Students must practice these AP Inter 2nd Year Accountancy Important Questions 6th Lesson Admission of a Partner to boost their exam preparation.

AP Inter 2nd Year Accountancy Important Questions 6th Lesson Admission of a Partner

Very Short Answer Questions

Question 1.

What are the aspects that need adjustment at the time of admission of a new Partner?

Answer:

When a person admitted into business as a partner immediately he acquires two rights- i) a share in profits and losses of business and ii) a share in assets and liabilities of the business. Therefore some adjustments are required on the admission of a partner.

- New profit sharing ratio.

- Distribution of accumulated profits/losses and reserves.

- Revaluation of assets and liabilities.

- Treatment of goodwill and

- Adjustment of partner’s capitals.

Question 2.

Sacrificing Ratio. [Mar. 2020; May 17 (AP)]

Answer:

The ratio in which the old partners agree to sacrifice their share of profit in favor of the incoming partner is called sacrificing ratio.

Sacrificing share = Old share of profit – New share profit.

![]()

Question 3.

Revaluation Account

Answer:

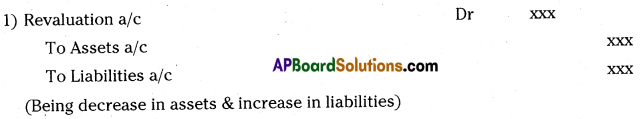

Assets and liabilities are revalued at the time of admission of a new partner. For this purpose a separate account is opened called “Revaluation Account” or “Profit and Loss Adjustment Account”. It is a nominal account.

Revaluation account is debited with decrease in the value of assets and increase in the value of liabilities and credited with increase in the value of assets and decrease in the value of liabilities.

The profit or loss arising out of revaluation will be shared by old partners in their old profit sharing ratio.

Journal entries:

Note : If there is a loss the above entry would be reversed).

Question 4.

Goodwill

Answer:

Compensation or premium payable by the new partner over and above his investment is called Goodwill. It is an intangible asset. It is the force of attracting the customers.

Question 5.

What are the methods of goodwill valuation ?

Answer:

Goodwill is calculated in various methods. The method by which goodwill is to be calculated may be specifically decided between the existing partners and incoming partner. The important methods are –

1. Average Profit Method : Under this method the goodwill is valued at agreed number of years purchase of the average profits of the past few years.

Goodwill = Average profit x No. of years purchase.

2. Super Profit Method : Super profit is the profit earned by the business that is in excess of the normal profits. Goodwill is determined by multiplying the super profit by the number of years purchase.

![]()

Actual profit = This is the profit earned by the firm during the year.

Super profit = Actual profit – Normal profit

Goodwill = Super profit x No. of years purchase.

3. Capitalisation Method : Under this method capitalized value of the business is determined by capitalizing the average profit by the normal rate return. Out of the value so determined, value of net assets / capital employed is deducted, the balance amount is the value of goodwill.

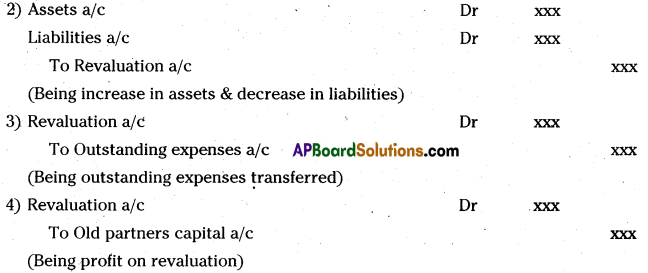

Enters regarding Goodwill:

Journal Entries

![]()

Exercise

Question 1.

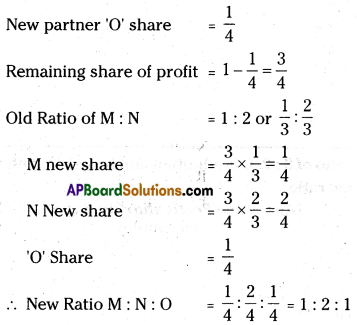

M and N are partners sharing profit and losses in the 1: 2 ratio. They have decided to admit ‘O’ by giving him 1/4th share in future profits. Calculate the New profit-sharing ratio. (Ans: New profit sharing ratio 1:2:1) [Mar ’19, ’17 (AP)]

Answer:

Assume the total profit = 1

Question 2.

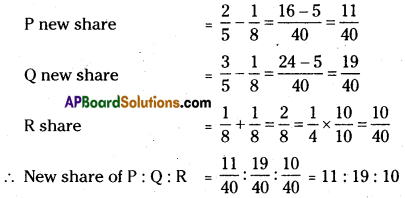

P & Q are partners sharing in the ratio of 2 : 3. They admit R for l/4th share and he gets this share equally from P & Q. Calculate new ratio.

(Ans: New Profit sharing Ratio is 11:19: IS)

Answer:

Old Ratio of P : Q = 2/5 : 3/5 or 2:3

New partner R share = 1/4

New Share = Old Share – Sacrificing Share

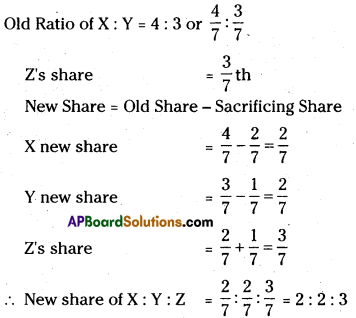

Question 3.

X and Y share profits and losses in the Ratio of 4 : 3, they admit Z with 3/7th share ; which he gets 2/7th from X and 1/7 from Y. What is the new profit sharing ratio?

(Ans: New Profit sharing Ratio is 2:2:3)

Answer:

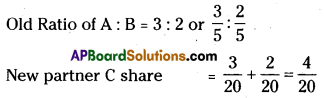

Question 4.

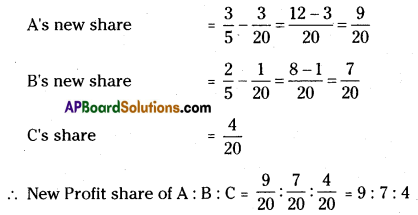

A & B are partners sharing in the ratio of 3: 2. C is admitted and he gets 3/20th from A and 1/20th from B. Calculate new ratio.

(Ans: New Profit sharing Ratio is 9: 7:4)

Answer:

New Share = Old Share – Sacrificing Share

Question 5.

X & Y are partners share profits in the ratio of 5 : 3. Z the new partner gets 1/5 of X’s share and 1/3rd of Y’s share. Calculate new ratio.

(Ans: New Profit sharing Ratio is 4:2:2)

Answer:

New profit sharing ratio X:Y:Z = 4/8 : 2/8 : 2/8 = 4:2:2 = 2:1:1

![]()

Question 6.

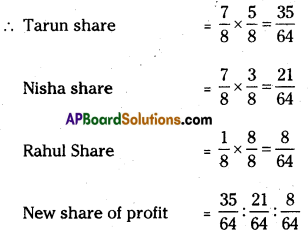

If Tarun and Nisha are partners sharing profits in the ratio of 5 : 3. Wljat will be their sacrificing ratio if Rahul is admitted for 1/8 share of profit in the firm?

(Ans: Sacrificing Ratio – 5:3)

Answer:

Tarun and Nisha old share = 5 : 3 or 5/8 : 3/8

Assume the total share = 1

Sacrificing ratio = Old share – New share

Sacrificing ratio Sacrificing ratio of Tarun and Nisha = 5:3

Question 7.

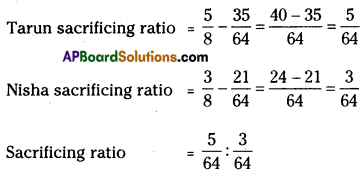

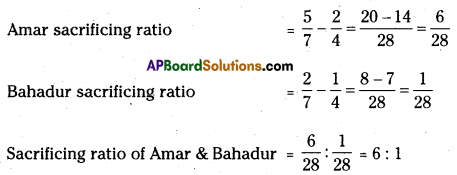

Amar and Bahadur are partners in a firm sharing profits in the ratio of 5 : 2. They admitted Mary as a new partner for 1/4 share. The new profit sharing ratio of the partners will be 2 : 1 : 1. Calculate their sacrificing ratio.

(Ans: Sacrificing Ratio – 6:1)

Answer:

Sacrificing ratio = Old share – New share

Question 9.

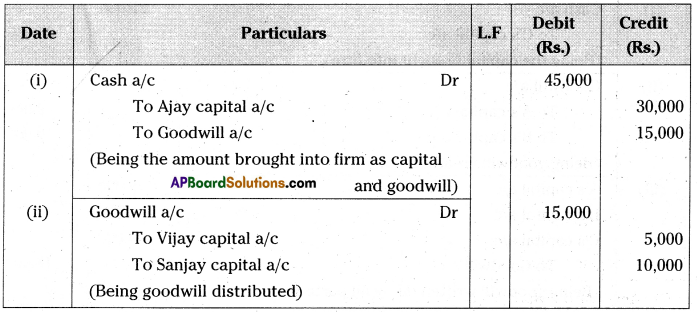

Vijay and Sanjay are partners in a firm sharing profits and losses in the ratio of 1: 2. They decide to admit Ajay into partnership with 1/4 share in profits. Ajay brings in Rs. 30,000 for capital and Rs. 15,000 for goodwill. Give necessary journal entries,

a) When the amount of goodwill is retained in the business.

b) When the amount of goodwill is fully withdrawn.

c) When 50% of the amount of goodwill is withdrawn.

Answer:

a) When the amount of goodwill is retained in the firm.

Journal Entries in the books of Annual traders

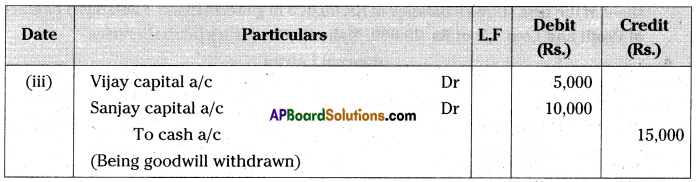

b) When the amount of goodwill is fully withdrawn.

Answer:

In addition to the above two entries.

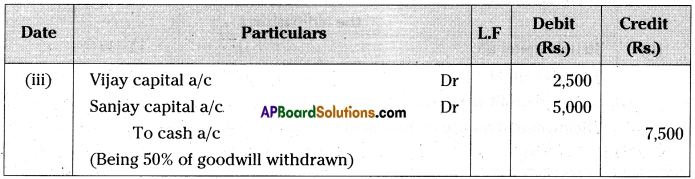

c) When 50% of the amount of goodwill is withdrawn.

Answer:

In addition to first above two entries.

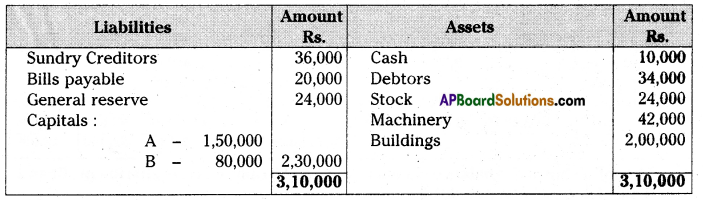

Question 10.

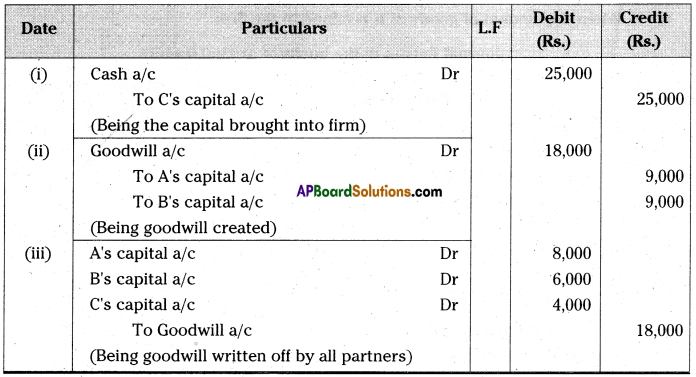

A and B are partners sharing profits and losses equally. They admit C into partner¬ship and the new ratio is fixed as 4 : 3 : 2. C is unable to. bring anything for goodwill but brings Rs. 25,000 as capital. The goodwill of the firm is valued at Rs. 18,000. Give the necessary journal entries assuming that the partners do not want goodwill to appear in the Balance Sheet.

Answer:

Journal Entries

Question 11.

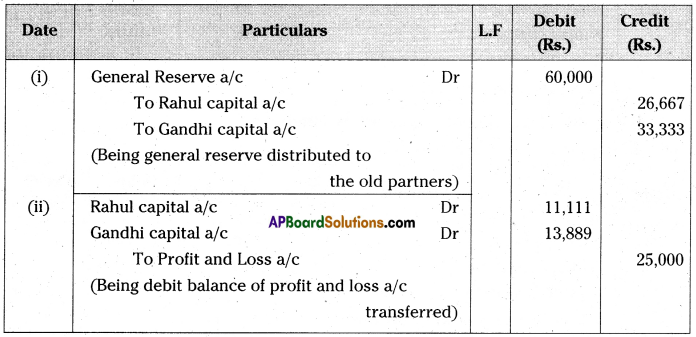

Rahul and Gandhi are partners sharing profit in the ratio of 4 : 5. On 1st April 2015 they admit Sonia as a new partner for 1/6 share in profits. On that date the balance sheet of the firm shows a balance of Rs. 60,000 in general reserve and debit balance of Profit and Loss A/c of Rs. 25,000. Make the necessary journal entries.

Answer:

![]()

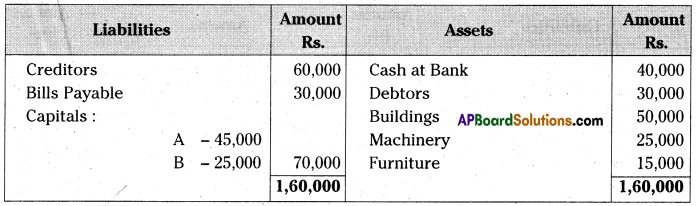

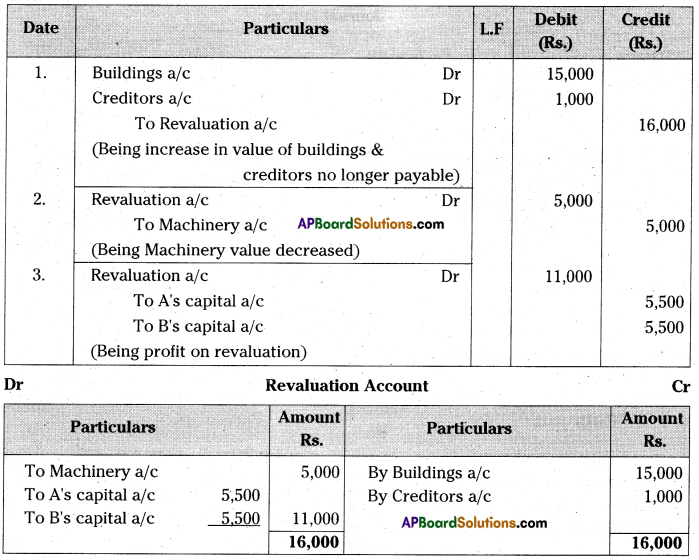

Question 12.

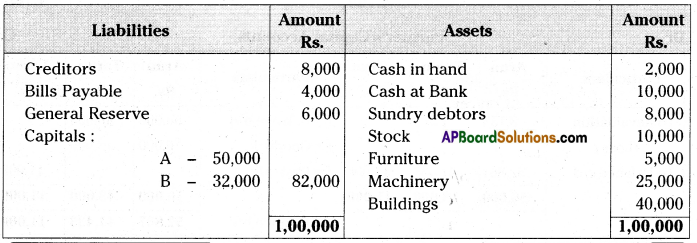

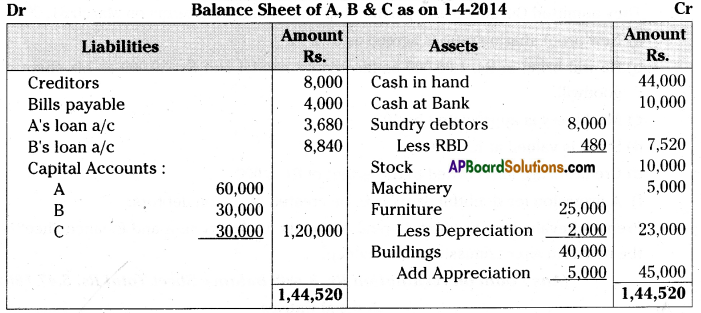

A and B are equal partners in a firm. They decide to admit C as a new partner for l/5th share in profit. On the date of admission the balance sheet of firm was as follows:

The terms of agreement on C’s admission were as follows :

a) Building will be valued at Rs. 65,000 and machinery at Rs. 20,000.

b) Creditors included Rs. 1,000 no longer payable.

Pass necessary Journal entries for revaluation of assets and liabilities.

(Ans: Revaluation profit – Rs. 11,000)

Answer:

Journal Entries

Question 13.

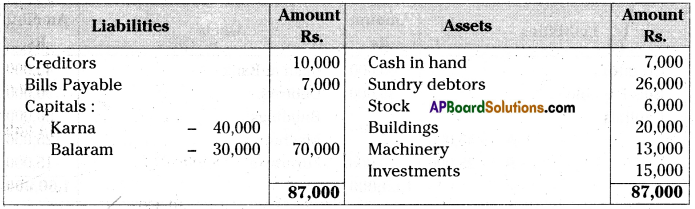

Krishna and Balaram are partners sharing profit and losses in the ratio 4:1. Their Balance Sheet was as follows :

Balance Sheet of Kama and Balaram as on December 31st, 2014.

Nikhil is admitted as a partner and assets are revalued and liabilities reassessed as follows :

i) Create a provision for doubtful debt on debtors at Rs. 800.

ii) Building and investments are appreciated by 10%.

iii) Machinery is depreciated at 5%.

iv) Creditors were overestimated by Rs. 500.

Make journal entries and prepare revaluation account before the admission of Nikhil.

(Ans: Revaluation Profit – Rs. 2,550)

Answer:

Journal Entries

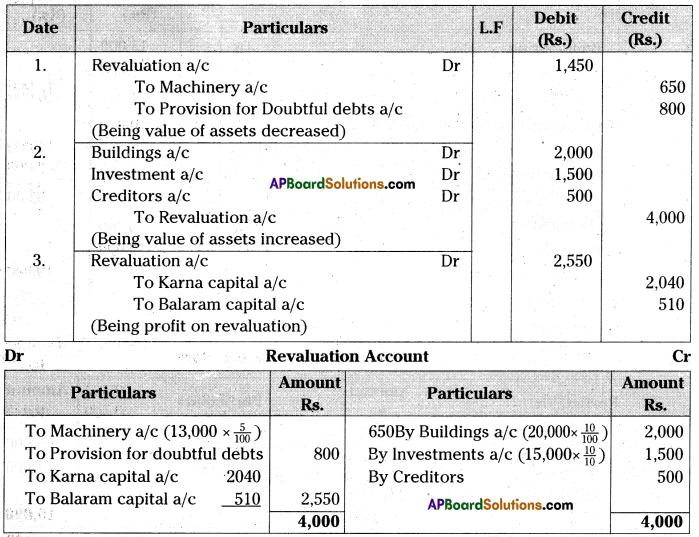

Question 14.

Balance Sheet of A and B as on 31.03.2014.

The other terms of agreements on C’s admission were as follows :

i) C will bring Rs. 12,000 for his share of capital.

ii) Building will be valued at 1,85,000 and Machinery at Rs. 40,000.

iii) A provision of 6% will be created on debtors for bad debts.

Prepare Revaluation Account and Partners Capital Accounts.

(Ans: Loss on Revaluation – Rs. 19,040)

Answer:

Journal Entries

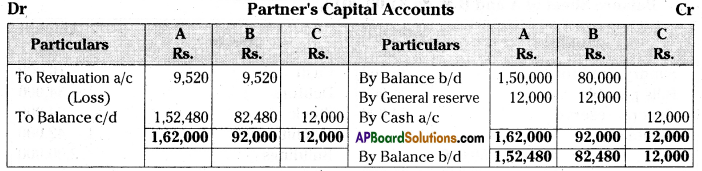

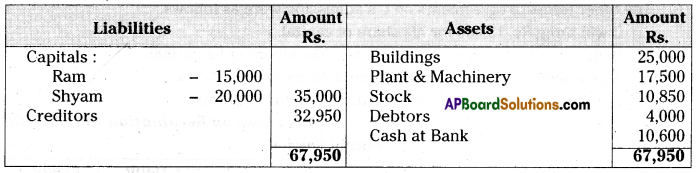

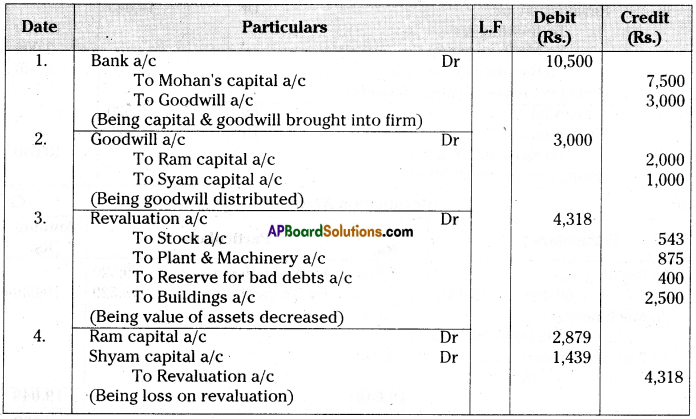

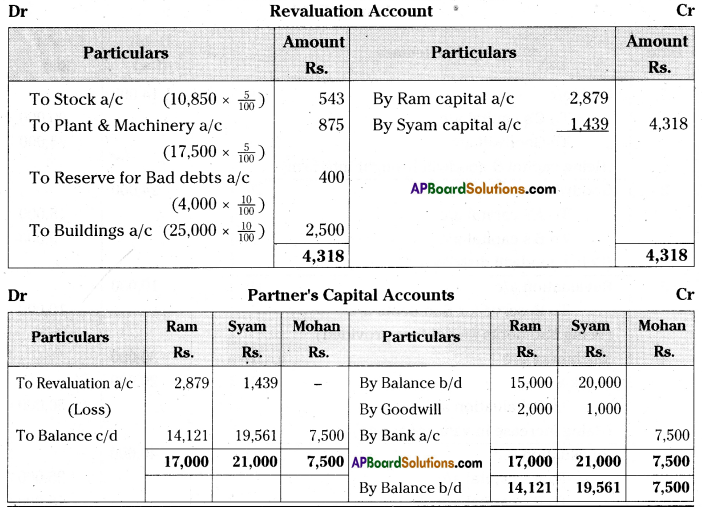

Question 15.

The following is the balance sheet of Ram and Shyam, who are sharing profit as 2/ 3 and 1/3 on 31st March 2014.

They agree to admit Mohan into the partnership on the following terms :

a) Mohan was to be given 1/3 share in the profit and to bring Rs. 7,500 as his capital and 3,000 as his share of goodwill.

b) That the value of stock and plant & machinery were to be reduced by 5%.

c) That a reserve of 10% was to be created in respect of Sundry Debtors.

d) The buildings were to be depreciated by 10%.

Pass Journal Entries and necessary Accounts.

(Ans: Loss on Revaluation – Rs. 4,318)

Answer:

Journal Entries

![]()

Question 16.

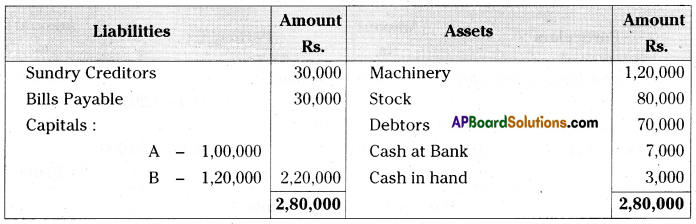

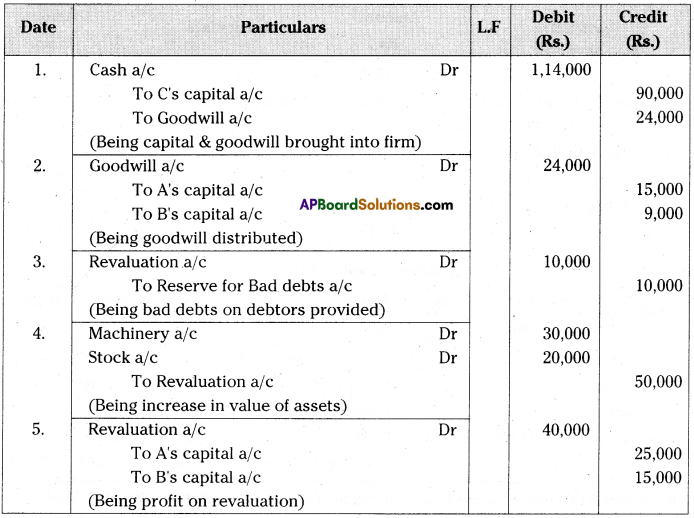

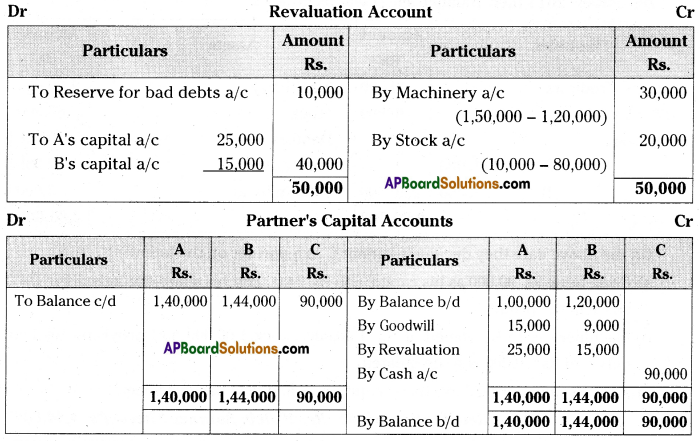

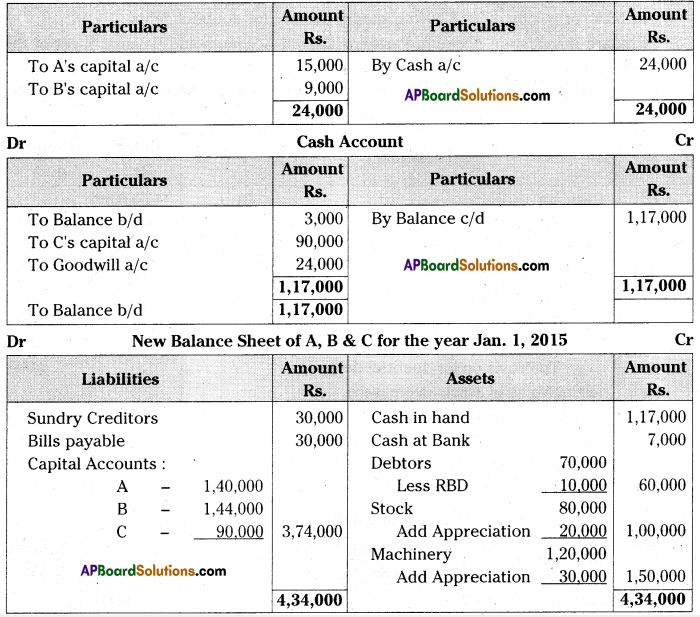

A and B are partners in a firm, sharing profits and losses in the ratio of 5 : 3, on 31st December 2014 their Balance sheet was as under :

On the above date they decided to admit C as a partner on the following terms :

a) C will bring Rs. 90,000 as his capital and Rs. 24,000 for his share of goodwill for l/4th share in the profit.

b) Machinery is to be valued at Rs. 1,50,000, stock 1,00,000 and provision for bad debts of Rs. 10,000 is to be created.

Prepare Revaluation A/C, partners’ capital A/C and new Balance Sheet.

(Ans: Revaluation profit – Rs. 40,000; Balance Sheet – Rs. 4,34,000)

Answer:

Question 17.

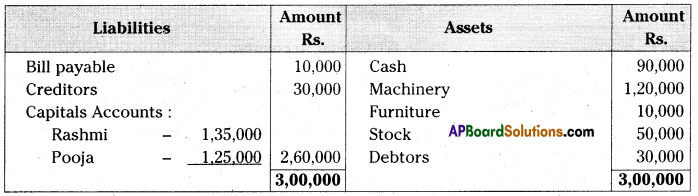

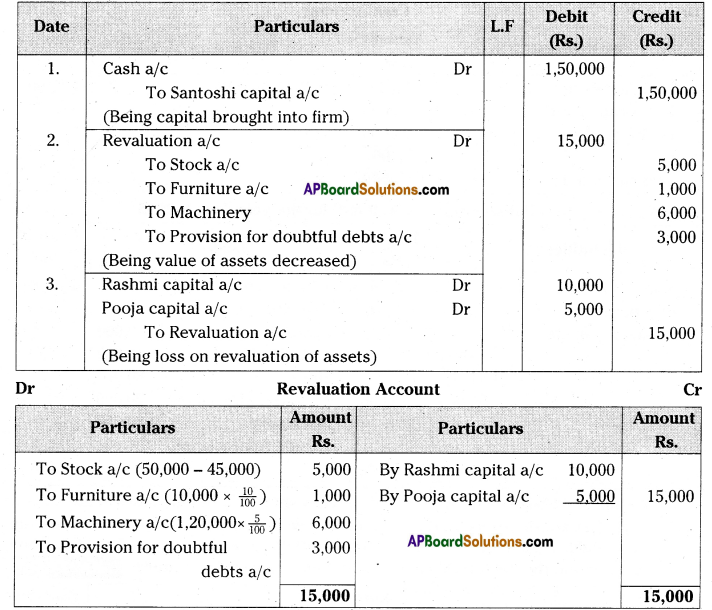

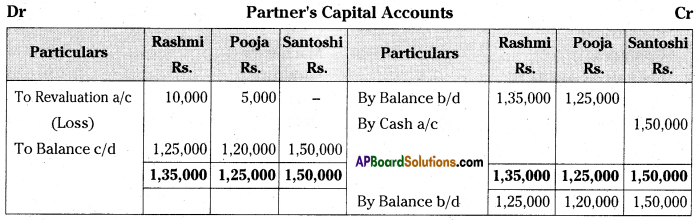

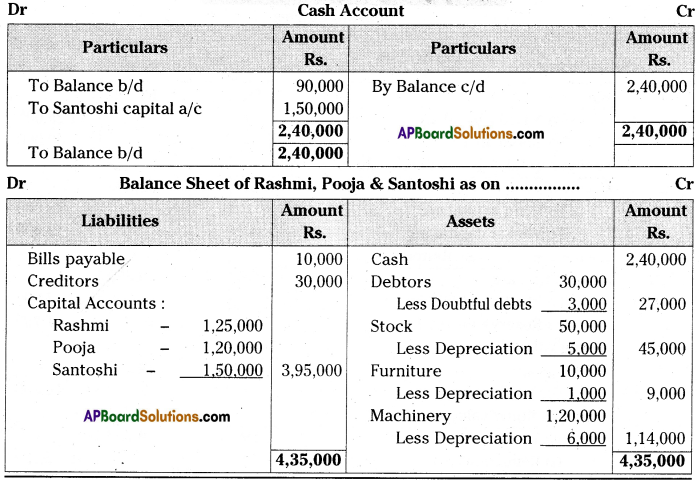

Rashmi and Pooja are partners in a firm. They share profits and losses in the ratio of 2:1. They admit Santoshi into partnership firm on the condition that she will bring Rs. 1,50,000 for capital and she will be given 1/3 share in future profits. At the time of admission the Balance Sheet of Rashmi and Pooja was as under. [May 2022]

It was decided to :

a) Revaluate stock at Rs. 45,000.

b) Depreciate furniture by 10% and machinery by 5%.

c) Make provision of Rs. 3,000 on sundry debtors for doubtful debts.

Prepare Revaluation Account, Partners’ Capital Accounts and Balance Sheet of the new firm.

(Ans: Loss on Revaluation Rs. 15,000 and Balance Sheet Total Rs. 4,35,000)

Answer:

Journal Entries

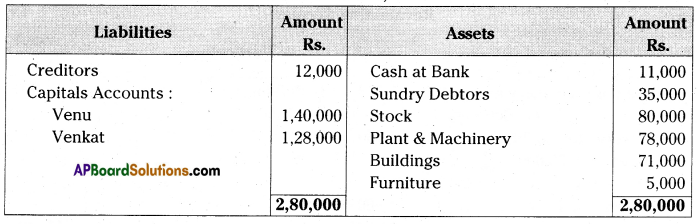

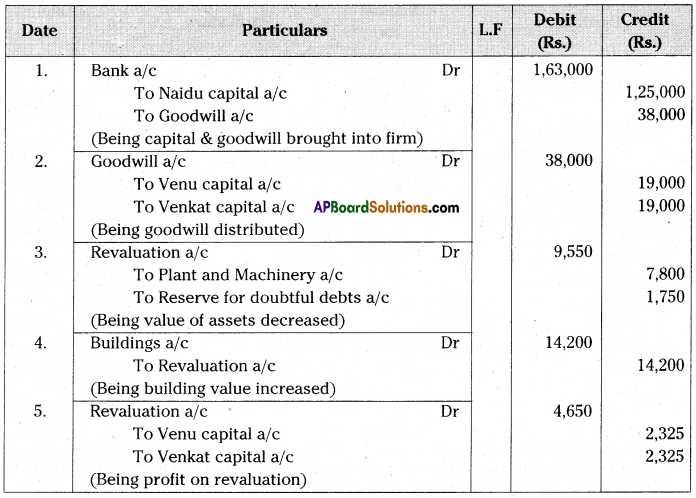

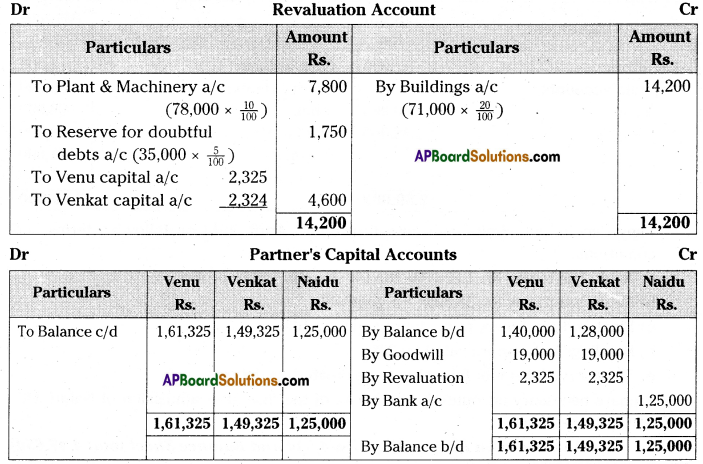

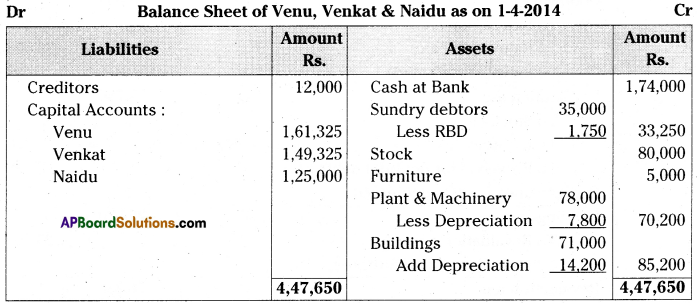

Question 18.

Venu & Venkat are partners in a business sharing profits and losses equally. Their Balance Sheet on 31-3-2014 stood as under;

They decided to admit Naidu into firm on 1st April, 2014 on the following terms and conditions.

a) Naidu has to pay Rs. 1,25,000/- for 1/4 share in future profits.

b) Naidu has to pay Rs. 38,000/- for goodwill.

c) Plant and machinery to be depreciated by 10%.

d) Buildings to be appreciated by 20%.

e) 5% reserve for doubt full debts to be created on debtors.

Prepare necessary accounts in the books of the firm after admission of Naidu with new Balance Sheet.

(Ans: Gain on Revaluation – Rs. 4,650 and Balance Sheet total 4,47,650)

Answer:

![]()

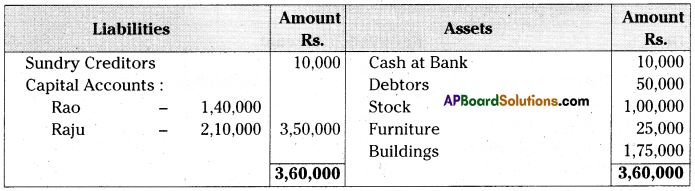

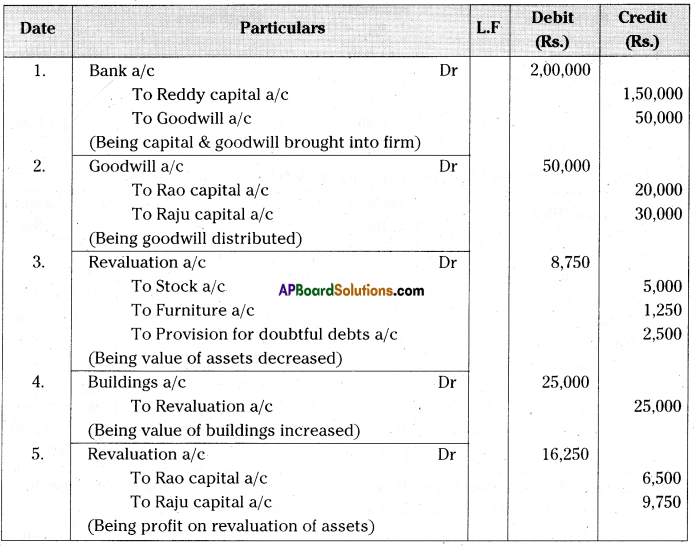

Question 19.

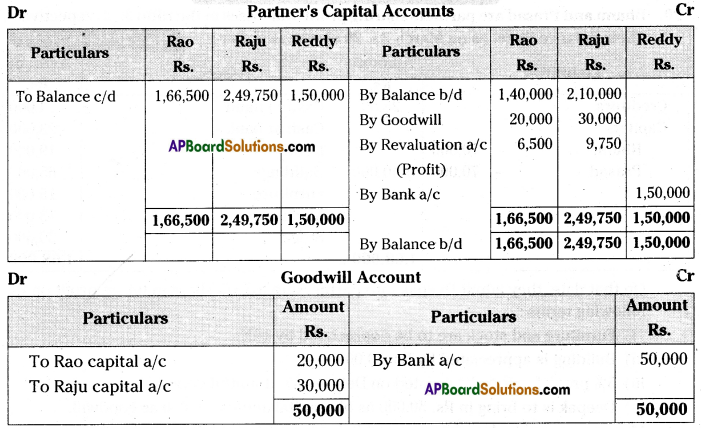

Rao and Raju are carrying on business in a partnership, sharing profit & loss in the ratio of 2 : 3. Their Balance sheet as on 31-12-2014 was as under.

On that day they admitted Reddy into partnership and gave him 1 /6th share in the future profits on the following terms.

a) Reddy is to bring in Rs. 1,50,000 as his capital and Rs. 50,000 as good will, which sum is to remain in the business.

b) Stock and furniture are to be reduced in value by 5%.

c) Buildings are to be appreciated by Rs. 25,000.

d) A provision of 5% to be created on sundry debtor for doubtful debts.

Write Journal entries to record the above arrangement and show the opening Balance sheet of the new firm.

(Ans: Revaluation profit – Rs. 16,250; Balance Sheet – Rs. 5,76,250)

Answer:

Journal Entries

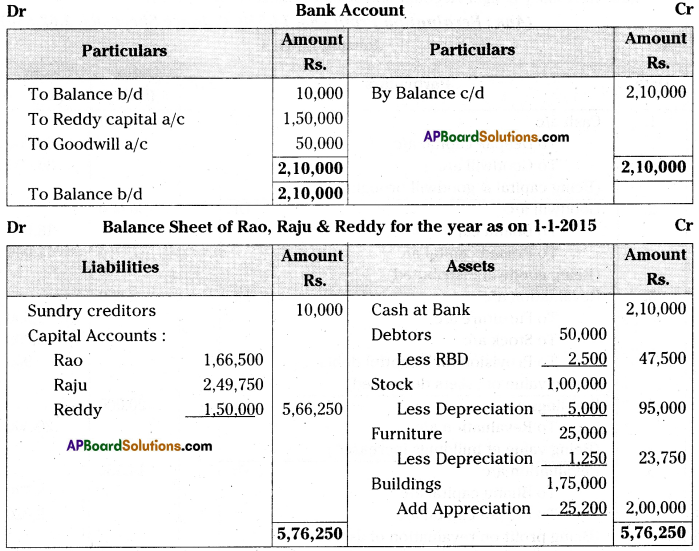

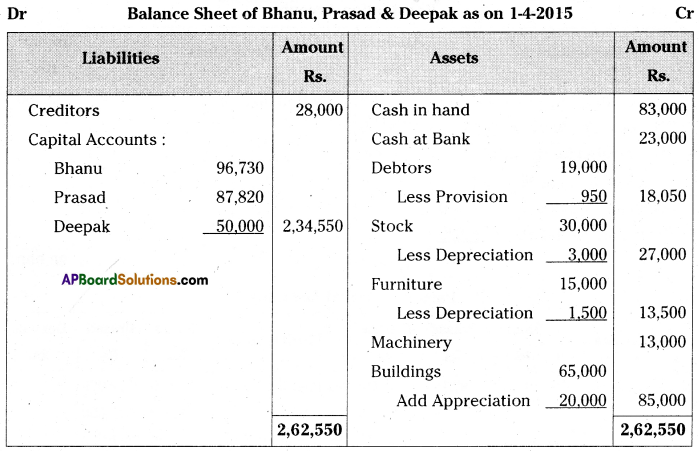

Question 20.

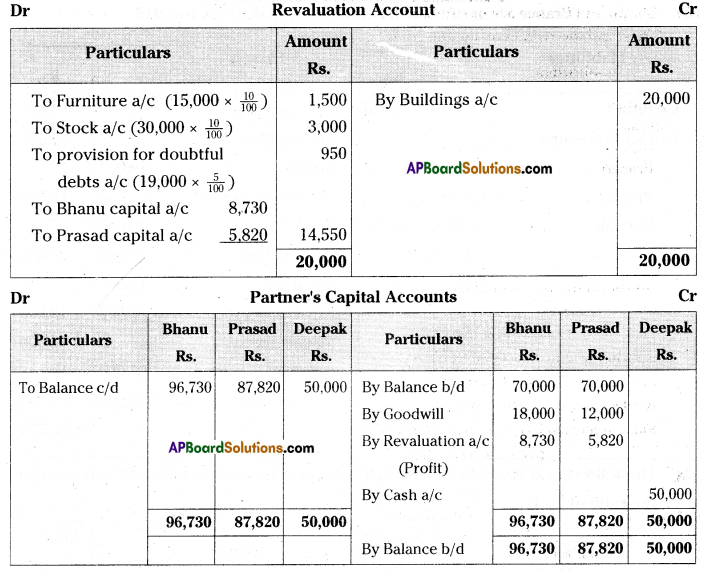

Bhanu and Prasad are partners sharing profit and losses in the ratio 3: 2 respectively. Their Balance Sheet as on March 31, 2015 was as under:

On that date, they admit Deepak into a partnership for 1/3 share in future profit on the following terms :

i) Furniture and stock are to be depreciated by 10%.

ii) Building is appreciated by Rs. 20,000.

iii) 5% provision is to be created on Debtors for doubtful debts.

iv) Deepak is to bring in Rs. 50,000 as his capital and Rs. 30,000 as goodwill.

Make necessary Ledger Account and Balance Sheet of the new firm.

(Ans: Revaluation Profit – Rs. 14,550; Balance Sheet – Rs. 2,62,550)

Answer:

Journal Entries

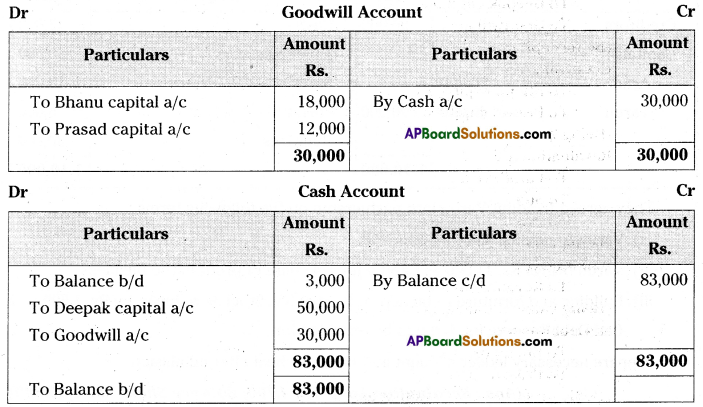

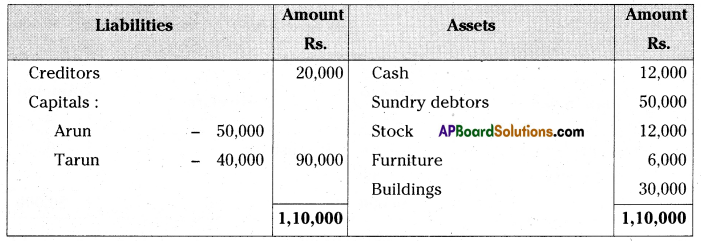

Question 21.

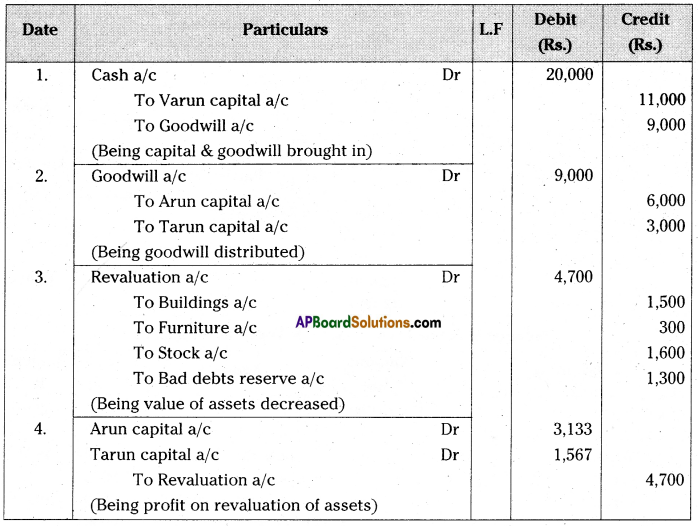

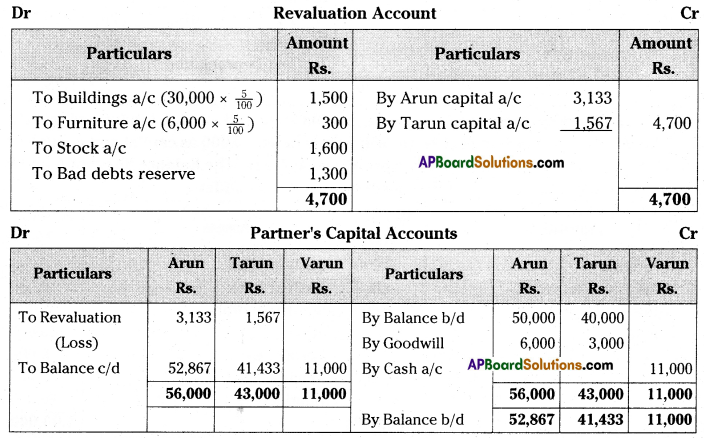

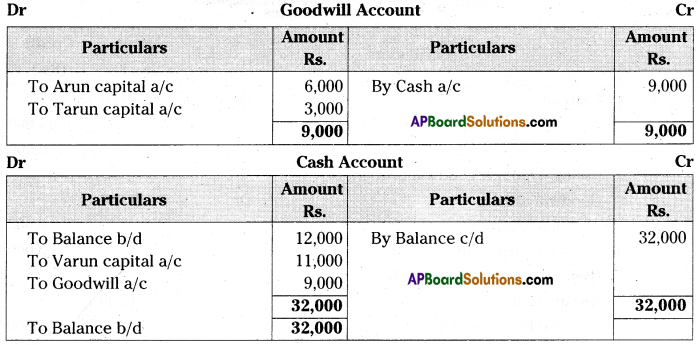

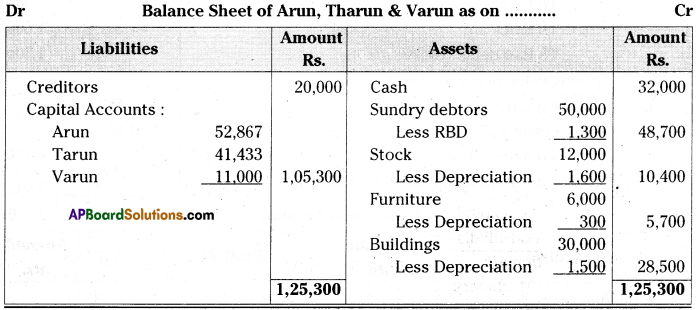

The following is the Balance Sheet of Arun and Tarun sharing profit and losses in the ratio of 2 : 1.

They agreed to admit Varun into partnership on the following terms :

i) Varun to pay Rs. 9,000 as Goodwill.

ii) Varun brings Rs. 11,000 as Capital for 1/4 share of profit in the business.

iii) Building and furniture to be depreciated at 5%. Stock is reduced by Rs. 1,600 and Bad Debt Reserve Rs. 1,300 to be provided for.

Prepare necessary ledger account and balance sheet after admission.

(Ans: Revaluation Loss – Rs. 4,700; Balance Sheet – Rs. 1,25,300)

Answer:

Question 22.

A and B are partners in a firm sharing profits in the ratio 2 : 1. C is admitted into the firm with 1/4 share in profits. He will brings in Rs. 30,000 as capital and capitals of A and B are to be adjusted in the profit sharing ratio. The Balance Sheet of A and B as on March 31, 2014 (before C’s admission) was as under:

Other terms of agreement are as under :

1) C will bring in Rs. 12,000 as his share of goodwill.

2) Building was valued at Rs. 45,000 and Machinery at Rs. 23,000.

3) A provision for bad debts is to be created @ 6% on debtors.

4) The capital accounts of A and B are to be adjusted against their loand accounts. Record necessary journal entries, show necessary ledger accounts and prepare Balance Sheet after C’s admission.

(Ans : Revaluation Profit – Rs. 2,520; Balance Sheet – Rs. 1,44,520)

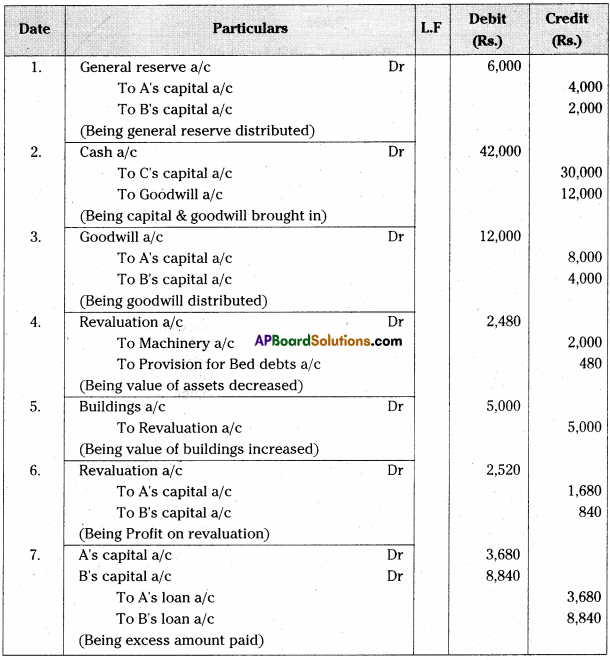

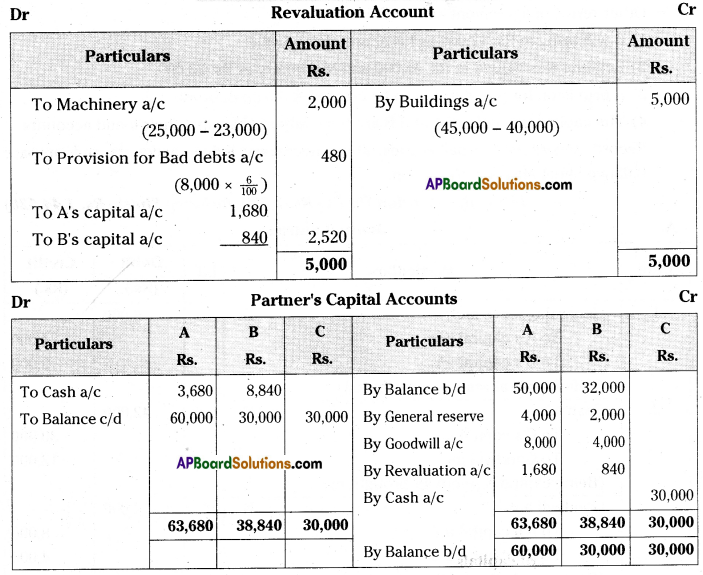

Answer:

Journal Entries

Working Notes:

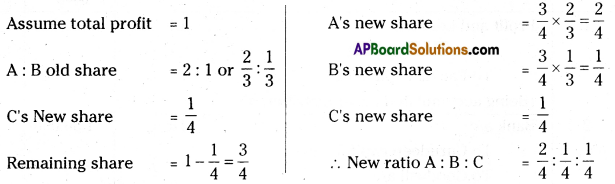

i) New profit sharing Ratio:

ii) Adjustment of capitals:

![]()

Question 23.

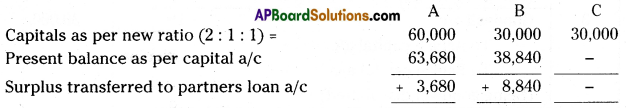

Ashish and Pankaj are partners sharing profit in the ratio of 5 : 2, their Balance sheet on March 31, 2015 was as follows:

They admitted Gurudeep into partnership on the following terms on March 31, 2015.

a) New profit sharing ratio is agreed as 3:2: 1.

b) He will bring in Rs, 1,00,000 as his shared capital and Rs. 30,000 as his share of goodwill.

c) Machinery is appreciated by 10%.

d) Stock is valued at Rs. 87,000.

e) Creditors are unrecorded to the extent of Rs. 6,000

f) A provision for doubtful debts is to be created by 4% on debtors.

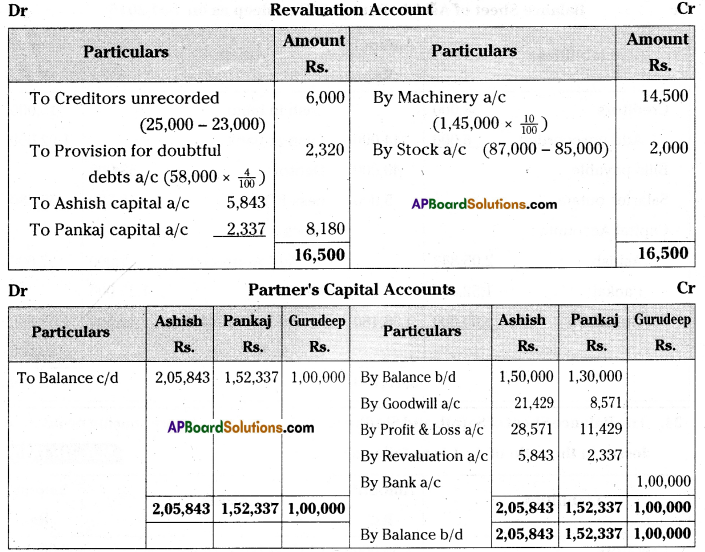

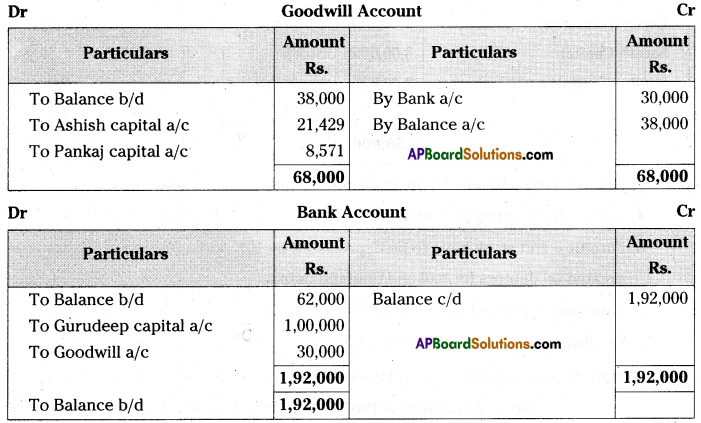

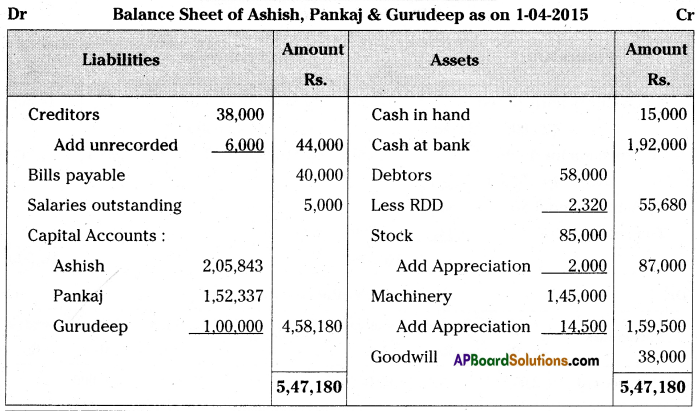

Prepare Revaluation Account, Capital Accounts, Bank Account and Balance Sheet of the new firm after admission of Gurudeep.

(Ans : Gain on revaluation Rs. 8,180; Balance Sheet Total Rs. 5,47,180)

Answer:

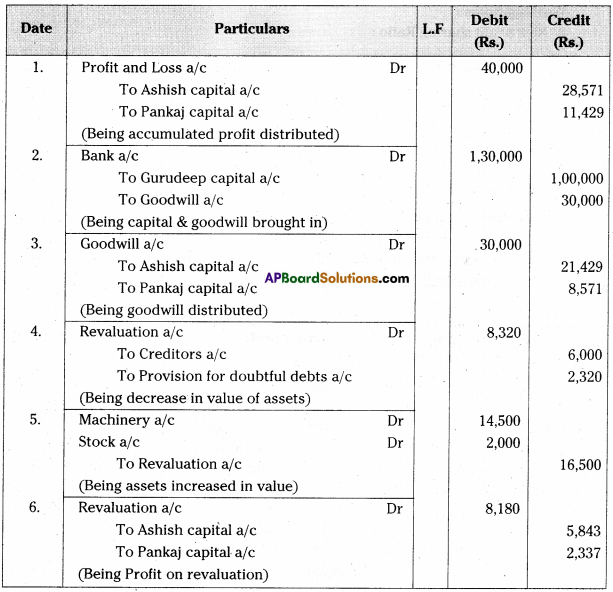

Journal Entries

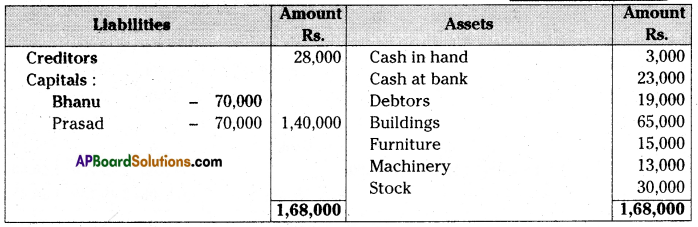

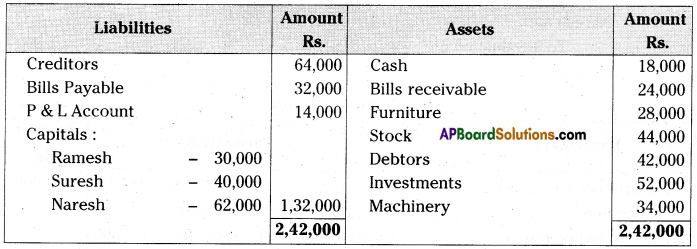

Question 24.

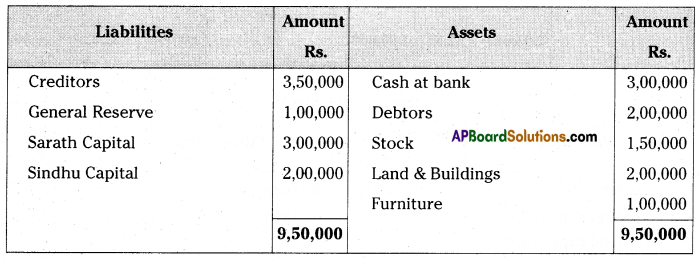

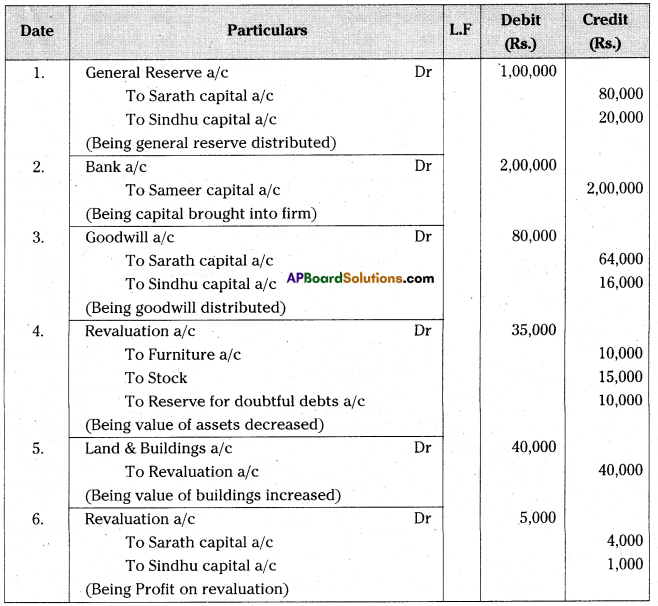

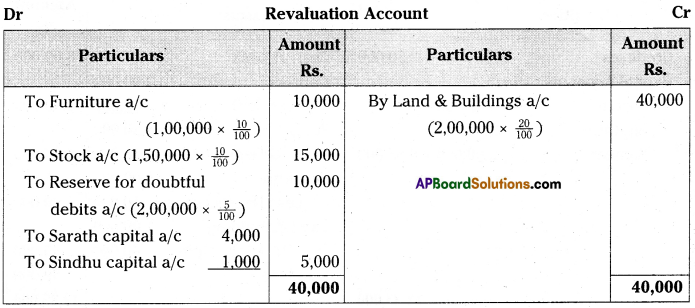

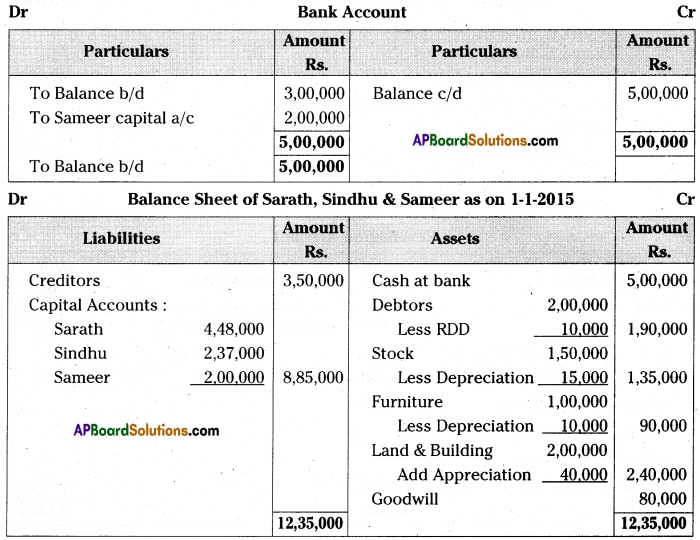

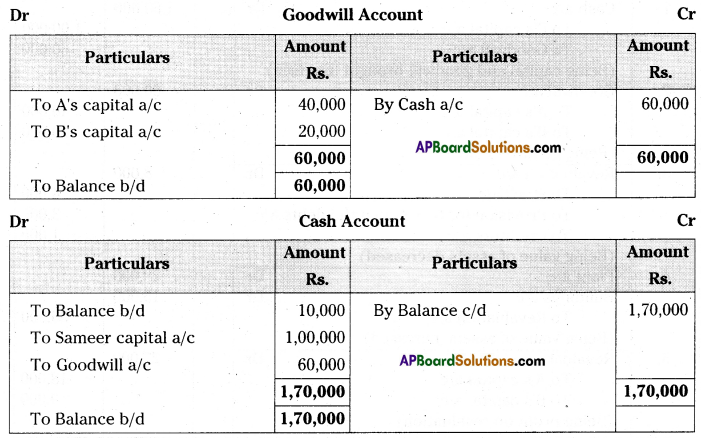

The Balance Sheet of Sarath and Sindhu as on 31.12.2014 who are sharing profits and losses in the ratio of 4 : 1 is as follows:

They have agreed to admit Sameer under the following conditions :

a) Sameer has to bring a capital of Rs. 2,00,000 for his 1/5th share of profits.

b) Furniture and stock have to be depreciated by 10% and a reserve of 5% has to be created on debtors for bad and doubtful debts.

c) Land and Buildings has to be appreciated by 20%.

d) Goodwill has to be raised by Rs. 80,000.

Prepare necessary ledger A/c and the balance sheet of the new firm.

(Ans : Revaluation Profit – Rs. 5,000; Balance Sheet – Rs. 12,35,000)

Answer:

![]()

Question 25.

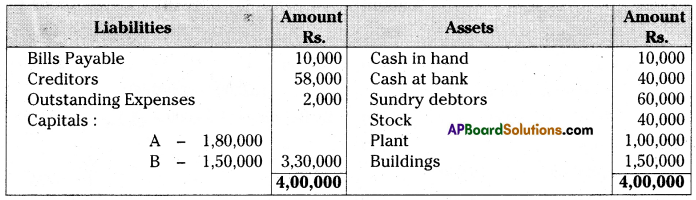

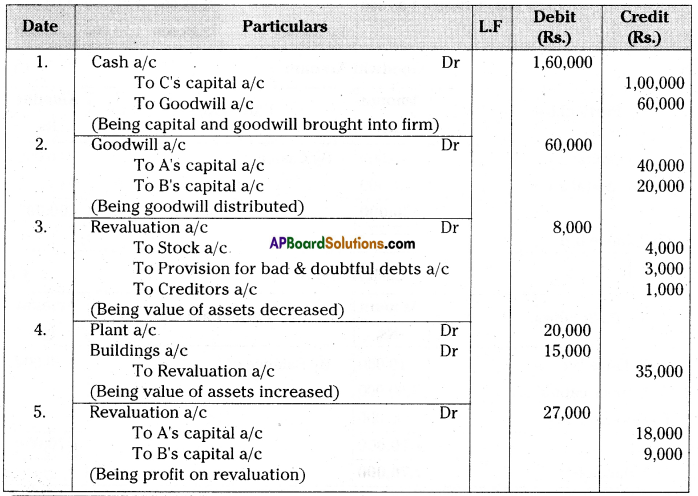

Given below is the Balance Sheet of A and B, who are carrying on partnership business on 31.12.2014. A and B are sharing profits and losses in the ratio of 2 : 1.

C is admitted as a partner on the date of the balance sheet on the following terms :

i) C will brings in Rs. 1,00,000 as his capital and Rs. 60,000 as his share of goodwill for 1/4 share in the profits.

ii) Plant is to be appreciated to Rs. 1,20,000 and the value of buildings is to be appreciated by 10%.

iii) Stock is found over valued by Rs. 4,000.

iv) A provision for bad and doubtful debts is to be created at 5% of debtors.

v) Creditors were unrecorded to the extent of Rs. 1,000.

Pass the necessary journal entries, prepare the revaluation account and partners’ capital accounts, and show the Balance Sheet after the admission of C.

(Ans : Gain of Revaluation Rs. 27,000; Balance Sheet Rs. 5,88,000)

Answer:

Journal Entries

Question 26.

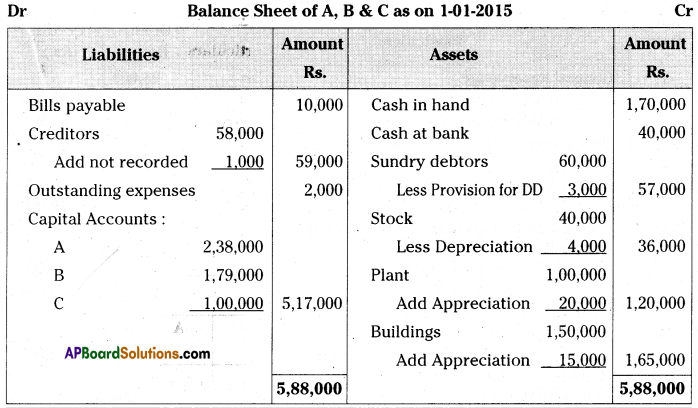

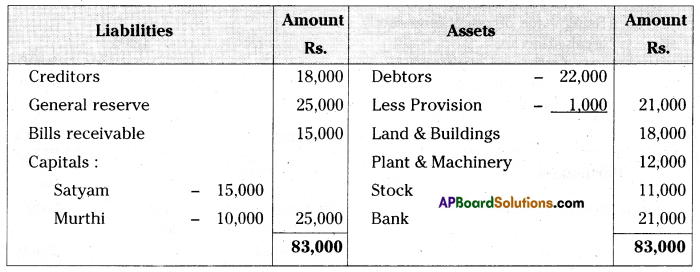

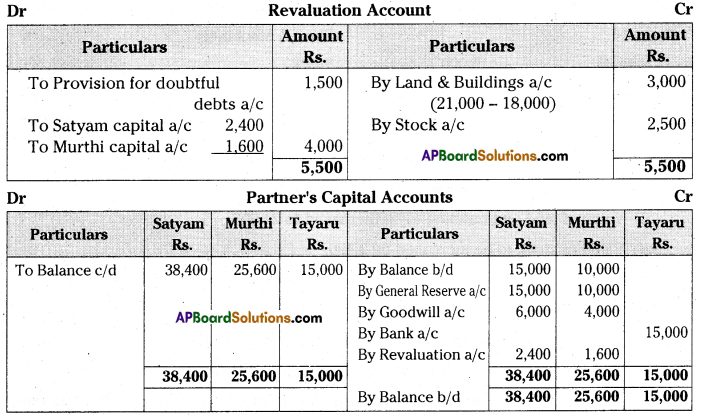

Following is the Balance Sheet of Satyam and Murthi sharing profit as 3 : 2.

On admission of Tayaru for l/6th share in the profit it was decided that:

i) Provision for doubtful debts to be increased by 1,500.

ii) Value of land and building to be increased to 21,000.

iii) Value of stock to be increased by 2,500.

iv) The liability of workmen’s compensation fund was determined to be 12,000.

v) Tayaru brought in as her share of goodwill 10,000 in cash.

vi) Tayaru was to bring further cash of 15,000 for her capital.

Prepare Revaluation A/c, Capital A/c and the Balance Sheet of the new firm.

(Ans : Revaluation Profit – Rs. 4,000; Balance Sheet – Rs. 1,12,000)

Answer:

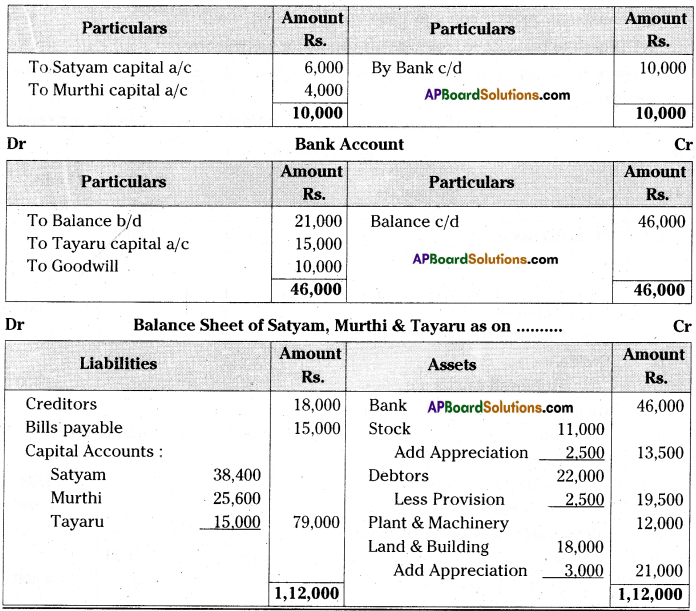

Question 27.

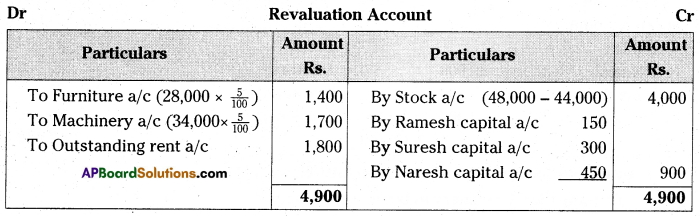

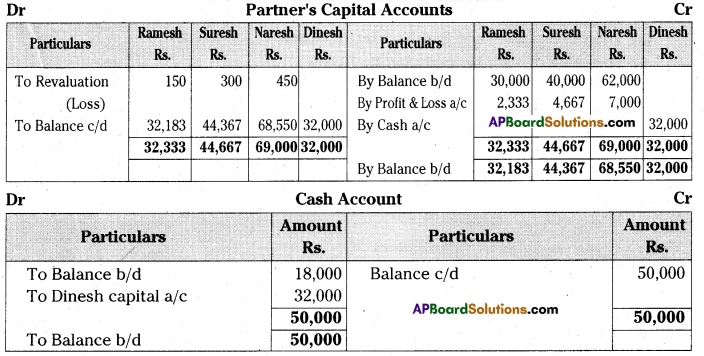

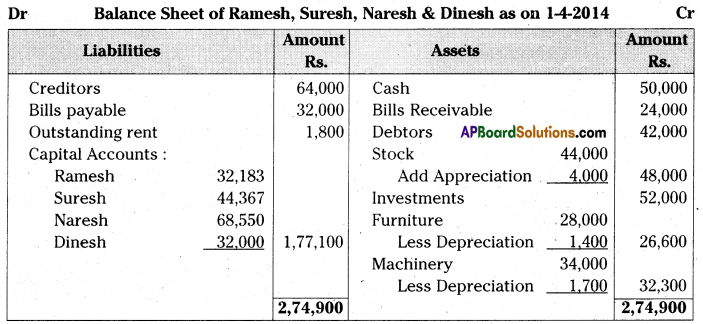

Ramesh, Suresh and Naresh are partners sharing profits and losses in the ratio of 1:2:3. On 31st March 2014, their Balance Sheet was as follows.

They admit Dinesh into partnership on the following terms :

i) Furniture and Machinery to be depreciated by 5%.

ii) Stock is revaluated at 48,000.

iii) Outstanding rent amount to 1,800.

iv) Dinesh to bring 32,000 towards his capital for 1/6th share.

Prepare Revaluation Account, Partners Capital Accounts and Balance Sheet of the new firm.

(Ans : Revaluation loss – Rs. 900; Balance Sheet – Rs. 2,74,900)

Answer:

Journal Entries

![]()

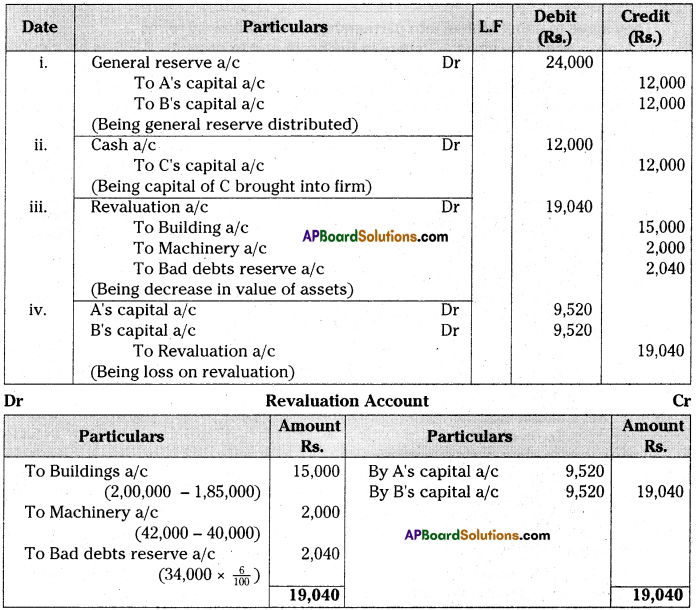

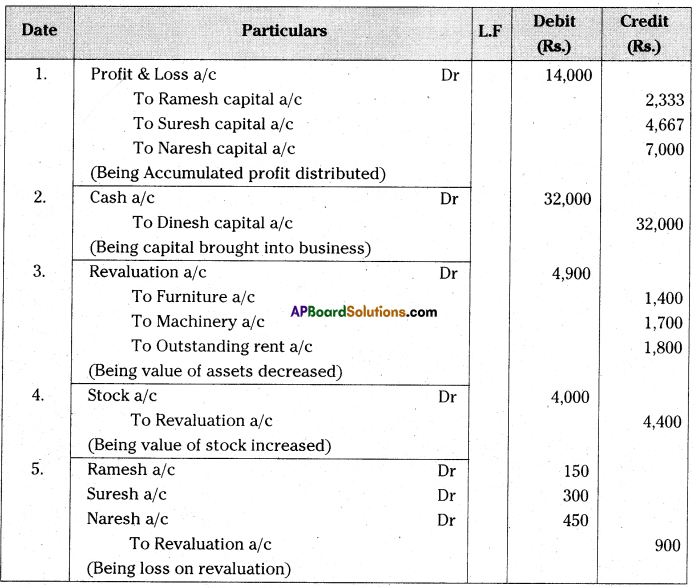

Question 28.

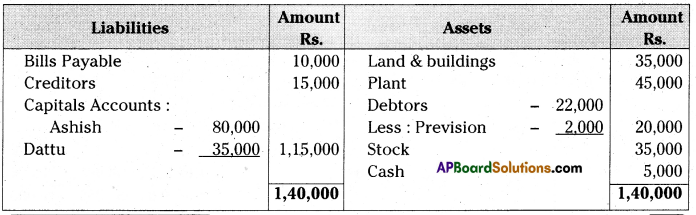

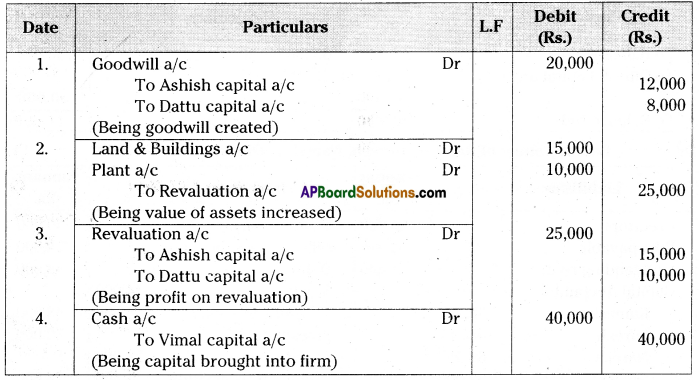

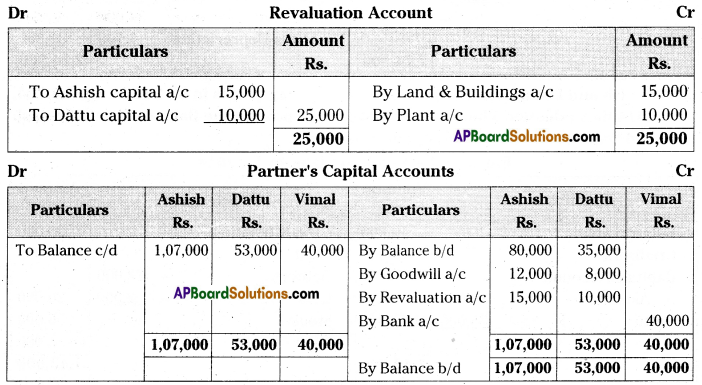

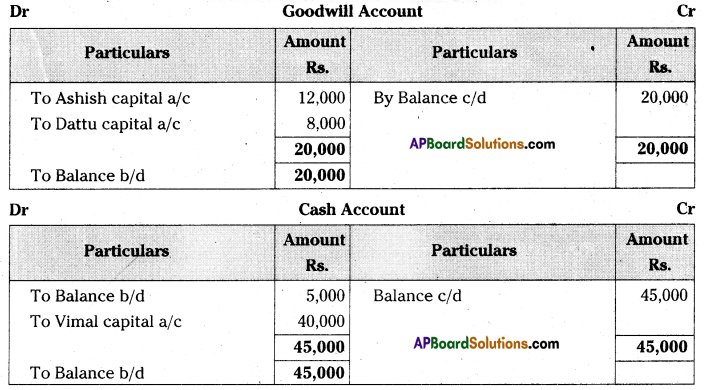

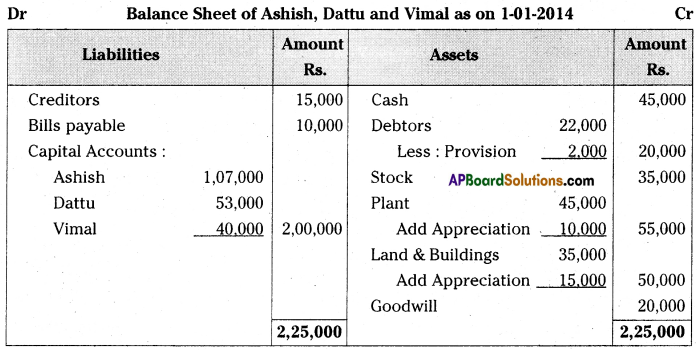

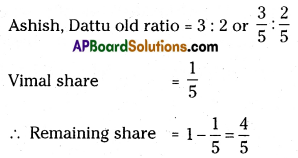

Ashish and Dattu were partners in a firm sharing profits in 3 : 2 ratio. On Jan. 01, 2014 they admitted Vimal for 1/5 share in the profits. The Balance Sheet of Ashish and Dattu as on Jan. 01, 2014 was as follows :

Balance Sheet of A and B as on 1.1.2014

It was agreed that:

i) The.value of Land and Buildings be increased by Rs. 15,000.

ii) The value of plant be increased by 10,000.

iii) Goodwill of the firm be valued at Rs. 20,000.

iv) Vimal to bring in capital to the extent of l/5th of the total capital of the new firm. Record the necessary journal entries and prepare the Balance Sheet of the firm after Vimal’s admission.

(Ans : Gain on Revaluation Rs. 25,000. Balance Sheet Total Rs. 2,25,000)

Answer:

Journal Entries

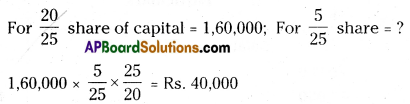

Working Note:

1) Assume profit = 1

ii) Calculation of Vimal capital:

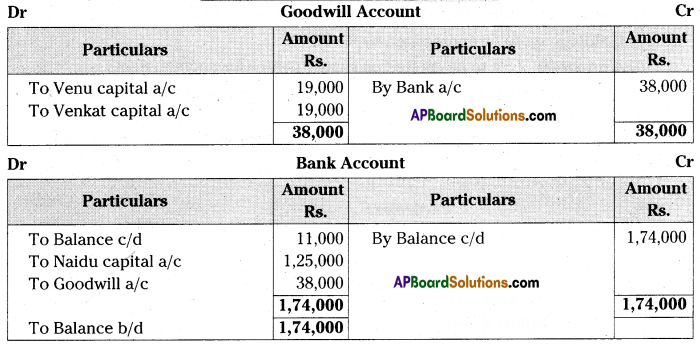

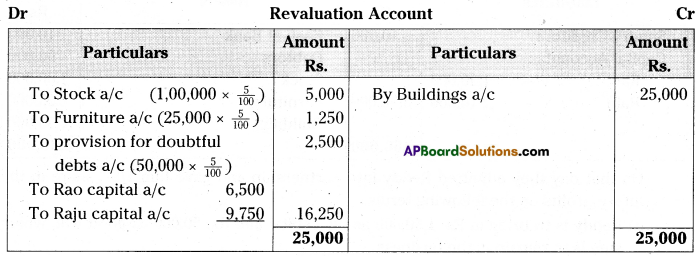

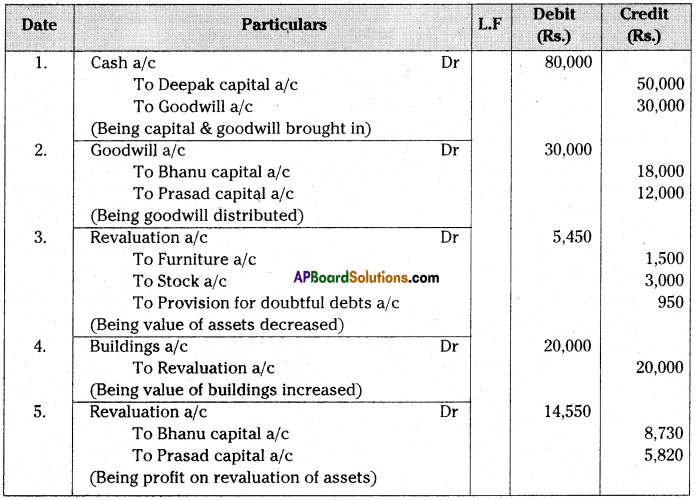

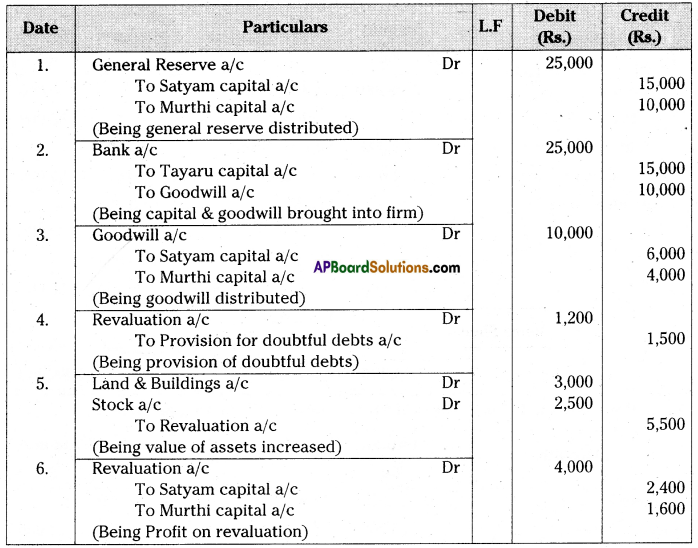

Question 29.

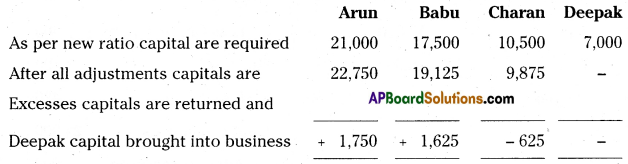

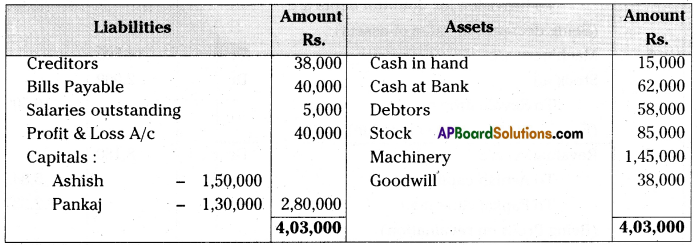

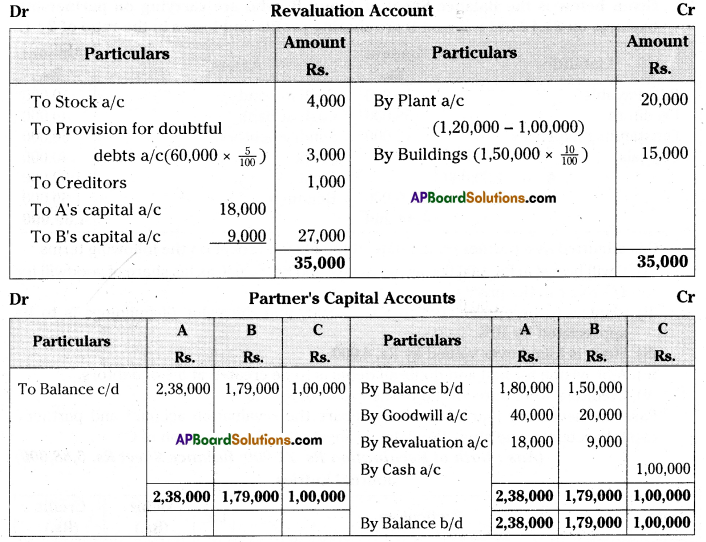

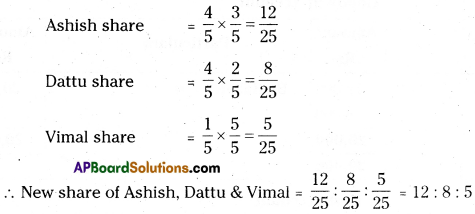

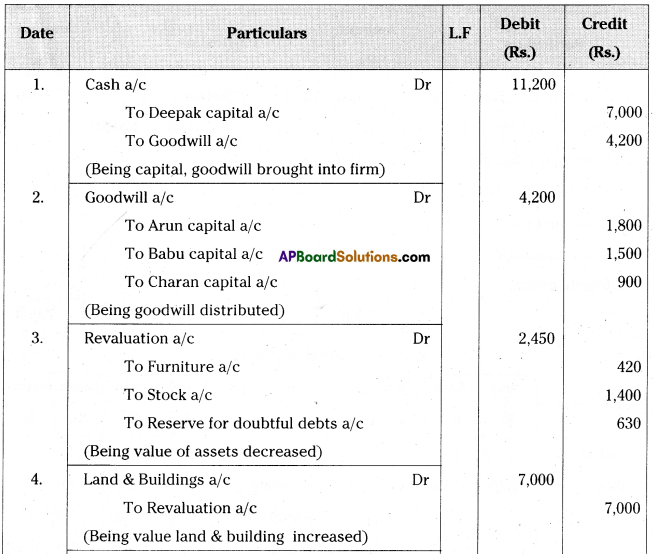

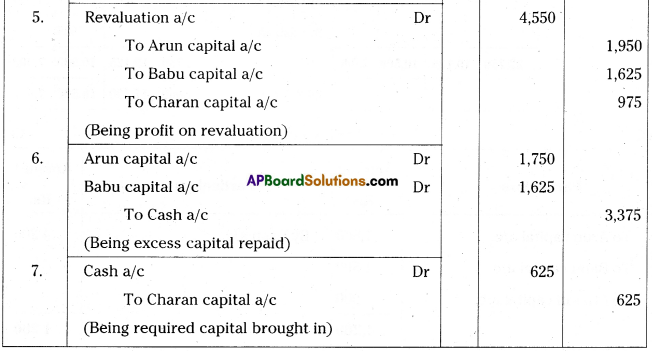

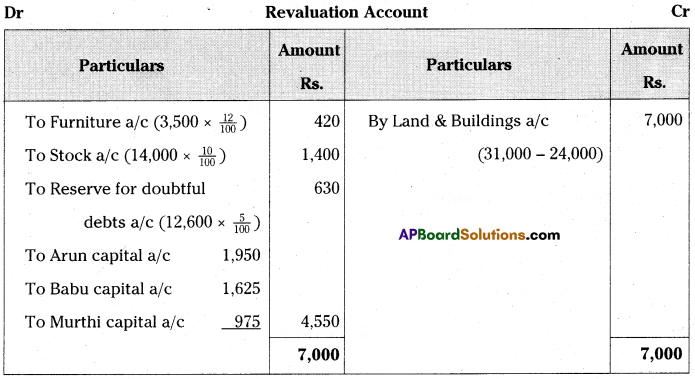

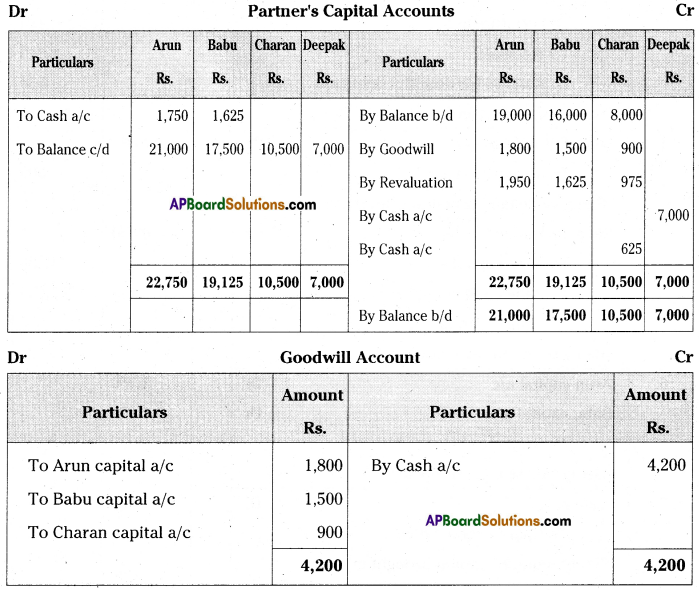

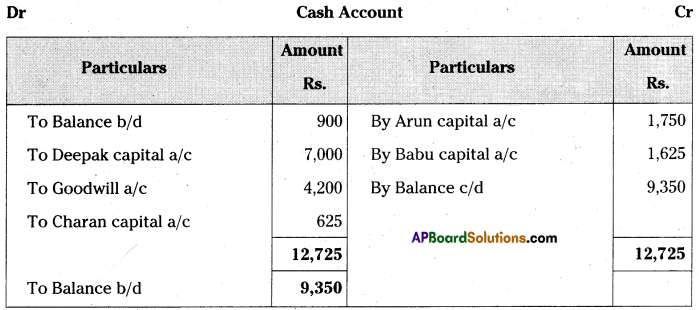

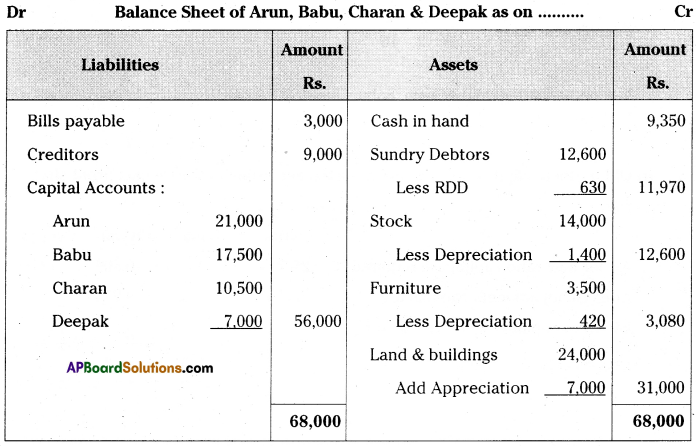

The following was the Balance Sheet of Arun, Babu and Charan sharing profits and losses in the ratio of 6 : 5 : 3 respectively.

They agreed to take Deepak into partnership and give him a share of 1/8 on the following terms : (a) that Deepak should bring in Rs. 4,200 as goodwill and Rs. 7,000 as his Capital; (b) that furniture be depreciated by 12%; (c) that stock be depreciated by 10% (d) that a Reserve of 5% be created for doubtful debts ; (e) that the value of land and buildings having appreciated be brought upto Rs. 31,000; (f) that after making the adjustments the capital accounts of the old partners be adjusted on the basis of the proportion of Deepak’s Capital to his share in the business, i.e., actual cash to be paid off, or brought in by the old partners as the case may be.

Prepare Necessary Accounts and the Opening Balance Sheet of the new firm.

(Ans: Gain on revaluation Rs. 4,550. Balance Sheet Total Rs. 68,000)

Answer:

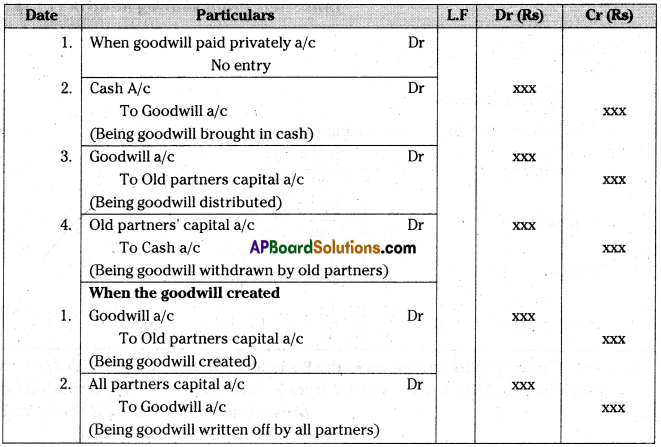

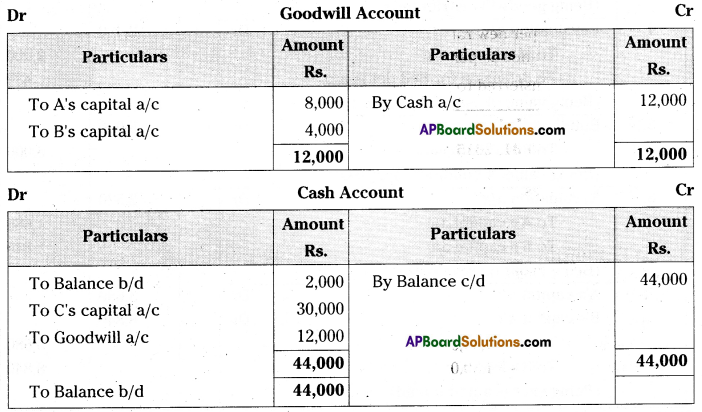

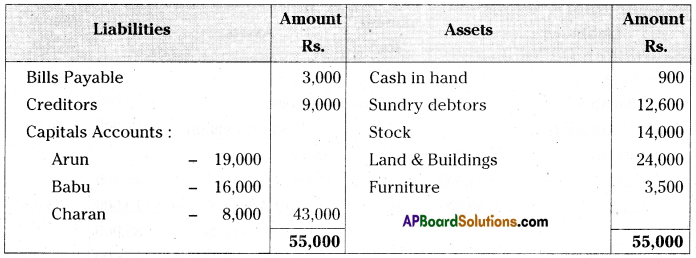

Working Notes:

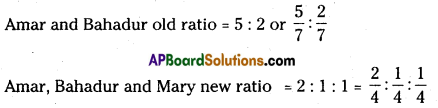

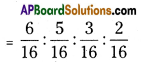

i) Calculation of new ratio :

Assume total profit =1

New profit sharing ratio of Arun, Babu, Charan & Deepak

= 6 : 5 : 3 : 2

![]()

ii) Old partners capital balances are adjusted according to the Deepak profit sharing ratio :