Students must practice these AP Inter 2nd Year Accountancy Important Questions 10th Lesson Accounts from Incomplete Records to boost their exam preparation.

AP Inter 2nd Year Accountancy Important Questions 10th Lesson Accounts from Incomplete Records

Short Answer Questions

Question 1.

What is meant by accounts from Incomplete records ? [Mar. 2020, ’19 (AP)]

Answer:

Under this system only one side aspect of the transaction is to be recorded instead of two aspects. Hence this system is called ’Single Entry System’. Personal Accounts and Cash Book are maintained, Real and Nominal accounts are not maintained. Hence this method is known as “Incomplete Double Entry System’.

![]()

Question 2.

Define accounts from Incomplete records. (OR) [May ’17 (AP)]

Define Single Entry System. [May 2022]

Answer:

Kohler defines Single Entry System as “A system of Book-Keeping in which as a rule only record of cash and of personal accounts are maintained, it is always Double Entry, varying with the circumstances”.

Hrishikesh Chakraborthy defines Single Entry System as a “Mixer of Double Entry, Single entry and No entry’.

Question 3.

What are the uses of Incomplete records? [Mar ’18 (AP)]

Answer:

- Single entry is a simple method of recording transactions.

- It is less expensive when compared to Double Entry System of Book-Keeping.

- It is mainly suitable to small business concerns.

- It is very easy to follow without any adequate knowledge of accounting.

- Ascertainment of profit or loss is very easy.

Question 4.

Write briefly the salient features of Incomplete records.

Answer:

- It is unsystematic method of recording transactions.

- It is very common to keep only personal accounts.

- It avoids real and nominal accounts.

- This system lacks uniformity.

- It is mostly suitable and used by sole traders and partnership concerns.

Question 5.

Give two main differences between a statement of affairs and a balance sheet.

Answer:

Differences between statement of affairs and a balance sheet.

| Statement of Affairs | Balance Sheet |

| 1. It is prepared with object to know the capital at the beginning or at the end of the year. | 1. It is prepared to know the financial position of the business. |

| 2. Statement of affairs is not accepted as a proof in the court of law. | 2. Balance sheet is accepted as an evidence in the court of law. |

| 3. It is prepared before the preparation of statement of profit or loss. | 3. It is prepared after trading and profit & loss account. |

| 4. Capital is taken as excess of assets over liabilities. | 4. Capital is taken from the ledger. |

Question 6.

How to ascertain profit under Incomplete records ?

Answer:

Under this system it is not possible to prepare a trading and profit and loss account as no record is kept of the nominal accounts and the exact proit or loss for the period cannot be ascertained. But, the net profit can be calculated by Statement of Affairs method.

1. Under this method, the net profit force period can be calculated by comparing the opening capital with the closing capital.

2. Opening and closing capitals can be ascertained by preparing two statements of affairs one at the beginning and the other at the end of the period.

3. Adjustments are to be made in respect of drawings and additional to capital during the period under consideration. Drawings must be added to the capital at the end.

4. Additional capital should be deducted from the capital at the end to know correct profit.

Net profit = Capital at the end + Drawings – Additional capital = Adjusted capital – Capital at the beginning.

Question 7.

Write in brief the limitations of Incomplete records of book keeping.

Answer:

1. It is an unscientific method of accounting.

2. Twofold aspects of every transaction is not recorded in the books of accounts. Hence, Trial balance cannot be prepared, therefore the arithmetical accuracy of the books of accounts cannot be checked.

3. In the absence of nominal accounts, trading and profit and loss account cannot be prepared.

4. In the absence of real accounts, it is not possible to know the exact financial position of the business on any particular day by preparing Balance sheet.

5. There is a scope for misappropriation and fraud.

6. In the absence of various checks it is very difficult to find and rectify the errors.

7. It is not suitable for planning and sound decision-making.

![]()

Question 8.

Write any five differences between double entry system and single entry system. [Mar ’17 (AP)]

Answer:

Differences between:

| Double Entry System | Double Entry System |

| 1. Type : It is perfect and complete system of book keeping. | It is an incomplete system and a crude form of book keeping. |

| 2. Nature: This system is scientific and follows certain accounting principles. | This system is unscientific and does not follow accounting principles. |

| 3. Two aspects: Both debit and credit aspects of each transation are recorded. | Both the aspects are not recorded but only one aspects of the each transation is recorded. |

| 4. Records: It provides complete and detailed records of business. | It does not provide complete and detailed records of business. |

| 5. Accounts: All types fo accounts are maintained. | All personal accounts and cash book only are maintained. |

| 6. Trial Balance : Arithmetical Accuracy of accounts can be checked. | Trial balance can be prepared to check the arithmetical accuracy. |

| 7. Ascertainment of profits : Profits can be ascertained by preparing a trading and profit and loss account. | True profit can be ascertained. |

| 8. Cost: It is a more expensive. | It is a less expensive. |

| 9. Errors: Errors can be easily detected and rectified. | Errors can not be detected and rectified. |

Exercise

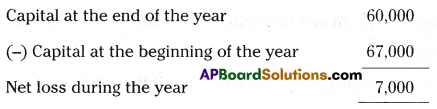

Question 1.

From the following find the profit earned by a trader.

Capital at the beginning of the year — Rs. 7,500

Capital at the end of the year — Rs. 10,000

[Ans: Profit Rs. 2,500]

Answer:

Statement of Profit or Loss

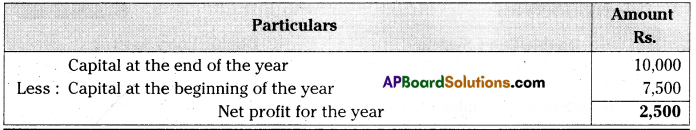

Question 2.

Calculate the profit or loss of a concern

Capital at the beginning of the year — Rs. 15,000

Capital at the end of the year — Rs. 14,000

[Ans: Net Loss Rs. 1,000]

Answer:

Statement of Profit or Loss

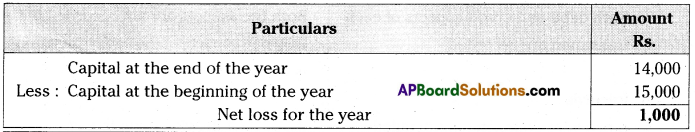

Question 3.

Calculate the missing figure

Capital at the beginning — ?

Capital at the end — Rs. 36,000

Capital introduced — Rs. 9,400

Drawings — Rs. 5,600

Loss — Rs. 2,800

[Ans: 35,000]

Answer:

Statement showing capital at the beginning

Question 4.

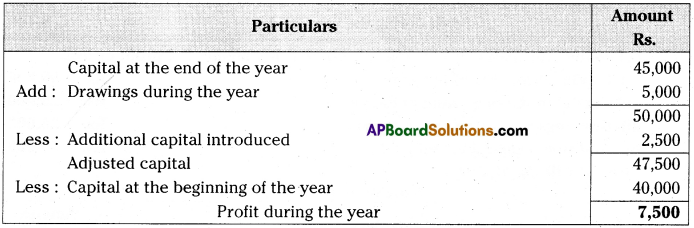

Find out the profit from the following, data:

Capital at the beginning for the year — Rs. 40,000

Capital at the end of the year — Rs. 45,000

Drawings during the year — Rs. 5,000

Capital introduced during the year — Rs. 2,500

[Ans : Profit Rs. 7,500]

Answer:

Statement of Profit or Loss

![]()

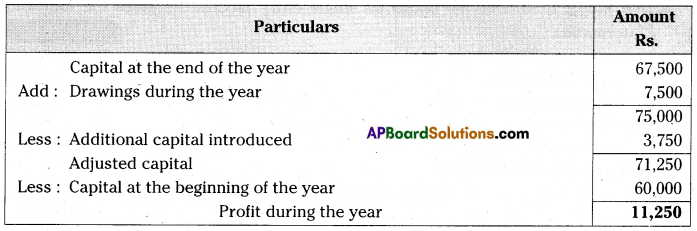

Question 5.

Find out the profit from the following data :

Capital at the beginning for the year — Rs. 60,000

Capital at the end of the year — Rs. 67,500

Drawings during the year — Rs. 7,500

Additional capital introduced during the year — Rs. 3,750

[Ans : Profit Rs. 11,250]

Answer:

Statement of Profit or Loss

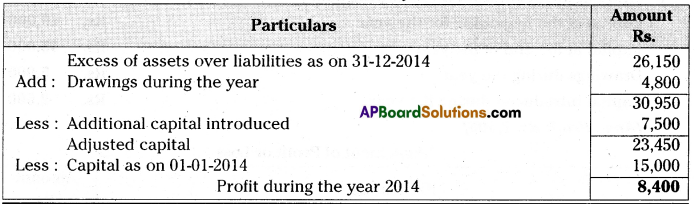

Question 6.

Ascertain profit earned by a trader who keeps this books under single entry system.

i) Excess of assets over liabilities as on 31-12-2014 — Rs. 26,150

ii) Additional capital introduced during the year — Rs. 7,500

iii) Drawings during the year — Rs. 4,800

vi) Capital as on 01-01-2014 — Rs. 15,000

[Ans: Profit Rs. 8,450]

Answer:

Statement of Profit or Loss for the year ended on 31-12-2014

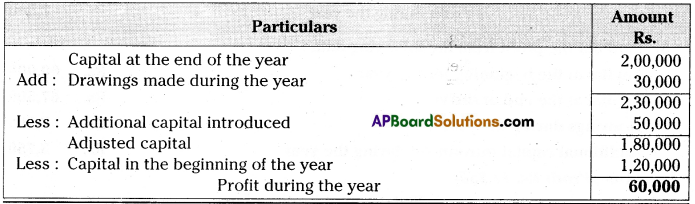

Question 7.

Following information given below prepare this statement of profit or loss.

i) Capital at the end of the year — Rs. 2,00,000

ii) Capital in the beginning of the year — Rs. 1,20,000

iii) Drawings made during the period — Rs. 30,000

iv) Additional capital introduced — Rs. 50,000

[Ans : Profit Rs. 60,000]

Answer:

Statement of Profit or Loss

Question 8.

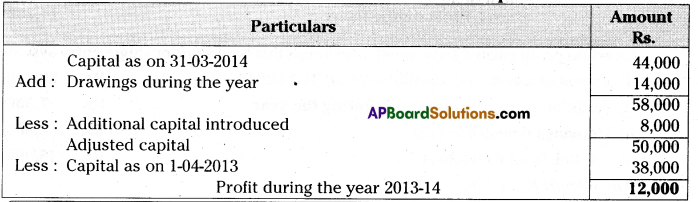

Mr. Gopal maintains his books on single entry method he gives the following information. [May 2022]

Capital on 01-04-2013 — Rs. 38,000

Capital on 31-3-2014 — Rs. 44,000

Drawings during the year — Rs. 14,000

Additional capital introduced during the year — Rs. 8,000

You are required to calculate profit or loss [Ans : Profit Rs. 12,000]

Answer:

Statement of Profit or Loss of Mr. Gopal

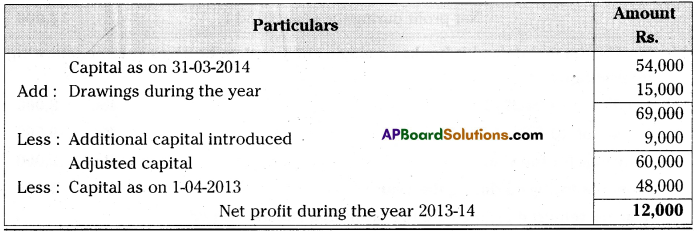

Question 9.

Mr. Jeevan maintains his books in the single entry system he gives the following information :

Capital on 01-04-2013 — Rs. 48,000

Drawings during the year — Rs. 15,000

Capital on 31-3-2014 — Rs. 54,000

Additional capital introduced during the year — Rs. 9,000

You are required to prepare a statement of profit or loss for the 31-03-2014. [Ans : Profit Rs. 12,000]

Answer:

Statement of Profit or Loss of Mr. Jeevan as on 31-03-2014

![]()

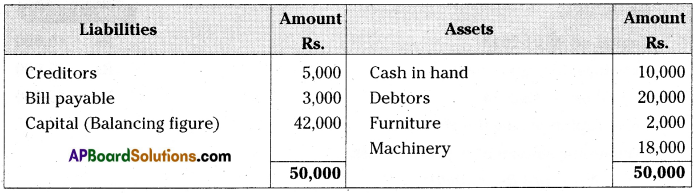

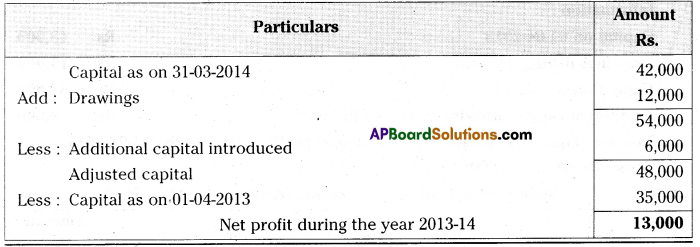

Question 10.

Mr. Ramesh commenced business on 1st April 2013 with a capital of Rs. 35,000. On 31st March 2014 his position was as follows.

Furniture — Rs. 2,000

Cash in hand — Rs. 10,000

Machinery — Rs. 18,000

Creditors — Rs. 5,000

Debtors — Rs. 20,000

Bills payable — Rs. 3,000

During the year he withdrew Rs. 12,000 for his personal use and introduced additional capital Rs. 6,000 find out profit or loss made by Mr. Ramesh during the year.

[Ans : Capital on 31-3-2014 Rs. 42,000; Profit Rs. 13,000]

Answer:

Statement of affairs of Mr. Ramesh as on 31st March 2014

Statement of Profit or Loss of Mr. Ramesh as on 31-03-2014

Question 11.

Mr. Harsha maintains his books on single entry system he gives you the following informations.

Capital on 01-04-2013 — Rs. 8,000

Capital on 31-3-2014 — Rs. 9,500

Drawings for the year — Rs. 2,000

Capital introduced during the year — Rs. 1,500

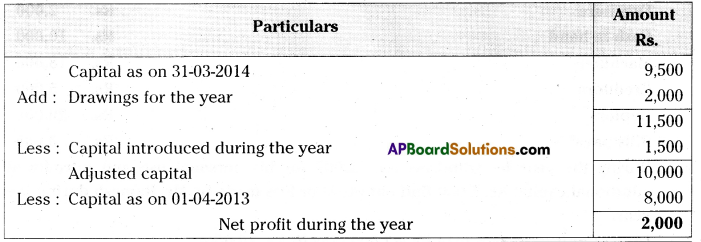

You are required to calculate the profit that Harsha earned.

[Ans : Net profit Rs. 2,000]

Answer:

Statement of Profit or Loss of Mr. Harsha as on 31-03-2014

Question 12.

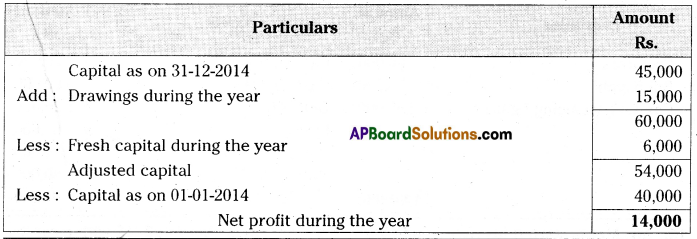

Mr. Ganesh maintain his books on single entry method. He gives you the following information. [Mar ’17 (AP)]

Capital on 01-01-2013 — Rs. 40,000

Drawings during the year — Rs. 15,000

Capital on 31-12-2014 — Rs. 45,000

Fresh capital during the year Prepare the statement of profit or loss.

[Ans : Net profit Rs. 14,000] Rs. 6,000

Answer:

Statement of Profit or Loss of Mr. Ganesh as on 31-03-2014

![]()

Question 13.

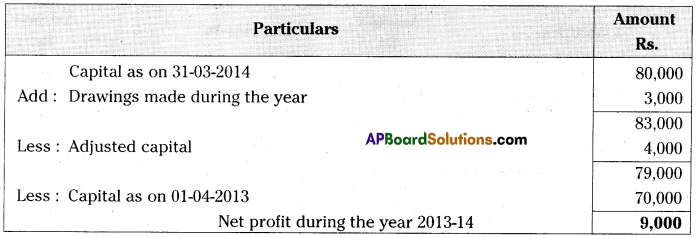

Mr. X keeps books in the single entry system. Find the profit from the following particulars. [March 2019]

Capital on 31-03-2014 — Rs. 80,000

Capital on 1-04-2013 — Rs. 70,000

Additional capital as on 2013 – 2014 — Rs. 4,000

Drawings made during the year — Rs. 3,000

[Ans: Profit Rs. 9,000]

Answer:

Statement of Profit or Loss of Mr. X as on 31-03-2014

Question 14.

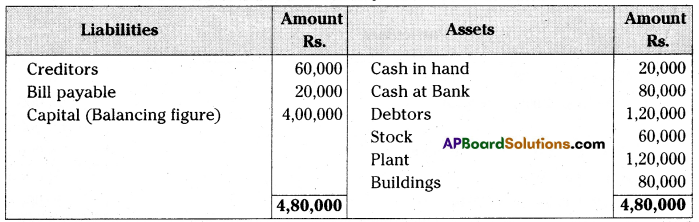

From the following details, ascertain Raju’s capital as on 01-01-2014.

Cash in hand — Rs. 20,000

Building — Rs. 80,000

Cash at Bank — Rs. 80,000

Plant — Rs. 1,20,000

Debtors — Rs. 1,20,000

Creditors — Rs. 60,000

Stock — Rs. 60,000

Bill payable — Rs. 20,000

[Ans : Capital as on 1-1-14 Rs. 4,00,000]

Answer:

Statement of affairs of Raju as on 01-01-2014

Question 15.

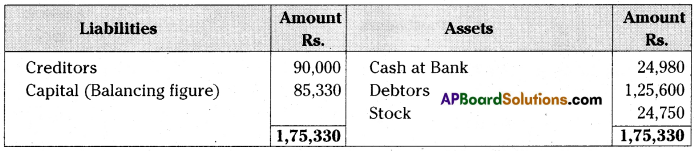

Mr. Mehta started his readymade garments business on April 1, 2013 with a capital of Rs. 50,000. He did not maintain his books according to double entry system. During the year he introduced fresh capital of 15,000. He withdrew Rs. 10,000 for personal use. On March 31, 2014, his assets and liabilities were as follows :

Total creditors — Rs. 90,000;

Total Debtors — Rs. 1,25,600;

Stock — Rs. 24,750;

Cash at Bank — Rs. 24,980.

Calculate profit or loss made by Mr. Mehta during the first year of his business using the statement of affairs method.

[Ans : Capital as on March 31, 2014 Rs. 85,330, Profit Rs. 30,330]

Answer:

Statement of Affairs of Mr. Mehta as on March 31, 2014

Statement of Profit or Loss of Mr. Mehta as on 31-03-2014

Question 16.

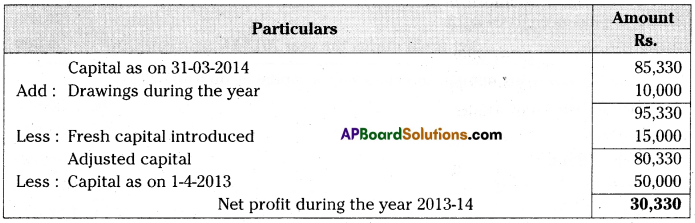

Mr. J. Keeps his books by single entry. He started business on 1st January 2014 with Rs. 20,000 on 31st December, 2014 his position was as under :

Assets : Cash in hand Rs. 500; Cash at bank Rs. 1,000; Furniture Rs. 2,500; Plant Rs. 10,000; Sundry debtors Rs. 5,000; Stock Rs. 9,000 and Bills receivables Rs. 1,000.

Liabilities : Sundry creditors Rs. 4,000; Bills payable Rs. 500 and Outstanding expenses Rs. 500. Ascertain the profit or loss made by J.

[Ans : Profit Rs. 4,000; Capital on 31-12-2014 Rs. 24,000]

Answer:

Statement of Affairs of Mr. J as on 31st December, 2014

Statement of Profit or Loss of Mr. J as on 31-12-2014

![]()

Question 17.

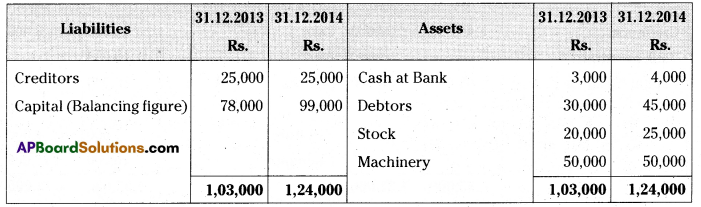

Mr. Ravikumar keeps his books on single entry his position on 31st December, 2013 was as follows : Cash at bank Rs. 3,000, Stock Rs. 20,000; Debtors Rs. 30,000; Machinery Rs. 50,000 and Creditors Rs. 25,000, His position on 31st December, 2014 was as follows : Cash at bank Rs. 4,000; Stock Rs. 25,000; Debtors Rs. 45,000; Machinery 50,000 and Creditors Rs. 25,000. During the year he introduced Rs. 10,000 as further capital and withdrew from business Rs. 3,000 per month. From the above information ascertain the profit or loss made by Mr. Ravikumar for the year ended 31st December 2014.

[Ans : Profit Rs. 47,000; capital on 31-12-2013 Rs. 78,000, 31-12-2014 – 99,000] Note : Drawings 3,000 per month, per year 36,000 (3,000 x 12 months).

Answer:

Statement of Affairs of Mr. Ravikumar as on 31-12-2013 & 31-12-2014

Statement of Affairs of Mr. Ravikumar as on 31-12-2014

Question 18.

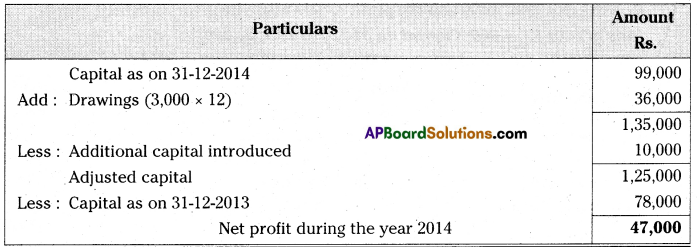

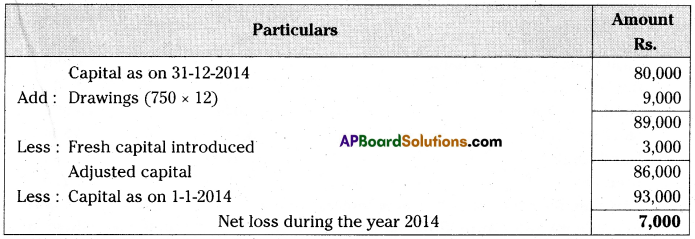

From the following particulars prepare a statement of profit and loss for the year ended 31st December 2014.

The proprietor drew at the rate of Rs. 750 per month he introduced Rs. 3,000 as fresh capital. [Ans : Loss Rs. 7,000; Capital on 1-1-2014 Rs. 93,000 on 31-12-2014, Rs. 80,000, Drawings 750 x 12 – 9,000]

Answer:

Statement of Affairs as on 1-1-2014 & 31-12-2014

Statement of Profit or Loss as on 31-12-2014

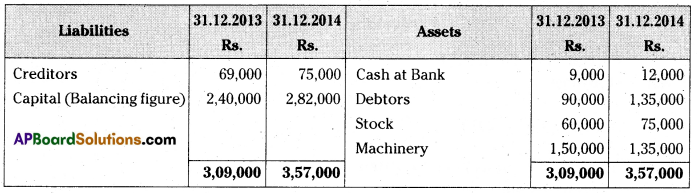

Question 19.

A trader keeps his book by the single entry method. His position on 31st December, 2013 was follows. Cash at bank Rs. 9,000, stock Rs. 60,000, Debtors Rs. 90,000, Machinery Rs. 1,50,000 and creditors Rs. 69,000. His position on 31st December

2014 was as follows. Cash at bank Rs. 12,000, stock Rs. 75,000, Debtors Rs. 1,35,000, Machinery Rs. 134,000 and creditors Rs. 75,000.

During the year the trader introduced Rs. 30,000 as further capital in business and withdrew Rs. 900 per month. From the above you are required to ascertain the profit or loss made by the trader for the year ended 31-12-2014.

[Ans: Capital as on 31-12-2013 Rs. 2,40,000; Capital as on 31-12-2014 Rs. 2,82,0000; Net profit Rs. 22,800]

Answer:

Statement of Affairs as on 31-12-2013 and 31-12-2014

Statement of Profit or Loss as on 31-12-2014

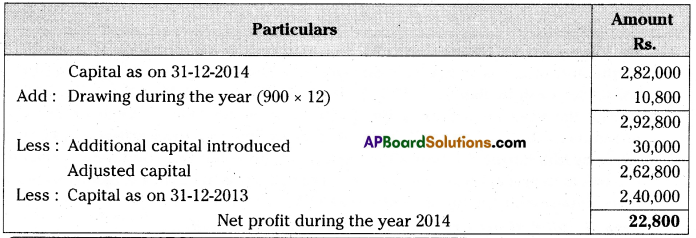

Question 20.

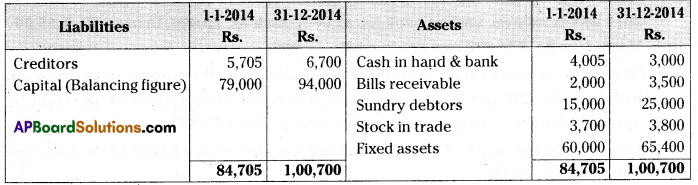

The assets and liabilities of Mr. Well on 01-01-2014 and on 31-12-2014 were as follows.

Calculate the profit after charging interest on capital in the beginning at 5 percent per annum after providing interest on drawings 6 percent. Drawings were Rs. 14,000.

[Ans: Profit Rs. 25,890; Capital on 11-2014 Rs. 79,000; Capital on 31-12-014 Rs. 94,000]

Answer:

Statement of Affairs of Mr. Well as on 01-01-2014 and 31-12-2014

Statement of Profit or Loss of Mr. Well as on 31-12-2014

![]()

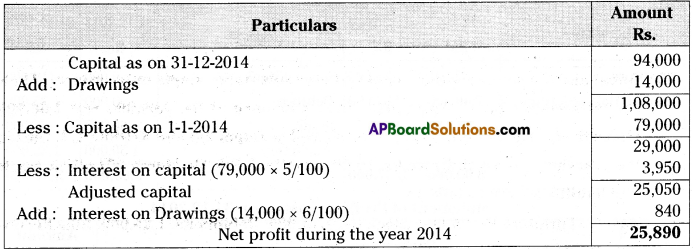

Question 21.

Mr. Vijay starts his business with Rs. 30,000 in cash as his capital on 1st April 2013. At the end of the year his position was as follows. Creditors Rs. 7,500; Debtors Rs. 6,000; Cash at Bank Rs. 12,750; Stock Rs. 7,500; and Machinery Rs. 15,000. During the year he withdrew Rs. 1,125 every month. On 1st October 2013 he introduced a further capital of Rs. 7,500. You are required to ascertain profit or loss made by him during the year after considering the following adjustments. Machinery was to depreciated at 12% and a reserve of 2% was to be raised against Debtors. Also prepare a statement of affairs as at 31 March 2014.

[Ans : Capital at the end Rs. 31,830; Net profit Rs. 7,830]

Answer:

Statement of affairs of Mr. Vijay as on 31st March 2014

Statement of Profit or Loss of Mr. Vijay as on 31-03-2014

Question 22.

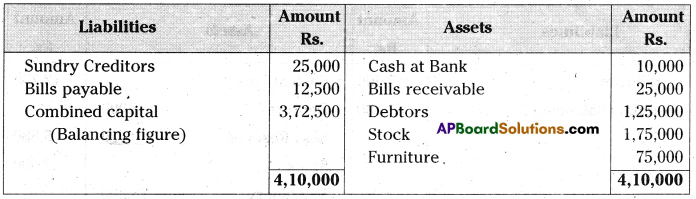

Gopal and Krishna kept their books of accounts under single entry system. Their capital accounts on 1st April 2013 show a balance of Rs. 2,00,000 and 1,00,000 respectively. The net profits are to be shared as Gopal 2/3 and Krishna 1/3. During the year they have withdrawn Rs. 10,000 and Rs. 7,500. On March 2014 their assets and liabilities were as follows.

Assets: Furniture Rs. 75,000; Stock Rs. 1,75,000; Debtors Rs. 1,25,000; Bills Receivable Rs, 25,000; Cash at bank Rs. 10,000.

Liabilities .‘ Sundry creditors Rs. 25,000; Bills payable Rs. 12,500.

Prepare a statement of affairs on 31st March 2014 and calculate the divisible profits of the partners.

[Ans : Combined capital of the partner at the end of the year Rs. 3,72,500. Net profit Rs. 90,000; Gopal’s share of profit Rs. 60,000 and Krishna’s share of the profit Rs. 30,000]

Answer:

Statement of affairs of Gopal & Krishna as on 31-3-2014

Statement of Profit or Loss of Gopal & Krishna as on 31-03-2014

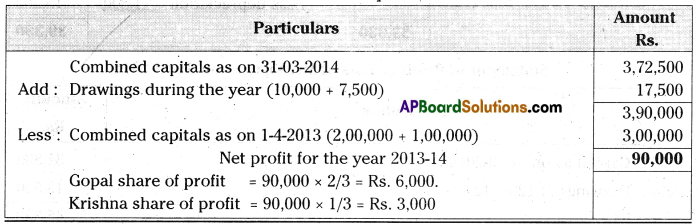

Question 23.

Ramesh and Rajesh are partners sharing the profit and losses in the ratio of 4 : 1 on 31st March 2013, their capital accounts show a credit balance of Rs. 1,00,000 and Rs. 25,000 respectively. During the year they have introduced a fresh capital of Rs. 25,000 and 6,250 respectively. Also they have withdrawn Rs. 1,875 and Rs. 625 each month respectively for their personal use. On 31st March 2014. Their business position was as follows :

Assets : Machinery Rs. 58,750; Stock Rs. 61,500; Sundry debtors Rs. 33,125; Bills Receivable Rs, 5,375; Sash in hand Rs. 3,750.

Liabilities : Sundry creditors Rs. 25,000. You are asked to prepare a statement of affairs and statement of profit on 31sf March 2014 and calculate the divisible profits or losses of the partners.

[Ans : Combined capital of the partners at the end of the year Rs. 1,37,500; Net profit for the year Rs. 11,250; Ramesh share Rs. 9,000; Rajesh share Rs. 2,250]

Answer:

Statement of Affairs of Ramesh & Rajesh as on 31-3-2014

Statement of Profit or Loss of Ramesh & Rajesh as on 31-03-2014

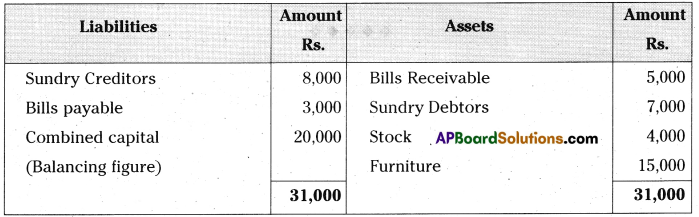

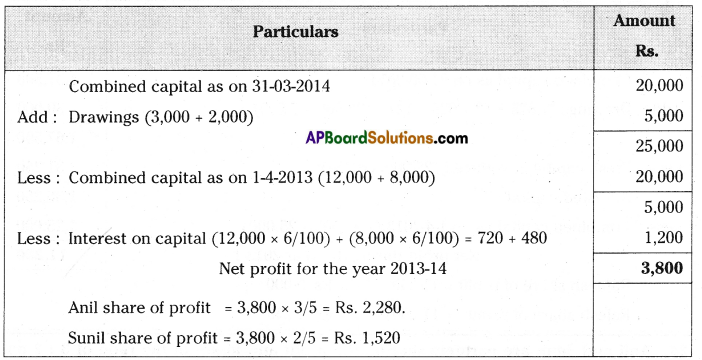

Question 24.

Anil and Sunil are partners sharing the profit and losses in the ratio of 3 : 2 on 31st March 2013, their capital accounts show a credit balance of Rs. 12,000 and Rs. 8,000 respectively. On 31st March 2014 their business position was as follows. Assets : Machinery Rs. 15,000; Stock Rs. 4,000; Bills Receivable Rs, 5,000; Sundry debtors Rs. 7,000.

Liabilities : Sundry creditors Rs. 8,000; Bills payable Rs. 3,000.

You are required to prepare a profit and loss statement of affairs as at the date after taking into the following.

a) Drawings made during the year by Anil Rs. 3,000, Sunil Rs. 2,000.

b) Interest on capital is to be allowed at 6%.

[Ans : Combined capital at the end of the year Rs. 20,000; Divisible profit Rs. 3,800; Anil’s share of profit 2,280; Sunil share of profit 1,520]

Answer:

Statement of Affairs of Anil & Sunil as on 31-3-2014

Statement of Profit or Loss of Anil & Sunil as on 31-03-2014

![]()

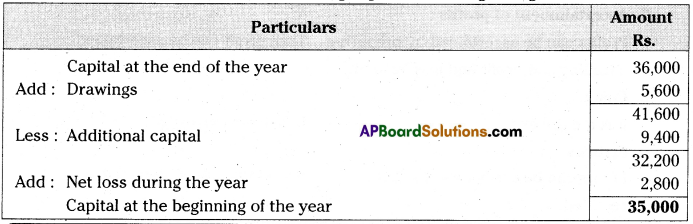

Question 25.

Find out the profit or loss from the following information. [May 2022]

Rs.

Capital at the beginning 67,500

Capital at the end 60,000

Answer: