — Auto charges — 45

30 — Paid to Vani — 50

Answer:

![]()

Question 23.

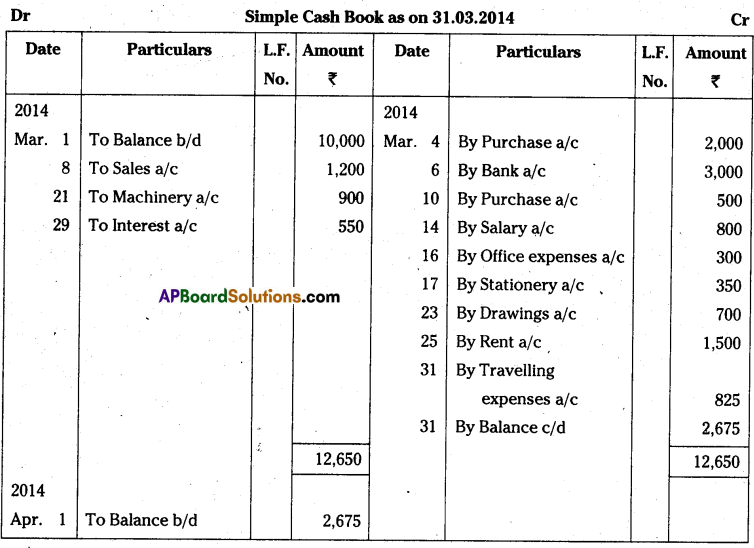

Prepare three column cash book from the following information.

2020 — Rs.

January 1 — Cashmhand — 10,000

Cash at bank — 7,500

3 — Cash sales — 3,000

6 — Issued cheque to Raju — 3,500

Discount Received — 500

10 — Deposited cash into bank — 1,000

15 — Received cash from Ravi — 5,600

Discount Allowed — 400

17 — Paid Interest — 1,200

18 — Withdrawn cash from bank for office use 1,000

20 — Cash purchases 2,600

25 — Paid salaries by cheque — 1,500

30 — Received interest — 500

Answer: