Students must practice these AP Inter 2nd Year Accountancy Important Questions 1st Lesson Bills of Exchange to boost their exam preparation.

AP Inter 2nd Year Accountancy Important Questions 1st Lesson Bills of Exchange

Short Answer Questions

Question 1.

What is a bill of exchange?

Answer:

Bill of exchange is a written acknowledgement of debt. It is legal document. When the accepted of the debtor is given a trade bill possesses a high degree of liquidity and certainty.

Question 2.

State the three parties involved in a bill of exchange.

Answer:

There are three parties to a bill of exchange. They are

- Drawer – The person who draws the bill.

- Drawee – The person to whom the bill is drawn.

- Payee – The person to whom the amount payable.

Question 3.

What is a Promissory Note?

Answer:

Promissory Note:

“A Promissory Note is an instrument in writing containing an unconditional undertaking signed by the maker, to pay a certain sum of money only to or to the order of a certain person or to the bearer of the instrument”.

![]()

Question 4.

What is due date of bill?

Answer:

The date on which the bill falls due is called the due date or date of maturity. Due date is calculated by adding three days of grace to the actual period of the bill.

Question 5.

What are days of Grace? [May ’22; Mar. 19. 18 (AP)]

Answer:

Three days added to the actual period of the bill is called ‘Grace days’. According to Negotiable Instrument Act 1881 the drawee can avail 3 days of grace as a Legal Right.

Question 6.

What do you mean by Noting Charges? [Mar. 2020, ’17 (AP)]

Answer:

To obtain the proof of dishonour of a bill, it is re-sent to the drawee through a legally authorized person called Notary Public. Notary Public charges a small fee for providing this service known as Noting Charges.

Question 7.

What is meant by acceptance of a bill of exchange?

Answer:

The drawee has to accept the bill prepared by the drawer. The bill prior to acceptance is called a ‘draft’. The drawee accepts it by writing the word ‘accepted’ on the face of the bill and sign with date and returns to the drawer. This is called ‘acceptance of bill of exchange’.

Question 8.

What is meant by discounting of a bill?

Answer:

When the bill is encashed from the bank before its due date it is known as ‘Discounting of bill’. Bank deducts a small amount as discount and remaining amount paid to the drawer.

Question 9.

What is retirement of a bill of exchange?

Answer:

When the drawee makes the payment of the bill before its due date it is called ‘Retirement of bill’. In such case drawer allows a certain rebate to the drawee.

Question 10.

What do you mean by renewal of bill of exchange?

Answer:

Some times the drawee unable to meet the bill on due date, he may request the holder of the bill to cancel the original bill and draw a new bill. If the holder agrees for cancellation and drawing of new bill with interest as per terms it is called the ‘renewal of a bill’.

Question 11.

What is meant by ‘Dishonour of a Bill’? [May ’19 (AP)]

Answer:

When the drawee of the bill fails to make payment of the bill on the due date, it is called ‘Dishonour of Bill’.

Long Answer Questions

Question 1.

Define a bill of exchange. Explain the main features of a bill of exchange.

Answer:

Definition: Section – 5 of the Negotiable Instruments Act 1881 defines “A Bill of Exchange is an instrument in writing containing an unconditioned order signed by the maker directing a certain person to pay a certain sum of money only to or to the order of a certain person or to the bearer of the instrument”.

Features of a Bill of Exchange:

- Bill must be in writing.

- It must contain an unconditional order.

- There must be an order to pay certain sum of money.

- It must be signed by the maker.

- It must be accepted by the drawee by signing on it.

- The amount in the bill payable on demand or on the expiry of a period.

- It must be stamped and dated.

![]()

Question 2.

What are the advantages of a bill of exchange?

Answer:

The advantages of a Bill of Exchange are –

- It helps in purchase and sale of goods on credit.

- It is a legally valid document in eyes of law. It assures easy recovery of a bill.

- It acts as a source of finance by discounting.

- It is written and signed acknowledgements of debt.

- It can be easily transferrable by endorsement.

- Accommodation bills are useful for raise only.

Question 3.

What are the different types of bills of exchange?

Answer:

Bills of Exchange can be classified as follows-

- Time and Demand Bills,

- Trade and Accommodation Bills,

- Inland and Foreign Bills.

1) Time and Demand Bills: When payment of a bill is to be made after a particular period of time, the bill is termed as a “Time Bill”. When the payment is to be made on demand it is termed as “Demand Bill”.

2) Trade and Accommodation Bills: Where a bill has been drawn and accepted for a genuine trade transaction it termed as a “Trade Bill”.

Those bills which are drawn to meet financial needs of drawer / drawee / both for temporary period it is called “Accommodation Bills”.

3) Inland and Foreign Bills: Inland bill is drawn in India on a person residing in India whether payable in or outside India.

A bill which is not an Inland Bill is a Foreign Bill. It is drawn in triplicate and each copy is sent by post. Drawee or Acceptor will sign on a single set. It becomes actual

It bill and paid on such bill.

Question 4.

Explain the differences between a bill of exchange and a promissory note.

Answer:

Differences between a Bill of Exchange and a Promissory Note:

| Basis | Bill of Exchange | Promissory Note |

| 1. Drawer | It is drawn by the creditor. | It is drawn by the debtor. |

| 2. Order or Promise | It contains an order to make the payment. | It contains a promise to make the payment. |

| 3. No. of Parties | It has three parties – 1. Drawer, 2. Drawee, 3. Payee. | It has two parties – 1. The maker, 2. Payee |

| 4. Acceptance | It is valid only when it is accepted by the drawee. | It does not require any acceptance. |

| 5. Payee | Drawer and Payee can be the same person. | Drawer cannot be the payee of it. |

| 6. Noting | In case of dishonour of bill noting becomes important. | Noting is not necessary in case of dishonour of promissory note. |

Question 5.

Explain the differences between a bill of exchange and a cheque.

Answer:

Differences between a Bill of Exchange and a Cheque:

| Basis | Bill of Exchange Cheque | |

| 1. Acceptance | It requires an acceptance. | It does not require any acceptance. |

| 2. Stamp Duty | It requires necessary stamp as per act. | It does not require any stamp. |

| 3. Crossing | It will not have any crossing on the instrument. | It may have crossing. |

| 4. Due date | The bill payable on the due date. | The cheque amount should be paid immediately as and when it is presented. |

| 5. Days of Grace | Three days of grace are allowed. | Days of grace are not applicable. |

| 6. Withdrawal | Once accepted, the bill cannot be withdrawn by drawee. | It can be withdrawn by the maker. |

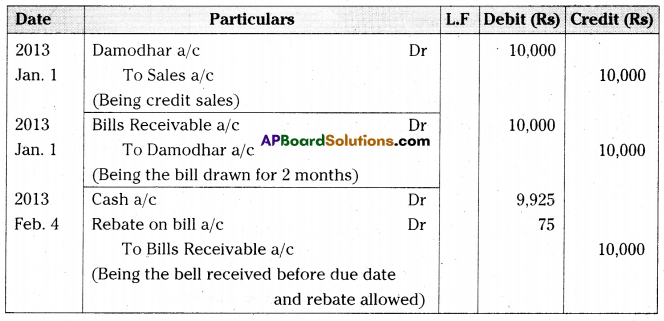

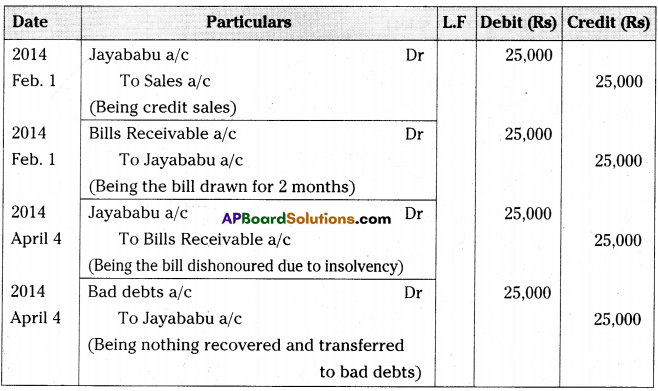

Question 6.

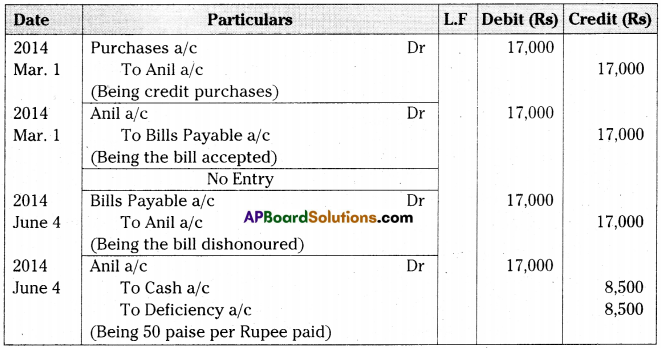

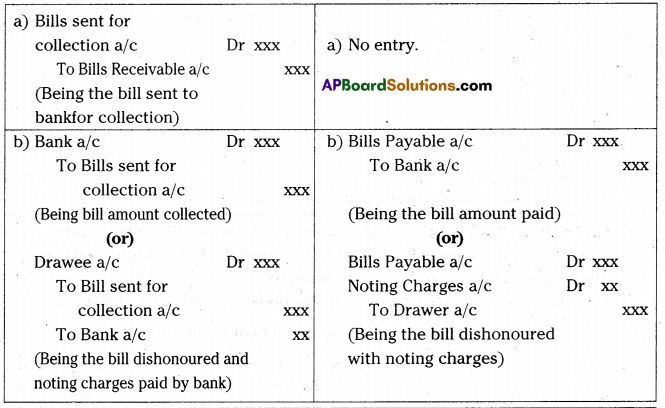

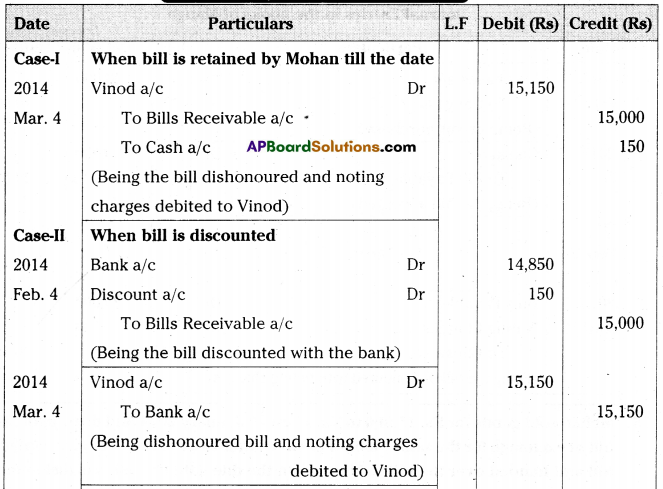

What are journal entries required in the books of drawer and drawee under various situations:

A. When the Bill retained by drawer still due date: Honoured and Dishonoured.

B. When the Bill is discounted with a bank: Honoured and Dishonoured.

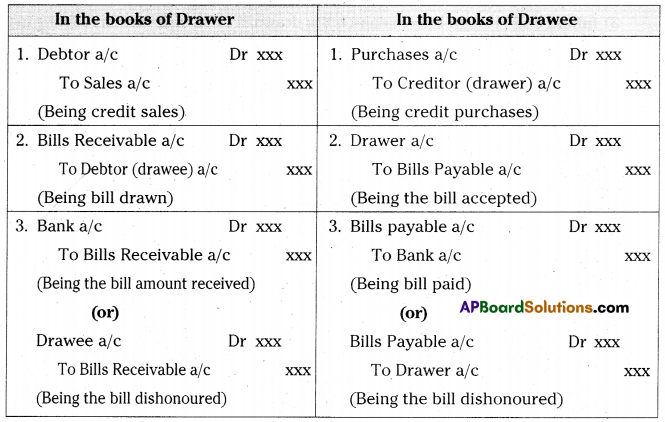

C. When the Bill is endorsed to a creditor: Honoured and Dishonoured

D. When the Bill is sent to Bank for collection: Honoured and Dishonoured

Answer:

A. When the Bill retained by drawer still due date: Honoured and Dishonoured.

B. When the Bill is discounted with a bank: Honoured and Dishonoured.

C. When the Bill is endorsed to a creditor: Honoured and Dishonoured

D. When the Bill is sent to Bank for collection: Honoured and Dishonoured

![]()

Exercise

A) Bills oF Exchange Honoured.

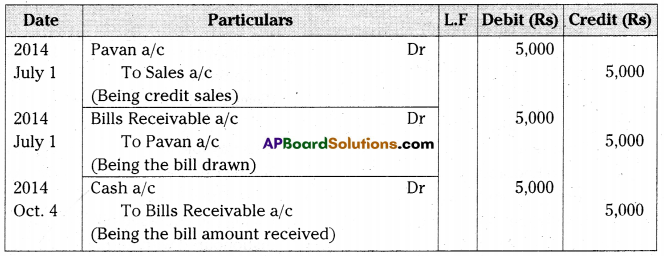

Question 1.

On 1st July 2014 Madhu sold goods to Pavan for Rs. 5,000 on credit and drew a bill of exchange for 3 months for the same amount. Pavan accepted the bill and returned it to Madhu. Pavan met his acceptance on maturity.

Pass the necessary journal entries in the books of Madhu and Pavan.

Answer:

Journal Entries in the books of Madhu

Journal Entries in the books of Pavan

Question 2.

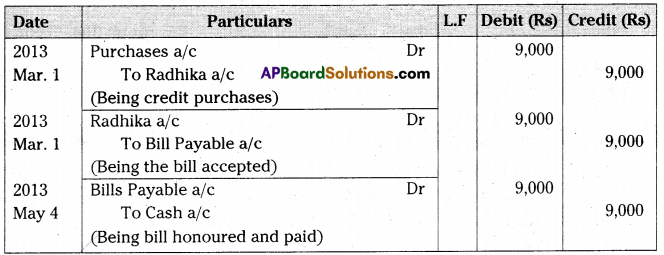

On 1st March 2(113 Radhika sold goods to Harika worth Rs. 9,000 and drew a bill for 2 months for the same amount. Harika accepted the bill and returned it to Radhika. The bill is honoured on the date of maturity.

Pass the necessary journal entries in the books of Radhika and Harika.

Answer:

Journal Entries in the books of Radhika

Journal Entries in the books of Harika

Question 3.

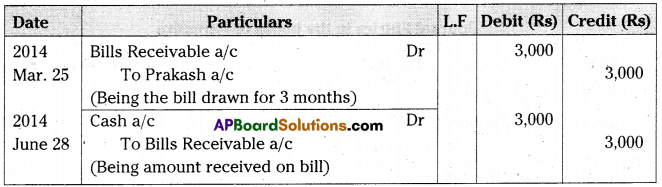

On 25th March 2014 Vinod drew a bill for 3 months on Prakash for Rs. 3,000. Prakash accepted the bill and handed over the bill to Vinod. The bill is honoured on the date of maturity.

Show the journal entries in the books of Vinod and Prakash.

Answer:

Journal Entries in the books of Vinod

Journal Entries in the books of Prakash

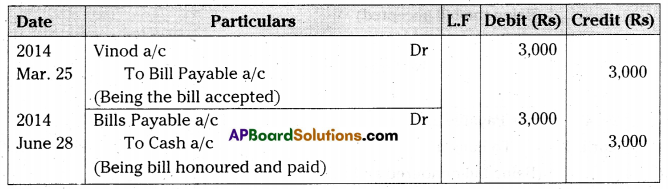

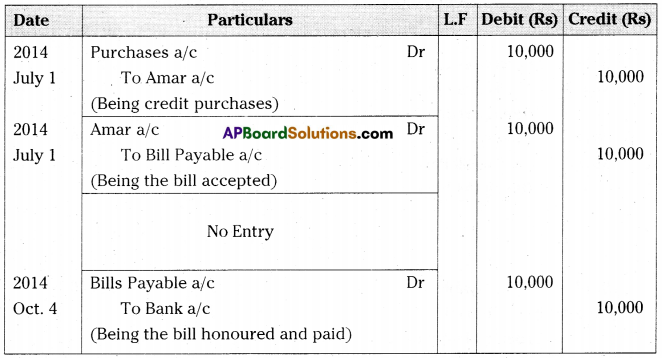

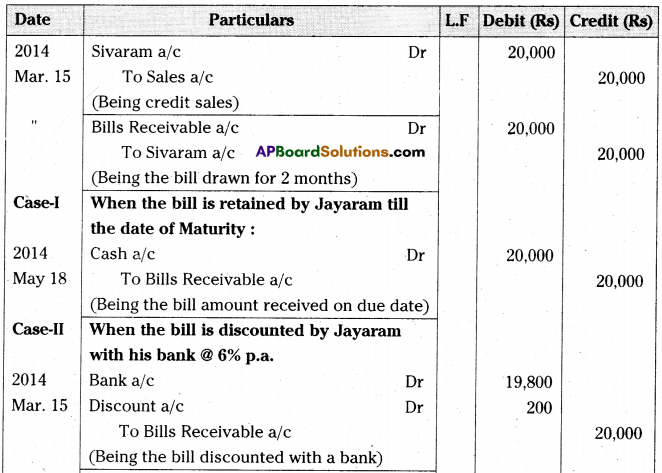

Question 4.

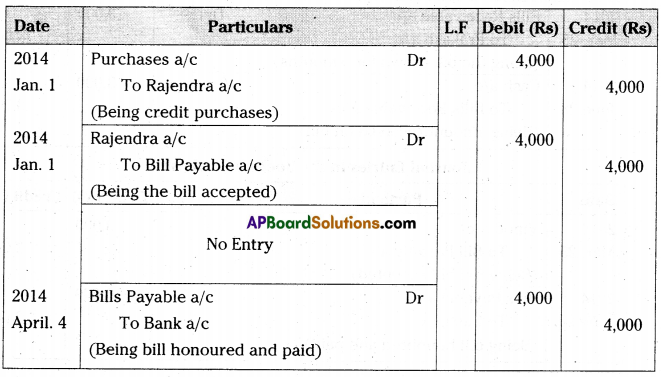

On 1st January 2014 Rajendra sold goods to Narendra worth Rs. 4,000 and drew a bill on Narendra payable after three months. After securing Narendra’s acceptance, Rajendra discounted the bill with his bank at 12% p.a. on 1st February 2014. On the due date the bill is honoured.

Pass necessary journal entries in the books Rajendra and Narendra.

[Discount Rs. 80]

Answer:

Journal Entries in the books of Rajendra

Journal Entries in the books of Narendra

Note: Discount = 4000 x 12/100 x 2/12 = 80

![]()

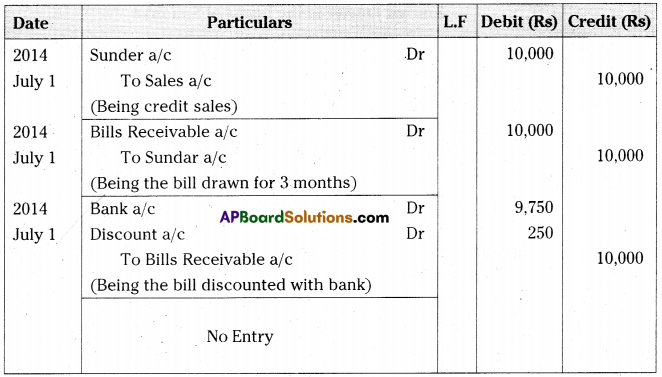

Question 5.

Amar sold goods for Rs. 10,000 to Sunder on credit on 1st July 2014. Amar drew a bill of exchange on Sundar for the same amount for three months. Sundar accepted the bill and returned it to Amar. Amar discounted the bill with his bank at 10% per annum on the same day. Sundar met his acceptance on maturity. [Mar ’18 (AP)]

Pass necessary journal entries in the books of Amar and Sundar. [Discount Rs. 250]

Answer:

Journal Entries in the books of Amar

Journal Entries in the books of Sundar

Note: Discount = 10000 x 10/100 x 3/12 = 250/-

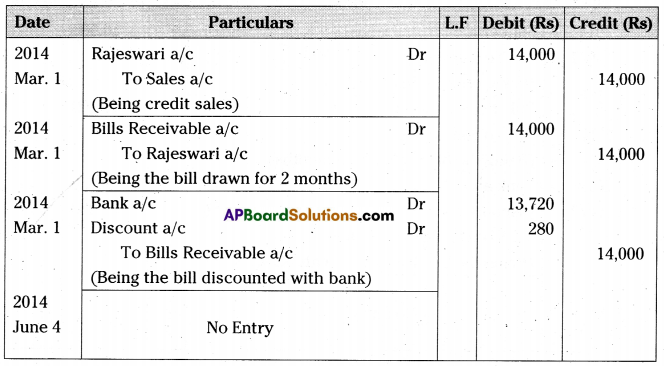

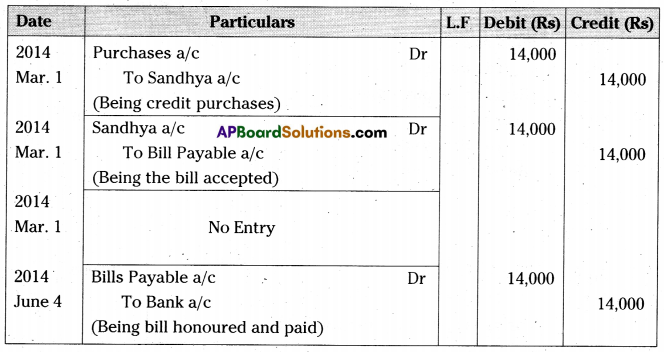

Question 6.

Sundhya sold goods for Rs. 14,000 to Rajeswari on 1st March 2014 and drew upon her a bill of exchange payable after 2 months. Rajeswari accepted the bill and handed over the same to Sandhya. Sandhya immediately discounted the bill with her bank @12% p.a. On the due date Rajeswari met her acceptance. [Mar ’17 (AP)]

Pass the necessary journal entries in the books of Sandhya and Rajeswari.

[Discount Rs. 280]

Answer:

Journal Entries in the books of Sundhya

Journal Entries in the books of Rajeswari

Note: Discount = 14,000 x 12/100 x 2/12 = 280/-

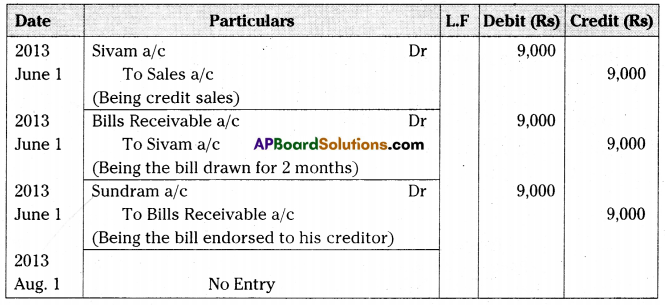

Question 7.

Satyam sold goods to Sivam worth Rs. 9000 on 1st June 2013 and drew a bill for 2 months for the same amount. Sivam accepted the bill and returned it to Satyam. Satyam endorsed the bill to his creditor Sundaram on 1st July 2013. The bill was honoured on the due date. [March 2019]

Answer:

Journal Entries in the books of Satyam

Journal Entries in the books of Sivam

Journal Entries in the books of Sundaram

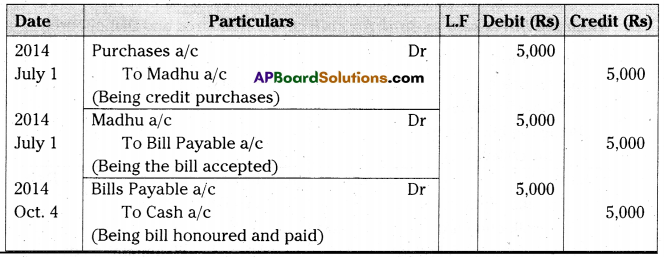

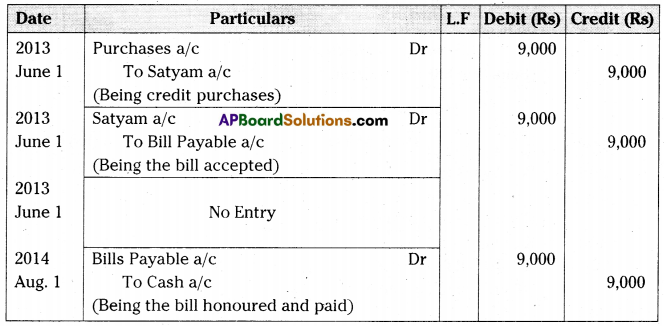

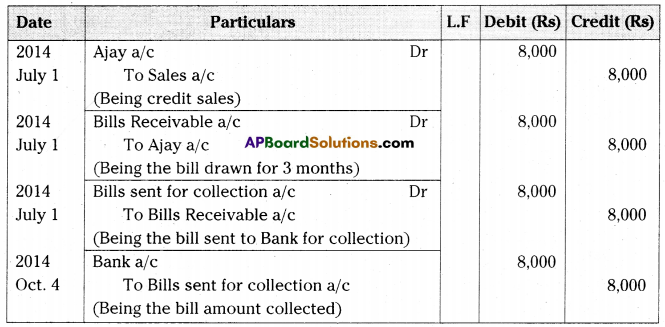

Question 8.

On 1st July 2014 Ajay purchased goods worth Rs. 8,000 from Kiran and accepted the bill which was drawn by Kiran payable after three months for the same amount. Kiran sent the bill to his bank for collection. The bill was honoured on the date of maturity.

Pass necessary journal entries in the books fo Kiran and Ajay.

Answer:

Journal Entries in the books of Kiran

Journal Entries in the books of Ajay

![]()

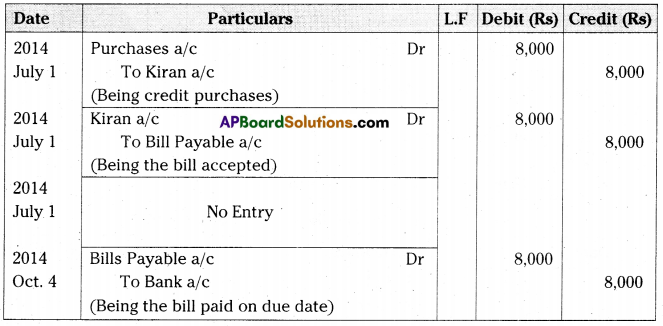

Question 9.

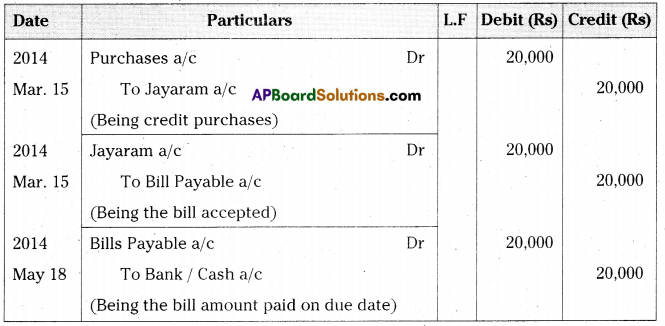

Jayaram sold goods for Rs. 20,000 to Sivaram on 15th March 2014 and drew upon him a bill of exchange payable after two months. Sivaram accepted the bill and returned the same to Jayaram. On the due date the bill was honoured.

Pass the necessary journal entries in the books of Jayaram and Sivaram in the following circumstances.

I. When the bill was retained by Jayaram till the date of its maturity.

II. When Jayaram immediately discounted the bill @6% p.a. with his bank.

III. When the bill was endorsed immediately by Jayaram in favour of his creditor Seetharam.

IV. When the bill was sent by Jayaram to his bank for collection on 25th April 2014.

[Discount Rs. 200]

Answer:

Journal Entries in the books of Jayaram

Note: Discount = 20000 x 6/100 x 2/12 = 200/-

Journal Entries in the books of Sivaram

B) Dishonour of Bills of Exchange

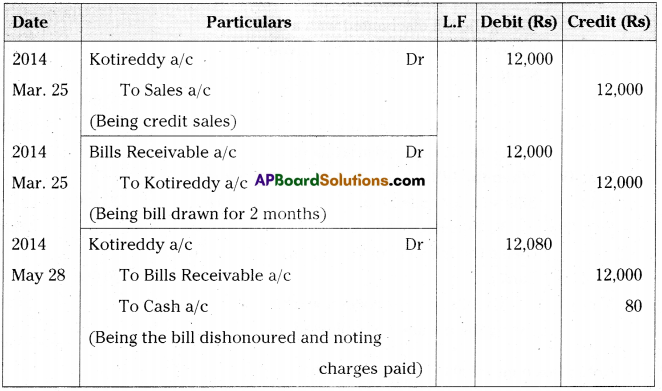

Question 10.

Kotireddy purchased goods worth Rs. 12,000 from Rajareddy on 25th March 2014 and accepted a bill of exchange drawn upon him by Rajareddy payable after two months. On the date of maturity, Kotireddy dishonoured the bill. Rajareddy paid Rs. 80 as noting charges.

Pass the necessary journal entries in the books of Rajareddy and Kotireddy.

Answer:

Journal Entries in the books of Rajareddy

Journal Entries in the books of Kotireddy

![]()

Question 11.

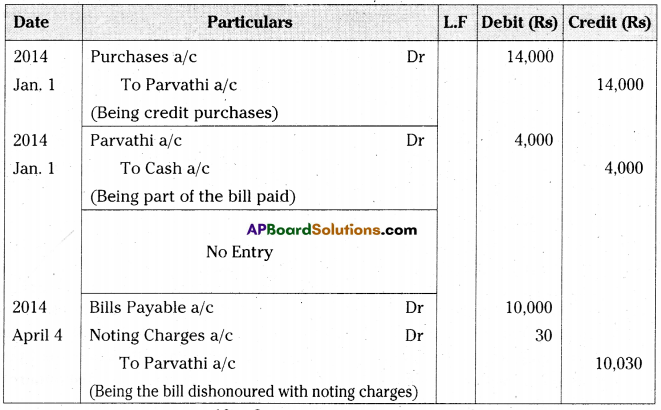

Parvathi sold goods worth Rs. 14,000 to Suneetha on 1st January 2014. Suneetha paid Rs. 4000 immediately and for the balance she accepted a bill of exchange drawn upon her by Parvathi payable after 3 months. Parvathi discounted the bill immediately with her bank @ 10% p.a. On the due date Suneetha dishonoured the bill and the bank paid Rs. 30 as noting charges.

Pass the necessary journal entries in the books of Parvathi and Suneetha.

[Discount Rs. 250]

Answer:

Journal Entries in the books of Parvathi

Journal Entries in the books of Suneetha

Note: Discount = 10000 x 10/100 x 3/12 = 250/-

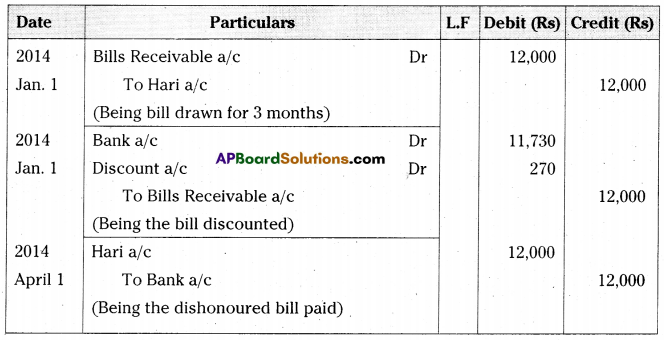

Question 12.

On 1st January 2014 Hari accepted 3 months bill for Rs. 12,000 drawn on him by Raju. Raju discounted the bill with his bank @ 9% p.a. on the Same day. On the due date Hari dishonoured his acceptance.

Pass the necessary journal entries in the books of Raju and Hari.

[Discount Rs. 270]

Answer:

Journal Entries in the books of Raju

Journal Entries in the books of Hari

Note: Discount = 12000 x 9/100 x 3/12 = 270/-

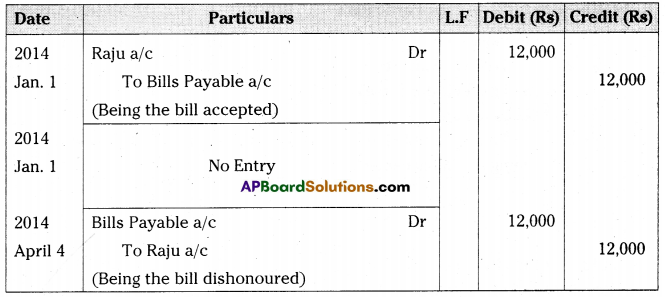

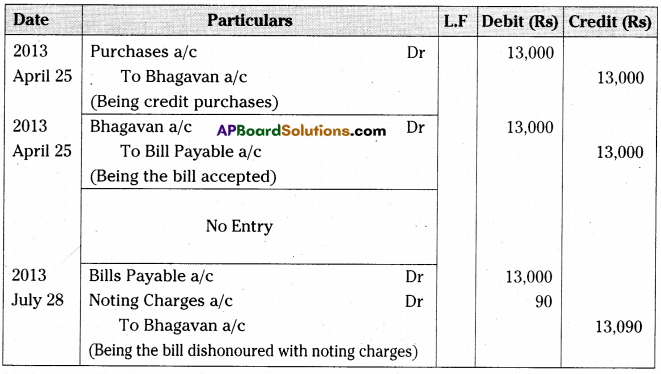

Question 13.

On 25th April 2013 Bhagavan sold goods for Rs. 13,000 to Lakshman and drew upon him a bill of exchange for 3 months for the same amount. Lakshman accepted the bill and sent the same to Bhagavan. Bhagavan endorsed the bill in favour of his creditor Raman. On the due date the bill was dishonoured and Raman paid Rs. 90 as Noting charges.

Pass the necessary journal entries in the books of Bhagavan and Lakshman.

Answer:

Journal Entries in the books of Bhagavan

Journal Entries in the books of Lakshman

![]()

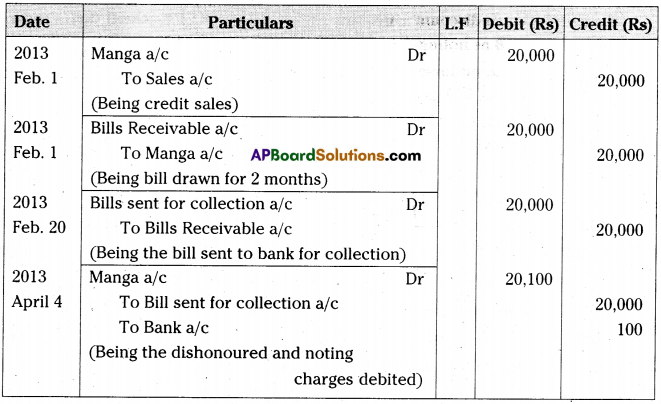

Question 14.

Manga purchased goods for Rs. 20,000 from Ganga on 1st February 2013 and accepted a bill of exchange drawn by Ganga for the same amount payable after 2 months. On 20th February 2013 Ganga sent the bill to her bank for collection. On the due date Manga dishonoured the bill and the bank paid Rs. 100 as noting charges.

Pass the necessary journal entries in the books of Ganga and Manga.

Answer:

Journal Entries in the books of Ganga

Journal Entries in the books of Manga

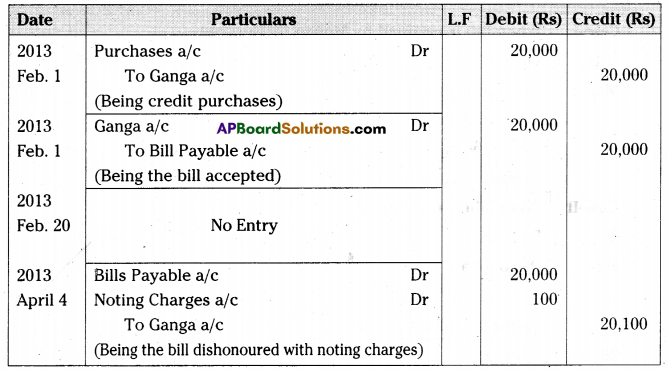

Question 15.

Mohan sold goods for Rs. 15,000 to Vinod on 1st January 2014 and drew upon him a bill of exchange for the same amount payable after two months. Vinod accepted the bill and handed over the bill to Mohan. On the due date the bill was dishonoured. Pass the necessary journal entries in the books of Mohan and Vinod in the following cases.

I. When Mohan retained the bill till the due date and paid Rs. 150 as noting charges.

II. When Mohan discounted the bill @ 12% p.a. on 4th February 2014 and the bank paid Rs. 150 as noting charges.

III. When Mohan endorsed the bill immediately in favour of his creditor Amar and Amar paid Rs. 150 as noting charges.

IV. When Mohan sent the bill to his bank for collection on 25th January 2014 and bank paid Rs. 150 as noting charges. [Discount Rs. 150]

Answer:

Journal Entries in the books of Mohan

Journal Entries in the books of Vinod

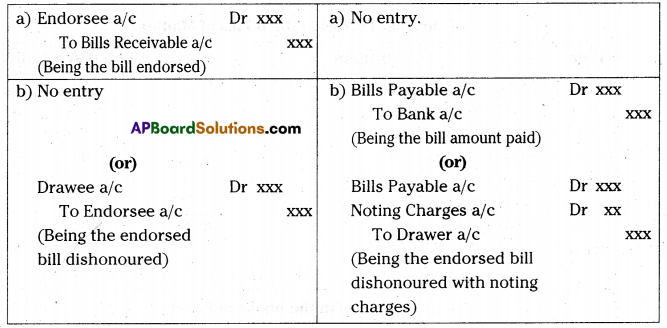

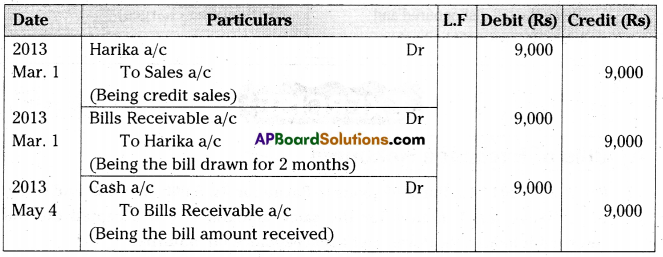

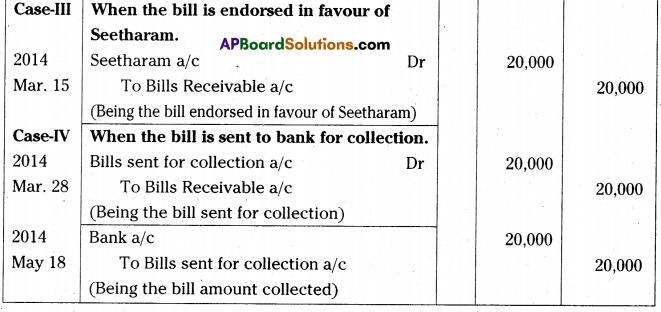

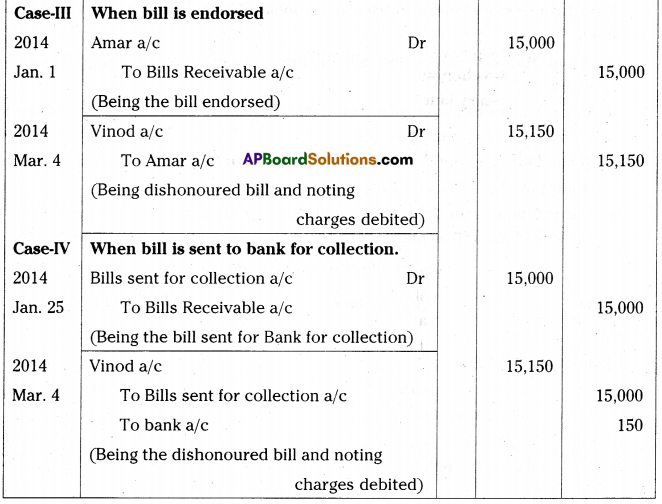

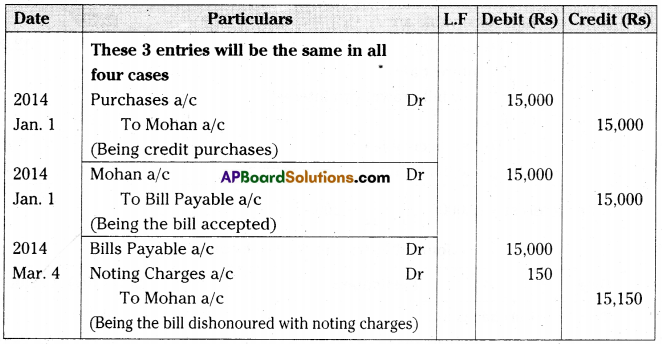

C) Renewal oF a bill

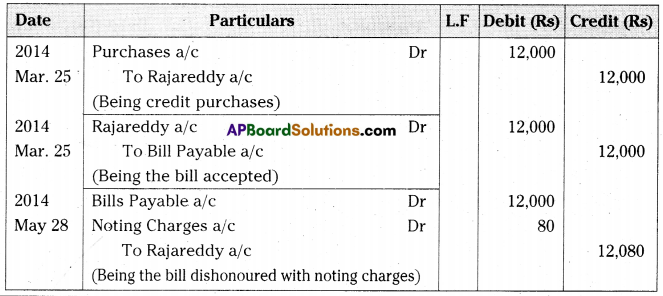

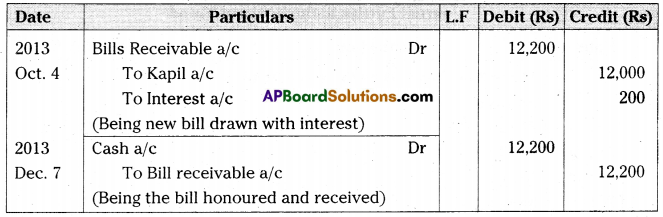

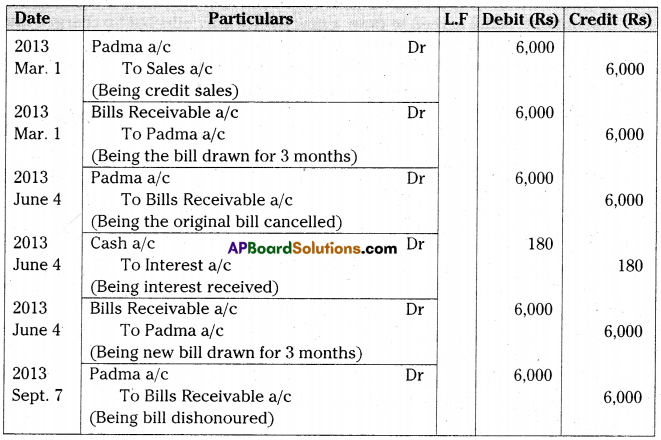

Question 16.

On 1st July 2013 Kalyan sold goods to Kapil for Rs. 24,000 and drew upon him a bill for the same amount payable after 3 months. Kapil accepted the bill and returned it to Kalyan. On due date Kapil expressed his inability to honour the bill and offered to pay Rs. 12,000 in cash and to accept a new bill for the balance amount including interest at 10% p.a. for 2 months. Kalyan agreed to this proposal. On the due date the new bill was honoured.

Pass the necessary journal entries in the books of Kalyan and Kapil.

[Interest Rs. 200]

Answer:

Journal Entries in the books of Kalyan

Note: Interest = 12,000 x 10/100 x 2/12 = 200/-

![]()

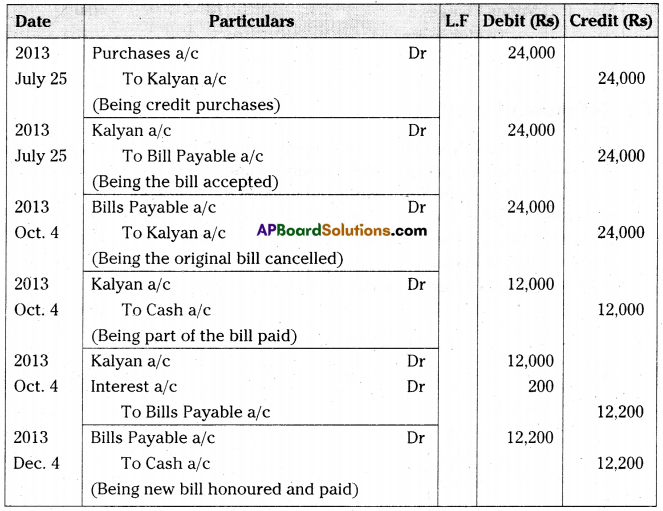

Journal Entries in the books of Kapil

Question 17.

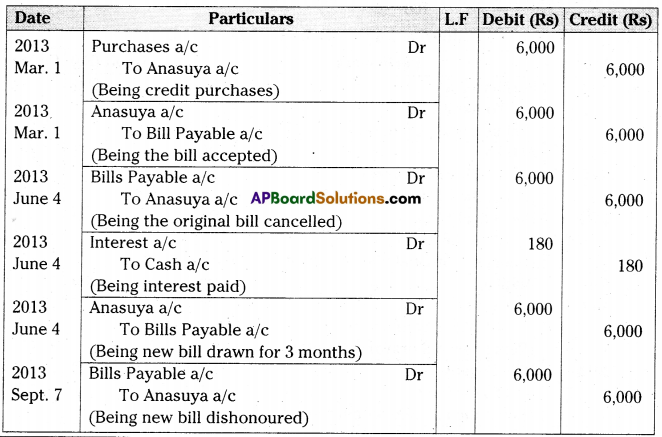

Anasuya sold goods worth Rs. 6,000 to Padma on 1st March 2013 and drew upon her a bill for the same amount payable after three months. Padma accepted the bill and sent it back to Anasuya. On the due date, Padma expressed her inability to honour the bill and requested Anasuya to cancel the original bill and to draw a new bill for three months. Anasuya agreed the proposal provided interest at 12% was paid immediately in cash. Padma paid such interest in cash and accepted a new bill. The new bill was dishonoured on the due date.

Pass necessary journal entries in the books of Anasuya and Padma. [Interest Rs. 180]

Answer:

Journal Entries in the books of Anasuya

Note: Interest = 6,000 x 12/100 x 3/12 = 180/-

Journal Entries in the books of Padma

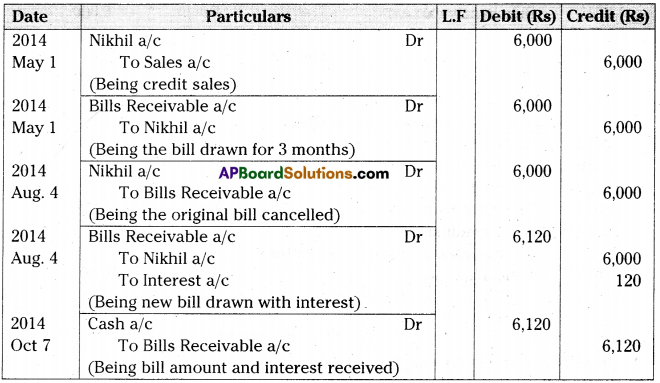

Question 18.

On 1st May 2014 Akhil sold goods to Nikhil for Rs. 6,000 on credit and drew a bill on him for three months for the same amount. Nikhil accepted the bill and returned it to Akhil. On 4th August 2014 Nikhil requested Akhil to draw a new bill for the amount due. Akhil agreed to draw a new bill for 2 months but he charged interest @12% p.a. This bill was honoured on its maturity.

Pass necessary journal entries in the books of Akhil and Nikhil. [Interest Rs. 120]

Answer:

Journal Entries in the books of Akhil

Note: Interest = 6,000 x 12/100 x 2/12 = 120/-

Journal Entries in the books of Nikhil

![]()

D) Retiring of bill under rebate

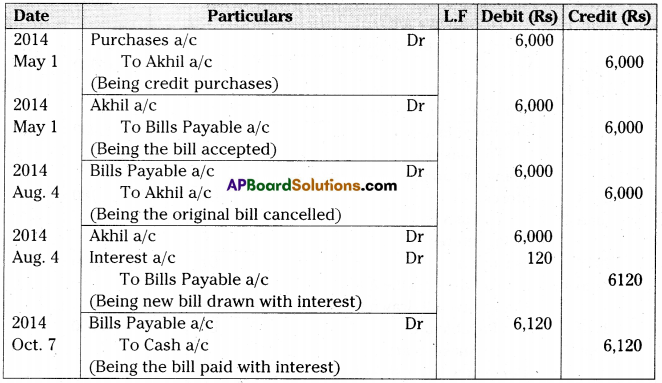

Question 19.

On 1st January 2013 Nagababu sold goods for Rs. 10,000 to Damodhar and drew upon him a bill of exchange payable after two months. Damodhar accepted the bill and handed over the same to Nagababu. One month before the maturity of the bill Damodhar approached Nagababu to accept the payment against the bill under rebate of 9% p.a. Nabababu agreed to the request of Damodhar. Damodhar retired the bill under the agreed rate of rebate.

Pass the necessary journal entries in the books of Nagababu and Damodhar.

[Rebate Rs. 75]

Answer:

Journal Entries in the books of Nagababu

Journal Entries in the books of Damodhar

Rebate = 10,000 x 9/100 x 1/12 = 75/-

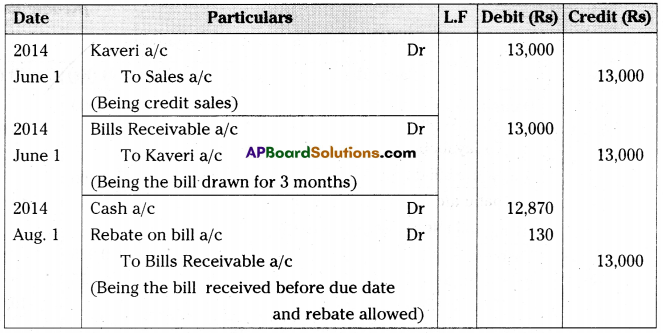

Question 20.

On 1st June 2014 Meghana sold goods for Rs. 13,000 to Kaveri and drew upon her a bill of exchange payable after 3 months. Kaveri accepted the bill and returned it to Meghana. One month before the maturity of the bill Kaveri approached Meghana to accept the payment against the bill under rebate of 12% p.a. Meghana agreed to the request of Kaveri and Kaveri retired the bill under the agreed rate of rebate.

Pass the necessary journal entries in the books of Meghana and Kaveri.

[Rebate Rs. 130]

Answer:

Journal Entries in the books of Meghana

Journal Entries in the books of Kaveri

Note: Rebate = 13,000 x 12/100 x 1/12 = 130/-

E) Insolvency of Drawee

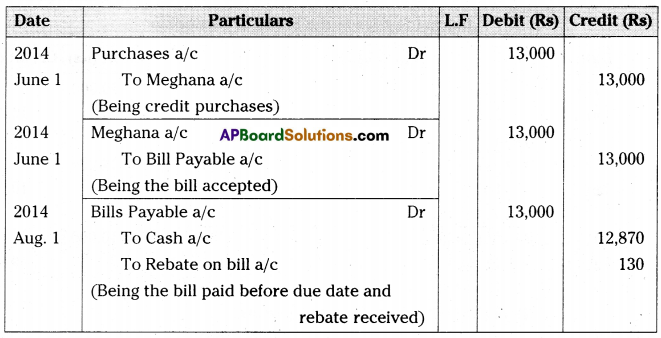

Question 21.

Jayababu purchased goods for Rs. 25,000 from Tatababu on 1st February 2014 and accepted a bill of exchange drawn by Tatababu for the same amount. The bill was payable after 2 months.* Before the due date of the bill, Jayababu became insolvent and nothing could be recovered from his estate.

Write necessary journal entries in the books of Tatababu and Jayababu.

Answer:

Journal Entries in the books of Tatababu

Journal Entries in the books of Jayababu

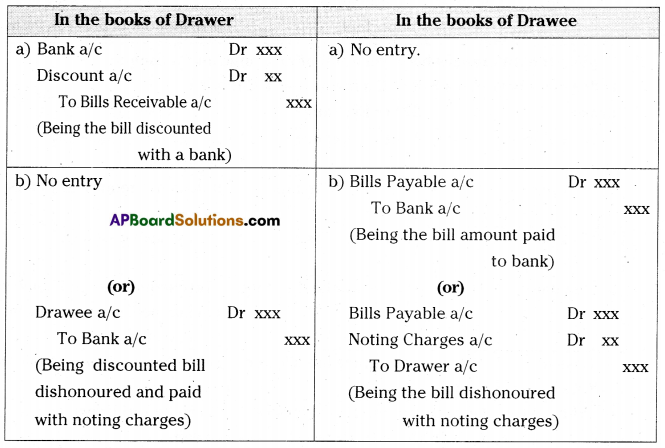

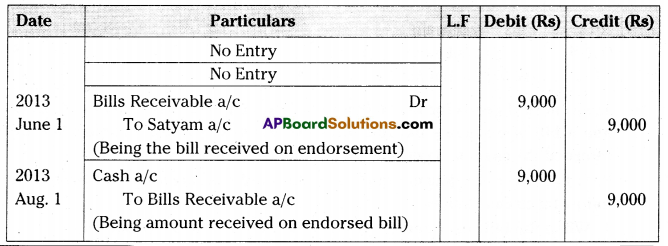

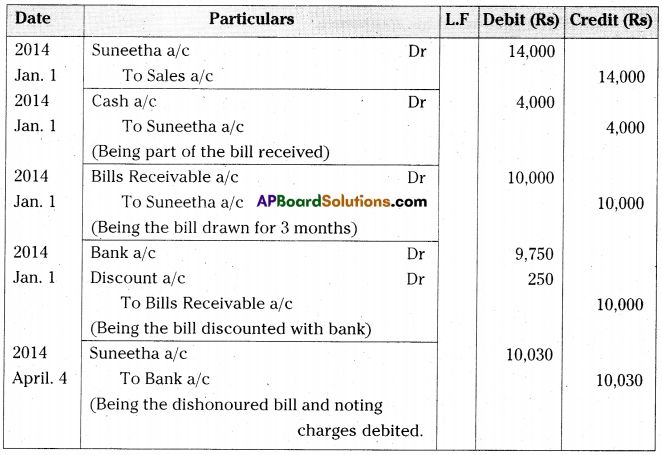

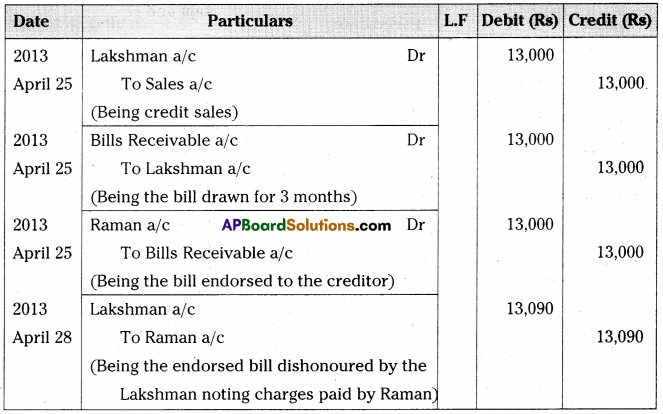

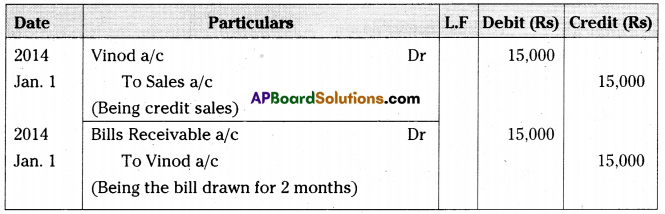

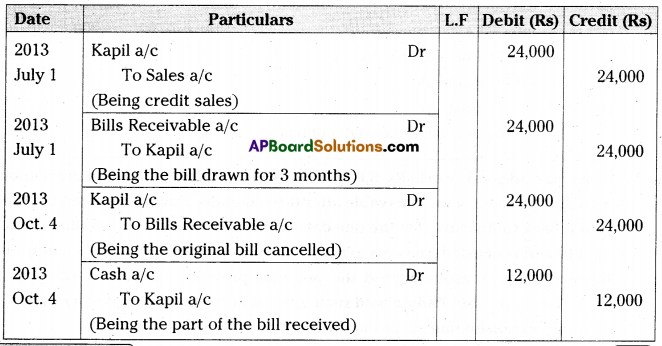

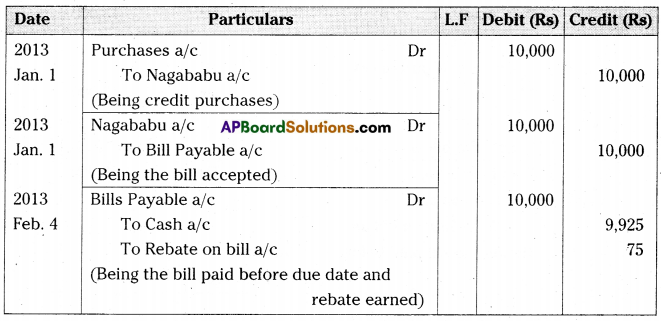

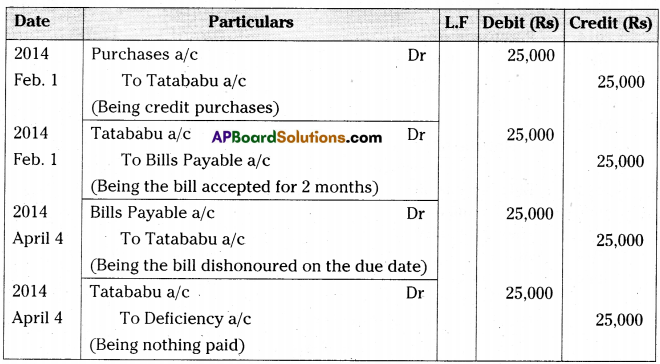

Question 22.

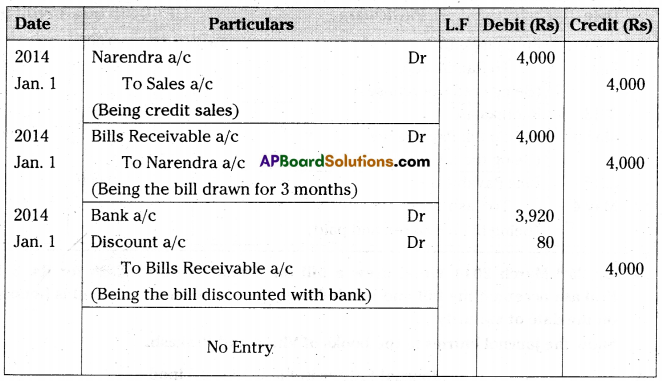

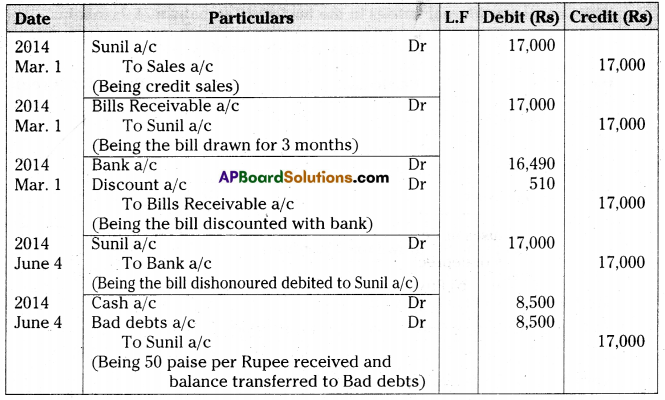

Anil sold goods worth Rs. 17,000 to Sunil on 1st March 2014 and drew upon him a bill for three months for the same amount. Sunil accepted the bill and handed over it to Anil. On the same day Anil discounted the bill @12% p.a. with his bank. Before the due date of the bill, Sunil became insolvent and only 50 paise in a rupee could be recovered from his estate.

Pass necessary journal entries in the books of Anil and Sunil. [Discount Rs. 510]

Answer:

Journal Entries in the books of Anil

Note: Discount = 17,000 x 12/100 x 3/12 = 510/-

![]()

Joumal Entries in the books of Sunil