Students must practice these AP Inter 1st Year Accountancy Important Questions 5th Lesson Ledger to boost their exam preparation.

AP Inter 1st Year Accountancy Important Questions 5th Lesson Ledger

Short Answer Questions

Question 1.

Define ledger and explain the advantages of ledger.

Answer:

Ledger is a book that facilitates the recording of all types of transactions related to Personal, Real and Nominal. All the debit and credit aspects that are recorded in the journal are transferred to the respective accounts in the ledger.

According to L.C.Cropper, “the book which contains a classified and permanent record of all transactions of a business is called the Ledger”.

ADVANTAGES:

The following are the advantages of a ledger.

1) Complete information at a glance: All the transactions pertaining to an account are collected at one place in the ledger. By looking at the balance of that account, one can understand the collective effect of all such transactions at a glance.

2) Arithmetical accuracy: With the help of ledger balances, Trial balance is prepared to know the arithmetical accuracy of accounts.

3) Result of business operations: It facilitates the preparation of final accounts for ascertaining the operating result and the financial position of the business concern.

4) Accounting information: The data supplied by various ledger accounts are summarized, analyzed and interpreted for obtaining various accounting information.

![]()

Question 2.

What do you mean by posting? Explain the rules relating to posting.

Answer:

The process of transferring the entries recorded in the journal or subsidiary books to the respective accounts opened in the ledger is called ‘Posting’. In other words, posting means process of a grouping of all the transactions relating to a particular account at one place.

RULES:

The following steps should be taken into account while making a posting.

A) Opening of separate accounts: Each transaction affects minimum two accounts for which separate accounts are to be opened in the ledger. All transactions relating to an account, debit as well as credit, are to be posted to know the net position of the account.

B) Posting journal entry to the concerned side: If an account is debited in the journal, posting will be made on the debit side of the account in the ledger. Similarly, if an account is credited in the journal, that account would be credited in the ledger.

C) Use of words “To” and “By”: While writing the debit side, commence with the word “To” and write the name of the account, which is credited in the journal. Write the word “By” on the credit side before writing the name of the account that is debited in the journal.

D) Balance in account: The difference between the debit and credit totals of an account is the net position of the account, known as the balance of the account.

Very Short Answer Questions

Question 1.

What is ledger? [Mar. ’13 – T.S]

Answer:

Ledger is a book that facilitates recording of all types of transactions related to Personal, Real and Nominal accounts separately in related accounts. In other words, the group of accounts recorded in a book is called a ‘Ledger’. Ledger is also called ‘Book of Final Entry’.

Question 2.

What is posting? [Mar. ’17 – T.S]

Answer:

The process of transferring the entries recorded in the journal or subsidiary books to the respective accounts opened in the ledger is called ‘Posting’. It is also the process of grouping of all the transactions relating to a particular account at one place.

Question 3.

What do you mean by balancing of an account?

Answer:

Balancing means writing of the difference between the amount columns of the two sides in the ledger (smaller total) side so that the totals of the two sides become equal.

Question 4.

What is the debit balance?

Answer:

The excess of the debit total over the credit total is called the debit balance.

Question 5.

What is a credit balance?

Answer:

The excess of credit total over the debit total is called the credit balance.

![]()

Problems

Question 1.

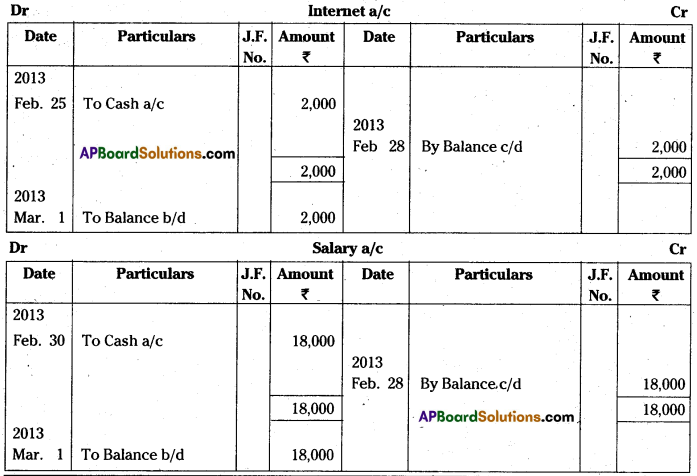

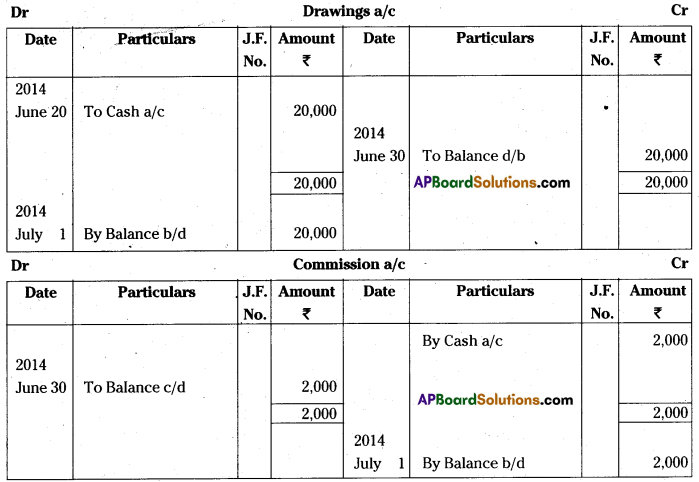

Journalize the following transactions of Mr. Prahlad and post them in the ledger and balance the same.

| February 2013 | 01 | Prahlad invested Rs. 5,00,000 cash in the business |

| “ | 03 | Paid into Bank Rs. 60,000 |

| “ | 05 | Purchased building for Rs. 2,00,000 |

| “ | 07 | Purchased goods for Rs. 50,000 |

| “ | 10 | Sold goods for Rs. 80,000 |

| “ | 15 | Withdrew cash from bank Rs. 12,000 |

| “ | 25 | Paid internet Rs. 2,000 |

| “ | 28 | Paid Salary Rs. 18,000 |

Answer:

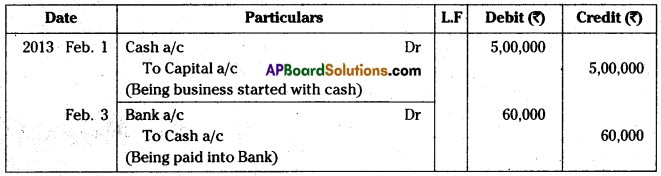

Journal Entries in the books of Mr. Prahlad

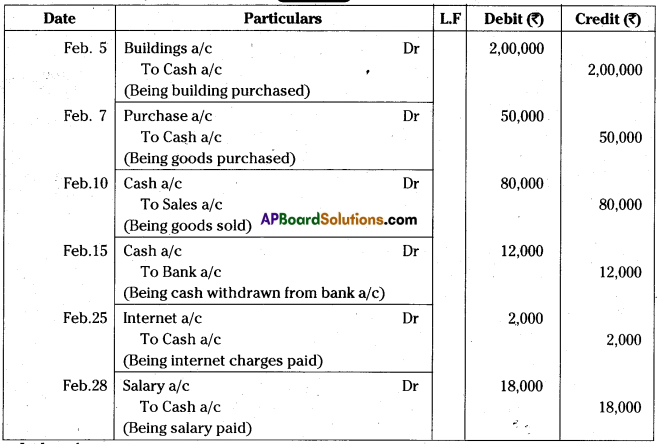

Ledger Accounts:

![]()

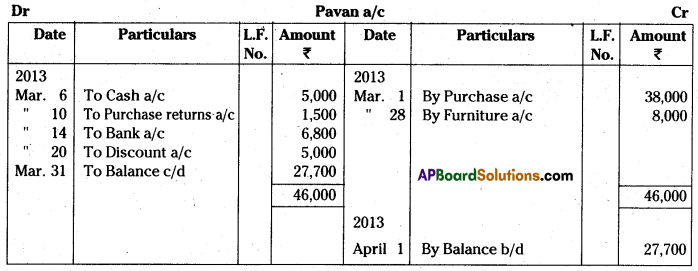

Question 2.

Prepare Pavan account from the following: [May. ’17 – T.S]

| 2013 | Rs. | ||

| March | 1 | Goods purchased from Pavan | 38,000 |

| “ | 6 | Cash paid to Pavan | 5,000 |

| “ | 10 | Goods returned to Pavan | 1,500 |

| “ | 14 | Paid to Pavan by Cheque | 6,800 |

| “ | 20 | Discount allowed by Pavan | 5,000 |

| “ | 26 | Goods purchased from Pavan for Cash | 2,500 |

| “ | 28 | Furniture purchased from Pavan | 8,000 |

Answer:

Question 3.

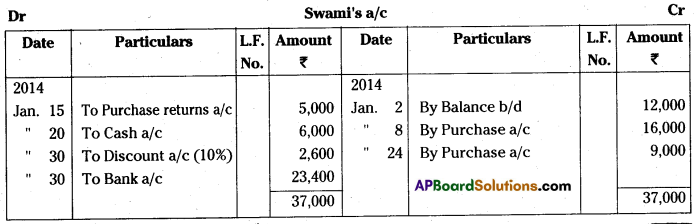

Prepare Sudha account from the following: 2014 [Mar. ’19 – T.S] [May ’17 – A.P.]

| February | 1 | Amount due from Sudha | 8,000 |

| “ | 4 | Goods sold to Sudha | 11,000 |

| “ | 12 | Goods returned by Sudha | 4,000 |

| “ | 16 | Cash received from Sudha | 3,000 |

| “ | 22 | Received cheque from Sudha | 6,000 |

| “ | 28 | Sudha account settled with 10% Discount |

Answer:

Question 4.

Prepare Swami’s account from the following: [Mar. 20 – T.S]

2014 — Rs.

January 2 — Amount due to Swami — 12,000

” 8 — Goods purchased from Swami — 16,000

” 15 — Goods returned to Swami — 5,000

” 20 — Cash paid to Swami — 6,000

” 24 — Goods purchased from Swami — 9,000

” 30 — Swami’s account is settled by cheque with 10% Discount

Answer:

Question 5.

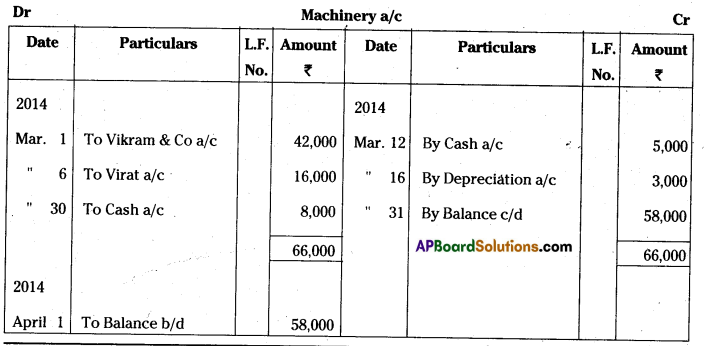

Prepare Machinery account from the following:

| 2014 | Rs. | ||

| March | 1 | Purchased machinery from Vikram & Co | 42,000 |

| “ | 6 | Machinery purchased from Virat | 16,000 |

| “ | 12 | Machinery costing Rs. 8,000 sold for | 5,000 |

| “ | 16 | Depreciation provided on Machinery | 3,000 |

| “ | 22 | Goods purchased from Swami | 9,000 |

| “ | 30 | Purchase of machinery for cash | 8,000 |

Answer:

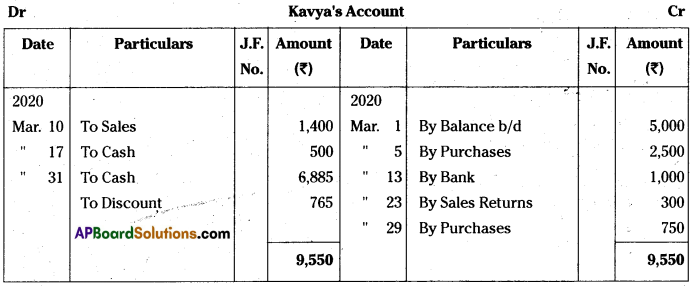

![]()

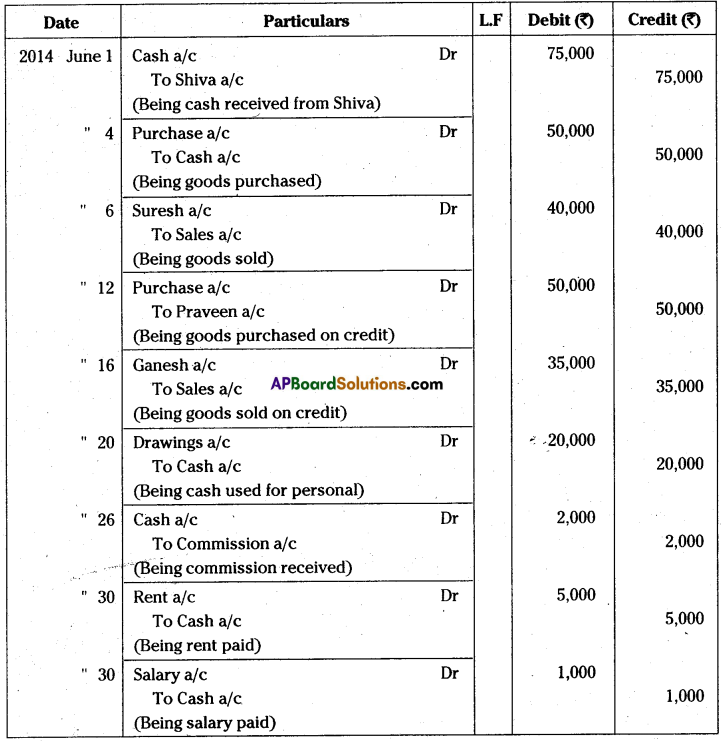

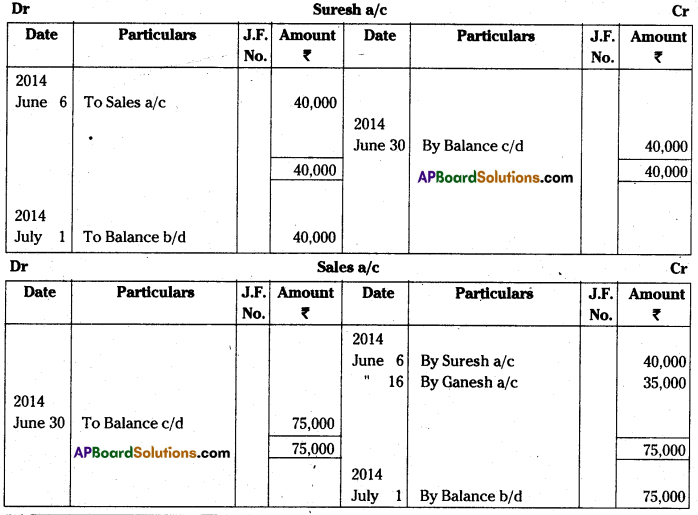

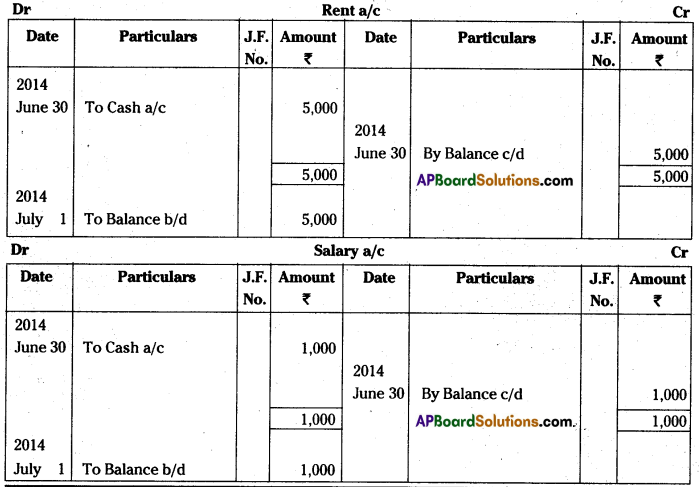

Question 6.

Prepare the Ledger account ofBhavya from the following particulars:

| 2014 | Rs. | ||

| June | 1 | Received cash from Shiva | 75,000 |

| “ | 4 | Bought goods for cash | 50,000 |

| “ | 6 | Sold to Suresh | 40,000 |

| “ | 12 | Bought goods from Praveen | 50,000 |

| “ | 16 | Sold goods to Ganesh | 35,000 |

| “ | 20 | Withdrew cash for personal use | 20,000 |

| “ | 26 | Received commission | 2,000 |

| “ | 30 | Paid rent | 5,000 |

| “ | 30 | Paid salary | 1,000 |

Answer:

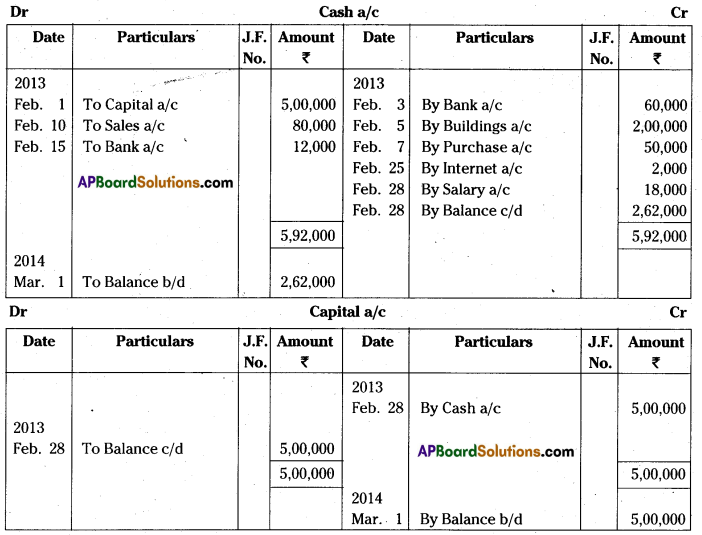

Journal Entries in the books of Bhavya

![]()

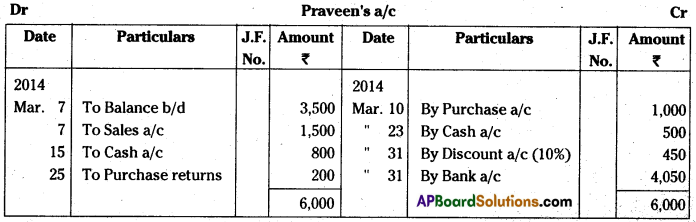

Question 7.

From the following information prepare Praveen’s Account as on 31-3-2Q14. [Mar. 2018 – A.P.]

| 2014 | Rs. | ||

| March | 7 | Balance due from Praveen | 3,500 |

| “ | 7 | Sold goods to Praveen | 1,500 |

| “ | 10 | Purchased goods from Praveen | 1,000 |

| “ | 15 | Paid cash to Praveen | 800 |

| “ | 23 | Received cash from Praveen | 500 |

| “ | 25 | Returned goods to Praveen | 200 |

| Praveen settled account with 10% Discount |

Answer:

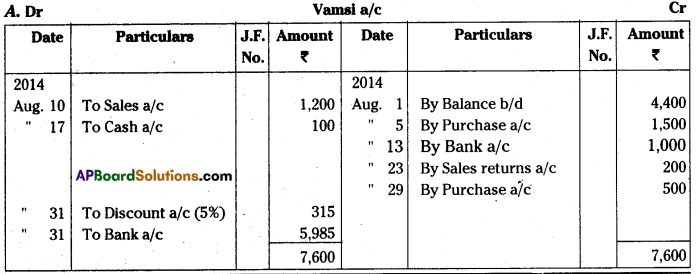

Question 8.

Prepare Vamsi’s Account from the following. [Mar. 2020 – A.P.]

| 2014(2019) | Rs. | ||

| August | 1 | Balance due to Vamsi | 4,400 |

| (January) | 5 | Purchased goods from Vamsi | 1,500 |

| “ | 10 | Sold goods to Vamsi | 1,200 |

| “ | 13 | Received cheque from Vamsi | 1,000 |

| “ | 17 | Paid cash to Vamsi | ‘ 100 |

| “ | 23 | Vamsi returned goods | 200 |

| “ | 29 | Purchased goods from Vamsi(Vamsi account settled with 5% discount) | 500 |

Answer:

![]()

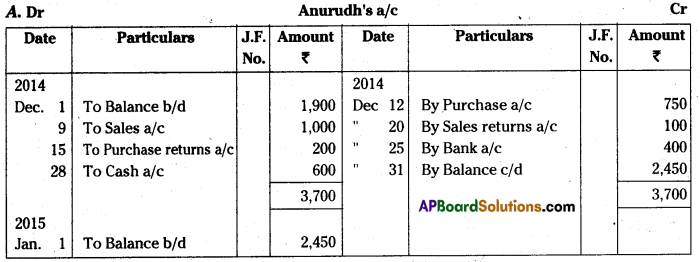

Question 9.

Prepare Anurudh’s Account from the following. [Mar. 2019 -A.P.]

2014 — Rs.

December 1 — Balance due from Anurudh — 1,900

” 9 — Sold goods to Anurudh — 1,000

” 12 — Purchased goods from Anurudh — 750

” 15 — Returned goods to Anurudh — 200

” 20 — Anurudh returned goods — 100

” 25 — Received cheque from Anurudh — 400

” 28 — Paid cash to Anurudh — 600

Answer:

Question 10.

Prepare Kavya’s account from the following particulars.? [May 2022]

2020 — Rs.

March — 1 Balance due to Kavya — 5,000

” 5 — Purchased goods from Kavya — 2,500

” 10 — Sold goods to Kavya — 1,400

” 13 — Received cheque from Kavya — 1,000

” 17 — Paid cash to Kavya — 500

” 23 — Kavya returned goods — 300

” 29 — Purchased goods from Kavya — 750

Answer: