Thoroughly analyzing AP Inter 2nd Year Commerce Model Papers and AP Inter 2nd Year Commerce Question Paper May 2019 helps students identify their strengths and weaknesses.

AP Inter 2nd Year Commerce Question Paper May 2019 with Solutions

Time: 3 Hours

Maximum Marks: 100

Part – I (50 Marks)

Section – A

(2 × 10 = 20)

Note:

- Answer any two of the following questions in 40 lines each.

- Each question carries 10 marks.

Question 1.

Define Insurance. Discuss the principles of insurance.

Answer:

Insurance means protection against the risk of loss. It compensates against any loss or damage due to the happening of an event. It is a contract between the two parties by which one of them undertakes to indemnify the other person against a loss that may arise due to some events.

Principles of Insurance

1. Insurable Interest:

A person cannot enter into a contract of insurance unless he has an insurable interest in the subject matter of insurance. It is an essential feature of insurance. Without this insurable interest, the contract of insurance will be treated as a wager or gambling contract. A person has an insurable interest in his own life or the life of his wife and a creditor has insurable interest in the debtor.

2. Utmost Good Faith:

Insurance is based on the principle of utmost good faith. It means both the parties of the contract must disclose all the facts relating to the subject matter of insurance. If the insured does not disclose all material facts, the contract between them is void. A person who had suffered from T.B. in the past had not disclosed it in the proposal form. Later on, the insurer comes to know of this fact. He may declare the contract as void.

3. Indemnity:

This is the chief principle of insurance. Indemnity means security against the risk of loss. Under this principle, the insured gets only the loss suffered by the insurer but not profits out of the contract of insurance. The principle of indemnity applies to contracts of fire and marine insurance only, but not to life insurance contracts.

4. Contribution:

Sometimes, goods are insured by more than one company. It is double insurance. The insured can get compensation only for the total loss from all insurance companies put together, but not the total loss from each company. The insurance companies will pay the compensation on a pro-rata basis.

5. Subrogation:

According to this principle, the insurer after compensating the loss of the insured, the right of ownership of the damaged goods is shifted from the insured to the insurance company.

Ex: Mr. X owns a scooter worth ₹ 36,000 and it was insured with an insurance company for full value. Later it was met with an accident and damaged beyond repairs. The insurance company paid the full value as compensation. Then all the rights on the scooter will be passed on to the insurance company.

6. Causa Proxima:

According to this principle, if the nearest and direct factor causes the loss, then only the insurer will have to bear the loss.

Ex: Biscuits in a ship are insured and are destroyed because of the seawater entered through a hole made by the mouse in the bottom of the ship and water entered into the ship. The nearest and direct cause is seawater. Hence, the insurer will have to bear the loss.

7. Mitigation of Loss:

It is the duty of the insured to take necessary steps to minimize the loss that happened due to some event. He should not act carelessly and negligently at the time of loss to the insured property.

![]()

Question 2.

What is SEBI? Explain the objectives and functions of SEBI.

Answer:

Introduction:

The Securities and Exchange Board of India (SEBI) was established by the Government of India in April 1988 to promote healthy growth of the securities market and for investor protection. It was to function under the administrative control of the Ministry of Finance of the Government of India. It got statutory status in January 1992.

Objectives of SEBI:

- To regulate stock exchanges and the securities industry to promote their orderly functioning.

- To protect the rights and interests of investors and to guide and educate them.

- To prevent trading malpractices in the securities industry.

- To regulate and develop a code of conduct and fair practices by intermediaries like brokers, merchant bankers, etc. to make them competitive and professional.

Functions of SEBI:

SEBI assigned regulatory, development, and protective functions to control and regulate the capital market.

(A) Regulatory Functions:

- Registration of brokers, sub-brokers, and other players in the market.

- Registration of collective investment schemes and mutual funds.

- Regulation of stock brokers, portfolio exchanges, merchant bankers in stock exchanges, and any other securities market.

- Regulation of takeover bids by companies.

- Calling for information by undertaking inspections, conducting inquiries, and audits of stock exchanges and intermediaries.

- Levying fee or other charges for carrying out the purpose of the act.

- Performing and exercising such powers under the Securities Contracts Regulation Act 1956, as may be delegated by the Government of India.

(B) Development Functions:

- Training for intermediaries of the securities market.

- Conducting research and publishing information useful to all market participants.

- Undertaking measures to develop the capital markets by adopting a flexible approach.

(C) Protective Functions:

- Prohibition of fraudulent and unfair trade practices like making misleading statements, manipulations, price rigging, etc.

- Controlling insider trading and imposing penalties for such practices.

Question 3.

Explain the redressal mechanism available to consumers under the Consumer Protection Act, of 1986.

Answer:

Consumer Protection refers to the measures adopted the protect consumers from unethical malpractices by businesses and to provide them with speedy redressal of their grievances. The judicial mechanism set up under the Consumer Protection Act 1986, consists of consumer courts (forums) at the district, state, and national levels. These are known as district forums, the State Consumer Disputes Redressal Commission (State Commission), and the National Consumer Disputes Redressal Commission (National Commission).

1. District Forum:

District forum is established by the State Government in each district.

- Composition: The district forum consists of a Chairman and two other members, one of them shall be a woman candidate. They are headed by the person of the rank of a District Judge.

- Jurisdiction: A written complaint can be filed before the District Consumer Forum, where the value of goods or services and the compensation claimed does not exceed ₹ 20 lakhs.

- Appeal: If a consumer is not satisfied by the decision of the District Forum, he can challenge the same before the State Commission, within 30 days of the order.

2. State Commission:

State commission is established by the state governments in their respective states.

- Composition: It consists of a president and two members, one of them shall be a woman. It is headed by a person of the level of High Court Judge.

- Jurisdiction: A written complaint can be filed before the State Commission where the value of goods or services and the compensation claimed exceeds ₹ 20 lakhs but does not exceed ₹ 1 crore.

- Appeal: In case the aggrieved party is not satisfied with the order of the state commission he can appeal to the National Commission within 30 days of passing of the order.

3. National Commission:

It was constituted in 1988 by the central government. It is the highest authority to settle consumer disputes at the national level.

- Composition: It consists of a president and not less than four members, one of them shall be a woman. It is headed by a sitting or retired Judge of the Supreme Court.

- Jurisdiction: All the complaints about those goods and services and compensation value of more than ₹ 1 crore can be filed directly before the National Commission.

- Appeal: An appeal can be filed against the order of the National Commission to the Supreme Court within 30 days from the date of the order passed.

Section – B

(4 × 5 = 20)

Note:

- Answer any four of the following questions in not exceeding 20 lines each.

- Each question carries 5 marks.

Question 4.

Explain the characteristics of entrepreneurs.

Answer:

Entrepreneurs tend to have specific characteristics that distinguish them from other people. The following are some characteristics that every successful entrepreneur must possess.

1. Innovation:

Innovation is an important characteristic of an entrepreneur in modern business. Innovation may take the form of the introduction of a new method or introducing improvements in the existing method. Innovation helps in increasing production and reducing the cost of production.

2. Risk-taking:

The entrepreneur has to pay for all factors of production in advance. There is a chance that he may be rewarded with a handsome profit or he may suffer a heavy loss. Therefore, the risk-bearing is the final responsibility of an entrepreneur.

3. Organisation of Production:

He makes arrangements for land, labor, capital, raw materials, etc, required for setting up a production process. He assesses the viability of having different production processes and selects one that is most suitable.

4. Decision Making:

Every activity of the business requires decision-making. An entrepreneur has to make decisions about the establishment of the business its management and the coordination of various resources.

5. Leadership:

An entrepreneur has to be a leader because he is such a person who organizes, directs, commands, and controls the functioning of the organization. His personality will influence the working of his subordinates because he is taken as a role model. He motivates them to achieve goals quickly and efficiently.

![]()

Question 5.

Explain the relationship between entrepreneur and entrepreneurship.

Answer:

Entrepreneur is the person, entrepreneurship is the process and enterprise is the creation of the person and output of the process. Though the term entrepreneur is often used interchangeably with entrepreneurship, they are conceptually different. The relationship between the two is just like the two sides of the same coin. The following points highlight the relationship between entrepreneurs and entrepreneurship.

- An entrepreneur is a person: Entrepreneurship is a process.

- Entrepreneur is organizer: Entrepreneurship is the organization.

- Entrepreneur is an innovator: Entrepreneurship is innovation.

- An entrepreneur is a risk bearer: Entrepreneurship is risk-bearing.

- Entrepreneur is motivator: Entrepreneurship is motivation.

- Entrepreneur is the creator: Entrepreneurship is the creation.

- Entrepreneur is visualizer: Entrepreneurship is vision.

- Entrepreneur is the leader: Entrepreneurship is leadership.

- Entrepreneur is imitator: Entrepreneurship is imitation.

Question 6.

Distinguish between Home Trade and Foreign Trade.

Answer:

The following are the differences between Home trade and Foreign trade.

| Home Trade | Foreign Trade | |

| 1. Trade | Trade carries within the country. | Trade carried with other countries. |

| 2. Currency | It does not involve any exchange of currency. | It involves the exchange of currencies. |

| 3. Restrictions | It is not subjected to any restrictions. | It is subject to many restrictions. |

| 4. Risk | Transport costs and risks are less. | Transport costs and risks are higher. |

| 5. Nature | It consists of sales, transfer, or exchange of goods within the country. | It involves the import and export of goods. |

| 6. Transport of Goods | The movement of goods depends on the internal transport system. e.g.: Roads and railways. | The movement of goods takes place usually by sea wherever possible. |

| 7. Specialisation | It helps to derive benefits of specialization within the country. | It helps all trading countries to derive the benefits of specialization. |

Question 7.

Explain the advantages of SEZs.

Answer:

Advantages:

The following major benefits can be attributed to Special Economic Zones (SEZ).

- Employment generation: Special Economic Zones are considered to be highly effective tools for job creation.

- Economic development: India can be made a transformed economy if special economic zones are implemented properly because special economic zones are engines for economic development.

- Growth of labor-intensive manufacturing industry: The establishment of special economic zones may lead to faster growth of labor-intensive manufacturing and service industries in the country.

- Balanced regional development: Special economic zones are beautifully crafted initiatives for achieving balanced regional development.

- Capacity building: Special economic zones are necessary for stronger capacity building.

- Export promotion: Special economic zones induce dynamism in the export performance of a country by eliminating

- Distortions resulting from tariffs and other trade barriers.

- The corporate tax system and excessive bureaucracy.

Question 8.

Write the advantages of E-Banking.

Answer:

E-banking brings certain advantages:

- It reduces costs: The cost of banking transactions is considerably reduced. It increases the profitability of the banks.

- Prompt in Services: There is a high degree of personalization and fast and flexible execution. Thus E-Banking prompt service and there is greater customer satisfaction.

- Anywhere and any time banking: It is 24-hour in a day and 7 days in a weekly banking service. Bank accounts can be accessed from anywhere. So the customer can obtain information on his account and conduct transactions from his home or office.

- Cashless banking: Handling of cash is not necessary in E-Banking.

- Global coverage: It provides global network coverage of bank services. NRIs can monitor their bank account in Indian banks, from abroad.

- Central database: The database of each branch is centralized. Customers can deposit, withdraw, or remit money from any branch of their bank.

Question 9.

What is a capital market? What is its importance?

Answer:

Capital Market:

A capital market is a market for long-term funds for more than one year. The main instruments traded in the capital market are equity shares, preference shares, debentures, bonds, etc. Development banks, stock exchanges, and investment. Companies play a major role in the capital market.

Importance of Capital Market:

- The link between Savers and Investors: The capital market plays an important role in mobilizing the savings and diverting them into productive investment.

- Encouragement of Savings: With the development of the capital market, financial institutions provide a vast range of instruments that encourage people to save them.

- Encouragement of Investments: Various assets like Shares, bonds, etc., encourage savers to lend to the government or to invest in industry. Thus the capital market facilitates lending to the businessmen and the government.

- Stability in Price: The capital market tends to stabilize the values of stocks and securities. In this process of stabilization, the capital market provides capital to borrowers at a lower rate of interest.

- Promotes Economic Growth: Economic growth is possible in any country with the proper allocation of resources among the industries. The capital market not only reflects the general conditions of the economy but also smoothens and accelerates the process of economic growth.

Section – C

(5 × 2 = 10)

Note:

- Answer any Five of the following questions in not exceeding 5 lines each.

- Each question carries 2 marks.

Question 10.

Define entrepreneurship.

Answer:

According to P.F. Drucker, “Entrepreneurship is neither a science nor an art. It has a knowledge base. Knowledge in entrepreneurship is a means to an end. Indeed, the ends largely define what contributes knowledge in practice”.

Question 11.

Explain any two functions of an entrepreneur.

Answer:

1. Formation of New Producing Organisation:

It is the function of an entrepreneur, to arrange land, labor, capital, raw materials, etc., required for setting up a production process. According to J.B.Say, the function of a producer/entrepreneur is to rationally combine the forces of production into a new producing organization.

2. Decision Making:

An entrepreneur as a decision maker takes various decisions regarding the following:

- Ascertaining the objective of the enterprise

- Sources of finance

- Product mix

- Pricing policies

- Promotion strategies etc.

Question 12.

Define wholesaler.

Answer:

Wholesale trade means buying and selling goods in large quantities or bulk. The trader who engages in wholesale trade is called a wholesaler. He buys goods in bulk from producers and sells them in small lots to retailers or industrial users.

![]()

Question 13.

Bonded warehouse.

Answer:

Bonded warehouses are licensed by the government to accept imported goods before payment of tax and customs duty. Importers are not permitted to remove goods from the docks or the airport till customs duty is paid.

Question 14.

National Highway.

Answer:

National highways are meant for intertransport. These roads also connect state capitals, major cities, etc. The National Highway Authority of India (NHAI) has the responsibility for the development, maintenance, and operation of the national highways.

Question 15.

Commercial Papers.

Answer:

Commercial paper is a short-term money market instrument, which is issued by companies to raise short-term funds at a lower rate of interest than market rates. It usually has a maturity period of 15 days to one year.

Question 16.

NIFTY.

Answer:

NIFTY is an index of the NSE, which consists of 50 companies from 24 different sectors listed on the NSE. The base year for the index is 1995-96 with the base value as 1000.

Question 17.

Give the meaning of Consumer.

Answer:

Under the Consumer Protection Act 1986, The word consumer has been defined separately for goods and services. For goods, a consumer buys any goods for consideration and any user of such goods other than the person who buys it, provided such use is made with the approval of the buyer. For services, a consumer has any service or services for consideration and any beneficiary of such services provided the service is availed with the approval of the person who had hired the service for consideration.

Part – II (50 Marks)

Section – D

(1 × 20 = 20)

Note: Answer the following question.

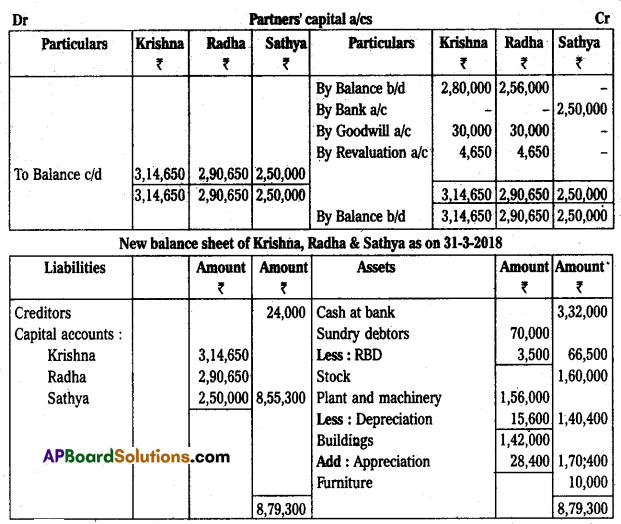

Question 18.

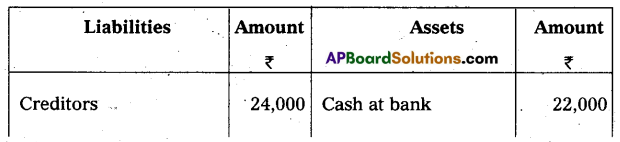

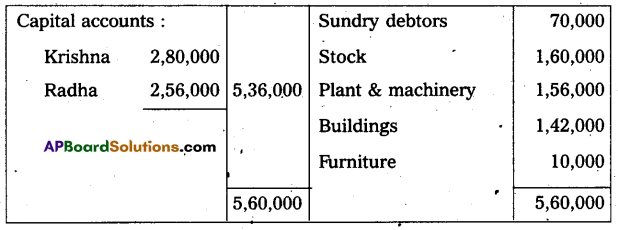

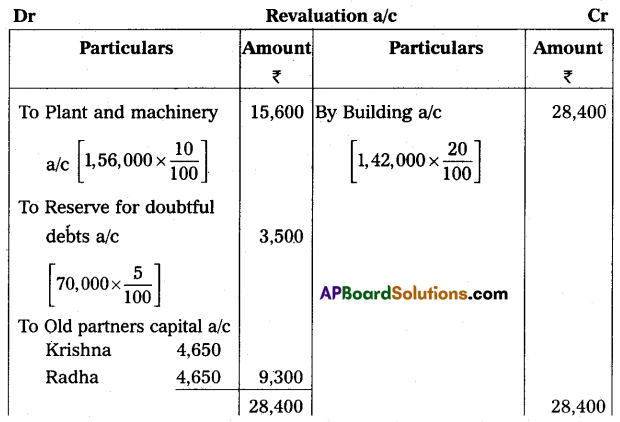

Krishna and Radha are partners in a business sharing profits and losses equally. Their Balance Sheet on 31-03-2018 stood as under:

They decided to admit Sathya into the firm on 01-04-2018 on the following terms and conditions:

(a) Sathya has to pay ₹ 2,50,000 for 1/4 share in future profits.

(b) Sathya has to pay ₹ 60,000 for goodwill.

(c) Plant and machinery to be depreciated by 10%.

(d) Buildings to be appreciated by 20%.

(e) 5% reserve for doubtful debts to be created on debtors.

Prepare necessary accounts in the books of the firm after the admission of Sathya with the new Balance sheet.

Answer:

Section – E

(1 × 10 = 10)

Note: Answer any one of the following questions.

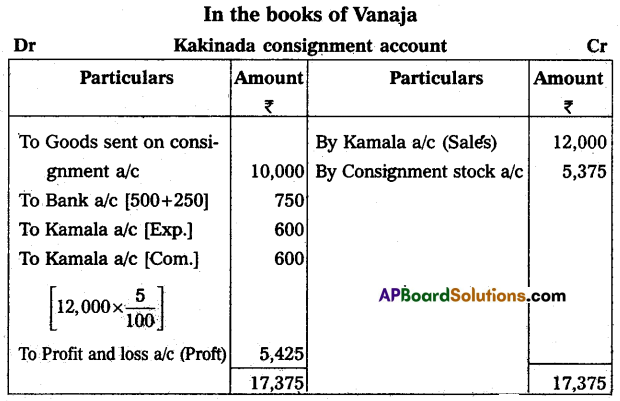

Question 19.

Vanaja of Vijayawada consigned goods worth ₹ 10,000 to his agent Kamala of Kakinada on consignment. Vanaja spent ₹ 500 on transport, and ₹ 250 on insurance, and Kamala sent ₹ 2,500 as advance. After two months. Vanaja received the account sales as follows:

(a) Half of the goods were sold for ₹ 12,000.

(b) Selling expenses were ₹ 600.

(c) 5% commission on sales.

Give ledger accounts in the books of Vanaja.

Answer:

![]()

Question 20.

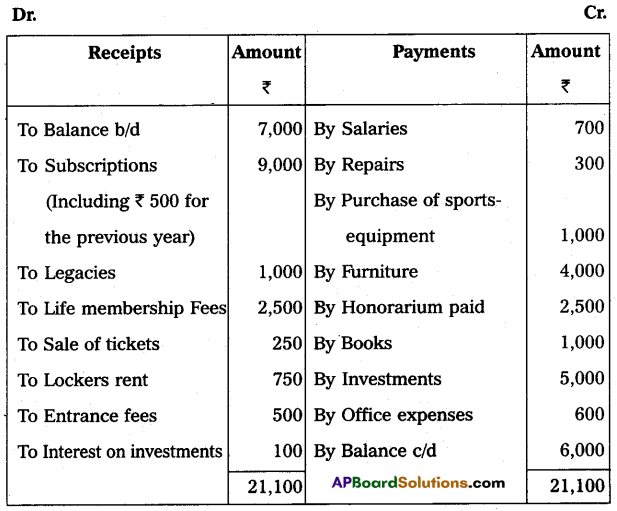

From the following Receipts and Payments Account of Vishakha Sports Club for the year ending 31 March 2018, prepare the Income and Expenditure Account.

Additional information:

(a) Outstanding salaries ₹ 300.

(b) Opening value of sports equipment ₹ 500. Closing value ₹ 250.

(c) Interest accrued on investments ₹ 100.

(d) Subscription receivable for the year 2018, ₹ 1,500.

(e) Capitalize entrance fees.

Answer:

Section – F

(2 × 5 = 10)

Note: Answer any Two of the following questions.

Question 21.

Explain the difference between a bill of exchange and a cheque.

Answer:

Bill of Exchange:

According to sec. 5 of the Negotiable Instruments Act, 1881, “A Bill of Exchange is an instrument in writing containing an unconditional order signed by the maker, directing a certain person to pay a certain sum of money only to or to the order of a certain person or to the bearer of the instrument”.

Cheque:

According to the Negotiable Instruments Act, 1881, Sec. 6. “A cheque is a Bill of Exchange drawn on a specified banker and payable on demand”.

The differences between a Bill of Exchange and a Cheque:

| Basis of Difference | Bill of Exchange | Cheque |

| 1. Acceptance | Bill of Exchange requires acceptance to become a valuable instrument. | Cheques do not require any acceptance. |

| 2. Stamp Duty | It requires the necessary stamp as per the act. | It does not require any stamp. |

| 3. Crossing | It will not have any crossing on the instrument. | It may have crossed. |

| 4. Due to Date | The bill proceeds will be payable on the due date of the instrument. | The cheque amount should be paid for payment immediately as and when it is presented to the bank for payment. |

Question 22.

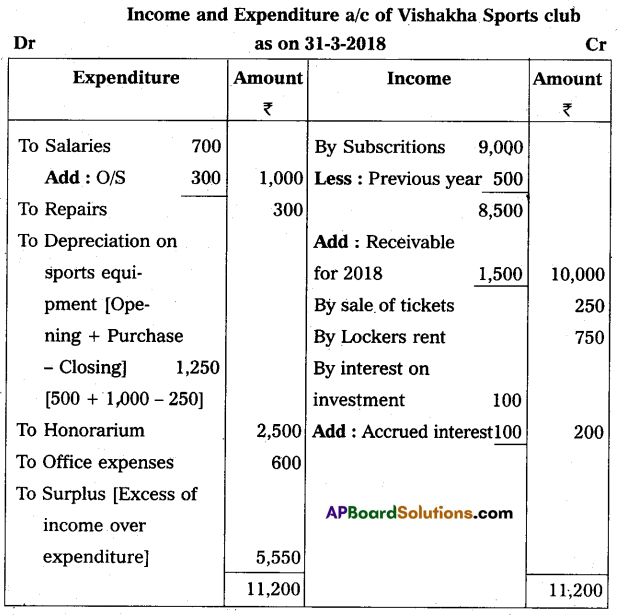

Vinod & Co. purchased plant and machinery for ₹ 35,000 on 1st January 2015 and spent ₹ 5,000 for installation expenses. Depreciation is to be provided at 10% on the Reducing Balance Method. Books are closed on 31st December every year. Prepare Plant and Machinery Accounts for the first three years.

Answer:

Question 23.

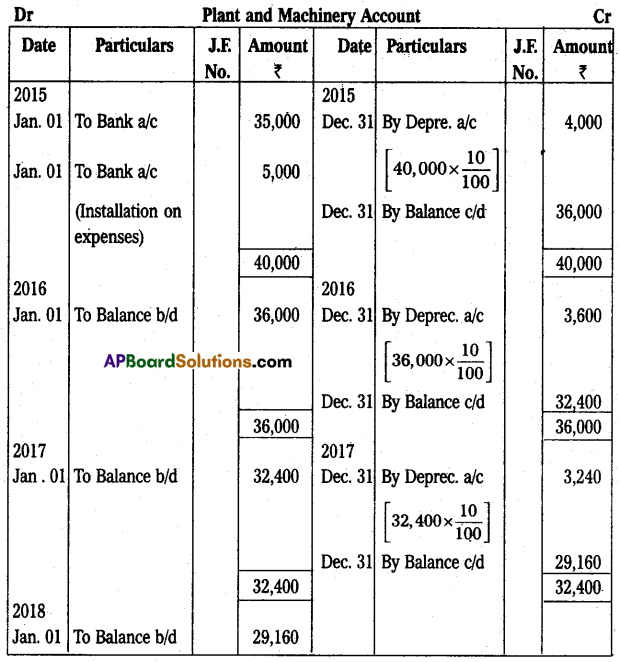

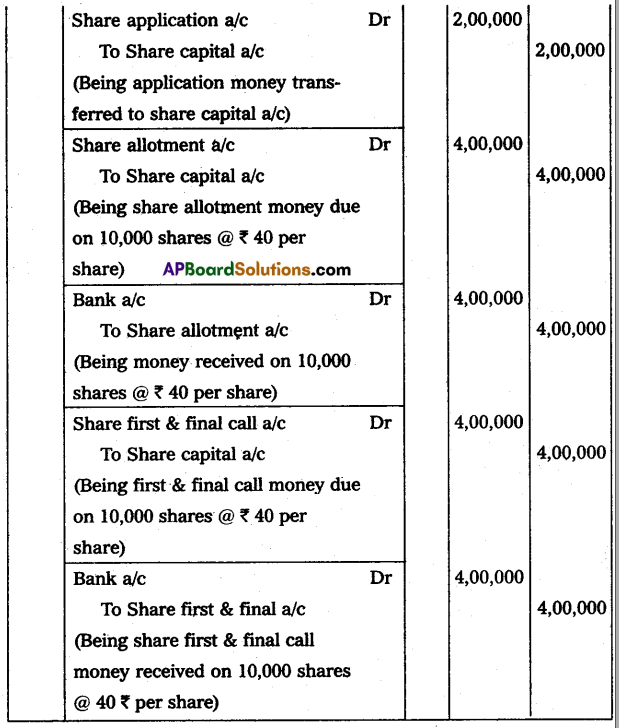

Ram Ltd. issued 10,000 shares of ₹ 100 each for the subscription payable at ₹ 20 per share on application. ₹ 40 per share on the allotment and the balance ₹ 40 on the first and final call. All the amounts were duly received. Make Journal entries in the books of the company.

Answer:

Question 24.

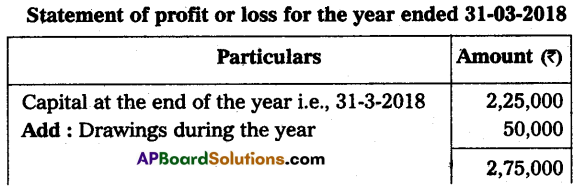

Capital at the beginning of the year i.e. 01-04-2017 – ₹ 2,50,000

Capital at the end of the year i.e., 31-03-2018 – ₹ 2,25,000

Capital brought in by the proprietor during the year – ₹ 12,000

Withdrawals by the proprietor during the year – ₹ 50,000

The above information to prepare the statement of profit or loss.

Answer:

Section – G

(5 × 2 = 10)

Note: Answer any Five of the following questions.

Question 25.

What is the due date of a bill?

Answer:

The date on which the bill falls due is called the “Due date” or “Date of Maturity”. The due date is calculated by adding 3 Grace days to the nominal expiry of the billing period.

Question 26.

What is Obsolescence?

Answer:

Obsolescence implies an existing asset becoming outdated due to technological changes or improvements in production methods. In other words, obsolescence means a reduction in the value of fixed assets due to new inventions, new improvements, and changes in customers’ tastes and preferences.

Question 27.

What do you mean by consignment?

Answer:

The word consignment is derived from the French word ‘Consignor’ which means “to hand over”, “to transmit” or “to send”. Consignment means one person sending goods to another person to sell them. The person who sends goods to another is called a “consignor” and the person who receives goods is called a “consignee”. In consignment consignee sold goods on behalf of the consignor on a commission basis.

Question 28.

What is Legacy?

Answer:

An Amount received by nonprofit organizations as per the will of a deceased person is called a “Legacy”. It is treated as capital income and should be shown on the liabilities side of the Balance sheet.

Question 29.

Goodwill.

Answer:

Goodwill is an intangible asset. Goodwill is the value of the reputation of a firm concerning the profits expected in the future over and above the normal profits.

Question 30.

What is authorized capital?

Answer:

Authorized capital is the amount of share capital that a company is authorized to issue to the public by the memorandum of association. It is also called Nominal or Registered capital.

![]()

Question 31.

Write any two advantages of the computerized accounting system.

Answer:

- Speed: Computerized accounting systems process accounting data faster than manual efforts. This is because computers require less time than human beings to perform a task.

- Reliability: Computerized accounting systems are more reliable than manual accounting systems, because, computer systems perform repetitive operations without tiredness and boredom.

Question 32.

Write any two advantages of incomplete records.

Answer:

- A single-entry system is a simple method of recording transactions.

- It is less expensive when compared to double-entry system bookkeeping.

- It is suitable for small business concerns.

- Ascertainment of profit or loss is very easy.