Thoroughly analyzing TS Inter 2nd Year Commerce Model Papers Set 3 helps students identify their strengths and weaknesses.

TS Inter 2nd Year Commerce Model Paper Set 3 with Solutions

Time: 3 Hours

Maximum Marks: 100

Part – I (50 Marks)

Section – A

(2 × 10 = 20)

Answer any two of the following questions not exceeding 40 lines each.

Question 1.

What is SEBI (Securities and Exchange Board of India)? What are its functions and powers?

Answer:

Securities and Exchanges Board of India (SEBI) was established to overcome undesirable practices in the stock exchanges. It is a controller of capital issues and it was established in the year 1988 and derived authority from Capital Issues Act 1947. Later on, SEBI came into existence through the SEBI Act, of 1992 The Indian Parliament Act was given statutory powers.

Functions of SEBI:

SEBI has three functions rolled into one body.

- Quasi legislative

- Quasi-judicial

- Quasi executive

It drafts regulations in its legislative capacity, it conducts investigation and enforcement action on its executive function and it passes rulings and orders in its Judicial capacity. These functions may be summarised as

- Regulating the business in stock exchanges.

- Registering and regulating the working of stock brokers, sub-brokers, issue bankers, underwriters, and other intermediaries who may be associated with securities markets in any manner.

- Registering and regulating the working of collective investment schemes including mutual funds.

- Promoting and regulating self-regulatory organizations.

- Prohibiting fraudulent and unfair trade practices relating to the securities market.

- Promoting investor’s education and training of intermediaries of the securities market.

- Prohibiting inside trading in securities.

- Regulating substantial acquisition of shares and takeover of companies.

- Calling for information from, undertaking inspections, conducting inquiries, and audits of the stock exchanges.

- Performing such functions may be delegated to it by the Central Government.

Powers of SEBI:

The SEBI ordinance has given it the following powers:

- It may be called periodical returns from stock exchanges.

- It has the power to prescribe maintenance of certain documents by the stock exchange.

- SEBI may call upon the exchange or any member to furnish an explanation or information relating to the affairs of the stock exchange or any members.

- It has the power to approve the bylaws of the stock exchange for regulation and control of the contracts.

- It can amend the bylaws of the stock exchange.

- In certain areas, it can grant to license the dealers in securities.

- It can compel a public company to list its shares.

The Securities Contract Act empowers the Central Government to delegate some of its powers to SEBI they are:

- Power to grant recognition to a stock exchange.

- Power to direct any stock exchange to amend the rules relating to the constitution of the stock exchange, admission of new members, etc.

- Power to supersede the governing body of any stock exchange.

- Power to suspend the business of a recognized stock exchange.

- Power to prohibit contracts in certain cases.

![]()

Question 2.

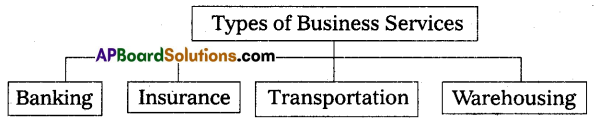

Explain the various business services.

Answer:

Business services refer to activities that facilitate the trade and exchange of goods. Business services facilitate in removing hindrances of “place, time, finance, information (knowledge) and risk” of business.

Banking:

Banking provides finance to businesses. A banker, being a buyer and seller of money, mobilizes the savings of the people and provides finance to business undertakings. The term Bank is derived from the word “Banco”, which means a bench or table. Bank credit is the major source of credit for business. The majority of the funds collected by banks are utilized for lending to business people. Such advances take three forms i.e., “loans, cash credit and overdraft”. Banks also provide money to businessmen by discounting bills. Bills an evidence of debt that is repayable on its maturity. Banks are classified as follows:

- Commercial Banks

- Industrial Banks

- Co-operative Banks

- Exchange Banks

- Central Banks

Insurance:

Insurance protects the businessman from financial loss by transferring the risk onto the insurance company. The business of the insurance company is to assume risks. The basic principle of insurance is spreading of the risk of loss among several persons. From the national standpoint, insurance pools the savings of the individual policyholders. In this way, insurance may be regarded as an important agency of capital information.

Insurance and Assurance:

The two terms are frequently used to mean the same thing. But these two terms are not synonymous. Insurance is a contract for paying compensation for any damage or loss that may or may not occur. Assurance is a contract under which the sum assured is bound to be payable.

Transportation:

The hindrance of place is removed by transportation. Transport is an arrangement whereby goods are moved from the point of production to the point of ultimate consumption. It creates a place of utility for the goods. Transport can be regarded as the kingpin of a developing economy.

Warehousing:

Warehousing creates time utility for goods. It involves the storing of goods from the time they are produced until they are needed for consumption. Warehousing may be defined as undertaking the responsibility for the storage of goods. Warehouses are performing the following functions.

- It provides a storage facility.

- These are risk-bearing.

- Warehousing receipts help in financing.

- Warehouse helps price stabilization.

- Warehouse renders ancillary services.

Types of Warehouses:

Warehouses are three types:

- Private warehouses

- Public warehouses

- Bonded warehouses

Question 3.

Management is considered to be both an ‘art and science’. Explain.

Answer:

Management is an Art:

The application of management skills is governed by the type of aptitudes and abilities possessed by the manager, which are a highly personalized blending of imagination, creativity, and insight. This permits management to be described as an art. Management cannot be compared with sciences like physics, chemistry, or mathematics so far as the degree of precision is concerned. No doubt, management is a science, but not as exact in its results as in the case of physics or chemistry. This is for the simple reason that management science deals with human beings who are more widely influenced by several material factors. Management as science is still in the evolutionary stage and management is practiced as yet largely as an art like the earlier period. However, the growing need for management services has evolved as a profession.

Management as Science:

Science is a systematized body of knowledge about a specific field of study and contains general facts that explain a phenomenon. It establishes the cause-and-effect relationship between two or more factors and ascertains the underlying principle governing the relationship. Theories are being continuously formulated as an aid to a more systematic analysis of managerial behavior thus resulting in the study of management moving into the management science. This expression stresses the constant search for evolving and verifying principles and rules as well as for further knowledge resulting in the emergence of managerial techniques effective universally. Scientific methods or attitudes have been increasingly adopted by good managers towards the performance of their job of managing. They have developed inquiring minds that first attempt to identify the problem, for hypothesis or tentative solutions, then investigate in terms of current knowledge and even controlled experiments, classify the data so obtained, and develop it into alternative courses of action.

Section – B

(4 × 5 = 20)

Answer any four of the following questions not exceeding 20 lines each.

Question 4.

What is the money market? Explain its functions.

Answer:

Introduction:

A money market is a credit market, where short-term debt instruments, having high liquidity, unsecured, and at low risk are being traded actively between the parties. In other words, the money market supplies short-term funds to the industry.

Definitions:

“A collective name was given to the various firms and institutions that deal with various grades of near-money”. – ‘Crowther’

The center for dealing mainly of a short-term character, in monetary assets, meets the short-term requirements of borrowers and provides liquidity or cash to the lenders. – The Reserve Bank of India (RBI)

Functions of Money Market (Important functions):

- It is an equilibrating mechanism to even out the demand for the supply of short-term funds.

- It provides a focal point for central bank intervention and influencing liquidity and the general level of interest rates in the economy.

- It enables reasonable access to providers and users of short-term funds.

- Money markets fulfill providers’ and users’ borrowing and investment requirements at an efficient and market-clearing price.

Other Functions:

- It provides short-term credit to the business to meet the working capital requirements.

- It funds the Government by issuing short-term instruments to the savers.

- It deals with credit instruments.

- It enables the savers of the funds and investors to transact with each other.

- It helps trade and commerce to develop in a better manner, by issue of bills.

- It helps in promoting the saving habit in the people.

- It provides valuable and accurate information to the transacting parties to save money, time, and effort.

![]()

Question 5.

Explain the functions of Insurance.

Answer:

The functions of insurance can be studied in two parts.

- Primary functions

- Secondary functions

(i) Primary Functions:

- Insurance provides certainty: Insurance provides certainty of payments at the uncertainty loss. The uncertainty of loss can be reduced with insurance.

- Insurance provides protection: The main function of the insurance is to protect against the problem chance of loss. The insurance guarantees the payment of loss and protects the assured from suffering.

- Risk-sharing: The risk is uncertain. When risk takes place the loss is shared by all the persons who are exposed to the risk.

(ii) Secondary Functions:

- It prevents loss: The insurance joins hands with those institutions that are engaged in preventing the losses of the assured so more saving is possible which will assist in reducing the premium.

- It provides capital: The insurance provides capital to society. The accumulated funds are invested in productive channels.

- It improves efficiency: The insurance eliminates worries and miseries of losses at death and destruction of property.

- It helps in economic progress: The insurance by protecting the society from huge losses of damage, destruction, and death provides an initiative to work hard for the betterment of the masses.

Question 6.

Differentiate entrepreneur and entrepreneurship.

Answer:

The following table may help us to understand the distinction between entrepreneur and entrepreneurship.

| Entrepreneur | Entrepreneurship |

| 1. He is a person. | 1. It is a plan of action. |

| 2. He is an administrator. | 2. It is an administration. |

| 3. He is a risk bearer. | 3. It is a risk-bearing activity. |

| 4. He is an innovator. | 4. It is a process of innovation. |

| 5. He combines factors of production. | 5. It is the process of use of factors of production. |

| 6. He is an initiator. | 6. It is taking an initiative. |

| 7. He is a leader. | 7. It is nothing but leadership. |

Question 7.

Why entrepreneurial development is important?

Answer:

Entrepreneurship development has become a matter of great concern in all developed and developing countries till over the world. It plays a vital role in eliminating poverty, unemployment helps in balanced regional developments. All these aspects are discussed below.

(a) Eliminates Poverty and Unemployment:

Increasing unemployment is a chronic problem in most developing countries. EDPs can help unemployed people to opt for self-employment and entrepreneurial careers.

(b) Balanced Regional Development:

Small-scale industries can be set up in remote areas with little financial resources which helps in achieving balanced regional development.

(c) Prevents Industrial Slums:

EDPS helps in the removal of industrial slums as the entrepreneurs are provided with various schemes, incentives, subsidies, and infrastructural facilities to set up their enterprises in all regions.

(d) Harnessing Locally Available Resources:

The EDP can help in harnessing these resources by training and educating the entrepreneurs.

(e) Defuses Social Tension:

Every young person feels frustrated if he does not get employment after completing his education. The talent of the youth must be diverted to self-employment careers to help the country in defusing social tension.

Question 8.

What are the advantages and disadvantages of departmental stores?

Answer:

The departmental stores have the following advantages and disadvantages.

| Advantages | Disadvantages |

| 1. It is established in a central location. | 1. The operating costs of departmental stores are high. |

| 2. It sells different types of products under a single roof in a specialized manner, it is thus convenient for the buyer. | 2. As the size of the stores is large, it may at times be difficult for the departments to draw personal attention. |

| 3. It facilitates economies of large-scale distribution. | 3. The prices are usually high due to the large establishment costs and large working capital requirements. |

| 4. It helps in eliminating middlemen. | 4. It requires huge capital. Usually, departmental stores are not situated in far-off posh localities which may cause difficulty for those living in middle-segment residential localities in reaching the stores. |

Question 9.

Do you think planning can work in a changing environment?

Answer:

Planning can work in a changing environment explained below.

1. Focus on Objectives:

Planning determines the objectives of the enterprise and also various departments. Besides it devises the ways for achieving the objectives, good plan is required. Planning compels managers to consider the future and makes them recognize the need for revising and extending plans in light of the dynamic business environment.

2. Economical Operation:

The working of the enterprise will be systematic and purposeful. Under planning there will be jointly directed effort instead of uncoordinated decisions made based on facts. The resources are utilized in the best possible way.

3. Reduces Uncertainty and Change:

An enterprise works in a dynamic world. The future is uncertain. Changes take place in the business environment, economic policies, and supply of resources. There may be changes in technology. Planning can work in a changing environment.

4. Facilitates Control:

Planning helps managers to exercise proper and effective control over their subordinates. In a planned organization, the work to be done is determined in advance. This enables the management to check on the performance of subordinates.

Section – C

(5 × 2 = 10)

Answer any five of the following questions not exceeding 5 lines each.

Question 10.

Stock Exchange.

Answer:

It is an association, organization, or body of Individuals, whether incorporated or not, established to assist, regulate, and control business in buying, selling, and dealing in securities.

![]()

Question 11.

A.T.M.

Answer:

ATM (Automatic Teller Machine) is an unattended or unmanned device usually located on or off the bank premises. The operation mechanism begins when the card is inserted into the ATM, the terminal reads and transmits the tape data to a processor, which activates the account. It works for 24 hours a day, 7 days a week (24 × 7).

Question 12.

Small Scale Industry Entrepreneurs.

Answer:

Based on the scale of operation of the unit entrepreneurs may be classified as large-scale, medium-scale, and small-scale industry entrepreneurs. He is essentially a manufacturer. He manufactures the products in small-scale and tiny industries. The government gave many facilities to these small-scale industry entrepreneurs.

Question 13.

Provisional Registration.

Answer:

Provisional registration enables a party to take the necessary steps to bring the unit into existence. After providing satisfactory proof that the unit has come into existence, it can be converted into a regular registration later. Application for provisional registration is submitted to the district industries center.

Question 14.

Wholesale Trade.

Answer:

Wholesale trade: Wholesale trade involves purchasing goods in large quantities from producers or manufacturers and selling in smaller lots to retailers for resale to ultimate consumers.

Question 15.

Bonded Warehouses.

Answer:

It is the warehouse that enables the importers and exporters to store their goods according to their convenience.

Question 16.

Multiple Shops.

Answer:

Multiple Shops: Multiple shops are identical shops that sell standardized products in different parts of a particular place city or town.

E.g.: Bombay dyeing.

Question 17.

Process of Organising.

Answer:

The following is the process of organizing:

- Identification and division of work.

- Departmentalization.

- Assignment duties.

- Establishing reporting relationships.

Part – II (50 Marks)

Section – D

(1 × 20 = 20)

Note: Answer the following question.

Question 18.

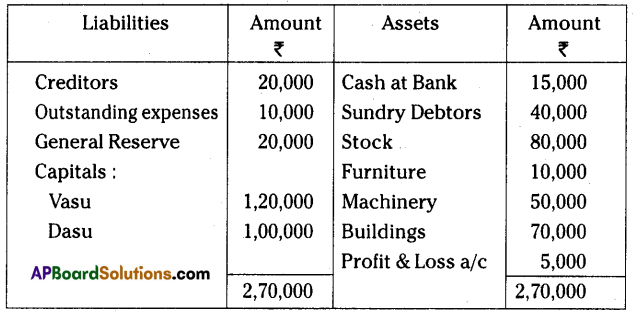

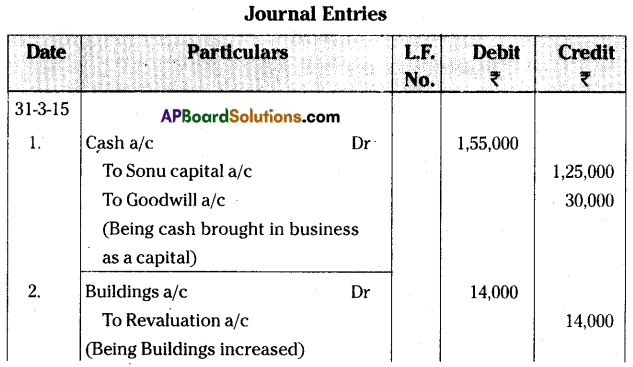

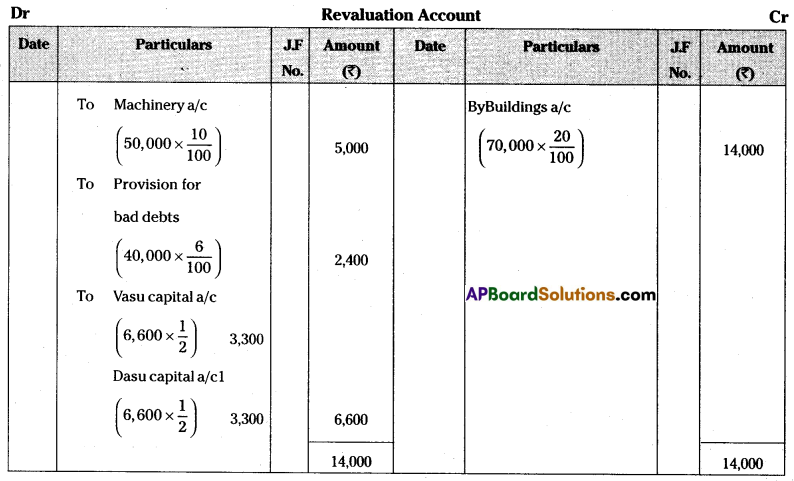

Vasu and Dasu are partners sharing profits and losses equally. Their balance sheet as of 31 March 2015 was as follows:

They decided to admit Mr. Sonu on 1st April 2015 on the following conditions:

(a) Sonu has to pay ₹ 1,25,000 as capital for 1/4th share in future profits.

(b) Sonu shall pay ₹ 30,000 as Goodwill.

(c) Machinery be depreciated by 10%.

(d) Buildings to be appreciated by 20%.

(e) Provide for bad debts @ 6% on debtors.

Pass necessary journal entries to effect the above and give the opening balance sheet of Vasu, Dasu, and Sonu.

Answer:

Section – E

(1 × 10 = 10)

Answer any one of the following questions.

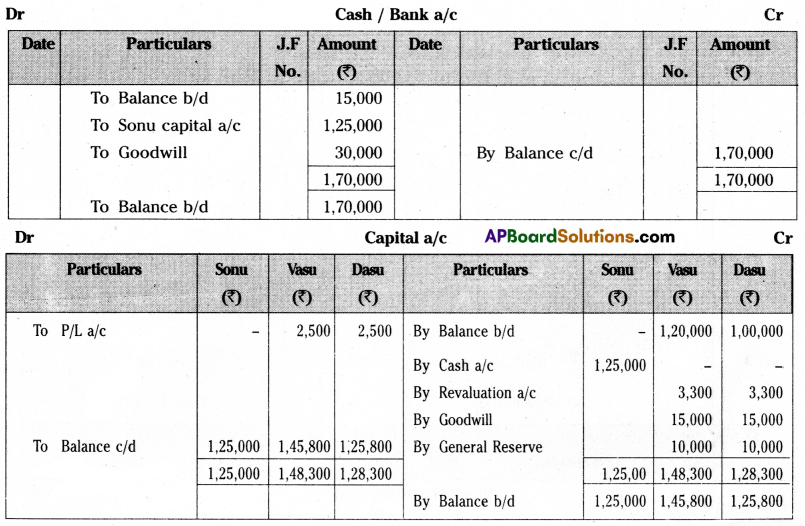

Question 19.

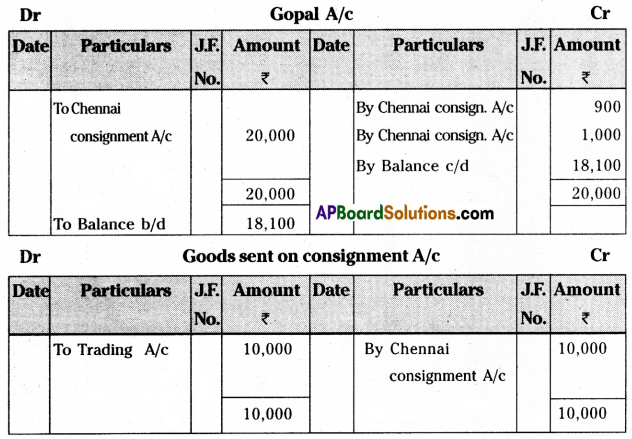

Krishna of Mumbai and Gopal of Chennai are in the consignment business. Gopal sent goods to Krishna ₹ 10,000. Gopal paid freight ₹ 500. Insurance ₹ 1,500. Krishna met sales expenses ₹ 900. Krishna sold the entire stock for ₹ 20,000 and he is entitled to a commission of 5% on sales. Prepare necessary ledger accounts in the books of Gopal and Krishna.

Answer:

![]()

Question 20.

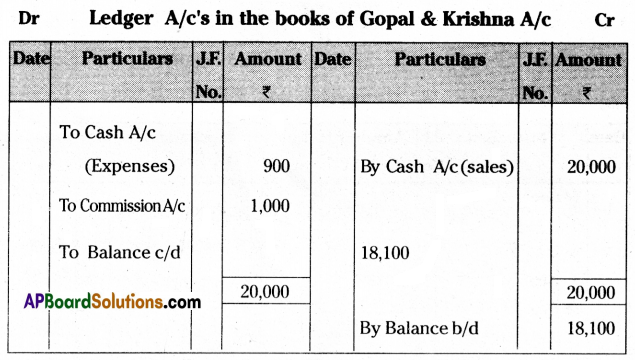

Warangal Youth Club gives you their receipts and payments account and other information and requests you to prepare their income and expenditure account for the year ended 31-3-2015.

Additional Information:

(1) Outstanding subscriptions on 31-3-2015 ₹ 1,500.

(2) Subscriptions received in advance on 31-03-2015 ₹ 500.

(3) The value of old furniture sold is ₹ 45,000.

Answer:

Section – F

(2 × 5 = 10)

Answer any two of the following questions.

Question 21.

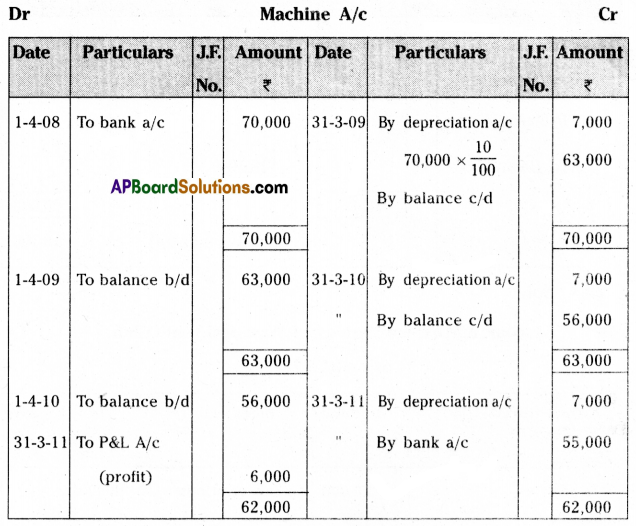

Vardhan purchased a machine on 31st March 2008 for ₹ 70,000. Depreciation is charged at 10%. Under the original cost method. After three years he found that the machine was not suitable and sold for ₹ 55,000. Show the machine a/c.

Answer:

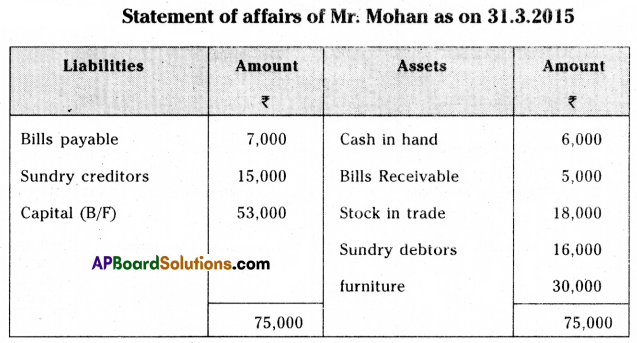

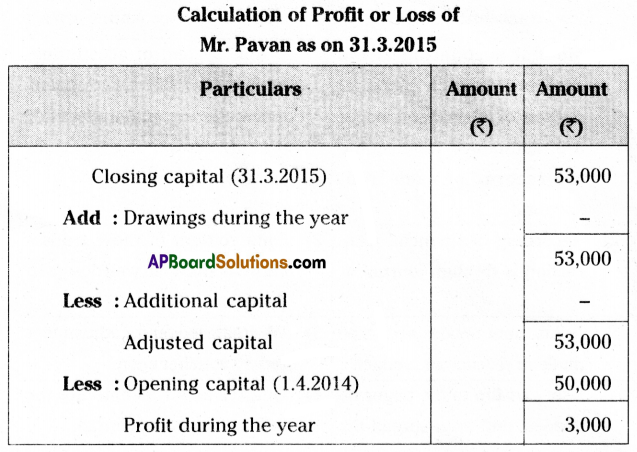

Question 22.

From the following information prepare a statement of affairs and find out the profit or loss of Mr. Pavan who keeps his books under a single entry system. Pavan started his business on 1st April 2014 with a capital of ₹ 50,000. His assets and liabilities on 31st March 2015 were as under.

Cash in hand ₹ 6,000; Bills receivable ₹ 5,000; Stock-in-trade ₹ 18,000; sundry debtors ₹ 16,000; Furniture ₹ 30,000; Bills payable ₹ 7,000; sundry creditors ₹ 15,000.

Answer:

Question 23.

What is Donation? Explain the types of donations.

Answer:

Donations are the amount received by the organizations from individuals and institutions as a gift. Donations are of two types:

- General Donations

- Special Donations (or) Specific Donations

(a) General Donations:

A general donation is the amount given by the individuals without mentioning the purpose. So that the amount can be utilized for any purpose by the not-for-profit organizations.

(b) Special Donations (or) Specific Donations:

A donation received by the organization for a specific purpose.

Question 24.

What are the differences between manual and computerized accounting?

Answer:

Differences between manual & computerized accounting are:

| Manual Accounting System | Computerised Accounting System |

| 1. Manual accounting is the system in which the physical register of the journal and ledger are maintained for keeping the records of each transaction. | 1. In this system of accounting, computers, and different accounting softwares are maintained for digital records of each transaction. |

| 2. Recording of financial transactions is through the journal. | 2. The data content of these transactions is stored in a well-designed database. |

| 3. Adjustment entries are to be made in the journal and ledger. | 3. We create a ledger for adjustment record voucher entry. |

| 4. The user can flip to the pages he needs and even spread the books out of a table if needed. | 4. Quicker as far as entering the transaction is concerned. |

| 5. It is time-consuming to search the relevant data in manual accounting. | 5. It is very easy to get the data immediately without wasting time. |

Section – G

(5 × 2 = 10)

Answer any five of the following questions.

Question 25.

What are the causes of depreciation?

Answer:

Causes of depreciation are:

- Wear and Tear

- Depletion

- Accidents

- Obsolescence

- Effluxion of time/pasage of time

- Fluctuations

Question 26.

What is a single-entry system?

Answer:

- Single entry is a simple method of recording business transactions.

- Profit or loss can be easily ascertained by comparing the opening capital with the closing capital.

- For keeping records in a single entry one does not require expert knowledge.

- It is less expensive when compared to the double-entry system of bookkeeping.

- It is easy to follow and understand.

- No principles are required in this system.

Question 27.

Proforma Invoice Price?

Answer:

Statement prepared by consignor containing the description of goods to be sold, quality rate, and discounts and sent to consignee.

![]()

Question 28.

Subscriptions.

Answer:

It is an amount paid by the members regularly at periodical intervals. Subscriptions are a regular source of income for the organization.

Question 29.

Ram and Rahim are partners sharing profits and losses in the ratio of 5 : 3. They decided to admit Robert by giving him a \(\frac{2}{8}\) share in the profits. Calculate the new profit-sharing ratio.

Answer:

Old Ratio of Ram and Rahim = 5 : 3

Share of Robert = \(\frac{2}{8}\)

Remaining Profit is 1 – \(\frac{2}{8}\) = \(\frac{6}{8}\) (or) \(\frac{3}{4}\)

New Ratio of Ram = \(\frac{3}{4} \times \frac{5}{8}=\frac{15}{32}\)

New Ratio of Rahim = \(\frac{3}{4} \times \frac{3}{8}=\frac{9}{32}\)

New Ratio of Robert = \(\frac{2}{8} \times \frac{4}{4}=\frac{8}{32}\)

New Ratio of Ram, Rahim and Robert = \(\frac{15}{32}: \frac{9}{32}: \frac{8}{32}\) = 15 : 9 : 8.

Question 30.

Partnership deed.

Answer:

It is a document that defines the rights and liabilities of partners of the firm besides containing other matters about the conduct and management of the firm.

Question 31.

Computerized Accounting.

Answer:

Computerized accounting is nothing but replacing the manual accounting system of maintaining the books of account with the use of relevant software packages for accounting on a computer. As its name suggests “Computerised Accounting” is an accounting done with the support of a computer. It tends to involve dedicated accounting software and digital spreadsheets to keep track of a business or client’s financial transactions.

Question 32.

Tally accounting package.

Answer:

Tally is a versatile and massive software package. It is used by various types of trade and industry. Tally’s software business was set up in 1986 by the late S.S. Goenkar, who was the founder of the company Peutronics Private Ltd. Bangalore. His son Bharat Goenkar is the original architect and programmer of the tally accounting system and also the developer of the “No-Code” concept of accounting entries. Tally is user-friendly software used to solve all the complicated accounting structures. Tally is a globally recognized name with 2 million users in over 90 countries experiencing the “Power of Simplicity”. Tally maintains ledger-wise balance and displays net debit or credit balance for a ledger. Using a reverse journal to make transient journal vouchers to get intermediate profit and loss accounts and balance sheets. Tally offers numerous options for interest calculation. While the simple mode meets the needs of average users, the advanced mode is meant for users having complex requirements and penal interests.