Students must practice these AP Inter 1st Year Economics Important Questions 6th Lesson Theory of Distribution to boost their exam preparation.

AP Inter 1st Year Economics Important Questions 6th Lesson Theory of Distribution

Long Answer Questions

Question 1.

Define Rent and explain Ricardian theory of Rent.

Answer:

Generally rent refers to the remuneration or price paid for the use of durable goods for some period of time like a car, cycle, etc. In Economics, rent refers to the reward/ price paid to the factor of production land, for its services.

Ricardian theory of rent / Classical economic rent: According to David Ricardo, rent is the price paid for the use of land or for free gifts of nature. He defines rent as follows:

” Rent is that portion of the produce of the earth which is paid by tenant for using the original and indestructible powers of soil.”

According to David Ricardo, rent is “differential surplus” earned by more fertile lands in comparison with less fertile land. He feels that rent arises because of differences in the fertility of soils or lands.

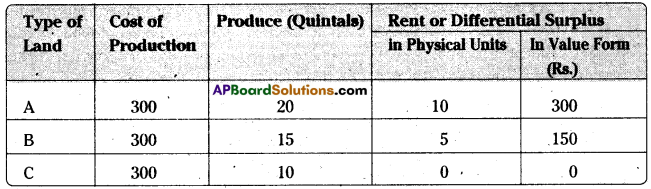

Prof. Ricardo explained the concept of rent with the help of an example A new island is discovered and people have migrated to that place. The first batch of people cultivate A-grade land which is highly fertile. The expenses of cultivation on that land are Rs. 300. The yield on this type of land is 20 quintals of paddy. So, the average cost per quintal is Rs. 15. To cover the expenses of agriculture (cultivation) paddy is to be sold in the market at Rs. 15 per quintal. So there is no rent for this land because the cost of cultivation is equal to the revenue obtained from the sale of the output.

Another batch of people come to that area and start cultivating B grade land which is less fertile than A grade land. For this land also, the expenses of cultivation are Rs. 300 but this land gives only 15 quintals of paddy. To recover cost of the cultivation, paddy received from this land is to be sold at Rs. 20 per quintal. The increase in this demand for paddy raises its price to Rs. 20 per quintal. So, the sale price of paddy in the market received from A-grade land, B-grade land (20 + 15 quintals) will be Rs. 20 uniformly per quintal. So, now A – grade land will have surplus rent of 5 quintals of paddy, having a value of Rs. 100. In this way, if only A-grade land is cultivated, there is no rent on it. Rent on A-grade land arises only When B-grade land is also cultivated, there is no rent on it. Rent on A -grade land arises only when B-grade land is also cultivated.

After sometime, C-grade land is cultivated by new batch of people. C-grade land is less fertile than B-grade land. The expenses of cultivation orfthis land are also Rs. 300 but this land gives only 10 quintals of paddy. The average cost per quintal is Rs. 30. To recover the cost of cultivation of this land, paddy is to be sold in the market per Rs! 30 per quintal. The increase in the demand for paddy further increases price of paddy to Rs. 30. So, at the market price of Rs. 30 per quintal B-grade land will have a surplus or rent of 5 quintals and its value is 150. The rent or surplus on A-grade land has increased from 5 quintals to 10 quintals, land vlaue from Rs. 100 to Rs. 300.

This theory can be explained with help of following table and diagram.

Economic Rent = Value of agricultural produce – Cost of cultivation The shaded area represents the rent or differential surplus.

The above table clearly shows that when less fertile lands, B-grade and C-grade, are cultivated the rent or differential surplus of more fertile lands increases. According to David Ricardo, fertile lands will not.have rent if less fertile lands are not cultivated. Lands which are not having rent or differential surplus are known as “Marginal Land”. Assumptions of the Law:

- Land is a free gift of nature and has no cost of production.

- Supply of land is absolutely fixed or the supply of land is perfectly inelastic.

- Land has original and indestructible powers.

- Land has only single use, i.e. cultivation of crops.

- Land is heterogeneous, which means lands differ in fertility.

- When used for agriculture, land is subject to the law of diminishing returns.

- Last grade of land, which does not have rent is called Marginal Land.

![]()

Question 2.

Explain the Marginal Productivity Theory of Distribution.

Answer:

This theory was introduced by Prof. David Ricardo but was later developed by J.B. Clark. According to this theory, the price-a factor of production is determined by its marginal productivity. Productivity refers to the quantity of output produced by the use of the factor or factor of production. When a worker produces 10 units in a day, the productivity of that worker is 10 units.

Marginal Productivity: Marginal productivity or marginal product means the increase in the total output when one more unit of a factor (labour) is employed, keeping the other factors constant. E.g: 10 workers can produce 50 pens in a day. 11 workers are producing 52 pens. So, the marginal product of the 11th worker is 2 pens because the quantity of pens has increased from 50 to 52 when the 11th worker is employed.

If the price of each pen is Rs.5 in the market, the value of the additional pens (output) produced by 11th worker is Rs. 10. So, the increase in the total value of pens by Rs. 10 is also called margined revenue product or marginal value product.

Assumptions of the theory: The theory is based on the following assumptions:

- There is full employment of factors of production.

- Substitution of factors of production for each other is possible.

- There is perfect competition both in product market and in factor markets.

- There is perfect mobility of factors of production.

- The firm employs the factor till its price becomes equal to its marginal productivity.

- The marginal productivity of an individual factor can be measured. ,

“Under static conditions every factor including entrepreneur would get a remuneration equal to its Marginal Product or Marginal Value/Revenue Product” – J.B. Clark

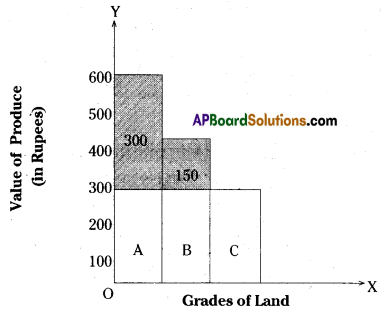

This theory states that the price or remuneration of each factor of production is determined basing on its marginal productivity. Factors having higher marginal productivity can get higher price/reward than factors having lower marginal productivity. In other words, the reward or price of any factor of production is equal to its Marginal Revenue Product (MRP) or Margined Value Product (MVP). The law can be explained with the following diagram.

In the above diagram the firm employee OL quantity/number of workers. This is because, when the firm employs or uses OL quantity of labour/workers, wage rate OP is equal to Margined Revenue Product of OL workers.

If the firm uses/employs less than OL quantity of labour (i.e., OL1 workers), Marginal Revenue Product (MRP) of OL1 workers is higher (E1L1) than the Wage Rate (OP). This means the employment of more workers up to OL, add to the revenue and profits of the entrepreneur.

If the firm employs more than OL, quantity of workers’ (i.e., OL2 workers), the Marginal Reveue Product of (MRP) of OL2 workers (E2L2) is less than the Wage Rate OP. It means, that employment of more workers than OL adds more to the cost of the firm than to the revenue firm. Hence, the firm employs/uses that quantity of factors/workers where the MRP of factor is equal to its price/reward.

Question 3.

What is meant by Real Wages? And what are the factors that determine real wages?

Answer:

The term real wage, refers to the quantity of goods and services that can be purchased with given money wages. It is the money wage expressed in terms of general price level or purchasing power. Real wage is an important concept that determines the standards of living of the people. There is an inverse relationship between real wage and price level.

Determinants of Real Wages:

1) Purchasing Power of Money: Whether real wage is higher or lower depends upon the purchasing power of money. An increase in the general price level, by lowering the purchasing of money, results in lower real wages and vic-versa.

2) Method or Form of Payment: If the worker gets additional facilities like free housing, free transport, free medical facilities, etc. along with money wages, his real wage will be higher.

3) Working Conditions: If workers are having good working conditions like more holidays, less hours of work, etc. their real wages will be higher.

4) Possibility of Extra Earnings (Subsidiary Earnings): In some occupations, there is a possibility or opportunity of having extra earnings. In such occupations, real wages will be higher.

E.g: Government doctors earning through private practice.

5) Regularity of Employment: If the employment is regular and permanent, real wage will be higher. But if employment is temporary and irregular, real wage will be lower.

6) Future Prospects: In jobs where there are better future prospects like promotional opportunities, etc. real wages will be higher.

7) Nature of Employment: Whether real wage is high or low depends upon the nature of work. If the job is a more dangerous, difficult and involves more risk, real wage will be less.

E.g: Pilots of airplanes, mining workers working underground, etc.

8) Timely Payment: If workers are employed in those organisations where there is regular payment of wages, real wage tends to be high, even though money wages are very low.

9) Social Prestige: Real wage tends to be very high if a person is employed in a job which carries a lot of social prestige.

E.g: District Collector, Judge of a High Court, etc.

10) Period of Education and Educational Expenses: Real wages are also influenced by length of education and amount of educational expenditure. Between two persons receiving the same amount of money wage, real wage of that person tends to be high who is less educated and incurred less expenditure on education.

Question 4.

What is meant by wages? Explain briefly various theories of wages.

Answer:

In Economics, the term wage refers to the reward paid to the factor of production, labour for its services. In other words, it is price or reward paid to labour to its services, whether physical or mental.

According to Benham, wage can be defined as “the sum of money paid under contract by an employer to a worker, for the services rendered.”

Theories of Wages:

1) Subsistence Theory of Wages: This theory was developed by a group of French economists, known as Physiocrats. According to them, wage rate should always be equal to the subsistence wage.

Subsistence wage is that amount of wage which enables the worker and his family to satisfy the basic or minimum requirements of life like food, clothing, shelter, etc.

According to Physiocrats, if the actual wage rate is above the subsistence wage * ‘rate, workers are encouraged to get married and to have more number of children. So, the supply of labour increases which results in a fall in the actual wage/market wage rate to subsistence level.

On the other hand, if the actual wage in the labour market is below the Subsistence Wage Rate, workers are discouraged to get married. In addition, there will be starvation and diseases in labour families. All these will result in a decrease in labour supply. The fall in the supply of labour in labour market will push up the actual wage to the subsistence level.

In the nutshell, the theory states that wage rates should always be at the subsistence wage level.

2) Wage Fund Theory: This theory was developed by J.S. Mill. According to J.S. Mill, in every organisation, the entrepreneur maintains (keeps aside) some amount of working capital towards the payment wages. Such amount or fund is known as wage fund.

![]()

According to J.S.Mill, wage rate depends on amount of wage fund (which cannot be increased in the short run) and quantity or supply labour. According to him, wage rate can increase if there is, either an increase in rhe wage fund or fall in the supply of labour.

Amount of wage fund

Wage Rate = Number or quantity of labour

According to this theory, wage rates are inversely related to the supply of labour and directly to the amount of wage fund.

3) Residual Claimant Theory of Wages: This theory was introduced by Prof. Walker. According to Prof. Walker, among the four factors of production, worker is the residual claimant. According to this theory, worker gets as his wages whatever residue or balance is left out, after making payments to land capital and entrepreneur (in the form of rent, interest, profit) from the sale value (sales revenue) of the goods sold.

Wages = Total Sales Revenue – (Rent + Interest + Profit)

4) Taussig’s Theory of Wages: This is a revised or modified version of marginal productivity theory. According to Prof. Taussig, the wages of workers are equal to the discounted (value of) marginal product (MRP/MVP) of labour.

Being very poor, workers in general have less waiting capacity. Similarly, there is a lot of time gap between the completion of work/completion of production and sale of the good. Workers expect advance payment of wages to be made before the completion of the sale of goods. For making such advance payment of wages to workers, the employer deducts a certain percentage from the final output (value of the work done by workers) to cover the risk involved in advance payment of wages. Hence, according to Prof. Taussig, wages are equal to the discounted marginal product of labour.

5) Modern Theory of Wages: This theory was introduced by Alfred Marshall and J.R.Hicks. According to them, price of labour, i.e., the wages of workers, like any other good, are determined by two forces namely, demand for labour and suppb’ of labour.

Demand for labour is dependent oh factors like demand for the product to be produced, prices of other supporting factors, technology, etc. Supply of labour depends on factors like size of the population, age composition of the population, qualifications, level of education, mobility of labour, etc.

According to Marshall and Hicks, wages in factor market or labour market, are determined at that point where demand for labour and supply of labour are equal.

![]()

Question 5.

What is meant by interest? Explain briefly various theories of interest.

Answer:

Interest is the price or reward paid for the use of capital. It is the reward paid to those who save and lend. In other words, it is the share of National Income that goes to the capitalists/capital.

According to Seligman, “Interest is the return from the fund of capital.”

According to J.M. Keynes, “Interest is the reward paid to the lender of money for parting with liquidity for the specific period.”

According to Carver, “Interest is the income which goes to capital.”

Theories of Interest:

1) Abstinence or Waiting Theory of Interest: This theory was introduced by Nassau Senior. According to him, creation or accumulation of capital is possible only through postponing consumption. It means that savings are possible only through abstaining or refraining from consumption/spending. But abstaining from consumption (not making expediture) is painful. Similarly, lending of funds or money involves lenders making sacrifices. Hence, interest is the reward for paid to lenders of money for refraining from spending/consumption and for the sacrifices involved in lending.

Marshall has substituted the word “waiting” for abstinence and as such this theory is also known as waiting theory of interest.

2) Agio Theory of Interest or Bohm – Bawerk’s Theory: The tendency of the people is to prefer present goods/consumption and present enjoyment to future goods and future enjoyment. Savings result in the loss of present goods and present enjoyment. So, interest is the premium or reward on present goods to future goods. Interest is the amount of incentive (reward) paid to the people to induce them to save and lend money and preparing them to have future enjoyment then present enjoyment. In this way, interest is the reward or premium paid for the postponement of present consumption.

3) Productivity Theory of Interest: This theory is developed by classical economists. According to them, demand for capital arises because capital is productive. According to classicals, the productivity of capital rises, up to a certain level, with the use of additional amount of capital. Beyond that level, marginal productivity of capital decreases due to the effect of law of variable proportions. This theory states that rate of interest is just equal to the productivity of capital. So, whenever demand for capital increases, the rate of interest falls or decreases. In other.words, the theory states that demand for capital and rate of interest are inversely related.

4) Loanable Fund Theory of Interest: This theory, a neo-classical theory, was formualted by Knutt Wicksell. According to Wicksell, rate of interest is determined at that point where there is equality (equilibrium) between demand for loanable funds and supply of loanable funds.

On supply side, supply of loanable funds is influenced or determined by factors like savings, dishoarding, bank,credit and disinvestment. Higher and larger the savings, dishoarding, bank credit, and disinvestment, larger the supply of loanable funds.

On demand side, demand for loanable funds is determined or’ influenced by factors like level of investment, level of consumption and demand for hoarding. Higher the demand for funds towards consumption, investment and hoarding, higher the demand for loanable funds.

Supply of loanable funds and rate of interest are inversely related while demand for loanable funds and rate of interest are directly related. This theory states the actual rate of interest, in capital market depends upon demand for loanable funds and supply of loanable funds.

5) Time Preference Theory: This theory was developed by Irving Fisher. According to Fisher, rate of the interest arises because people have time preference. They prefer present satisfaction to future satisfaction, in view of the future uncertainty and falling value of money. Hence, according to Fisher, interest is the compensation (reward) paid to the people to sacrifice present satisfaction/present enjoyment. If people have more preference to present enjoyment/satisfaction (time preference), higher the compensation/reward they should be offered/paid, in the form of interest.

Fisher states that the degree of time preference depends upon factors like, size of income, distribution of income, the composition of income, certainty of enjoying income in future, temperament and character of the individual.

6) Keynes’ Liquidity Preference Theory: This theory was developed by J.M. Keynes. According to J.M. Keynes, (the rate of) interest rate is determined by both demand for (liquidity preference) money and supply of money. According to him, “Interest is the reward paid for parting with liquidity for the specific period.

On the supply side, supply of money refers to the total money in circulation and is determined by Central Bank (Reserve Bank) of the country. On demand side, demand for money is determined by liquidity preference.

Liquidity preference refers to desire of the people to keep money in the form of liquid cash. Liquidity preference arises because of 3 motives, namely, transactions motive, precautionary motive and speculative money. According to Keynes, liquidity preference and rate of interest are directly related. Supply of money and rate of interest are inversely related.

Question 6.

What is meant by profit ? Explain briefly various theories of profit.

Answer:

Generally, the term profit refers to the (surplus of income) difference between total revenue/total income and total cost of production. In Economics, profit is the reward paid/payable to the factor of production, organiser or entrepreneur. It is the reward to the organiser/entrepreneur for the risk and uncertainty borne by him in the form of business and for his-entrepreneurial abilities/skills.

Theories of Profits:

1) Dynamic Theory of Profits: This theory is associated with the name of J.B. Clark. According to J.B. Clark, among the four factors of production, organiser/ entrepreneur is highly dynamic and profit is the reward paid for his entrepreneurial dynamism.

Being very dynamic, entrepreneurs introduce dynamic changes in business like introduction of new products, new production processes, new varieties of products, etc. For all such dynamic changes the entrepreneur is paid reward in the form of extra or special profits. Over a period of time, when such dynamic changes are introduced by other sellers also competition among sellers increases. Because of such intense competition in all in the long run, all sellers / firm earn normal profit, the wage of the entrepreneur.

2) Innovation Theory: This theory was developed by Prof. Joseph Schumpeter. According to Schumpeter, profit is the reward paid to entrepreneur for his inventive/ innovation skills.

According to Schumpeter, in a closed capitalist economy, with a stationary equilibrium and with no innovations, prices are equal to cost of production. So, profits do not arise. But the innovations introduced by the entrepreneurs like introduction of new goods, introduction of new methods of production, opening up of or exploring new markets, discovery of new sources of raw meterials, etc. result in a wide difference between selling price and cost of production and attractive profits.

In this way, profits, according to Schumpeter, are the reward for innovation and not for risk borne.

3) The Risk Theory of Profit: This theory was proposed by Prof. Hawley. Among the 4 factors of production, entrepreneur is only factor of production who bears the risk in the form of production and sale of goods. He bears various types of risks like fluctuations in future prices, fluctuations in demand, possible entry of new firms sudden change in the taxes of the consumers, etc.

For all such risks taken by the entrepreneur, entrepreneur, as a factor of production, gets an excess payment (comparatively a higher share in National Income) in the value of goods/output produced. In this way, profit is the reward for the wisely selected business risk taking.

4) Uncertainty Theory of Profit: Prof. Knight developed this theory, which is a slightly modified version of risk theory of profit. In business, there are two types of risks – foreseeable/insurable and unforeseeable/non-insurable risks. Unforeseen and non¬insurable risks and uncertainties in business are contingencies like changes in prices, demand, supply, competition from substitutes in business are contigencies like changes in prices, demand, supply, competition from substitutes, trade cycles, government interference, etc. For bearing such uncertainties in business, the entrepreneur should be rewarded in the form of profit. Hence, according to Prof. Knight, it is not only the entrepreneur who is rewarded in the form of profit, but also his uncertainty bearing abilities.

5) Walker’s Theory of Profit: This theory was developed by Prof. Walker, which is similar to Ricardian theory of rent. According to Walker, capitalists are different from entrepreneurs. He feels that all entrepreneurs are not same, in the sense their managerial/entrepreneurial abilities differ. Some are more efficient whereas some less efficient. According to Walker, only efficient and able entrepreneurs are paid profits. Similar to Ricardian theory of rent, profits arise as the difference between the output produced by a more efficient firm and the output of a less efficient firm. They are the reward payable to superior managerial ability of the entrepreneur and does not enter the list of production.

![]()

Short Answer Questions

Question 1.

Explain the concept of Distribution.

Answer:

In Economics, the term distribution (theory of distribution) refers to the pricing of factors of production as well as the distribution of the total national income among the factors of production, which contributed to/made possible the production and National Income.

“Distribution accounts for the sharing of wealth produced by a community among the agents or owners which have been active in its production” – Chapman.

Distribution is of two types namely, A) Functional Distribution B) Personal Distribution. Functional distribution is of 2 types, namely Micro Distribution and Macro Distribution.

Question 2.

What are the factors that determine factor prices ?

Answer:

The prices of factor of production like any other good, is determined by its demand and its supply.

On demand side, the price/reward of a factor of production is determined by factors like

- The demand for the goods produced by the factor

- Price of that factor of production

- Prices of other participating/supporting factors of production

- Technological changes

- The stage of returns to scale that apply in production.

On the supply side, the price of factor of production depends on factors like

- The size of the population and its age composition.

- Mobility of factors of production

- The efficiency of factors of production

- Geographical conditions

- The level of wages in factor / Labour Markets

- Income level of the people/ working class.

Question 3.

Explain the concept of Quasi-rent.

Answer:

Quasi-rent: The concept of Quasi-rent was introduced by Prof. Marshall. Quasi-rent means “The additional income derived from machines and other man-made appliances of production in the short-run.

In the short run, the supply of man-made appliances like ships, trucks and machines etc. is fixed or inelastic. So, in the short run, when demand for them increases, their income increases and they earn a surplus. Such additional earnings or surplus in the price of such machines, etc. is quasi-rent.

Quasi-rent appears/exists in the short run but disappears in the long run.

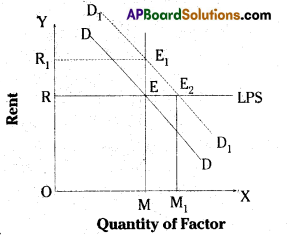

In the above diagram, on X – axis is the Quantity of factor of production is shown and on Y-axis rent is shown. In the above diagram, when demand has increased the short run, rent has increased from OR to OR1. But, with the supply of input increasing from OM to OM1, in the long run, the Quasi Rent of RRj has disappeared and became OR.

Question 4.

Explain the concept of Scarcity rent.

Answer:

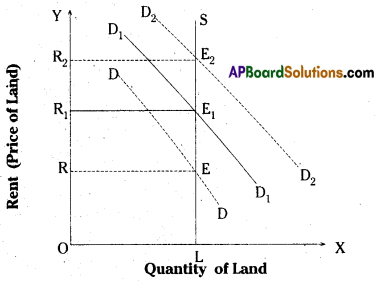

SCARCITY-RENT: The concept of scarcity rent was introduced by Prof. Marshall. According to Marshall, the supply of land is fixed or perfectly inelastic. It cannot be increased. When demand for land increases, the price of land rises. Such additional price or rise in the price of land due to its scarcity is known as scarcity rent. In this way, according to modern economists, rent arises even if all lands are homogeneous and also not only to land but also to any other factor of production if its supply is inelastic.

In the above diagram, on X-axis quantity of land is shown. On Y-axis, rent is shown. SL is the line that shows the supply of land which is perfectly inelastic. DD is the line showing the original demand for land and original rent is OR. When demand for land has increased from DD to D1D1 and D1D1 to D2D2 rent has increased from OR to OR1 and OR1 to OR2.

Question 5.

Explain the concepts of Gross Interest, Net Interest and their components.

Answer:

Interest is the price paid for the use of capital. It is the reward paid to those who save and lend. In other words, it is the share of National Income that goes to the capitalists/capital.

According to Seligman, “Interest is the return from the fund of capital”.

Keynes considers interest as “Purely monetary phenomenon”. According to him, interest is the “reward paid to the lender of money for parting with liquidity”.

There are two types of interest. They are:

1) Gross Interest,

2) Net Interest.

1) Gross Interest: Generally, interest means gross interest. It is the actual amount paid by the borrower to the lender as the price or reward for funds borrowed. Gross interest includes not only net interest (price for the use of capital), but also the following elements.

Gross interest = Net interest + Reward for risk taking + Reward for inconvenience + Reward for management.

A) Net Interest: Net interest is the reward for the services of capital alone. Net interest is the interest paid on government bonds and government loahs.

B) Reward for Risk Taking: Lending money always involves risk of non – repayment of loan by the borrower. These risks may be trade risks or business risks and personal risks. So, the capitalist charges some extra amount, in addition to the net interest to cover these risks. Greater the risk involved in lending the money, higher will »be the rate of interest.

C) Compensation for Inconvenience: Lending of money always involves some inconvenience in making savings. In the same way, the lender may not get back his money when he requires it for his own use. So, the lender charges some extra amount to these inconveniences over and above the net interest. This is included in gross-interest.

D) Rewards for Management Services: A money lender has to incur the expenditure on maintaining records relating to loans, repayments, etc. He has to maintain office and clerical staff. Sometimes, he has to incur legal expenses for the recovery of loans. So, gross interest includes some extra amount to recover all such expenses in addition to other elements.

2) Net Interest: Net interest is the reward for the services of capital alone. It is the interest paid on government bonds and loans. It is the gross interest minus the total of payment for the inconvenience, reward for management and insurance against risk.

Net Interest = Gross interest – (Reward for risk-taking + Compensation for inconvenience + Reward for management).

![]()

Question 6.

Explain the components of Gross profits and Net profits.

Answer:

Profit is the reward of the factor of production organisation or entrepreneur. It is the reward of the organiser for the risk and uncertainty incurred by him in the form of starting and running of a business.

According to Taussing, “Profit is a mixed and vexed income”. Hawley considers, “profit as a reward for risk bearing”. According to J.B. Clark “Profits are the reward for the dynamic role of an entrepreneur”.

According to Prof. Knight, “Profits are the rewards for uncertainty”.

There are two important concept-of profits.

1. Gross Profit: Normally profit means gross profit. It is the difference between (excess of) total revenue and total cost of production.

Components of Gross Profit: Gross profit includes various components as given below.

Implicit rent, Implicit wages, Implicit interest, normal profit, depreciation charges, windfall gains or profits and net profits.

Gross Profit = Net profit + (Implicit rent + Implicit wage + Implicit interest + Depreciation charges + Insurance premium).

2. Net Profit: Net profit is the economic profit or pure business profit. It is the reward received by the entrepreneur for his entrepreneurial services alone.

Components of Net Profit: Net profit includes the following components. They are: Reward for coordinating the services of factors of production, Reward for bearing risk and uncertainty, Reward for making innovations, Reward for bargaining the price of factors of production, etc.

Net Profit = Gross profit – (Implicit rent + Implicit wage + Implicit interest + Depreciation charges + Insurance premium).

Very Short Answer Questions

Question 1.

Contract rent.

Answer:

Generally, rent means the reward/price paid to the factor of production land. But contract rent means a periodical payment by the tenant/ user to the owners of durable goods for the use of durable commodities as per agreement or contract. E.g: Monthly rent of a house, Hourly rent of a cycle, etc.

Question 2.

Economic rent.

Answer:

Rent is the price or reward paid to the factor of production, land, for its services in the production of goods and services. Economic rent is the reward paid to land, in terms of money. It is two types. 1) Classical economic rent, introduced by Prof. David Ricardo, 2) Modern economic rent, like Scarcity rent, Quasi – rent, etc.

Question 3.

Scarcity rent.

Answer:

The concept of scarcity rent was introduced by Prof. Marshall. The supply of land is fixed or perfectly inelastic. In other words, there is scarcity of land with an increase in demand for land, the price of land increases/rises. The additional price or the rise in the price of land due to such scarcity of land is known as scarcity rent.

Question 4.

Quasi-rent.

Answer:

The concept Quasi – rent was introduced by Prof. Marshall. In the short run, the supply of man – made appliances like ships, trucks, etc. is fixed or inelastic. In the short run, when the demand for them increases, they get additional income or a surplus. Such additional income derived from machines and other man-made appliances of production in the short run is called Quasi – rent. Quasi – rent appears/ exists only in the short run but disappears in the long run.

Question 5.

Transfer-earnings.

Answer:

The term transfer – earnings refers to the excess or surplus amount which a factor of production (E.g.: a worker ) earns in the present use/employment over what he / it could earn in the next best use.

Question 6.

Money wages.

Answer:

Money wage refers to the amount of wage expressed or measured in terms of money or in rupees. Such wages are also known as nominal wages. They are the wages paid by the employer to the workers for their services in terms of money.

Eg: A salary of Rs. 10,000 per month to a bank employee.

Question 7.

Real wages.

Answer:

Real wage refers to the amount / quantity of goods that can be purchased with the money wage at any particular time. It is the money wage expressed in terms of purchasing power or general price level. It mainly depends upon the general price level. There is an inverse relationship between price level and real wage.

Question 8.

Time wages.

Answer:

The wage paid according to the period of time is called time wage. Time wages are paid either on daily, weekly, monthly, or yearly basis. Such wages are paid, when it is not possible to measure the output of the workers. Time wages will be uniform irrespective of the efficiency of the workers.

![]()

Question 9.

Piece wages.

Answer:

The wages paid according to (basing on) the work done by the worker are known as piece wages. This type of wages are paid when it is possible to measure the work done by the workers. When wages are paid according to piece rate system, efficient workers can earn more income /wages.

E.g.: If the piece rate for each unit produced is Rs. 10 each and if a worker produces 40 units in a day, the total piece wage earned by that worker is Rs. 400.

Question 10.

Gross interest.

Answer:

A. Generally, interest means gross interest. It is the actual amount paid by the borrower to the lender as the price or,reward for funds borrowed. Gross interest includes not only net interest (price paid for the use of capital) but also the following elements.

Gross Interest = Net interest + Insurance against risk + Reward for inconvenience + ‘ Reward for management.

Question 11.

Net interest.

Answer:

Intent is the price paid for the use of capital. Net interest is the reward paid for the use of capital alone. The interest paid on government bonds and government loans is called net interest.

It is the gross interest minus the total of payment for inconvenience, reward for management ?-d insurance against risk.

Net Interest = Giuss interest – (Insurance against risk + Compensation for inconvenience + Reward for management)

Question 12.

Gross profit.

Answer:

It is the difference between (Excess of) total revenue and total cost of production.

Gross profit includes various elements like implicit rent, implicit wages, implicit interest, normal profit, depreciation charges, chance gains (unexpected or windfall gains) and net profits.

Question 13.

Net profit.

Answer:

Generally, profit means the reward or price paid to the factor or production entrepreneur for his entrepreneurial abilities/functions.

Net profit is the reward earned by entrepreneur exclusively or purely for their entrepreneurial functions/skills/abilities.