Students must practice these AP Inter 1st Year Economics Important Questions 8th Lesson Macro Economic Aspects to boost their exam preparation.

AP Inter 1st Year Economics Important Questions 8th Lesson Macro Economic Aspects

Long Answer Questions

Question 1.

Discuss the implications of the classical theory of employment. [May 2016]

Answer:

The classical theory of employment was developed by Economist such as Adam Smith, David Ricardo, Robert Mathus, etc. It is based on the famous “Law of Markets” advocated by J.B. Say. According to this law, “Supply creates its own Demand”.

The implications of the classical theory of employment may be sumfnorized as follows.

- There is no general over production and general unemployment.

- There is an automatic adjustment of demand and supply levels through the price mechanism.

- There is no need for the interference by the government.

- The whole income is spent. Even if there is saving, all savings will be gradually spent on capital goods. Thus the whole income is spent either on consumption good or on capital goods. It means savings and investments are equal.

- A flexible interest rate keeps saving and investment in equilibrium.

- A flexible wage rate brings about equilibrium in the labour market.

- It is possible to increase output and employment as long as there are unemployed or idle resources.

- Goods are exchanged for goods. Money facilitates such exchange of goods. Hence, money has no other role except acting as medium of exchange.

![]()

Question 2.

Explain salient features of Classical Theory of Employment.

Answer:

The classical economists held the view that in a capitalistic economy, there is always a stable equilibrium at full employment level in the long run under conditions of perfect competition. They consider full employment as a general feature and unemployment a rare phenomenon. If there is unemployment at anytime, the economy has a tendency to movejowards full employment. There would be automatic adjustment through free play of market forces, provided there is no interference by the government. Thus, the classical economists ruled out any general unemployment in the long run. These views are broadly known as the classical theory of output, income and employment.

A. Assumptions of classical theory of employment: The classical theory of employment including J.B. Say’s market law is based on the following assumptions:

- There is a free enterprise economy.

- There is perfect competition in the economy.

- There is no government interference in the functioning of the economy. Price mechanism is allowed to work freely.

- The equilibrium process is considered from the long term point of view.

- All savings are automatically invested.

- The interest rate is flexible.

- The wage rate is flexible.

- There are no limits to the expansion of the market.

- Money acts as the medium of exchange and it has no role to play in the determination of output and employment. It is neutral.

The classical theory of employment can be discussed with three dimensions:

A) Goods market equilibrium.

B) Money market equilibrium and

C) Equilibrium of the labour market (Pigou wage – cut policy).

The equilibrium of the first two markets was propounded by J.B. Say, whereas the third one was advocated by A.C. Pigou.

B. Major aspects of classical theory of employment: The major aspects of the classical theory of employment may be summarized as follows:

- There is no general overproduction and general unemployment.

- There is an automatic adjustment of demand and supply levels through the price mechanism.

- There is no need for the interference by the government.

- The whole income is spent. Even if there are savings, all savings will be gradually spent on capital goods. Thus the whole income is spent either on consumption goods or on capital goods. It means savings and investment are equal.

- Flexible interest rate keeps saving and investment in equilibrium.

- Flexible wage rate brings about equilibrium in the labour market.

- It is possible to increase output and employment as long as there are unemployed or idle resources.

- Goods are exchanged for goods. Money facilitates such exchange of goods. Hence money has no other role except acting as medium of exchange.

Question 3.

Explain the Keynesian theory of employment. [Mar. 19 (TS); Mar. ’18, ’17]

Answer:

The classical employment theory assumed that there is always full employment in the economy. The classical economists consider full employment as a general situation in the long run. But J.M. Keynes criticized it and he considered full employment as a rare phenomenon. He considered full employment as special case in short run.

J.M. Keynes stated his employment theory in his famous book entitled “The General Theory of Employment, Interest and Money”, published in 1936. His theory is known as Keynesian theory of employment.

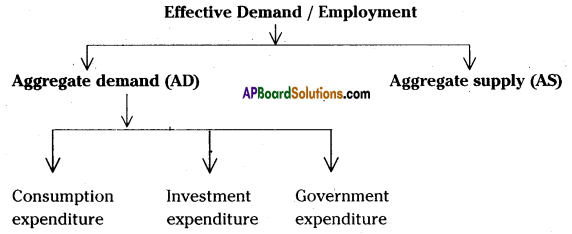

He says that the level of employment is determined by two factors.

- Aggregate supply

- Aggregate demand.

The term effective demand is used to denote that level of aggregate demand which is equal to aggregate supply.

Aggregate Supply: Aggregate supply refers to the toted supply of goods and services in the economy. The level of aggregate supply depends on the level of employment. The minimum amount of money which the producers in the economy must receive by selling the goods and services at different levels of employment is called aggregate supply price. As the level of output increases with the level of employment the aggregate supply price also increases with every increase in the level of employment.

Aggregate Supply Schedule: It shows the various amounts of supply at different levels of employment. It is shown in the table given below.

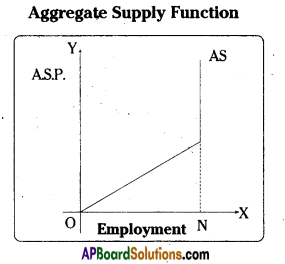

Aggregate Supply Function

| Level of employment (In lakhs of workers) | Aggregate supply price (In crore of rupees) |

| 10 | 500 |

| 11 | 550 |

| 12 | 600 |

| 13 | 650 |

| 14 | 700 |

| 15 | 750 |

| 16 | 800 |

From the above table, we know that as employment increases aggregate supply is increasing. So there is a direct relationship between level of employment and aggregate supply.

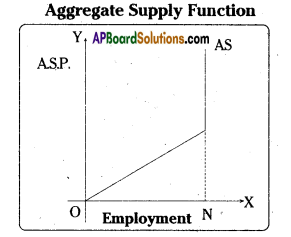

Aggregate Supply Curve: If the above schedule is shown in graph, then we get a curve. This curve is called aggregate supply curve.

Aggregate supply curve can be seen sloping upwards from left to right. It started . from the origin which means the aggregated supply is zero, when the employment is nil. In the above diagram as employment levels increase the AS curve rises to the right. ON is assumed to be full employment level. At this level, aggregate supply the function.AS is parallel to Y – axis which means that the aggregated supply is perfectly inelastic.

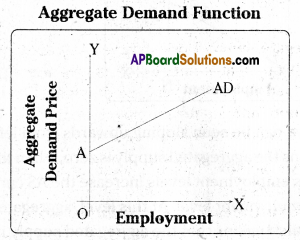

Aggregate Demand: Aggregate demand means the total demand for all commodities in the economy at a particular level of employment. The amount they spend on consumption goods is called consumption expenditure (C) and their expenditure on capital goods is called investment (I). The entrepreneurs expect that the community as a whole is willing to spend certain amount towards purchase of the total output. That expected expenditure is termed as aggregate demand price.

In the above table, as employment increases AD also increases. So there is direct relationship between levels of employment and aggregate demand.

Aggregate Demand Schedule: It shows the aggregate demand at different levels of empioyment.-As the level of employment rises, the total income of the community also rises and therefore the aggregate demand price also increases. This can be seen in the following table.

Aggregate Demand Function

| Level of employment (In lakhs of workers) | Aggregate demand price (In crores of rupees) |

| 10 | 600 |

| 11 | 625 |

| 12 | 650 |

| 13 | 675 |

| 14 | 700 |

| 15 | 725 |

| 16 | 750 |

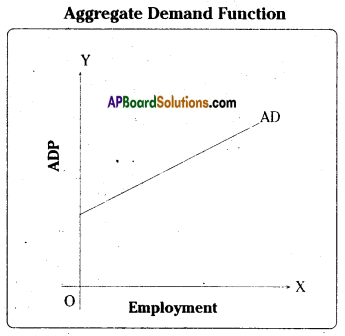

Aggregate Demand Curve: If the AD schedule is shown on a graph, then we get a curve. This curve is called aggregate demand curve. This is shown in the diagram given below.

In the above diagram, AD curve is the aggregate demand curve. It slopes upwards from left to right.

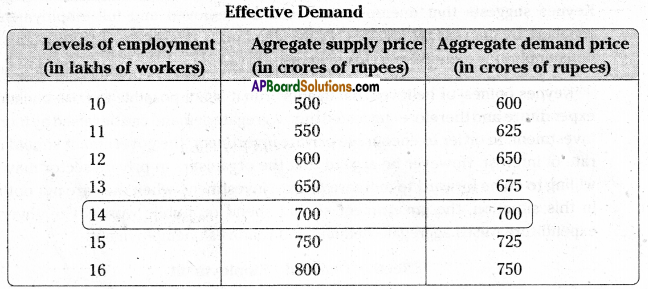

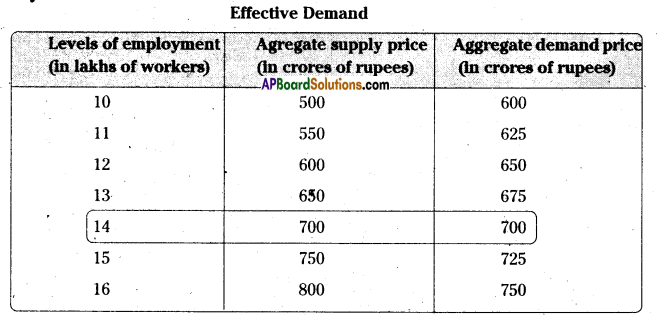

Effective Demand: The level of employment will be in equilibrium at a point where aggregate demand and aggregate supply are equal. The aggregate demand at which it is equal to aggregate supply is called effective demand. This is shown in the table given below.

In the above table, at the employment of 14 lakhs, the aggregate supply and aggregate demand are equal. At the level of employment of below 14 lakhs, aggregate supply is less than aggregate demand. Similarly, at the level of employment of above 14 lakhs aggregate supply is more than aggregate demand. Only at the level of 14 lakhs the A.D and AS are equal. Hence, it is called effective demand.

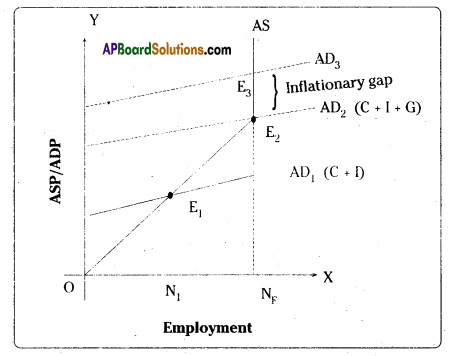

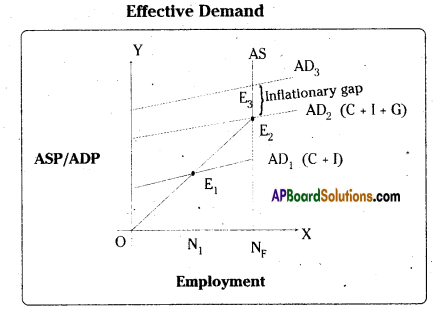

In this diagram, Aggregate demand price curve (AD) and aggregate supply price curve (AS) intersect each other at point “E1“, It shows the equilibrium point. The equilibrium has been attained at “ON1“, level of employment. It is assumed that ON1 in the above diagram does not indicate full employment as the economy is having idle factors of production. So it is considered as under- employment equilibrium.

According to Keynes, to achieve full employment an upward shift of aggregte demand curve is required. This can be possible through government expenditure on goods and services supplied in the economy, whenever private entrepreneurs may not show interest to invest. With this the AD1 curve (C + I) shifts as AD2 (C + I + G) at new point of effective demand E„ where the economy reaches full employment level i.e., ONF.

![]()

Question 4.

How does Keynes advocate government expenditure to reduce unemployment ? Explain.

Answer:

J.M. Keynes was one of the famous British economist of the 20th century. According to Keynes theory, lack of effective demand is the basic cause for unemployment in India.

Keynes suggests that unemployment can be removed and full employment level reached by increasing the aggregate demand. Aggregate demand consists of consumption expenditure (C) .and investment (AD = C + I).

Keynes opines or believes that in short run it is not possible to raise consumption . expenditure and therefore suggested that aggregate demand can be raised by increasing investment. In order to encourage private investment the government should reduce rate’of interest. However he argued that the organisers in private sector may not be willing to come forward to increase private investment, when they are not optimistic.

In this situation, the government should spend on public works. The government expenditure raises aggregate demand and removes unemployment.

In the view of Keynes, the level of employment in the short run will depend on effective demand for goods in the country. Greater the effective demand leads higher volume of employment and vice – versa. Total employment depends on total demand and unemployment is result of a deficiency of total demand.

Effective demand represents the total money spent on consumption and investment. The total national expenditure is equal to total national income which is equal to national output.

So Effective Demand = National Income (Y) = National Output (O)

Effective demand determines the volume of employment in the economy at a particular time, the deficiency of effective demand in employment. The deficiency of effective demand is due to the gap between income and consumption. As income increases, consumption also increases but it is in a smaller proportion than the increase in national income. Since consumption is less, the demand is less. The gap must be filled by increasing investment and hence effective demand. In order to maintain employment at high level. Thus it is increase in effective demand which results in increase in employment or total output or national income.

In terms of expenditure, effective demand means, the total expenditure of the community at a particular level of employment. This expenditure is just equal to economy’s aggregate supply. So effective is the aggregate or total demand of community both for consumption and investment.

Question 5.

Discuss how the Keynesian theory is an improvement over the classical theory of employment.

Answer:

Keynesian theory has a greater particular value in the world of reality. Keynesian theory is entirely new and marks a revolutionary thinking. So it has been aptly called a Keynesian Revolution. Based on ary some point Keynesian theory is better than classical theory, of employment.

Keynesian theory relates to Macro Economics, which studies the economy as a whole but the classical economic theory deals with the individual aspect of the economy that is Micro Economics. Keynes, dealt with Aggregates. Whereas classical economics system, in terms of it innumerable decision – marking units. The classical economists believed that a state of full employment could be brought about through cuts in money wages. But Keynes held that this theory was not only unrealistic but theoretically unsound.

According to Keynes, lowering of wages in any particular industry might increase employment there. But in reality reducing wages caused for reduction in income level of the public. It leads reduce in effective demand and the volume of employment.

In the point view of classical group of economists, interest is the reward for “waiting”. But in the point view of Keynes, rate of interest is the reward for parting with liquidity. The classical economists opined that Rate of Interest is determined by the intersection of the saving and investment schedule. The Keynes theory gives us a set of liquidity preference schedule’s various levels of income.

The classical theory is based on the conception of static economy. Whereas Keyne’s theory is dynamic. Keynes theory is a general theory and as such as a very wide application to all situations – unemployment, partial employment and’near full employment.

The classical theory analysis relates only to full employment. The classical economists consider full employment a general feature and unemployment a rare phenomenon. Keynes integrated the theory of money with the theory of value and output.

According to the classical economists, increase in money supply brings about inflation and must, therefore, be avoided, this arose from their convention that allows existed full employment. But Keynes pointed out that full employment was a rare phenomenon, actually there was generally less than full employment so that some productive resources of the community lay idle and unemployed, totally or partially. That being, an increase in money supply would increase employment and output and may riot thus necessarily be in inflation.

Thus Keynes’ theory has great relevance to the world reality and has great particular value. Whereas the view of the classical economists are more or less theoretical and devoid of any particular importance.

Question 6.

Explain the concept of underemployment equilibrium with the help of a diagram.

Answer:

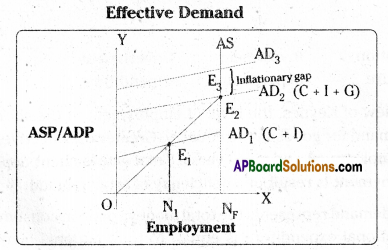

Keynes dealt with underemployment equilibrium in his employment theory. Keynesian employment theory states that in general there is unemployment in the economy in the short run and that unemployment is caused by the deficiency of aggregate demand. This can be explained with the help of the following diagram.

In the above diagram, the aggregate demand price curve (AD), aggregate supply curve (AS) intersect each other at point E1. It shows the equilibrium point. The equilibrium has been attained at ON, level of employment. It is assumed that ON, in the above diagram does not indicate full employment as the economy is having idle factors of production. So it is considered as underemployment.

Aggregate demand helps determine output in the Keynesian approach. In the Keynesian approach “AS” is an upward sloping curve unlike a vertical line in the classical work or approach. Hence, the first observation is that when AD intersect AS at E1, it implies that a modern market economy can get trapped. An underemployment equilibrium is a balance of aggregate supply and demand, in which output is far below potential and a substantial fraction of the work force is involuntarily unemployed.

For instance, if AD is depressed shown as a point E, in the above figure, the economy may get stuck in high unemployment equilibrium for a long period. Keynes’ second observation is that through monetary fiscal policies, the government can stimulate the economy and maintain high levels of output and employment.

To achieve full employment an upward shift of aggregate demand curve is required. This can be possible through government expenditure on goods and services supplied in the economy whenever private entrepreneurs may not show interest to invest. With this the AD1 curve (C + I) shifts as AD1, (C + I + G) at new point of effective demand E2, where the economy reaches full employment levels i.e., ONF.

![]()

Question 7.

Describe the various methods of redemption of public debt. [Mar. ’19 (AP & IS); May 2018. 2017]

Answer:

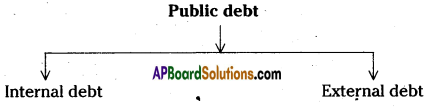

When the government’s expenditure exceeds its revenue, the government can borrow funds from various sources within the country or from abroad. Such debts are known as public debt.

On the basis of the sources, public debt is classified into two categories

Internal debt: It is the fund which is borrowed by a government from the people and institutions within the country. In other words, debts floated within the country is called internal debt.

External debt: It is the fund / amount which is borrowed by a government from the individuals, institutions, and governments of other countries, (or) In other words, debt floated from abroad is called “external debt”.

Redemption of public debt: Repayment of debt by government is called redemption of public debt. Internal debt can be repaid in the domestic currency, but to repay external debt foreign exchange is necessary (dollars.).

The following are the methods of redemption of public debt.

1) Surplus budget: Surplus budget means having public revenue is excess of public expenditure. If the government plans for a surplus budget, the excess revenue may be utilized to repay public debt.

2) Refunding: In this method, the government sells new bonds and securities in the •market and the money thus raised is utilized for the repayment of old or maturing debts.

3) Annuities: By using this method, the government repays part of the public debt every year. These are called annuities. Such annual payments are made regularly till the debts are completely cleared.

4) Sinking fund: By using this method, the government creates a separate fund called ’sinking fund’ for the purpose of repaying public debt. A part of the public revenue is deposited into fund every year. Public debt is repaid from the sinking fund. This method is considered as the better method of redemption.

5) Conversion: Conversion means that existing loans are changed into new loans before the date of their maturity. This method is advantageous when the rate of interest charged on the new loans is less than the rate of interest to be paid on the existing loans.

6) Additional taxation: The government can levy new taxes and raise funds for the repayment of old debts. Under this method new taxes are imposed.

7) Capital levy: It is a heavy one – time tax on the capital assets and estates.

8) Surplus balance of payment: This is useful to repay external debt for which foreign exchange is required. Surplus balance of payment implies exports in excess of imports by which reserves of foreign exchange can be created.

Short Answer Questions

Question 1.

“Supply creates its own demand.” Comment on the statement. [March 2018, 2017]

Answer:

Jean Baptist Say (1767 -1832) was a French economist and a business man. He founded the French classical school of Economics. He wrote a book titled “Treatise on Political Economy” in 1803 which became so much famous that it was used as a textbook in American colleges in those days. His writings influenced many countries.

The classical theory of employment is based on the Say’s law of market. The famous law of markets propounded by J.B. Say states that “Supply creates its own demand.” This law is generally interpreted as supply always equals demand or it can be expressed as S = D. Whenever additional output is produced in the economy, the factors of production which participate in the process of production, earns income in the form of rent, wages, interest and profit.

The total income so generated is equivalent to the total value of the additional output produced. Such income creates additional demand necessary for the sale of the additional output. Therefore the question of the additional output not being sold does not arise. It is assumed that the whole income is spent on purchase of commodities, partly on consumption goods and partly on capital goods.

Question 2.

Enumerate the assumptions of Classical theory of employment.

Answer:

The classical theory of employment is based on the Say’s law of market. The famous law of market propounded by the J.B. Say states that “Supply creates its own demand. The above law is generally interpreted as supply always equals demand. So it can be expressed as S = D.

Assumptions:

- There is a free enterprise economy.

- There is a perfect competition in the economy. .

- There is no government interference in the functioning of the economy. Price mechanism is allowed to work freely.

- The equilibrium process is considered from the long term point of view.

- All savings are automatically invested.

- The interest rate is flexible.

- The wage rate is flexible.

- There are no limits to the expansion of the market.

- Money is neutral. It acts as medium of exchange and it has no role to play in the determination of output and employment.

Question 3.

Explain the criticism against the classical theory of employment.

Answer:

J.M. Keynes criticized, the basic assumptions of classical theory. According to him, the assumption of classical theory are far from reality. The main points of criticism are as follows.

1) The assumption of full employment is unrealistic. It is a rare phenomenon and not a normal feature.

2) The wage cut policy is not a practical policy in the modern times. The supply of labour is a function of money wage and not real wage. Trade unions would never accept and reduction in the money wage rate.

3) Equilibrium between savings and investment is not brought about by a flexible rate of interest. In fact, saving is asfunction of income and not of interest.

4) Classical economists believe that the economic forces automatically adjust by themselves without interference of government. But automatic adjustment mechanism failed to restore full employment during the period of economic depression in 1930.

5) Long run approach to the problem of unemployment is also not realistic. Keynes commented, “We are all dead in the long run”. He considered unemployment as a £hort run problem.

6) J.M. Keynes dissolved the classical assumption that “Money is neutral”. He integrated monetary variables with real variables through rate of interest and successfully demonstrated effect of change in money supply in the real variables.

![]()

Question 4.

Explain the wage cut policy. [Mar. 19 (AP); May 2018]

Answer:

Wage cut is the policy advocated by A.C. Pigou, classical economist to reduce unemployment in the economy. It suggests that the wage of the labour should be reduced so that the unemployed can be employed. Wage cut policy is associated with the name of A.C. Pigou who defended the classical theory and its full employment assumption. Pigou and others considered the wage fund as given. With the given wage fund, a reduction in the wage rate results in the increase in employment.

According to classical theory supply of and demand for labour are determined by the real wage rate. Demand for labour is determined by the marginal productivity of labour.

Margined productivity of labour declines as the employment of labour increases, due to the operation of the law of diminishing returns. Therefore demand for labour also declines as more labour get employed. The labour is paid wages equivalent to their marginal productivity.

The marginal productivity is reflected in the reed wage rate.

The demand for labour is the inverse function of the real wage rate. It goes on increasing as the real wage rate increases. At a particular real wage rate the supply of and the demand for the labour in the economy become equal and thus equilibrium is attained in the labour market.

In other words, it can be stated that all workers who are willing to work at the prevailing wage rate get employed. Thus there is full employment of labour. It means that there is no involuntary unemployment.

Question 5.

Distinguish between aggregate Supply price and aggregate demand price.

Answer:

Aggregate Supply: Aggregate supply refers to the total supply of goods and services in the economy. The level of aggregate supply depends on the level of employment. The minimum amount of money which the producers in the economy must receive by selling the goods and services at defferent levels of employment is called aggregate supply price. As the level of output increases with the level of employment the aggregate supply price also increases with every increase in the level of employment.

Aggregate Supply Schedule: It shows the various amounts of supply at different levels of employment. It is shown in the table given below.

Aggregate Supply Function

| Level of employment (In lakhs of workers) | Aggregate supply price (In crore of rupees) |

| 10 | 500 |

| 11 | 550 |

| 12 | 600 |

| 13 | 650 |

| 14 | 700 |

| 15 | 750 |

| 16 | 800 |

From the above table, we know that as employment increases aggregate supply is increasing. So there is a direct relationship between level of employment and aggregate supply.

Aggregate Supply Curve: If the above schedule is shown in graph, then we get a curve. This curve is called aggregate supply curve.

Aggregate supply curve can be seen sloping upwards from left to right. It started from the origin which means the aggregated supply is zero, when the employment is nil.

In the above diagram as employment levels increase the AS curve rises to the right. ON is assumed to be full employment level. At this level, aggregate supply the function AS is parallel to Y – axis which means that the aggregated supply is perfectly inelastic.

Aggregate Demand: Aggregate demand means the total demand for all commodities in the economy*at a particular level of employment. The amount they spend on consumption goods is called consumption expenditure (C) and their expenditure on capital goods is called investment (I). The entrepreneurs expect that the community as a whole is willing to spend certain amount towards purcha’se of the total output. That expected expenditure is termed as aggregate demand price.

Aggregate Demand Schedule: It shows the aggregate demand at different levels of employment. As the level of employment rises, the total income of the community also rises and therefore the aggregate demand price also increases. This can be seen in the following table.

| Level of employment (In lakhs of workers) | Aggregate demand price (In crores of rupees) |

| 10 | 600 |

| 11 | 625 |

| 12 | 650 |

| 13 | 675 |

| 14 | 700 |

| 15 | 725 |

| 16 | 750 |

In the above table, as employment increases AD also increases. So there is direct relationship between levels of employment and aggregate demand.

Aggregate Demand Curve: If the AD schedule is shown on a graph, then we get a curve. This curve is called aggregate demand curve. This is shown in the diagram given below.

In the above diagram, AD curve is the aggregate demand curve. It slopes upwards from left to right.

Question 6.

Explain the concept of effective demand. [May 2017, 2016]

Answer:

Effective demand is that level of aggregate demand which is equal to the aggregate supply. Every level of aggregate demand cannot be called effective demand. When aggregate demand is equal to the aggregate supply the economy is in equilibrium.

Effective Demand: The level of employment will be in equilibrium at a point where aggregate demand and aggregate supply are equal. The aggregate demand at which it is equal to aggregate supply is called effective demand. This is shown in the table given below.

Effective Demand

In the above table, at the employment of 14 lakhs, the aggregate supply and aggregate demand are equal. At the level of employment of below 14 lakhs, aggregate supply is less than aggregate demand. Similarly, at the level of employment of above 14 lakhs aggregate supply is more than aggregate demand. Only at the level of 14 lakhs the A.D and AS are equal. Hence, it is called effective demand.

In this diagram, demand price curve (AD) and aggregate supply price curve (AS) intersect each other at point “E,”. It shows the equilibrium point. The equilibrium has been attained at “ON,”, level of employment. It is assumed that ON, in the above diagram does not indicate full employment as the economy is having idle factors of production. So it is considered an under-employment equilibrium.

According to Keynes, to achieve full employment an upward shift of aggregate demand curve is required. This can be possible through government expenditure on goods and services supplied in the economy, whenever private entrepreneurs may not show interest to invest. With this the AD1 curve (C + I) shifts as AD2 (C + I + G) at new point of effective demand E2, where the economy reaches full employment level i.e., ONF.

![]()

Question 7.

What are the sources of public revenue? [Mar. 19 (AP&TS); May, Mar. 18, 17]

Answer:

Revenue received by the government from different sources is called public revenue. Public revenue is broadly classified into two kinds.

- Tax revenue

- Non – tax revenue.

1) Tax Revenue: Revenued received through a collection of taxes from the public is called tax revenue. Both the Central and State governments collect taxes as per their allocation in the Constitution.

Broadly taxes are divided into two categories,

a) Direct taxes:

- Taxes on income and expenditure. E.g: Personal income tax, corporate tax, interest and expenditure tax.

- Taxes on property and capital assets. E.g: Wealth tax, gift tax, estate duty.

b) Indirect taxes:

- Taxes levied on goods and services. E.g: Excise duty, customs duty, service tax.

- Non-tax Revenue: Government receives revenues from sources other than taxes and such revenue is called the non-tax revenue. The sources of non-tax revenue are as follows.

a) Administrative revenue: Government receives money for certain administrative services. Ex: License fee, tuition fee, penalty, etc.

b) Commercial revenue: It is the second most important source of public revenue. Modern governments establish public sector units to manufacture certain goods and offer certain services. These goods and services are exchanged for the prices. The government gets revenue from public sector units like IOC, BSNL, Indian Railways, Indian Airways, etc.

c) Loans and advances: When the revenue received by the government from taxes and from the above non – tax sources is not sufficient to meet the needs of government expenditure, it may receive loans from the financial institutions operating within the country and also from the public. Modern governments can also obtain loans from foreign governments and international financial institutions.

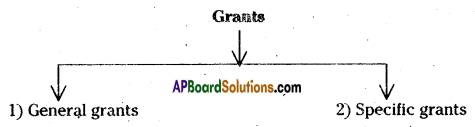

d) Grants-in-aid: Grants are amounts received without any condition of repayment. They are not repaid. State governments receive such grants from the central government. The Central government may receive such grants from foreign governments or any international funding agency.

Grants are of two types.

1) General grants: When a grant is given to meet the shortage of funds in general without specifying a purpose, it is called general grant.

2) Specific grants: When a grant is given for a specific purpose, it is called a specific grant. It cannot be spent on any other purpose.

E.g.: Education grant, Family planning grant, etc.

Question 8.

List out various Items of public expenditure. [May 2018, 2016]

Answer:

Public expenditure is an important part of public finance. Modern governments spend money to perform various functions. The expenditure incurred by the government on various economic activities is called the public expenditure. Usually public expenditure will be made on following aspects.

- Defence

- Internal security (Police)

- Economic services (agriculture, industry, power, transport, communication, science and technology, etc.)

- Social services (education, health, broadcasting, etc.)

- Other general services (organs of State, tax collection, external affairs, etc.)

- Pensions

- Subsidies

- Grants to state governments

- Grants to foreign governments

- Loans to state governments

- Loans to public enterprises

- Loans to foreign governments

- Repayment of loans (principal amount, interest and debt management)

- Assistance to states on natural calamities, etc.

- Expenditure made for day to day administration

Public expenditure transfers money to the community. The income of the society increases on account of the increase in public expenditure. Development may take place.

Very Short Answer Questions

Question 1.

Classical Economics.

Answer:

The term ‘Classical Economics’ refers to the body of economic doctrines which held their way from the latter half of the 18th century to the early part of the 20th century. The most important tenets of classicism are personal liberty, private property and freedom of private enterprise, i.e., Laissez faire.

Question 2.

Laissez faire. [May 2016]

Answer:

According to classical the role of government in economic activities should be nominal or very less. The free play of economic forces itself brings about the fuller utilization of economic resources including labour. Any interference with the free play of market force, Say’s theory shall fail to bring about full employment.

Question 3.

Say’s Law of Markets. [Mar. 19 (AP & TS); May 2018]

Answer:

J.B. Say, French economist advocated the famous “Law of markets” on which the classical theory of employment is based. According to this law “Supply creates its own demand’. According to this law, whenever additional output is created, the factors of production which participate in that production receive incomes equal to that value of that output.

Question 4.

Market Mechanism.

Answer:

Market mechanism plays an important part under capitalism in the allocation of productive resources. Under the market mechanism, the prices are determined based on the demand and supply forces. The equilibrium price is determined, where the demand is equal to the supply of a commodity. In the private sector, the decisions regarding production are taken by the private people in accordance with relative profitability of that type of production.

Question 5.

Full Employment. [May, March – 2017 ; May 2016]

Answer:

Full employment is a situation in which all those who are willing to work at the existing wage rate are engaged in work. Full employment implies the absence of involuntary unemployment.

Question 6.

Aggregate Demand Function.

Answer:

The schedule showing aggregate demand price at different levels of employment is called the aggregate demand function.

Question 7.

Aggregate Supply Function.

Answer:

The schedule showing the aggregate supply price at different levels of employment is called the aggregate supply function.

![]()

Question 8.

Effective Demand. [Mar. 19(AP)

Answer:

Effective demand is that aggregate demand which becomes equal to the aggregate supply. This refers to the aggregate demand at equilibrium.

Question 9.

Difference between Revenue Account and Capital Account.

Answer:

Current account consists of current transactions and includes value of transactions relating to exports, imports, travel expense, insurance, investment income, etc. Capital account refers to capital transactions such as borrowing and lending of capital, repayment of capital, sale and purchase of securities, etc.

Question 10.

Difference between Internal Debt and External Debt.

Answer:

Internal debt is the debt raised from the sources such as banks, financial institutions, private individuals within the country and the borrowings of the government from the sources outside the country are.called external debt.

Question 11.

Structure of Budget. [March – 2018]

Answer:

In the structure of budget, budget estimates for the ensuing financial year is shown along with the actual expenditure of the preceding financial year budget estimates and revised estimates for the current financial year.

Question 12.

Deficit Budget. [Mar. 19(TS); May 2017]

Answer:

Deficit budget refers to the budget in which the total expenditure exceeds the total revenue.

Question 13.

Fiscal Deficit. [May. March – 2018; March 2017]

Answer:

Fiscal deficit is the difference between the total expenditure and the total revenue minus the market borrowings. In other words, fiscal deficit is the budget deficit plus the market borrowings and other liabilities.

Fiscal deficit = (Total revenue – Total expenditure) + market borrowings & other liabilities, (or)

Fiscal deficit = Budget deficit + market borrowings and other liabilities.

Question 14.

Primary Deficit.

Answer:

When we subtract the interest payments from fiscal deficit, we get primary deficit. Primary deficit = Fiscal deficit – Interest payments.