Students must practice these AP Inter 2nd Year Accountancy Important Questions 8th Lesson Company Accounts to boost their exam preparation.

AP Inter 2nd Year Accountancy Important Questions 8th Lesson Company Accounts

Short Answer Questions

Question 1.

What is authorized capital? [May 2022; Mar. 17 (AP)]

Answer:

It is the amount of share capital, which a company is authorized to issue to the public by the memorandum of association. It is also called nominal or registered capital.

Question 2.

What is a preference share?

Answer:

As per Section 85 of the Companies Act 1956, preference shares are those shares that carry special rights in respect of dividends and also repayment of capital at the time of winding up of the company. The rate of divided on these shares are fixed.

![]()

Question 3.

What is an Equity share? [Mar. ’20 ’19, ’18; May. 18 (AP)]

According to Section 85 of the Companies Act 1956, an equity share is a share which do not enjoy any preferential right in the payment of dividend or repayment of capital are called as ‘equity shares’. The dividend on equity shares is not fixed and it may vary from year to year depending up on profits.

Question 4.

Explain the issue of shares at par.

Answer:

When a company issues its shares at their face value the shares are known to have been issued at par. Example : The face value of the share is Rs. 100 and it is issued for Rs. 100.

Question 5.

Explain the issue of shares at premium.

Answer:

When a company issues its shares at the price of more than the face value, it is said to be an issue at a premium. The money collected more than the face value is “premium”. Example: The face value of the share is Rs. 100 and issued at Rs. 110. The excess amount Rs. 10 is treated as capital income.

Question 6.

Explain the issue of shares at discount.

Answer:

When a company issues its shares at a price less than the face value, it is said to be an issue at a discount. It is capital loss. It is shown on the assets side of the balance sheet. The maximum rate of discount is 10 percent only.

Long Answer Questions

Question 1.

Explain the categories of share capital. [Mar. ’19; May ’22, ’17 (AP)]

Answer:

The share capital of the company can be classified as

1. Authorised capital: It is the amount of share capital which a company is authorised to issue to the public by the Memorandum of Association. It is also called as “nominal” or “registered capital”.

2. Issued capital: It is the part of the authorised capital actually issued to the public , for a subscription. The company may issue in parts from time to time as per the

needs of the company.

3. Subscribed capital: It is the part of the issued capital, actually subscribed by the public. It can be equal to or less than the issued capital.

4. Called up capital : The amount on the subscribed shares which is actually de¬manded by the company to be paid is known as called-up capital.

5. Paid-up capital: It is the part of the called-up capital which is actually paid by the share holders. The sum which is still to be paid is known as calls-in arrears.

Question 2.

Explain the classes of shares.

Answer:

The capital of the company is divided into equal units or segments. Each unit is called a share. The persons who buy such shares are called as share holders. The capital contributed by issue of shares is called as share capital. Section 86 of the Company Act 1956, a

company can issue two types of shares 1) Preference shares and 2) Equity Shares.

1. Preference Shares : The capital raised by issue of preference shares is called

“preference share capital”. Preference share holders have a preferential claim over dividend and repayment of capital. Preference share holders gets fixed rate of dividend. Generally they do not enjoy any voting rights. A company can issue different types of preference shares. .

2. Equity Shares or Ordinary Shares : According to section 85 of the Companies Act 1956 an equity share is a share which do not enjoy any preferential right in the payment of dividend or repayment of capital. The dividend on equity shares in not fixed and it may vary from year to year depending upon profits. They are owners of the company and have voting rights.

Question 3.

Explain the types of issue of shares. [Mar ’17 (AP)]

Answer:

The share capital of a company can be collected in easy installments spread over a period of time depending upon financial requirement. The first installment is collected along with application and it is known as “application money”. The second on allotment it is called “allotment money” and the remaining is collected in instalments are termed as “first call, second call and final call”.

Company shares are issued at par value (or) face value, issued at premium or at a discount. Shares issued at par value or face value : When a company issues its shares at their face value the shares are known to have been issued at par. Example: The face value of the share is Rs. 100 and it is issued for Rs. 100.

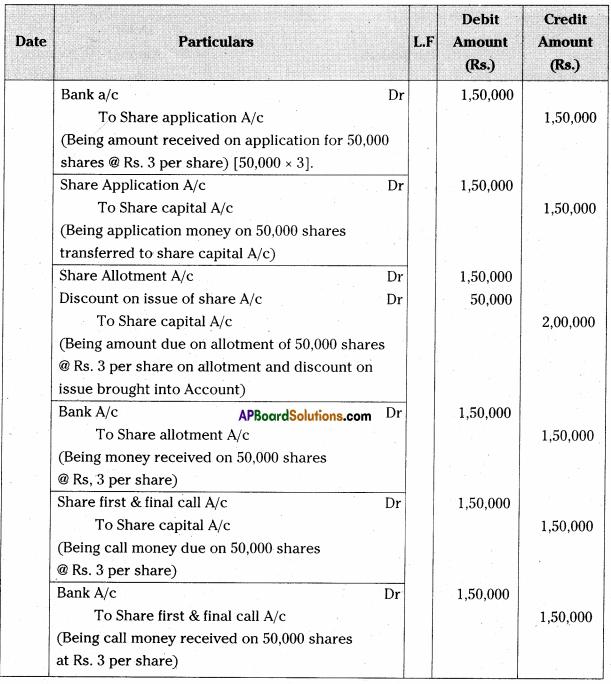

![]()

Journal Entries

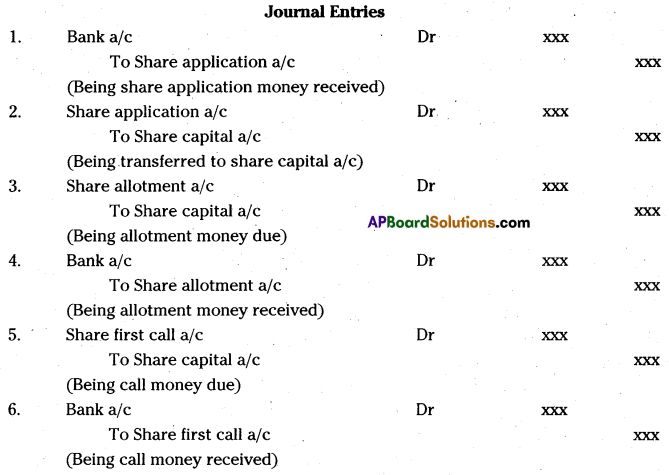

Shares issued at Premium (Section 52):

When company issues its shares at a price of more than the face value. It is said to be an issue at a premium.

Example : The face value of the share is Rs. 100 and issued at Rs. 110. The excess amount Rs. 10 is treated as capital income – ice premium.

Journal Entries

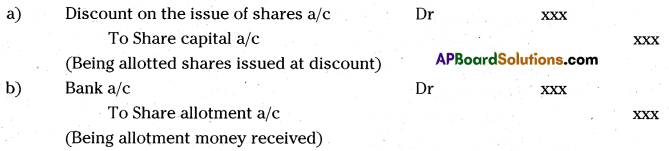

Shares issued at Discount (Section 53):

When a company issues its shares at a price less than the face value, it is said to be an issue at a discount. It is a capital loss. The maximum rate of discount is 10% only.

Journal Entries

Exercise

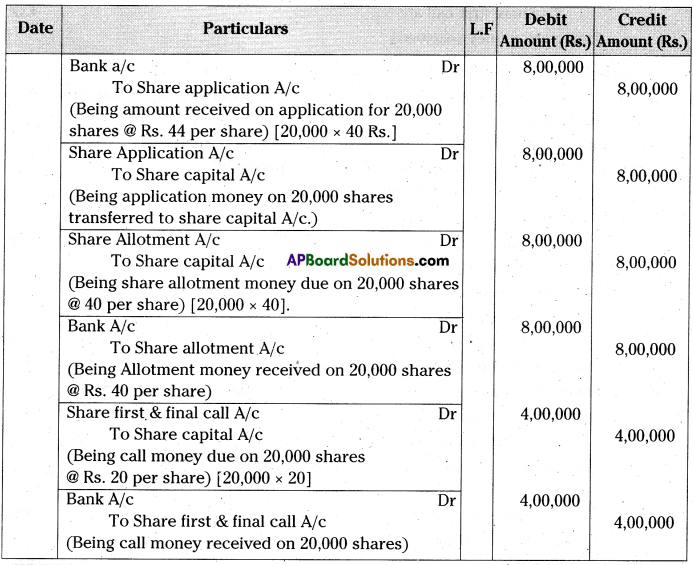

Question 1.

Dhana Ltd issued 20,000 shares of Rs. 100 each for the subscription. Payable at Rs. 40 per share on application, Rs. 40 per share on allotment and the balance Rs. 20 on first and final call. All the amounts were duly received. Make journal entries in the books of the company.

Answer:

Journal Entries in the Books of Dhana Ltd.

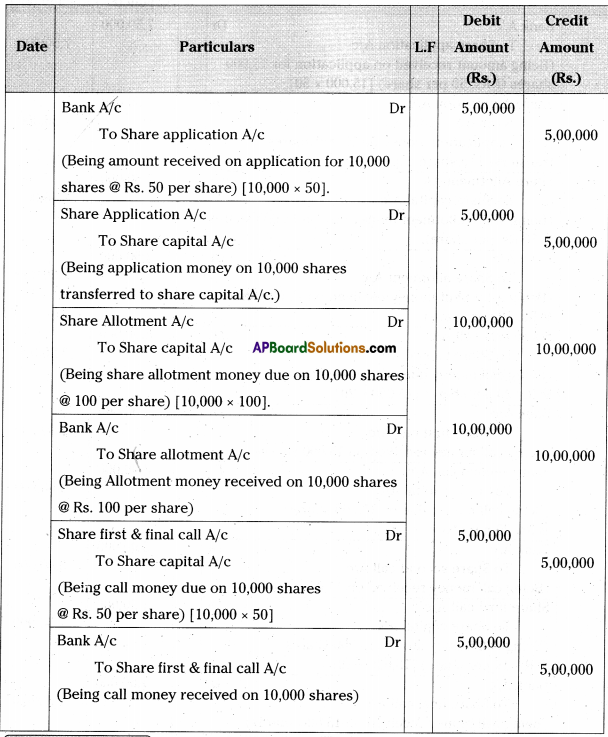

Question 2.

Charan Ltd. decided to issue 10,000 shares of Rs. 200 each for the subscription. Payable at Rs. 50 per share on application, Rs. 100 per share on allotment and the balance Rs. 50 on first and final call. All the money was duly received. Write journal entries in the books of the company.

Answer:

Journal Entries in the Books of Charan Ltd.

.

.

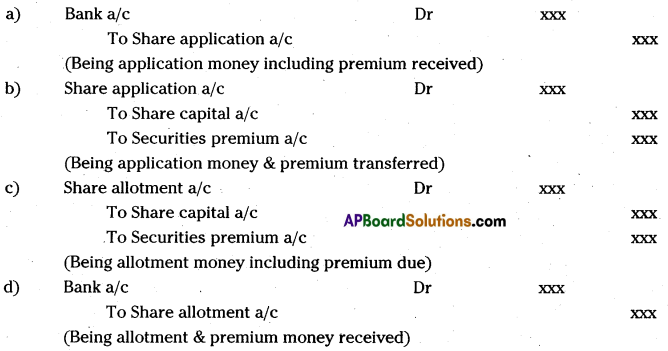

![]()

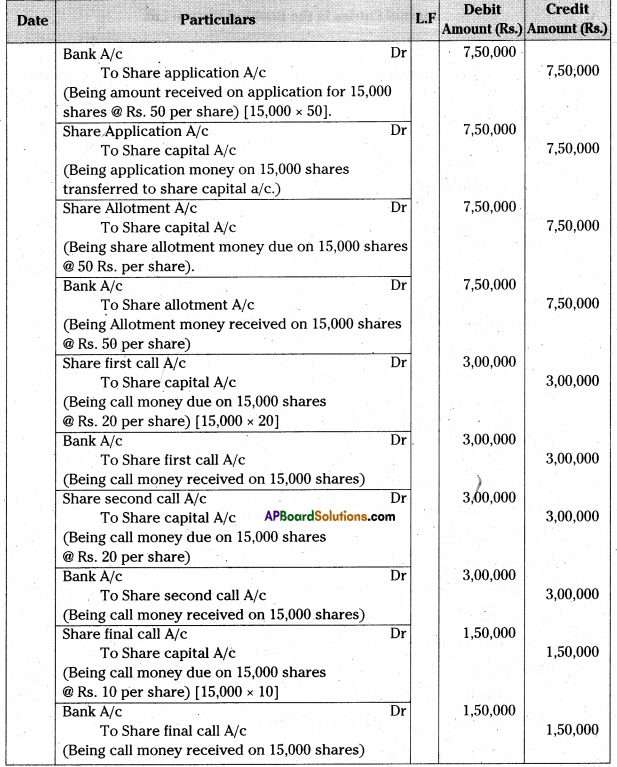

Question 3.

Gayatri Cloths Ltd issued 15,000 shares of Rs. 150 each, Payable at Rs. 50 per share on application, Rs. 50 per share on allotment and the balance Rs. 20 on first call, Rs. 20 on second call and Rs. 10 final call. All the money was duly received. Prepare journal entries in the books of the company.

Answer:

Journal Entries in the books of Gayatri Cloths Ltd.

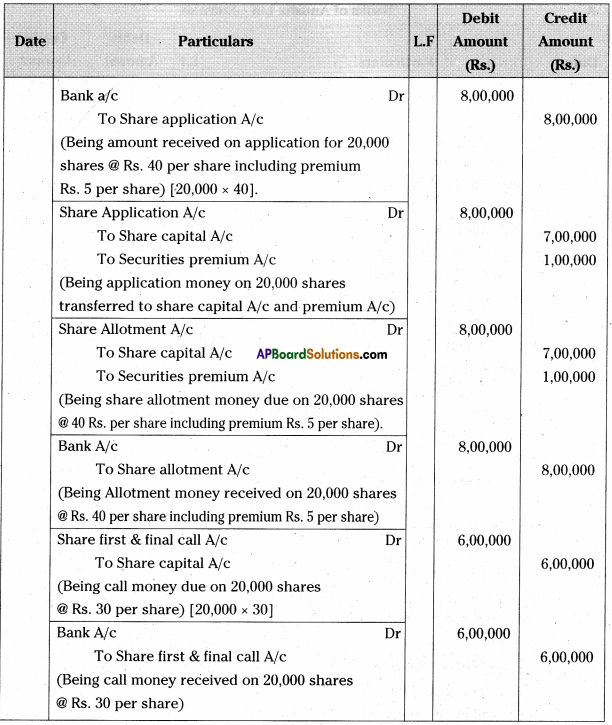

Question 4.

Jayaram Furniture’s Ltd issued 20,000 share of Rs. 100 each at a premium of Rs. 10 per share payable as follows, on application Rs. 40 (including premium Rs. 5 per share), on allotment Rs. 40 (Including premium Rs. 5 per share) the remaining balance Rs. 30 on first and final call, the issue was fully subscribed. All the money was duly received. Make the Journal entries in the books of the company.

Answer:

Journal Entries in the Books of Jayaram Furniture’s Ltd.

Question 5.

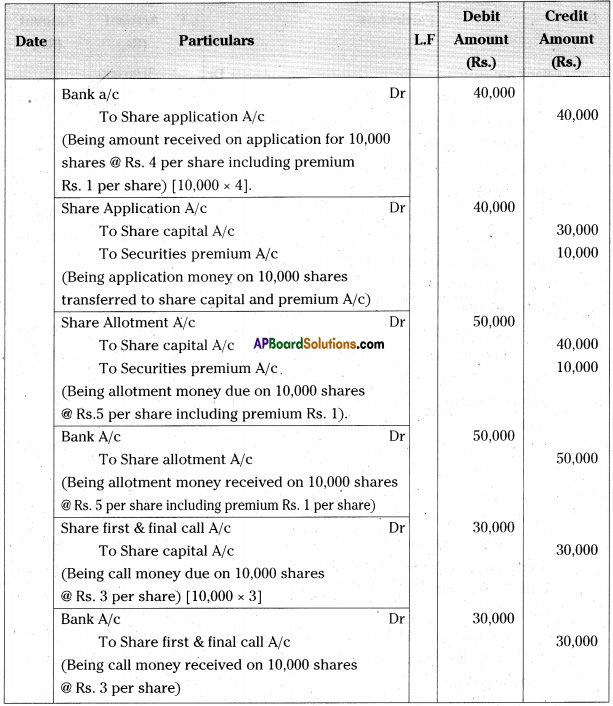

Anusha Ltd having an authorized capital of Rs. 1,00,00,000 in share of 10 each issued 10,000 at a premium of Rs. 2 per share payable at Rs. 4 on application (Including premium Rs. 1 per share), Rs. 5 on allotment (including premium Rs. 1 per share) the remaining balance Rs. 3 on first and final call, the issue was fully subscribed. All the money was duly received. Prepare the Journal entries in the books of the company.

Answer:

Books of Anusha Ltd – Journals

Question 6.

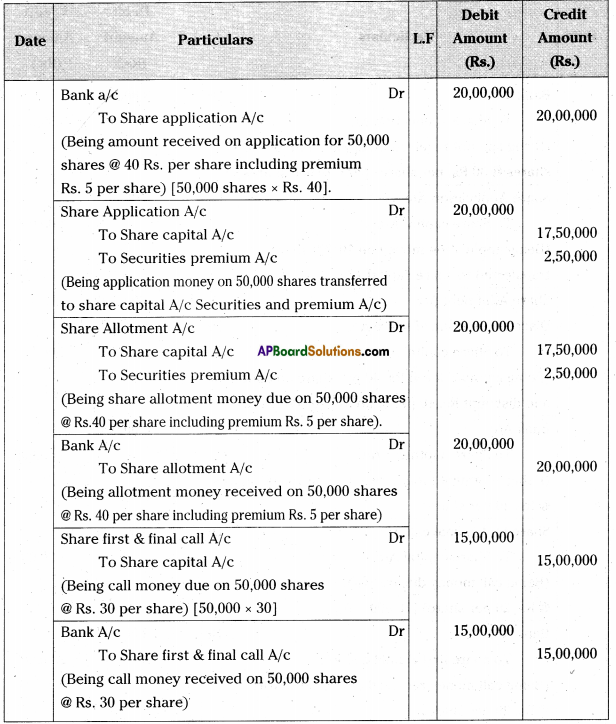

Karthik Ltd issued 50,000 shares of Rs. 100 at a premium of Rs. 10 per share, payable at Rs. 40 on application (including premium Rs. 5 per share), Rs. 40 on allotment (including premium of Rs. 5 per share) the remaining balance Rs. 30 on first and final call, the issue was fully subscribed. All the money was duly received. Record the Journal entries in the books of the company.

Answer:

Journal Entries in the books of Karthik Ltd.

![]()

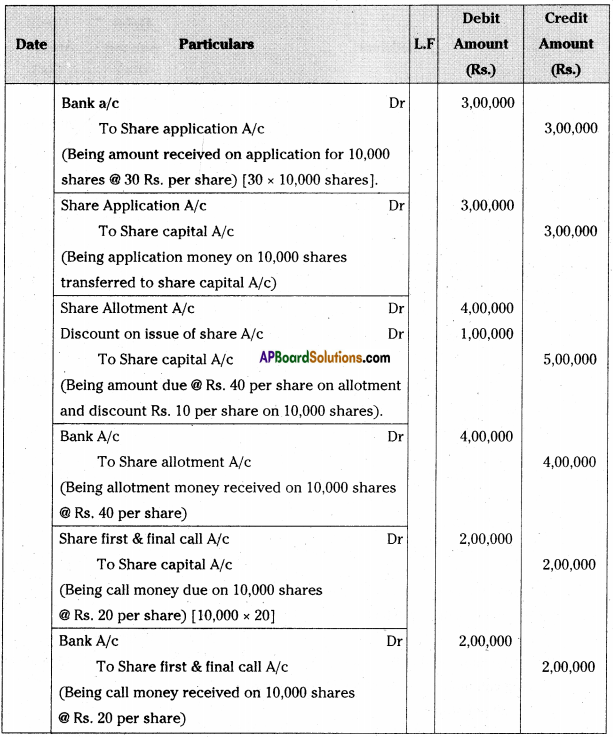

Question 7.

Padmavati Ltd issued to the public for subscription of 10,000 shares of Rs. 100 each at a discount of 10% per share, payable at Rs. 30 on application, Rs. 40 on allotment and Rs. 20 on first and final call, the issue was fully subscribed. All the money was duly received. Write the Journal entries in the books of the company.

Answer:

Journal Entries in the books of Padmavati Ltd.

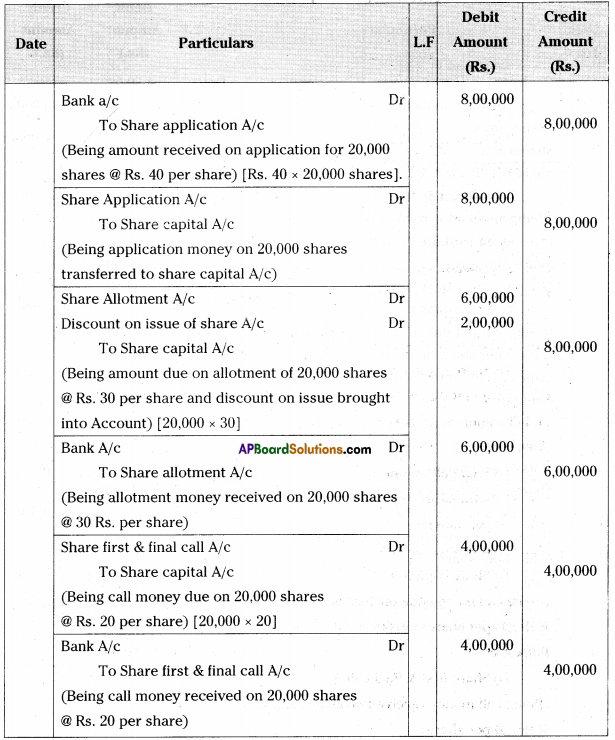

Question 8.

Abishek Ltd issued 20,000 shares of Rs. 100 each at a discount of 10% per share, the shares were payable at Rs. 40 on application, Rs. 30 on allotment and Rs. 20 on first and final call, the issue was fully subscribed. All the money was duly received. Record the Journal entries in the books of the company.

Answer:

Journal Entries in the books of Abishek Ltd.

![]()

Question 9.

Venkat Ltd. issued 50,000 shares of Rs. 10 each at a discount of 10% per share, the shares were payable at Rs. 3 on application, Rs. 3 on allotment and Rs. 3 on first and final call, the issue was fully subscribed. All the money was duly received. Give Journal entries in the books of the company.

Answer:

Journal Entries in the books of Venkat Ltd.