Students must practice these AP Inter 2nd Year Accountancy Important Questions 4th Lesson Not-for-Profit Organizations to boost their exam preparation.

AP Inter 2nd Year Accountancy Important Questions 4th Lesson Not-for-Profit Organizations

Question 1.

State the meaning of Not-for-profit organizations. Give suitable examples.

Answer:

It is an association of persons formed mainly with a view to rendering services to its members in particular and to the society in general.

Hospitals, clubs, educational institutions, libraries, religions and charitable associations, cooperative societies are some of the examples.

Question 2.

Write the characteristics of Non-for-Profit organizations.

Answer:

- They are formed for providing services to specific group or public such as education, recreation, health and soon.

- These are organised as charitable trusts, societies etc.

- The main sources of income are Donations, legacies subscriptions etc.

- The members elect the Managing Committee and look after the organization affairs.

- The Not-for-profit organizations earn their reputation on the basis of their contribution.

![]()

Question 3.

Distinguish between Profitable organizations and Not-for-Profitable organizations.

Answer:

| Basis | Profitable organizations | Not-for-Profitable organizations |

| 1. Motive | The main motto is to earn profit. | The main motive is to render service to its members and society. |

| 2. Funds | Funds are represented by capital contributed. | Funds are represented by capital fund. |

| 3. Financial statements | These include manufacturing account, trading and profit & loss A/c and balance sheet. | They include Receipts and Payments A/c, Income and Expenditure a/c and Balance Sheet. |

| 4. Surplus / Profit | The balance of profit & loss A/c is either Net profit / Net loss. | The balance in the income and expenditure A/c is either surplus / deficit. |

Question 4.

List out the accounts prepared by Not-for-Proflt organizations.

Answer:

In order to achieve financial position of a concern the following are to be prepared.

- Receipts and Payments Account.

- Income and Expenditure Account.

- Balance Sheet.

Question 5.

What are the final accounts prepared by Not-for-Profit organizations?

Answer:

- Receipts and Payments Account.

- Income and Expenditure Account.

- Balance Sheet.

Question 6.

What do you mean by receipts and payments account?

Answer:

It is summary of cash transactions for a given period. It is prepared at the end of the year on the basic principles of real accounts.

Question 7.

What are the characteristics of receipts and Payments account?

Answer:

- It is a real account.

- All the receipts are recorded on the debit side and all the payments on the credit side.

- It starts with opening balance and ends with closing balance.

- Non-cash items are not shown in this account.

Question 8.

In what way receipts and payment account differ from cash book?

Answer:

| Basis | Receipts & Payments A/c | Cash Book |

| 1. Cash transaction | It is a summary of cash book-all cash transactions are recorded. | All cash transactions are recorded. |

| 2. Period | It is prepared at the end of accounting period. | It is written daily. |

| 3. Chronological order | Transactions are not written date wise. | Transactions are written in chronological order. |

Question 9.

What is an income and expenditure account?

Answer:

Income and expenditure account is prepared just like a profit and loss account. It is a nominal a/c. It is prepared to know the surplus or deficit of a Not-for-profit organization.

![]()

Question 10.

Explain the basis features of income and expenditure account.

Answer:

Features:

- It is a nominal account.

- It is similar to profit and loss a/c.

- Expenses and losses are recorded on debit side and incomes are on credit side.

- Only revenue expenditure & incomes are shown whereas capital items are ignored.

- Adjustments are made like a profit & loss a/c.

Ex: out expenses, prepaid expenses & prepaid insurance depreciation etc. - The balance in the account shows surplus or deficit.

Question 11.

Difference between receipts and payments account and Income and Expenditure account.

Answer:

| Receipts & Payments A/c | Income & Expenditure A/c |

| 1. It is a real account. | 1. It is a nominal account. |

| 2. It is basically a summarised cash book. | 2. It is like a profit and loss account. |

| 3. It commences with the opening balance of cash. | 3. There is no opening balance. |

| 4. All receipts are debited and all payments are credited. | 4. Revenue expenses are debited and revenue incomes are credited. |

| 5. In includes both capital and revenue items. | 5. It includes only revenue items. |

| 6. It records the receipts and payments whether they related to previous, current or future year. | 6. It records only current year expenses and incomes. |

| 7. It is prepared on the basis of cash system of accountancy. | 7. It is prepared on the basis of mercantile system of accountancy. |

| 8. No adjustments are made at the end of the year. | 8. Adjustments are made at the end of the year. |

| 9. Closing balance represents cash or bank at the end. | 9. Closing balance represents either surplus or deficit. |

Question 12.

In what way Income and expenditure a/c differ from profit and loss a/c?

Answer:

1. Income and Expenditure account is account which is prepared for finding the excess of income over expenditure. Whereas profit and loss is the account which is prepared for finding net profit or net loss.

2. Income and Expenditure account in prepared by not-for-profit organization whose aim is not to earn money. Whereas profit & loss account is prepared by business whose aim is to earn money.

3. Income and Expenditure account is prepared on the bassis of receipt and pay¬ments whereas profit and loss in prepared on the basis of trail balance.

Question 13.

What do you mean by Revenue Expenditure? Give examples. [May ’22; Mar. 17 (AP)]

Answer:

Any amount spent to earn revenue or profits is called ’revenue expenditure’. Examples: Salaries, rent, wages, electricity, insurance, repairs etc.

Question 14.

What do you mean by capital expenditure? Give examples.

Answer:

The expenditure which is incurred for the acquisition of assets and to increase the earning capacity of the business. It gives benefit for number of years.

Example: Machinery, furniture, buildings, patents, trade marks, good will etc.

Question 15.

How do you prepare receipts and payments account ?

Answer:

- Opening balances of cash in hand, cash at bank are recorded on debit side. In case of overdraft on the credit side.

- Receipts are shown on the debit side and payments are shown on the credit side irrespective of the year and nature.

- Find out the difference between debit & credit sides. If debit is more it is bank balance and credit is more it is overdraft balance.

![]()

Question 16.

Explain the procedure to convert Receipts and payments account into Income and Expenditure account.

Answer:

- Ignore opening and closing cash and bank balances appearing in receipts and payments account.

- Take only revenue items of income and expenditure and leave all capital nature items.

- Make all adjustments for outstanding, prepaid incomes and expenses, provision of depreciations or bad debts etc.

- Take current period revenue expenses and incomes only. Items relating to the preceding and succeeding years are tq be ignored.

- Expenditure is recorded on the debit side and income is recorded on the credit side income & expenditure account.

- Income and expenditure account is balanced it shows either surplus or deficit.

Question 17.

What is capital income? Give two examples.

Answer:

Any amount received as investment by owners or raised by the way of loans or sale of fixed assets is known as “capital income” or “capital receipt”. These are non-recurring in nature. They are shown on the liabilities of the Balance sheet.

Question 18.

What is revenue income? Give two examples. [March 2020]

Answer:

Any amount received in the normal course of business is called as “revenue receipt”. It is recurring in nature. Example: Sales, interest received, discount, commission, rent received etc.

Question 19.

Distinguish between capital income and revenue income.

Answer:

Capital income

Any amount received as investment by owners or raised by the way of loans or sale of fixed assets is known as “capital income” or “capital receipt”. These are non-recurring in nature. They are shown on the liabilities of the Balance sheet.

Revenue income.

Any amount received in the normal course of business is called as “revenue receipt”. It is recurring in nature. Example: Sales, interest received, discount, commission, rent received etc.

Question 20.

Distinguish between revenue expenditure and capital expenditure.

Answer:

Revenue expenditure

Any amount spent to earn revenue or profits is called ’revenue expenditure’. Examples: Salaries, rent, wages, electricity, insurance, repairs etc.

Capital expenditure.

The expenditure which is incurred for the acquisition of assets and to increase the earning capacity of the business. It gives benefit for number of years.

Example: Machinery, furniture, buildings, patents, trade marks, good will etc

Question 21.

What is subscription?

Answer:

The members are generally required to make the annual payment are called “Sub¬scriptions”. It is the major source of income. It is debited to Receipts and payments a/c and credited to the Income and expenditure a/c.

Question 22.

What is the capital fund?

Answer:

It is the fund accumulated through donations, entrance fee, life membership fee etc. It is shown on liabilities side of the Balance Sheet.

Question 23.

What is Legacy? [Mar. 19; May’22, 17 (AP)]

Answer:

It is an amount received by a Not-for-profit organization as per the will. It is like a donation. It appears on the receipts side of the Receipts and payments account. It should be treated as a capital receipt and shown on liabilities side of the Balance Sheet.

![]()

Question 24.

What is differed Revenue expenditure give examples.

Answer:

The expenditure incurred in lumpsum amount and benefit spread over several years is called as differed revenue expenditure. Eg: Advertisements, incurred on research and development, innovation etc.

Question 25.

What is Entrance fee?

Answer:

This is the amount received from a member at the time of admission or re-admission into the Not-for-profit organization. It appears on the receipt side of the Receipts and payments account and credited to the income and expenditure account.

There is a different of opinions about Entrance fee. Hence, act according to the instructions given in the problem.

Question 26.

What is meant by life membership fee.

Answer:

The members are generally required to make the payments in a lumpsum only once which enable them to become the member for whole life. It is desirable that this amount should be shown as liability in the balance sheet as a separate fund and a fair amount be credited to income and expenditure account in subsequent years.

Question 27.

What are Donations? Explain different types. [Mar ’18 (AP)]

Answer:

Amount received from any source by way of gift is described as ’Donations’. Donations are two types

a) General Donation: When donor does not lay down any specific conditions for using the amount of donation, then it is called ‘general donation’. If the amount is small treated as revenue and if the amount is big it is to be capitalised.

b) Specific donations: A donation received for specific purpose then it is called ‘specific donation’. It should be capitalised and shown as a liability in the balance sheet. Eg: Donations for building, pavilion or donations for library.

Exercise

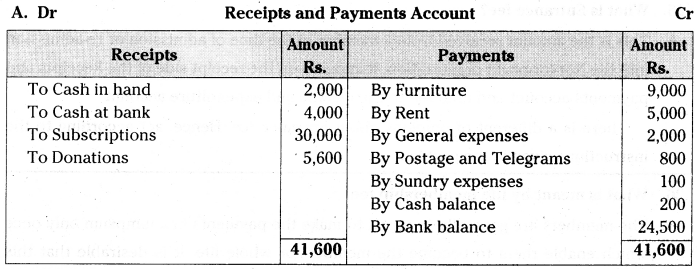

Question 1.

From the following particulars, prepare Receipts and Payments A/c.

Cash in hand 2,000

Cash at bank 4,000

Subscriptions received 30,000

Donations Received 5,600

Purchase of furniture 9,000

Rent Paid 5,000

General Expenses 2,000

Postage and Telegram 800

Sundry Expenses 100

Cash balance at close 200

(Ans: Cash at bank closing Rs. 24,300)

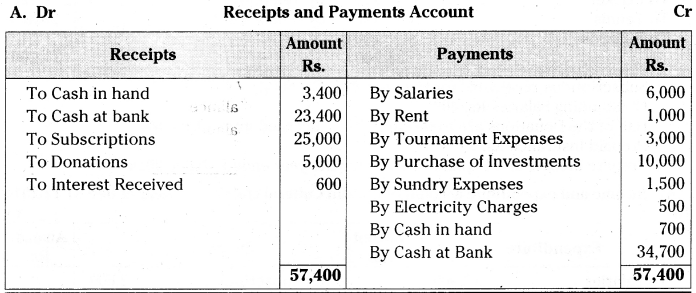

Answer:

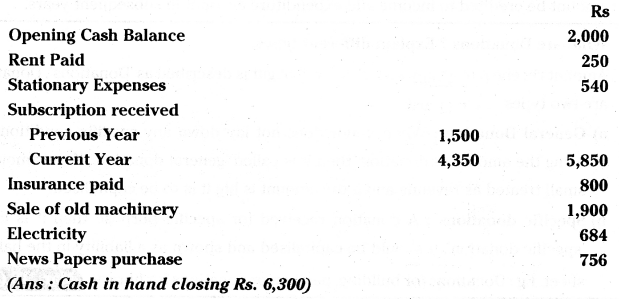

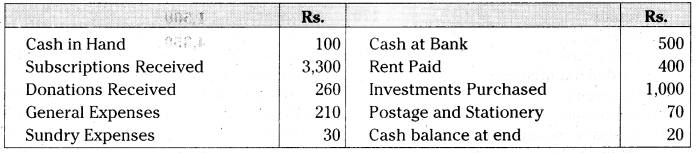

Question 2.

Prepare a Receipts and Payments Accounts.

(Ans: Cash in hand closing Rs. 6,300)

Answer:

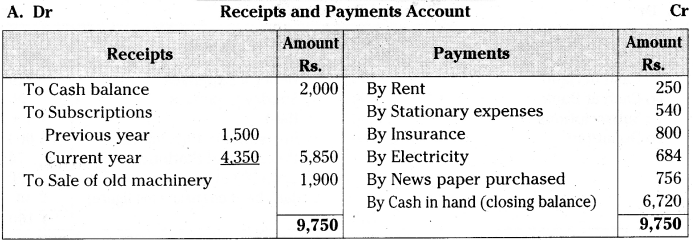

Question 3.

From the following details prepare receipts and payments A/c.

(Ans: Receipts and payments A/c Total Rs. 57,400)

Answer:

![]()

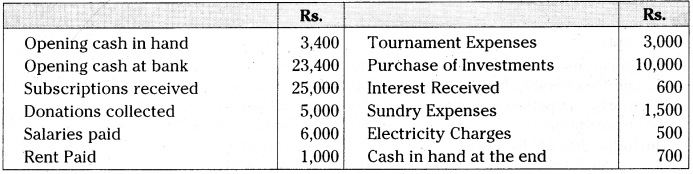

Question 4.

From the following particulars Prepare Receipts and Payments A/c.

(Ans: Cash at bank closing Rs. 2,430)

Answer:

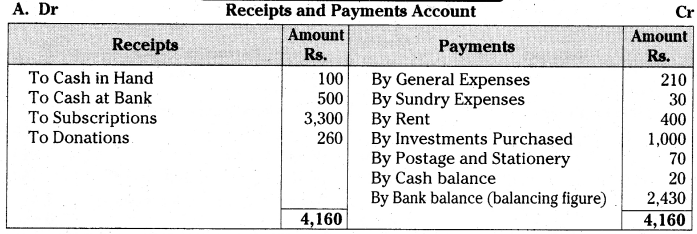

Question 5.

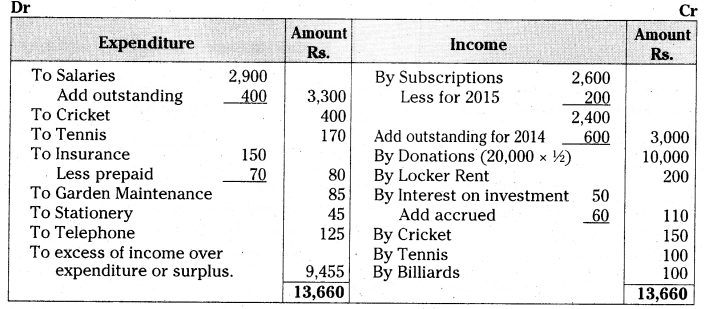

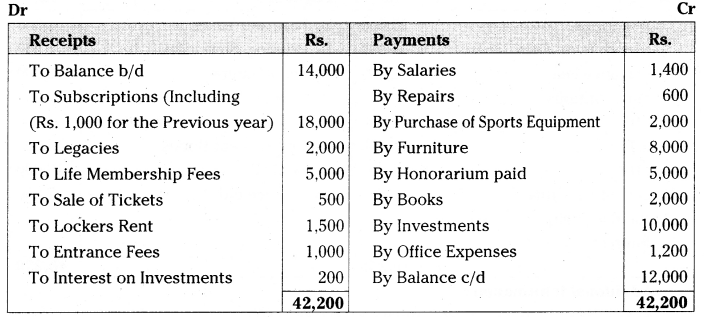

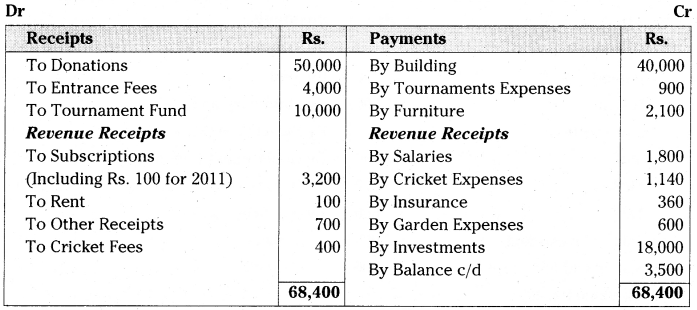

Following is the receipts and payments A/c of Gandhi Cultural Club for the year ended 31-Dec-2014.

Subscriptions receivable for the year 2014 Rs. 600,

Outstanding Salaries Rs. 400.

Half of the Donations are to be capitalized, accrued interest Rs. 60,

Prepaid Insurance Rs. 70

Prepare income and Expenditure A/c for the year ended 31-Dec-2014.

Answer:

Income and expenditure account of Gandhi Cultural club for the year ended 31.12.2014

Hints:

- Outstanding salaries are added to the salaries.

- Current year outstanding added to subscriptions and previous & future year are deducted from subscriptions to get subscriptions earned.

- Half of the donations are to be capitalised i.e. 20,000 x 1/2 = Rs. 10,000.

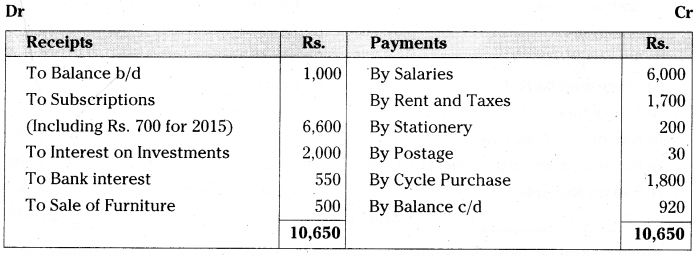

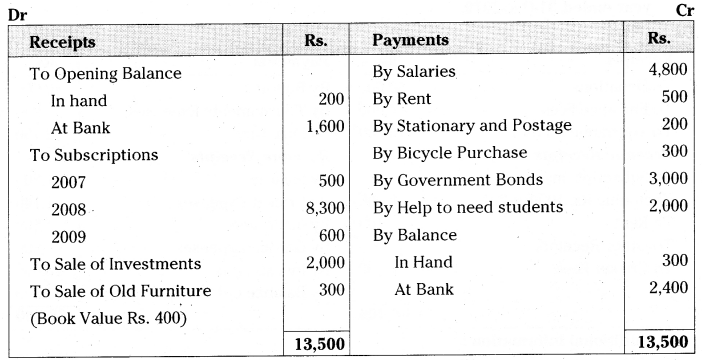

Question 6.

Prepare income and expenditure A/c of Tirupathi Club from the following receipts and payments A/c, for the year ending 31-Dec-2014. [Mar ’18 (AP)]

Adjustments:

a) Rent paid included Rs. 200 for December 2013.

b) Salaries Payable Rs. 900

c) Subscriptions received included Rs. 600 for the year 2013.

d) Subscriptions Due for the year 2014, Rs. 400

e) Cost of furniture sold Rs. 800

Answer:

Income and expenditure account of Tirupathi Club for the year ended 31 Dec. 2014

![]()

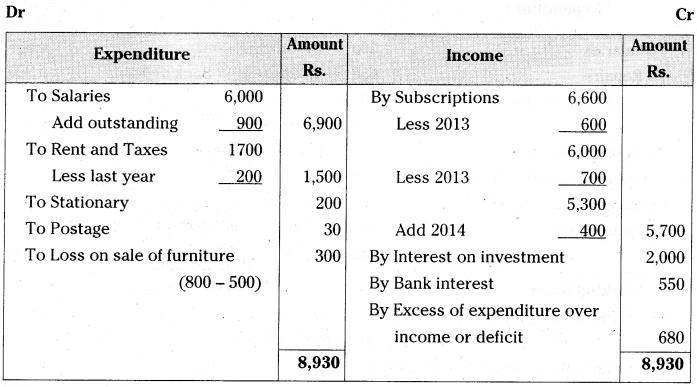

Question 7.

From the following receipts and payments a/c of the Venkateswara Society for the year ended 3 l-Dec-2014. Prepare income and expenditure a/c for the year ended 31-Dec-2014. [May ’17 (AP)]

The Entrance fees and donations are to be capitalized. Sports materials value Rs. 4,000 as on 31-Dec-2014.

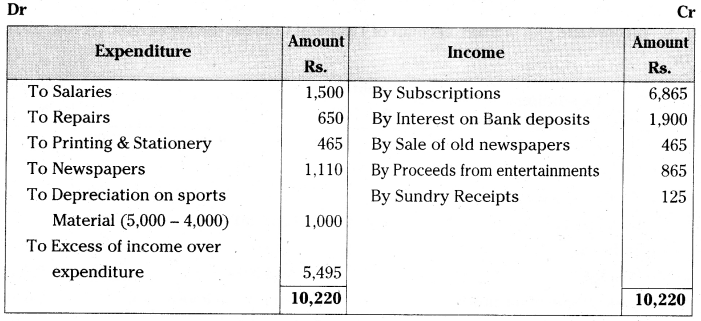

(Ans: Excess of income over expenditure Rs. 5,495)

Answer:

Income and expenditure account of the Venkateswara Society for the year ended 31 Dec. 2014

Working Notes:

- Depreciation on sports material (purchases – at the end value)

= 5,000-4,000 = Rs. 1,000 - Entrance fee & Donations are capitalised i.e. shown liability.

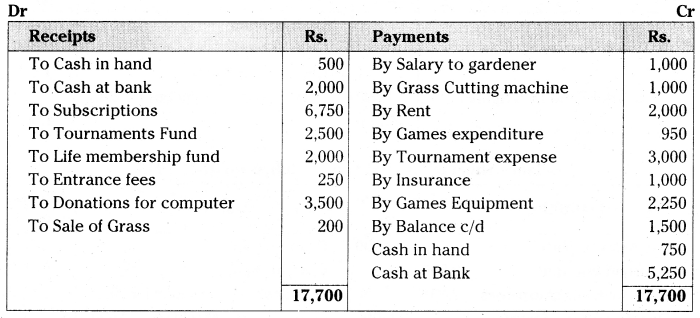

Question 8.

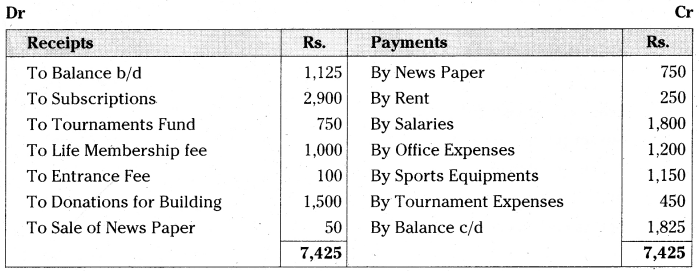

Visakha Sports Association extracts the following receipts and payments A/c for the year ended 31-Dec-2014. From the particulars given, prepare income and expenditure a/c.

Adjustments:

a) Subscriptions outstanding on 31-Dec-2013, Rs. 450, and on 31-Dec-2014 Rs. 400. Subscriptions received includes Rs. 100 on account of the year 2015.

b) Sports equipments was valued on 31-Dec-2013, @ Rs. 550, and on 31-Dec-2014, @ Rs. 1090.

c) Office expenses include Rs. 150, for the year 2013 whereas Rs. 200 is still payable on this account for 2014. (Ans: Surplus Rs. 1,760)

Answer:

Income and expenditure account of Visakha Sports Association the year ended 31-12-2014.

Working Notes:

![]()

Question 9.

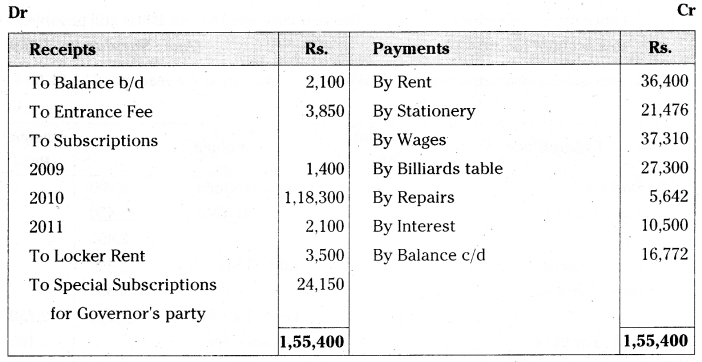

From the following, Prepare income and expenditure A/c of Tirupathi Sports Men Club for the year ended 31-Dec-2010.

Adjustments:

Locker rent Rs. 420 pertaining to 2009 and Rs. 630 is still owing. Rent Rs. 9,100. Pertaining to 2009 and Rs. 9,100 is still due. Stationary expenses Rs. 2,184 relating to 2009 and Rs. 2,548 is still owing. Subscriptions receivable for the year 2010. Rs. 3,276.

(Ans: Surplus Rs. 17,444)

Answer:

Income and expenditure account of Tirupathi Sports Men Club for the year ended 31-Dec-2010.

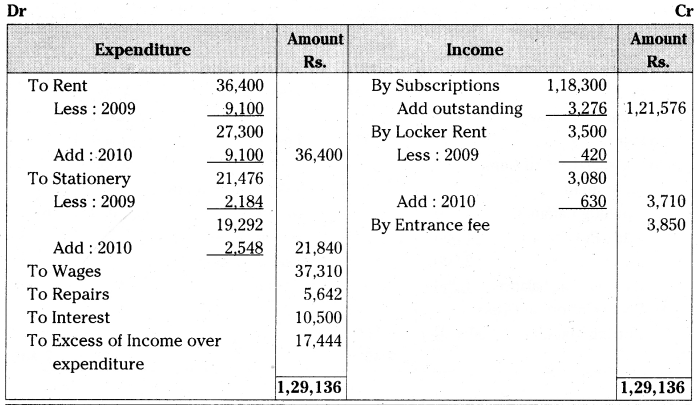

Question 10.

Sri Hari Sports Club’s, Ongole receipts and payments for the year ending 31-Dec-2014. Is given below.

Additional Information:

a) Subscription receivable for 2013 were Rs. 1,000 and For 2014 Rs. 1,050. Subscription already received including Rs. 400 for the year 2015.

b) Games equipment in the beginning was Rs. 1,000, and at the end Rs. 1,250.

c) Provide depreciation @ 10% Grass cutting machine.

Prepare income and expenditure A/c for the year ending 31-Dec-2014. And opening closing balance sheet.

Answer:

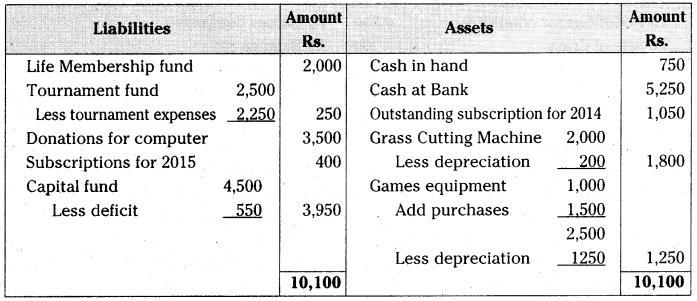

Income and expenditure account of Sri Hari Sports Club for the year ending 31-12-2014.

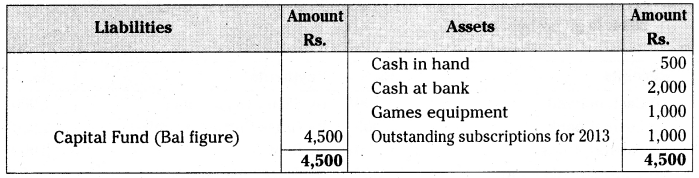

Balance Sheet of Sri Hari Sports Club as on 1-1-2014

Balance Sheet of Sri Hari Sports Club as on 31-12-2014

Hints:

- Tournament expenses are deducted from tournament fund and balance shown as liability.

- Depreciation is calculated 10% on gross cutting machine i.e., 2,000 x 1/10 = Rs. 200.

- Previous year and future year subscriptions are deducted and current year sub¬scriptions are added.

- Depreciation on games equipment is calculated Opening balance + Purchases – Closing Stock = depreciation.

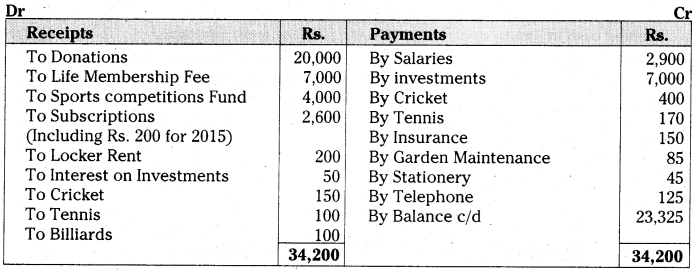

![]()

Question 11.

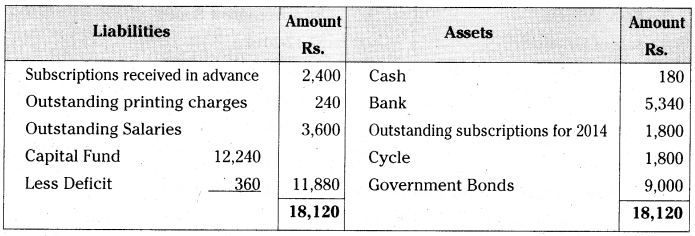

From the following receipts and payments accounts of other information of Kadapa City Club, Prepare income and expenditure A/c as on 31-Dec-2014 and balance sheet as on that date.

Adjustments:

a) Subscriptions received included Rs. 1,200 for the year 2013, and Rs. 2,400 for the year 2015.

b) Subscriptions due for the year 2014 Rs. 1,800

c) Printing Charges payable for 2014 Rs. 240

d) Salaries payable for the year 2014 Rs. 3,600

(Ans: Deficit Rs. 360), Capital fund on 1-1-2014 Rs. 12,240, Balance Sheet total Rs. 18,120)

Answer:

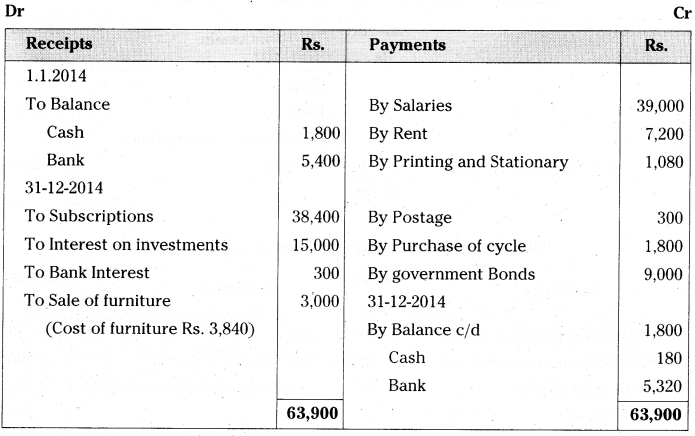

Income and expenditure account Kadapa City Club for the year ending 31-12-2014.

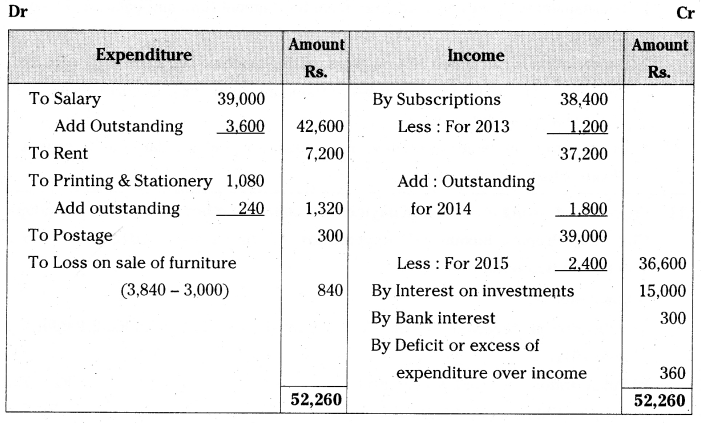

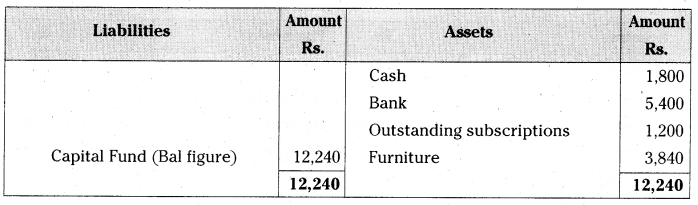

Balance Sheet of Kadapa City Club as on 1-1-2014

Balance Sheet of Kadapa City Club as on 31-12-2014

Question 12.

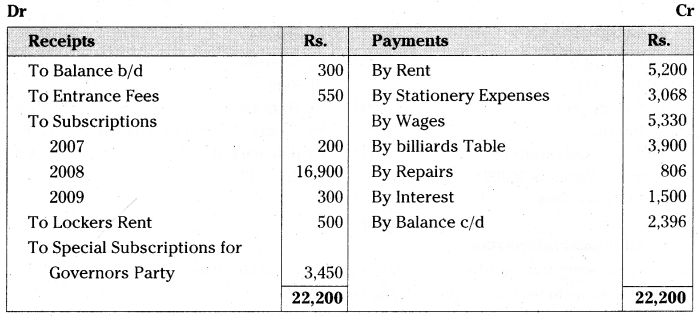

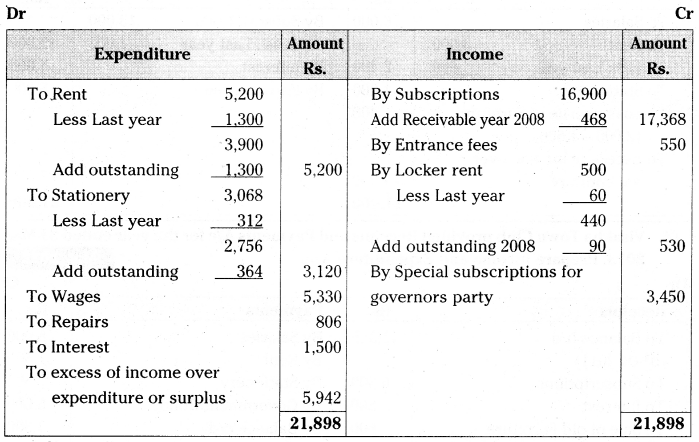

From the following Receipts and payments a/c of Amaravathi Sports Club for the year ended 31st Dec – 2008, prepare income and expenditure account.

Lockers Rent Rs. 60, Pertained to 2007 and Rs. 90 is still owing. Rent Rs. 1,300 pertained to 2007 and Rs. 1,300 is still due. Stationery Expenses rs. 312 relating to 2007 and Rs. 364 is still owing.

Subscription Receivable for 2008 is Rs. 468. (Ans: Surplus Rs. 5,392)

Answer:

Income and expenditure account of Amaravathi Sports Club for the year ending 31-12-2008.

Note: Entrance fees is treated as income and credited to Income & expenditure account.

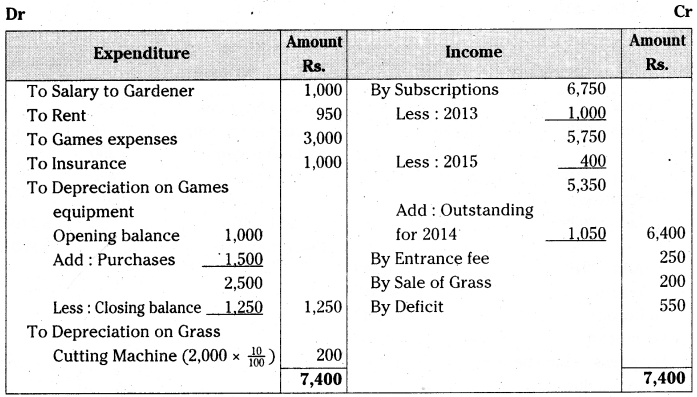

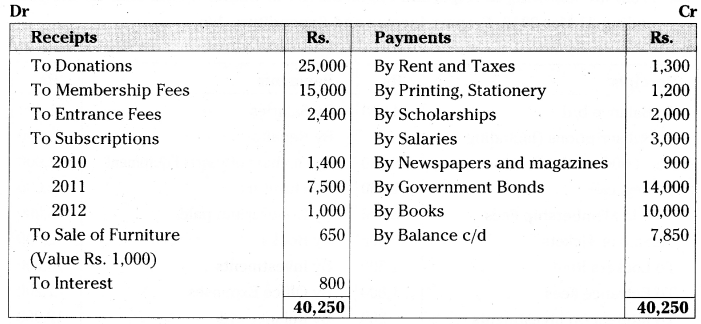

Question 13.

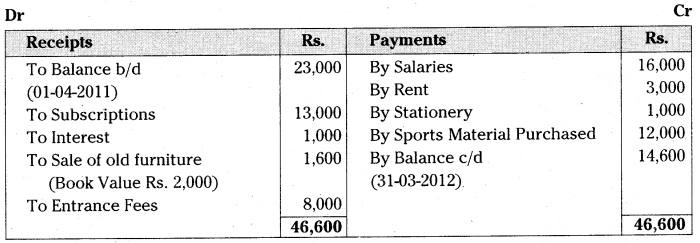

From the following Receipts and Payments of Nethajee Sports Club, prepare income and Expenditure A/c for the year ended on 31-Mar-2012. [March 2019]

Additional Information:

a) Subscriptions Include Rs. 1,000 Received for the last year.

b) Rent Includes Rs. 600 paid for the last year.

From the above particulars Prepare Income and Expenditure A/c for the year ending 31-03-2012.

Answer:

Income and expenditure account of Nethajee Sports Club for the year ending 31-03-2012.

![]()

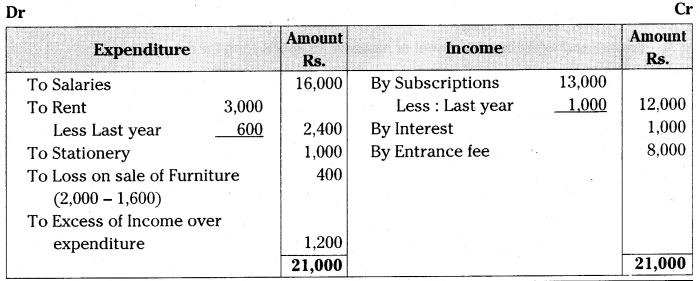

Question 14.

Visakha Town Club provided Receipts and Payments A/c for the year ended 31-Mar- 2013. Prepare Income and Expenditure A/c. [May 2022]

Adjustments:

a) Subscriptions include Rs. 500 received for last year.

b) Rent includes Rs. 300 paid for last year.

c) Book value of Furniture sold Rs. 1,000. (Ans: Surplus Rs. 600)

Answer:

Income and expenditure account of Visakha Town Club for the year ending 31-03-2013.

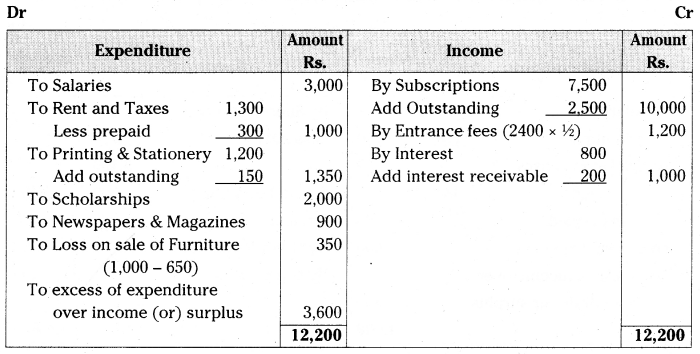

Question 15.

Additional Information :

From the following Receipts and Payments A/c of Guntur Sports Club for the year ending 31-Mar-2012, Prepare income and Expenditure A/c.

Additional Information:

a) Outstanding Salaries Rs. 600

b) Opening values of sports equipments Rs. 1,000, closing value Rs. 500

c) Interest accrued on investments Rs. 200

d) Subscription receivable for the year 2012 Rs. 3,000.

(Ans: Surplus: Rs. 12,100)

Answer:

Income and expenditure account of Guntur Sports Club for the year ending 31-03-2012.

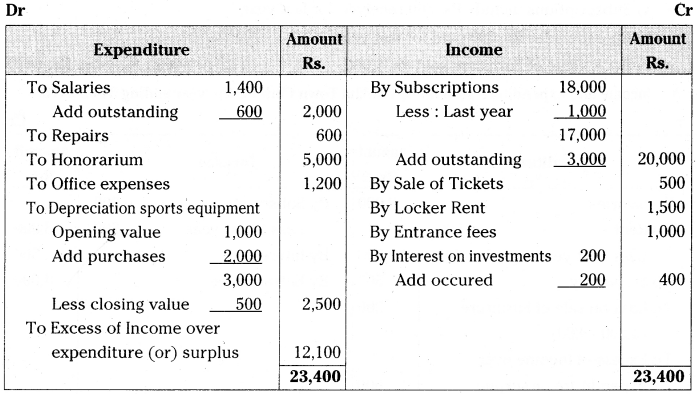

Question 16.

From the following Receipts and Payments A/c of Sai Charitable Trust, Anantapur, Prepare Income and Expenditure A/c.

Additional information:

a) Subscription receivable for the year 2011 Rs. 2,500

b) Prepaid Rent Rs. 300.

c) Outstanding Stationary bill Rs. 150

d) Capitalize donations

e) Half of the Entrance fees capitalized.

f) Interest Receivable for the year 2011 Rs. 200.

Answer:

Income and expenditure account of Sai Charitable Trust for the year ending 31-12-2011.

Hints:

- Rent prepaid deducted from rent Rs. 300.

- Outstanding stationery added to the stationery Rs. 150.

- Loss on sale of furniture is shown on debit side of I & E a/c as loss Rs. 100.

- 1/2 of entrance fee is treated as income.

![]()

Question 17.

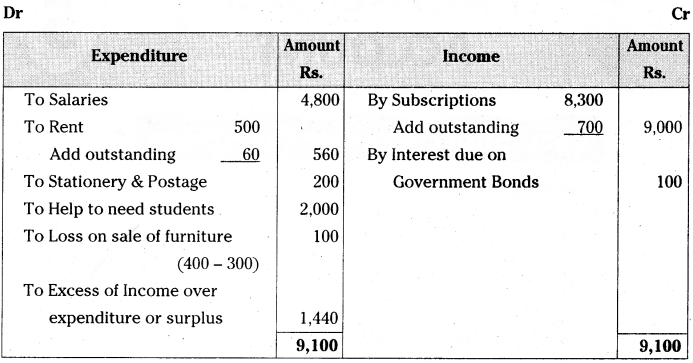

Nellore Sports Club started on 01-01-2010. Their Receipts and Payments A/c for the year ended 31-Dec-2010.

Additional information:

a) Subscription receivable for the year 2010 – Rs. 300

b) Salaries Unpaid – Rs. 170

c) Entrance fees are to be capitalized.

d) Insurance includes 9 months premium for 2011. (Ans: Surplus Rs. 800)

Answer:

Income and expenditure account of Nellore Sports Club for the year ending 31-12-2010.

Hints:

- Unpaid salaries is added to salary Rs. 170.

- Prepaid insurance for 9 months (360 x 9/12) Rs. 270 is deducted from insurance.

Question 18.

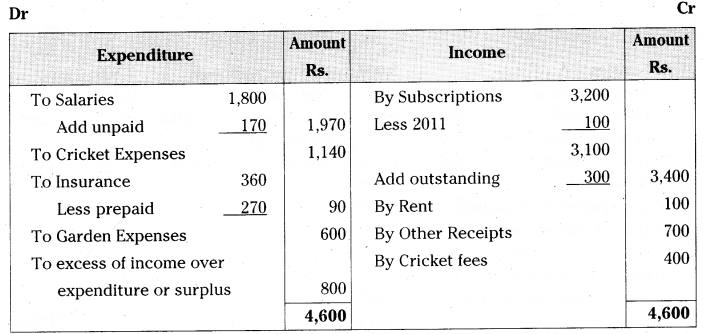

From the following Receipts and Payments A/c of Balaji Trust, prepare Income and Expenditure A/c for the year ending 31-Dec-2008. [Mar ’17 (AP)]

Adjustments:

Subscriptions for the year 2008 still receivable were Rs. 700, interest due on Government Bonds Rs. 100 and rent outstanding Rs. 60. (Ans: Surplus Rs. 1,440)

Answer:

Income and expenditure account of Balaji Trust for the year ending 31-12-2008.

Hints:

- Rent outstanding is added to the rent Rs. 60.

- Loss on sale of furniture (400 – 300) is a loss, hence debited to income & expendi¬ture a/c.

- Subscriptions outstanding Rs. 700 added to the subscriptions.

- Interest on Government Bonds due shown as income.