Students must practice these AP Inter 2nd Year Accountancy Important Questions 7th Lesson Retirement / Death of a Partner to boost their exam preparation.

AP Inter 2nd Year Accountancy Important Questions 7th Lesson Retirement / Death of a Partner

Very Short Answer Questions

Question 1.

What is meant by the retirement of a partner?

Answer:

A partner may retire from the firm a) in accordance with an agreement b) with the consent of all other partners and c) in case of partnership at will’ by giving 20 days notice in writing to all other partners. That means a partner may come out of the firm. He is entitled to receive from the firm any amount due to him.

Question 2.

What do you understand by ‘Gaining Ratio’?

Answer:

The ratio in which the share of the retiring partners is taken over by the continuing partners is called the ‘Gaining Ratio’.

Gaining Ratio = New Ratio – Old Ratio.

Note: When the new ratio is not given in the problem “the gaining ratio will be equal to old ratio”.

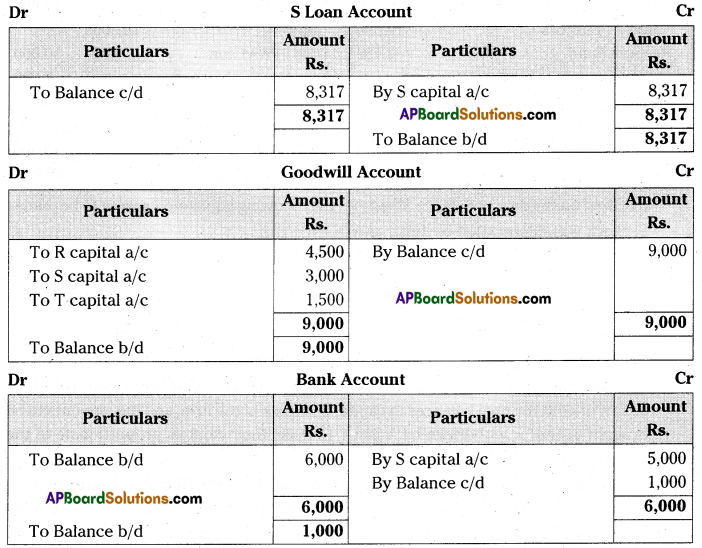

![]()

Question 3.

What are the adjustments required on the retirement or death of a partner?

Answer:

A partner opts retire from an existing partnership firm it is called retirement of a partner. On the retirement of a partner certain adjustments are to be made.

a) Profit sharing ratio: When a partner retires from the firm, it is necessary to calculate new profit sharing ratio of continuing partners.

b) Revaluation of Assets & Liabilities: Assets and Liabilities are revalued and profit/ loss transferred to all partners capital accounts.

c) Undistributed Profits: It any undistributed profits or loss are found in the balance sheet the same should be distributed among all the partners in the old profit sharing ratio.

d) Goodwill: Goodwill is an intangible asset. All the partners have a right to take over the goodwill of the firm. Therefore it is valued as per partnership deed.

e) Payment of amount due to retiring partner: After making all adjustments balance in the retiring partner capital account will be settled either in lumpsum or trans¬ferred to his loan a/c.

f) New Balance Sheet: Basing on the old balance sheet and after making all adjustments a new balance sheet is prepared with the continuing partners.

Question 4.

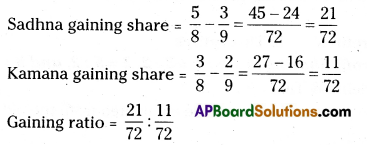

How is the account of the deceased partner settled?

Answer:

The deceased partner’s account is settled as per the terms of the partnership deed i.e., in lumpsum immediately or in various installments with or without interest. Hence the total amount due to the retiring / deceased partner with is ascertained after all adjustments have been made,-the amount due is transferred to the deceased partner’s executor’s account.

Journal Entries

Question 5.

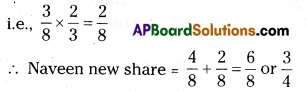

Explain the modes of payment to a retiring partner.

Answer:

The total amount due to the retiring partner is ascertained after all adjustments have been made is to be paid immediately or transferred to the retiring partner s loan account.

Journal Entries

Exercise

Question 1.

Madhii, Nehra and Tina are partners sharing profits in the ratio 5:3:2. Calculate new profit sharing ratio of

1. Madhu retires 2. Nehra retires 3. Tina retires

(Ans: New Profit Sharing Ratio: 1 = 3:2, 2 = 5:2, and 3 = 5:3)

Answer:

Profit sharing ratio of Madhu, Nehra & Tina = 5:3:2.

a) Madhu retiring from business, ‘Madhu’ share will be eliminated from the old ratio.

Madhu, Nehra & Tina = 5:3:2.

Remaining ratio of Nehra & Tina = 3:2

New ratio of Nehra & Tina = 3:2.

b) Nehra retiring from business, ‘Nehra’ share will be eliminated.

Remaining ratio of Madhu & Tina = 5:2

∴ New ratio of Madhu & Tina = 5:2.

c) Tina retiring from business, Tina’ share will be eliminated.

Remaining ratio of Madhu & Nehra = 5:3

∴ New ratio of Madhu & Nehra = 5:3.

![]()

Question 2.

Hari, Prasad and Anwar are partners sharing profits in the ratio of 3: 2: 1. Hari retires and his share is taken up by Prasad and Anwar in the ratio of 3: 2. Calculate the new profit sharing ratio.

(Ans: New Profit Sharing Ratio of Prasad and Anwar = 19:11)

Answer:

Old profit sharing ratio of Hari, Prasad & Anwar = 3:2:1 or 3/6: 2/6: 1/6

Hari share taken up by Prasad & Anwar in the ratio = 3: 2 or 3/5: 2/5

∴ New profit ratio of Prasad and Anwar = 19/30: 11/30 or 19:11.

Question 3.

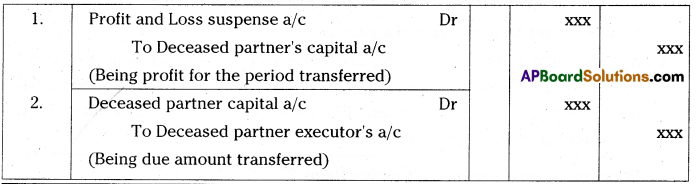

Ranjana, Sadhna and Kamana are partners sharing profits in the ratio 4:3:2. Ranjana retires, Sadhna and Kamana decided to share future profits in the ratio of 5: 3. Calculate the Gaining Ratio. (Ans: Gaining ratio = 21:11)

Answer:

Old ratio of Ranjana, Sadhna and Kamana = 4:3:2 or 4/9: 3/9: 2/9

New ratio of continuing Sadhna: Kamana = 5: 3 or 5/8: 3/8

Thus the gaining ratio of Sadhna & Kamana = 21: 11.

Question 4.

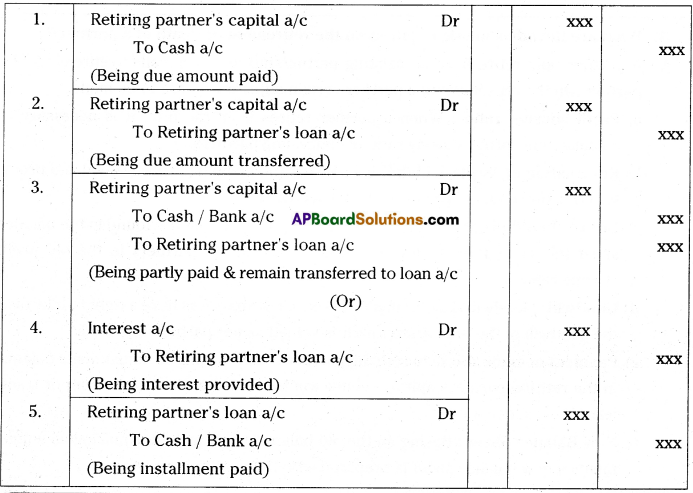

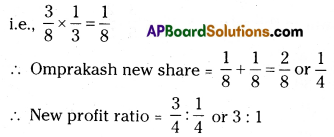

Murali, Naveen and Omprakash are partners sharing profits in the ratio of 3: 4: 1 Murali retires and surrenders 2/3rd of his share in favour of Naveen and the remaining share in favour of Omprakash. Calculate new profit sharing and the gaining ratio of the remaining partners.

(Arts: New Profit Sharing Ratio -3:1 and gaining ratio = 2:1)

Answer:

Old ratio of Murali, Naveen & Omprakash = 3:4:1

Murali’s old share is 3/8 of which he surrenders 2/3 rd of his share in favour of Naveen.

Murali’s old share is 3/8 of which he surrenders 1/3 rd of his share in favour of Omprakash.

Calculation of gaining ratio:

Question 5.

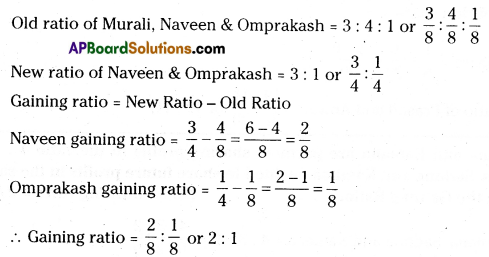

Vasu, Dasu and Bosu are partners sharing profits in the ratio of 1: 2: 3. Dasu retires and at the time of retirement, goodwill is valued at Rs. 84,000. Vasu and Bosu decided to share future profits in the ratio of 2: 1. Record the necessary journal entries.

Answer:

Journal Entry

Question 6.

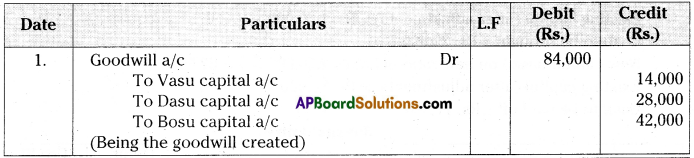

Rama, Krishna and Reddy are partners in a firm sharing profits and losses in the ratio of 2: 2: 1. On Rama’s retirement, the goodwill of the firm is valued at Rs. 46,000. Krishna and Reddy decided to share future profits equally. Record the necessary journal entry of the treatment of goodwill without opening’s Goodwill Account.

Answer:

Journal Entry

Question 7.

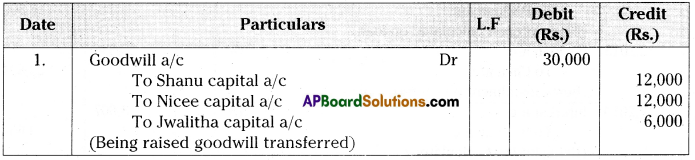

Shanu, Nicee and Jwalitha are partners sharing profits in the ratio of 1: 3: 5. Goodwill is appearing in the books at the value of Rs. 60,000. Nicee retires and goodwill is valued at Rs. 90,000. Shanu and Jwalitha decided to share future profits equally. Record necessary journal entries.

Answer:

Journal Entry

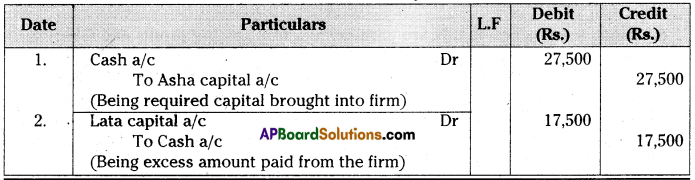

Question 8.

Asha, Deepa and Lata are partners in a firm sharing profits in the ratio of 3: 2: 1. Deepa retires. After making all adjustments relating to revaluation, goodwill and accumulated profit etc., the capital accounts of Asha and Lata showed a credit balance of Rs. 1,60,000 and Rs. 80,000 respectively. It was decided to adjust the capitals of Asha and Lata in their new profit sharing ratio. They decided that the requirement of capital is Rs. 2,50,000. You are required to calculate the new capitals of the partners and record necessary journal entries for bringing in or withdrawal of the necessary amounts involved.

(Ans: Asha’s capital brought – Rs. 27,500 & Lata’s capital withdrew – Rs. 17,500)

Answer:

The new profit sharing ratio Asha & Lata = 3:1

Total capital of the firm = Rs. 2,50,000

New capital based on new ratio of Asha = 2,50,000 x ¾ = 1,87,500

Existing capital (after adjustments) = Rs. 1,60,000

Cash to be brought = Rs. 27,500.

New capital based on new ratio of Lata = 2,50,000 x ¼ = 62,500.

Existing capital (after adjustments) = Rs. 80,000.

Cash to be paid off = Rs. 17,500

Journal Entry

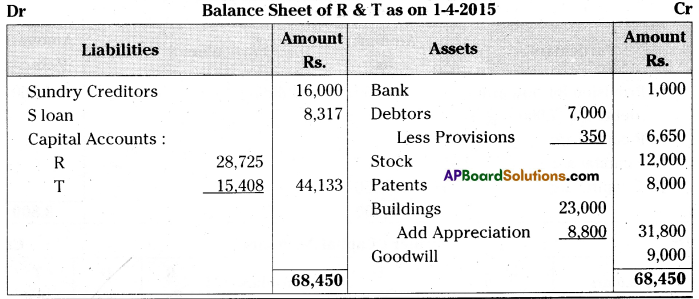

![]()

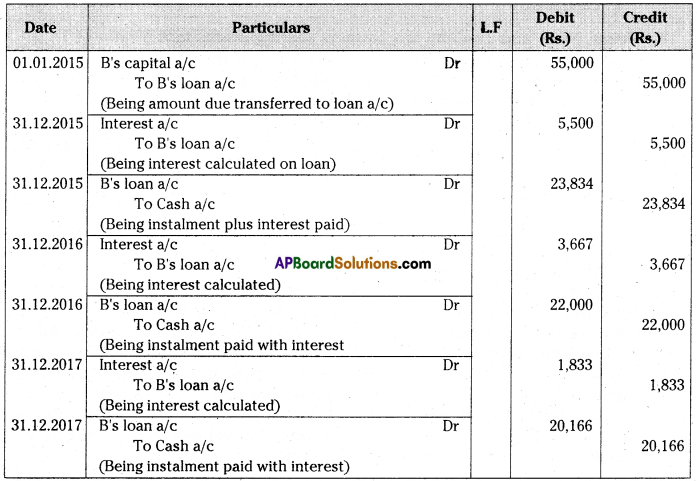

Question 9.

A, B and C are partners in a firm. B retires from the firm on 1st Jan. 2015. On the date of his retirement Rs. 55,000 were due to him. It was decided that the payment will be done in 3 equal yearly instalments together with interest @ 10% p.a. on the unpaid balance. Prepare necessary entries.

Answer:

Journal Entries

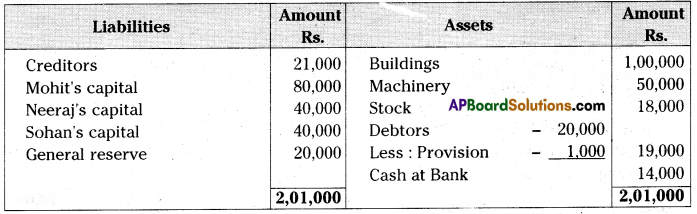

Question 10.

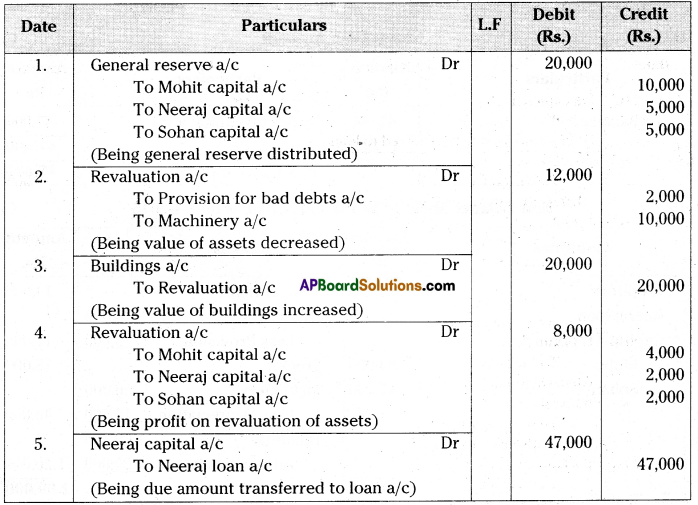

The Balance Sheet of Mohit, Neeraj and Sohan who are partners in a firm sharing profits according to their capitals as on March 31, 2015 was as under:

On that date, Neeraj decided to retire from the firm and was paid for his share in the firm subject to the following:

1. Buildings to be appreciated by 20%.

2. Provision for Bad debts to be increased to 15% on Debtors.

3. Machinery to be depreciated by 20%.

Prepare necessary accounts and new Balance Sheet after retirement.

(Ans: Gain on Revaluation ~Rs. 8,000;Mohit’s capitalA/c-Rs. 94,000, Sohan’s capital A/c – Rs. 47,000; Neeraj’s loan A/c Rs. 47,000; New Balance Sheet – Rs. 2,09,000).

Answer:

Journal Entries

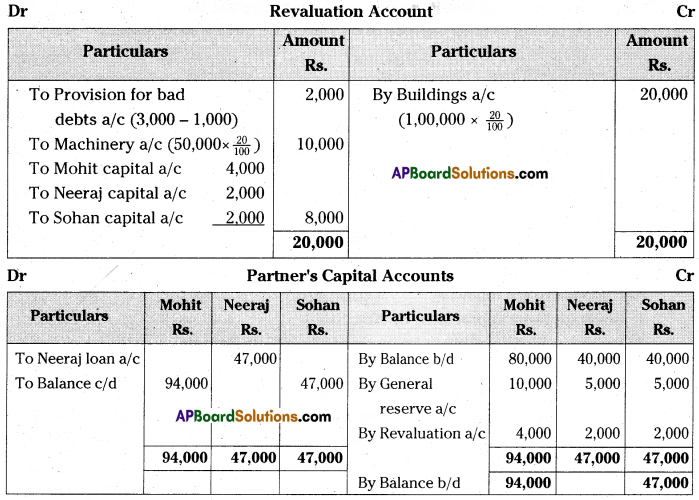

Question 11.

Siva, Rama and Krishna were partners in a firm sharing profits in the ratio of 2: 2:1. Their Balance Sheet as on March 31, 2015 was as follows.

Rama retired on March 31, 2015 on the following terms:

i) Goodwill of the firm was valued at Rs. 70,000 and was not to appear in the books.

ii) Bad debts amounting to Rs. 2,000 were to be written off.

iii) Patents were considered as valueless.

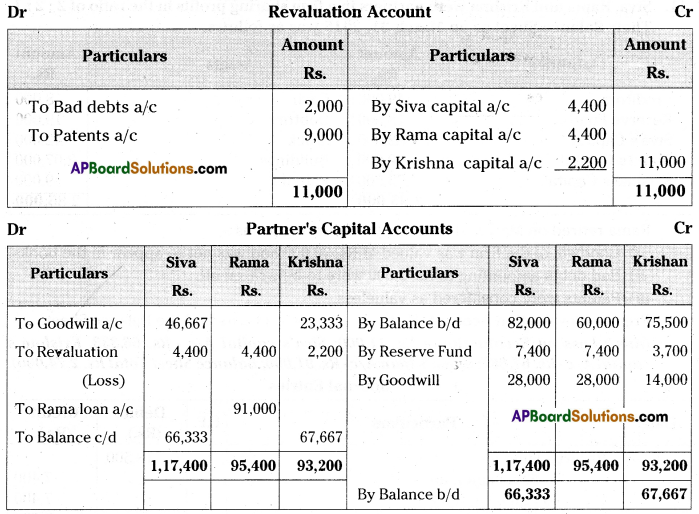

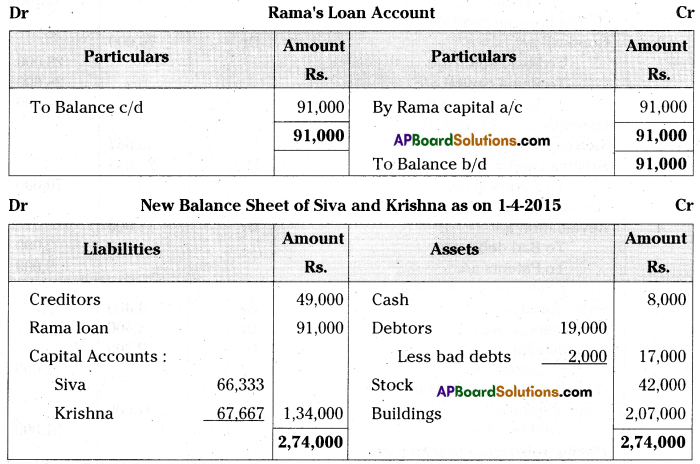

Prepare Revaluation Account, Partners’ Capital Accounts and the Balance Sheet.

(Ans: Loss on Revaluation – Rs. 11,000; Siva’s capital A/c – Rs. 66,333, Krishna’s capital A/c – Rs. 67,667; Rama’s loan A/c – Rs. 91,000; Balance Sheet Total Rs. 2,74,000).

Answer:

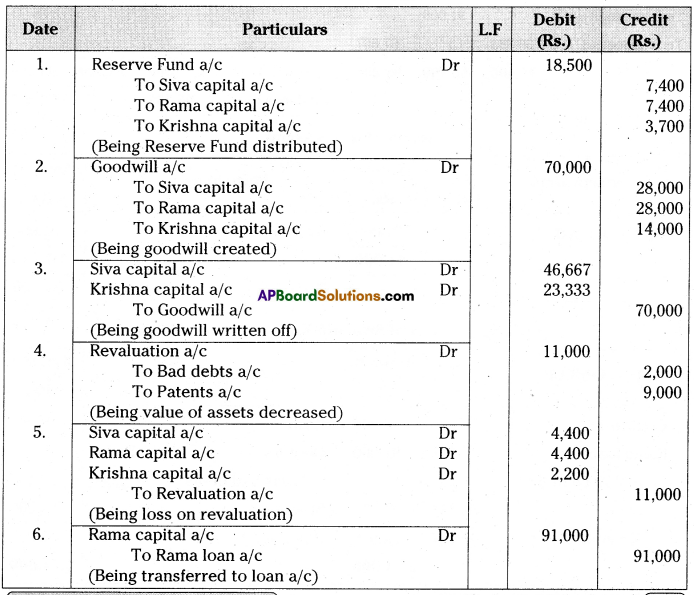

Journal Entries

Question 12.

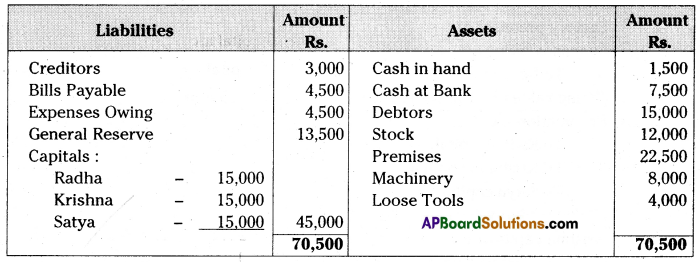

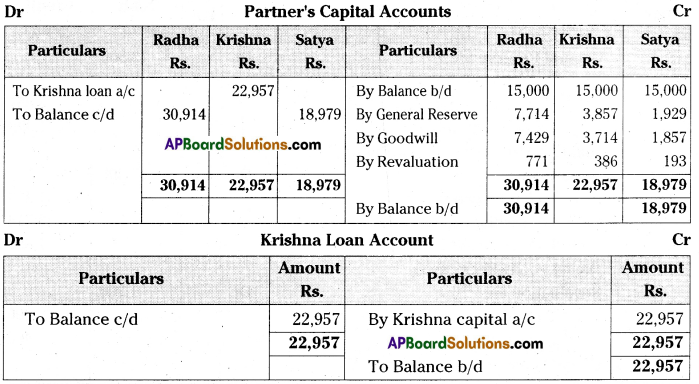

Radha, Krishna and Satya were in partnership sharing profit and losses in the ratio of 4: 2: 1. On April 1, 2015, Krishna retires from the firm. On that date, their Balance Sheet was as follows:

The terms were:

a) Goodwill of the firm was valued at Rs. 13,000.

b) Expenses owing to be brought down to Rs. 3,750.

c) Machinery and Loose Tools are to be valued at 10% less than their book value.

d) Factory premises are to be revalued at Rs. 24,300.

Prepare: 1. Revaluation account.

2. Partner’s capital accounts and

3. Balance sheet of the firm after retirement of Krishna.

(Ans: Profit on Revaluation Rs. 1,350; Radha’s capital A/c – Rs. 30,914, Satya’s capital A/c – Rs. 18,979; Krishna’s loan A/c – Rs. 22,987; Balance Sheet Total = Rs. 81,100).

Answer:

Journal Entries

Journal Entries

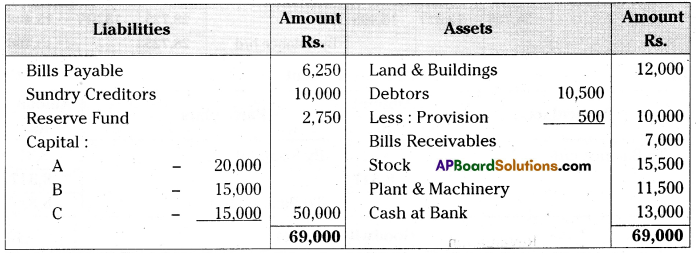

![]()

Question 13.

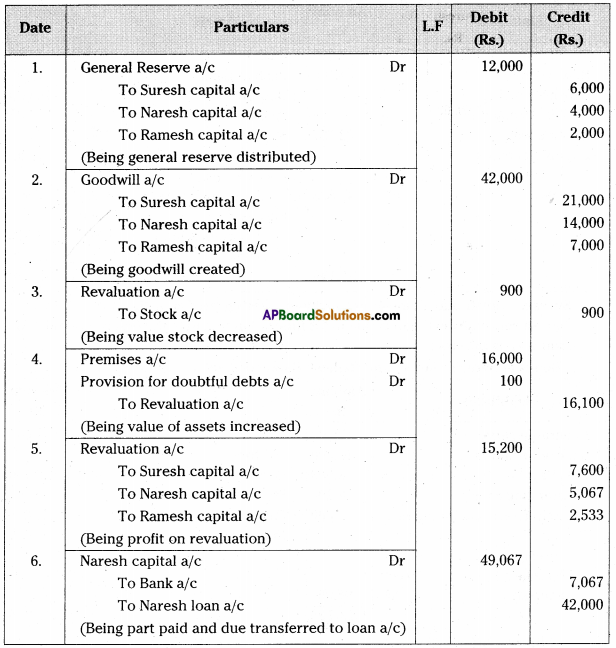

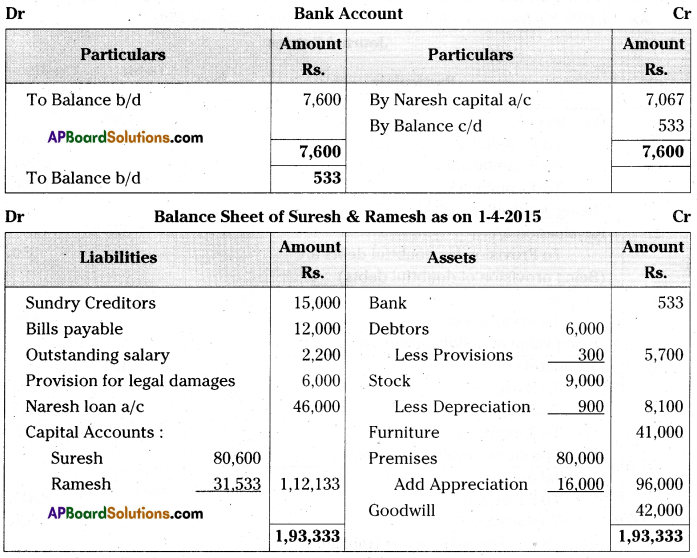

Suresh, Naresh and Ramesh are partners sharing profits in the ratio of 3: 2: 1. Naresh retired from the firm due to his illness. On that date the Balance Sheet of the firm was as follows:

Books of Suresh, Naresh and Ramesh Balance Sheet as on March 31, 2015.

Additional Information:

i) Premises have appreciated by 20%, stock depreciated by 10% and provision for doubtful debts was to be made 5% on debtors.

ii) Goodwill of the firm valued at Rs. 42,000.

iii) Rs. 46,000 from Naresh’s Capital account be transferred to his loan account and balance be paid through bank.

iv) New profit sharing ratio of Suresh and Ramesh is decided to be 5: 1.

Give the necessary ledger accounts and balance sheet of the firm after Naresh’s retirement.

(Ans: Profit on Revaluation Rs. 15,200; Suresh’s capital A/c – Rs. 80,600, Ramesh’s capital A/c – Rs. 31,533; Paid to Naresh – Rs. 7,067; Balance Sheet – Rs. 1,93,333).

Answer:

Journal Entries

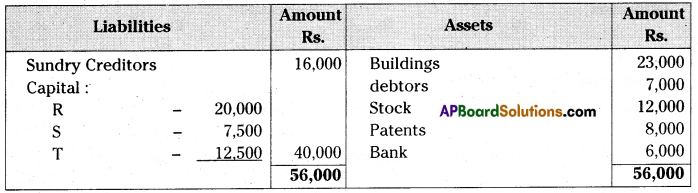

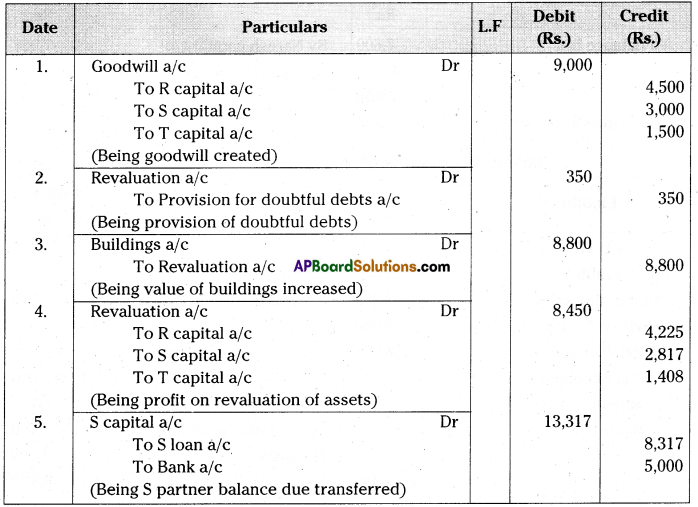

Question 14.

R, S and T were carrying on business in partnership sharing profits in the ratio of 3:2:1 respectively. On March 31, 2015, Balance Sheet of the firm stood as follows:

S retired on the above-mentioned date on the following terms:

a) Buildings to be appreciated by Rs. 8,000.

b) Provision for doubtful debts to be made @ 5% on debtors.

c) Goodwill of the firm to be valued at Rs. 9,000.

d) Rs. 5,000 to be paid to S immediately and the balance due to him to be treated as a loan carrying interest @ 6% per annum.

Prepare the balance sheet of the reconstituted firm.

(Ans: Profit on Revaluation Rs. 8,450; R’s capital A/c – Rs. 27,725, T’s capital A/c – Rs. 15,408; S’s loan A/c – Rs. 8,317; Balance Sheet – Rs. 68,450).

Answer:

Journal Entries

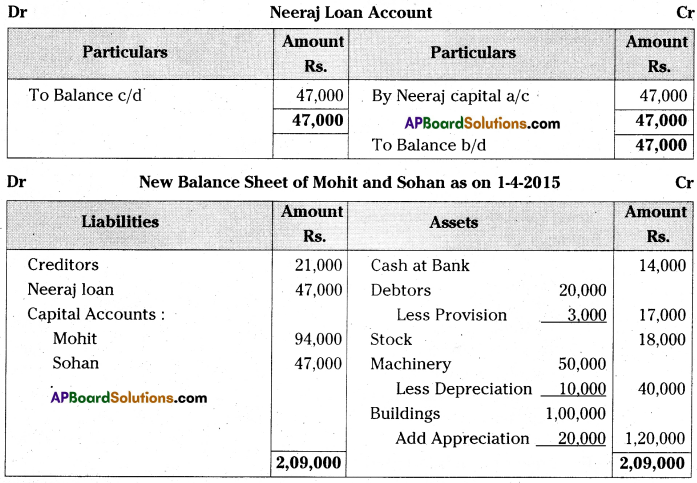

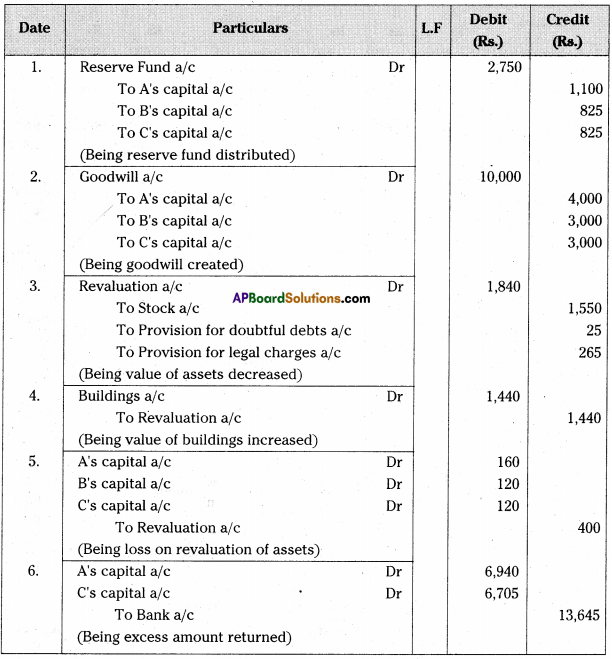

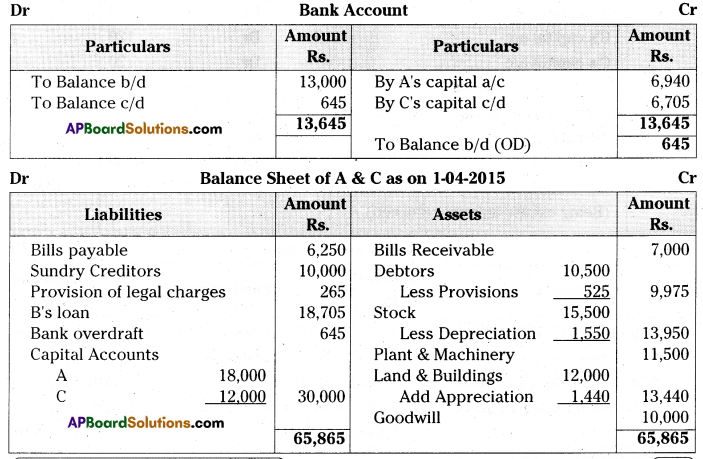

Question 15.

The Balance Sheet of A, B and C who were sharing the profits in proportion to their capitals stood as on March 31, 2015.

Balance Sheet as on March 31, 2015

B retired on the date of Balance Sheet and the following adjustments were to be made:

a) Stock was depreciated by 10%.

b) Factory building was appreciated by 12%.

c) Provision for doubtful debts to be created up to 5%.

d) Provision for legal charges to be made at Rs. 265.

e) The goodwill of the firm to be fixed at Rs. 10,000

f) The capital of the new firm to be fixed at Rs. 30,000.

The continuing partners decide to keep their capitals in the new profit sharing ratio of 3: 2. Work out the final balances in capital accounts of the firm, and the amounts to be brought in and/or withdrawn by A and C to make their capitals proportionate to the new profit sharing ratio.

(Ans: Loss on Revaluation Rs. 400; A’s capital A/c – Rs. 18,000, C’s capital A/c – Rs. 12,000; Cash withdrawn by A – Rs. 6,940 & C – Rs. 6,705; B’s Loan A/c – Rs. 18,705; Balance Sheet – Rs. 65,220).

Answer:

Journal Entries

Working Notes:

1) Adjustment of capitals:

The capital of the new firm = Rs. 30,000

The new profit sharing ratio between A & C = 3: 2

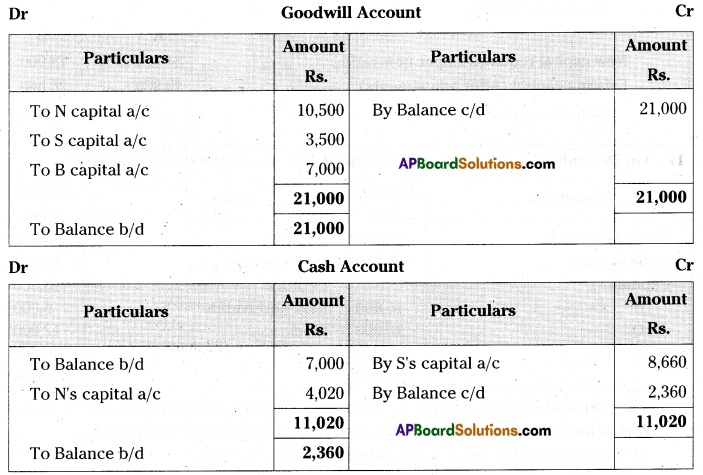

![]()

Question 16.

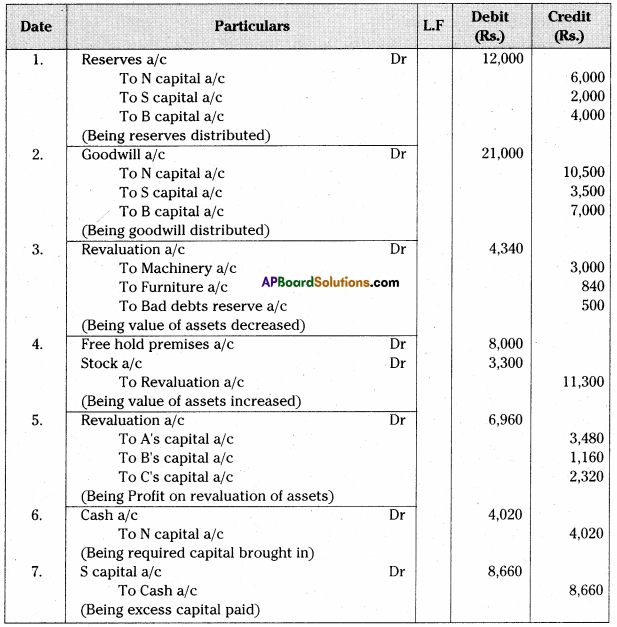

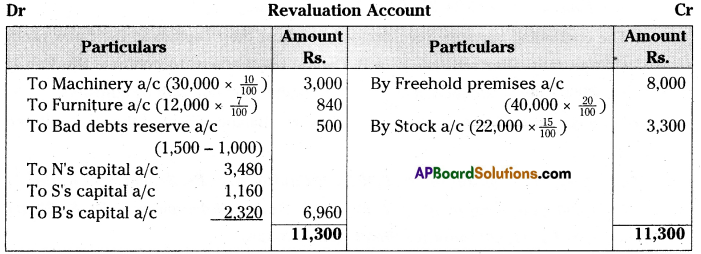

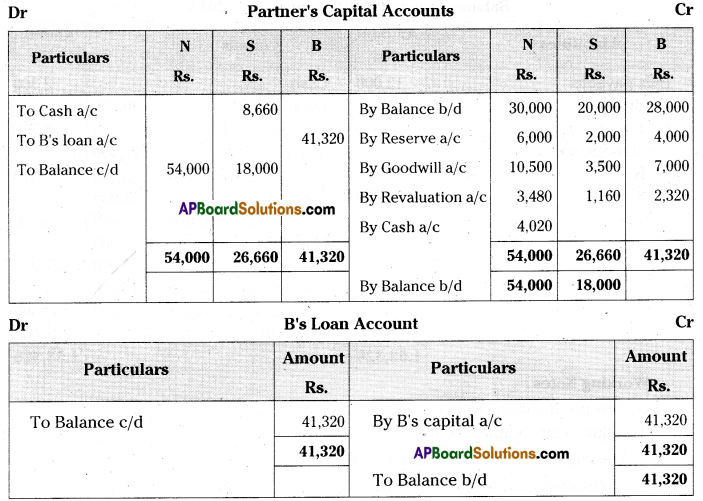

N, S and B are partners in a firm sharing profits and losses in ratio of 3: 1: 2. The Balance Sheet on April 1, 2015 was as follows:

B retires from the business and the partners agree to the following:

a) Freehold premises and stock are to be appreciated by 20% and 15% respectively.

b) Machinery and furniture are to be depreciated by 10% and 7% respectively.

c) Bad Debts reserve is to be increased to Rs. 1,500.

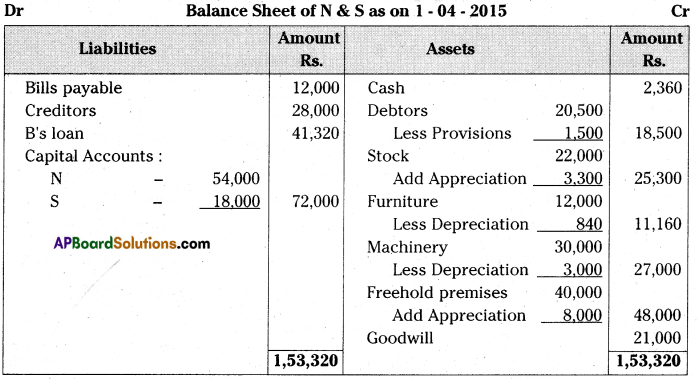

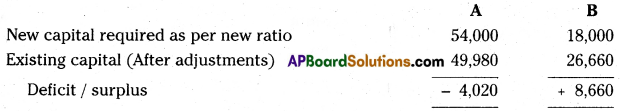

d) Goodwill is valued at Rs. 21,000 on B’s retirement.

e) The continuing partners have decided to adjust their capitals in their new profit-sharing ratio after the retirement of B. Capital requirement to continue the firm is Rs. 72,000. Surplus/deficit, if any, in their capital accounts will be adjusted.

Prepare necessary ledger accounts and draw the Balance Sheet of the reconstituted firm.

(Ans: Profit on Revaluation Rs. 6,960; N’s Capital A/c – Rs. 54,000, S’s Capital A/ c – Rs. 18,000; Cash supplied byN-Rs. 4,020, Cash withdrawn by S -Rs. 8,660; B’s Loan A/c – Rs. 41,320; Balance Sheet – Rs. 1,53,320).

Answer:

Journal Entries

Working Notes:

i) New profit sharing ratio of N & S = 3: 1

ii) Adjustment capital accounts:

The capital of the new firm = Rs. 72,000

N’s share = 72,000 x ¾ = 54,000

S’s share = 72,000 x ¼ = 18,000

Question 17.

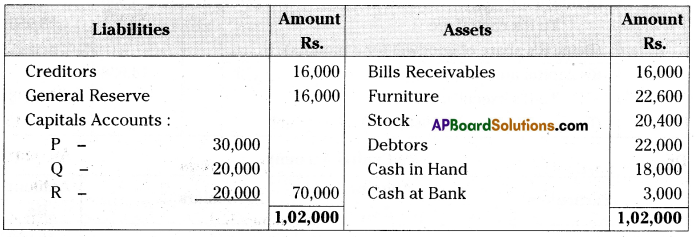

On December 31, 2014, the Balance Sheet of P, Q and R showed as under:

The partnership deep provides that the profit be shared in their ratio of 2: 1: 1 and that in the event of death of partner, his executors entitled to be paid out:

a) The capital of his credit at the date of last Balance Sheet.

b) His proportion of reserves at the date of last Balance Sheet.

c) His proportion of profits to the date of death base on the average profits of the last three completed years.

d) By way of goodwill, his proportion of the total profits for the three preceding years. The net profits for the last three years were:

2012 – 16,000; 2013 – 16,000; 2014 – 15,400

R died on April 1, 2015. He had withdrawn Rs. 5,000 to the date of his death.

Prepare R’s Capital Account that of his executors.

(Ans: R’s share in profits – Rs. 988; R’s Executors A/c – Rs. 14,938)

Answer:

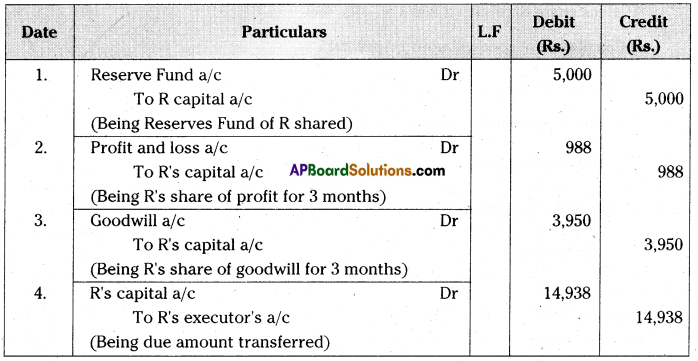

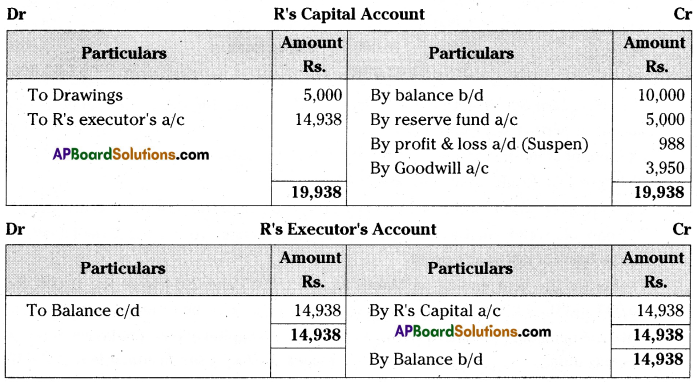

Journal Entries

Working Notes:

a) Reserve Fund Rs. 20,000.

R’s Share: 20,000 x ¼ = Rs. 5,000

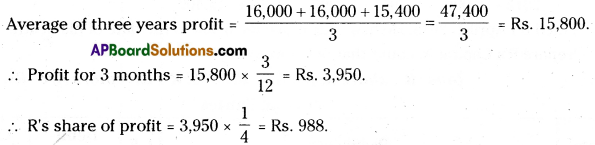

b) Calculation of profit upto 1 April 2015

∴ Profit for 3 months = 15,800 x 3/12 = Rs. 3,950.

∴ R’s share of profit = 3,950 x ¼ = Rs. 988.

c) Calculation of goodwill upto 1 April 2015

Average of profit = 47,400/3 = 15,800

Goodwill for the year = Rs. 15,800.

∴ R’s share of goodwill = 15,800 x ¼ = Rs. 3,950.

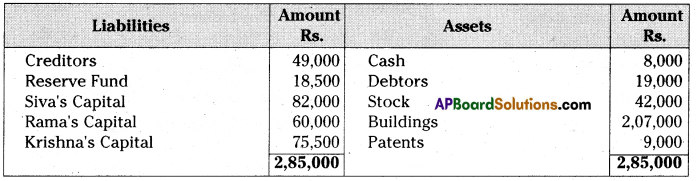

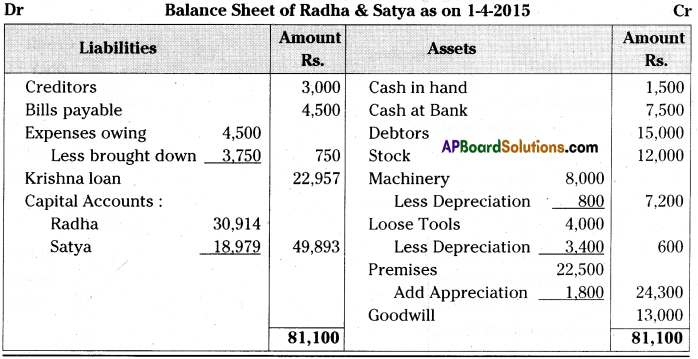

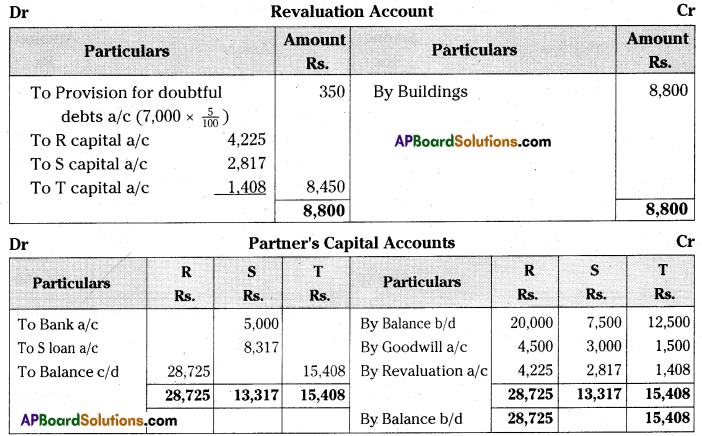

Question 18.

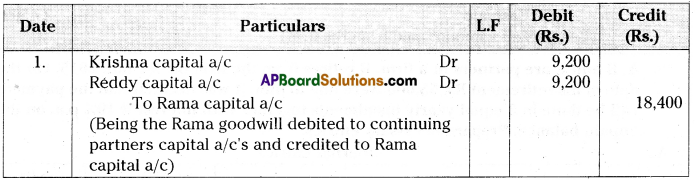

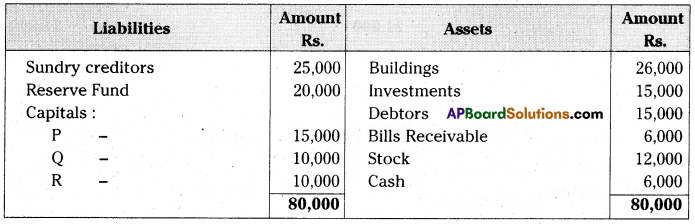

Following is the Balance Sheet of P, Q and R as on March 31, 2014.

Q died on June 30, 2014. Under the terms of the partnership deed, the executors of a deceased partner were entitled to:

a) Amount standing to the credit of the Partner s Capital account;

b) Interest on capital at 5% per annum;

c) Share of goodwill on the basis of twice the average of the past three years’ profit;

d) Share of profit from the closing date of the last financial year to the date of death on the basis of last year’s profit.

Profits for the year ending on March 31, 2012, 2013 and 2014 were Rs. 12,000, Rs. 16,000 and Rs. 14,000 respectively. Profits were shared in the ratio of capitals.

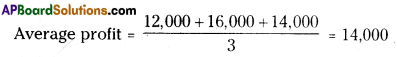

Pass the necessary journal entries and draw up Q’s capital account to be rendered to his executor. (Ans: Q’s Executor Account is rs. 33,821)

Answer:

Journal Entries

![]()

Working Notes:

a) General Reserve Rs. 16,000.

Q’s Share of general reserve = 16,000 x 2/7 = Rs. 4,571

b) Calculation of profit and loss:

Profit = Last year profit

Profit for 3 months his share = Rs. 1,000

c) Calculation of goodwill:

Goodwill = Twice the average of the past three years profit.

2 years Average profit = 14,000 x 2 = 28,000

Goodwill = 28,000 x 2/7 = Rs. 8,000/-

d) Calculation of Interest on capital:

∴ Interest on capital = 20,000 x 5/100 x 3/12 = Rs. 250.