Students must practice these AP Inter 2nd Year Accountancy Important Questions 3rd Lesson Consignment to boost their exam preparation.

AP Inter 2nd Year Accountancy Important Questions 3rd Lesson Consignment

Short Answer Questions

Question 1.

What do you mean by consignment?

Answer:

The despatch of goods from one place to another place for the purpose of sale through an agent on commission basis is called ‘Consignment’.

Question 2.

Briefly explain about consignor and consignee

Answer:

The person who sends goods is called ‘consignor’. The person to whom the goods sent is known as ‘Consignee’.

Consignor sends goods to the consignee for sale on commission basis. Consignee sells the goods as per directions of the consignor.

Question 3.

What is a proforma invoice?

Answer:

Along with goods, a statement is prepared by the consignor and forward to the consignee, giving a description of the goods consigned i.e., about quantity, quality, price colour etc.

![]()

Question 4.

What is a Account sales? [Mar ’22, ’17 (AP)]

Answer:

It is a statement prepared by the consignee and sent to the consignor stating the particulars of goods sold, amount realised, expenses incurred agent commission, remittance, made and balance due is called as ‘Account Sales. It is prepared after completion sales or periodically.

Question 5.

What is Commission?

Answer:

It is the remuneration paid by consignor to the consignee for selling the goods. It is calculated on the total sales as a fixed percentage.

Question 6.

What is Del Credere Commission? Mar. 2020, 19, 17 (AP)

Answer:

When goods are sold on credit by consignee, it is a risk of bad debts. In order to avoid the risk of Bad-debts the consignor provides an additional commission to consignee known as “Del-Credere Commission”. It is also calculated on gross sales at fixed percentage.

Question 7.

What is over-riding Commission ? [Mar ’18 (AP)]

Answer:

It is an extra commission allowed by consignor to the consignee, to encourage the consignee to work hard to increase sales when new products introduced into market, which is called as “over-riding commission”. It is also calculated on total sales at a fixed percentage.

Question 8.

Briefly explain about recurring expenses and non recurring expenses.

Answer:

All the expenses incurred to bring the goods to the godown of the consignee are treated as non-recurring or direct expenses. These expenses will increase the value of goods. Hence they should be added to cost of the goods. Example – freight, carriage, insurance, packing dock dues, customs duty, loading charges, etc.

All the expenses incurred by the consignee after the goods reach the godown are treated as recurring expenses or indirect expenses. These expenses do not increase the cost of goods. Hence these expenses should not be added to the unsold stock. Examples: Godown rent, godown insurance, salary to salesmen, advertisement charges, selling expenses etc.

Question 9.

Explain the procedure for valuation of unsold stock in consignment.

Answer:

The stock left with the consignee at the end of the accounting period is called “unsold stock”. It is valued at cost price or market price. Whichever is less. Cost price means not purchase price, includes all proportionate non recurring expenses whether in¬curred by consignor or consignee. Examples for such expenses are packing, freight, customs duty, insurance, octroi duty cartage etc.

But expenses of recurring nature or selling expenses are not to be included in value of unsold stock. Examples are, godown rent, godown insurance advertising sales mens salary etc.

Question 10.

Explain the term of normal loss.

Answer:

Some goods even after taking fill precautions some loss of quantity is bound to take place. It is called as “normal loss’. It is happened due to the inherent nature of goods. For examples coal, oils and petroleum products.

Question 11.

Accounting treatment for normal loss.

Answer:

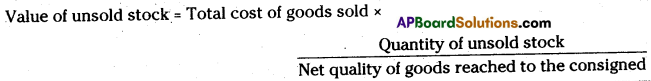

Normal loss has to spread over the remaining stock. Therefore for calculating the value of unsold stock the following formula can be applied.

Long Answer Questions

Question 1.

What do you mean about consignment? Explain the difference between consign¬ment and sale. [May 2022]

Answer:

Differences between consignment and sale.

| Consignment | Sale | |

| 1. Ownership | Ownership remains with the consignor. | Ownership passes form the seller to the buyer. |

| 2. Relationship | The relationship between the consignor and consignee is that of Principal & Agent. | The relationship between the buyer and seller is that of debtor and creditor. |

| 3. Return of goods | Consignee may return the goods (unsold). | Goods once sold can not be returned. |

| 4. Risk | Consignor bears all the risks attached to the goods. | Risk is transferred along with goods to the buyer. |

| 5. Consideration | The consignee sells goods for commission. | The goods are sold for profit against the price. |

| 6. Expenses | The expenses are borne by the consignor. | After sales the expenses are borne by the buyer. |

| 7. Account sales | Consignee sends periodical account sales to the consignor. | No account sales are prepared. |

| 8. Profit or Loss | The profit or loss on consignment belongs to consignor. | The profit or loss on sales belongs to the seller. |

![]()

Question 2.

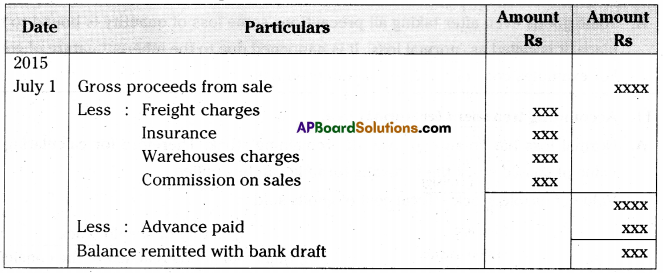

What is an account sales? Give a specimen copy of account sales.

Answer:

It is a statement prepared by the consignee and sent to the consignor stating the particulars of goods sold, amount realised, expenses incurred agent commission, remittance, made and balance due is called as “Account Sales”. It is prepared after Completion sales or periodically.

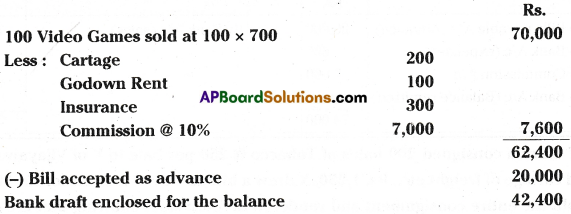

Specimen of Account Sales

Question 3.

What is meant by Commission? Explain different types of Commission

It is the remuneration paid by consignor to the consignee for selling the goods. It is calculated on the total sales as a fixed percentage.

Commission payable to consignee can be divided into three types,

- Ordinary Commission,

- Del Credere Commission and

- Over-riding Commission.

a) Ordinary Commission: It is the commission paid by the consignor to the con¬signee. It is calculated as a fixed percentage on the gross sale proceeds.

b) Del Credere Commission: When goods are sold on credit by consignee, it is a risk of bad debts. In order to avoid the risk of Bad-debts the consignor provides an additional commission to consignee known as “Del-Credere Commission”. It is also calculated on gross sales at fixed percentage.

c) Over-riding Commission: It is an extra commission allowed by consignor to the consignee, to encourage the consignee to work hard to increase sales when new products introduced into market, which is called as “Over-riding Commission”. It is also calculated on total sales at a fixed percentage.

Question 4.

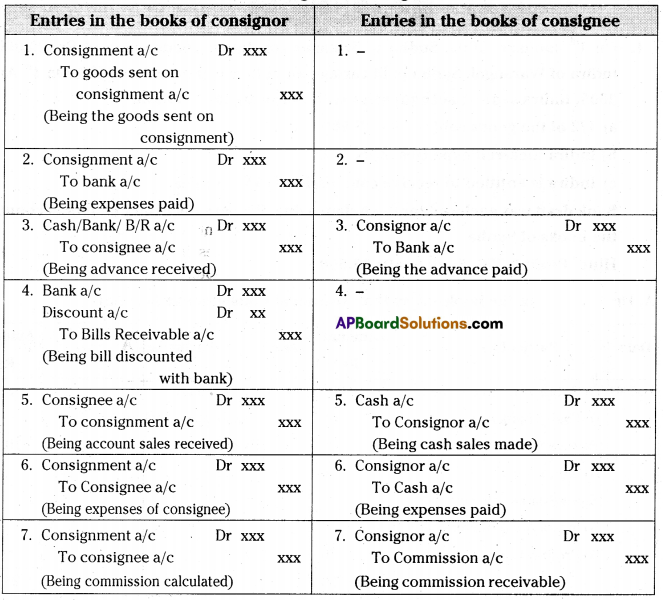

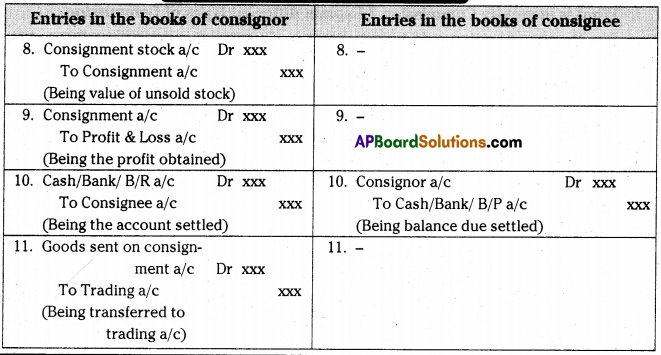

Journal entries in the books of consignor & consignee.

Answer:

Exercise

Question 1.

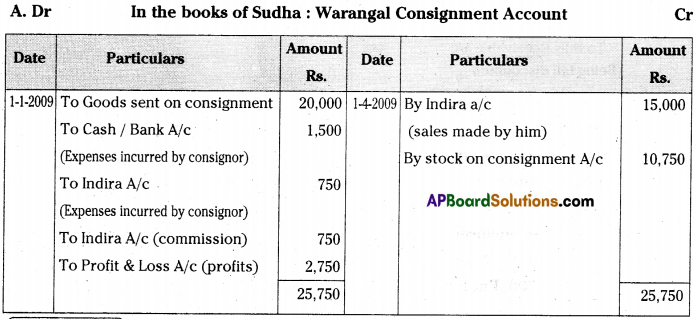

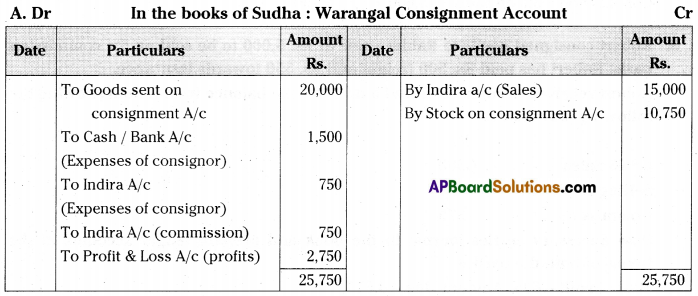

On 1st January, 2009, Sudha of Srinagar consigned goods value of Rs. 20,000 to Indira of Warangal. Sudha paid cartage and other expenses Rs. 1,500. On 1st April, 2009, Indira sent on account sales with following information.

a) 1/2 of the goods sold for Rs. 15,000

b) Indira incurred expenses of Rs. 750

c) Indira is entitled to receive commission @ 5% on sales.

Bank draft was enclosed for the balance due. Prepare necessary Ledger accounts in the books of Sudha.

Hint: Profit 2,750, Bank Drafts 13,500.

Answer:

Working Note -1:

Valuation of unsold stock

Working Note – 2:

Valuation of unsold stock

Calculation of Commission

Commission = 5% on sales i.e., 15,000 x 5/100 = 750

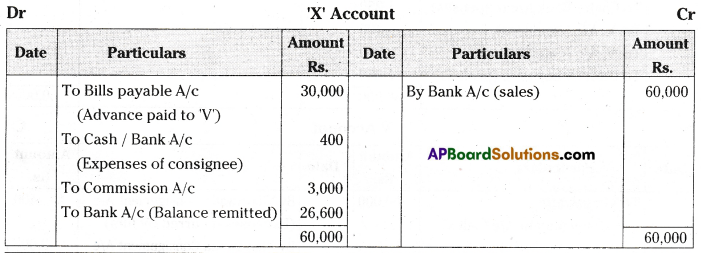

![]()

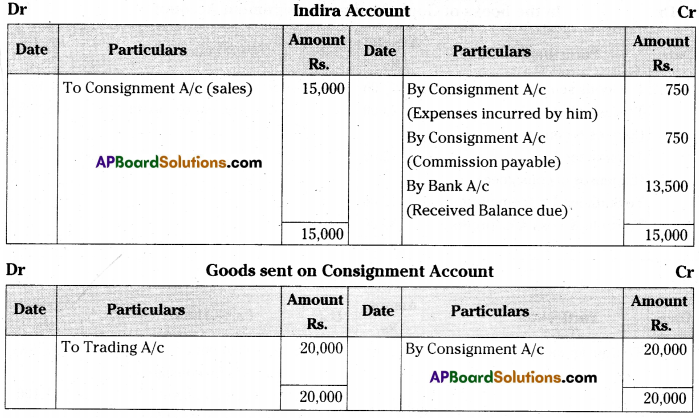

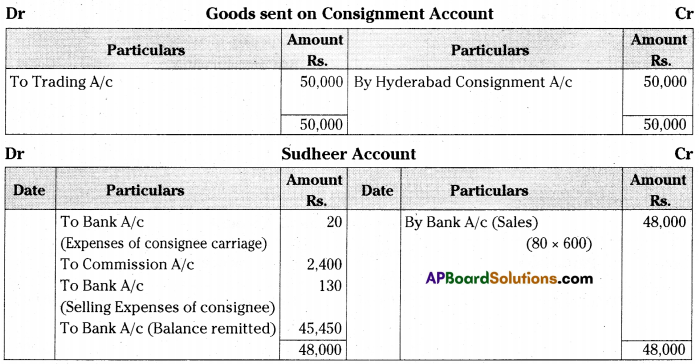

Question 2.

On 1st January, 2012, Gopi of Hyderabad consigned goods valued at Rs. 30,000 to Sudheer of Madras. Gopi paid cartage and other expenses Rs. 2,000 on 1st April, 2012, Sudheer sent the account sales with the following information. [Mar ’17 (AP)]

a) 50% of the goods sold for Rs. 22,000

b) Sudheer incurred expenses amounting to Rs. 1,200

c) Sudheer is entitled to receive commission @ 5% on sales.

Bank draft was enclosed for the balance due. Prepare the necessary ledger accounts in the books of Gopi.

Hint: Profit 3,700, Bank Drafts 19,700.

Answer:

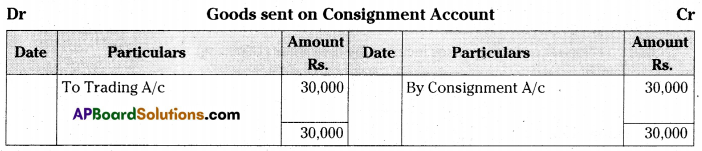

Working Notes – 1:

Valuation of unsold stock

Working Notes – 2:

Calculation of Commission:

Commission = 5% on sales = 22,000 x 5/100 = 1,100

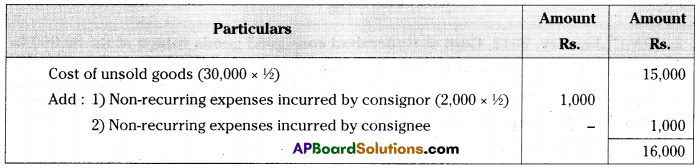

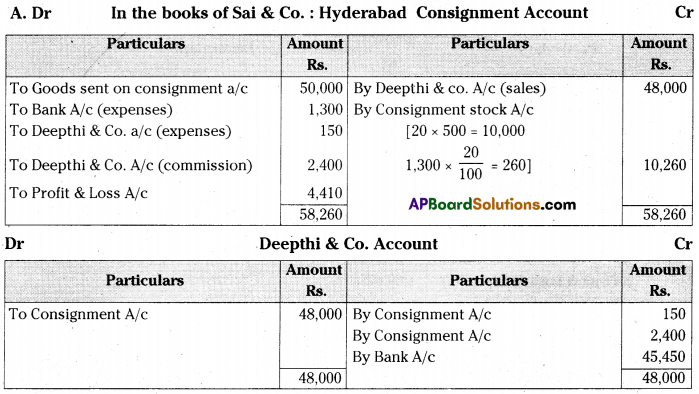

Question 3.

Sai and Co., of Chennai consigned 100 Radios to Deepthi and Co. of Hyderabad. The cost of each Radio was Rs. 500. Sai and Co paid insurance Rs. 500; Freight Rs. 800. Account sales was received from Deepthi and Co., showing the sale of 80 Radios at Rs. 600 each. The following expenses were deducted by them. [Mar ’18 (AP)]

Carriage Rs. 20

Selling expenses Rs. 130

Commission Rs. 2,400

Sai and Co., received a bank draft for the balance due. Prepare important Ledger . accounts in the books of Deepthi and Co.,

Hint: Profit – 4,410, Bank Draft – 45,450.

Answer:

Question 4.

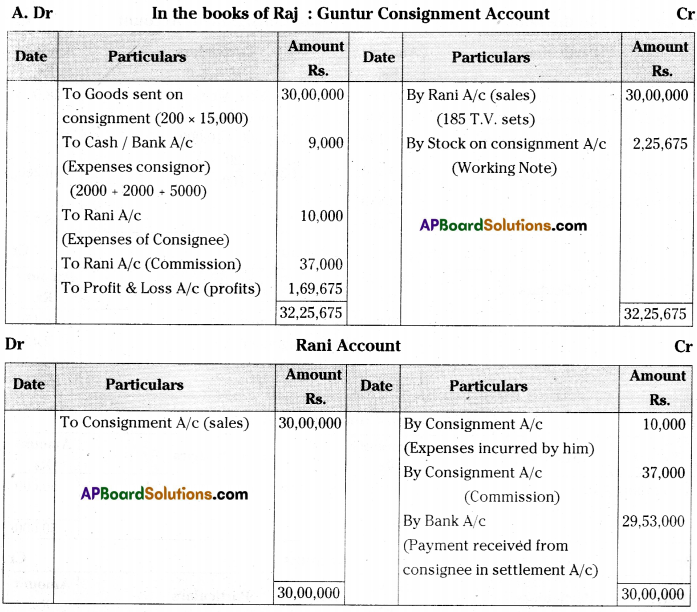

Raj of Bandar sends 200 T.V. sets each costing Rs. 15,000 to Rani of Guntur to be sold on consignment basis. He incurred the following expenses. Freight Rs. 2,000; Loading and unloading charges Rs. 2,000 and Insurance Rs. 5,000.

Rani sold 185 TVs for Rs. 30,00,000 and paid Rs. 10,000 as shop rent which is to be borne by Raj as per terms and conditions of consignment. Consignee is entitled for a Commission of Rs. 200 per T.V. sold. Assuming that Rani settled the account by sending bank draft to Raj. Prepare the necessary Ledger Accounts in the books of Raj.

Hint: Profit – 1,69,675, Bank Draft – 29,53,000.

Answer:

Working Note -1: Calculation of Commission:

Commission = 200 per T.V. Sold => 200 x 185 = 37,000

Working Note – 2:

Valuation of unsold stock

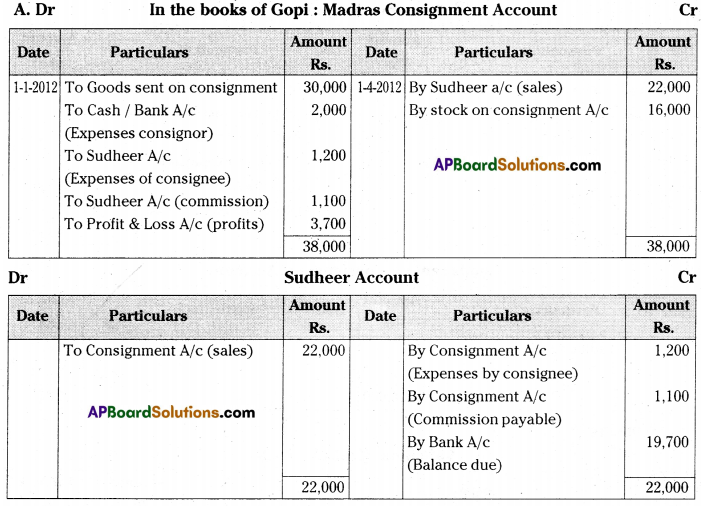

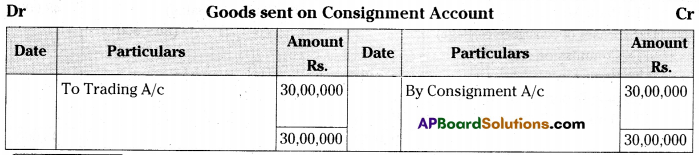

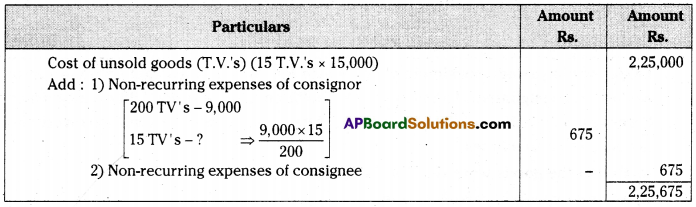

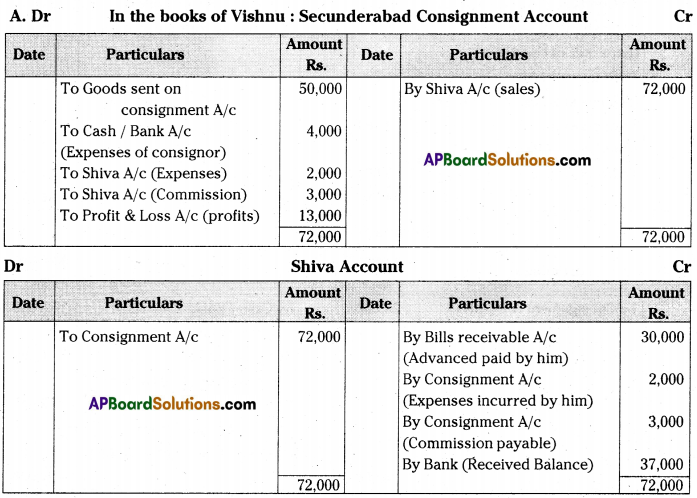

Question 5.

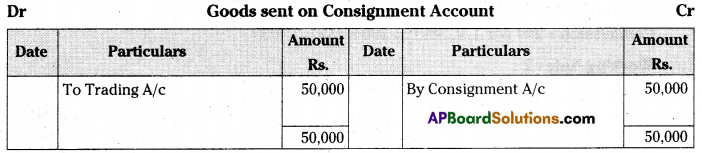

Vishnu of Vijayawada consigned goods value of Rs. 50,000 to Shiva; of Secunderabad. Vishnu paid transport charges Rs. 4,000 and drew a bill of two months on Shiva for Rs. 30,000 as advance. The bill was discounted with bankers for Rs. 29,500. Shiva sent the account sales of the consignment stating that the entire stock was sold for Rs. 72,000; Cartage 2,000; Commission 3,000 and a Bank Draft for the balance. Prepare necessary accounts in the books of Vishnu.

Hint: Profit – 13,000, Bank Draft – 37,000.

Answer:

![]()

Question 6.

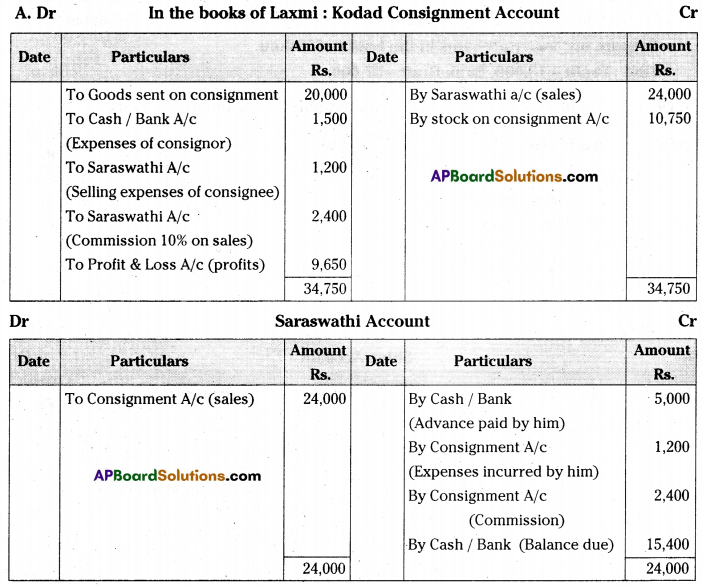

Laxmi of Vijayawada consigned goods worth Rs. 20,000 to his agent Saraswathi of Kodad on consignment. Laxmi spent Rs. 1,000 on transport, Rs. 500 on insurance: Saraswathi sent Rs. 5,000 as advance. After two months, Laxmi received the account sales as follows;

a) Half of the goods were sold for Rs. 24,000.

b) Selling expenses were Rs. 1,200.

c) 10% commission on sales.

Give ledger accounts in the books of Laxmi.

Hint: Profit – 9,650, Balance Due – 15,400.

Answer:

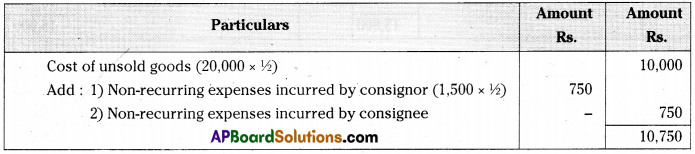

Working Note – 1:

Valuation of unsold stock

Working Note – 2:

Calculation of Commission:

Commission = 10% on sales = 24,000 x 10/100 = 2,400

Question 7.

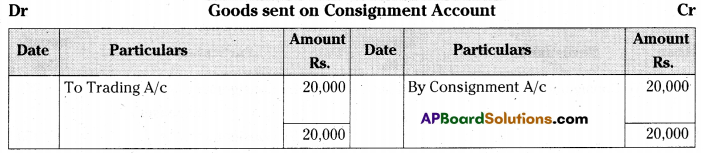

On 1st January, 2009, Sudha of Srinagar consigned goods value of Rs. 20,000 to Indira of Warangal. Sudha paid cartage and other expenses Rs. 1,500. On 1st April, 2009, Indira sent on account sales with following information.

a) 50% of the goods sold for Rs. 15,000

b) Indira incurred expenses of Rs. 750

c) Indira is entitled to receive commission @ 5% on sales.

Bank draft was enclosed for the balance due. Prepare the necessary Ledger accounts in the books of Sudha.

Hint: Profit – 2,750, Bank Draft – 13,500.

Answer:

Working Note -1:

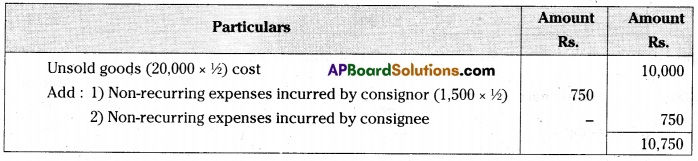

Valuation of unsold stock

Working Note – 2:

Calculation of Commission

Commission = 5% on sales = 15,000 x 5/100 = 750

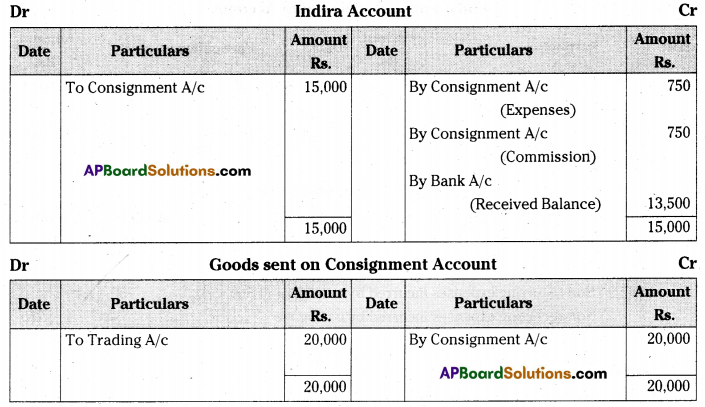

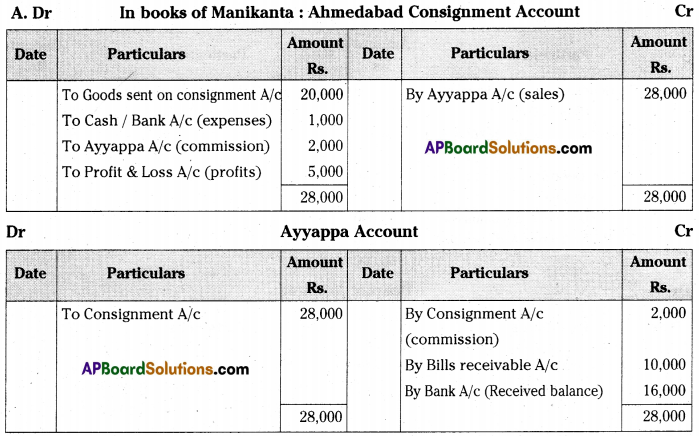

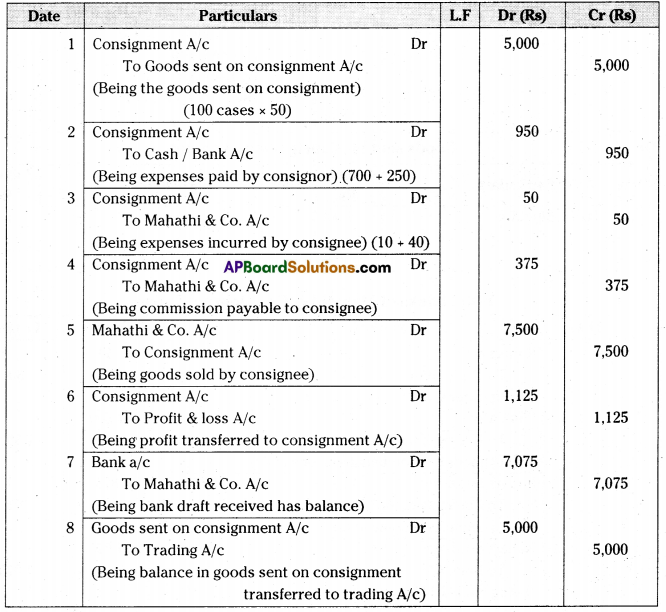

Question 8.

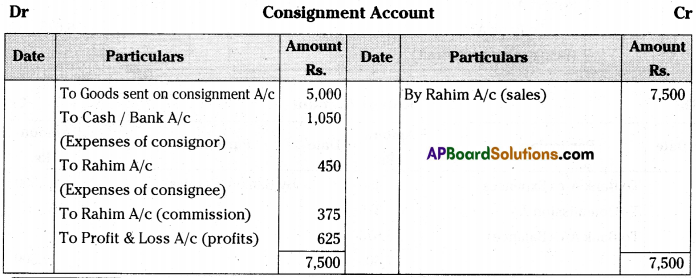

Robert consigned goods to Rahim value at Rs. 5,000 to be sold on 5% commission basis. Robert has paid Rs. 500 freight and Rs. 550 towards insurance.

Robert received account sales and a draft for the balance from Rahim showing the following particulars.

Rs.

Gross Sales 7,500

Selling Expenses 450

Commission 375

Pass necessary entries journal in the book and prepare ledger accounts in the books of both the parties.

Hint:

Profit – 625, Amount Due – 6,675.

Answer:

In the books of Robert:

Journal Entries in the books of Robert

In the books of Rahim: Journal Entries

![]()

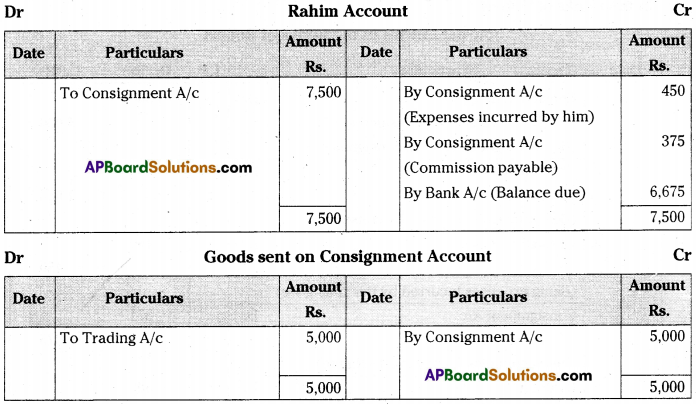

Question 9.

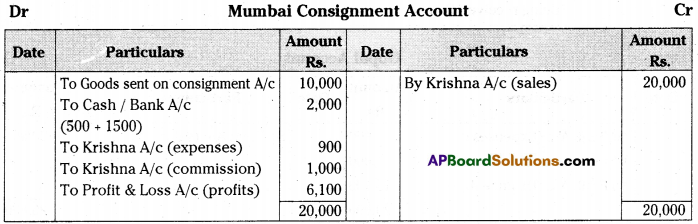

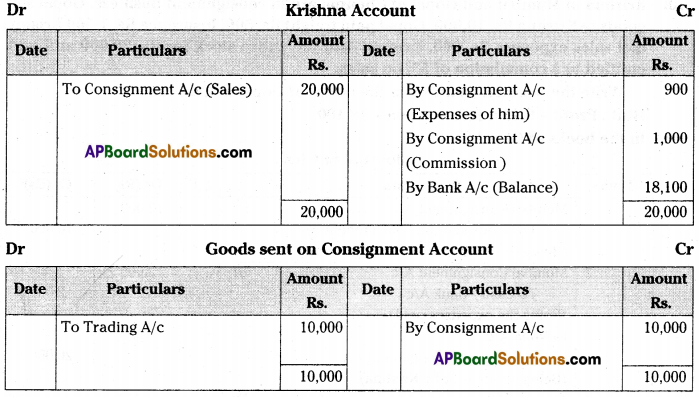

Krishna of Mumbai and Gopal of Chennai are in consignment business. Gopal sent goods to Krishna Rs. 10,000. Gopal paid freight Rs. 500. Insurance Rs. 1,500 Krishna met sales expenses Rs. 900, Krishna sold the entire stock for Rs. 20,000 and he is entitled to a commission of 5% on sales.

Write the necessary entries in the books of Gopal & Krishna.

Hint: Profit – 6,100, Balance due – 18,100.

Answer:

In the books of Gopal:

In the books of Krishna:

Journal Entries

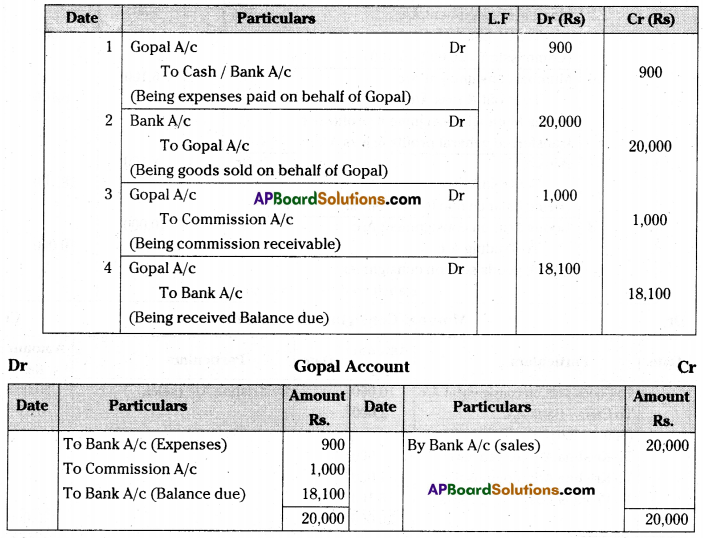

Question 10.

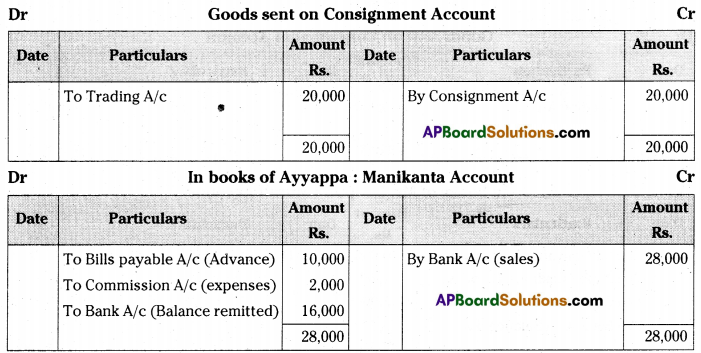

Manikanta of Vijayawada Consigned goods of value of Rs. 20,000 to Ayyappa of Ahmedabad. Manikanta paid forwarding charges Rs. 1,000 and drew a bill of two months on Ayyappa for Rs. 10,000. The bill was discounted with bankers for Rs. 9,500. Ayyappa sent received the account sales of the consignment stating that the entire stock was sold for Rs. 28,000 agents commission Rs. 2,000 and a bank draft for the balance. Prepare necessary accounts.

Hint: Profit – 50,000, Balance due – 16,000.

Answer:

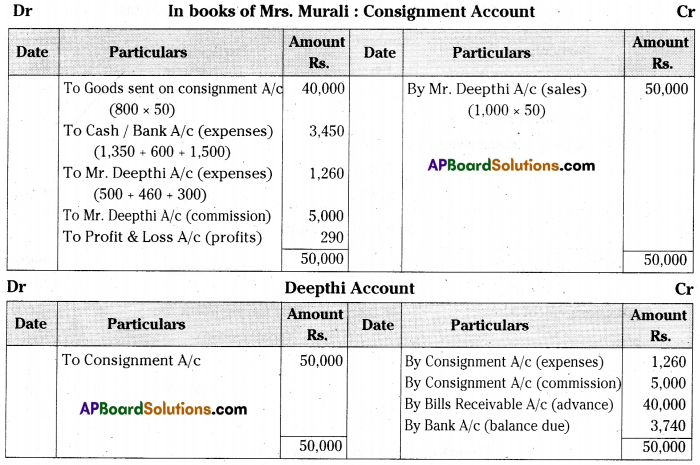

Question 11.

Mrs. Murali sent 50 Bicycles on consignment to Mr. Deepthi invoiced at Rs. 800 each on Jan. 1st 2009. She has paid the following expenses Rs. 1,350 freight, Rs. 600 – Insurance Rs. 1,500 other expenses. On 5th January, she received a bill from Deepthi for Rs. 40,000. On Feb. 20th Depthi sent an account sales showing that the bicycles have realized Rs. 1,000 each: He incurred expenditure on carriage Rs. 500, warehousing Rs. 460 and Rs. 300 miscellaneous expenses. He charged commis¬sion at 10% on sales. Prepare the books of consignor and consignee.

Hint: Profit – 290, Balance due – 3,750.

Answer:

Working Note -1:

Calculation of Commission:

Commission = 10% on sales = 50,000 x 10/100 = 5,000

![]()

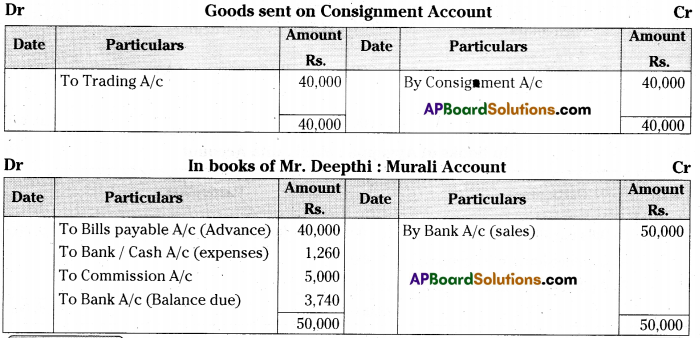

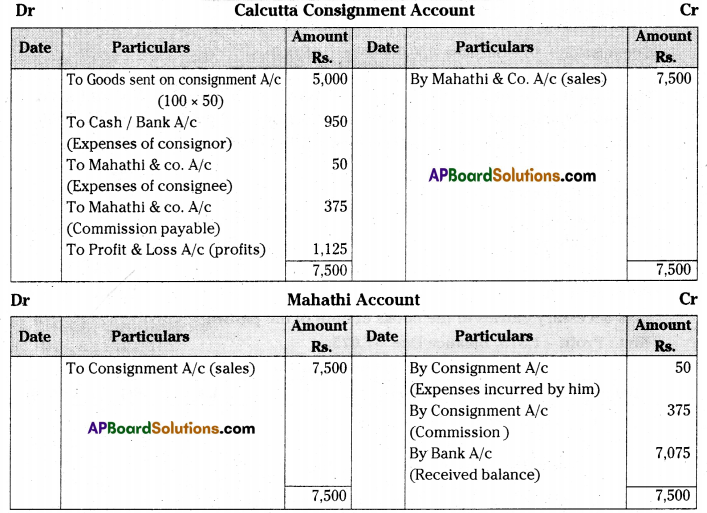

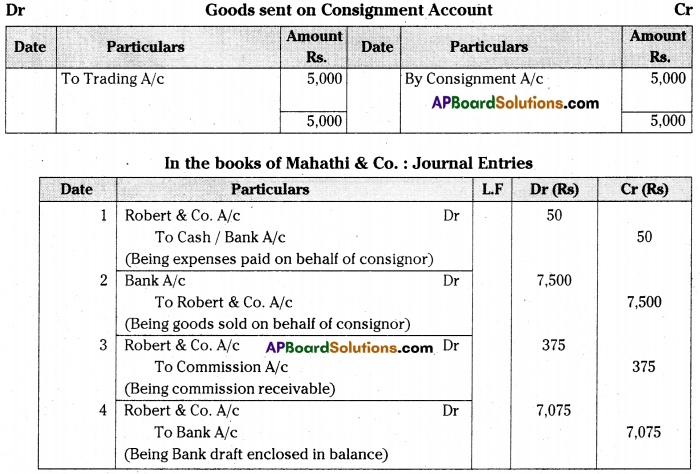

Question 12.

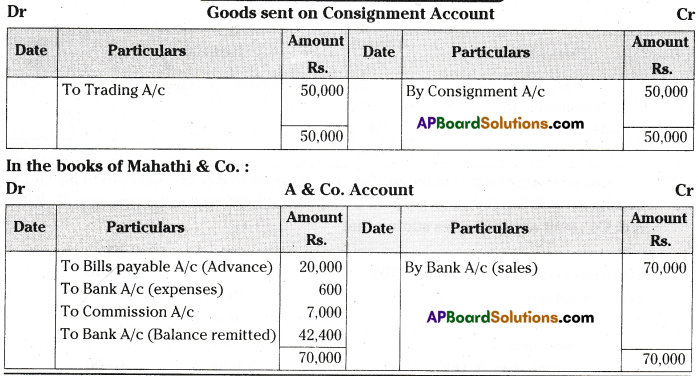

M/s. Robert & Co. of Bangalore consigned 100 cases @ 50 each to Mahathi & Co., of Calcutta. M/s. Robert & Co., spent Rs. 700 Carriage and paid insurance Rs. 250.

In due course account sales was received with the following details:

Pass necessary entries in the books of both of the parties.

Hint: Profit – 1,575, Balance Due – 7,075.

Answer:

In the books of M/s Robert & Co.: Journal Entries

Question 13.

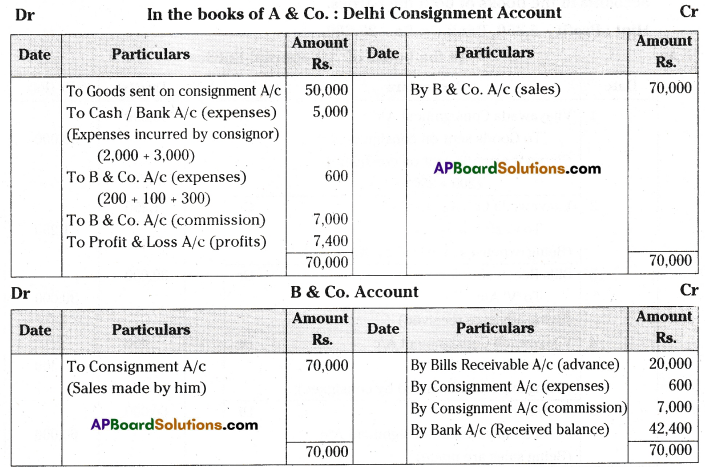

A & Co., of Hyderabad consigned 100 Video Games to B & Co., of Delhi to be sold on consignment @ Rs. 500 each. He paid transport Rs. 2,000 warehouse charges Rs. 3,000. B & Co., sent account sales stating that

Prepare necessary ledger accounts of both the books. Hint: Profit – 7,400, Bank Drafts – 42,400.

Answer:

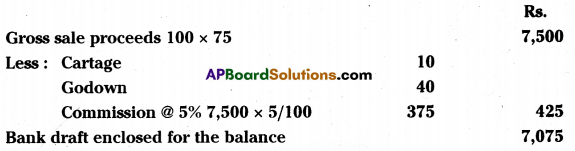

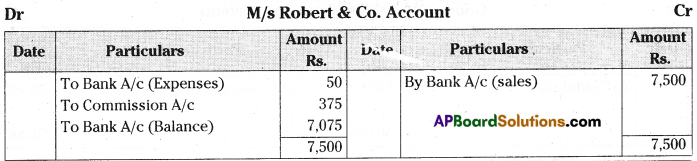

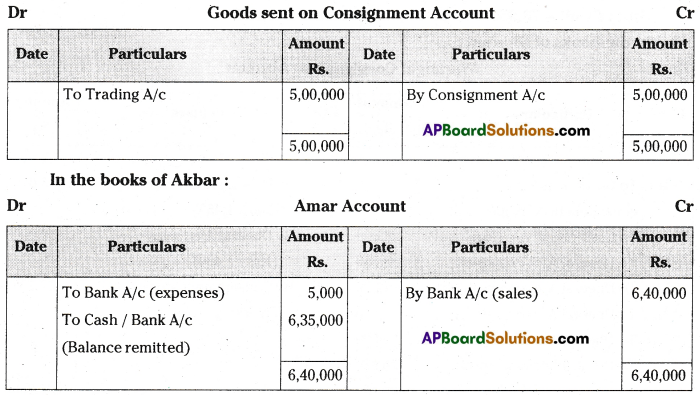

Question 14.

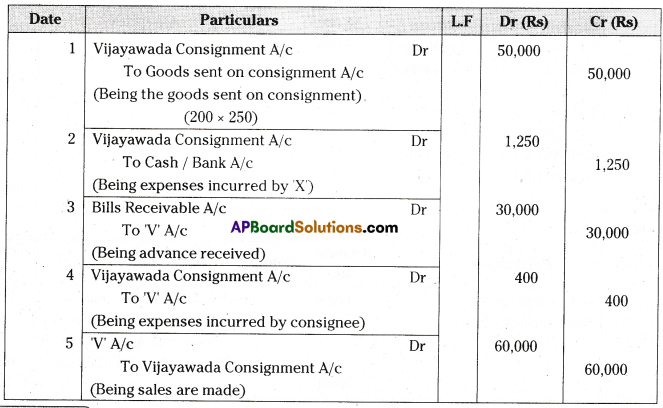

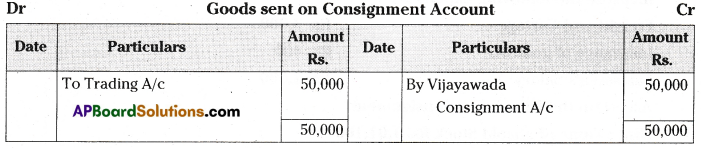

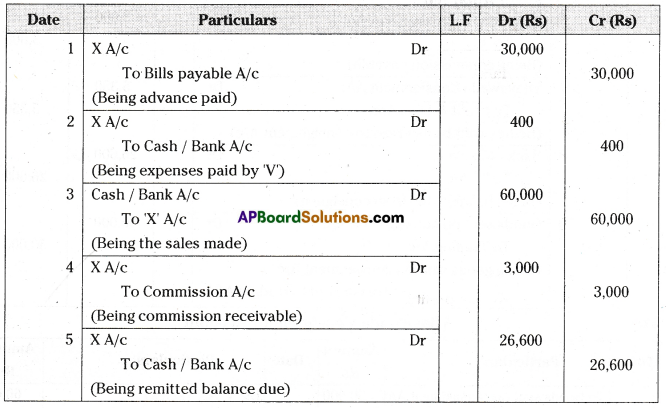

X of Chirala consigned 200 bales of Tobacco @ 250 per bale to V of Vijayawada. X paid cartage of freight etc., Rs. 1,250. X drew a bill on V for 3 months for Rs. 30,000. V sold the entire consignment and rendered account sales showing that the goods realized Rs. 60,000 out of which he deducted his charges amounting to Rs. 400 and commission at 5% on sales. Make entries in the journal and show necessary ledger accounts in the books of both the parties.

Hint: Profit – 5,350, Bank Drafts – 26,600.

Answer:

In the books of ’X’: Journal Entries

In the books of ‘V’: Journal Entries

![]()

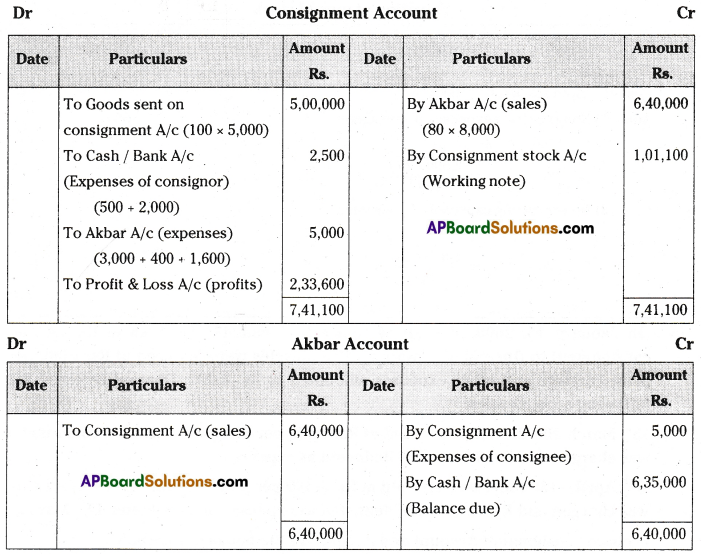

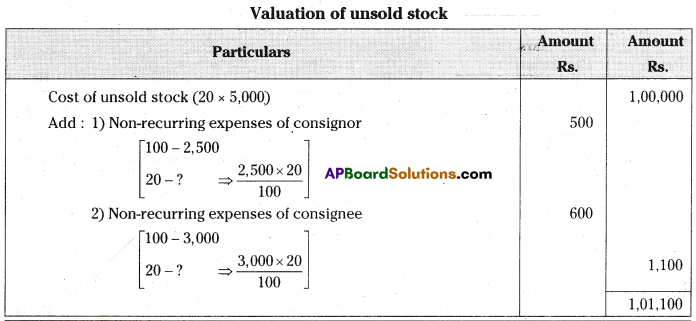

Question 15.

Amar consigned 100 bales of cloth to Akbar at Rs. 5,000 per bale. Amar incurred the following expenses:

Packing and Forwarding Charges Rs. 500

Insurance in Transit Rs. 2,000

Akbar received the consignment and sold 80 bales at Rs. 8,000 per bale. They

incurred the following expenses:

Freight and Cartage Rs. 3,000

Insurance of godown Rs. 400

Salesmen’s Salary Rs. 1,600

Ascertain the value of on consignment.

Hint: Value of unsold Stock Rs. 1,01,100

(140)

Answer:

In the books of Amar (consignor):

Working Note:

Question 16.

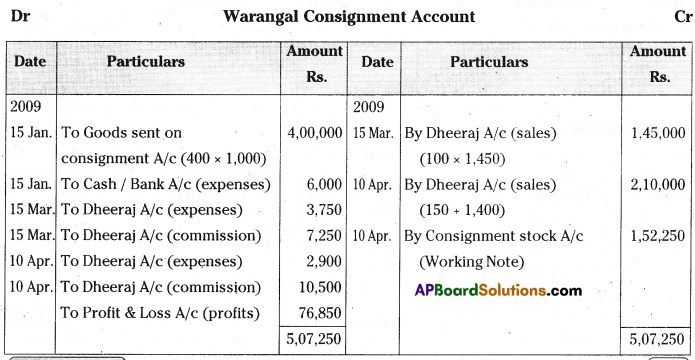

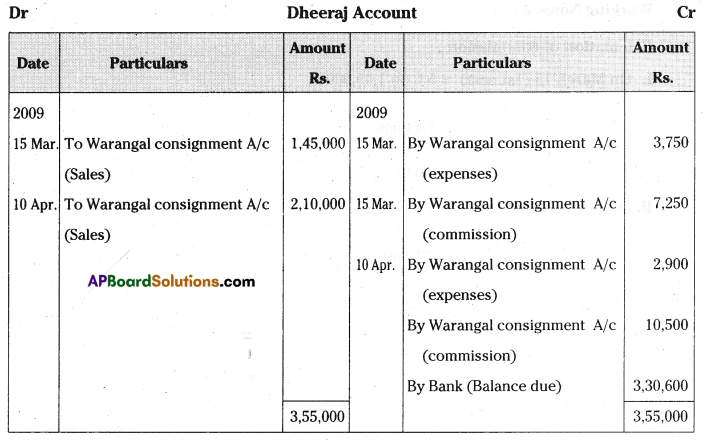

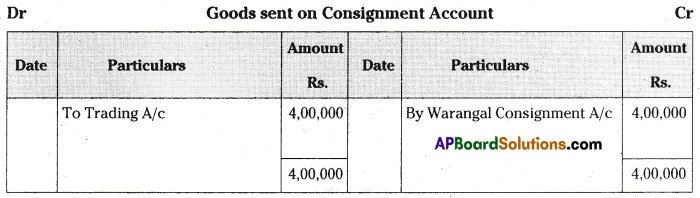

On January 15, 2069 Dharani of Hyderabad sent 400 Bicycles to be sold on consignment to Dheeraj of Waraegal. The Bicycles were invoiced at Rs. 1,000 per piece carriage and other expenses amounted to Rs. 6,000. Dharani received the following account sales.

15th March 100 Bicycles were sold at Rs. 1,450 per piece on which 5% commission was charged and Rs. 3,750 were deducted as expenses.

10th April – 150 Bicycles were sold at Rs. 1,400 per piece on which 5% commission was charged and Rs. 2,900 were deducted as expenses incurred after 15th March.

Prepare consignment Account and Account in the books of Dharani.

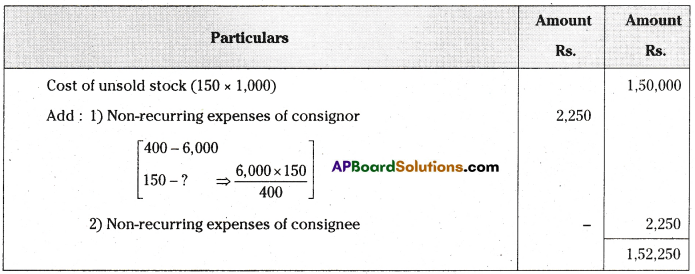

Hint: Profit – 76,850, Stock on consignment – 1,52,250.

Answer:

In the books of Dharani:

Working Note 1:

Working Notes 2:

Calculation of commission:

I. On March 15 (1st sale) = 5% on 1,45,000

= 1,45,000 x 5/100 = 7,250

II. On April 10 (2nd sale) = 5% on 2,10,000

= 2,10,000 x 5/100

= 10,500