Collaborative study sessions centered around AP Inter 1st Year Commerce Model Papers and AP Inter 1st Year Commerce Question Paper March 2015 can enhance peer learning.

AP Inter 1st Year Commerce Question Paper March 2015

Time : 3 Hours

Max. Marks : 100

Part – I (50 Marks)

Section – A

Answer any TWO of the following questions in not exceeding 40 lines each.

Question 1.

Define partnership. Discuss its merits and limitations.

Answer:

Partnership is defined by section 4 of Indian Partnership Act of 1932 “as the relation between persons who have agreed to share the profits of the business carried on by all or any of them act for all”.

Merits:

- Easy formation: It is very easy and simple to form a partnership. There are no legal formalities to start the business. No formal documents are required. A simple agreement among partners is sufficient to start the business. Even the registration is not compulsory.

- Large resources : The resources of more than one person are available for the business. The partners can contribute to start a moderately large scale concern.

- Higher managerial power: We can pool capital, organising ability, managerial capacity, technical skill etc., in the partnership. It will leads to work efficiently among partners.

- Promptness in decision making: The partners meet frequently and they can take prompt decisions.

- Flexibility: The partnership is flexible in nature at any time the partners can decide the size or nature of business or area of its operations after taking necessary consent of all the partners.

- Sharing risks: The risk of business is shared by more persons.

- Cautions and sound approach : The principle of unlimited liability induces the partners to work hard for the success of the business. They take keen interest in the affairs of the business.

- Business secrecy : Annual accounts are not published and audit report is also not required. So, business secrets can be maintained.

- Benefits of specialisation : All partners actively participate in the business as per their specialisation and knowledge.

Limitations:

- Unlimited liability : The unlimited liability is fundamental drawback of partnership. The partners are personally liable for the debts of the firm.

- Instability : The partnership concern suffers from uncertainity of duration because it can be dissolved on the death, lunacy or insolvency of the partner.

- Limited resources : There is limitation in raising additional capital for expansion purposes. The business resources are lim-ited to the personal funds of the partners.

- Non-transferability of share: No partner can transfer his share to third party without the consent of other partners.

- Mutual distrust: The mutual distrust among partners is the main cause for dissolution of partnership firms.

- Delay in decisions: Before any decision is taken all the partners must be consulted. Hence quick decisions cannot be taken.

Question 2.

What is Memorandum of Association ? Explain its clauses.

Answer:

The Memorandum of Association is the most important document of the company. It is to be filed with the Registrar for obtaining the certificate of incorporation. It is the charter of the company. It forms the foundation on which the super structure of the company is based. It establishes the relationship between the company and the outside world. The contents of the Memorandum cannot be altered at the option of directors or even the shareholders. It is to be altered only with the central governments approval and court approval in many cases.

The Memorandum has to be divided into paragraphs, consecu-tively numbered and has to be printed. It should be signed by seven members in the case of public company and by two members in the case of Private company.

Memorandum of Association contains the following clauses.

1) Name clause: In this clause, the name of the company should be stated. The company is free to adopt any name it likes. But it should not resemble the name of another registered company. It should not any words pertaining to Government or local government, such as royal, crown, state etc. The name’ of the company must end with the word Limited’ if it is a public company or with the words Private Limited’ if it is a private company.

2) Situation clause : The place and the state in which the regis-tered oPice is to be situated must be mentioned in this clause.

3) Objects clause: This is the most important Clause of the Memorandum. This gives out the various objects for which the company is formed. The objects of the company must be legal and be very clearly defined. A company has power to carry on only those types of business which are included in the objects clause. Any action beyond the express powers of the company is ultravirus i.e., beyond the scope of the memorandum. Therefore, it should be carefully drafted.

4) Liability clause: This clause clearly states that the liability of members is limited to the extent of the face value of the shares purchased by them.

5) Capital clause : The amount of capital required by the com-pany is stated in this clause. This is called authorised or nominal or registered capital. This capital is divided into small units called as shares. The company must mention the number and kinds of shares and the value of each share.

6) Association and subscription clause : This clause contains the names of the persons who signed in the memorandum. The memorandum must be signed by atleast seven persons in case of public company and atleast two persons in the case of private company. Each subscriber must take atleast one share in the company. The subscribers declare that they agree to incorporate the company and agree to take the shares stated against their name. The signatures of the subscribers are attested by atleast one witness each. The addresses and occupations of subscribers and the witnesses are also given.

![]()

Question 3.

What is Business Finance ? Explain its need and significance in the Business Organisation.

Answer:

The requirement of funds by business firm to accomplish its various activities is called business finance.

R.C. Osborn defines business finance as “The process of acquiring and utilising funds by business”.

Need and signifiance of business finance:

- To commence a new business : Money is needed to start a new business and to procure fixed assets like land and buildings etc., working capital is required to meet the day-to-day expenses and holding current assets like cash, stock-in-trade etc.

- To expand the business: Huge amount of funds are required for purchasing Sophisticated machinery and for employing technically skilled labour. The quality of the product can be improved and cost per unit can be reduced by adopting new technology.

- To develop and market new products: Business needs money to spend on developing and marketing new products.

- To enter new markets : Creation of new markets leads attracting new customers. Business spend money on advertisement and retail shops in busy areas.

- To take over another business : In other to overcome competition an enterprise may decide to take over another business.

- To more to new premises : Sometimes a business may be forced to shift the business in another place.

- Day-to-day running ; A business needs money to meet the day-to-day requirements like wages, taxes etc.

Section – B (4 × 5 = 20)

Answer any four of the following questions in not exceeding 20 lines each:

Question 4.

Define sole proprietorship and discuss its four merits.

Answer:

In this organisation only one individual is at the helm of all affairs of business. He makes all the investments. He bears all risks and takes all profits. He manages and controls the business himself. The business is run with the help of his family members or paid employees. His liability is unlimited. The sole trader is the sole organiser, manager, controller and master of his business.

Kimball and Kimball defines “Sole Proprietorship is a form of business where the individual proprietor is the supreme judge of all matters pertaining to his business”.

Merits:

- Easy to form : It is very easy and simple to form a sole trading business. The capital required is small. There are no legal formalities for starting the business.

- Prompt decisions and quick action: The sole trader is the sole dictator of his business. There is no need to consult any body while taking decisions. So, decisions can be taken quickly.

- Incentive to work hard : The Sole trader takes all the profits. There is a direct connection between the effort and reward. So, it is an incentive for him to work hard. He manages the business to the best of his ability.

- Flexibility in operation: Changes in the business are necessary. The sole trading concern is dynamic in its nature. The nature of the business can be easily changed according to charging market conditions.

- Business secrecy : Since the whole business is handled by the proprietor, his business secrets are known to him only. He need not publish annual accounts and there is no need to disclose the information to outsiders. So, he can maintain business secrets.

- Contact with customers: It is easy to maintain personal contact with the customers. He can easily know their tastes, likes and dislikes and adjust his operations accordingly. This results in increase of sales.

Demerits:

- Limited resources: The resources of sole trader are limited. He has only two sources of securing capital, personal savings and borrowing on personal security. Hence, he can raise very limited amount of capital.

- Instability: It has no separate legal status. The business and the owner are inseparable from one another. The business comes to an end on the insolvency, insanity or death of the sole trader.

- Unlimited liability : The liability of a sole trader is unlimited. The creditors can recover the loan amounts not only from the business assets but also from his private property.

- Not suitable for large scale operations: The resources are limited. Therefore, it is suitable only for small business and not large scale operations.

- Limited managerial skill : The managerial ability is limited. A person may not be an expert in all matters. Sometimes, wrong decisions may be taken.

Question 5.

Briefly explain five different types of Cooperative Societies.

Answer:

According to the needs of people the following of co-operative societies are started in India.

1. Consumers Co-operative Society: These are started to help lower and middle class people. These societies protect weaver sections from the cultches of hungry business men. These societies make bulk purchases directly from the producers and sells these goods to the members on retail basis. The commission and profits of the middle men are eliminated. The members contribute capital and membership is open to all irrespective of caste, creed, colour etc.

2. Producers Co-operative Society: Small producers find it difficult to collect various factors of production and they also face marketing problems. The production of goods is undertaken by members in their houses or at common place. They are paid wages for their services. They are supplied raw material and equipment by the society. The output is collected and sold by the society. The profits are distributed among members after retaining some profits in the general pool.

Ex: Apco, Cooptex, Emmiganur weavers co-operative society.

3. Marketing Cooperative Society: These societies are established by producers for selling their products at remunerative prices. These societies pool production from different members and undertake to sell these products by eliminating middle men. The goods are sold when the market is favourable. These societies provide some advance money to the members for helping them in meeting their urgent needs The sale proceeds are shard among members according to thei contributions. These societies provide services like grading, wert housing, insurance, finance etc.

4. Co-Operative Credit Societies : These societies are voluntai associations of people. They are formed with the objectives to provide the short time financial accommodation to their members. These societies are formed with the idea of saving their members from the cultches of money-lenders.

5. Co-Operative Housing Societies : Such societies are formed to provide residential accomodation to their members either on ownership basis or at fair rents. They are organized by poor and middle class people in big cities where housing is a serious problem. Housing co-operative buys and land and constructs flats which are alloted to members.

Question 6.

What is Article of Association ? Also explain its contents.

Answer:

Articles of Association is another important document to be registered with the Registrar at the time of incorporation. Some rules and regulations are necessary for conducting the internal affairs of the company efficiently. Articles contain only those rules and regulations and guide the management in day-to-day administration. It defines the relationship between the members and the company. It defines clearly the rights, duties and liabilities of shareholders, directors and chief executives. According to Section 2(2) of the companies Act “Articles of Association of the company as originally framed or as altered from time to time in pursuance of any previous companies law or of this Act”.

The private companies limited by shares, limited by guarantee and unlimited companies must have their articles of association. A public company limited by shares may not have own articles. If the company not prepared articles, it may adopt all or any regulations contained in Table A Schedule I of the Act.

The articles must be printed, divided into paragraphs, numbered consecutively, stamped and side by each subscriber of memorandum is duly witnessed and filed along with memorandum.

Contents : The Articles of Association contain the following details.

- Share capital – Division, number of shares, value of the shares, rights of the shareholders.

- Calls on shares.

- Rights of the underwriters.

- Transfer and transmission of shares.

- Forfeiture of shares and reissue.

- Lieu on shares.

- Conversion of shares into stock and stock into shares.

- Alteration of share capital.

- Issue of share warrants.

- Company meetings and resolutions.

- Borrowing powers of the company.

- Reserves, dividends, conversion of profits into capital.

- Company common seal.

- Approval of preliminary contracts.

- Quorum for the meetings.

- Voting procedure for members.

- Rights, duties, remuneration and their liabilities.

- Appointment, rights and remuneration of secretary and managing director.

- Minimum subscription.

- Company accounts and audit.

- Arbitration.

- Winding up of the company.

Question 7.

Differentiate between the Shares and Debentures.

Answer:

The following are the differences between shares and Debentures.

| Shares | Debentures |

| 1. A share is a part of owned capital. | 1. A Debenture is an acknowledge of debt. |

| 2. Share holders are paid dividend on the shares held by them. | 2. Debenture holders are paid interest on debentures. |

| 3. The rate of dividend depends upon the amount of divisible profits and policy of the company. | 3. A fixed rate of interest is paid on debentures irrespective of profit or loss. |

| 4. Dividend on shares is a charge against profit and loss Appropriation account. | 4. Interest on debenture is a charge against profit and Loss account. |

| 5. Share folders have voting rights. They have control over the management of the company. | 5. Debenture holders are only creditors of the company. They cannot participate in management. |

| 6. At the time of liquidation of the company, share capital is payable after meeting all out side liabilities. | 6. Debentures are payable in priority over share capital at the time of liquidation of the company. |

![]()

Question 8.

What are the sources of Short-term Finance ?

Answer:

The following are the sources of short-term finance :

1. Bank credit : Commercial banks extend the short term financial assistance to business in the form of loans, cash credits, overdrafts and discount of bills. Bank loans are provided for a specific short period. Such advance is credited to loan account and the borrower has to pay interest on the entire amount of loan sanctioned. Bank grants cash credits upto a specific limit. The firm can withdraw any amount within that limit. Interest is charged on the actual amount withdrawn. In overdraft, the customer can overdraw his current account. The arrangement is for short period only. Commercial banks finance the business houses by discounting the bills of exchange and promissory notes.

2. Trade credit: Just as firm grants credit to customers, so it often gets credit from suppliers. It is known as trade credit. It does not make available of funds in cash but it facilitates the purchase of goods without immediate payment of cash.

3. Installment credit: Business firms get credit from equipment suppliers. The suppliers may allow the purchase of equipment with payments extended over a period of 12 months or more. Some portion of the cost price is paid on delivery and the balance is paid in number of installments. The supplier charges interest on the unpaid balance.

4. Customers advance: Many times, the manufacturer of goods insist on advance by customers incase of big order. The customers advance represent a part of the price of the product which will be delivered at a later date.

5. Commercial paper : Commercial paper is an unsecured promissory note issued by a firm to raise funds for shorter period, varying from 90 days to 365 days. It is issued by one firm to another firm. The amount raised by C.P. is large. As the debt is totally unsecured, firms having good credit rating can issue commercial paper.

Question 9.

Explain any five disadvantages of Multinational Corporations to the host country.

Answer:

The following are the disadvantages of MNC to host country.

- Threat to sovereignty : MNCs pose a danger to the independence of host countries. These corporations tend to interfere in the political affairs of the host nation.

- Spread of foreign culture: MNCs tend to vitiate the cultural heritage of local people. They propagate their own culture to sell their products.

- Depletion of natural resources: MNCs cause rapid depletion of the some of the resources of the host nation.

- Retard growth of employment: They create relatively few job opportunities and fail to solve chronic problems like unemployment etc.

Section – C

(5 × 2 = 10)

Answer any five of the following questions in not exceeding 5 lines each:

Question 10.

What is Profession ?

Answer:

Profession is an occupation involving the provision of personal service of a specialised and expert nature. The service is based on professional education, knowledge, training etc. The specfied service is provided for a professional fees charged from the clients. For example; a doctor helps his patients through his expert knowledge of science of medicine and Charges a fee for the service.

Question 11.

Define Genetic Industries.

Answer:

Genetic industry is related to the reproducing and multiplying certain species of animals and plants with the object of earning profit from their sale. E.g. : Nurseries, cattle breeding, poultry farm, fish hatcheries etc.

Question 12.

Define Joint Hindu Family.

Answer:

This form of organisation is prevalent in India only and that to among Hindus. It does not have any separate and distinct legal existance from that of its members. No outsider can be admitted into this form of business and the membership can be acquired by birth. The business of Joint Hindu Family is controlled under the Hindu law.

All the affairs of the Joint Hindu Family are controlled and managed by the senior male member of the family known as Karta or Manager. The other members are co-parceners. He works in consultation with other members of the family and act on behalf of them. He is not accountable to any one. He has a final say on all the matters. The liability of the Karta is unlimited but the liability of the other members is limited to their share in the business.

Joint Hindu family business is governed by two laws – Dayabhaga and Mitakshara.

Mitakshara: It is applicable to whole of India except Assam and Bengal. According to this law, three successive generations in the male line (son, grand son, great grand son) inherit the ancestral property by birth.

Dayabhaga: It is applicable in Assam and Bengal. According to this, the male heirs become members only on the death of the father.

Question 13.

What is prospectus ?

Answer:

A public limited company soon after its incorporation issues a prospectus. It is a circular inviting the public to subscribe to the shares of the company. It is issued by the public company with a view to raising necessary funds from the investors. It will be in the form of appeal describing the prospectus of the company Section 2(36) of the companies Act, defines prospectus as “any notice, circular, advertisement or other invitation offering to the public for subscription or purchase of any shares or debentures of body corporate”.

The objects of issue of prospectus is to bring to the notice of the public that a new company has been formed, it has able and competent board of directors and to create confidence in the public about the company and its profitability.

The prospectus should be dated and signed by the directors. A copy of the prospectus must be filed with the Registrar on or before the date of publication. No copy of the prospectus should .be’ issued until a copy has been filed with the Registrar.

Every prospectus contains an application form on which an intending investors can apply for the purchase of shares and debentures. A public company must get minimum subscription within 120 days from the date of issue of prospectus. If it fails to get the minimum subscription, it has to return the amount already collected.

Question 14.

What is Fixed Capital ?

Answer:

The capital which is used to acquire fixed assets such as land and buildings, plant and machinery etc., is called fixed capital. Capital used by the business organisations to meet the long term requirements is called fixed capital or block capital. The amount of fixed capital required by the business concern depends on the size and nature of business.

![]()

Question 15.

Define Equity Shares.

Answer:

These shares are also known as ordinary shares. Equity shareholders are the real owners of the company, as these shares carry voting rights. Equity shareholders are paid dividend after paying the preference shares. The rate of dividend depends upon the profits of the company. There may be higher rate of dividend or they may not get anything. These shareholders take more risk as compared to preference shares. Equity share capital is returned after meeting all other claims including preference shares.

Question 16.

Define Small Enterprises.

Answer:

In case of manufacturing enterpirses, a Small Enterprise is an enterprise where the investment in Plant and Machinery is more than ₹ 25 lakhs but does not exceed ₹ 5 crores.

In case of service enterprises, a small enterprise is an enterprise where investment in equipment is more than ₹ 10 lakhs but does not exceed ₹ 5 crores.

Question 17.

What is E-Marketing ?

Answer:

Electronic marketing provides a world wide platform for buying and selling of goods without having any geographical barriers. The Internet allows companies to react to the individual customers demands immediately without any loss of time. It does not matter where customer is located. It can be done by e-mails etc.

Part – II (Marks 50)

Section – D (1 × 20 = 20)

Answer the following question :

Question 18.

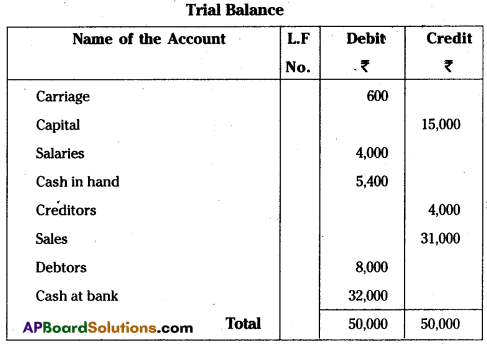

From the following Trial Balance of Mr. Pavan, prepare Final Accounts for the year ending 31-12-2014.

Trial Balance on 31-12-2014

Adjustments:

i) Closing stock Rs. 7,500

ii) Depreciation on machinery Rs. 12%

iii) Commission received in advance Rs. 1,200

iv) Interest receivable Rs. 1,500

v) Further bad debtors Rs. 400

vi) Prepared Insurance Rs. 500

Answer:

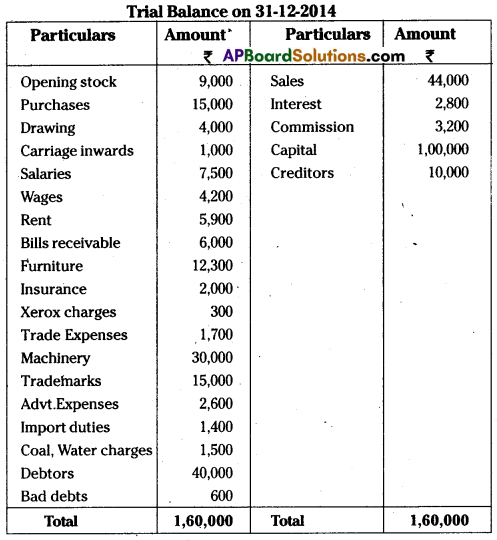

Trading, Profit and Loss a/c of a trader for the year ending 31-3-2014

Balance Sheet as on 31-03-2014

Note : Rent is taken as ₹ 5,900

Section – E (1 × 10 = 10)

Answer any one of the following questions :

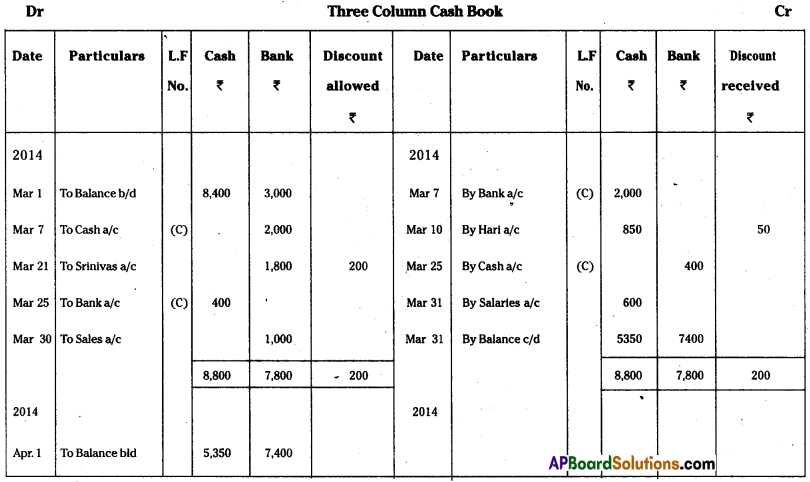

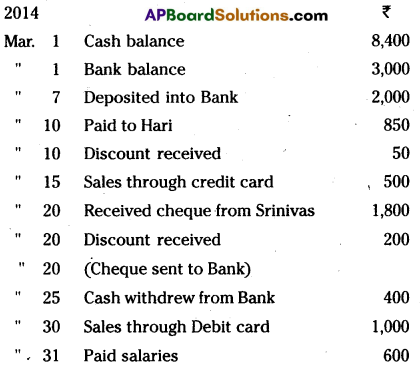

Question 19.

Prepare three Column cash book from the following:

Answer:

Question 20.

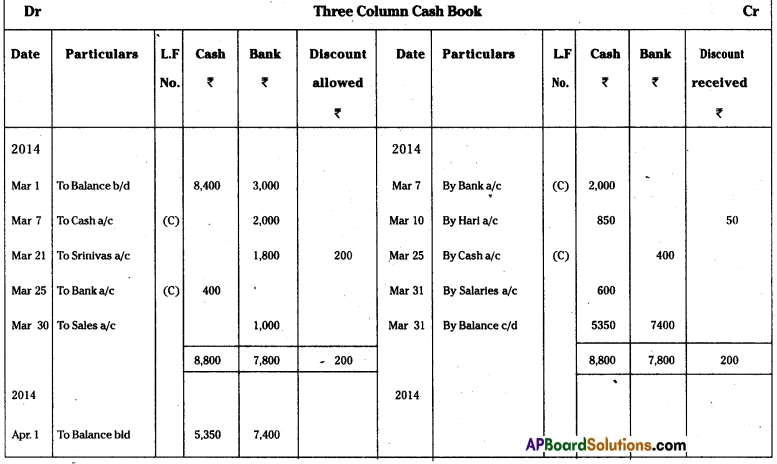

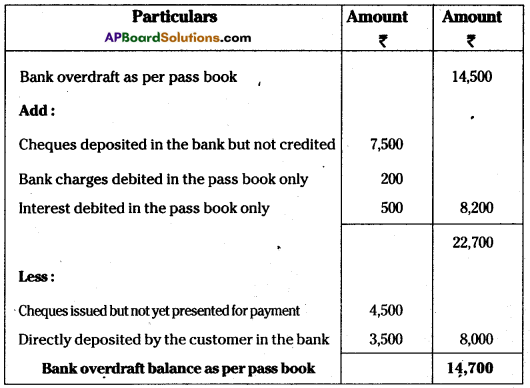

Prepare Bank Reconciliation Statement from the following transactions on 31-03-2014:

a) Bank overdraft as per cash book Rs. 14,500.

b) Cheque issued but not vet presented for payment Rs. 4,500.

c) Directly deposited by customer in Bank Account Rs. 3,500.

d) Cheques deposited in bank but not credited Rs. 7,500.

e) Debited in pass book of Bank charges Rs. 200.

f) Interest debited in the pass book only Rs. 500.

Answer:

Bank overdraft as per pass book

Section – F (2 × 5 = 10)

Answer any two of the following questions :

Question 21.

Explain different types of Accounts along with their Debit and Credit principles.

Answer:

Accounts are broadly divided into two types.

1) Personal Accounts

2) Impersonal accounts.

1) Personal Accounts : These accounts which relate to the persons, group of persons or institutions are called personal accounts. Ex.: Rama’s a/c, Andhra Bank a/c., LIC a/c, Infosys Ltd. The rule in personal accounts is “Debit the receiver and credit the giver”. According to this, benefit receivers account is debited and benefit givers account is credited.

2) Impersonal Accounts : Impersonal accounts are those accounts which are not personal accounts. They are again divided into

i) Real Accounts

ii) Nominal Accounts.

i) Real Accounts: These accounts related to the assets and properties of the business firm. Ex.: Building, machinery, stock, goodwill etc.

The rule in real accounts is “Debit what comes in and credit what goes out”. When an asset is received the asset account is debited and when the asset goes out of the business, the asset is credited.

ii) Nominal Accounts : These accounts relate to expenses, incomes or gains or losses. Ex. : Salary a/c, Rent a/c, Commission received a/c etc.

The rule in nominal accounts is “Debit all expenses and losses and credit all incomes and gains”.

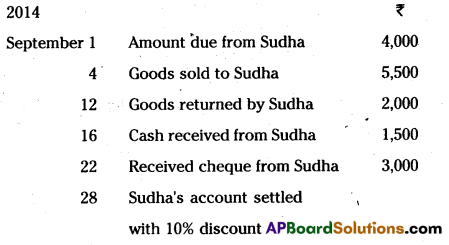

Question 22.

Prepare Sudha’s 2014 account from the following :

Answer:

Question 23.

What is meant by Suspense Account ? Why is it opened ? Explain.

Answer:

When the tried balance does not agree, an effort is made to locate the errors and rectify them. But if the errors cannot be located easily and quickly and at the same time, if the final accounts are to be prepared urgently, the difference in the trial balance is made good by writing it to smaller side of the trial balance under the name ‘suspense account’ such temporary suspense account is closed later when once errors are located and rectified.

The suspense account is an imaginary account opened temporarily for the purpose of just tallying trial balance. Ex: if the debit side of the trial balance exceeds credit side, then the difference put on the credit side and the suspense account shows credit balance. If the credit side of the trial balance exceeds debit side, then the difference is put – on the debit side and suspense account shows debit balance. The difference in trial balance are due to one side errors and not due to other errors. The errors which involve both the accounts permits the trial balance to agree and therefore they do not give rise to suspense account. The balance of suspense account is shown on the balance sheet either on liabilities or assets side, depending upon whether the suspense account has a credit or debit balance.

![]()

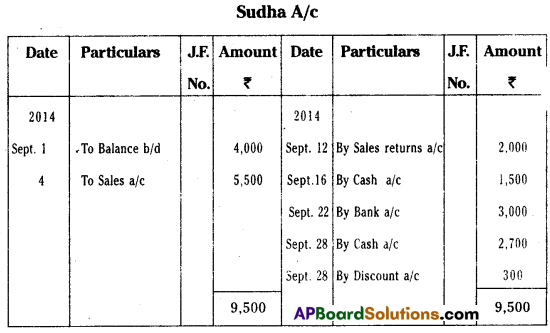

Question 24.

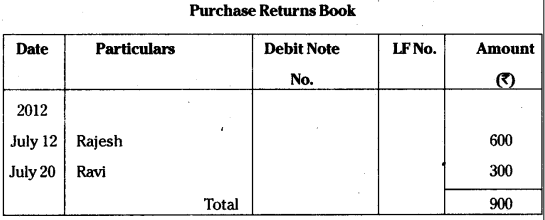

Enter the following in purchase book purchase return book :

Answer:

Section – G (5 × 2 = 10)

Answer any five of the following questions :

Question 25.

What is Accounting ?

Answer:

The American Institute of Public Accountants defined accounting as “the art of recording, classifying and summerising in significant manner and interms of money transactions and events which are in part, atleast of financial character and interpreting the results thereof”.

Question 26.

Define Dual Aspect concept.

Answer:

Under this concept, every transaction has got a two fold aspect,

- Receiving the benefit and

- Giving of that benefit.

For instance, when a firm acquires an asset, (receiving the benefit) it must pay cash (giving of that benefit). Therefore, two accounts are to be passed in the books of accounts, one for receiving the benefit and other for giving the benefit. Thus, there will be a double entry for every transaction debit- for receiving the benefit and credit for giving the benefit.

Question 27.

What is meant by Overdraft ?

Answer:

Overdraft is a credit facility given by a bank to draw the amounts repeatedly up to a certain limit sanctioned as and when the need arises. This can be repaid by depositing cash and cheques and bank charges interest on the overdraft facility availed by the firm. The overdraft can be called as ‘unfavourable balance’.

Question 28.

Define Capital Income.

Answer:

Any amount received as investment by the owners, raised by way of loans and income received on sale of fixed assets is called capital income.

Ex.: Capital, sale of machinery.

Question 29.

Define Contra Entry.

Answer:

Contra means the other side, if the double entry of a transaction is complete in the cash book it self such entry is called contra entry. Contra entry arise when the cash and bank accounts are simultaneously involved in a transaction. It happens when either cash or cheques are deposited in the bank or cash is withdrawn from it for office use. In both the cases entries are to made in cash and bank columns.

![]()

Question 30.

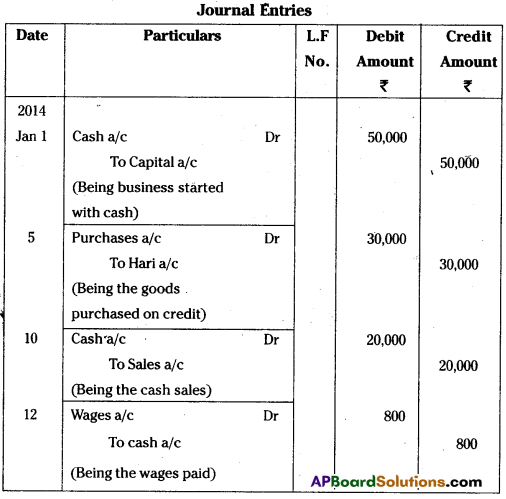

Journalise the following transactions :

Answer:

Question 31.

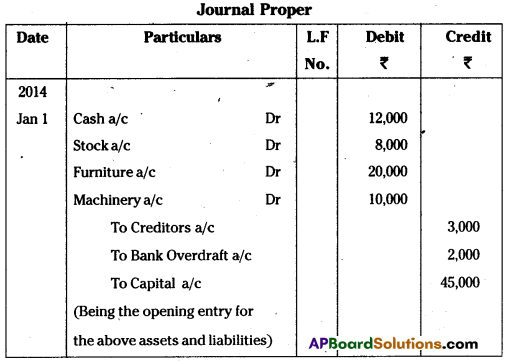

Write the following particulars as opening Journal Entries on 1-01-2014:

Answer:

Question 32.

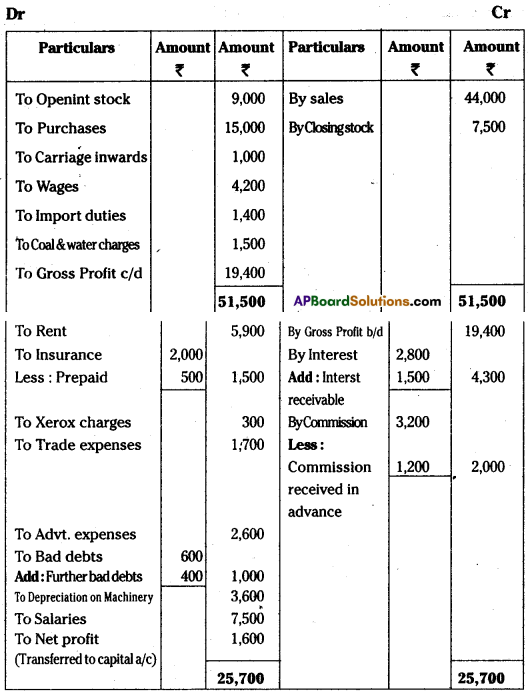

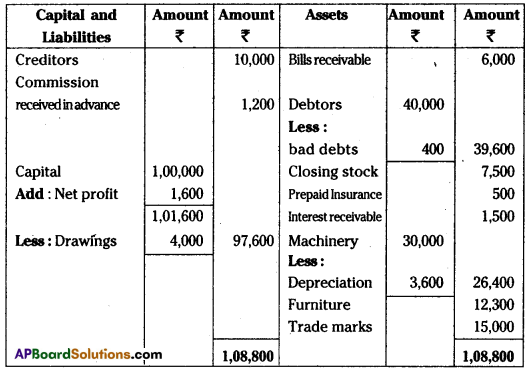

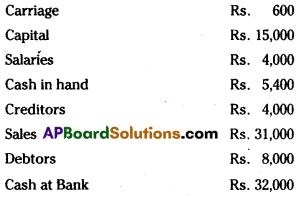

Prepare Trial Balance from the following transactions :

Answer: