Students must practice these AP Inter 1st Year Accountancy Important Questions 6th Lesson Subsidiary Books to boost their exam preparation.

AP Inter 1st Year Accountancy Important Questions 6th Lesson Subsidiary Books

Short Answer Questions

Question 1.

Explain the various Subsidiary Books with suitable examples.

Answer:

Separate Books or special books which are maintained to record a particular category of transactions are known as “Subsidiary books”.

The journal is divided into eight subsidiary books. They are :

a) Purchase book: This book records all the goods purchased on credit. Cash purchases and purchases of assets are not recorded in this book.

Whenever goods are bought on credit we receive an invoice from the seller. It is called “Inward Invoice”. It is evidence for recording in purchase book.

b) Sales book: The goods sold on credit are recorded in this book. Cash sales and assets sold for cash or credit are not recorded in this book.

Whenever goods are sold on credit we send an Invoice to the customer. It is called “Out¬ward Invoice”. It is evidence for recording in sales book.

c) Purchase returns book: This book is also known as returns outward book. This book records the goods returned to the suppliers.

When goods are returned to their sellers a ‘Debit Note’ is prepared and sent to the suppliers along with goods.

![]()

d) Sales returns book: This book is also known as returns inward book. This book records the goods returned by the customers.

When the sellers receive goods back from the customer along with a debit note, then he prepares a credit note, and sends to the customer. ,

e) Cash book: Cash book is used for recording all cash transactions i.e. cash receipts and cash payments either in cash or by cheque are recorded in this book.

f) Bills receivable book: This book is used to record all the bills received from the customers for the amount due. It contains details of acceptor of the bill, its due date, date bill, the amount due, etc.

g) Bills payable book: If the goods are purchased on credit and bills are accepted for the due amounts, all these bills payable are recorded in this book. It contains the amount due, date of bill, place of payment, due date, etc.

h) Journal proper: This book is used to record only those transactions, which cannot be recorded in any one of the seven subsidiary books side above.

Question 2.

Give the advantages of subsidiary books.

Answer:

Subsidiary Book Advantages:

a) Saving of Time: No need of writing the Journal Entries. Transactions are directly entered into their respective journals.

b) Division of Work: By entrusting different Subsidiary Books to different persons, division of principle can be implemented.

c) Easy Recording: Transactions can be recorded very fast and easy.

d) Improves Efficiency: Accounting work will be done efficiently by allotting work to different experts who prepare the Special Books.

e) Detection of Errors: Since Separate Books are maintained to record a particular set of transactions, errors can be easily noticed.

![]()

Question 3.

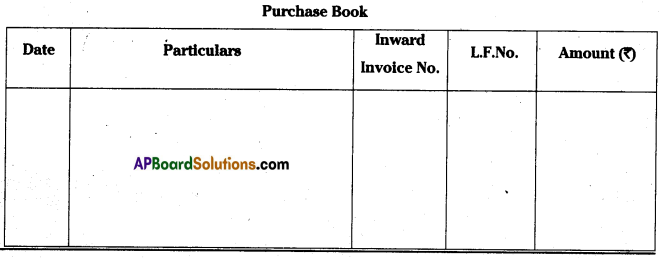

Explain about the Purchases book and draw the pro forma of it.

Answer:

This book records all the goods purchased on credit. Cash purchases and purchases of assets are not recorded in this book.

Whenever goods are bought on credit we receive an Invoice from the seller. It is called “Inward Invoice”. It is evidence for recording in the purchase book. It is numbered serially and filed in a separate file.

Proforma of purchase book:

Purchase book contains five columns, such as Date, Particulars, Invoice No., L.F.Nb. and Amount

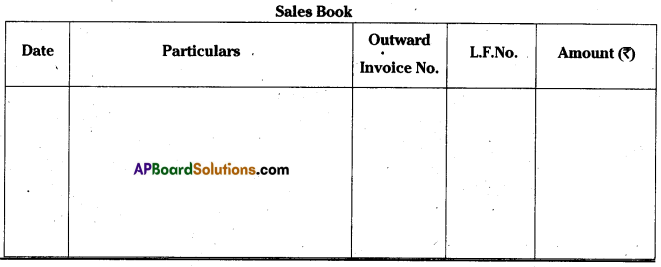

Question 4.

Explain about Sales book and draw the pro forma of it.

Answer:

The goods sold on credit are recorded in this book. Cash sales and assets sold for cash or credit are not recorded in this book.

Whenever goods are sold on credit we send an invoice to the customer. It is called “Outward invoice”. It is evidence for recording in sales book. It is serially numbered and kept in a separate file.

Proforma of sales book:

Sales book contains five columns, such as Date, Particulars, Invoice No., L.F.No. and Amount.

Question 5.

Answer the following in not more than 5 lines. [Mar. 17 – A.P.]

a) Invoice

b) Debit Note

c) Credit Note

d) Tradp Discount

e) Journal Proper

Answer:

a) Invoice:

It is the document prepared by the supplier of goods with all the details like quantity, price discount offered and other terms and conditions. This is also known as “Inward Invoice”.

b) Debit Note: [May 2022, Mar. 2019 – A.P, Mar. 2018 – T.S.]

If goods are returned to the supplier, a debit note or letter is sent along with goods, informing the supplier about the debit given to his account for the value of the goods returned. This note is known as debit note.

c) Credit Note:

If the customer returned the goods, a credit note is sent to him by the traders informing the customer that his account has been credited with the value of the goods returned.

d) Trade Discount:

It is a reduction in the catalogue price of an article. This is given by the wholesaler to the retailer to enable him to sell at a catalogue price and make a profit. It is not entered in books.

e) Journal Proper: [May 17 – A.P.]

This book is used for recording only those transactions which cannot be recorded in any one of the seven subsidiary books said above.

Examples: Opening entries, closing entries, adjustment entries, transfer entries.

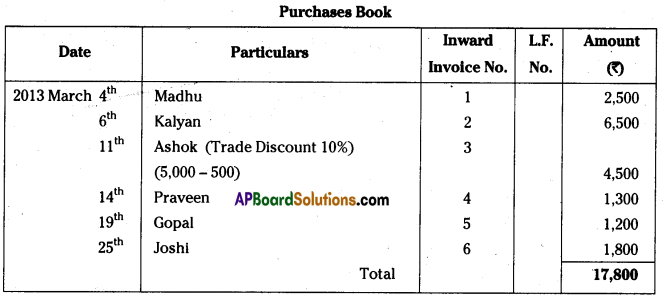

Problems

Question 1.

Record the following transactions in the purchases book.

| 2013 | Rs. | |

| March 4th | Purchased goods from Madhu | 2500 |

| 6th | Purchased goods from Kalyan | 6500 |

| 11th | Bought goods from Ashok | 5000 |

| Trade Discount 10% | ||

| 14th | Purchased goods from Praveen | 1300 |

| 17th | Purchases | 4000 |

| 19th | Purchased goods from Gopal | 1200 |

| 25th | Purchased goods from Joshi | 1800 |

Hint 1: For transaction dated on 11th calculate trade discount @ 10% on Rs. 5,000/- i.e. 5000 x 10/100 = 500, and take net purchases as 5000 – 500 = 4500.

Hint 2: Transaction dated 17th March is a cash transaction. So, it is not to be taken in purchase book.

Answer:

![]()

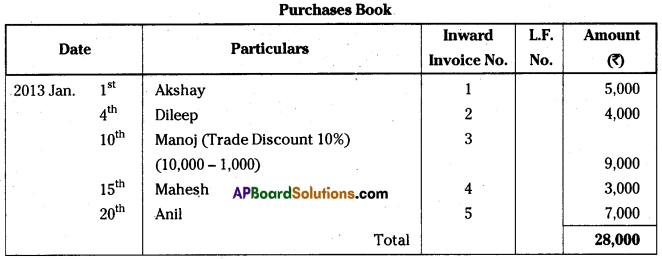

Question 2.

Prepare Purchases Book from the following:

2013 — Rs.

Jan 1st — Purchased goods from Akshay — 5,000

” 4th — Goods purchased from Dileep — 4,000

” 10th — Goods purchased from Monoj (Trade Discount 10%) — 10,000

” 12th — Cash Purchases — 6,000

” 15th — Purchased Goods from Mahesh — 3,000

” 20th — Purchased Goods from Anil — 7,000

Hint 1: For transaction dated on 10th calculate discount @ 10% on 10,000/- i.e. 1,000 and takes net purchases as 10,000 – 1,000 = 9,000.

Hint 2: Transaction dated on 12th is a cash transaction. So, it is not entered in the purchases book.

Answer:

Purchases Book

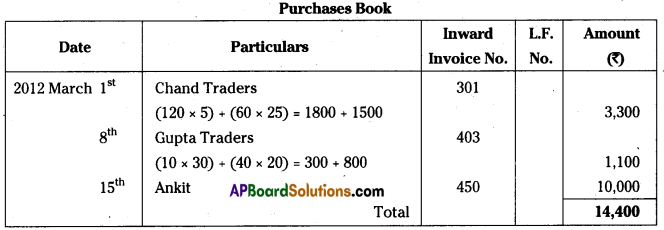

Question 3.

Record the following in Purchases Book:

2012

March 1st — Purchase goods on credit from Chand traders Invoice No. 301. 120 reams of white paper @ 15 per ream 60 dozen ink pots @ 25 per dozen

8th — Purchased from Gupta traders Invoice No. 403 10 Drawing boards @ 30 each 40 Notebooks @ 20 each

10th — Purchased goods from Goyal and Company for cash 3,000.

15th — Purchased goods from Ankit Rs. 10,000 as per Invoice No. 450.

Hint 1: Transaction dated on March 1st Net Purchases amount is to be calculated as, (120 x 15) + (60 x 25) = 1800 + 1500 = 3300

Hint 2: Transaction dated on March 8th Net Purchases amount is,

(10 x 30) + (40 x 20) = 300 + 800 = Rs. 1100

Answer:

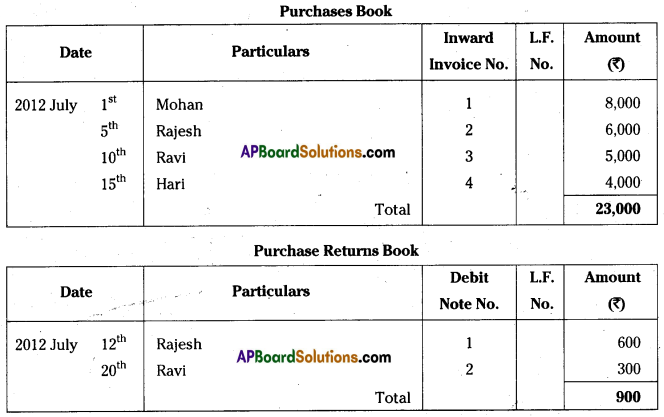

Question 4.

Enter the following in Purchase Book and Purchase Returns Book: [Mar ’20, ’19 (AP&TS)]

| 2012 (2019) | Rs. | |

| July 1st | Purchased goods from Mohan | 8,000 |

| 5th | Purchased goods from Rajesh | 6,000 |

| 10th | Purchased goods from Ravi | 5,000 |

| 12th | Returned goods to Rajesh | 600 |

| is”‘ | Purchased goods from Hari | 4,000 |

| 20th | Goods returned to Ravi | 300 |

Answer:

![]()

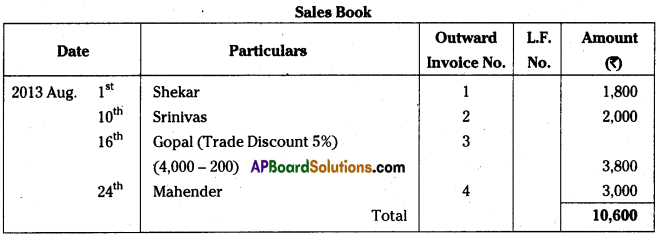

Question 5.

Prepare Sales Book [May ’17 (AP)]

| 2013 | Rs. | |

| Aug. 1st | Goods sold to Shekar | 1800 |

| 10th | Sold goods to Srinivas | 2000 |

| 14th | Sales | 800 |

| 16th | Sold goods to Gopal | 4000 |

| (Trade Discount 5%) | ||

| 20th | Sold furniture to Krishna | 500 |

| 24th | Sold goods to Mahender | 3000 |

Hint 1: Trade discount is 4000 x 5/100. Net sales = 3,800.

Hint 2: Transaction dated on 14th is a Cash transaction.

Answer:

Question 6.

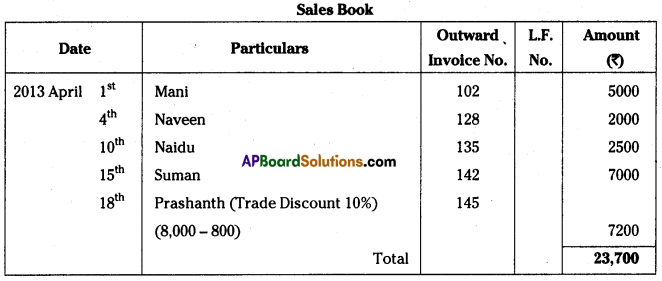

Enter the following transactions in Sales Book and prepare Ledger.

2013 — Rs.

April 1st — Sold goods to Mahi — 5000

Invoice No: 102

4th — Goods sold to Naveen — 2000

Invoice No: 128

10th — Sold goods to Naidu — 2500

Invoice No: 135

15th — Sold goods to Suman — 7000

Invoice No: 142

18th — Sold goods to Prashanth — 8000

Invoice No: 145 (Trade Discount 10%)

20th — Sold goods to Sainath for cash — 4000

Hint 1: For the transaction dated on 18th calculate trade discount

i.e. 8000 x 10/100 = 800, net sales = 7200.

Hint 2: The transaction dated on 20th is a cash transaction.

Answer:

Ledgers:

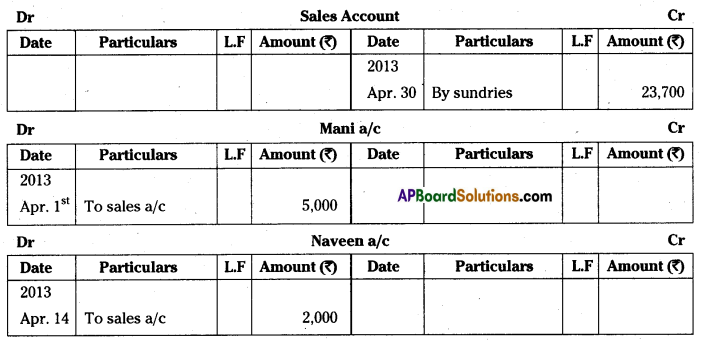

Question 7.

Prepare Sales Book and Sales Returns Book from the following. [Mar. 2018 -A.P. & T.S.]

2013 — Rs.

May 1st — Sold goods to Rahul — 6500

3rd — Sold goods to Manish — 6000

8th — Returned goods by Rahul — 700

11th — Sold goods to Raj Kumar — 12000

14th — Sold goods to Bhanu — 11000

17th — Returned goods from Raj Kumar — 2000

21st — Sold goods to Anand — 9000

Answer:

![]()

Question 8.

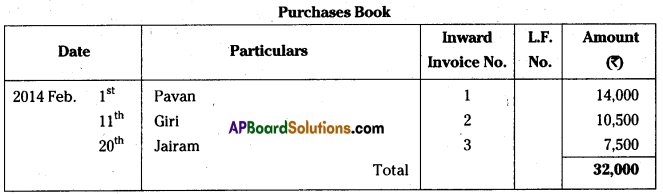

Record the following transactions in Proper Subsidiary Books.

2014 — Rs.

Feb. 1st — Purchased goods from Pavan — 14000

6th — Sold goods to Sandeep — 8000

10th — Sendeep returned goods — 500

11th — Purchased goods from Giri — 10500

12th — Sold goods to Arjun — 6500

13th — Goods returned to Giri — 500

15th — Sold goods to Charan — 3500

18th — Goods returned by Arjun — 300

20th — Purchased goods from Jairam — 7500

25th — Returned goods to Jairam — 400

Answer:

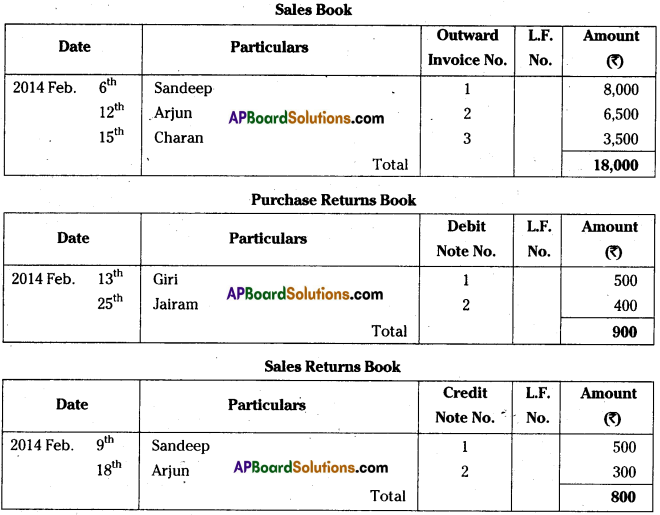

Question 9.

Enter the following transactions in the related Subsidiary Books.

2013 — Sep.

1st — Purchased goods from Siva — Rs. 2000

5th — Purchased goods from Prasad — 4500

7th — Sold goods to Rahim — 9000

8th — Goods returned to Prasad — 500

10th — Purchased goods from Vinod (Trade Discount 10%) — 15000

14th — Sold goods to Pradeep — 12000

16th — Goods returned by Pradeep — 1000

18th — Goods purchased for cash — 6000

20th — Sold goods to Praneeth (Trade discount 5%) — 3000

24th — Purchased goods from Vijay — 3700

26th — Sold old machinery — 1400

27th — Bought goods from Venkat (Trade discount 15%) — 8000

29th — Returned goods to Vijay — 200

Hint 1: For transaction dated on 10th Trade discount is 15000 x 10/100 = 1500

Net purchases = 13500

Hint 2: The transaction dated on 18th is a cash transaction.

Hint 3: For transaction dated on 20th Trade discount is 3000 x 5/100 = 150

Net sales – 2850

Hint 4: Transaction dated on 26th is to be entered in the journal proper.

Hint 5: For transaction dated on 27th Trade discount is 8000 x 15/100 = 1200

Net sales = 6,800

Answer:

![]()

Question 10.

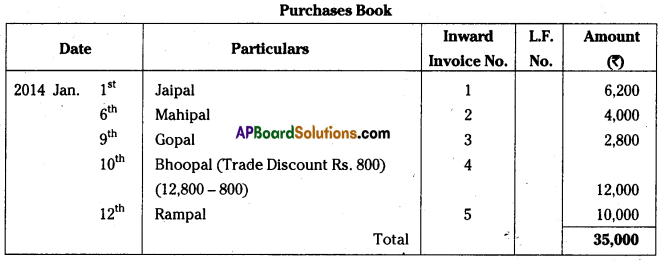

Prepare Purchases Book.

2014 — Rs.

Jan. 1st — Purchased goods from Jaipal — 6200

6th — Purchased goods from Mahipal — 4000

9th — Purchased goods from Gopal — 2800

10th — Purchased goods from Bhoopal — 12,800

(Trade discount Rs. 800)

12th — Purchased goods from Rampal — 10000

Answer:

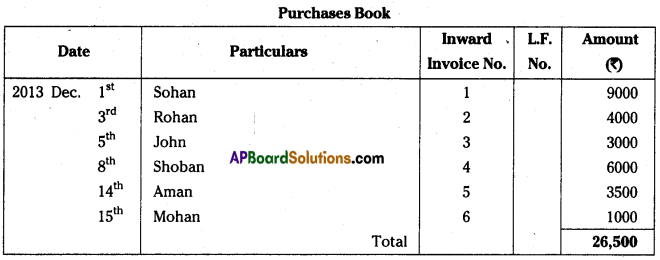

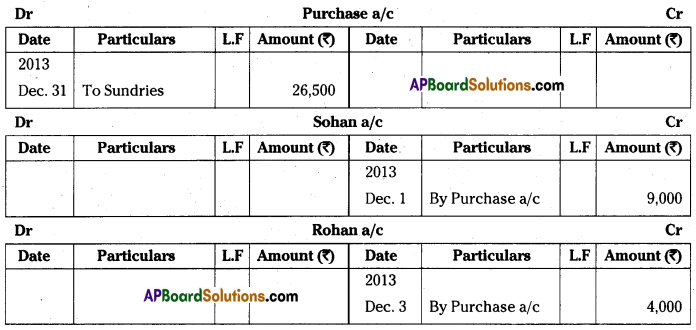

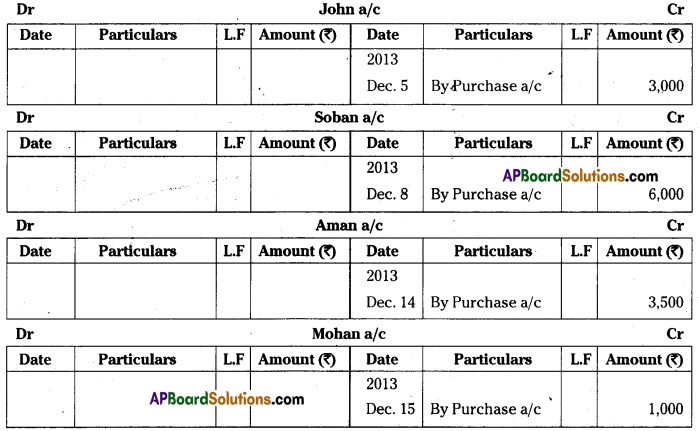

Question 11.

Enter the following transactions in Purchases Book and post them in Ledger.

2013 — Rs.

Dec. 1st — Goods purchased from Sohan — 9000

3rd — Purchased goods from Rohan — 4000

5th — Goods purchased from John — 3000

8th — Purchased goods from Shoban — 6000

10th — Purchased office furniture from Anil — 13000

14th — Purchased goods from Aman — 3500

15th — Purchased goods from Mohan Purchases Book — 1000

Answer:

Ledgers:

Question 12.

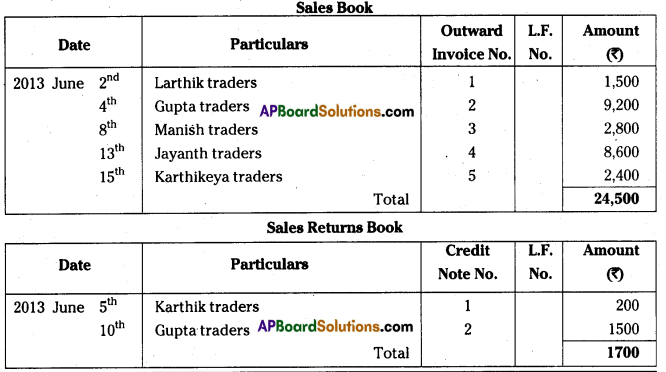

Record the following in Sales Book and Sales Returns Book.

2013 — Rs.

June 2nd — Sold goods to Larthik traders — 1500

4th — Sold goods to Gupta traders — 9200

5th — Goods returned from Karthik traders — 200

8th — Sold goods to Manish traders — 2800

10th — Return inwards from Gupta traders — 1500

13th — Sold goods to Jayanth traders — 8600

15th — Goods sold to Karthikeya traders — 2400

Answer:

Question 13.

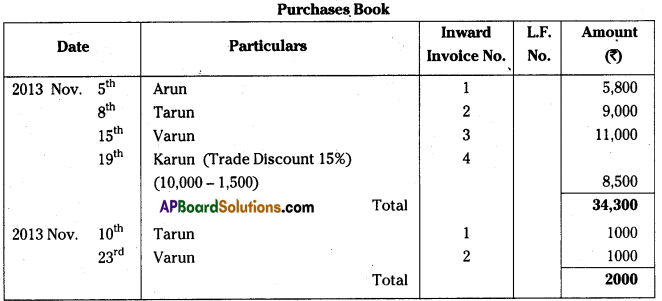

Enter the following transactions in Proper Subsidiary Books: [May 17 -A.P.]

2013 — Rs.

Nov 5th — Purchased goods from Arun — 5800

8th — Purchased goods from Tarun — 9000

10th — Returned goods to Tarun — 1000

15th — Purchased goods from Varun — 11000

17th — Purchased machinery from Jagan — 5000

19th — Purchased goods from Karun — 10000

(Trade discount 15%)

23rd — Return outwards to Varun — 1000

Hint: Transaction dated Nov. 19th trade discount 15% of 10000 i.e., 10000 x 15/100 = 1500 is to be deducted from purchase amount Rs. 10000 Net purchases 10000 – 1500 = 8500

Answer:

![]()

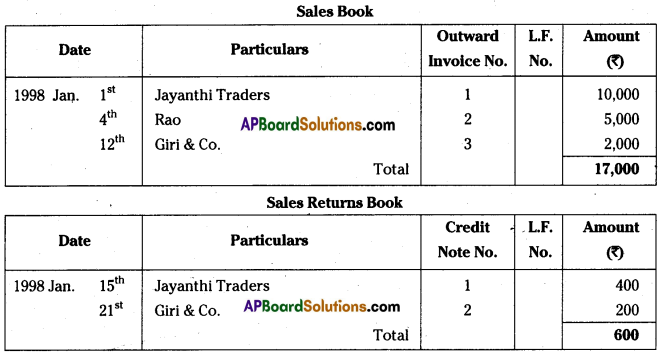

Question 14.

From the following transactions prepare Sales Book and Sales Returns Book.

1998 — Rs.

Jan 1st — Sales to Jayanthi Traders

4th — Sales to Rao

12th — Sales to Giri & Co.

15th — Returns from Jayanthi Traders

21st — Returns from Giri & Co.

Answer:

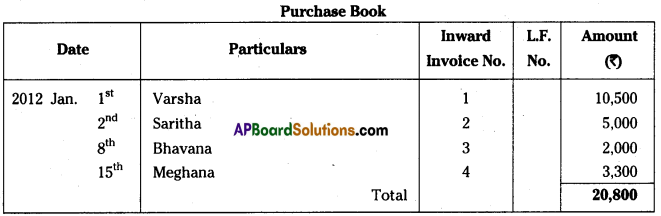

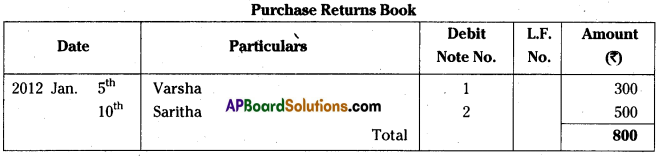

Question 15.

Enter the following transactions in proper Subsidiary Books. [IPE. Mar. 14]

2012 — Rs.

Jan. 1st — Purchased goods from Varsha — 10,500

2nd — Purchased goods from Saritha — 5,000

5th — Returned goods to Varsha — 300

8th — Purchased goods from Bhavana — 2,000

10th — Returned goods to Saritha — 500

15th — Purchase from Meghana — 3,300

Answer:

![]()

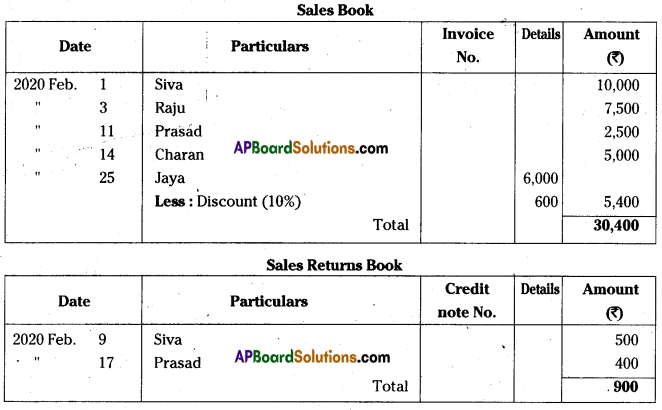

Question 16.

Record the following transactions in proper Subsidiary Books. [May 2022]

2020 — ?

February 1 — Sold goods to Siva — 10,000

” 3 — Sold goods to Raju — 7,500

” 9 — Goods returned by Siva — 500

” 11 — Sold goods to Prasad — 2,500

” 14 — Sold goods to Charan — 5,000

” 17 — Goods returned by Prasad — 400

” 25 — Sold goods to Jaya — 6,000

(Trade discount 10%)

Answer: